- Home

- »

- Medical Imaging

- »

-

U.S. Imaging Services Market Size, Industry Report, 2033GVR Report cover

![U.S. Imaging Services Market Size, Share & Trends Report]()

U.S. Imaging Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Mobile & Interim Imaging, Fixed Radiology), By Application (Orthopedics, Gynecology), By End Use (Hospitals, Diagnostic Imaging Centers), And Segment Forecasts

- Report ID: GVR-4-68038-625-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Imaging Services Market Summary

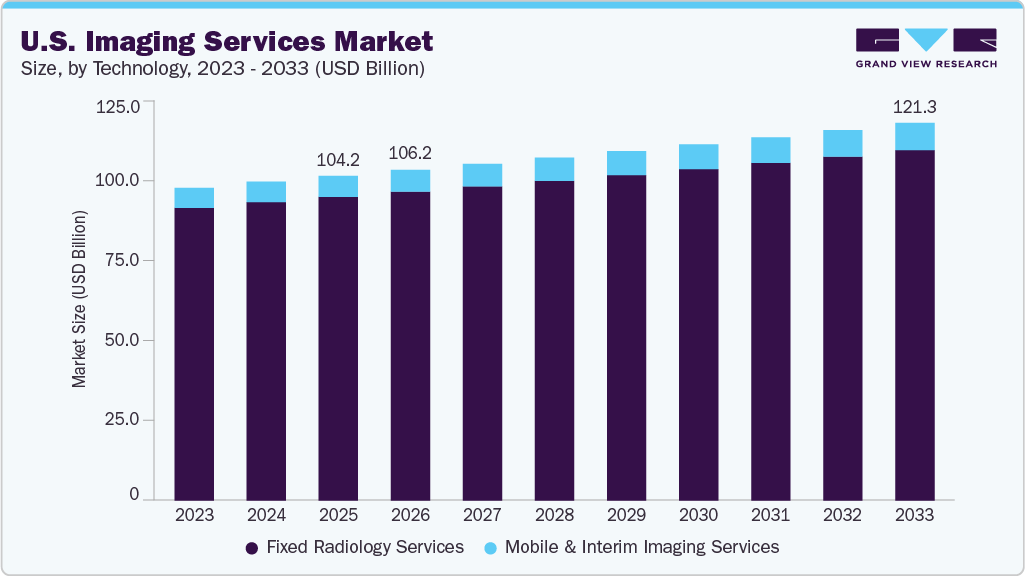

The U.S. imaging services market size was estimated at USD 104.25 billion in 2025 and is expected to reach USD 121.32 billion by 2033, growing at a CAGR of 1.9% from 2026 to 2033. The major factors attributed to the growth include the increasing prevalence of cancer and cardiac disorders, coupled with growing awareness about medical imaging technology.

Key Market Trends & Insights

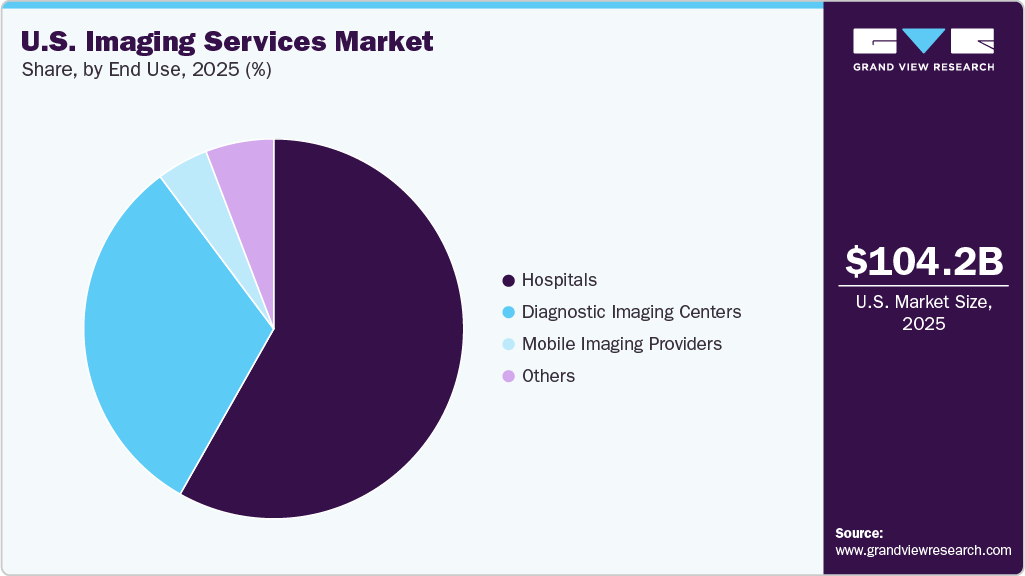

- By technology, the fixed radiology services segment accounted for the largest revenue share of 93.5% in 2025.

- By application, the orthopedics segment held the largest revenue share of 21.7% in 2025.

- By end use, hospitals held the largest revenue share of 58.2% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 104.25 Billion

- 2033 Projected Market Size: USD 121.32 Billion

- CAGR (2026-2033): 1.9%

In addition, developing various technologies for enhancing medical imaging services is anticipated to boost market growth during the forecast period. Medical imaging is the preferred diagnostic technique, providing vital information with speed, safety, and accuracy. Imaging services involve different imaging modalities such as X-ray, ultrasound, nuclear medicine scans, MRI, and CT scans, which are non-invasive techniques that can be used to diagnose various diseases easily. In addition, these imaging services help in the early diagnosis of the disease, which leads to positive treatment outcomes. The development of various technologies for enhancing medical imaging services is anticipated to boost market growth in the coming years. Furthermore, the rapidly increasing aging population and high cancer incidence are factors expected to drive market growth. Growing funding to support ongoing research activities and rising private-public initiatives related to medical imaging are factors likely to propel overall market growth.

Medical imaging helps with the early and accurate diagnosis of diseases, which helps in providing effective disease treatment. Therefore, to control the growing disease burden, a large number of medical professionals are using medical imaging devices in imaging services before performing surgeries. The growing prevalence of cancer and cardiovascular diseases is expected to drive the need for medical imaging services. According to the National Cancer Institute, an estimated 2,041,910 new cases of cancer will be diagnosed in the U.S. and 618,120 deaths from the disease in 2025. This indicates a major rise from a total of 611,720 cancer deaths projected for 2024.

In interventional radiology, healthcare professionals use medical imaging systems to guide minimally invasive surgical procedures that treat, diagnose, and cure several conditions. Imaging modalities include CT, fluoroscopy, ultrasound, and MRI. Minimally invasive surgeries offer numerous benefits, such as faster recovery time, smaller incisions, reduced scarring and pain, increased accuracy, and shorter hospital stays compared to open surgery techniques, which are expected to fuel the industry.

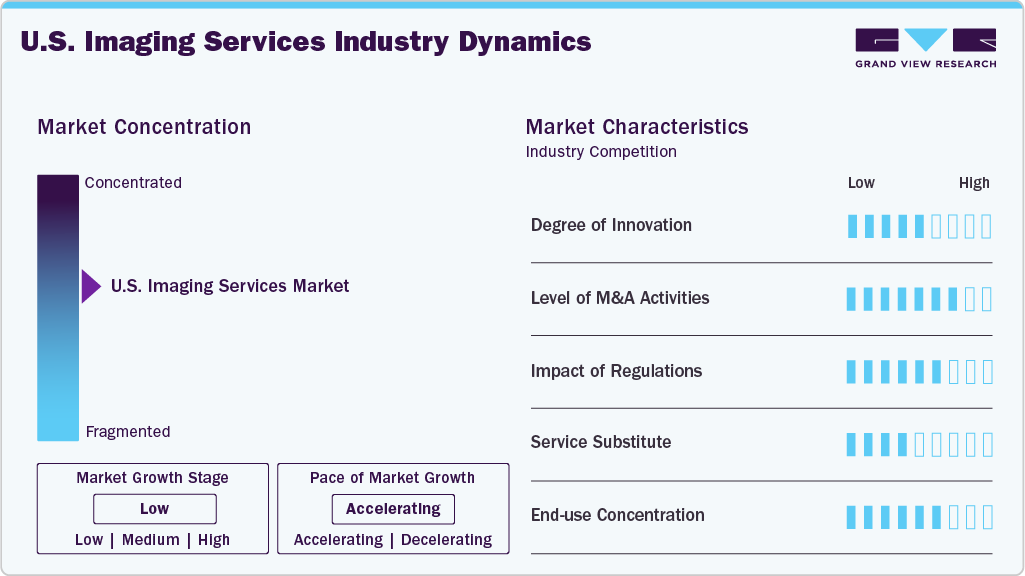

Market Characteristics & Concentration

The industry growth stage is low, and the pace of the growth is accelerating. The U.S. imaging services industry is characterized by a low to moderate degree of growth. Key driving factors include the increasing prevalence of chronic disorders, rising awareness about medical imaging techniques, and a growing number of outpatient settings with imaging services. However, the high cost of medical imaging services and the dearth of skilled radiologists operating medical imaging equipment may hamper industry growth in the forecast period.

The key players in the industry are utilizing strategies such as new product launches, mergers & acquisitions, business expansion, partnerships & collaborations, and implementing other effective strategies to maintain their position in the industry. For instance, in January 2025, Sutter Health partnered with GE HealthCare with a focus on helping patients, doctors, and health workers with improved AI-powered imaging services. This partnership aims to offer top-notch AI-powered imaging technology and digital solutions to patients. These include PET/CT, SPECT/CT, MRI, CT, X-ray, nuclear medicine, and ultrasound.

The degree of innovation in the industry constantly evolves as new technologies and techniques are developed and adopted. The industry has seen significant growth in recent years due to the increasing demand for diagnostic imaging services and the implementation of advanced imaging technologies such as MRI, CT, and PET-CT. Furthermore, there has been a rise in the use of artificial intelligence and machine learning algorithms in medical imaging, which is expected to further enhance the industry's degree of innovation.

The U.S. imaging services industry is witnessing a high level of partnerships and collaboration. Companies are considering expanding their service offerings and reaching a wider customer base through this strategy. Companies can combine their strengths and expertise to provide better customer solutions and services. Moreover, partnerships and collaborations can help companies to reduce costs and increase efficiency, as they can share resources and knowledge. Due to the rising demand for imaging services, more partnerships and collaborations are expected. For instance, in March 2025, NVIDIA announced a partnership with GE HealthCare to develop autonomous diagnostic imaging with a focus on developing new X-ray technologies and ultrasound applications.

Stringent regulations control the U.S. imaging services industry to ensure patient safety, privacy, proper handling, and disposal of medical equipment. Regulatory authorities such as the Food and Drug Administration (FDA) and the Centers for Medicare and Medicaid Services (CMS) play a significant role in the imaging services industry. Laws such as the Affordable Care Act and the Medicare Access and CHIP Reauthorization Act (MACRA) also impact the industry by promoting value-based care and driving the adoption of new technologies. The U.S. imaging services industry operates in a heavily regulated environment, with numerous laws and regulations impacting the industry at the federal and state levels.

The U.S. medical imaging services industry has a low threat from direct substitutes. However, services such as telemedicine and remote monitoring offer convenient and cost-effective options for patients who are not able to undergo traditional medical imaging procedures. The industry is highly competitive, with companies competing on factors such as price, quality of services, and geographic coverage.

In terms of geographical expansion, several imaging centers in the U.S. have been expanding to other states and regions to cater to a larger patient population. For instance, in April 2023, MetroHealth's Lumina Imaging partnered with Siemens Healthineers to increase affordable outpatient imaging services in the U.S. Siemens Healthineers will provide MRI and CT equipment for all future Lumina sites, which include both corporate-owned and franchise locations. This expansion has improved access to imaging services and patient care.

Technology Insights

The fixed radiology services segment held the largest share of 93.5% in 2025. Rising awareness levels among physicians and clinical researchers regarding the benefits of nuclear imaging scans, coupled with increasing application areas, such as cases in oncology and neurological diseases, are the factors driving the market. Moreover, increasing partnerships and collaborations between market players further contribute to this growth. For instance, in October 2024, Jubilant Radiopharma and Simplified Imaging Solutions formed a strategic partnership to enhance nuclear medicine services across U.S. healthcare facilities. This collaboration offers a comprehensive, cost-effective solution by integrating radiopharmacy networks with diagnostic services, streamlining operations, and reducing administrative burdens for nuclear labs.

Moreover, the Mobile & Interim Imaging services segment is expected to grow at the highest CAGR of 3.4% over the forecast period, owing to factors such as the increasing geriatric population, technological advancements such as the introduction of hybrid MRI equipment, high-field MRI, superconducting (SC) magnets, and installation of software, availability of universal health coverage, and growing burden on chronic diseases. This segment also includes Positron Emission Tomography (PET), Computed Tomography (CT), Catheterization & Angiography (Cath/Angio), Nuclear Medicine, Bone Density (DEXA Scan), Ultrasound imaging, and Mammography (2D & 3D). The growth and development in these areas are also fueling the market growth.

Application Insights

The orthopedics segment dominated the U.S. market with the largest share in 2025. This segmentis mainly driven by a rising geriatric population with higher rates of osteoarthritis, fractures, and degenerative spine disease, plus higher activity among aged adults, which raises the need for injury imaging services. Providers are also using more musculoskeletal ultrasound, MRI, and image-guided procedures, while new workflows make imaging easier and faster to access. Furthermore, the payment and appropriateness programs (CMS), such as Medicare and Medicaid policy, are used to promote more advanced imaging in healthcare services, which influences what advanced imaging is being used and where it is delivered, inpatient or outpatient care.

The neurology segment is expected to grow at the fastest CAGR over the forecast period. This is attributable to rising demand for stroke imaging, higher rates and screening for dementia and Alzheimer’s, and wider use of advanced imaging methods. Federal research programs and clinical trials, help bring new imaging biomarkers into use. AI and advanced imaging tools also make identifying and treatment of stroke patients faster, which increases neuroimaging volumes and the need for specialized neurology scans. These factors contribute to the growth of the neurology applications segment in the market.

End Use Insights

The hospitals segment held the largest market share in the U.S. market in 2025, owing to the increasing prevalence of various conditions such as cancer and cardiac disorders. The availability of multiple imaging modalities in a single facility and reimbursement policies for the imaging procedures are also expected to impact the overall market growth. Moreover, rising efforts to increase the presence of hospitals offering imaging services in the country further contribute to segment growth. For instance, in June 2023, Inspira Health Network, Atlantic Medical Imaging (AMI), and Regional Diagnostic Imaging (RDI) formed a joint venture to operate nine imaging centers in New Jersey. This partnership aims to improve patient access, speed up scheduling, and expand services at different locations. They will rename six centers as "AMI at Inspira Health."

The mobile imaging providers segment is projected to witness the fastest CAGR during the forecast period, due to the increasing demand for outpatient imaging services. The shift toward value-based healthcare and cost-reducing measures has led healthcare providers to prefer outpatient settings, offering lower costs and greater patient convenience. In addition, advancements in imaging technology, such as AI-assisted diagnostics and portable imaging solutions, enable diagnostic centers to provide faster and more accurate results. Many imaging centers are also expanding their service offerings to include advanced modalities such as PET-CT and 3D mammography, attracting a larger patient base and increasing their market presence.

Key U.S. Imaging Services Company Insights

The U.S. imaging services market is highly competitive and has several key players. The major market players are focused on forming partnerships to enhance imaging services and patient care, taking advantage of important cooperation activities, and exploring mergers & acquisitions. For instance, in December 2025, Onyx Healthcare and NVIDIA partnered at RSNA 2025 to enhance patient outcomes and streamline clinical workflows by bringing real-time AI processing directly into hospitals and medical devices. Moreover, the company is aiming for more such AI or metaverse-driven partnerships to advance medical imaging & medical devices.

-

RadNet, Inc. is the largest provider of outpatient diagnostic imaging services in the U.S., operating over 400 imaging centers across multiple states and completing more than 10 million imaging procedures annually. The company partners with hospitals, health systems, and payors to deliver comprehensive radiology solutions, including advanced imaging technology, quality assurance programs, and innovative workflow platforms. RadNet’s mission focuses on delivering high-quality, accessible, and cost-effective imaging care supported by strategic growth and technological innovation.

-

Sonic Healthcare is a leading healthcare provider and one of the largest medical diagnostics companies in the world. It offers laboratory medicine, pathology, and radiology services to doctors, hospitals, and patients in many countries. The company also runs primary care medical centers and occupational health services, with a strong presence in Australia, Europe, and the U.S.

Key U.S. Imaging Services Companies:

- Radnet, Inc.

- Alliance Medical imaging

- Inhealth Group

- Sonic Healthcare

- Dignity Health

- Medica Group

- Global Diagnostics

- Novant Health

- Concord Medical Services Holdings Limited

- Center for Diagnostic Imaging, Inc.

- Unilabs

- Healius Limited

- Simonmed Imaging

Recent Developments

-

In November 2025, GE HealthCare announced an agreement to acquire Intelerad, a leading medical imaging software provider, in order to enhance its cloud-enabled and AI-powered solutions across care settings.

-

In November 2025, Siemens Healthineers launched new AI-enabled radiology and imaging services, at RSNA 2025, to help healthcare providers address a range of challenges, simulate complex scenarios, and recommend improvements with AI.

-

In October 2024, IKS Health partnered with Radiology Partners to enhance radiology services using its AI-powered Care Enablement Platform. This collaboration aims to streamline workflows, reduce administrative burdens, and improve imaging access, allowing over 3,900 radiologists to dedicate more time to patient care.

-

In April 2024, Rayus Radiology partnered with AI startup Ezra to introduce whole-body MRI services in Seattle, aiming to detect early-stage cancers and over 500 other conditions across 13 organs. This collaboration addresses the growing demand for comprehensive disease monitoring.

U.S. Imaging Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 106.16 billion

Revenue forecast in 2033

USD 121.32 billion

Growth rate

CAGR of 1.9 % from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, application, end use

Country scope

U.S.

Key company profiled

Radnet, Inc.; Alliance Medical; Inhealth Group; Sonic Healthcare; Dignity Health; Medica Group; Global Diagnostics; Novant Health; Concord Medical Services Holdings Limited; Center for Diagnostic Imaging, Inc.; Unilabs; Healius Limited; Simonmed Imaging

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Imaging Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. imaging services market report based on technology, application, and end use:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Mobile & Interim Imaging Services

-

Magnetic Resonance Imaging (MRI)

-

Positron Emission Tomography - Computed Tomography (PET/CT)

-

Catheterization & Angiography (Cath/Angio)

-

Nuclear Medicine

-

Bone Density (DEXA Scan)

-

Ultrasound

-

Mammography (2D & 3D)

-

-

Fixed Radiology Services

-

MRI

-

Computed Tomography (CT)

-

X-ray

-

Mammography

-

Ultrasound

-

Nuclear Imaging

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Orthopedics

-

Gynecology

-

Oncology

-

Cardiology

-

Gastroenterology

-

Neurology

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Imaging Centers

-

Mobile Imaging Providers

-

Others

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include growing prevalence of cardiac disorders and cancer, growing number of outpatient settings with imaging services, and growing awareness of medical imaging.

b. Some key players operating in the U.S. imaging services market include Radnet, Inc., Novant Health, Alliance Medical, Inhealth Group, Sonic Healthcare, Dignity Health, Medica Group, Global Diagnostics, Healthcare Imaging Services Pty Ltd., Concord Medical Services Holdings Limited, Alliance HealthCare Services, Inc., Center for Diagnostic Imaging, Inc., Unilabs, Healius Limited, and Simonmed Imaging.

b. The U.S. imaging services market size was estimated at USD 104.25 billion in 2025 and is expected to reach USD 106.16 billion in 2026.

b. The global U.S. imaging services market is expected to grow at a compound annual growth rate of 1.9% from 2026 to 2033 to reach USD 121.32 billion by 2033.

b. The fixed radiology technology segment dominated the U.S. imaging services market with a share of 93.5% in 2025. Rising awareness levels among physicians and clinical researchers regarding the benefits of nuclear imaging scans, coupled with increasing application areas, such as cases in oncology and neurological diseases, are the factors driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.