- Home

- »

- Next Generation Technologies

- »

-

U.S. Mixed Reality Headset Market, Industry Report, 2030GVR Report cover

![U.S. Mixed Reality Headset Market Size, Share & Trends Report]()

U.S. Mixed Reality Headset Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Operating System, By Storage, By Charging, By End-user, By Industry, By Resolution, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-275-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mixed Reality Headset Market Trends

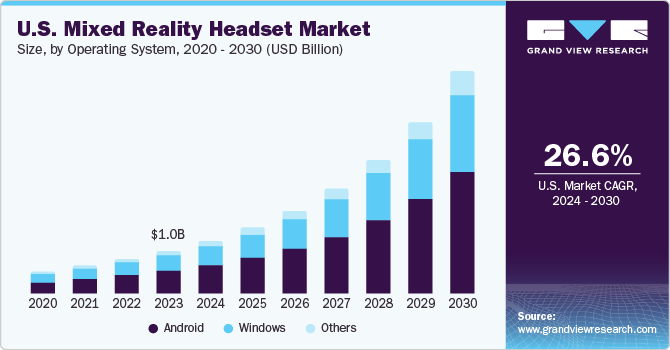

The U.S. mixed reality headset market size was estimated at USD 1.03 billion in 2023 and is projected to grow at a CAGR of 26.6% from 2024 to 2030. The market growth is driven by the emergence of the metaverse and the rising need for immersive gaming. Additionally, the development of 5G technology and the Internet of Things (IoT) is further expected to drive the growth of the market.

The metaverse is a collective virtual shared space created by converging physical and digital realities, enabling users to interact with a computer-generated environment and other users in real time. This concept has sparked interest in immersive technologies, such as mixed reality headsets, which blend virtual and augmented reality experiences. The demand for advanced mixed reality headsets increases as the metaverse gains traction across various industries, including entertainment, education, and business applications. U.S.-based companies are investing in innovative mixed reality headset technologies in response to this trend. For instance, in September 2023, Meta announced the launch of Meta Quest 3, a mass-market MR headset featuring Qualcomm's Snapdragon XR2 Gen 2 chipset, a 4K Infinite Display, and spatial surround sound. It is available in two variants 128 GB and 512 GB.

The increasing demand for immersive and interactive gaming experiences has led to a surge in the popularity of mixed reality headsets. These devices offer gamers a unique and immersive experience by seamlessly blending virtual and augmented reality elements into their gameplay. The adoption of mixed reality headsets has been fueled by technological advancements, which have led to the development of cutting-edge technologies such as higher resolutions, faster refresh rates, improved tracking capabilities, and more comfortable designs to provide a truly immersive gaming experience.

Moreover, the rising need for immersive gaming experiences is driving innovation in the market. Game developers are investing in developing state-of-the-art technologies to meet the demands of gamers, leading to the integration of mixed reality headsets with popular gaming platforms and titles, further fueling the market's growth. Game developers are creating content specifically designed for mixed reality headsets, offering players a wide range of immersive gaming experiences that take full advantage of the capabilities of these devices.

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The mixed reality headset industry is characterized by a high degree of innovation due to the rapid technological advancements driven by the increasing demand for higher resolution and framerate, better motion control, wider field of view (FOV), and a lighter and more comfortable headset body.

In the mixed reality headset market, mergers and acquisitions are becoming increasingly common as companies strive to enhance their product offerings, strengthen their positions, and gain a competitive edge. The need for technological advancements, industry expansion, and acquiring innovative technologies and intellectual property drives these strategic deals. By acquiring companies with advanced technology or expertise in optics, display technology, tracking systems, or software development, they can accelerate their product development and stay ahead of their competitors. In addition, these initiatives can help companies expand their industry reach, access new markets, distribution channels, and customer segments, increase their industry share and revenue, and diversify their product portfolio. MajorMega, Infinite Reality, Inc., and DIH Holding US, Inc. are the companies acquired by Bay Tech Entertainment, Newbury Street Acquisition Corporation (NBSTU), and Aurora Technology Acquisition Corp., respectively.

Component Insights

The hardware segment dominated the market with a revenue share of 72.4% in 2023, owing to the increasing popularity of virtual and augmented reality experiences. Consumers and businesses seek to create more immersive and engaging experiences, so the demand for high-performance hardware solutions has risen significantly. This trend is driven by the need for better quality visuals and sensory experiences, as well as the growing number of applications for mixed reality technology in industries such as gaming, education, healthcare, and retail. As a result, manufacturers are investing heavily in research and development to create innovative products that meet the evolving needs of their customers.

The service segment is expected to witness a rapid CAGR from 2024 to 2030. The increasing use of sophisticated technologies, including artificial intelligence (AI) and machine learning (ML), propels the market. These cutting-edge technologies are essential to the development of mixed reality solutions that can provide users with personalized and adaptive experiences. With AI and ML, mixed reality headsets can analyze user data and preferences to offer tailored experiences that meet individual needs. This level of personalization enhances user engagement and satisfaction, leading to a better overall experience.

Operating System Insights

The android segment captured the largest market share in 2023, owing to the widespread adoption of android-based devices, including smartphones, tablets, and other gadgets. The android platform's popularity and flexibility have made it a preferred choice for mixed reality headset manufacturers, enabling them to offer advanced features and functionalities to users. Additionally, the segment's growth can be attributed to the increasing demand for immersive gaming experiences, virtual tours, and other entertainment applications seamlessly supported by android-based mixed reality headsets.

The windows segment is expected to grow significantly from 2024 to 2030. The strategic partnerships and collaborations established by Windows with hardware manufacturers and content developers drive the segment. Such alliances facilitate the expansion of the availability of Windows Mixed Reality headsets, improve product offerings, and increase market penetration. The close collaboration with partners enables Microsoft to leverage its expertise and resources to enhance the overall ecosystem for mixed reality technology. For instance, in October 2022, Microsoft collaborated with Meta to bring Windows, MS Office, Teams, and Xbox Cloud Gaming to Meta Quest VR headsets.

Storage Insights

The <128GB segment held the largest market share in 2023, owing to the need for an entry-level product and the advent of cloud computing. Consumers often opt for headsets with lower storage capacities due to their affordability and suitability for casual usage. The accessibility of these headsets to a broader consumer base has played a pivotal role in contributing to the segment’s growth. Furthermore, technological advancements in cloud computing and streaming services impact the demand for mixed reality headsets with lower storage capacities. With the ability to offload processing and storage requirements to the cloud, users can access a wide range of content and applications without needing extensive onboard storage.

The >128GB segment is expected to witness the fastest CAGR from 2024 to 2030. The rapid advancements in mixed reality technology have paved the way for developing sophisticated applications and content that necessitate enhanced storage capabilities. As mixed reality headsets continue to evolve and offer advanced features, users are demanding devices that can accommodate larger files and deliver a seamless and uninterrupted immersive experience, thereby driving the demand for higher storage options. As a result, businesses and manufacturers must focus on creating devices with larger storage and cater to the growing needs of consumers to remain competitive in the market.

Charging Insights

The wired segment led the market in revenue share in 2023. This growth is attributed to the increasing need for quick and efficient charging solutions. Wired charging is the preferred method for powering up mixed reality headsets due to its reliability and speed. It ensures minimal downtime between uses, essential in professional settings where productivity is paramount. Wired charging extends the device's battery life by charging it correctly and efficiently, making it an essential component of modern mixed reality headsets.

The wireless segment is expected to grow substantially from 2024 to 2030. Wireless charging technology offers numerous advantages, such as eliminating cords and cables, which can be inconvenient and cumbersome for users. It is essential for mixed reality headsets that require significant power to operate and can quickly drain traditional batteries. Additionally, wireless charging also presents several safety benefits. Eliminating cords and cables reduces the risk of tripping or tangling, which can help prevent accidents and injuries. It is a useful technology for businesses and academic settings where safety is a top priority.

Industry Insights

The gaming segment dominated the market in 2023 due to technological advancements in mixed reality hardware and software. As manufacturers continue to improve the performance, graphics quality, and tracking capabilities of mixed reality headsets, gamers are presented with more sophisticated and visually stunning gaming experiences. These advancements attract gamers looking for cutting-edge technology and innovative gameplay features. Furthermore, the increasing popularity of e-sports is promoting market growth. According to the National Research Group, 72% of VR owners used it for playing games, 42% for media and entertainment, and 35% for exercising in 2022.

The media and entertainment segment is expected to grow at the fastest CAGR from 2024 to 2030. The increasing demand for immersive content consumption is a significant factor driving this segment. MR headsets offer users a unique and interactive way to experience movies, TV shows, live events, and virtual concerts in a more engaging and immersive format, enhancing the overall entertainment experience and providing a new level of immersion that traditional media platforms may not offer.

Resolution Insights

The HD segment held a significant market share in 2023. High-definition (HD) resolution has become increasingly popular in mixed reality headsets, especially in industries like healthcare. The medical field uses this technology for medical training and simulation, allowing medical professionals to train in a virtual environment that resembles real-life situations. The high resolution provides a more immersive and realistic experience, which is crucial in preparing healthcare workers for the complexities of their jobs. By using mixed reality headsets, medical professionals can hone their skills and improve their confidence in dealing with challenging scenarios without risking any harm to patients. Moreover, HD resolutions are much more cost-effective compared to higher-resolution MR headsets.

The 4K and above resolution segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to the increasing demand for ultra-high-definition visuals and immersive experiences. Users of mixed reality headsets demand unparalleled clarity, detail, and realism in virtual environments, making crucial feature for delivering lifelike and visually stunning experiences that can enhance immersion and engagement. Advancements in display technology and graphics processing capabilities are driving the segment’s growth. As manufacturers continue to improve the resolution, pixel density, and color accuracy of mixed reality headsets, users are presented with sharper, more detailed, and vibrant visuals that can elevate the quality of virtual content and applications to new levels. Higher resolutions enable users to experience virtual worlds with exceptional clarity and realism, enhancing their mixed reality experiences.

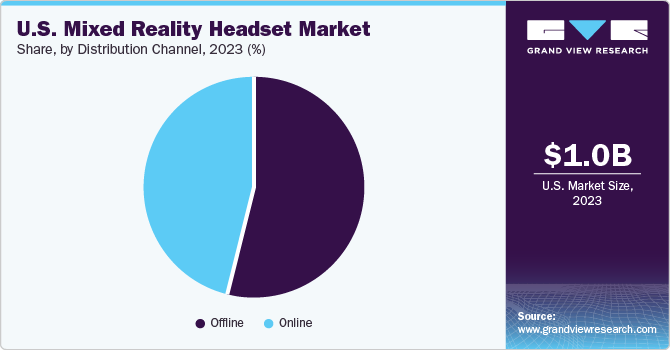

Distribution Channel Insights

The offline segment held the largest market share in 2023. The demand for personalized and hands-on experiences drives the segment. Users often prefer to try out physically, and experience mixed reality headsets before making a purchase decision. Offline distribution channels such as retail stores, trade shows, and experiential events allow users to interact with the devices, test functionalities, and assess comfort levels, leading to a more informed purchasing decision.

The online segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to the increasing prominence of e-commerce and online shopping. The rapid expansion of digital platforms and the widespread adoption of internet-enabled devices have revolutionized how consumers shop and conduct transactions, leading to a surge in online activities across various industries. E-commerce platforms provide consumers with a convenient and efficient way to browse, compare, and purchase products and services from the comfort of their homes or on the go. This shift towards online shopping has reshaped consumer behavior, preferences, and expectations, driving businesses to enhance their online presence and offer seamless digital experiences to attract and retain customers.

End-user Insights

The consumer segment dominated the market in 2023 and is expected to sustain its dominance. The growing popularity of gaming is one of the key market drivers. With technological advancements, gamers increasingly seek immersive and interactive gaming experiences. Mixed reality headsets provide a unique gaming experience that combines the real and virtual worlds, allowing gamers to interact with their environment in a new way. It has led to a surge in demand for mixed reality headsets in the gaming industry.

The military & government segment is expected to witness significant growth from 2024 to 2030 owing to the emergence of simulation training and mission planning. Creating realistic scenarios in a safe environment allows soldiers to develop skills and experiences crucial in real-world combat situations. Mixed reality headsets also enable military personnel to experience virtual simulations of complex equipment and machinery, which can improve maintenance and repair processes. Moreover, these devices are increasingly used by government organizations for various applications, including disaster response, law enforcement, and border security. In disaster response scenarios, mixed reality headsets can provide real-time information and situational awareness to first responders, allowing them to make more informed decisions.

Key U.S. Mixed Reality Headset Company Insights

Some key players operating in the market include Meta, Apple, Microsoft, and Google.

-

Meta, formerly known as Facebook, is a technology company that has been actively investing in the development of mixed reality offerings, aiming to revolutionize how people interact with each other and digital content. The company's Meta Quest Pro headset is one of the well-known AR and VR devices available worldwide.

-

Microsoft Corporation, commonly known as Microsoft, is a multinational technology company. It is one of the world's largest technology companies, known for its software products like the Windows operating system, Microsoft Office suite, and cloud services like Azure. Microsoft's HoloLens 2 is a high-end MR headset targeted towards enterprise applications. It is used in various sectors, such as healthcare, manufacturing, and training.

VRgineers and FYR Medical are some of the emerging market participants.

-

VRgineers is a Slovak-based company specializing in developing and producing virtual reality (VR) and mixed reality (MR) devices. VRgineers provide MR solutions for professionals. Their XTAL headset offers 180-degree FOV and 8K resolution.

-

FYR Medical is an organization that specializes in developing and providing mixed reality solutions for the healthcare industry. FYR Medical offers MR headsets for medical practitioners, providing digital information and augmented imagery.

Key U.S. Mixed Reality Headset Companies:

- Meta Platforms, Inc.

- Microsoft Corporation

- Apple Inc.

- Magic Leap, Inc.

- Google LLC

- Valve Corporation

- Dell Technologies, Inc.

- FYR Medical

- VRgineers, Inc.

Recent Developments

-

In June 2023, Meta Corporation announced the launch of its upcoming mixed reality headset, Quest 3. The Quest 3 is slimmer than the earlier version and offers a color-mixed reality experience. Additionally, the company has decided to reduce the prices of its current Quest 2 models while improving their performance. The Quest 3 is equipped with a new Qualcomm chipset that boasts double the graphics performance of the Quest 2.

-

In June 2023, Apple launched the mixed reality headset Vision Pro at Apple's Worldwide Developers Conference. The device is primarily designed for augmented reality and offers a virtual reality experience. One of its key features is the Digital Crown, which enables users to seamlessly switch between AR and VR, making it a hybrid of immersive VR headsets and AR glasses.

-

In February 2023, Samsung, Google, and Qualcomm joined forces to develop a mixed reality platform. The collaboration between these companies aims to create immersive digital experiences to challenge Meta and Apple in the industry.

U.S. Mixed Reality Headset Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.27 billion

Revenue forecast in 2030

USD 5.35 billion

Growth rate

CAGR of 26.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, operating system, storage, charging, end-user, industry, resolution, distribution channel

Key companies profiled

Meta Platforms, Inc.; Microsoft Corporation; Apple Inc.; Magic Leap, Inc.; Google LLC; Valve Corporation; Dell Technologies, Inc.; FYR Medical; VRgineers, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mixed Reality Headset Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mixed reality headset market report based on component, operating system, storage, charging, end-user, industry, resolution, and distribution channel:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Headset

-

Microphone

-

Sensors

-

Depth Sensor

-

G-Sensor

-

Gyroscope

-

Proximity Sensor

-

Others

-

-

Display

-

LED Technology

-

LCD Technology

-

-

Battery

-

Processor

-

Camera

-

Speakers

-

Others

-

-

Controller

-

Sensors

-

G-Sensor

-

Gyroscope

-

Others

-

-

Battery

-

Others

-

-

Accessories

-

Casing & Covers

-

Wrist Wearable

-

Cables

-

Power Adapter

-

External Battery

-

Gloves

-

Full Body Trackers

-

Lenses

-

Strap Belts

-

Others

-

-

-

Software

-

Services

-

-

Operating System Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

Windows

-

Others

-

-

Storage Outlook (Revenue, USD Million, 2018 - 2030)

-

<128GB

-

>128GB

-

-

Charging Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Consumer

-

Military & Government

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Education

-

Gaming

-

Media and Entertainment

-

Healthcare

-

Retail and E-Commerce

-

IT & Telecom

-

Energy and Renewables

-

Oil and Gas

-

Automotive

-

Manufacturing

-

Sports

-

Others

-

-

Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

HD

-

4K and Above

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. mixed reality headset market size was estimated at USD 1.03 billion in 2023 and is expected to reach USD 1.27 billion in 2024

b. The U.S. mixed reality headset market is expected to grow at a compound annual growth rate of 26.6% from 2024 to 2030 to reach USD 5.35 billion by 2030

b. The hardware segment dominated the market with a share of 72.4% in 2023, owing to the increasing popularity of virtual and augmented reality experiences.

b. Some key players operating in the U.S. mixed reality headset market include Meta Platforms, Inc.; Microsoft Corporation; Apple Inc.; Magic Leap, Inc.; Google LLC; Valve Corporation; Dell Technologies, Inc.; FYR Medical; VRgineers, Inc.

b. Factors such as the emergence of the metaverse and the rising need for immersive gaming are driving the demand for mixed reality headsets in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.