- Home

- »

- IT Services & Applications

- »

-

U.S. IT Services Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. IT Services Market Size, Share & Trends Report]()

U.S. IT Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (AI & ML, Big Data Analytics), By Approach (Proactive, Reactive), By Deployment, By Enterprise Size, By End-use, By Type, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-271-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. IT Services Market Size & Trends

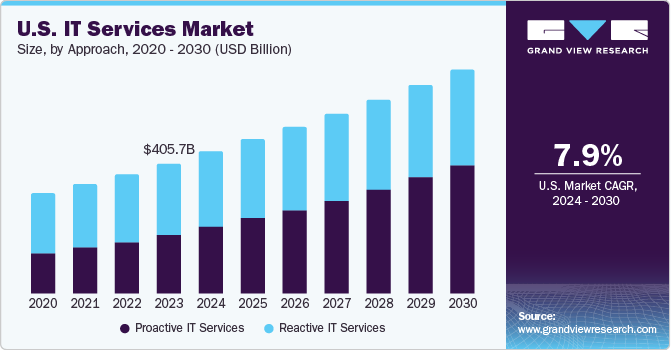

The U.S. IT services market size was valued at USD 405.7 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030. The penetration of big data analytics, artificial intelligence, the Internet of Things (IoT), and machine learning (ML) has brought a paradigm shift in the business landscape. Besides, the surging demand for robust cybersecurity solutions amidst privacy protection concerns has encouraged stakeholders to inject funds into IT services. Incumbent companies are likely to innovate and capitalize on technology advancements and data availability.

American consumers have exhibited a notable trend for cloud-based solutions and software-as-a-service (SaaS). Businesses have sought advanced services to foster automation and streamline the supply chain. The use of business intelligence and cloud technologies has become pronounced across the U.S. Digital tools have gained ground to foster cost savings, gain insights into their operations and boost efficiency. For instance, customers have sought personalization, customization and mobility from services, prompting stakeholders to look for new ideas.

Managed services have emerged as a vital cog to gain a competitive edge in the U.S. industry. To illustrate, the financial sector is counting on managed services to assess complex regulatory ambiance, adopt the latest security measures, leverage technology know-how and adopt a secure and scalable infrastructure. Furthermore, the manufacturing industry can cash in on managed services to minimize monotonous activities with automation and manage the soaring volume of data.

Market Concentration & Characteristics

Innovation is poised to bring a paradigm shift in the IT services ecosystem in the U.S. The expanding footfall of smart devices has unraveled growth opportunities across industry verticals. For instance, the healthcare sector has gained an impetus with remote access and monitoring. Advanced analytics and big data have helped companies use customer data to tailor and personalize their services. The expanding penetration of 5G devices and connected devices will enable service providers to enhance user experience and bolster new deployment models.

With the pace of customization and innovation rising, the level of mergers & acquisitions activities could be instrumental. Robust M&A strategies will help C-suite service providers and other stakeholders to gain a competitive edge. For instance, vertical and horizontal mergers and acquisition strategies are likely to be pronounced to expand global IT services market reach, diversify products and services and reduce OPEX.

The level of regulation is slated to be noticeable amidst rampant data security concerns. To illustrate, allowing employees to use BYOD could be a pivotal approach to cost saving; however, a dearth of BYOD policy may dent the company’s brand value. Meanwhile, healthcare IT compliance-The Healthcare Insurance Portability and Accountability Act (HIPAA)-emphasizes disclosure and usage of health information to protect sensitive patient health information.

The impact of substitutes is likely to be moderate as end-users are expected to count on advanced IT services. The penetration of cloud and on-premises services has spurred innovation across business verticals. Besides, the presence of giants, including IBM, Microsoft and Infosys, will provide a fillip to the market outlook. However, expensive switching costs and legal limitations could compel companies to look for substitutes.

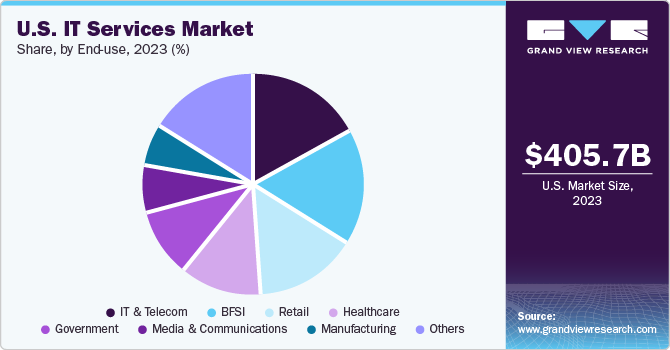

End-users, such as healthcare, manufacturing, BFSI, media & communication, IT & telecom, retail and government, are slated to inject funds into the landscape. IT services have become sought-after to streamline company operations and enhance customer experience. The rising prominence of industrial IoT and the application of AI across the end-use industries have mustered up the confidence of incumbents.

Approach Insights

The reactive IT services segment spearheaded the U.S. IT services market, accounting for 55.5% revenue share in 2023. The growth is partly attributed to the trend for cloud-based services for alerting, monitoring and incident management capabilities. Additionally, the surging cost of downtime has prompted industry leaders to infuse funds into robust reactive IT services and focus on safeguarding IT assets.

The proactive IT services will observe notable growth on the back of soaring cases of cybercrime. 2023 was a year replete with data breaches in the U.S. According to the 2023 Annual Data Breach Report published by the Identity Theft Resource Center (ITRC), the number of data compromises rose by 78% in 2023 vis-à-vis 2021. Investment in proactive IT services could help companies augment security, and agility and optimize IT resources.

Type Insights

The operations & maintenance segment is poised to witness an uptake in light of the rising footprint of AI, ML, and robotic process automation. Besides, the market penetration of cloud computing and data analytics has encouraged business verticals to infuse funds into IT services. Businesses are expected to invest in IT operation and maintenance to bolster resilience and performance. Moreover, surging security concerns will compel stakeholders to underpin their portfolios.

The design & implementation segment will rise against the backdrop of heightened demand for user-centric solutions and technological advancements. End-users have also observed an uptick in IT deployment as they exhibit traction for designing and implementing their IT systems and applications. Additionally, stable economies in the U.S. have augured well for leading companies and startups gearing up to expand their footprint.

Application Insights

The application management segment is likely to grow in the wake of the need to minimize ownership costs, boost performance and reliability and enhance security. The advanced application management solution helps maintain, optimize and monitor applications. End-users are poised to bank on the robust management solution to protect sensitive data, foster cost-savings, ensure compliance with industry regulations and maximize business value.

The data management segment will depict notable growth due to an influx of volume of data across major industry verticals. The trend for cloud-based services and solutions, data analytics and big data has encouraged stakeholders to invest in data management. Lately, the penetration of scalable data management- and data governance -solutions has boded well for the industry outlook.

Technology Insights

The AI & machine learning segment is forecast to depict a significant uptake during the assessment period. The robust outlook comes against the backdrop of automation trends reshaping the industry verticals. AI and ML have become sought-after to foster customer service and predictive maintenance and provide real-time fraud detection service. Bespoke solutions will gain traction to optimize decision-making processes and streamline operations.

The big data analytics segment is estimated to contribute notably during the forecast period, partly due to the demand for real-time analytics for quick and robust decision-making. End-users have sought cloud-based big data analytics solutions for flexibility, scalability and enhanced performance. Besides, the increasing penetration of edge computing has played a vital role in minimizing latency. Stakeholders are likely to seek big data analytics to assess the surging volume and variety of data and drive faster decision-making.

Deployment Insights

The on-premises segment will grow on the heels of heightened demand to manage data and applications more effectively. Prominently, stakeholders are banking on on-premises IT services for increased security and customization. For instance, organizations can choose networking gear, hardware components and software solutions to keep up with their needs. Besides, direct control over security measures and data storage has encouraged leading companies to inject funds into on-premises deployment.

The cloud segment is poised to exhibit considerable growth during the assessment period, largely due to the increasing footprint of big data analytics and cloud-based infrastructure. Cloud installation has gained ground across end-use sectors, alluding to the compelling opportunities the U.S. holds for shareholders and other stakeholders. End-users are poised to show traction for managed services (cloud-based) and hybrid cloud, auguring well for the business outlook.

Enterprise Size Insights

The large enterprise segment is likely to depict significant uptake during the forecast period. The growth outlook is mainly attributed to the trend for cloud computing. The demand for IT services has become pronounced across large enterprises to augment efficiency and agility and boost customer experience. Besides, IT services have received an impetus to unburden IT staff, security improvement and financial savings.

The small & medium enterprise segment will observe an uptake as cloud-based solutions provide a fillip to the industry growth. The upsurge of mobile internet and advances in digital payments have provided opportunities and challenges for SMEs. To illustrate, mobile technologies have gained prominence to enhance sales tracking and inventory management. SMEs are touted to count on service automation and digital technologies to reduce CAPEX and OPEX.

End-use Insights

The IT & telecom segment to witness a notable uptick on the back of a bullish adoption of cloud computing and other bespoke solutions. The demand for managed IT services will be pronounced to reinforce customer experience and maintain a competitive edge. The U.S. companies have depicted a need for specialized IT services, operational efficiency, cost reduction and better decision-making. To illustrate, big data-powered IT services can gauge customer needs and assess data from devices, applications and sensors.

The retail segment will rise in light of the surging penetration of the e-commerce sector and the need for omnichannel retail strategies. Furthermore, CRM solutions have become an important cog to help retailers offer personalized services and establish strong customer relationships. Additionally, inventory management solutions have become sought-after to track inventory levels, handle orders and control stock levels. Retailers are expected to inject funds into IT services amidst a surge in the demand for automation and streamlined operations.

Key IT Services Company Insights

Some of the leading players operating in the market include IBM, Amazon, Cisco, Hewlett Packard Enterprise Development LP and Microsoft. They are likely to focus on organic and inorganic strategies to underpin their strategies in the regional landscape.

-

In March 2024, Wipro collaborated with Nutanix to expedite hybrid multi-cloud adoption and digital transformation. Wipro claimed the venture would minimize carbon footprint and energy consumption in data centers.

-

In January 2024, IBM announced it joined forces with American Tower to expedite the deployment of a hybrid, multi-cloud computing platform at the edge.

-

In March 2023, Hewlett Packard Enterprise announced the acquisition of OpsRamp to effectively manage IT investments and minimize the operational complexity of multi-vendor and multi-cloud IT environments.

Some emerging companies are slated to expand their portfolios to bolster their value propositions. Some of the prevailing dynamics are delineated below:

-

In January 2024, HPE announced the acquisition of Juniper Networks to expedite the AI-fueled innovation.

-

In November 2023, DXC Technology and Amazon Web Services teamed up to expedite cloud adoption and digital transformation. The former expects the partnership will help them modernize the IT infrastructure and fuel efficiencies and innovation.

Key IT Services Companies:

- Amazon Web Services, Inc.

- Avaya

- Cisco Systems, Inc.

- DXC Technology Company

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM Corp.

- Juniper Networks, Inc.

- Microsoft

- Broadcom (Symantec Corporation)

- Oracle

Recent Developments

-

In January 2024, IBM announced the acquisition of application modernization capabilities from Advanced. The acquisition is expected to help the American giant bolster its AI and hybrid cloud strategy.

-

In December 2023, Cisco announced the acquisition of Isovalent to augment its secure networking capabilities across public clouds.

U.S. IT Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 441.7 Billion

Revenue Forecast in 2030

USD 695.6 Billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Approach; Type; Application; Technology; Deployment; Enterprise size; End-use

Key Companies Profiled

Amazon Web Services, Inc.; Avaya; Cisco Systems, Inc.; DXC Technology Company; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM Corp.; Juniper Networks, Inc.; Microsoft; Broadcom (Symantec Corp.); Oracle

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. IT Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. IT services market based on approach, type, application, technology, deployment, enterprise size, and end-use:

-

Approach Outlook (Revenue, USD Billion, 2017 - 2030)

-

Reactive IT Services

-

Proactive IT Services

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Design & Implementation

-

Operations & Maintenance

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Systems & Network Management

-

Data Management

-

Application Management

-

Security & Compliance Management

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

AI & Machine Learning

-

Big Data Analytics

-

Threat Intelligence

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Media & Communications

-

Retail

-

IT & Telecom

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. IT services market size was estimated at USD 405.7 billion in 2023 and is expected to reach USD 441.7 billion in 2024.

b. The U.S. IT services market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 695.6 billion by 2030.

b. Reactive IT services dominated the U.S. IT services market with a share of 55.5% in 2023. The growth is partly attributed to the trend for cloud-based services for alerting, monitoring, and incident management capabilities. Additionally, the surging cost of downtime has prompted industry leaders to infuse funds into robust reactive IT services and focus on safeguarding IT assets.

b. Some key players operating in the U.S. energy management systems market include Amazon Web Services, Inc., Avaya, Cisco Systems, Inc., DXC Technology Company, Fortinet, Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM Corp., Juniper Networks, Inc., Microsoft, Broadcom (Symantec Corporation), Oracle

b. Key factors that are driving the market growth include an increase in demand for cloud services, increased investment by small and medium enterprises in IT support services, and integration of support services with social media.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.