- Home

- »

- Medical Devices

- »

-

U.S. Medical Device Contract Manufacturing Market, 2033GVR Report cover

![U.S. Medical Device Contract Manufacturing Market Size, Share & Trends Report]()

U.S. Medical Device Contract Manufacturing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Class I, Class II, Class III), By Services (Accessories Manufacturing, Assembly Manufacturing), By Therapeutic Area, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-633-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Medical Device Contract Manufacturing Market Summary

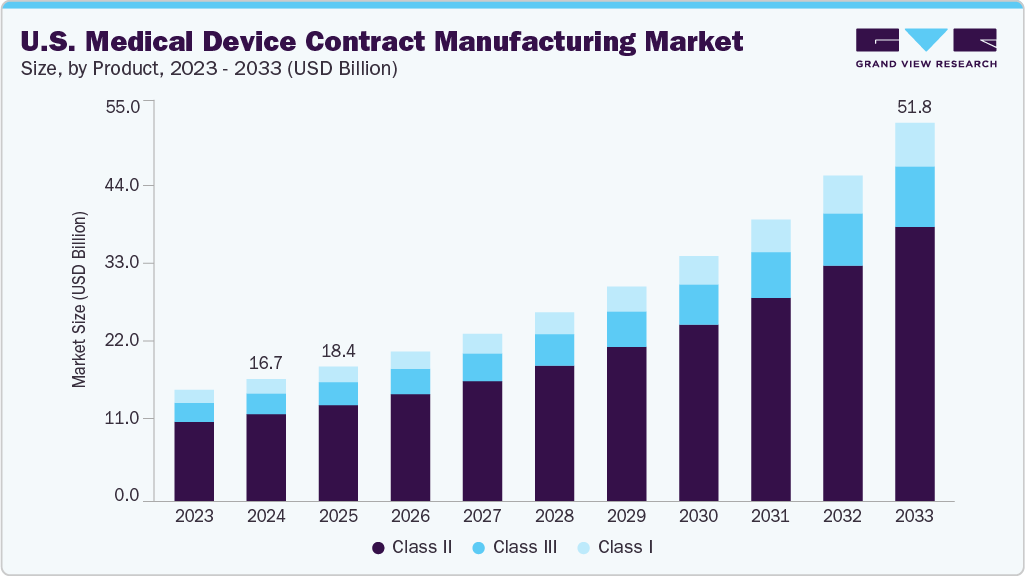

The U.S. medical device contract manufacturing market size was estimated at USD 16.72 billion in 2024 and is projected to reach USD 51.76 billion by 2033, growing at a CAGR of 13.77% from 2025 to 2033. The U.S. medical device contract manufacturing sector is witnessing significant growth, fueled by increasing incidence of chronic illnesses such as diabetes, cardiovascular issues, and cancer, rising outsourcing among small to medium sized original equipment manufacturers (OEMs), the growing complexity of medical technologies, rising demand for advanced, high-quality devices and growing need for cost-efficiency.

Key Market Trends & Insights

- U.S. medical device contract manufacturing market is anticipated to grow at a CAGR of 13.77% over the forecast period.

- By product, the Class II segment held the largest market share of 71.32% in 2024.

- Based on services, the accessories manufacturing segment held the largest market share in 2024.

- By therapeutic area, the cardiovascular devices segment held the highest market share in 2024.

- Based on end use, the original equipment manufacturers (OEMs) segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.72 Billion

- 2033 Projected Market Size: USD 51.76 Billion

- CAGR (2025-2033): 13.77%

ext-align: justify;">

Moreover, integration of automation, 3D printing, and smart manufacturing technologies to enhance precision and scalability is anticipated to drive the market growth. In addition, rising investments and strategic mergers and acquisitions in U.S. medical device contract manufacturing is expected to expand the market’s service portfolios, further contributing to market growth.

In addition, in the U.S. Original Equipment Manufacturers (OEMs) are increasingly outsourcing various production processes to improve operational efficiency, reduce capital expenses, and expedite product launches. These companies are increasingly shifting to CMOs to enhance their operations with standard quality, addressing the evolving demands of the medical device industry. Moreover, CMOs support facilitating faster market entry for medical devices, improving production and workflow efficiencies by managing multiple functional areas within production processes. Besides, medical devices companies are increasingly focusing on outsourcing a portion of their production further reducing the pressure on internal resources while maintaining lower costs. In addition, partnering with CMOs reduces the cost of device development by 10-30%, enabling further medical device companies to deliver innovative medical devices to stay ahead in a competitive market.

Moreover, in the U.S., strict regulatory standards imposed by the FDA necessitate contract manufacturers to establish comprehensive quality control systems, enhancing their competitiveness on a global scale. Moreover, with the increasing demand for smart and connected devices, medical device contract manufacturers are investing in Internet of Medical Things to focus on adhering the cybersecurity standards. In addition, trends such as reshoring and diversifying supply chains are expected to accelerate geopolitical developments and recent tariff adjustments, which further supports market growth.

Furthermore, the medical device manufacturers are increasingly witnessing increasing competition with rapid product development, increasing the need for contract manufacturers to address these challenges. Moreover, advancements in medical devices, such as minimally invasive techniques, wearable technologies, and diagnostic tools, combined with an increased focus on regulatory quality assurance are anticipated to drive the market growth over the estimated time period. These innovations are likely to enhance precision, scalability, and customization in the production of devices, particularly within minimally invasive and wearable technologies, as well as combination products. Thus, the U.S. medical device contract manufacturing market is expected to witness new opportunities within a technology-driven and innovation-centric landscape, addressing the evolving requirements of medical device companies by offering a wide array of services, including design, prototyping, assembly, testing, and regulatory compliance.

Opportunity Analysis

The U.S. medical device contract manufacturing market is driven by range of factors such as growing demand for outsourcing services from original equipment manufacturers (OEMs), advancements in technology, and a shifting trend toward reshoring. Besides, medical devices in the U.S. are becoming more sophisticated, integrating a range of software, sensors, and artificial intelligence. Thus, OEMs are increasingly turning to contract manufacturing organizations for their specialized engineering expertise, rapid prototyping, and scalable production capabilities.

In addition, the emergence of advanced manufacturing techniques such as additive manufacturing, micro-molding, and miniaturization is expected to create new growth opportunities, particularly in the development of wearables, diagnostics, and implantable devices. The rising need for digital health solutions and remote monitoring is anticipated to drive the demand for contract manufacturers skilled in electronics integration and wireless connectivity. Moreover, the trend of reshoring, driven by evolving geopolitical factors and tariff complexities, is expected to boost the prompt OEMs to reduce their dependence on overseas production, leading to increased demand for medical device contract manufacturing services. These manufacturers, which often provide cleanroom assembly, regulatory guidance, and vertically integrated solutions, are well-positioned to benefit from a more consolidated supplier strategy. In addition, the Mid-sized OEMs and healthtech startups are particularly important, as they tend to value flexible production capabilities, design-for-manufacturing services, and rapid time-to-market.

Impact of U.S. Tariffs on the U.S. Medical Device Contract Manufacturing Market

The U.S. tariffs had mixed impact on domestic medical device contract manufacturing sector. Tariffs imposed on imported components especially from China under Section 301 have raised the cost of raw materials, electronic parts, plastics, and metal components used in Class II and III devices. The increased input costs have led to margin pressure for contract manufacturers, particularly operating under fixed-price or long-term volume-based agreements. Besides, to mitigate the U.S. tariff impact, many U.S. CMOs have adopted cost-sharing models, renegotiated supplier contracts, and diversified sourcing to Mexico, Southeast Asia, or domestic suppliers. Moreover, at the same time, tariffs have created new opportunities by encouraging OEMs to reshore or nearshore production, thereby increasing domestic outsourcing requirements. This trend is particularly strong in categories like diagnostic devices, surgical instruments, and patient monitoring equipment. Furthermore, regulatory complexity and tariff uncertainty have led many OEMs to consolidate suppliers, preferring CMOs with integrated capabilities and supply chain resilience. While tariffs have added complexity and cost volatility, however, the impact has also supported to boost the new strategic initiatives, encouraging investment in automation, local sourcing, and expanded domestic capacity strengthening the role of U.S. based CMOs in the global medtech supply chain.

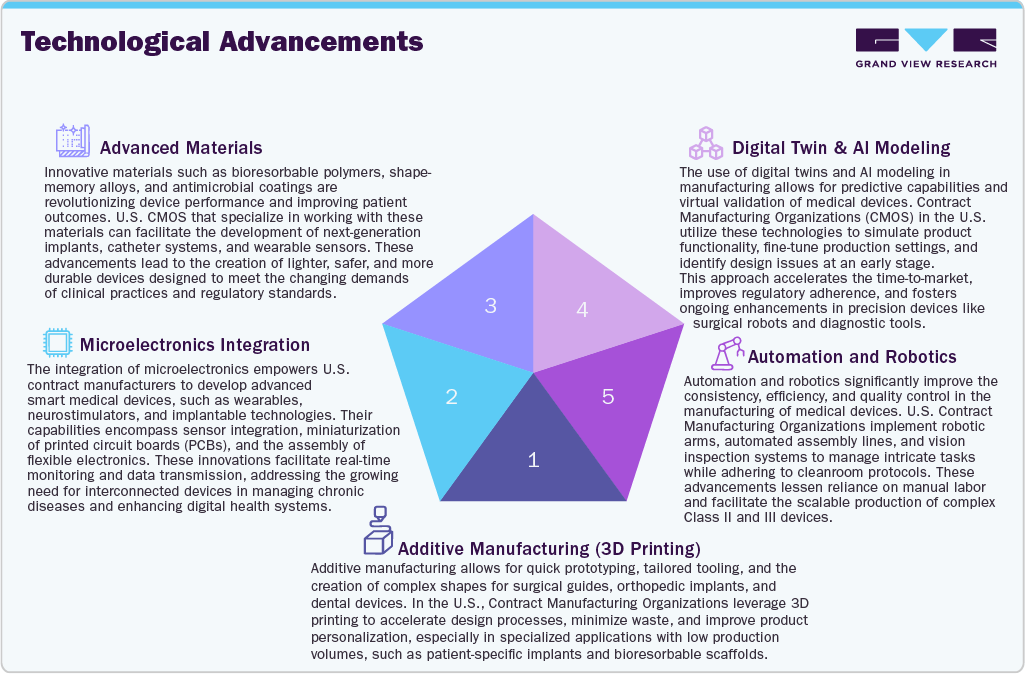

Technological Advancements

In U.S., the technological innovations are transforming the landscape of medical device contract manufacturing, facilitating faster development, increased accuracy, and enhanced patient outcomes. Among technological advancements, the additive manufacturing, or 3D printing is a commonly used method for prototyping and low-volume production of customized implants, surgical instruments, and anatomical models. This technological advancement not only shortens lead times but also offers significant design flexibility. Besides, the integration of microelectronics is essential for advancing next-generation devices, including wearables, neurostimulators, and diagnostic tools. Besides, the CMOs are increasingly investing in capabilities such as miniaturized PCB assembly, sensor embedding, and wireless connectivity to address the rising demand for smart, interconnected medical devices.

Moreover, automation and robotics are becoming more prevalent to enhance production uniformity and minimize human error in cleanroom settings. Robotic assembly, automated packaging, and visual inspection technologies improve both throughput and quality control, especially in high-precision device markets. The use of digital twins and AI modeling enables CMOs to simulate device performance, manufacturing processes, and anticipate failures prior to production, thereby boosting the medical device innovations and ensuring compliance with regulatory standards. Furthermore, the use of advanced materials like bioresorbable polymers, antimicrobial coatings, and shape-memory alloys is enhancing device designs. CMOs with expertise in materials science are well-positioned to drive innovation in implants, catheters, and diagnostic devices, positioning themselves as vital partners in the rapidly evolving medical technology landscape.

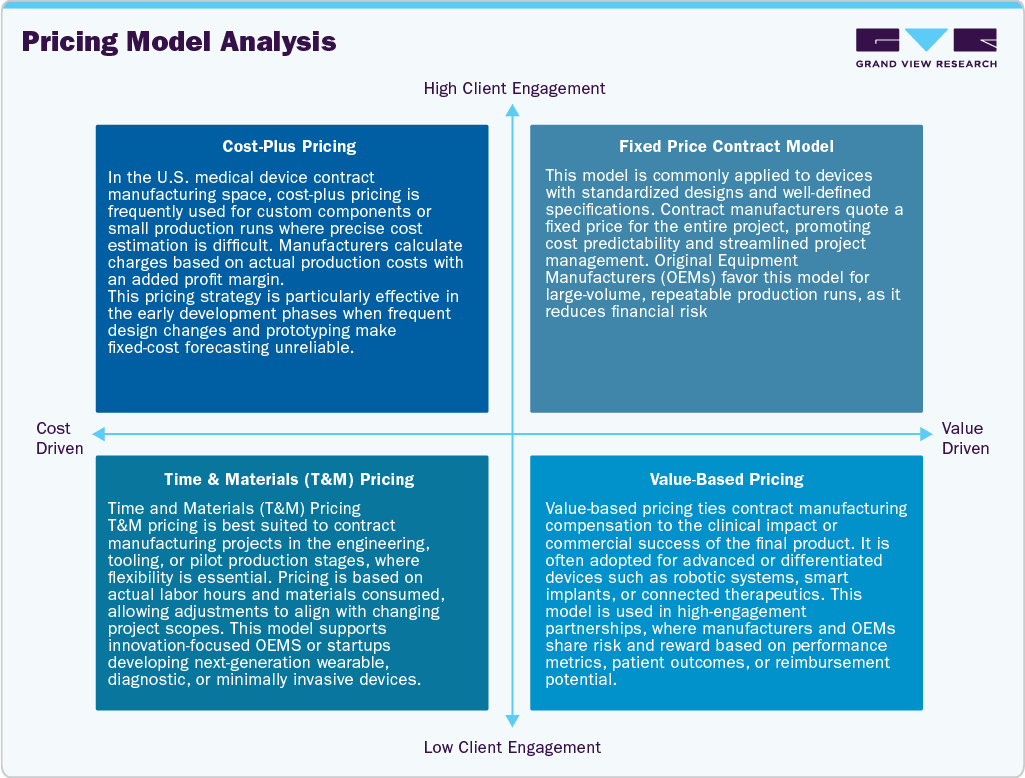

Pricing Model Analysis

In the U.S. medical device contract manufacturing sector, a variety of pricing models are utilized, based on various stages of the product lifecycle to meet diverse client requirements, production volumes, and regional market dynamics. The most common pricing models include cost-plus pricing, fixed-price contracts, and time and materials (T&M) pricing. Among the pricing model, the cost-plus pricing is a common approach for custom- products or pilot manufacturing.

In, cost-plus pricing model, the contract manufacturers charge the clients for the actual production and overhead costs, plus a negotiated markup, making it suitable for less visible projects like the next-generation diagnostic devices or Class III implantable that need iterative improvements.

Market Concentration & Characteristics

The U.S. medical device contract manufacturing market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

The U.S. market for contract manufacturing of medical devices is experiencing significant innovation, largely due to advancements in miniaturization, the integration of digital health technologies, and the use of additive manufacturing. Companies are leveraging AI, machine learning, and advanced robotics to improve precision and efficiency in production.

Regulatory frameworks like the FDA’s Quality System Regulation (QSR) and the Medical Device Regulation (MDR) for exports to Europe have a substantial impact on U.S. contract manufacturers. Adhering to ISO standards, validation protocols, and evolving cybersecurity regulations present both cost and procedural challenges; however, it is essential for ensuring product safety and facilitating market access.

Mergers and acquisitions are observed to be moderate to high as larger companies seek consolidation to enhance their capabilities in high-margin sectors such as diagnostics, robotics, and comprehensive development services. Strategic purchases are focused on firms with specialized expertise in regulatory compliance, additive manufacturing, and microelectronics to meet the demands of original equipment manufacturers (OEMs) and improve supply chain integration across essential device categories.

U.S. Contract Manufacturing Organizations (CMOs) are increasingly pursuing vertical expansion into research and development, regulatory consulting, and post-market services. Concurrently, they are diversifying into areas such as sterilization, packaging, and labeling. This transition towards comprehensive service offerings aligns with original equipment manufacturers' (OEMs) preference for single-vendor solutions, streamlining time-to-market and facilitating the management of complex device programs across diagnostics, surgical instruments, and therapeutic technologies.

Regional growth is concentrated in medical device hubs such as California, Minnesota, Massachusetts, and Texas, taking advantage of their proximity to original equipment manufacturers (OEMs), hospitals, and research institutions. In addition, contract manufacturing organizations (CMOs) are establishing secondary facilities in the Midwest and Southeast to benefit from reduced operational costs and improved logistics efficiency. Nearshoring to Mexico further supports U.S. production by managing volume-based manufacturing, allowing U.S.-based companies to concentrate on the development and production of high-value, low-volume, and regulatory-sensitive devices.

Product Insights

On the basis of product segment, in 2024, class II segment held the largest market share of 71.32%. The demand for Class II medical devices is driven by increasing regulatory requirements and applications in diagnostic, surgical, and therapeutic fields. Class II medical devices ideally involve moderate risk; however, they have higher risks than Class 1 but have lower risks than Class III devices. Besides, some Class II devices include infusion pumps, powered wheelchairs, surgical drapes, and diagnostic tools such as glucose meters, blood pressure monitors, and x-ray machines. This factor has led manufacturers to focus on enhancing precision and compliance with the FDA’s 510(k) premarket notification process.

Class I is anticipated to grow at the second-fastest CAGR over the forecast period. Class I medical devices increasingly witness prominent demand in the U.S. medical device contract manufacturing sector due to regulatory requirements, capacity for high-volume production, and growing demand for essential healthcare items. Some class I medical devices include surgical tools, bandages, examination gloves, and handheld diagnostic instruments. These generally fall under general control and do not require premarket approval, making them suitable for outsourcing. Moreover, the U.S. CMOs increasingly offer scalable and cost-effective manufacturing solutions that comply with FDA quality standards, further driving market growth. The growing focus on preventive healthcare, the needs of an aging population, and increased infection control practices are further driving the expansion of Class I device production. Such factors are expected to drive market growth

Services Insights

On the basis of services segment, the accessory manufacturing segment accounted for the largest market share in 2024. The accessory manufacturing is becoming a crucial aspect of the U.S. medical device contract manufacturing industry. The rising demand for customized, modular, and more functional devices drives the segment growth. Medical device accessories such as holders, battery packs, software interfaces, and disposable components are increasingly enhancing the core devices in various segments, including diagnostics, surgical applications, and patient monitoring. Moreover, OEMs increasingly shift towards U.S.-based contract manufacturers to handle accessory production, ensuring design compatibility, adherence to regulations, and timely delivery.

The device manufacturing segment is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is driven by increasing demand for high-quality, advanced technology products. Besides, the OEMs and pharmaceutical/biopharmaceutical companies are turning to contract manufacturing organizations (CMOs) to enhance their expertise in precision engineering, adherence to regulatory standards, and rapid prototyping. Moreover, growing expansion in surgical instruments, diagnostic devices, and minimally invasive technologies is expected to support the segment's growth. Furthermore, U.S. CMOs are increasingly focusing on providing comprehensive services in the changing landscape of healthcare manufacturing, driven by trends in reshoring, quality control requirements, and the need for quicker product launches, which further contribute to segment growth.

On the basis of the rapeutic area segment, the cardiovascular devices segment held the largest market share in 2024. Cardiology devices are driven by the increasing prevalence of heart-related conditions and the demand for innovative diagnostic and therapeutic solutions. The growing innovations of high-precision components such as stents, catheters, implantable monitors, and wearable cardiac devices are expected to drive the market growth. Besides, increasing innovation of minimally invasive techniques and remote monitoring for cardiovascular diseases is boosting the advancements and scalability of the devices. Moreover, the U.S. manufacturers have increased expertise in robust regulatory knowledge, maintain stringent quality control, and offer adaptable production capabilities, making them pivotal in advancing next-generation cardiology technologies and enhancing cardiovascular disease outcomes.

The surgical instrument segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is driven by rising innovative medical devices with precision, durability, and adherence to regulatory standards. Besides, OEMs are increasingly turning to CMOs specializing in advanced materials, micro-manufacturing, and rigorous quality control, further supporting an innovative range of surgical devices. Moreover, the U.S.-based CMOs are equipped to handle high-volume and customized production for various surgical applications, including general, orthopedic, and minimally invasive procedures, which further fuels the segment's growth. Thus, a growing focus on cost-effectiveness and advancements in surgical methods is expected to drive the segment growth over the estimated period.

End Use Insights

On the basis of the end use segment, the original equipment manufacturers (OEMs) segment accounted for the largest market share in 2024. Currently, original equipment manufacturers (OEMs) are witnessing a growing demand for contract manufacturing services, which allow them to outsource specialized design, engineering, and scalable production capabilities to external providers. This strategy enables OEMs to focus on their core competencies while mitigating the operational challenges and substantial capital expenses associated with maintaining in-house manufacturing facilities, ultimately enhancing their efficiency, reducing costs, and accelerating their time-to-market.

The pharmaceutical & biopharmaceutical companies’ segment is expected to grow at the second fastest CAGR during the forecast period. Pharmaceutical and biopharmaceutical companies in the U.S. are increasingly partnering with medical device contract manufacturers to drive the development and production of drug-device combination products, delivery systems, and companion diagnostics. This shifting trend is driven by the growing demand for biologics, personalized medicine, and self-administration devices, including auto-injectors and infusion pumps, which further contributes to market growth.

Key U.S. Medical Device Contract Manufacturing Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in March 2025, Flex announced the new product introduction center near Boston to serve healthcare consumers. This facility will focus on manufacturing, enhancing the comprehensive product development process from prototype to pre-clinical builds, design verification, & production transfer supporting customers get their products to market faster, at scale, and with less risk. This expansion builds on existing NPI capabilities in Flex's healthcare facilities across the globe, further enhancing the integrated, end-to-end solutions that clients depend on for delivering high-quality products at scale, with improved productivity and speed.

Key U.S. Medical Device Contract Manufacturing Companies:

- Jabil Inc.

- Terumo Corporation

- WuXi AppTec, Inc.

- Integer Holdings Corporation

- Flex Ltd.'s U.S

- Sanmina Corporation

- TE Connectivity

- Sonic Healthcare

- Forefront Medical Technology

- Nortech Systems

- Phillips-Medisize (a Molex company)

- Celestica HealthTech

- Viant Medical

Recent Developments

-

In April 2025, Nortech Systems Incorporated mentioned its refreshed brand, "Connections Reimagined." This rebranding reflects the modern and innovative approach to tackling complex challenges across critical industries. The company’s rebrand highlights position as a progressive partner, reaffirming unwavering commitment to deliver an excellent solution.

-

In November 2024, Viant announced the acquisition of Knightsbridge Plastics. This acquisition will increase the company’s ability to produce specialized plastic injection-molded parts & intricate micro-components, which are in growing demand for next-generation medical devices and advanced drug delivery systems. Furthermore, the acquisition expands Viant’s global network of centers of excellence & strengthens its comprehensive solutions, encompassing the design and full-scale manufacturing of complex medical devices & components.

U.S. Medical Device Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.44 billion

Revenue forecast in 2033

USD 51.76 billion

Growth rate

CAGR of 13.77% from 2025 to 2033

Historical Year

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, services, therapeutic area, end use

Country scope

U.S.

Key companies profiled

Jabil Inc.; Terumo Corporation; WuXi AppTec, Inc.; Integer Holdings Corporation; Flex Ltd.'s U.S; Sanmina Corporation; TE Connectivity; Sonic Healthcare; Forefront Medical Technology; Nortech Systems; Phillips-Medisize (a Molex company); Celestica HealthTech; Viant Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Device Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. medical device contract manufacturing market report based on product, services, therapeutic area, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Class I

-

Class II

-

Class III

-

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Accessories Manufacturing

-

Assembly Manufacturing

-

Component Manufacturing

-

Device Manufacturing

-

Packaging and Labeling

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular Devices

-

Orthopedic Devices

-

Ophthalmic Devices

-

Diagnostic Devices

-

Respiratory Devices

-

Surgical Instruments

-

Dental

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Original Equipment Manufacturers (OEMs)

-

Pharmaceutical & Biopharmaceutical Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. medical device contract manufacturing market size was estimated at USD 16.72 billion in 2024 and is expected to reach USD 18.44 billion in 2025.

b. The U.S. medical device contract manufacturing market is expected to grow at a compound annual growth rate of 13.77% from 2025 to 2033 to reach USD 51.76 billion by 2033.

b. Class II dominated the U.S. medical device contract manufacturing market with a share of 71.32% in 2024. The segment growth is driven by increasing regulatory requirements and applications in diagnostic, surgical, and therapeutic fields. Class II medical devices ideally involve moderate risk; however, they have higher risks than Class I but have lower risks than Class III devices. Besides, the growing focus on remote monitoring and outpatient care further supports the demand for portable and user-friendly Class II devices.

b. Some key players operating in the U.S. medical device contract manufacturing market include Jabil Inc., Terumo Corporation, WuXi AppTec, Inc., Integer Holdings Corporation, Flex Ltd.'s U.S, Sanmina Corporation, TE Connectivity, Sonic Healthcare, Forefront Medical Technology, Nortech Systems, Phillips-Medisize (a Molex company), Celestica HealthTech, and Viant Medical, among others.

b. Key factors driving the U.S. medical device contract manufacturing market growth are the rising incidence of chronic illnesses such as diabetes, cardiovascular issues, and cancer, the rising outsourcing among small to medium-sized OEMs, the growing complexity of medical technologies, the rising demand for advanced, high-quality devices, and the growing need for cost-efficiency. Moreover, integration of automation, 3D printing, and smart manufacturing technologies to enhance precision and scalability is anticipated to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.