- Home

- »

- Next Generation Technologies

- »

-

U.S. Industrial Internet of Things Market Size Report, 2033GVR Report cover

![U.S. Industrial Internet of Things Market Size, Share & Trends Report]()

U.S. Industrial Internet of Things Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Solution, Services), By End-use (Aviation, Metal & Mining, Chemical), By Software, By Connectivity Technology, By Device & Technology, And Segment Forecasts

- Report ID: GVR-4-68040-210-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Industrial Internet of Things Market Size & Trends

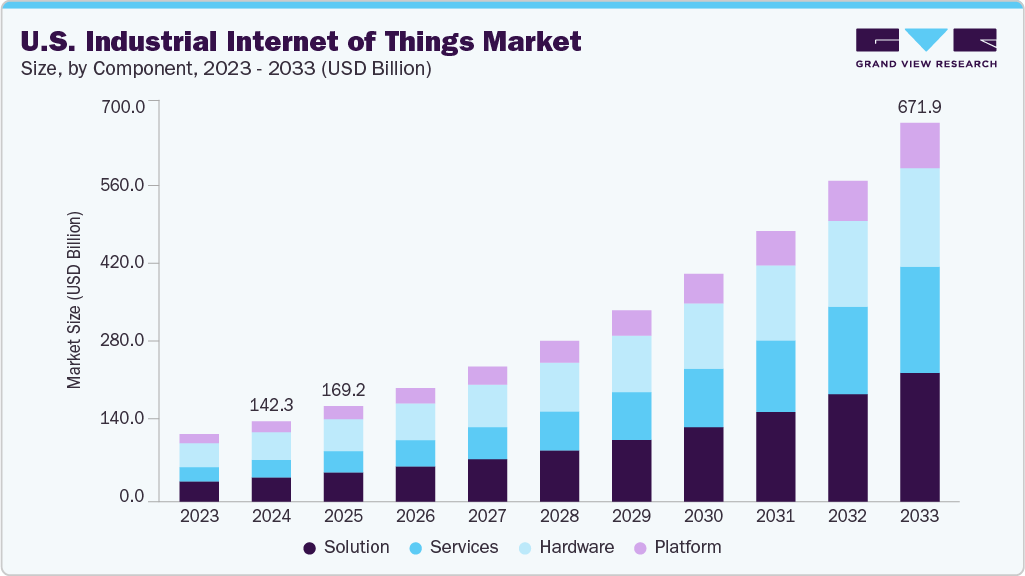

The U.S. industrial internet of things market size was estimated at USD 142.35 billion in 2024 and is projected to reach USD 671.92 billion by 2033, growing at a CAGR of 18.8% from 2025 to 2033. The increasing demand for real-time data analytics is driving rapid adoption of IIoT platforms across manufacturing and industrial enterprises in the U.S. Businesses are leveraging sensor-generated data to monitor asset performance, predict maintenance needs, and optimize production workflows. This capability is crucial for reducing unplanned downtime and improving operational efficiency. As industries strive for data-driven decision-making, real-time analytics remains a critical enabler of competitive advantage.

The accelerated adoption of artificial intelligence (AI) and machine learning (ML) is transforming operations across the U.S. industrial internet of things market. These technologies enable industrial systems to autonomously detect anomalies, forecast equipment failures, and optimize production in real time. For instance, AI and ML drive smarter, faster decision-making by converting large volumes of raw sensor data into actionable insights. As competitive pressures increase, businesses are leveraging these tools to enhance productivity, reduce costs, and improve operational resilience.

Cloud-native platforms are becoming the preferred infrastructure choice in the U.S. Industrial Internet of Things (IoT) industry owing to their scalability, flexibility, and cost-effectiveness. These platforms streamline device management, data integration, and analytics while supporting real-time collaboration across global operations. Businesses benefit from simplified deployment, lower IT overhead, and seamless upgrades. As the need for digital agility grows, cloud-native adoption is accelerating across industrial sectors.

The growing demand for supply chain visibility drives IIoT adoption among logistics, manufacturing, and distribution players in the U.S. Industrial Internet of Things industry. Businesses are implementing connected sensors, trackers, and analytics tools to monitor inventory, transit conditions, and delivery timelines in real time. Enhanced visibility supports better forecasting, risk mitigation, and customer satisfaction. IIoT-enabled transparency is a key differentiator in supply chain management in an era of global disruptions.

Component Insights

The hardware segment dominated the market with a share of over 34% in 2024, driving demand for intelligent automation, real-time monitoring, and asset optimization is sustaining the relevance of the hardware segment in the U.S. industrial internet of things market. Devices such as sensors, industrial robotics, and smart meters are critical enablers of data acquisition across manufacturing, energy, and smart infrastructure sectors. However, despite steady hardware deployment, the market is witnessing a gradual shift toward higher-value software, platform, and service layers. As a result, while hardware remains essential, its growth trajectory is comparatively slower amid rising enterprise focus on analytics, connectivity, and cloud-driven intelligence.

The services segment is expected to register the fastest CAGR of 22.2% from 2025 to 2033, driven by the need for seamless integration, real-time support, and long-term scalability. The segment in the U.S. industrial internet of things market is experiencing strong growth. Organizations increasingly rely on professional and managed services to deploy, manage, and optimize their IIoT infrastructure across diverse operational environments. This rising demand is fueled by the complexity of multi-vendor systems, the need for 24/7 uptime, and the growing focus on data-driven outcomes. As a result, the services segment is emerging as the fastest-growing component, playing a pivotal role in enabling end-to-end IIoT transformation.

End-use Insights

The manufacturing segment dominated the market in 2024, owing to the rising need for operational efficiency, real-time monitoring, and automation. The manufacturing segment continues to dominate the U.S. industrial internet of things market. Manufacturers are increasingly deploying smart sensors, robotics, and manufacturing execution systems (MES) to optimize production processes and reduce unplanned downtime. The integration of technologies like edge computing, 5G, and AI further enhances flexibility and responsiveness in factory environments. As a result, while other industries are gaining traction, manufacturing remains a critical anchor for IIoT adoption and innovation.

The aviation segment is expected to grow at the fastest CAGR over the forecast period. The rising demand for predictive maintenance, flight safety, and real-time fleet visibility is accelerating IIoT adoption in the U.S. aviation segment. Airlines and airport operators are increasingly implementing connected sensors, engine monitoring systems, and IoT-enabled diagnostics to minimize downtime and optimize operational efficiency. These advancements are further supported by technologies such as digital twins, AI-powered analytics, and private 5G connectivity. As a result, aviation is becoming one of the fastest-growing sectors in the industrial internet of things market, with a strong focus on data-driven decision-making and system reliability.

Software Insights

The SCADA segment dominated the market in 2024, driven by the need for real-time monitoring, centralized control, and enhanced operational efficiency. Industries such as energy, water management, and manufacturing are modernizing legacy SCADA systems by integrating them with cloud platforms, edge computing, and AI-driven analytics. This transformation enables faster decision-making, remote asset management, and improved system responsiveness. As a result, SCADA is evolving from a traditional control system into a dynamic, data-centric backbone of industrial automation.

The transit management systems segment is expected to grow at the fastest CAGR during the forecast period. The growing demand for efficient public transportation, real-time fleet monitoring, and enhanced commuter experience is fueling the expansion of the Transit Management Systems (TMS) segment in the U.S. industrial internet of things market. Transit agencies are increasingly leveraging GPS/GNSS, connected sensors, and cloud-based analytics to optimize route planning, reduce delays, and improve service reliability. These systems also support dynamic scheduling, automated fare collection, and passenger information services that enhance operational agility. As a result, TMS is rapidly becoming a cornerstone of smart city infrastructure and urban mobility strategies.

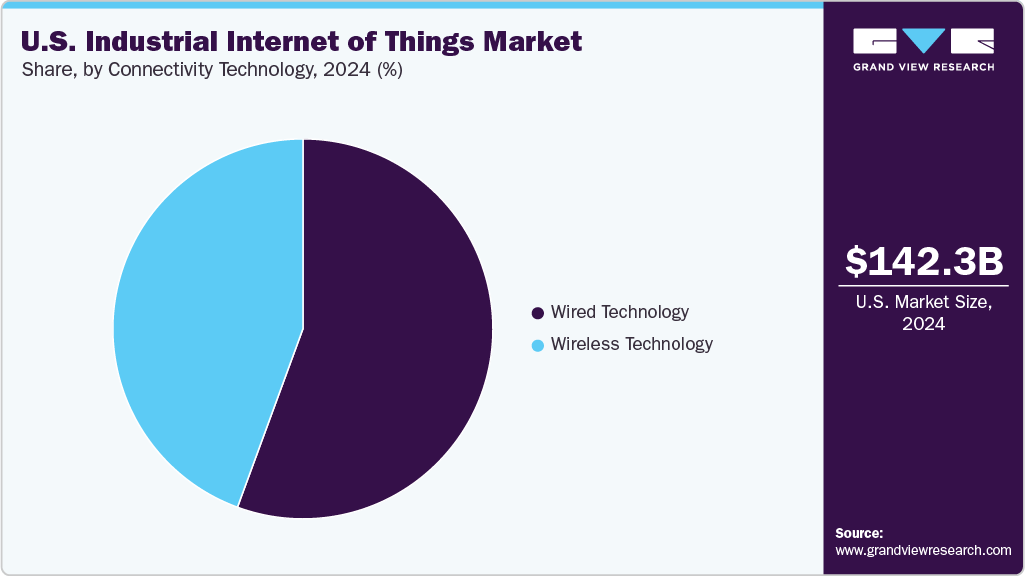

Connectivity Technology Insights

The wired technology segment dominated the market in 2024. The growing demand for reliable, high-speed, and deterministic connectivity is reinforcing the dominance of wired technologies in the U.S. IIoT landscape. Ethernet-based industrial networks, including Profinet and CC-Link IE, are increasingly favored for mission-critical applications requiring low latency, high bandwidth, and strong cybersecurity. Additionally, fieldbus systems such as Modbus and Foundation Fieldbus continue to support legacy deployments, although they are gradually being modernized or migrated toward converged Ethernet systems. As a result, wired technology remains the backbone of industrial IIoT, delivering the robust performance and determinism necessary for scalable, secure operational environments.

The wireless technology segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by the need for flexible connectivity, real-time insights, and cost-efficient deployments, as the wireless technology segment is rapidly transforming the U.S. industrial internet of things market. Industries are increasingly adopting 5G, Wi-Fi 6, LPWAN, and satellite technologies to connect mobile, remote, and hard-to-wire assets. This shift is enabling smarter infrastructure, scalable sensor networks, and enhanced mobility across manufacturing, smart grids, and agriculture. As a result, wireless is emerging as a critical enabler of next-generation IIoT, supporting agile, data-driven industrial operations.

Device & Technology Insights

The sensors segment dominated the market in 2024, owing to the rising need for real-time monitoring, operational efficiency, and predictive maintenance, the sensors segment continues to be a vital enabler of the U.S. industrial internet of things market. Industries across manufacturing, energy, and logistics are increasingly deploying advanced sensors to capture critical data on temperature, pressure, vibration, and environmental conditions. Innovations in sensor miniaturization, wireless integration, and edge processing are expanding their applicability across both industrial and remote settings. As a result, sensors remain fundamental to data-driven decision-making, even as the ecosystem evolves toward intelligent platforms and analytics.

The electronic shelf labels segment is expected to grow at the fastest CAGR over the forecast period, owing to the increasing demand for dynamic pricing, real-time inventory visibility, and in-store operational efficiency. Retailers are adopting ESL systems to automate price changes, reduce manual labor, and deliver a more consistent and responsive shopping experience. Advances in wireless communication, battery optimization, and centralized pricing platforms are making large-scale ESL deployments more feasible and cost-effective. As a result, ESL is becoming a key enabler of digital transformation in physical retail environments.

Key U.S. Industrial Internet of Things Company Insights

Some of the key players operating in the market include Microsoft corporation and Cisco Systems, Inc., among others.

-

Microsoft Corporation is a key enabler of industrial digital transformation through its Azure IoT platform, which connects, monitors, and manages billions of devices across industries. Its solutions offer predictive maintenance, real-time insights, and seamless integration with AI and analytics tools to enhance operational efficiency. With strong enterprise-grade security and scalable infrastructure, Microsoft supports U.S. manufacturers, energy providers, and logistics companies in building resilient, cloud-driven IIoT systems.

-

Cisco Systems, Inc. leads the industrial internet of things market with robust networking, edge computing, and secure connectivity solutions designed for industrial environments. The company helps U.S. businesses integrate operational technology (OT) with IT systems to enable real-time monitoring, data flow, and remote control of assets. Cisco’s infrastructure ensures scalable, secure, and intelligent IIoT deployments across sectors like manufacturing, energy, and transportation.

ARM Holding Plc and Rockwell Automation, Inc. are some of the emerging market participants in the U.S. Industrial Internet of Things market.

-

ARM Holding Plc plays a vital role in enabling IIoT by providing low-power, high-efficiency chip architectures used in billions of edge devices. Its Cortex-M series processors power sensors and microcontrollers that collect and process data across IIoT environments. ARM's Pelion IoT platform also offers secure device management and cloud connectivity, making it ideal for industrial environments with large-scale deployments. Though primarily known for semiconductor IP, ARM is expanding its footprint in IIoT by enabling scalable and secure edge intelligence.

-

Rockwell Automation Inc. is emerging as a strong force in IIoT by integrating industrial control systems with advanced data analytics. The company’s FactoryTalk® software and Logix control architecture provide real-time monitoring, automation, and diagnostics for industrial processes. Rockwell focuses on discrete and hybrid industries, helping manufacturers adopt IIoT through scalable, secure infrastructure. Its growing investment in digital transformation, AI, and edge computing positions it as a rising power in industrial connectivity and automation.

Key U.S. Industrial Internet of Things Companies:

- ABB Ltd.

- ARM Holding Plc

- Atmel Corporation

- Cisco Systems, Inc.

- General Electric Company (GE)

- Honeywell International Inc.

- Intel Corporation

- Microsoft Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

Recent Developments

-

In June 2025, Cisco Systems, Inc. introduced secure network architecture to accelerate AI adoption in the workplace. The solution features AgenticOps, an AI-driven operations layer with tools like Cisco AI Assistant and AI Canvas. It includes high-performance hardware such as smart switches, secure routers, and Wi-Fi 7 access points with quantum-resistant encryption. Cisco aims to help businesses modernize networks to be AI-ready, secure, and resilient.

-

In March 2025, Digi International launched its Digi X-ON Industrial IoT platform. The solution integrates hardware, software, and cloud connectivity into one unified ecosystem. It supports large-scale use cases like agriculture, smart cities, and industrial automation. A successful deployment with FeverTags enabled early cattle illness detection, reducing antibiotic use and improving ROI.

-

In January 2025, Siemens AG introduced breakthrough innovations in industrial AI and digital twin technology at CES. It launched the Siemens Industrial Copilot for Operations to enhance shop floor efficiency using AI. Strategic partnerships with JetZero, NVIDIA, and Sony aim to advance digital engineering and sustainability goals. Siemens also unveiled programs with AWS and startups to expand access to industrial tech.

U.S. Industrial Internet of Things Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 169.25 billion

Revenue forecast in 2033

USD 671.92 billion

Growth rate

CAGR of 18.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, software, connectivity technology, device & technology

Country Scope

U.S.

Key companies profiled

ABB Ltd.; ARM Holding Plc; Atmel Corporation; Cisco Systems, Inc.; General Electric Company (GE); Intel Corporation; Rockwell Automation, Inc.; Siemens AG; Microsoft Corporation; Schneider Electric SE; Honeywell International Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Internet of Things Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. Industrial Internet of Things market report based on component, end-use, software, connectivity technology, and device & technology:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Solution

-

Remote Monitoring

-

Data Management

-

Analytics

-

Security Solutions

-

Others

-

-

Services

-

Professional

-

Managed

-

-

Platform

-

Connectivity Management

-

Application Management

-

Device Management

-

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Aviation

-

Metal & Mining

-

Chemical

-

Manufacturing

-

Energy & Power

-

Smart Grids

-

Oil & Gas

-

Healthcare

-

Logistics & Transport

-

Intelligent Signaling System

-

Video Analytics

-

Incident Detection System

-

Route Scheduling Guidance System

-

-

Agriculture

-

Precision Farming

-

Livestock Monitoring

-

Smart Greenhouses

-

Fish Farming

-

-

Retail

-

Point of Sales

-

Interactive Kiosks

-

Self-Checkout Systems

-

Others

-

-

-

Software Outlook (Revenue, USD Billion, 2021 - 2033)

-

Product Lifecycle Management

-

Manufacturing Execution Systems

-

SCADA

-

Outage Management Systems

-

Distribution Management Systems

-

Remote Patent Monitoring

-

Retail Management Software

-

Visualization Software

-

Transit Management Systems

-

Farm Management Systems

-

-

Connectivity Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Wired Technology

-

Ethernet

-

Modbus

-

Profinet

-

CC-Link

-

-

Foundation Fieldbus

-

-

Wireless Technology

-

Wi-Fi

-

Bluetooth

-

Cellular Technologies

-

4G/LTE

-

5G

-

-

Satellite Technologies

-

-

-

Device & Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Sensors

-

Radio Frequency Identification (RFID)

-

Industrial Robotics

-

Distributed Control Systems

-

Condition Monitoring

-

Smart Meters

-

Electronic Shelf Labels

-

Cameras

-

Smart Beacons

-

Interface Boards

-

Yield Monitors

-

Guidance & Steering

-

GPS/GNSS

-

Flow & Application Control Devices

-

Networking Technology

-

Frequently Asked Questions About This Report

b. The U.S. industrial internet of things market size was estimated at USD 142.35 billion in 2024 and is expected to reach USD 169.25 billion in 2025

b. The U.S. industrial internet of things market is expected to grow at a compound annual growth rate of 18.8% from 2025 to 2033 to reach USD 671.92 billion by 2033

b. The manufacturing segment accounted for the largest market share in 2024, driven by the need for operational efficiency. Manufacturers are adopting IIoT to automate processes, monitor equipment in real-time, and minimize unplanned downtime.

b. Some of the key players operating in the U.S. industrial IoT market include ABB Ltd.; ARM Holding Plc; Atmel Corporation; Cisco Systems, Inc.; General Electric Company (GE); Intel Corporation, Rockwell Automation, Inc.; Siemens AG; Microsoft Corporation; Schneider Electric SE; and Honeywell International Inc.

b. Key factors that are driving the market growth include the widespread adoption of edge computing for faster data processing, a growing emphasis on industrial cybersecurity to protect connected systems, and the rapid deployment of 5G-enabled IIoT solutions to enhance connectivity and real-time decision-making.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.