- Home

- »

- Advanced Interior Materials

- »

-

U.S. Metal Stamping Market Size, Industry Report, 2030GVR Report cover

![U.S. Metal Stamping Market Size, Share & Trends Report]()

U.S. Metal Stamping Market (2024 - 2030) Size, Share & Trends Analysis Report By Process (Blanking, Embossing), By Application (Automotive, Industrial Machinery), By Thickness (? 2.5 mm, < 2.5 mm), By Press Type (Mechanical, Hydraulic), And Segment Forecasts

- Report ID: GVR-4-68040-217-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Metal Stamping Market Size & Trends

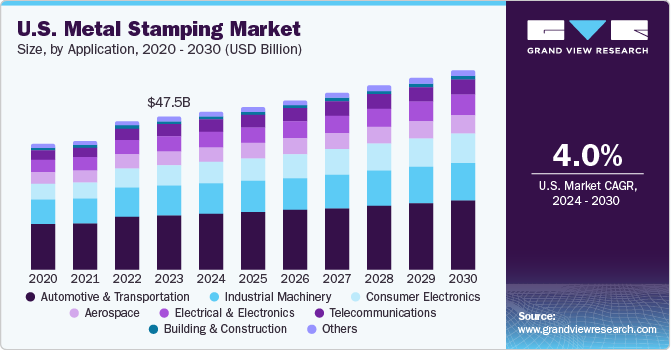

The U.S. metal stamping market size was estimated at USD 47.47 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.0% from 2024 to 2030. Growth is attributed to rise in construction, infrastructure development, and car manufacturing activities. Expansion of construction sector in the U.S. plays a significant role in fueling the need for metal stamping in the country. Moreover, the industry's growing inclination towards accurate metal components is favoring demand for metal stamping.

Escalating demand for smartphones, advent of artificial intelligence, dropping electronic prices, and product replacement cycles are factors that are anticipated to boost the growth of consumer appliances industry, thereby propelling the metal stamping demand over the forecast period.

Smartphone market is expected to generate a significant USD 60.8 billion sales by 2024 in the U.S. In addition, average volume per person in the U.S. smartphone market is predicted to be 0.4 pieces in 2024, and by 2028 the market is projected to reach a volume of about 141.2 million pieces. In realm of mobile phones, metal stamping is employed in production of antennas, frames, and camera lens mounts due to its superior tolerance, resistance to corrosion, electrical conductivity, and polished finish.

In addition, increasing acceptance of electric vehicles (EVs) in the U.S. will further stimulate the metal stamping market during the forecast period. The U.S., a notable automotive market with established industry players' manufacturing facilities, positively impacts the demand for metal stamping.

Ongoing product innovation and development can fuel market expansion. Introduction of new and improved products can draw in consumers and broaden market possibilities. Furthermore, changes in product-related regulations can influence market trends, presenting either growth opportunities or hurdles for companies in this sector.

Market Concentration & Characteristics

The U.S. metal stamping industry is characterized by the presence of numerous small and medium-sized manufacturers that cater to a variety of industries and applications. While there are major players who hold a substantial market share, the market landscape is defined by a plethora of different companies offering specialized products and services.

Market exhibits a moderately high degree of innovation, driven by widespread adoption of advanced automation. From robotic arms used for precise stamping processes to automated quality control systems, manufacturers are utilizing automation to boost efficiency, cut labor costs, and increase overall production rates. However, compared to other sectors such as technology and biotech, level of innovation in the market is not as high.

Rate of mergers and acquisitions in the market is moderate, with significant consolidation observed particularly among small businesses seeking economies of scale and large companies aiming for market expansion. For Instance, In July 2023, D&H United, a company providing testing and inspection services for fueling stations and electric-vehicle charging stalls, acquired Tanknology Inc., a Texas-based provider of environmental compliance and fuel-quality solutions, to broaden its service capabilities and geographic reach.

Potential for product expansion in the market might be limited due to its focus on producing metal components through the stamping process. However, there could be opportunities for companies to diversify their product range by incorporating complementary services such as assembly and finishing processes.

Process Insights

Blanking segment accounted for the largest market share of 26.4% in 2023. Growth is attributed to its cost-effectiveness and rapid production of identical components in bulk. These benefits have made blanking a popular choice in industries such as aerospace, automotive, and home appliances, where large-scale production is common. Blanking is a metal shaping process in which a piece of metal is detached from its original material and then used as the required blank or workpiece. Tools made from carbide or hardened steel are commonly used in the blanking process to work on metals like carbon steel, stainless steel, and aluminum.

Embossing also held a substantial market share in 2023, due to its ability to create various patterns and sizes based on roll dies. Embossing is a metal shaping process that creates raised or recessed designs or reliefs on sheet materials using matching male and female roller dies. Embossed tags are recognized for their strength and durability.

Moreover, bending segment also held a significant market share in 2023, owing to its strength and durability. Bending process involves applying pressure to a metal to a flat surface to achieve the desired shape. It is a straightforward method for manufacturing metal stamping parts and is cost-effective when used for small to medium metal quantities. Bent parts find use in various applications, such as wheels, door hinges, and engine assembly, in automobiles.

Application Insights

Automotive & transportation sector dominated the market and accounted for highest revenue share of nearly 36.0% in 2023. Increasing focus on reducing the weight of vehicles is anticipated to boost the demand for metal stamping in the forthcoming years. Automotive industry, which includes passenger cars, light commercial vehicles (LCVs), heavy-duty trucks, buses, and coaches, employs metal stamping parts in the manufacture of body panels to adhere to safety standards and manage end costs.

Additionally, the process is extensively used for underbody components. While the upper body of EVs has not seen much change compared to traditional vehicles, there is a significant potential for metal stamping in the underbody as the constantly evolving battery packaging necessitates a different structure. Therefore, the rising production of EVs is expected to benefit market growth in the coming years.

Industrial machinery segment also held a notable market share in 2023, driven by the expansion of the manufacturing sector. The sector is experiencing the integration of various automated and intelligent industrial solutions, which is anticipated to stimulate market growth further. In addition, industrial machinery forms a crucial part of metal stamping market, and the industrial equipment, which relies on extreme precision, is employed in several industries such as agriculture, construction, and power generation, thereby driving the market growth.

Consumer electronics segment held a considerable market share in 2023, attributed to the increasing use of lightweight metal components to enhance durability of electronics. Metal components are replacing their plastic equivalents to improve impact resistance of electronic products. Consequently, demand for metal-stamped parts in the consumer electronics application segment is projected to increase significantly over the forecast period.

Press Type Insights

Mechanical press category led the market and accounted for the largest market share of more than 47.0% in 2023. This growth is due to its high-speed capabilities, making it well-suited for stamping applications. Mechanical presses provide quick and consistent operations, leading to cost efficiencies in large-scale production. Moreover, these presses are eco-friendly as they do not utilize hydraulic oil, thus eliminating the risk of oil spills or leaks. Mechanical presses, characterized by their rapid and continuous pressure application over a limited distance, are commonly used for sheet metal processing.

Hydraulic press category also secured a notable market share in 2023. This growth is attributed to its ability to exert more force than the mechanical press and offer a higher level of flexibility with adjustable stroke lengths, die space, and pressure levels. Hydraulic presses are often the preferred choice when fabricating components with intricate and deep shapes and where production speed is not the main priority.

Servo press segment is anticipated to witness the fastest growth due to its versatility, which allows it to be used for a broad range of stamping applications in metalworking. Servo presses are employed in the metalworking industry for precision metal forming processes, particularly stamping. They offer highly precise control over the ram's movement, including its speed, position, and force. Furthermore, they are adaptable and can easily transition between different tooling setups, making them perfect for handling various materials and part geometries.

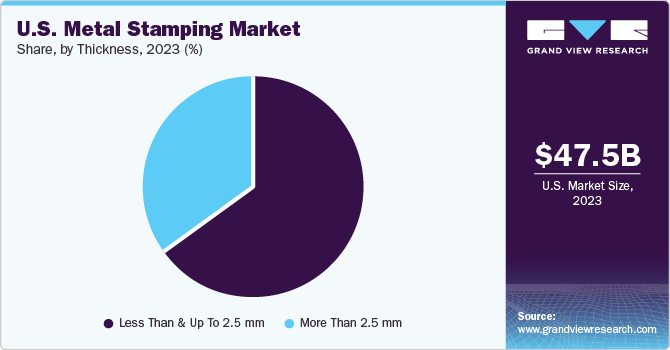

Thickness Insights

Based on thickness, less than or equal to 2.5 mm dominated the market and accounted for largest revenue share of over 64.0% in 2023. This growth is attributed to rising investments in the automotive industry, which has led to an increased usage of sheet metal of this thickness range in the forecast period. Sheet metal of less than 2.5 mm thickness is typically used in metal stamping applications. It is particularly suitable for fabricating small, precise components for electronic devices, such as components for batteries and circuit boards, and is commonly found in devices like laptops, smartphones, and tablets.

The segment, greater than 2.5 mm, also held a considerable market share in 2023. This is due to rising investments in construction industry, which in turn is driving the demand for sheet metal with this thickness over the forecast period. Sheet metal is available in various gauges, with medium gauges ranging from 3 mm to 6 mm. This gauge is frequently used for applications that require a fine balance between strength and formability.

Key U.S. Metal Stamping Company Insights

Market is characterized by intense competition with the presence of multiple participants. Many key players in the market are adopting strategies such as joint ventures, capacity expansions, and investments in new technologies.

Some of the key players in the market include Acro Metal Stamping; Clow Stamping Company; and D&H Industries, Inc.

-

D&H Industries, Inc. is known for its specialization in deep-drawn stampings, progressive stampings, and robotic welded assemblies, including resistance & MIG/TIG welding, as well as value-added assemblies. The company also produces a variety of simple components, including metal stamping, deep-drawn parts, welded fabrication, and lasered components.

-

Clow Stamping Company is involved in fabrication and stamping of metal components for various industries such as hydraulic, commercial refrigeration, exercise equipment, light & heavy equipment, recreational, and agriculture.

-

Goshen Stamping Company; Ford Motor Company; and Kenmode, Inc. are some other participants in the U.S. metal stamping market.

-

Kenmode, Inc. is a manufacturer of custom metal stampings and assemblies for industries like automotive, electronics, medical devices, and insert molding. The company offers a wide range of metal stamping services, including 3D tool design, in-house tool building, precision metal stamping, 3D high-speed hard milling, and EDM machining.

Key U.S. Metal Stamping Companies:

- Acro Metal Stamping

- American Industrial Company

- Clow Stamping Company

- D&H Industries, Inc.

- Ford Motor Company

- General Motors Co.

- Goshen Stamping Company

- Kenmode, Inc

- Klesk Metal Stamping Co.

- Tempco Manufacturing Company, Inc

Recent Developments

-

In November 2023, Generational Growth Capital, a Milwaukee-based equity firm, took over Federal Tool & Engineering, BP Metals, and Rockford Specialties, which are located in Wisconsin, Minnesota, and Illinois, U.S., respectively. These companies are known for their expertise in metal stamping and structural steel manufacturing. This acquisition is expected to offer various advantages to the new entity, such as the expansion of its manufacturing capabilities and the provision of uninterrupted delivery to customers through a robust logistics supply chain.

-

In June 2023, General Motors revealed plans to invest over USD 500 million in its assembly plant in Arlington, Texas, U.S., to manufacture next-generation SUVs. The investment is intended for the procurement of new equipment for metal stamping, the body shop, and other assembly parts.

-

In July 2022, Ford Motor Company announced an investment of R15.8 billion ($600 million) in its Silverton Assembly Plant operations in Pretoria, South Africa. This investment has led to the completion of one of its most significant and ambitious projects to date - a high-tech new Stamping Plant, which is now operational. The massive facility spans an impressive 10,320 square meters.

U.S. Metal Stamping Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 48.93 billion

Revenue forecast in 2030

USD 62.08 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Process, application, thickness, press type.

Key companies profiled

Acro Metal Stamping; Clow Stamping Company; Goshen Stamping Company; D&H Industries, Inc.; Ford Motor Company; Kenmode, Inc.; Klesk Metal Stamping Co.; General Motors Co.; Tempco Manufacturing Company, Inc.; American Industrial Company.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Metal Stamping Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. metal stamping market report based on process, application, thickness, and press type.

-

Process Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blanking

-

Embossing

-

Bending

-

Coining

-

Flanging

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive & Transportation

-

Industrial Machinery

-

Consumer Electronics

-

Aerospace

-

Electrical & Electronics

-

Telecommunications

-

Building & Construction

-

Others

-

-

Thickness Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than & up to 2.5 mm

-

More than 2.5 mm

-

-

Press Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mechanical Press

-

Hydraulic Press

-

Servo Press

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. biofuels market was valued at USD 31.93 billion in the year 2023 and is expected to reach USD 30.05 billion in 2024.

b. The U.S. biofuels market is expected to grow at a compound annual growth rate of 11.8% from 2024 to 2030 to reach USD 68.29 billion by 2030.

b. The liquid biofuel segment emerged as a dominating segment in the market with over a share of 49.0% in 2023 due to rising government funding.

b. The key market players in the U.S. biofuels market include Poet; Renewable Energy Group, Inc.; Clean Energy; Enviva; Green Plains, Inc.; Rentech; U.S. Gain; Gevo, Inc.; World Energy, LLC.; ECL Group; Viridos; Tri-State Biodiesel; NextEra Energy Seabrook, LLC; Rio Valley Biofuels

b. The key factors that are driving the U.S. biofuels market include, a shift towards low-carbon fuels and the presence of stringent environmental regulations in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.