- Home

- »

- Biotechnology

- »

-

Life Science Tools Market Size, Share, Industry Report, 2033GVR Report cover

![Life Science Tools Market Size, Share & Trends Report]()

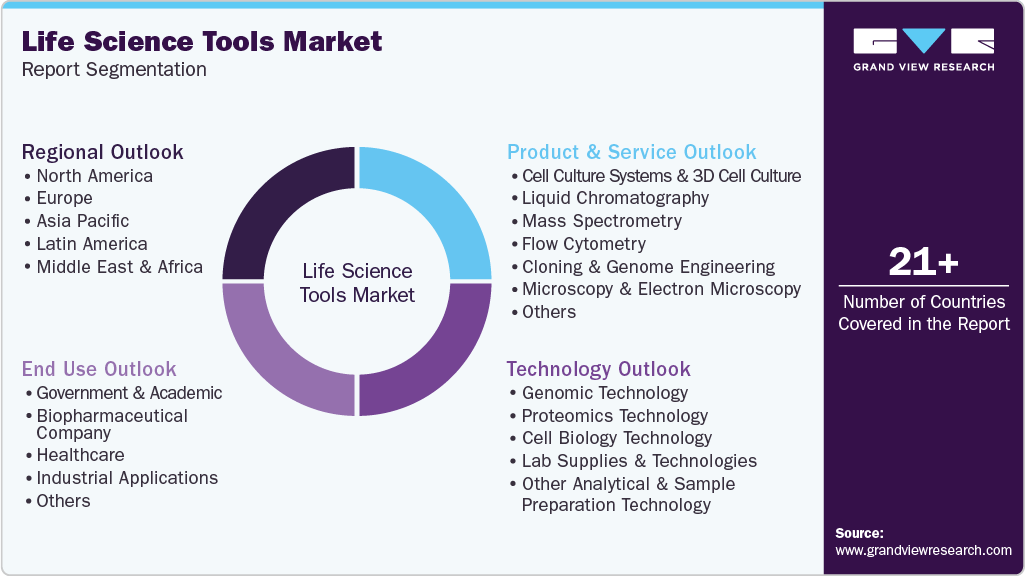

Life Science Tools Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Cell Biology, Proteomics Technology), By Product & Service (Liquid Chromatography, Mass Spectrometry), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-505-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Life Science Tools Market Summary

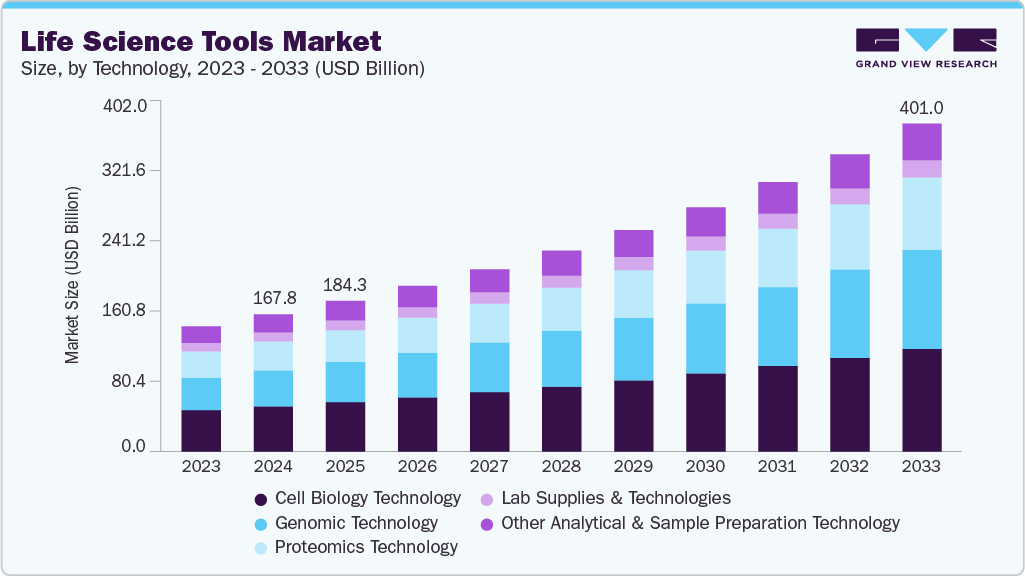

The global life science tools market size was estimated at USD 167.82 billion in 2024 and is projected to reach USD 401.01 billion by 2033, growing at a CAGR of 10.21% from 2025 to 2033. The main drivers of this growth are the expanding use of genomic technologies, increasing investments in pharmaceutical and biotechnology R&D, and the growing demand for sophisticated research instruments.

Key Market Trends & Insights

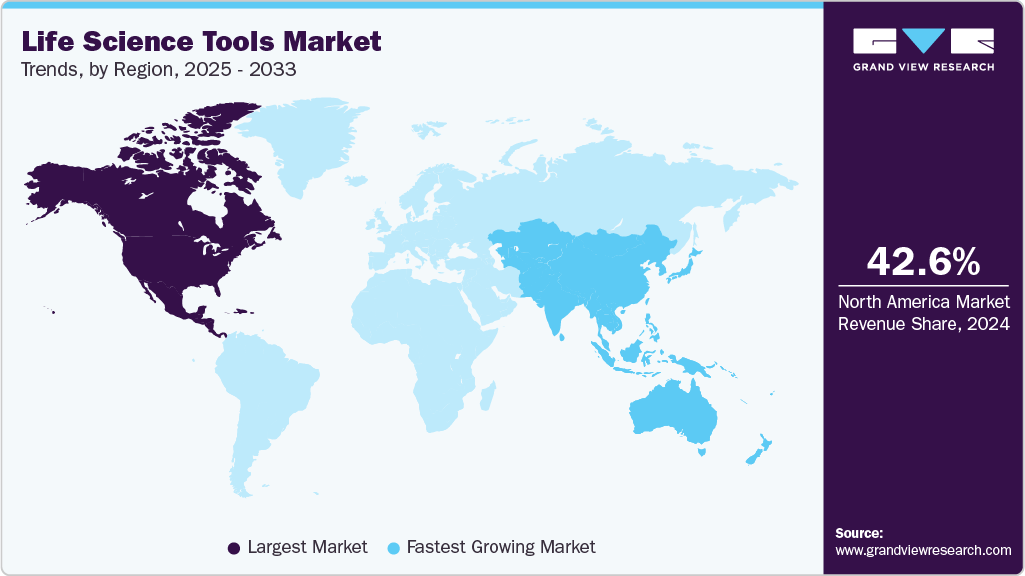

- North America dominated the global life science tools industry with the largest revenue share of 42.56% in 2024.

- The life science tools industry in the U.S. dominated the North America region, primarily due to its advanced healthcare infrastructure and substantial investment in biomedical research.

- By technology, the cell biology segment held the largest revenue share of 32.93% in 2024.

- By end use, the healthcare segment held the largest life science market revenue share of 31.92% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 167.82 Billion

- 2033 Projected Market Size: USD 401.01 Billion

- CAGR (2025-2033): 10.21%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

AI-Driven Transformation in the Life Science Tools Market

Artificial Intelligence (AI) is rapidly speeding up the life science tools sector, becoming part of research and development processes. Companies are increasingly utilizing AI to augment data analysis functions, simplify complex biological experiments, and speed up the discovery of new therapeutics. The incorporation of AI in life science tools enables researchers to analyze enormous data sets produced from genomics, proteomics, and metabolomics instruments at increased velocity and accuracy, significantly lowering discovery-to-application time.

Machine learning algorithms are used to discover molecular targets, predict drug response, and refine compound screening workflows. AI is also used to augment diagnostic imaging and pathology instruments for early and enhanced disease detection. These applications improve research results, facilitate regulatory compliance, and lower operational expenses by automating repetitive and data-driven tasks.

A key driver behind this trend is the growing volume of complex biological data and the need for more efficient tools to derive meaningful insights. Life science companies are increasingly partnering with AI technology providers to develop customized solutions tailored to research challenges. Cloud-based platforms and AI-as-a-service models further democratize access to advanced analytics, enabling even mid-sized firms and academic institutions to harness AI's potential without significant upfront investment in infrastructure.

Looking forward, the convergence of AI with next-generation sequencing (NGS), CRISPR gene-editing tools, and single-cell analysis are expected to redefine the capabilities of life science tools. As AI algorithms become more sophisticated and interpretable, their role will evolve from being a data-processing tool to a strategic asset driving innovation. Companies investing in AI-driven life science tools will likely gain competitive advantages through faster innovation cycles, improved product efficacy, and better alignment with personalized healthcare trends. This technological shift underscores the importance of AI as a catalyst for growth and transformation in the global life science tools industry.

Rising Government Investment in Life Science Technologies

Governments across the globe have realized that life sciences are key to tackling pressing health concerns such as pandemics, chronic diseases, and aging populations. As such, research, innovation, and infrastructure in biotechnology, genomics, molecular diagnostics, and personalized medicine receive sizeable funding. Public financing covers everything from basic research to commercializing state-of-the-art tools and technologies. Big sums are pledged through programs such as the U.S. National Institutes of Health (NIH) and Horizon 2020 of the European Union. These programs underscore gene editing, high-throughput screening, precision diagnostics, and lab automation, all pushing strong demand for advanced life science tools and growing the market.

Besides funding them directly, governments mostly invest in public-private partnerships, attracting venture capital and encouraging startups to commercialize undue innovation. Established companies equally benefit from the partnerships and funding that speed up product development and commercialization.

Market Concentration & Characteristics

The life science tools industry is characterized by a high degree of innovation, driven by rapid technological advancements, increasing investment in R&D, and growing demand for personalized medicine. Emerging fields such as genomics, proteomics, and AI-driven analytics are transforming research capabilities. At the same time, collaborations between academic institutions, biotech firms, and healthcare providers continue to accelerate the development of novel tools and solutions.

The life sciences industry is witnessing an increasing number of mergers and acquisitions to grow product portfolios, access cutting-edge technology, and fortify market positions. Therefore, companies opt for strategic consolidation to lay more emphasis on research, attain economies of scale, and fast-track innovation. For instance, in July 2025, Waters Corporation announced a USD 17.5 billion merger with BD’s Biosciences and Diagnostics Solutions in the USA, doubling its market to USD 40 billion and targeting USD 345 million in synergies by 2030. This trend is also triggered by competition, seeking integrated solutions, and focusing on new markets with high growth potential.

The regulator governs and substantially influences life sciences at varying stages of development. Its stringent guidelines strongly emphasize the safety and efficacy of products, while their quality generally captivates the public's confidence in their alliance in international markets. However, over the years, regulators have enhanced their approval processes for therapies and technologies on the cutting edge of scientific discovery. Such an evolving global regulatory landscape offsets investment, thus reducing time-to-market and fostering sustained industrial growth in all regions.

Companies in the life science industry are gaining traction from ongoing attempts to improve existing products and all biotech, diagnostics, and research tools. With the growing demand for precision medicine, molecular biology, and data-driven research, companies are adding new offerings to their stable products. For instance, in March 2025, Beckman Coulter Life Sciences launched the CytoFLEX mosaic Spectral Detection Module, the industry’s first modular spectral flow cytometry solution. This module enables up to 88 detection channels for advanced cellular analysis. The expanded catalog improves competitive positioning and provides customized solutions for the healthcare, pharmaceutical, and academic markets, resulting in greater innovation speed and larger customer capture.

Regional expansion plays an important role in accelerating the growth of the life science industry around the world. North America and Europe led the way, based on their research infrastructure, their significant investments in biotechnology and pharmaceutical R&D, and their supportive regulatory environments. Moreover, both regions feature some of the best and oldest academic institutions, the highest percentage of adoption of advanced technologies, and the highest presence of industry players, contributing to innovative science and substantial scientific and commercial success globally.

Technology Insights

The cell biology technology segment held the largest revenue share of 32.93% in 2024. This can be credited to its significant contributions to drug discovery, cancer research, regenerative medicine, and vaccine development. Increasing demand for advanced cell analysis methods (flow cytometry and high-content screening) has also fueled segment growth. Furthermore, increasing investment in stem cell research and development of biologics has extended the application range for tools based in cell biology. Academic institutions and biopharmaceutical companies continue to adopt the tools, providing top-line revenue across global markets.

The genomic technology sector in the life science tools industry is anticipated to witness the fastest CAGR over the forecast period, supported by demand for personalized medicine, advancements in next-generation sequencing, and decreasing costs of genomic analysis. Rising research in gene therapy, cancer genomics, and rare diseases, as well as growing applications in clinical diagnostics, are also driving the adoption of genomic tools in research environments and healthcare settings.

Product Insights

The PCR & qPCR segment held the second largest revenue share of 18.91% in 2024, driven by their widespread adoption as essential tools in molecular biology research, clinical diagnostics, and pharmaceutical development. The growth comes from increasing rates of infectious diseases, increased demand for quick and accurate diagnostics, and growing use of PCR-based techniques in oncology, genetic testing, and personalized medicine. Moreover, continuous technological advances leading to higher sensitivity, a faster turnaround time, and better automation to improve efficiency and reliability have advanced their leadership position.

The next-generation sequencing segment is projected to witness the fastest CAGR during the forecast period, owing to increased clinical diagnostics, oncology, and personalized medicine usage. As sequencing accuracy, speed of sequencing, and cost have improved, NGS has become more accessible for clinical and research applications. Expanding use of NGS for population genomics, infectious disease monitoring, and biomarker discovery contributes to overall demand and positions next-generation sequencing as a major platform compatible with innovation in the life science tools industry.

End Use Insights

The healthcare segment held the largest revenue share of 31.92% in 2024. This segment has grown due to increased utilization of sophisticated research tools for diagnostic purposes, therapeutic development, and disease monitoring. Furthermore, the increasing investments in precision medicine, biologics, and clinical research have increased demand for life science technologies across hospitals, laboratories, and pharmaceutical settings. To complement these advancements, the increasing incidence of chronic and genetic diseases has contributed to faster integration of cutting-edge tools into the healthcare ecosystem.

The biopharmaceutical company segment is expected to grow fastest throughout the forecast period. This growth is linked to increasing demand for biologics, including monoclonal antibodies, cell and gene therapies, and vaccines. Efficiencies associated with bioprocessing innovations and the funding of R&D are contributing to innovation and productivity in the manufacture of biopharmaceutical products. Furthermore, the increasing prevalence of chronic and rare diseases and enabling regulatory support for new therapies induce the uptake of life science tools supporting novel biopharmaceuticals.

Regional Insights

North America life science tools industry dominated globally with the largest revenue share of 42.56% in 2024, driven by the presence of key market players, advanced research facilities, and substantial investment in the biotechnology and pharmaceutical R&D sector by government and private players. The region also benefits from high adoption of cutting-edge technologies, robust funding from both government and private sectors, and a well-established regulatory framework supporting innovation.

U.S Life Science Tools Market Trends

The U.S. life science tools industry was the largest market in the North American region in 2024, primarily due to its advanced healthcare infrastructure and substantial investment in biomedical research. The presence of leading biotech firms and academic institutions further drives innovation and adoption.

Europe Life Science Tools Market Trends

Europe life science tools industry holds a significant share of the global industry, supported by strong government funding, well-established research institutions, and a growing biopharmaceutical sector. Countries such as Germany, the UK, and France lead in adopting advanced technologies for genomics, proteomics, and cell biology research. Europe’s emphasis on sustainability and digital health further strengthens its position in the evolving global life science tools landscape.

The UK life science tools industry is experiencing strong growth, with robust government support, expanding biotech startups, and advanced research infrastructure. An increasing focus on genomics, precision medicine, and public-private partnerships is further accelerating market development

Germany life science tools industry is experiencing significant growth, driven by its strong pharmaceutical and biotechnology sectors, advanced manufacturing capabilities, and substantial R&D investment. Supportive government policies and a focus on innovation in diagnostics and therapeutics further accelerate market expansion.

Asia Pacific Life Science Tools Market Trends

Asia-Pacific life science tools industry is expected to grow at the fastest CAGR of 10.72% during the forecast period, owing to rising healthcare expenditure, expanding biotechnology and pharmaceutical industries, and increasing government initiatives to support life science research. For instance, in November 2024, Carl Zeiss AG inaugurated its first Global Capability Centre (GCC) in Bengaluru, India. Spanning 43,000 sq. ft. at Prestige Tech Park, the center focuses on cloud computing, cybersecurity, AI, and software development for its medical technology subsidiary, Carl Zeiss Meditec AG. Zeiss plans to double its Indian workforce to 5,000 by 2028, aligning with its broader expansion strategy in India. A large patient population, improving regulatory frameworks, and the presence of skilled scientific talent are attracting global players to expand their operations in the region, driving robust market growth.

China's life science tools industry is set to grow significantly, fueled by increased government investment in biotechnology, expanding pharmaceutical R&D, and a rapidly growing healthcare sector. The country focuses on innovation through strategic policies and funding for genomics, diagnostics, and drug discovery. In addition, the rise of local biotech firms and partnerships with global players is accelerating technology adoption and market expansion.

Japan's life science tools sector is advancing quickly due to the heavy prioritization of medical research, an aging populace requiring high-value healthcare options, and substantial government support for biotechnological innovation. For instance, in April 2025, U.S.-based Hapatune grew its global presence by establishing Hapatune GK in Tokyo to support life science marketing solutions for biopharma and tools suppliers in Japan and the Asia Pacific. Japan's advances in precision medicine, diagnostics, and regenerative therapies also support enhanced adoption of high-tech life science tools.

MEA Life Science Tools Market Trends

The Middle East and Africa life science tools industry is projected to drive the demand for life science tools and grow considerably due to rising investments in healthcare infrastructure, the rising incidence of chronic diseases, and the increasing interest in biomedical research. In the region, governments prioritize modernization and innovation in health care in their national strategies and through public-private partnerships. Sustainable growth in the life sciences tools industry is supported by improving regulatory environment in the region and a focus on local manufacturing in the health care sector.

Kuwait's life science tools industry is expected to grow consistently, resulting from increased investment in healthcare infrastructure, growing demand for new diagnostic technologies, and an increasing emphasis on research and development. With its established interest in improved healthcare and advances in innovative solutions, Kuwait is well positioned in the region's life science landscape.

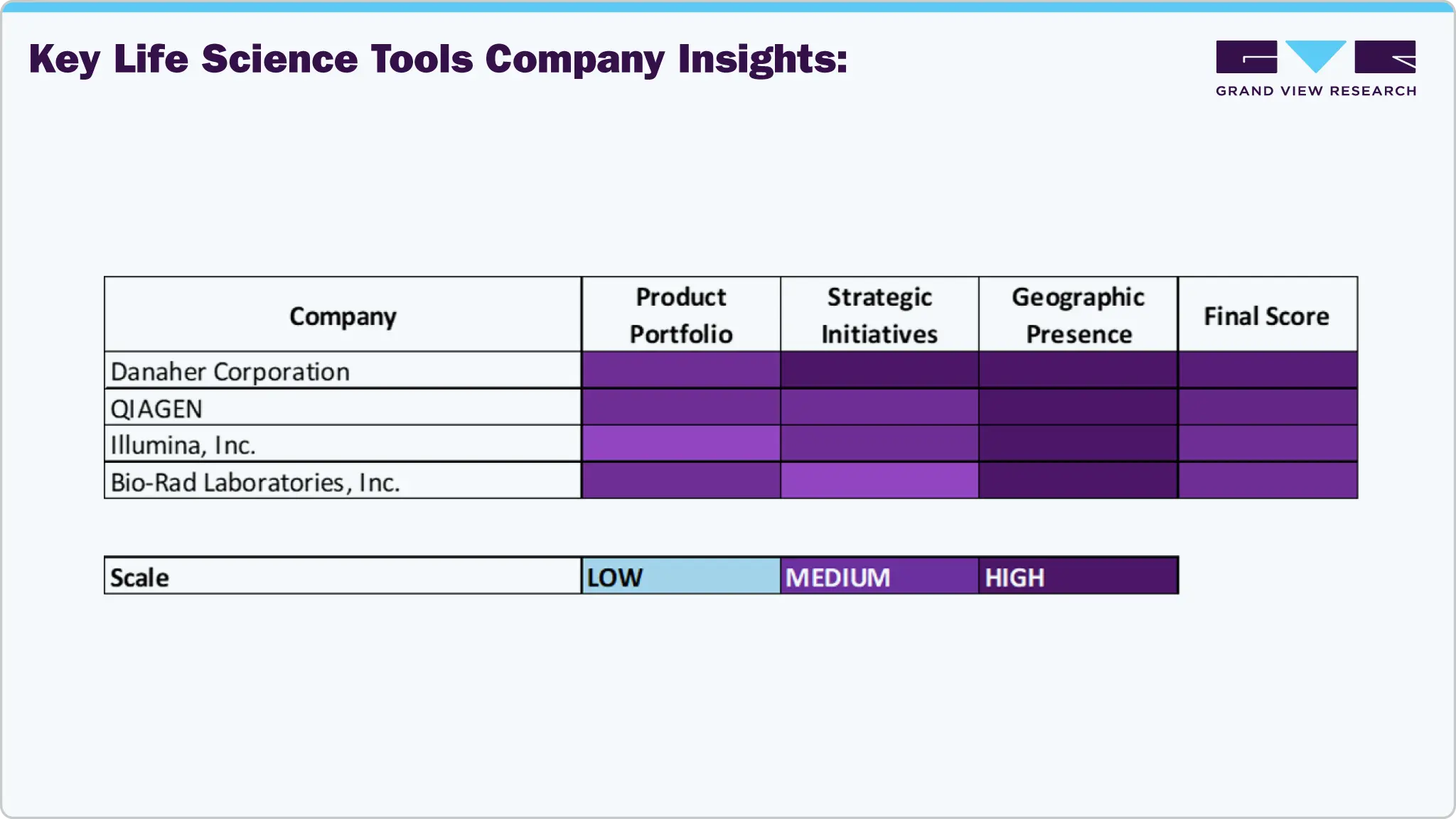

Key Life Science Tools Company Insights

The life science tools industry is both highly competitive and fast-changing. It is marked by frequent innovation, collaboration, and ongoing product advancement. Major industry players prioritize product portfolio expansion to satisfy the increasing demand in genomics, proteomics, cell biology, and bioinformatics. Acquisitions continue to be an important part of the strategy for companies to strengthen their market presence, further develop new technologies, and expand their footprint.

Companies increasingly integrate artificial intelligence, automation, and cloud-based platforms into their tools to deliver multifunctional, user-friendly solutions that streamline complex workflows in real time. The market is dominated by global leaders such as Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, and Illumina, who leverage expansive portfolios, R&D investment, and strategic partnerships to maintain their edge. At the same time, emerging Asian and European players are gaining momentum with cost-effective, innovative solutions. Meanwhile, startups in niche areas such as CRISPR, single-cell analysis, and AI-driven platforms are disrupting the landscape and attracting significant investor interest.

As companies aim to update their portfolios according to changing research priorities, regulatory changes, and healthcare trends, competition is expected to intensify. Success will increasingly rely on rapid innovation, comprehensive solutions, and strong customer support. Companies that anticipate scientific and technological changes and efficiently use resources will likely lead the next phase of growth in this competitive market.

Key Life Science Tools Companies:

The following are the leading companies in the life science tools market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Merck KGaA

- Shimadzu Corporation

- Hitachi, Ltd.

- Bruker Corporation

- Oxford Instruments plc

- Zeiss International

Recent Developments

-

In July 2025, Bio-Rad Laboratories expanded its droplet digital PCR offerings in the USA through the launch of four new platforms, including QX Continuum and QX700 systems, following its acquisition of Stilla Technologies.

-

In March 2025, Shimadzu Scientific Instruments opened a Boston, USA R&D lab to advance customer-driven pharmaceutical technologies, focusing on mass spectrometry, metabolomics, and collaborative product development.

Life Science Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 184.28 billion

Revenue forecast in 2033

USD 401.01 billion

Growth rate

CAGR of 10.21% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Switzerland; India; China; Japan; Australia; South Korea; Thailand; Singapore; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Agilent Technologies, Inc.; Becton, Dickinson and Company; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Illumina, Inc.; Thermo Fisher Scientific, Inc; QIAGEN N.V.; Merck KGaA; Shimadzu Corporation; Hitachi Ltd.; Bruker Corporation; Oxford Instruments plc; Zeiss International

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Life Science Tools Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the life science tools market report based on product & service, technology, end use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Culture Systems & 3D Cell Culture

-

Instruments

-

Consumables

-

Cell & Tissue Culture Services

-

-

Liquid Chromatography

-

Instruments

-

Consumables

-

Services

-

-

Mass Spectrometry

-

Instruments

-

Consumables

-

Services

-

-

Flow Cytometry

-

Instruments

-

Consumables

-

Services

-

-

Cloning & Genome Engineering

-

Kits, Reagents, and Consumables

-

Services

-

-

Microscopy & Electron Microscopy

-

Instruments

-

Consumables

-

Services

-

-

Next Generation Sequencing

-

Instruments

-

Consumables

-

Services

-

-

PCR & qPCR

-

Instruments

-

Consumables

-

Services

-

-

Nucleic Acid Preparation

-

Instruments

-

Consumables

-

Services

-

-

Nucleic Acid Microarray

-

Instruments

-

Consumables

-

Services

-

-

Sanger Sequencing

-

Instruments

-

Consumables

-

Services

-

-

Transfection Devices & Gene Delivery Technologies

-

Equipment

-

Reagents

-

-

NMR

-

Instruments

-

Consumables

-

Services

-

-

Other Separation Technologies

-

Instruments

-

Consumables

-

Services

-

-

Other Products & Services

-

Antibodies

-

General Supplies

-

Others

-

Instruments

-

Consumables

-

Services

-

-

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Genomic Technology

-

Proteomics Technology

-

Cell Biology Technology

-

Other Analytical & Sample Preparation Technology

-

Lab Supplies & Technologies

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government & Academic

-

Biopharmaceutical Company

-

Healthcare

-

Industrial Applications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Singapore

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global life science tools market size was estimated at USD 167.82 billion in 2024 and is expected to reach USD 184.28 billion in 2025.

b. The global life science tools market is expected to grow at a compound annual growth rate of 10.21% from 2025 to 2033 to reach USD 401.01 billion by 2033.

b. The cell biology technology segment dominated the market for life science tools and accounted for the largest revenue share of 33.94% in 2024.

b. Some key players operating in the life science tools market include Agilent Technologies; Becton, Dickinson and Company; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Bruker Corporation; Danaher Corporation; GE Healthcare; Hitachi, Ltd.; Illumina, Inc.; Merck KGaA; Oxford Instruments plc; Qiagen N.V.; Shimadzu Corporation; Thermo Fisher Scientific, Inc.; and ZEISS International.

b. Key factors that are driving the market growth include Increased government funding for life science technologies, growth of cell and gene therapies, rise in demand for biopharmaceuticals, technological advancements in life science tools, rise in the number of strategic deals & developments, and applications of genomic and proteomic technologies for precision medicine.

b. The cell culture systems and 3D cell culture segment dominated the market for life science tools and accounted for the largest revenue share of 16.48% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.