- Home

- »

- Next Generation Technologies

- »

-

Industrial Cooling Systems Market Size, Industry Report, 2030GVR Report cover

![Industrial Cooling Systems Market Size, Share & Trends Report]()

Industrial Cooling Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hybrid Cooling, Air Cooling, Water Cooling, Evaporative Cooling), By End Use (Utility and Power, Pharmaceutical, Chemical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-571-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Cooling Systems Market Summary

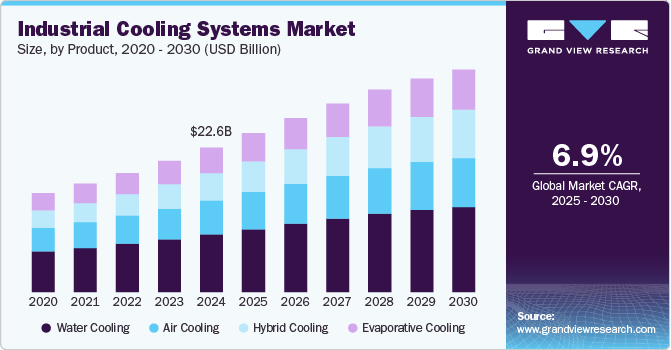

The global industrial cooling systems market size was estimated at USD 22.58 billion in 2024 and is expected to reach USD 34.71 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The market growth is propelled by the increasing demand for intelligent, connected solutions that enhance operational efficiency, the rising global temperatures, and the growing need to prevent overheating of critical industrial equipment.

Key Market Trends & Insights

- North America industrial cooling systems market accounted for a significant revenue share of over 26% in 2024.

- The U.S. industrial cooling systems market dominated with a revenue share of over 75% in 2024.

- Based on product, the water-cooling segment dominated the market with a revenue share of over 39% in 2024.

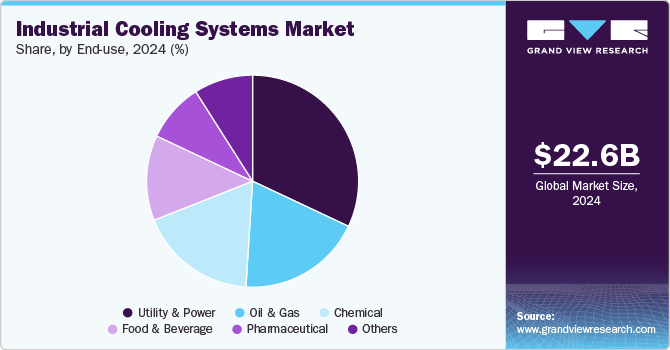

- Based on end use, the utility & power segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.58 Billion

- 2030 Projected Market Size: USD 34.71 Billion

- CAGR (2025-2030): 6.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, stringent environmental regulations and growing concerns about energy efficiency are pushing industries to adopt energy-efficient, eco-friendly, and renewable energy-powered cooling technologies. Key trends such as the integration of hybrid cooling systems, heat recovery applications, remote monitoring and maintenance, and customized cooling solutions for specific industrial processes are expected to drive the industrial cooling systems industry expansion.

Rising energy costs and the increasing emphasis on operational efficiency are driving industries to adopt more energy-efficient cooling solutions. Manufacturers are prioritizing technologies that deliver a higher Coefficient Performance (COP), incorporate variable speed drives, and enable energy recovery, all of which contribute to lower energy usage and operational expenses. As companies aim to improve profitability while aligning with sustainability goals, investing in high-efficiency, low-maintenance cooling systems is gaining traction.

Additionally, the integration of Internet of Things (IoT), AI, and automation in industrial cooling systems is enhancing operational efficiency and enabling real-time monitoring, predictive maintenance, and energy optimization. Smart cooling technologies are increasingly being adopted across industries to improve system reliability, reduce downtime, and extend equipment lifespan. This trend aligns with broader industrial digitalization (Industry 4.0), where data-driven decision-making and system interconnectivity are becoming standard expectations in cooling system management, which is further driving the market growth.

Furthermore, the rise of cloud computing, digital services, and artificial intelligence (AI) has fueled rapid growth in the data center industry, a major consumer of precision cooling solutions. Cooling infrastructure is essential to prevent overheating in data centers, semiconductor fabrication plants, and high-performance computing facilities. Industrial cooling systems tailored for temperature control, humidity regulation, and continuous operation are increasingly being deployed in these tech-intensive sectors, contributing significantly to the industrial cooling systems industry.

Moreover, environmental concerns and the need to reduce operating costs are pushing industries to adopt energy-efficient cooling technologies. Regulations promoting carbon neutrality and resource conservation, such as those in the U.S., EU, and Japan, are prompting companies to transition from traditional systems to advanced cooling towers, chillers, and hybrid cooling technologies. The integration of energy recovery systems and the use of low-GWP refrigerants reflect a broader trend toward sustainable industrial operations, enhancing both compliance and corporate responsibility, which is expected to further fuel the industrial cooling systems industry in the coming years.

Product Insights

The water-cooling segment dominated the market with a revenue share of over 39% in 2024, owing to its widespread application across high-load industrial processes that require efficient heat dissipation. Water-cooled systems are preferred in industries such as power generation, petrochemicals, and manufacturing, where continuous, large-scale cooling is essential. These systems offer higher heat transfer efficiency compared to air-based systems and are capable of handling greater thermal loads with relatively compact equipment. The availability of water resources and established infrastructure in key industrial regions is further driving segmental growth.

The hybrid cooling segment is expected to witness the highest CAGR of over 9% from 2025 to 2030, driven by increasing demand for energy-efficient and environmentally sustainable cooling solutions. Hybrid cooling systems combine the benefits of both wet and dry cooling technologies, allowing facilities to switch between modes based on ambient conditions, water availability, and energy costs. This flexibility makes hybrid systems particularly attractive in regions facing water scarcity or stringent environmental regulations. Industries such as data centers, pharmaceuticals, and electronics manufacturing are adopting hybrid systems to optimize performance while minimizing water and energy consumption, which is further driving the segmental growth.

End Use Insights

The utility & power segment accounted for the largest revenue share in 2024, owing to the high demand for cooling solutions in power generation plants and utilities. Power plants, particularly thermal, nuclear, and combined-cycle plants, require substantial cooling systems to maintain efficient operation, prevent overheating, and ensure safety. The growing global demand for electricity, the need to upgrade and modernize aging infrastructure, and the implementation of more stringent environmental regulations have driven investments in advanced cooling technologies. Additionally, the increased use of renewable energy sources, such as solar and wind power, also requires efficient cooling systems to optimize energy production and distribution, which is further fueling the segment’s growth.

The pharmaceutical segment is expected to witness the highest CAGR from 2025 to 2030, driven by the growing need for precise temperature control in the manufacturing, storage, and transportation of pharmaceutical products. The pharmaceutical industry is increasingly adopting advanced cooling systems to maintain the integrity of sensitive drugs, particularly biologics, vaccines, and other temperature-sensitive products, which require stringent cold chain management. Additionally, the rising focus on biotechnology and the rapid expansion of the pharmaceutical industry in emerging markets are further propelling the demand for high-performance and energy-efficient cooling solutions. These factors are expected to drive the market growth in the coming years.

Regional Insights

North America industrial cooling systems market accounted for a significant revenue share of over 26% in 2024, driven by increasing demand for energy-efficient cooling technologies across industries such as manufacturing, power generation, and data centers. Additionally, the shift toward renewable energy sources, such as wind and solar power, is creating demand for specialized cooling solutions in energy production. The market is also seeing growth due to advancements in digitalization and the integration of smart cooling technologies.

U.S. Industrial Cooling Systems Market Trends

The U.S. industrial cooling systems market dominated with a revenue share of over 75% in 2024, driven by the increasing demand for cooling in data centers, power plants, and manufacturing facilities. With the country’s strong industrial base, cooling systems are critical for maintaining operational efficiency and ensuring regulatory compliance, especially in sectors like chemicals, oil and gas, and automotive manufacturing. The U.S. government’s focus on reducing greenhouse gas emissions and increasing energy efficiency has encouraged businesses to adopt sustainable and high-performance cooling solutions.

Europe Industrial Cooling Systems Market Trends

Europe industrial cooling systems market is expected to grow at a CAGR of over 6% from 2025 to 2030, primarily driven by stringent environmental regulations and the growing demand for energy-efficient and sustainable cooling solutions. Countries in the region are increasingly focusing on reducing carbon footprints, leading industries to adopt cooling technologies that reduce energy consumption and environmental impact. Additionally, the ongoing industrial modernization and digitalization in manufacturing, power generation, and data centers are boosting the demand for advanced and reliable cooling systems in Europe.

The UK industrial cooling systems market is expected to grow at a significant rate in the coming years. This growth is attributed to the country’s commitment to achieving net-zero carbon emissions by 2050. The demand for energy-efficient cooling solutions is growing in various sectors, including manufacturing, data centers, and the food and beverage industry, as businesses seek to comply with strict sustainability regulations. The UK government’s focus on green energy and the shift toward low-carbon technologies are key drivers of innovation in the cooling systems market.

Germany industrial cooling systems market is driven by the country's focus on Industry 4.0 and smart manufacturing technologies are promoting the use of advanced cooling solutions that integrate with digital systems to optimize performance. Environmental regulations, particularly those set by the European Union, are pushing German industries to adopt more energy-efficient and sustainable cooling systems.

Asia Pacific Industrial Cooling Systems Market Trends

The Asia Pacific industrial cooling systems market is expected to grow at the highest CAGR of over 8% from 2025 to 2030, driven by rapid industrialization, urbanization, and increasing demand for energy-efficient cooling solutions across various industries. The growing adoption of technologies aimed at reducing energy consumption, such as advanced cooling towers and heat exchangers, is a significant trend in APAC. Additionally, strict environmental regulations and the push for sustainable solutions are encouraging industries to adopt eco-friendly cooling technologies. The rise of manufacturing and power generation industries in countries such as India, South Korea, and Southeast Asia is further fueling the demand for industrial cooling systems.

Japan industrial cooling systems market is gaining traction, driven by the need for high efficiency and sustainability in cooling solutions, especially in the semiconductor, automotive, and power generation industries. The Japanese government’s strong focus on reducing carbon emissions and promoting energy-efficient technologies has led to increased adoption of environmentally friendly and advanced cooling systems.

China industrial cooling systems market is rapidly expanding, driven by the country’s rapid industrial growth and the expansion of its manufacturing and power generation sectors. The government’s ongoing initiatives to improve energy efficiency and reduce carbon emissions are pushing the adoption of advanced cooling technologies. The demand for cooling systems in industries such as chemicals, steel, and electronics is growing significantly.

Key Industrial Cooling Systems Company Insights

Some key players operating in the market are Johnson Controls Inc. and SPX Corporation, among others.

-

Johnson Controls Inc. provides a range of building technologies and industrial cooling solutions. The company specializes in HVAC systems, cooling towers, chillers, and energy management systems for various sectors, including commercial, industrial, and residential. Known for its focus on sustainability, Johnson Controls designs products like the YORK® chillers that improve energy efficiency while minimizing environmental impact. The company operates globally, helping businesses optimize energy usage and comply with regulations.

-

SPX Corporation offers engineered products and technologies across several industries, including industrial cooling. The company provides cooling towers, heat exchangers, and refrigeration systems designed to enhance energy efficiency and performance. SPX serves sectors such as energy, food and beverage, and industrial manufacturing. Its emphasis on sustainable solutions helps customers reduce operational costs and improve system reliability.

Paharpur Cooling Towers and Hamon Group are some emerging market participants in the industrial cooling systems market.

-

Paharpur Cooling Towers designs and manufactures cooling towers and related equipment for a variety of industries. Headquartered in India, the company serves sectors like power generation, petrochemicals, and chemicals with custom-designed cooling solutions. Paharpur is known for producing energy-efficient and reliable cooling systems, focused on minimizing water and energy consumption, offering sustainable solutions to industrial clients.

-

Hamon Group provides industrial cooling and energy recovery solutions. The company specializes in cooling towers, heat exchangers, air pollution control systems, and more, serving industries such as power generation, petrochemicals, and HVAC applications. Hamon Group prioritizes sustainability, offering technologies designed to reduce environmental impact and improve energy efficiency across its product range. The company continues to expand its presence globally while focusing on innovation.

Key Industrial Cooling Systems Companies:

The following are the leading companies in the industrial cooling systems market. These companies collectively hold the largest market share and dictate industry trends.

- Baltimore Aircoil Company

- Bell Cooling Tower

- Brentwood Industries Inc.

- Hamon Group

- Johnson Controls Inc.

- Paharpur Cooling Towers

- SPIG S.p.A.

- SPX Corporation

- Alfa Laval

- Danfoss

Recent Developments

-

In April 2025, Alfa Laval introduced the TS25 semi-welded plate heat exchanger, designed to enhance energy efficiency across clean energy and process industries.

-

In April 2025, SPX Technologies announced the completion of its acquisition of Sigma Heating and Cooling and Omega Heat Pump ("Sigma & Omega") for approximately CAD 200 million (USD 144 million).

-

In December 2024, Johnson Controls introduced the YORK YK-CP Centrifugal Chiller, optimized for ultra-low GWP refrigerant R-1234ze(E). This chiller offers up to 30% higher energy efficiency, a 22% smaller footprint, and is designed to support the decarbonization of large commercial buildings.

Industrial Cooling Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.84 billion

Revenue forecast in 2030

USD 34.71 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regions scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Baltimore Aircoil Company; Bell Cooling Tower; Brentwood Industries Inc.; Hamon Group; Johnson Controls Inc.; Paharpur Cooling Towers; SPIG S.p.A.; SPX Corporation; Alfa Laval; Danfoss

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Industrial Cooling Systems Market Report Segmentation

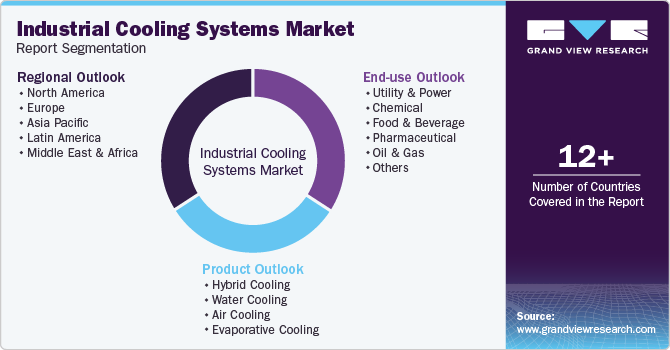

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial cooling systems market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hybrid Cooling

-

Water Cooling

-

Air Cooling

-

Evaporative Cooling

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Utility & Power

-

Chemical

-

Food & Beverage

-

Pharmaceutical

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial cooling systems market size was estimated at USD 22.58 billion in 2024 and is expected to reach USD 24.84 billion in 2025.

b. The global industrial cooling systems market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 34.71 billion by 2030.

b. The water-cooling segment dominated the market with a market share of over 39% in 2024, owing to its widespread application across high-load industrial processes that require efficient heat dissipation.

b. Some key players operating in the industrial cooling systems market include Baltimore Aircoil Company, Bell Cooling Tower, Brentwood Industries Inc., Hamon Group, Johnson Controls Inc., Paharpur Cooling Towers, SPIG S.p.A., SPX Corporation, Alfa Laval, and Danfoss.

b. The key factors driving the market growth include the increasing demand for intelligent, connected solutions that enhance operational efficiency, the rising global temperatures, and the growing need to prevent overheating of critical industrial equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.