- Home

- »

- Next Generation Technologies

- »

-

U.S. Industrial Cooling Systems Market, Industry Report 2033GVR Report cover

![U.S. Industrial Cooling Systems Market Size, Share & Trends Report]()

U.S. Industrial Cooling Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Hybrid Cooling, Air Cooling, Water Cooling, Evaporative Cooling), By End Use (Utility & Power, Chemical, Food & Beverage), And Segment Forecasts

- Report ID: GVR-4-68040-702-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

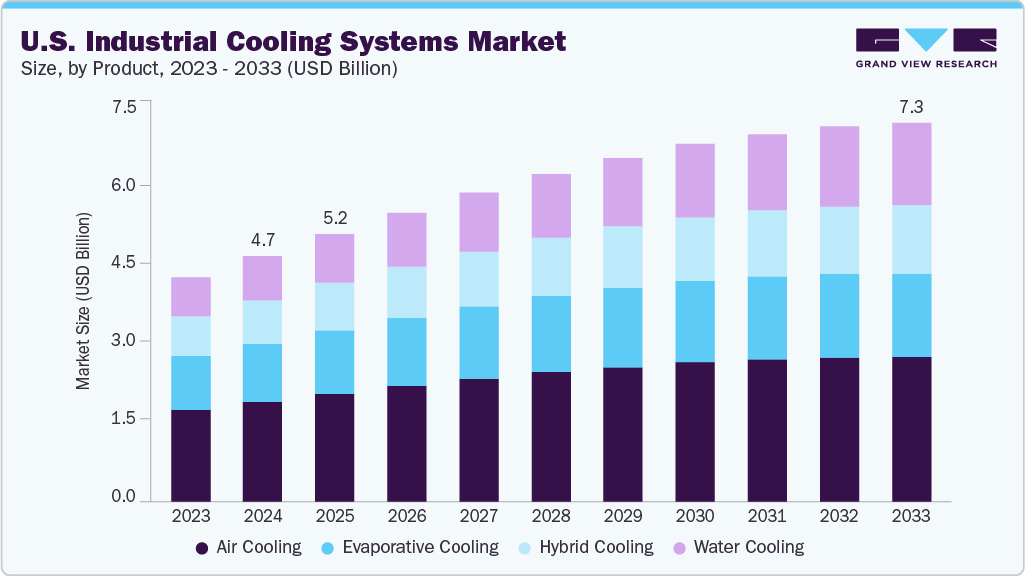

The U.S. industrial cooling systems market size was estimated at USD 4.75 billion in 2024 and is projected to reach USD 7.34 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The growth is primarily driven by increasing demand for energy-efficient and environmentally sustainable cooling solutions across industrial sectors such as manufacturing, data centers, and power generation. Additionally, the rising penetration of Industry 4.0 and smart manufacturing practices is promoting the integration of IoT-enabled and AI-driven cooling systems for real-time monitoring and predictive maintenance. These innovations are optimizing system performance, reducing downtime, and driving cost savings across the U.S. industrial cooling systems industry.

The increasing integration of data-intensive technologies such as artificial intelligence (AI), machine learning (ML), and industrial IoT is significantly transforming the U.S. industrial cooling systems market. As manufacturing facilities, logistics hubs, and smart factories adopt automated systems for real-time monitoring and predictive maintenance, the need for precise and efficient thermal management is becoming paramount. High-performance computing infrastructure, robotics, and sensor-heavy environments generate substantial heat loads, requiring advanced industrial cooling systems to ensure equipment reliability, minimize downtime, and extend operational lifespan. This digital transformation is creating robust demand for scalable, energy-efficient cooling solutions, thereby accelerating the expansion of the U.S. industrial cooling systems industry.

Additionally, the accelerated growth of hyperscale data centers and cloud infrastructure providers is further propelling the demand for the U.S. industrial cooling systems. The shift toward liquid cooling, immersion cooling, and hybrid air-liquid systems reflects a growing emphasis on sustainability, energy efficiency, and regulatory compliance. Government initiatives promoting green building standards and energy-efficiency incentives are also bolstering investments in advanced cooling architectures, thereby shaping the future trajectory of the U.S. industrial cooling systems market.

Furthermore, the rising focus on clean energy production and decarbonization efforts across industrial sectors is driving innovation in the U.S. industrial cooling systems. Facilities in power generation, chemical processing, and steel manufacturing are modernizing legacy systems to support heat recovery, water reuse, and emissions control. The transition to low-carbon technologies such as hydrogen production, carbon capture and storage (CCS), and electrified furnaces necessitates highly specialized cooling infrastructure to handle complex thermal dynamics and enhance process safety. This alignment with broader environmental, social, and governance (ESG) goals is positioning industrial cooling systems as an enabler of sustainable industrial operations in the U.S.

Product Insights

The water-cooling segment dominated the market and accounted for the largest revenue share of over 40% in 2024. The widespread adoption of water-cooling systems is primarily driven by their superior thermal efficiency, energy-saving potential, and ability to manage high-heat loads in heavy-duty industrial environments. Industries such as data centers, power generation, petrochemicals, and automotive manufacturing rely heavily on water-based cooling solutions to maintain optimal operational temperatures and ensure uninterrupted performance of critical machinery. As facilities seek to enhance productivity while minimizing operational risks, the preference for water-cooling technologies, known for their precision and scalability, continues to rise across the U.S. industrial cooling systems industry.

The hybrid cooling solution segment is expected to witness the highest CAGR of over 6% from 2025 to 2033. This growth is driven by the increasing need for energy-efficient and environmentally sustainable cooling technologies across power plants, manufacturing facilities, and data centers. Hybrid systems, which combine the benefits of both dry and wet cooling methods, offer greater operational flexibility and reduced water consumption, making them ideal for regions facing water scarcity and strict environmental regulations. The push for decarbonization and compliance with EPA guidelines encourages industries to adopt low-impact, cost-effective cooling alternatives. The rising demand for high-performance cooling in high-load IT infrastructure is further propelling the adoption of hybrid cooling solutions in the U.S. industrial cooling systems market.

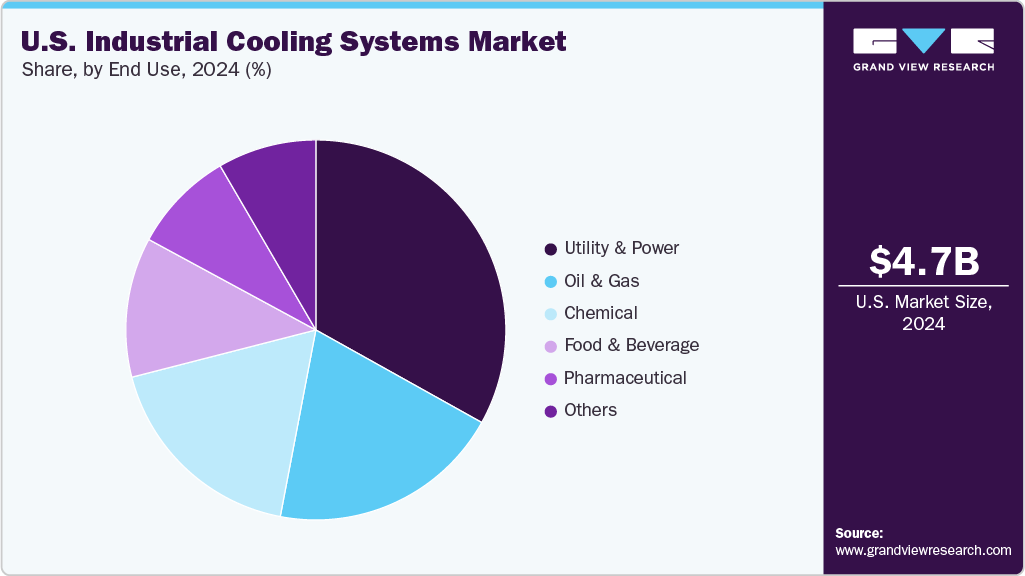

End Use Insights

The utility & power segment accounted for the largest revenue share in 2024, driven by the rising need for efficient thermal management in power generation, transmission, and distribution infrastructure. As utilities increasingly integrate renewable energy sources such as solar and wind, the complexity of grid operations and associated heat loads have intensified, necessitating advanced cooling solutions. The expansion of smart grids, energy storage systems, and high-voltage equipment is amplifying the demand for robust and scalable cooling technologies. Aging infrastructure upgrades and stricter federal emission regulations are also encouraging utility providers to adopt energy-efficient and environmentally friendly cooling systems. These trends collectively position the utility & power segment as the fastest-growing sector in the U.S. industrial cooling systems industry.

The pharmaceutical segment is expected to witness the highest CAGR from 2025 to 2033 in the U.S. industrial cooling systems market. This growth is driven by the increasing demand for temperature-sensitive drug manufacturing, stringent regulatory requirements, and the rise of biologics and mRNA-based therapies. Advanced cooling systems are essential for maintaining product stability, ensuring compliance with FDA guidelines, and supporting cleanroom environments. The rapid expansion of pharmaceutical R&D facilities and vaccine production plants post-pandemic is accelerating investments in high-precision, energy-efficient cooling technologies, positioning this segment as a key growth driver. As a result, industrial cooling has become a critical enabler of innovation and safety in the U.S. pharmaceutical manufacturing landscape.

Key U.S. Industrial Cooling Systems Company Insights

Some key players operating in the market include Johnson Controls and Trane Technologies plc, among others.

-

Johnson Controls delivers advanced industrial cooling solutions tailored for power plants, manufacturing, and data centers, emphasizing energy efficiency, smart automation, and sustainability. With a strong U.S. presence and deep integration into building management systems, Johnson Controls remains a dominant force shaping the future of industrial cooling infrastructure across the utility and commercial sectors.

-

Trane Technologies plc provides cutting-edge industrial cooling systems through its Trane and Thermo King brands, combining performance-driven HVAC technologies with environmentally responsible refrigerants. Its focus on decarbonization and digital controls has reinforced Trane’s leadership in driving innovation and efficiency within large-scale utility and industrial operations in the U.S. market.

EVAPCO, Inc. and Delta Cooling Towers, Inc. are some emerging market participants in the U.S. industrial cooling systems market.

-

EVAPCO, Inc. specializes in evaporative cooling systems, cooling towers, and closed-circuit coolers, catering to industrial, power generation, and refrigeration markets. Known for its engineering excellence and modular product designs, EVAPCO is emerging as a key player in the U.S. industrial cooling systems market, especially as demand grows for sustainable, low-energy cooling technologies.

-

Delta Cooling Towers, Inc. manufactures corrosion-resistant cooling towers using high-density polyethylene (HDPE), offering long-lasting, low-maintenance solutions for industrial operations. Its emphasis on chemical resistance and water efficiency has positioned Delta as a rising contender in sectors demanding durable and eco-conscious cooling systems in the U.S. industrial cooling systems industry.

Key U.S. Industrial Cooling Systems Companies:

- Johnson Controls.

- Trane Technologies plc

- Carrier.

- SPX Cooling Tech, LLC

- Baltimore Aircoil Company, Inc.

- EVAPCO, Inc.

- DAIKIN APPLIED

- Lennox International Inc.

- AIREDALE INTERNATIONAL AIR CONDITIONING LTD.

- Delta Cooling Towers, Inc.

Recent Developments

-

In July 2025, Johnson Controls expanded its OpenBlue smart-building platform to enhance real-time monitoring and intelligent energy management across industrial facilities. Alongside the platform upgrade, the company announced a $9 billion share-buyback initiative, signaling its strong financial commitment to long-term innovation in HVAC and cooling technologies. These efforts reinforce Johnson Controls' dedication to advancing the U.S. industrial cooling systems market through smart infrastructure and next-generation thermal solutions.

-

In March 2025, SPX Cooling Technologies completed the acquisitions of SGS Refrigeration Inc. and Cincinnati Fan & Ventilator Co. to enhance its capabilities in industrial refrigeration and engineered air movement solutions. These strategic moves expand SPX’s product portfolio and strengthen its manufacturing footprint in the U.S., enabling more efficient and customizable cooling systems for critical infrastructure. This consolidation reinforces SPX’s commitment to advancing the U.S. industrial cooling systems market through innovation, scalability, and integrated thermal management solutions.

-

In February 2025, Carrier, through its venture arm Carrier Ventures, announced a strategic investment and technology partnership with ZutaCore, a pioneer in waterless, direct-to-chip liquid cooling solutions for data centers. This collaboration aims to address the surging demand for high-density, AI-driven computing by delivering scalable, energy-efficient thermal management technologies. This initiative highlights Carrier’s commitment to advancing the U.S. industrial cooling systems market through innovation in sustainable, high-performance data center cooling.

U.S. Industrial Cooling Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.17 billion

Revenue forecast in 2033

USD 7.34 billion

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Country scope

U.S.

Key companies profiled

Johnson Controls.; Trane Technologies plc; Carrier.; SPX Cooling Tech, LLC; Baltimore Aircoil Company, Inc.; EVAPCO, Inc.; DAIKIN APPLIED; Lennox International Inc.; AIREDALE INTERNATIONAL AIR CONDITIONING LTD.; Delta Cooling Towers, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Industrial Cooling Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. industrial cooling systems market report based on product and end use:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hybrid Cooling

-

Water Cooling

-

Air Cooling

-

Evaporative Cooling

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Utility & Power

-

Chemical

-

Food & Beverage

-

Pharmaceutical

-

Oil & Gas

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. industrial cooling systems market size was estimated at USD 4.75 billion in 2024 and is expected to reach USD 5.17 billion in 2025.

b. The U.S. industrial cooling systems market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 7.34 billion by 2033.

b. The water-cooling segment dominated the market with a share of over 40% in 2024, owing to their superior thermal efficiency, energy-saving potential, and ability to manage high-heat loads in heavy-duty industrial environments.

b. Some key players operating in the U.S. industrial cooling systems market include Johnson Controls, Trane Technologies plc, Carrier Global Corporation, SPX Cooling Tech, LLC, Baltimore Aircoil Company, Inc., and Lennox International Inc., among others.

b. The increasing demand for energy-efficient and environmentally sustainable cooling solutions across industrial sectors, rapid advancements in cooling technologies, and the rising penetration of Industry 4.0 and smart manufacturing practices are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.