- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Mailer Packaging Market Size, Industry Report, 2033GVR Report cover

![U.S. Mailer Packaging Market Size, Share & Trends Report]()

U.S. Mailer Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Non-cushioned Mailers, Cushioned Mailers), By Insulation (Non-Insulated, Insulated), By Material Type (Paper, Plastic, Foil), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-671-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mailer Packaging Market Summary

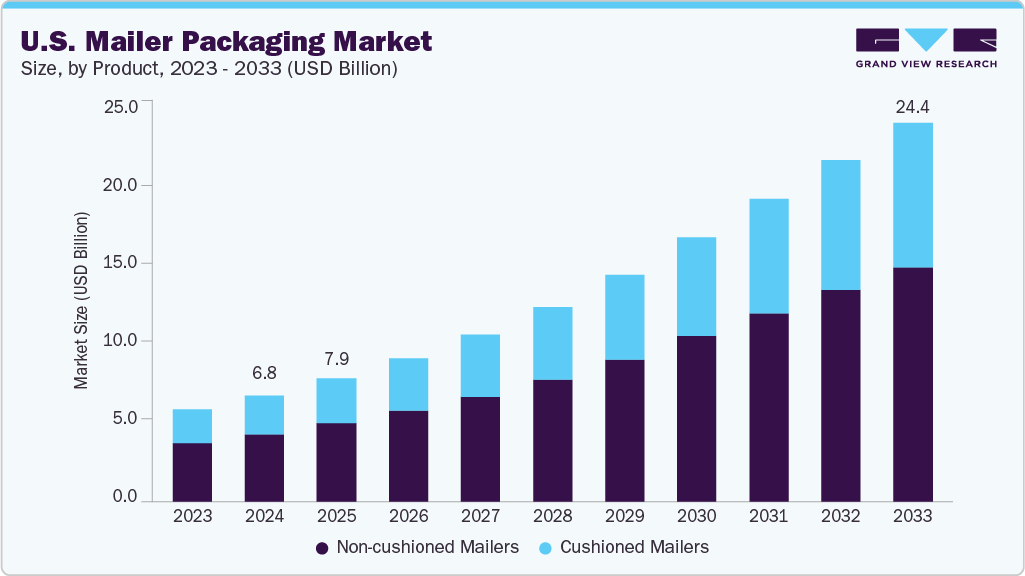

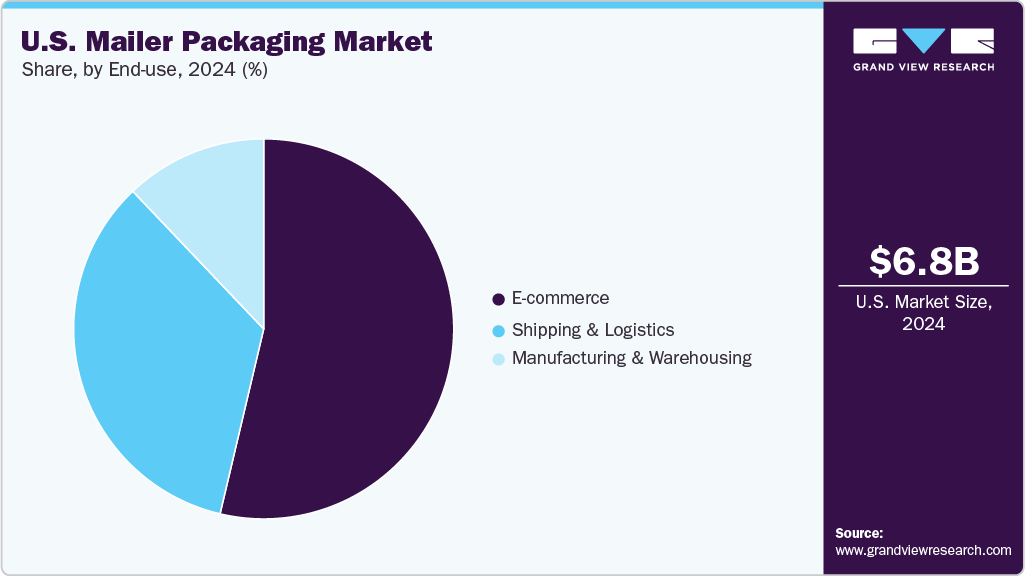

The U.S. mailer packaging market size was estimated at USD 6.82 billion in 2024 and is projected to reach USD 24.38 billion by 2033, growing at a CAGR of 15.1% from 2025 to 2033. The market is driven by the rapid growth of e-commerce and increasing demand for sustainable, lightweight packaging solutions.

Key Market Trends & Insights

- By product, the cushioned mailers segment is expected to grow at a considerable CAGR of 15.6% from 2025 to 2033 in terms of revenue.

- By insulation, the insulated segment is expected to grow at a considerable CAGR of 15.5% from 2025 to 2033 in terms of revenue.

- By material type, the paper segment is expected to grow at a considerable CAGR of 15.3% from 2025 to 2033 in terms of revenue.

- By end use, the e-commerce segment is expected to grow at a considerable CAGR of 15.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 6.82 Billion

- 2033 Projected Market Size: USD 24.38 Billion

- CAGR (2025-2033): 15.1%

Rising consumer preference for doorstep delivery and advancements in protective packaging technologies further boost market growth. The U.S. mailer packaging industry is primarily driven by the exponential growth of e-commerce, which has increased demand for durable, lightweight, and cost-effective packaging solutions. With online retail sales surpassing USD 1 trillion in 2022 (U.S. Census Bureau), businesses require mailers that protect goods during transit while minimizing shipping costs. For example, companies like Amazon and Shopify favor poly mailers and padded envelopes for small items like apparel and electronics due to their lightweight nature, which reduces freight expenses compared to rigid boxes. Additionally, the rise of subscription box services and direct-to-consumer (DTC) brands has further fueled demand for customizable and branded mailers that enhance unboxing experiences.Sustainability is another key driver, as consumers and regulators push for eco-friendly packaging alternatives. Many states, including California and New York, have implemented strict regulations on single-use plastics, pushing brands to adopt recyclable or compostable mailers. For instance, companies like EcoEnclose and noissue offer biodegradable mailers made from plant-based materials, appealing to environmentally conscious consumers. Major retailers, such as Walmart and Target, have also committed to reducing plastic waste, incorporating recycled-content mailers into their supply chains. This shift not only aligns with corporate sustainability goals but also helps brands differentiate themselves in a competitive market.

Technological advancements in smart packaging and automation are also shaping the market. Innovations like self-sealing adhesives, tamper-evident designs, and IoT-enabled tracking labels improve efficiency and security in logistics. For example, UPS and FedEx have integrated automated sorting systems that handle flexible mailers more efficiently than rigid boxes, reducing processing time. Additionally, brands like Salazar Packaging use AI-driven design tools to create optimized mailer sizes, minimizing material waste and lowering shipping costs. As automation and smart packaging solutions evolve, they will continue to drive efficiency, cost savings, and enhanced customer experiences in the mailer packaging industry.

Market Concentration & Characteristics

The U.S. mailer packaging industry features a moderately consolidated structure, where a few major players such as International Paper, PAC Worldwide, Sealed Air, Pregis, 3M, and ProAmpac dominate significant market share. These players have strong distribution networks and advanced production capabilities. However, there is still room for small to mid-sized regional firms offering niche solutions or focusing on sustainable or customized mailers. Strategic partnerships, acquisitions, and innovation-driven competition characterize the market dynamics.

The industry is demand-elastic, closely tied to trends in e-commerce, omnichannel retailing, and third-party logistics (3PL). With the U.S. e-commerce sector continuing to expand rapidly, mailer packaging has become a mission-critical element in logistics, fulfillment, and last-mile delivery. The ability to cater to fluctuating order sizes, high-speed fulfillment, and customer experience expectations (e.g., “unboxing”) makes this sector highly responsive to downstream market shifts.

Product Insights

The non-cushioned mailers segment recorded the largest market revenue share of over 60.0% in 2024. Non-cushioned mailers are lightweight, flat envelopes made from materials such as paper, plastic, or composite films without any internal padding. These mailers are predominantly used for shipping documents, clothing, brochures, and other flat, non-fragile items. Due to their slim profile, they offer cost savings on postage. They are space-efficient for storage and shipping, making them ideal for industries like apparel, publishing, and direct mail marketing.

The cushioned mailers segment is expected to grow at the fastest CAGR of 15.6% during the forecast period. Cushioned mailers are envelopes with built-in protective padding, commonly using bubble wrap or foam linings to safeguard fragile or sensitive items during shipping. These mailers are popular for electronics, cosmetics, books, and small consumer goods that require added protection from impact, vibration, or rough handling. They offer a compact yet protective alternative to box packaging and reduce the need for secondary protective materials like air pillows or void fill. The main driver behind cushioned mailers is the increased shipment of delicate consumer electronics, small gadgets, and beauty products through e-commerce platforms.

Insulation Insights

The non-insulated mailers segment recorded the largest market revenue share of over 90.0% in 2024. Non-insulated mailers are the most commonly used type of mailer packaging in the U.S., primarily made from materials such as kraft paper, polyethylene, or bubble linings. Their minimal material usage contributes to lower shipping costs and improved environmental sustainability when recyclable or biodegradable materials are used. The primary driver for non-insulated mailers is the booming e-commerce and direct-to-consumer retail industry in the U.S. The rise in small parcel shipping for apparel, electronics, accessories, and subscription boxes continues to create demand for lightweight and cost-effective packaging solutions.

The insulated segment is expected to grow at the fastest CAGR of 15.5% during the forecast period. Cushioned mailers are envelopes with built-in protective padding, commonly using bubble wrap or foam linings to safeguard fragile or sensitive items during shipping. These mailers are popular for electronics, cosmetics, books, and small consumer goods that require added protection from impact, vibration, or rough handling. They offer a compact yet protective alternative to box packaging and reduce the need for secondary protective materials like air pillows or void fill. The main driver behind cushioned mailers is the increased shipment of delicate consumer electronics, small gadgets, and beauty products through e-commerce platforms.

Material Type Insights

The paper segment recorded the largest market revenue share of over 50.0% in 2024 and is expected to grow at the fastest CAGR of 15.3% during the forecast period. Paper-based mailer packaging, including kraft paper mailers and padded paper envelopes, is gaining popularity in the U.S. due to its eco-friendly profile and ease of recyclability. The key driver for paper mailers is the growing consumer and regulatory demand for sustainable packaging solutions. With increased pressure from federal and state policies aimed at curbing single-use plastics (e.g., California’s Plastic Pollution Prevention and Packaging Producer Responsibility Act), brands are switching to renewable and recyclable alternatives. Additionally, paper mailers support a brand’s eco-conscious image, which is a decisive factor in attracting environmentally aware consumers.

Plastic mailers, often made from polyethylene (PE), remain a dominant material in the U.S. mailer packaging market due to their durability, water resistance, lightweight properties, and lower cost. They are widely used for shipping clothing, electronics, and other items requiring tamper resistance and protection from the elements. Plastic mailers continue to thrive due to cost-effectiveness, superior barrier properties, and compatibility with automated packaging lines. Many brands favor plastic due to its lightweight nature, which reduces shipping costs, and its ability to offer strong product protection. Furthermore, innovations in recycled plastics and biodegradable plastic films are helping companies meet sustainability goals without compromising functionality.

End Use Insights

The e-commerce segment recorded the largest market share of over 50.0% in 2024 and is projected to grow at the fastest CAGR of 15.5% during the forecast period. The e-commerce sector represents the largest end-use segment for mailer packaging in the U.S., driven by a rapid shift in consumer buying behavior toward online platforms. With increasing demand for cost-effective and brand-enhancing packaging solutions, many e-commerce retailers are adopting sustainable and customizable mailers that offer both product protection and an enhanced unboxing experience. The primary driver for mailer packaging demand in e-commerce is the exponential growth of online retail across categories, including fashion, electronics, and health products. The rising number of small businesses and D2C (Direct-to-Consumer) brands on platforms like Shopify, Etsy, and Amazon has further increased the consumption of mailer envelopes.

In the shipping and logistics segment, mailer packaging plays a vital role in streamlining operations and reducing freight costs. Logistics companies use mailers for non-fragile, compact goods where rigid boxes may be unnecessary. These mailers reduce dimensional weight charges and contribute to quicker processing and handling in automated sorting facilities. Large logistics players, including FedEx, UPS, and USPS, offer standardized mailer envelopes integrated with tracking and security features for reliable delivery. The key driver here is the increasing need for cost optimization and efficiency in last-mile delivery, especially amid rising fuel and labor costs. Lightweight mailers significantly cut shipping expenses and improve delivery turnaround.

Key U.S. Mailer Packaging Company Insights

The U.S. mailer packaging market is highly competitive, characterized by the presence of both large multinational players and smaller regional manufacturers competing on price, sustainability, and customization. Key differentiators include cost efficiency, supply chain reliability, and value-added features such as tamper-evident designs or branding capabilities. Private-label brands from retailers (such as Amazon’s frustration-free packaging) further pressure traditional suppliers, while sustainability regulations and consumer preferences drive competition toward greener alternatives. The market remains moderately consolidated, with competition hinging on scalability, technological advancements, and partnerships with e-commerce giants.

-

In March 2024, 3M launched the 3M Padded Automatable Curbside Recyclable (PACR) Mailer Material, a pioneering padded, paper-based mailer designed for shipping across industries that combines padding with recyclability. It is made from a single layer of durable, moisture-resistant kraft paper. this mailer offers robust protection against shipping hazards such as drops and vibrations while being over 99% repulpable and curbside recyclable where facilities exist.

-

In March 2024, Pregis LLC, a global provider of protective packaging, launched the EverTec Automated Mailer in North America. Made from specialty kraft paper, the mailer is designed to integrate seamlessly with Pregis’ Sharp MaxPro automated bagging machines, increasing throughput and efficiency while reducing freight costs for e-commerce businesses with medium- to high-volume packing requirements. The curbside-recyclable EverTec Automated Mailer is available in three stock sizes and offers one-color custom printing. This new solution addresses the growing demand for sustainable, paper-based packaging.

Key U.S. Mailer Packaging Companies:

- Mondi

- Henkel Corporation

- 3M

- Pregis LLC

- International Paper

- PAC Worldwide

- Sealed Air

- Pregis LLC

- ProAmpac

- Novolex

- Intertape Polymer Group (IPG)

- Georgia-Pacific LLC

U.S. Mailer Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.92 billion

Revenue forecast in 2033

USD 24.38 billion

Growth rate

CAGR of 15.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, insulation, material type, end use

Key companies profiled

Mondi; Henkel Corporation; 3M; Pregis LLC; International Paper; PAC Worldwide; Sealed Air; ProAmpac; Novolex; Intertape Polymer Group (IPG); Georgia-Pacific LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mailer Packaging Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. mailer packaging market report based on product, insulation, material type, and end use:

-

Product Outlook (Revenue, USD Million 2021 - 2033)

-

Non-cushioned Mailers

-

Cushioned Mailers

-

-

Insulation Outlook (Revenue, USD Million 2021 - 2033)

-

Non-Insulated

-

Insulated

-

-

Material Type Outlook (Revenue, USD Million 2021 - 2033)

-

Paper

-

Plastic

-

Foil

-

-

End Use Outlook (Revenue, USD Million 2021 - 2033)

-

E-commerce

-

Shipping & Logistics

-

Manufacturing & Warehousing

-

Frequently Asked Questions About This Report

b. The U.S. mailer packaging market is expected to grow at a compound annual growth rate of 15.1% from 2025 to 2033 to reach around USD 24.38 billion by 2033.

b. E-commerce emerged as the dominating end use segment in the U.S. mailer packaging market due to lightweight, cost-effective design that cuts shipping expenses and enhances protection for a wide array of product types.

b. The key players in the U.S. mailer packaging market include Mondi; Henkel Corporation; 3M; Pregis LLC; International Paper; PAC Worldwide; Sealed Air; ProAmpac; Novolex; Intertape Polymer Group (IPG); and Georgia-Pacific LLC.

b. The U.S. mailer packaging market is driven by the rapid growth of e-commerce and increasing demand for sustainable, lightweight packaging solutions. Rising consumer preference for doorstep delivery and advancements in protective packaging technologies further boost market growth.

b. The U.S. mailer packaging market was estimated at around USD 6.82 billion in the year 2024 and is expected to reach around USD 7.92 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.