- Home

- »

- Medical Devices

- »

-

U.S. Interventional Cardiology And Peripheral Market 2033GVR Report cover

![U.S. Interventional Cardiology And Peripheral Market Size, Share & Trends Report]()

U.S. Interventional Cardiology And Peripheral Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Interventional Catheters, Microcatheters, Peripheral Stents), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-581-2

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Interventional Cardiology And Peripheral Market Summary

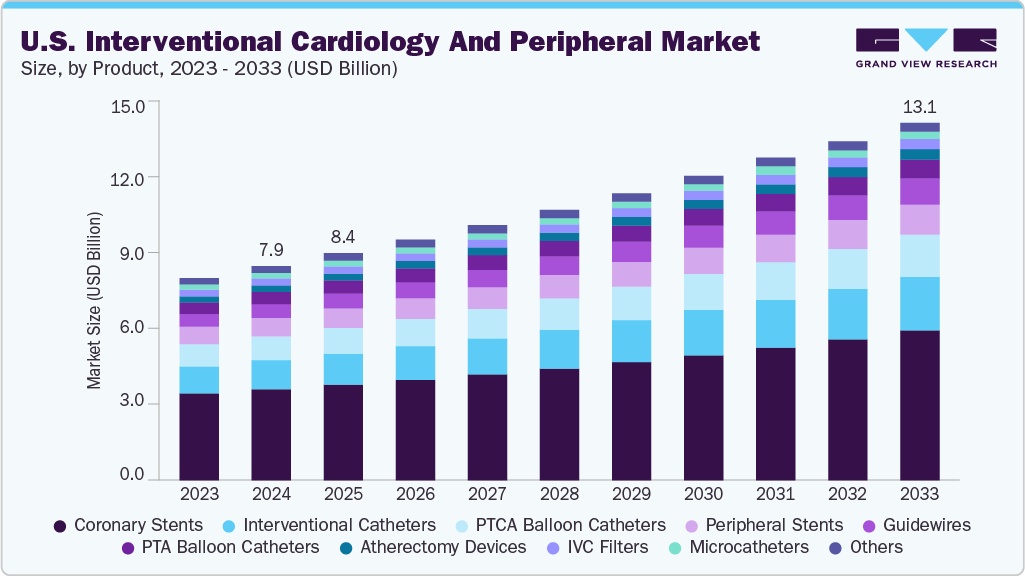

The U.S. interventional cardiology and peripheral market size was estimated at USD 7.9 billion in 2024 and is projected to reach USD 13.1 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The growth is driven by the growing burden of cardiovascular and peripheral vascular diseases, rising preference for minimally invasive procedures, and continuous advancements in device technology.

Key Market Trends & Insights

- The U.S. interventional cardiology and peripheral industry is expected to grow significantly over the forecast period.

- By product, the coronary stents segment held the highest market share of 41.5% in 2024.

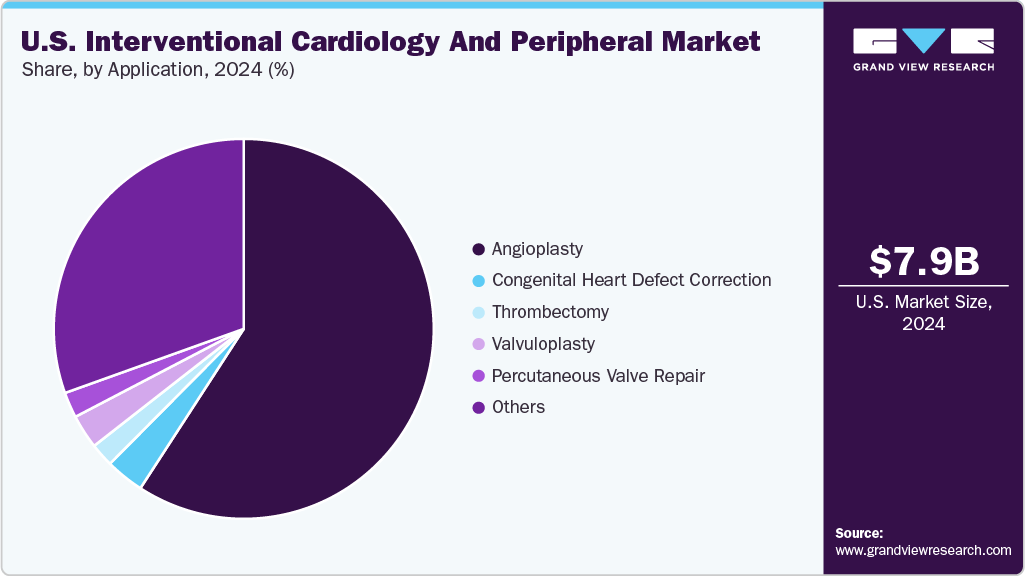

- Based on application, the angioplasty segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.9 Billion

- 2033 Projected Market Size: USD 13.1 Billion

- CAGR (2025-2033): 5.8%

The increasing geriatric population, higher rates of diabetes and hypertension, and supportive reimbursement policies further fuel market expansion. As more primary care professionals and specialists adopt proactive screening protocols, referral rates to interventionalists have increased. Integrating preventive care with interventional therapies drives a shift in treatment paradigms, positioning minimally invasive techniques as first-line interventions in many clinical scenarios. This progression continues to support the market's expansion across coronary and peripheral segments.An aging population's demographic trend is pronounced, affecting interventional cardiology and peripheral care markets. In January 2024, the Population Reference Bureau released a fact sheet highlighting the unprecedented growth of the U.S. population aged 65 and older, projected to increase by 47% by 2050. It also noted the rising racial and ethnic diversity among older Americans, with a significant shift expected by mid-century. Older adults often present with multiple comorbidities that make them less suitable for invasive surgical procedures, increasing reliance on catheter-based solutions. These minimally invasive techniques provide a viable alternative for managing vascular blockages and related complications in high-risk patients, with a focus on maintaining quality of life.

Advancements in interventional cardiology devices are reshaping clinical decision-making and procedural outcomes. Newer generations of stents, balloons, and adjunctive tools are designed to improve precision, reduce complications, and enhance long-term vessel patency. These innovations enable physicians to address increasingly complex lesions and expand the pool of eligible patients. Improved deliverability and trackability have made devices more versatile across challenging anatomies. In January 2024, AngioDynamics received FDA 510(k) clearance for its Auryon XL Radial Access Catheter, designed for treating Peripheral Arterial Disease (PAD). The catheter expands treatment options, reduces bleeding risks, and accelerates recovery by utilizing radial access, offering a safer alternative to femoral access in atherectomy procedures.

The introduction of intravascular imaging tools and physiology-guided assessment techniques has added a layer of procedural accuracy. These tools support better visualization and decision-making during interventions, contributing to higher procedural success rates. In the peripheral space, technologies such as atherectomy systems and drug-coated devices have effectively treated long or calcified lesions with reduced need for repeat interventions. In February 2024, Biotronik and IMDS launched the Micro Rx Rapid Exchange Microcatheter in the U.S. This advanced device enhances guidewire support, offering improved push transfer and a tapered tip for better penetration. Designed for percutaneous coronary interventions, it aims to reduce procedure time and minimize vascular trauma, addressing challenges in complex vascular anatomies.

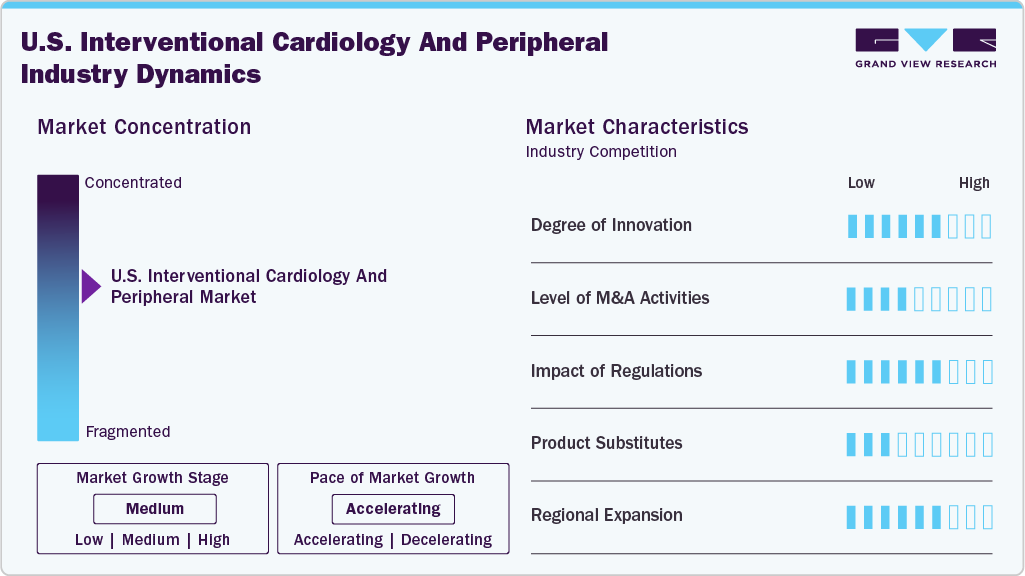

Market Concentration & Characteristics

The U.S. interventional cardiology and peripheral market is rapidly advancing with innovations in minimally invasive procedures, structural heart therapies such as TAVR and mitral repair, and next-generation stents, including bioresorbable and drug-eluting options. Integration of advanced imaging (CCTA, IVUS, OCT) and AI enhances diagnosis and procedural accuracy. Robotic-assisted interventions, regenerative medicine, shorter antiplatelet regimens, and AR/VR technologies improve safety, outcomes, and operator training, driving ongoing market growth. In April 2025, Shockwave Medical, part of Johnson & Johnson MedTech, initiated the FORWARD CAD IDE study in the U.S. and U.K. to evaluate the Javelin IVL Catheter for calcified coronary lesions to address unmet needs in coronary interventions.

The market experiences frequent mergers, acquisitions, and strategic partnerships among leading device firms and startups. These activities expand product portfolios, enable entry into new segments such as peripheral vascular devices, and access advanced R&D and intellectual property, thereby driving market consolidation, innovation, and faster commercialization of new technologies. For instance, in March 2025, Boston Scientific announced its acquisition of SoniVie Ltd., a private medical device firm in Israel, for approximately USD 360 million upfront, with potential additional payments, to expand its interventional cardiology portfolio with ultrasound-based renal denervation therapy for hypertension.

The FDA oversees interventional cardiology device regulation under 21 CFR Part 870, classifying devices into Class I (low risk), Class II (moderate risk, cleared via 510(k)), and Class III (high risk, requiring Premarket Approval). Specialized pathways such as HDE and EFS facilitate innovation for rare conditions and early evaluation. Post-market surveillance ensures ongoing safety, while recent trends include expanded indications based on registry data, balancing rapid access with safety standards amidst regulatory and reimbursement influences.

Due to their proven clinical effectiveness and minimally invasive approach, the threat of substitutes for core interventional procedures such as angioplasty, stent placement, and TAVR is low to moderate. Noninvasive therapies and medications may delay intervention but rarely replace it. Imaging modalities such as IVUS, OCT, and CCTA are complementary, resulting in limited substitution risk and supporting stable demand for advanced devices.

The U.S. maintains a strong presence in major metropolitan and healthcare hubs nationwide. The Northeast, including New York, Boston, and Philadelphia, features leading academic centers and high patient volumes. The Midwest, with Chicago, Cleveland, and Minneapolis, is home to top cardiac hospitals and research activity. The West Coast, particularly the San Francisco Bay Area and Los Angeles, is known for innovation and clinical trials. At the same time, Texas and Florida serve large populations with high cardiovascular disease rates. In May 2025, during the SCAI Scientific Sessions in Washington, DC, the Society for Cardiovascular Angiography & Interventions launched its third “Ready to Launch: Careers in Cardiology” program, connecting U.S. medical students and residents with interventional cardiology leaders to promote diversity and mentorship.

Product Insights

Coronary stents led the U.S. interventional cardiology and peripheral market. They accounted for a share of 41.5% in 2024, fueled by technological advancements, rising cardiovascular disease prevalence, and increased use of minimally invasive procedures. Key players such as Abbott Laboratories, Boston Scientific, and Medtronic are innovating with drug-eluting stents such as XIENCE, Synergy, and Resolute Onyx to improve outcomes. Companies are adopting R&D, product development, and expansion strategies to drive market growth. For instance, in April 2024, Abbott received U.S. FDA approval for the Esprit BTK Resorbable Scaffold, a dissolving stent designed for below-the-knee arteries in peripheral artery disease patients. This innovative device supports vessel healing and offers a superior alternative to balloon angioplasty, improving long-term outcomes.

The guidewires segment is expected to grow at the fastest CAGR of 8.3% over the forecast period. Guidewires are essential for precisely positioning balloon catheters and devices during angioplasty, as measurement tools for accurate device alignment. Key players are introducing technologically advanced products, such as radiofrequency (RF) guidewires that use RF energy to safely navigate occlusions, reducing vessel damage and improving outcomes in vascular interventions. These innovations are driving overall market growth in the evolving medical technology sector. In March 2024, Baylis Medical Technologies announced the U.S. launch and 510(k) clearance of the PowerWire Pro RF Guidewire, enhancing venous stent recanalization for total occlusions. This innovative device employs radiofrequency technology to safely cross in-stent and native occlusions, expanding treatment options for vascular professionals.

Application Insights

Angioplasty dominated the U.S. interventional cardiology and peripheral industry and accounted for a share of 59.2% in 2024. Angioplasty is a minimally invasive procedure that restores blood flow by widening narrowed or blocked coronary arteries, often using balloons and stents. According to an April 2024 University of Michigan article, over 500,000 individuals in the U.S. undergo percutaneous coronary intervention (PCI) annually. Advances such as the Serranator SL-PRO, with proprietary micro-serration technology delivering up to 1,000 times more force, improve arterial expansion, especially in complex lesions. Growing procedure volumes and innovative devices drive market growth and enhance treatment outcomes.

Congenital heart defect correction is projected to grow significantly over the forecast period. Congenital heart defects (CHDs) are structural anomalies present at birth, affecting blood flow. According to a CDC article published in March 2025, in the U.S., CHDs are the most common type of birth defect, impacting nearly 1% of all live births, equating to approximately 40,000 infants annually. Of these, around one in four are classified as critical congenital heart defects, necessitating surgery or catheter-based interventions within the first year of life. Rising prevalence and technological advances are driving growth in pediatric interventional cardiology.

Key U.S. Interventional Cardiology And Peripheral Company Insights

Some key companies operating in the market include B. Braun SE, BD, Cardinal Health, Medtronic, Teleflex Incorporated, and W. L. Gore & Associates Inc., among others. Organizations are undertaking various strategic initiatives to increase their market shares, such as launching new products, geographic expansions, partnerships and collaborations, and innovations. Emerging players are adopting diverse strategies, such as new product launches, to strengthen their market presence.

-

B. Braun develops and markets medical products such as infusion therapy, pain management, clinical nutrition, dialysis, and pharmacy admixture systems, supported by divisions such as B. Braun Interventional Systems, Aesculap, and CAPS, to improve patient safety and clinical efficiency.

-

Teleflex Incorporated operates globally, providing diverse solutions in vascular and interventional access, surgical procedures, anesthesia, cardiac care, urology, emergency medicine, and respiratory care, aiming to enhance overall health and well-being.

Key U.S. Interventional Cardiology And Peripheral Companies:

- B. Braun SE

- BD

- Cardinal Health

- Medtronic

- Teleflex Incorporated

- W. L. Gore & Associates Inc.

- Cook

- Boston Scientific Corporation

- AngioDynamics

- Abbott

- OrbusNeich Medical Group Holdings Limited

Recent Developments

-

In March 2025, GE HealthCare launched Flyrcado (flurpiridaz F 18) in the U.S., a first-of-its-kind PET MPI agent for coronary artery disease diagnosis, supported by Medicare pass-through payment status, aiming to enhance diagnostic accuracy and patient outcomes.

-

In October 2024, Gore announced three-year data from the ASSURED Study in the U.S., demonstrating long-term safety and 100% closure success of the GORE CARDIOFORM ASD Occluder, with low adverse event rates and an 84% clinical success rate at 36 months.

-

In February 2024, Biotronik launched the PK Papyrus covered coronary stent in the U.S., providing a flexible, ultrathin device for emergency treatment of acute coronary artery perforations, aiming to improve patient outcomes and reduce the need for bypass surgeries.

-

In January 2024, AngioDynamics received FDA 510(k) clearance for the Auryon XL Radial Access Catheter in the U.S., expanding atherectomy options for PAD treatment, reducing access site complications, and supporting faster patient recovery with innovative laser technology.

U.S. Interventional Cardiology And Peripheral Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.9 billion

Revenue forecast in 2033

USD 13.1 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

B. Braun SE; BD; Cardinal Health; Medtronic; Teleflex Incorporated; W. L. Gore & Associates Inc.; Cook; Boston Scientific Corporation; AngioDynamics; Abbott; OrbusNeich Medical Group Holdings Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Interventional Cardiology And Peripheral Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. interventional cardiology and peripheral market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Interventional Catheters

-

Microcatheters

-

Support Microcatheters

-

Delivery Microcatheters

-

Others

-

-

Guidewires

-

Peripheral Stents

-

Self-expanding

-

Balloon-expandable

-

Drug-eluting Stents

-

-

Coronary Stents

-

Bioabsorbable Stents

-

Drug-Eluting Stents

-

Bare Metal Stents

-

-

PTCA Balloon Catheters

-

Atherectomy Devices

-

Chronic Total Occlusion Devices

-

Synthetic Surgical Grafts

-

Embolic Protection Devices

-

IVC Filters

-

PTA Balloon Catheters

-

Thrombectomy Devices

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Angioplasty

-

Congenital Heart Defect Correction

-

Thrombectomy

-

Valvuloplasty

-

Percutaneous Valve Repair

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. interventional cardiology and peripheral market size was estimated at USD 7.9 billion in 2024 and is expected to reach USD 8.4 billion in 2025.

b. The U.S. interventional cardiology and peripheral market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 13.1 billion by 2030.

b. Coronary stents led the U.S. interventional cardiology and peripheral market and accounted for a share of 41.5% in 2024, fueled by technological advancements, rising cardiovascular disease prevalence, and increased use of minimally invasive procedures.

b. Some key companies operating in the market include B. Braun SE, BD, Cardinal Health, Medtronic, Teleflex Incorporated, W. L. Gore & Associates Inc., Cook, Boston Scientific Corporation, AngioDynamics, Abbott, and OrbusNeich Medical Group Holdings Limited

b. Key factors driving the U.S. interventional cardiology and peripheral market growth include growing burden of cardiovascular and peripheral vascular diseases, rising preference for minimally invasive procedures, and continuous advancements in device technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.