- Home

- »

- Biotechnology

- »

-

U.S. Life Science Tools Market Size, Industry Report, 2030GVR Report cover

![U.S. Life Science Tools Market Size, Share & Trends Report]()

U.S. Life Science Tools Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Genomic, Proteomics), By Product (Mass Spectrometry, Flow Cytometry), By End-use (Healthcare, Industrial Applications), And Segment Forecasts

- Report ID: GVR-4-68040-241-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Life Science Tools Market Size & Trends

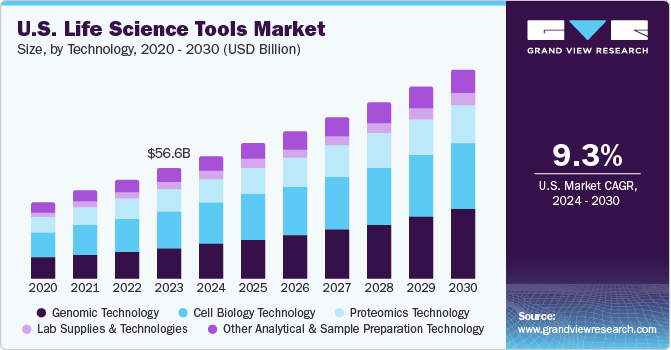

The U.S. life science tools market size was estimated at USD 56.61 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030. This can be attributed to a rise in government funding for life science technologies, growth of cell & gene therapies, increase in demand for biopharmaceuticals, and rise in competition among prominent market entities. An increase in the number of strategic deals & developments, coupled with growing investments in R&D for life science tools, is expected to further drive the market. The increase in revenue is primarily attributed to the swift progress made by life science tool companies in areas such as sequencing, mass spectrometry, chromatography, nuclear magnetic resonance, and other diverse products.

The U.S. accounted for over 44.8% of the global life science tools market in 2023. The market is propelled by investments and funding aimed at developing advanced therapeutics, coupled with a persistent demand for innovative medicines and treatments. This demand is fuelled by the escalating prevalence of diseases like cancer, kidney and thyroid disorders, and diabetes. The COVID-19 pandemic has had a significant effect on numerous industries and their related supply chains worldwide. This is primarily due to interruptions in the provision of essential materials, such as a lack of raw materials and workforce. Moreover, the transportation of raw materials across various regions was suspended. These circumstances have resulted in a deficit of medical supplies, including molecular and immunoassay kits, digital solutions, life-support machines, and medications in various parts of the world.

Moreover, the pandemic has led the market to develop quick diagnostic tests for the SARS-CoV-2 virus, leading manufacturers to introduce innovative solutions. Some of these tests identify the SARS-CoV-2 nucleic material using the PCR technique or methods related to nucleic acid hybridization, while others are serological and immunological assays that detect antibodies produced in response to the virus. For instance, in December 2021, Siemens Healthineers obtained Emergency Use Authorization from the U.S. FDA for its COVID-19 rapid test, CLINITEST Rapid COVID-19 Antigen Self-Test, which can be used for self-testing by individuals aged 14 and above. The market will be propelled by new developments related to the pandemic, government funding, product approvals, and ongoing product launches.

The market is expected to grow due to the increasing demand and development of gene and cell therapies. Companies are intensifying their research and development efforts to create effective gene therapies that address diseases at the genomic level, in response to the need for strong disease treatment methods. The number of products approved by the FDA is increasing, indicating a promising future for gene therapies. Furthermore, the progress in recombinant DNA technology is likely to increase the number of clinical trials for gene therapy. For example, the FDA anticipated receiving over 200 applications each year for clinical trials of cell and gene therapies by 2029, as of 2020.

The field of cancer therapy is witnessing rapid advancements with the evolution of monoclonal antibodies. As per a January 2021 article by mAbxience, 27 such antibodies have received approval for the treatment of various cancers. The use of biologics is expanding due to the increasing FDA approvals of monoclonal antibodies in diagnostics and cancer therapy. For example, in January 2022, the FDA approved a monoclonal antibody named Tebentafusp-tebn, which is beneficial in treating metastatic uveal melanoma. The market growth is expected to be propelled by government support and the escalating demand for innovative therapeutics.

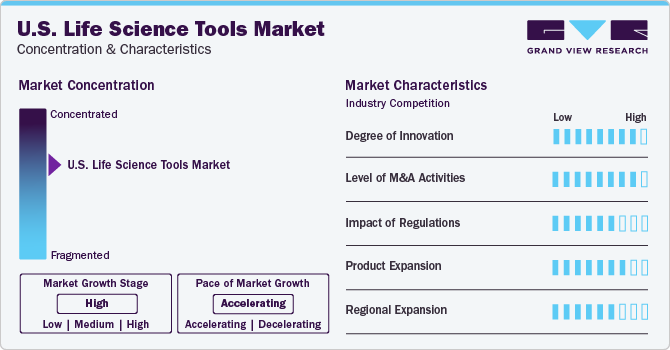

Market Characteristics & Concentration

Industry is highly competitive with companies actively participating in activities such as product innovation, mergers and acquisitions, and regional expansion to fortify their position. Numerous U.S. industry players are continuously developing advanced life science research tools, leading to a higher product penetration. The presence of key companies like PerkinElmer, Thermo Fisher Scientific, and Agilent, along with a structured environment for tissue & genomics diagnostic tests, is driving industry growth. In March 2022, Thermo Fisher Scientific launched a new collection of qPCR biopharma tools, the QualTrak suite, to expedite drug development and meet the rising demand for new biologics.

Degree of innovation is high in the industry and many industry players are investing in R&D to strengthen their place in the industry. Latest developments in the life science tools industry have boosted technological innovations aimed at advancing diagnostics and research. Incorporation of smart technology has enhanced the effectiveness of patient assessment, driving the demand for life science technologies such as NGS, and PCR, among many others.

Key players in the industry are also engaging in collaborative research to convert newborn stem cells from umbilical cord tissue and blood into Induced Pluripotent Stem Cells (iPSCs). For instance, in January 2022, EdiGene and Haihe Laboratory formed a strategic partnership to develop platform technologies and therapies based on stem cell regeneration. The collaboration is focused on discovering new biomarkers to enhance the quality control of stem cell production. Such collaborations are anticipated to propel the industry during the forecast period.

CMS, FDA, and the Federal Trade Commission regulate NGS testing standards and recommendations simultaneously. Other genetic variation-detection technologies, such as PCR and SNP arrays, are generally designed to capture preset data points that are known in advance of testing and are, therefore, better suited to regulation using conventional methods. For instance, in February 2021, Thermo Fisher Scientific, Inc. Received FDA Emergency Use Authorization for Applied Biosystems TaqPath COVID-19, Flu A, Flu B Combo Kit. This multiplex RT PCR diagnostic kit can differentiate and detect influenza B, A, and SARS-CoV-2 simultaneously. This also expanded the company’s portfolio of infectious disease diagnostics.

Players in this industry undertake this strategy to strengthen their product portfolios and offer diverse technologically advanced & innovative products to their customers. This strategy is the most prominently adopted strategy by companies to attract more customers in the life science tools industry. For instance, in September 2022, Illumina, Inc. Launched the NovaSeq X Series (NovaSeq X and NovaSeq X Plus). This innovative technology can generate more than 20,000 whole genomes per year, significantly accelerating clinical insights & genomic discovery, to identify diseases and transform patient lives.

Industry players adopt this strategy to expand the outreach of their products in the industry and increase the availability of their products & services in diverse geographical areas. For instance, in March 2021, Thermo Fisher Scientific, Inc. announced expansion plans will pump USD 600 million into capital investments through 2022. The company’s cell culture media and process liquid sites in Scotland, Florida and New York will increase their production capacity of Gibco cell culture media, process liquids and supplements.

Technology Insights

Cell biology technology dominated the market and accounted for the largest share of 33.9% in 2023. Continuous developments in cells analysis technologies such as microscopy, cytometry, high content analysis, have a significant impact over the growth of immunology, oncology research, stem cell research, and drug discovery. For instance, a novel nanofluidic technology developed with early input by Amgen and invented by Berkeley Lights uses light to manipulate cells. This novel digital cell biology technology can enable scientists’ resource-efficient and rapid ways to run standard biotech experiments. Introduction of novel technologies for usage and adoption of stem cells, CAR T-cells, TCR T-cells, NK T-cells, and other cell therapies boosts revenue generation in this segment. Automation in the storage and processing of cord blood and adult stem cells is expected to positively influence segment growth.

Genomics technology is expected to grow at the fastest CAGR of 12.6% over the forecast period. Genomics, which encompasses the evolutionary, comparative, and functional study of genomes, has seen a rapid expansion in its product range for conducting genomic analysis, thanks to the advent of various supportive technologies. Major innovators such as Thermo Fisher Scientific, QIAGEN, Illumina, and Pacific Biosciences of California, Inc. are at the forefront of developing instruments for diverse genomic applications. The increasing awareness of genomics’ role in managing human diseases and its potential in unconventional applications has spurred the use of genomic data. This has intensified competition among companies to launch new products and technologies that utilize genetic information, thereby tapping into the abundant opportunities in the market.

Product Insights

Cell culture systems and 3D cell culture dominated the market and held the largest share of 18.7% in 2023. Research into the potential of cell biology have yielded significant breakthroughs, thereby contributing to revenue growth. Comprehensive understanding of cell biology has become a crucial component in laboratory workflows, paving the way for market expansion. Furthermore, life science researchers are keen to incorporate new and sophisticated instruments, which is anticipated to strengthen this segment further. This trend in the industry has also motivated numerous major manufacturers to broaden their range of instruments. Companies such as Cytiva, BioTek Instruments, Horizon Discovery, and Seahorse Bioscience, to name a few, are striving to launch instruments related to cell analysis, cell biology, and imaging.

Next-generation sequencing (NGS) is expected to grow at the fastest CAGR of 19.8% during the forecast period. NGS systems enable the concurrent sequencing of numerous genome samples. These systems are adept at handling a vast array of sequencing reactions at the same time. The streamlining of the NGS process, coupled with ongoing reductions in the cost of equipment and reagents, is expected to encourage more widespread use of this biotechnological method. Furthermore, advancements in bioinformatics are likely to increase the use of NGS in both high-throughput and even low-throughput research. For instance, in February 2022. Beckman Coulter Life Sciences entered into an application development agreement with Illumina, Inc. for the Biomek NGeniuS Next Generation Library Preparation System.

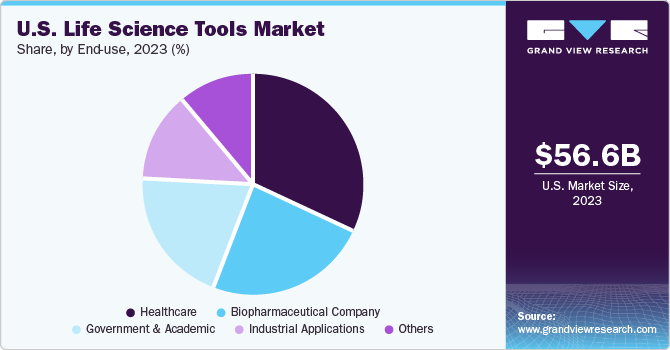

End-use Insights

The healthcare segment dominated the market and held the largest share of over 32.0% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The increasing use of proteomic and genomic workflows in hospitals for diagnosing and treating various diseases is anticipated to spur growth. Furthermore, the rising use of tissue diagnostics and NGS services in hospitals is predicted to propel the market. Numerous hospitals and clinics are presently offering sequencing facilities to patients and are exploring the application of advanced tools and technology in everyday medical practice. Stanford Medicine, for instance, offers sequencing services to individuals with rare or undiagnosed genetic conditions. Partners HealthCare in the U.S. is among the first hospital systems to provide public genomic sequencing, analysis, and interpretation services. The use of genomic sequencing in a hospital or clinical environment is expected to enhance patient care while reducing healthcare costs. As a result, the healthcare sector is projected to experience the most rapid growth in the coming years.

Biopharmaceutical companies is expected to have a lucrative growth during the forecast period. The surge in biopharmaceutical R&D activities is fostering the use of life science tools. Companies like Thermo Fisher Scientific and Merck KGaA have invested heavily in bioprocessing capabilities and biopharmaceutical manufacturing units, respectively. The growing demand for biologics has led to increased investments in expanding manufacturing facilities. For example, Alexion invested in drug production facilities in Ireland, and Upperton Pharma Solutions invested in facility expansion, significantly increasing R&D space and GMP manufacturing. These strategic initiatives, aimed at enhancing the production of novel biologics, are expected to drive market growth.

Key U.S. Life Science Tools Company Insights

The U.S. life science tools market is intensely competitive, with numerous players offering innovative products. These companies are constantly broadening their product portfolios and introducing new platforms through rigorous R&D to maintain their market position. In addition, strategic actions by leading firms, such as collaborations, mergers, acquisitions, and product launches, are driving market growth and heightening competition. For example, Agilent Technologies, Inc. formed a partnership with Biosciences, Inc. in February 2022 to integrate the AVITI System with SureSelect target enrichment panels, enhancing customer access to genomic tools. This initiative is anticipated to open new growth avenues for the company.

Key U.S. Life Science Tools Companies:

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Merck KGaA

- Shimadzu Corporation

- Hitachi, Ltd.

- Bruker Corporation

- Oxford Instruments plc

- Zeiss International

Recent Developments

-

In January 2023, Agilent Technologies, Inc. announced investment of USD 725 million to expand its manufacturing capacity for production of nucleic acid based therapeutics. This expansion is intended to cater to the increasing market demand, bolster production capabilities, and aid in the creation of drugs aimed at treating various ailments such as cancer and cardiovascular diseases.

-

In September 2022, Becton, Dickinson and Company (BD) launched BD Research Cloud software solution to streamline flow cytometry workflow for quick and quality insights for researchers working across several disciplines, including oncology, immunology, virology, and infectious disease monitoring.

-

In September 2022, Agilent Technologies, Inc. announced collaboration with METTLER TOLEDO to minimize errors in the sample preparation workflow for enhanced chromatographic results.

U.S. Life Science Tools Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 107.15 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, end-use

Country scope

U.S.

Key companies profiled

Agilent Technologies, Inc.; Becton, Dickinson and Company; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Illumina, Inc.; Thermo Fisher Scientific, Inc.; QIAGEN N.V.; Merck KGaA; Shimadzu Corporation; Hitachi, Ltd.; Bruker Corporation; Oxford Instruments plc; Zeiss International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Life Science Tools Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. life science tools market based on technology, product, and end-use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Genomic Technology

-

Proteomics Technology

-

Cell Biology Technology

-

Other Analytical & Sample Preparation Technology

-

Lab Supplies & Technologies

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Culture Systems & 3D Cell Culture

-

Instruments

-

Consumables

-

Cell & Tissue Culture Services

-

-

Liquid Chromatography

-

Instruments

-

Consumables

-

Services

-

-

Mass Spectrometry

-

Instruments

-

Consumables

-

Services

-

-

Flow Cytometry

-

Instruments

-

Consumables

-

Services

-

-

Cloning & Genome Engineering

-

Kits, Reagents, and Consumables

-

Services

-

-

Microscopy & Electron Microscopy

-

Instruments

-

Consumables

-

Services

-

-

Next Generation Sequencing

-

Instruments

-

Consumables

-

Services

-

-

PCR & qPCR

-

Instruments

-

Consumables

-

Services

-

-

Nucleic Acid Preparation

-

Instruments

-

Consumables

-

Services

-

-

Nucleic Acid Microarray

-

Instruments

-

Consumables

-

Services

-

-

Sanger Sequencing

-

Instruments

-

Consumables

-

Services

-

-

Transfection Devices & Gene Delivery Technologies

-

Equipment

-

Reagents

-

-

NMR

-

Instruments

-

Consumables

-

Services

-

-

Other Separation Technologies

-

Instruments

-

Consumables

-

Services

-

-

Other Products & Services

-

Antibodies

-

General Supplies

- Others

-

Instruments

-

Consumables

-

Services

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Academic

-

Biopharmaceutical Company

-

Healthcare

-

Industrial Applications

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. life science tools market size was estimated at USD 56.61 billion in 2023

b. The U.S. life science tools market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 107.15 billion by 2030.

b. Based on technology, cell biology technology dominated the market and accounted for the largest share of 33.9% in 2023.

b. Some of the key players in the market are Agilent Technologies, Inc.; Becton, Dickinson and Company; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Illumina, Inc.; Thermo Fisher Scientific, Inc.; QIAGEN N.V.; Merck KGaA; Shimadzu Corporation; Hitachi, Ltd.; Bruker Corporation; Oxford Instruments plc; and Zeiss International

b. Key factors driving the market include increased government funding for life science technologies, growth of cell and gene therapies, and rise in the demand for biopharmaceuticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.