- Home

- »

- Biotechnology

- »

-

U.S. Multiomics Services Market Size, Industry Report, 2033GVR Report cover

![U.S. Multiomics Services Market Size, Share & Trends Report]()

U.S. Multiomics Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Services (Research, Data Analysis), By Type (Single-cell Multiomics, Bulk Multiomics), By Application (Biomarker Discovery, Synthetic Biology), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-639-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Multiomics Services Market Trends

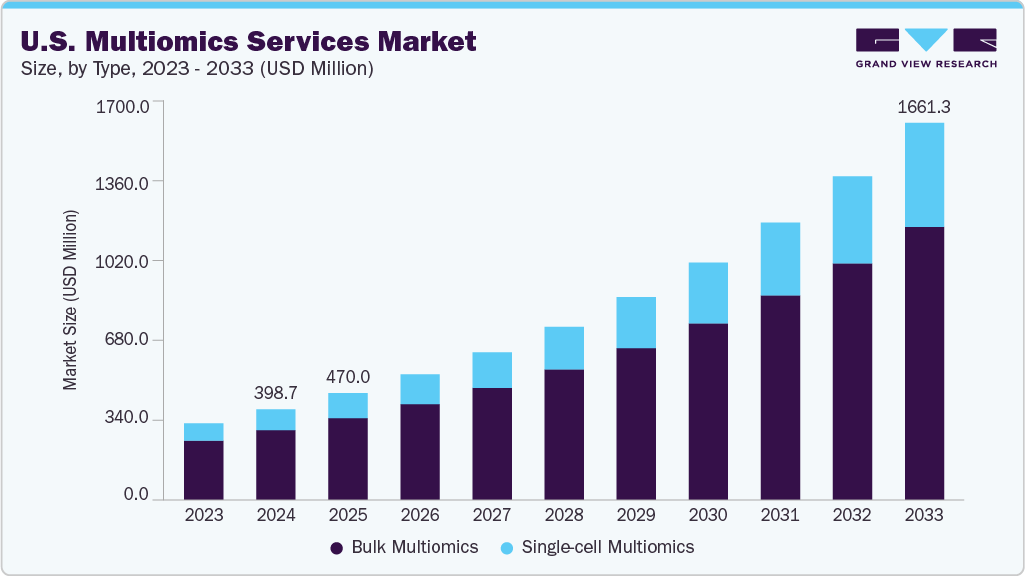

The U.S. multiomics services market size was valued at USD 398.7 million in 2024 and is projected to grow at a CAGR of 17.10% from 2025 to 2033. This growth is primarily driven by increasing demand for personalized medicine, the rising prevalence of chronic and complex diseases, and the growing need for integrated biological data to enhance diagnostic accuracy and treatment strategies. For instance, in June 2024, NVIDIA partnered with industry leaders in the U.S. to accelerate genomics, drug discovery, and healthcare innovation through advanced AI computing and collaborative technology initiatives. Moreover, advancements in data analytics, reduction in sequencing costs, and expanding research in fields like oncology and neurology are also accelerating the adoption of multiomics approaches across academic, clinical, and pharmaceutical settings.

Rising Prevalence of Chronic and Complex Diseases

The growing burden of chronic and complex diseases, including cancer, diabetes, cardiovascular disorders, and neurodegenerative conditions such as Alzheimer’s and Parkinson’s disease. For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in October 2024, chronic illnesses such as heart disease, cancer, and diabetes are the leading causes of death and disability in the U.S. Approximately 60% of Americans live with at least one chronic disease, while about 40% suffer from two or more chronic conditions. These illnesses often result from multifaceted interactions between genetic predispositions, environmental factors, and lifestyle choices, making their diagnosis and treatment highly challenging. Traditional diagnostic methods typically analyze single layers of biological information, limiting the ability to fully understand the underlying molecular mechanisms. Multiomics approaches overcome these limitations by integrating data from genomics, proteomics, metabolomics, and other biological domains to provide a comprehensive view of disease processes. This holistic understanding is critical for identifying early biomarkers, understanding disease progression, and developing effective, personalized therapeutic interventions.

As the prevalence of these diseases continues to rise, the demand for more precise and tailored healthcare solutions increases. Healthcare providers, pharmaceutical companies, and research institutions increasingly adopt multiomics services to address this need. By leveraging multiomics data, researchers can discover novel drug targets and biomarkers, leading to the development of targeted therapies and improved clinical outcomes. Moreover, multiomics-based diagnostics enable earlier and more accurate detection of diseases, which is essential for effective treatment and management. Therefore, the increasing incidence of chronic and complex diseases is a significant driver of growth in the U.S. multiomics services market, supporting the shift toward precision medicine and innovative healthcare solutions.

Advancements in Technology and Data Analytics

Advancements in sequencing technologies, computational tools, and data analytics are critical in driving the growth of the U.S. multiomics services market. Over the past decade, sequencing costs have dropped dramatically, making whole-genome, transcriptome, and proteome analysis more accessible to researchers, clinicians, and pharmaceutical companies. This cost reduction, combined with the increasing speed and accuracy of next-generation sequencing (NGS) and other molecular profiling platforms, has enabled the routine generation of large-scale multiomics datasets. For instance, in October 2024, Illumina showcased its latest innovations in next-generation sequencing (NGS) and multiomic technologies, highlighting advancements to improve genomic research, clinical applications, and data analysis efficiency. These technologies have become more user-friendly and scalable, supporting their integration into research and clinical workflows.

Significant progress in bioinformatics, machine learning, and AI-driven analytics has transformed how multiomics data are interpreted. Advanced computational platforms can now integrate and analyze large, complex datasets across multiple biological layers, discovering patterns and associations that would be impossible to detect through single-omics approaches. These tools support faster identification of disease mechanisms, drug targets, and predictive biomarkers, driving efficiency in drug discovery and precision medicine. As a result, both academic and industry stakeholders are increasingly investing in multiomics solutions to improve patient outcomes and accelerate innovation in healthcare and life sciences.

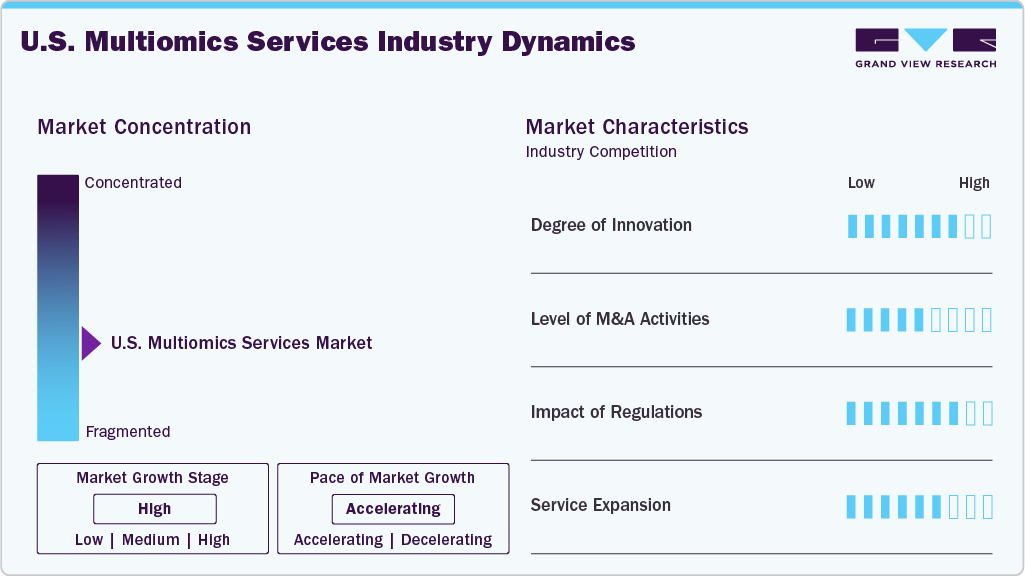

Market Concentration & Characteristics

The U.S. multiomics services industry is characterized by a high degree of innovation fueled by advancements in sequencing technologies, integration of multiple biological data types, and the growing use of artificial intelligence and machine learning for data analysis. Leading organizations and startups continuously develop cutting-edge platforms and cloud-based solutions that make multi-omics analysis more accessible and scalable, positioning the U.S. at the forefront of global multiomics research and application. For instance, in May 2025, Signios Bio launched its AI-driven bioinformatics and advanced multiomics platform in the U.S., aiming to transform precision medicine and drug discovery through cutting-edge technologies and data integration.

The level of mergers and acquisitions (M&A) activity in the U.S. multiomics services market has steadily increased, reflecting the growing demand for integrated and innovative solutions. Large pharmaceutical companies, biotech firms, and tech companies are actively seeking to expand their capabilities in multiomics to accelerate drug discovery, improve clinical diagnostics, and enhance personalized medicine. For instance, in October 2024, Vizgen and Ultivue merged to enhance spatial multiomics capabilities, aiming to drive innovation in disease mechanism insights and accelerate advancements in precision medicine and biomarker discovery, demonstrating how established players invest in high-growth market areas. The increased level of M&A activity in this space signifies both the market's maturation and the critical role multiomics will play in the future of healthcare.

Regulations play a significant role in shaping the U.S. multiomics services market, as they ensure data privacy, accuracy, and safety in research and clinical applications. The Food and Drug Administration (FDA) and the Centers for Medicare & Medicaid Services (CMS) oversee diagnostic tests and medical devices, including multiomics-based tools for patient treatment and diagnostics. Regulations surrounding genetic data, such as those outlined in the Genetic Information Nondiscrimination Act (GINA) and the Health Insurance Portability and Accountability Act (HIPAA), also impact the handling of sensitive biological information. While regulations introduce challenges, they also help build trust, promote innovation, and ensure that multiomics services meet high standards of quality and reliability.

Service expansion is a key growth driver in the U.S. multiomics services market. Companies strive to diversify their offerings and cater to the increasing demand for comprehensive, personalized healthcare solutions. Multiomics service providers are expanding their product portfolios to include advanced sequencing platforms, integrated data analysis tools, and cloud-based solutions for easier data access and collaboration. For instance, in April 2025, Metabolon launched a microbiome research solution combining a new microbiome panel, metagenomics sequencing, and multiomics bioinformatics tools to advance microbiome-based research and clinical applications. This service expansion enhances the capabilities of multiomics in understanding complex biological systems and paves the way for more targeted and personalized healthcare interventions.

Services Insights

The research services segment dominated the U.S. multiomics services market in 2024, driven by the increasing demand for advanced data analysis, disease understanding, and biomarker discovery across various therapeutic areas. Academic institutions, biotech firms, and pharmaceutical companies invest heavily in multiomics research to explore the molecular mechanisms of complex diseases and develop more targeted, personalized treatments. For instance, in March 2025, multiple industry leaders joined forces to advance single-cell spatial multiomics, aiming to enhance disease understanding and accelerate drug discovery through innovative technologies and integrated research approaches. As a result, this segment has captured the largest market share, with an ongoing trend of expanding capabilities in genomic sequencing, proteomics, metabolomics, and bioinformatics.

The data analysis services segment is expected to expand at the fastest CAGR during the forecast period, driven by the increasing complexity of multiomics data and the growing need for advanced analytics tools. For instance, in June 2024, a report highlighted how data-driven healthcare, powered by digital engineering, improves patient outcomes: the initiative leveraged AI, analytics, and digital tools to optimize healthcare delivery, enabling more accurate predictions, disease modeling, and the discovery of new biomarkers for personalized healthcare.

Type Insights

The single-cell multiomics segment is expected to expand at the fastest CAGR throughout the forecast period, driven by the increasing need for precise, cell-level insights into complex biological systems. As researchers and clinicians seek to understand cellular heterogeneity in diseases like cancer, neurodegenerative disorders, and autoimmune conditions, single-cell multiomics enables the analysis of individual cells across multiple biological layers, providing a deeper understanding of disease mechanisms and personalized treatment strategies. For instance, in September 2024, researchers published a study in Nature Communications, revealing advancements in multi-omics approaches to understanding complex diseases, integrating genomics, transcriptomics, and proteomics for deeper biological insights. This growing demand, combined with advancements in single-cell technologies and data analysis, is fueling rapid growth in this segment.

The bulk multiomics segment held the largest revenue market share in 2024, driven by the increasing demand for integrated multiomics data across various research and clinical applications. This segment involves analyzing multiple biological layers simultaneously, such as genomics, proteomics, and metabolomics, to gain comprehensive insights into complex diseases. The growing adoption of bulk multiomics solutions by research institutions, pharmaceutical companies, and diagnostic labs has solidified its leading position in the market.

Application Insights

The drug discovery & development segment dominated the market. It accounted for the highest revenue share of 35.52% in 2024. This dominance is driven by the increasing reliance on multiomics approaches to identify novel drug targets, understand disease mechanisms at a molecular level, and accelerate the development of personalized therapies. For instance, in March 2025, a groundbreaking approach in 3D multiomics was introduced to revolutionize drug discovery and precision medicine, enhancing the understanding of disease mechanisms and improving therapeutic development processes. As pharmaceutical companies continue to invest in more precise and effective drug development processes, integrating the multiomics services industry has become essential for improving the efficiency and success rates of clinical trials and drug formulations.

The synthetic biology segment is anticipated to grow at the fastest CAGR of 19.11% throughout the forecast period. This rapid growth is driven by the increasing applications of multiomics in designing and engineering biological systems for various purposes, including drug development, agriculture, and bio-based manufacturing. For instance, in February 2025, a new biweekly update in BioTechniques highlighted innovations in molecular precision through circular dichroism microspectroscopy and advancements in silico drug discovery, aiming to refine therapeutic development and molecular analysis. As advancements in synthetic biology continue to enable more precise modifications of genetic and metabolic pathways, integrating multiomics data will be crucial for optimizing synthetic biology processes and ensuring more efficient, sustainable outcomes.

End-use Insights

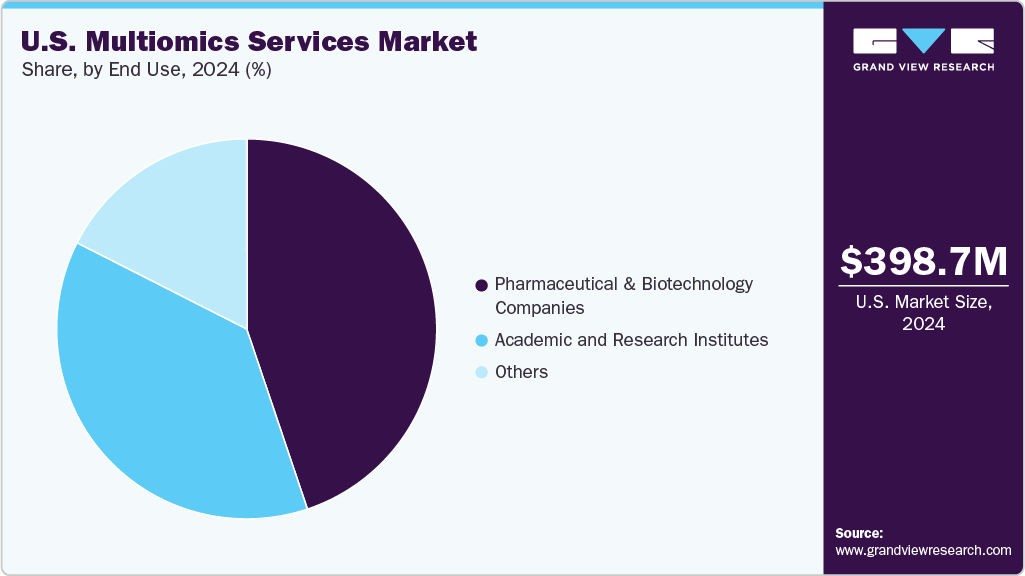

The pharmaceutical and biotechnology companies segment dominated the market in 2024, capturing the largest share of 44.83%. This dominance is largely attributed to these companies' investments in multiomics to enhance drug discovery, biomarker identification, and personalized treatment strategies. For instance, in April 2025, MultiOmic Health and Alloy Therapeutics collaborated to discover and develop renal tissue-targeting drugs, combining advanced multi-omics technologies with innovative therapeutic approaches to address kidney diseases. By leveraging multiomics technologies, pharmaceutical and biotech firms can gain deeper insights into disease mechanisms, improve the precision of clinical trials, and accelerate the development of novel therapies, driving their leading position in the multiomics services industry.

The academic and research institutes segment is anticipated to grow at a significant CAGR throughout the forecast period. This growth is driven by the increasing adoption of multiomics approaches in academic research, where they are leveraged to explore complex biological processes, discover new biomarkers, and gain deeper insights into disease mechanisms. As funding for scientific research continues to rise, alongside the growing demand for more accurate and comprehensive data across fields like genomics, proteomics, and systems biology, academic and research institutes are positioned to play a critical role in advancing the application of multiomics technologies. For instance, in September 2023, the National Institutes of Health (NIH) awarded USD 503 million to support multiomics research to advance human health, deepen understanding of disease mechanisms, and drive innovations in precision medicine and biomedical discoveries.

Key U.S. Multiomics Service Company Insights

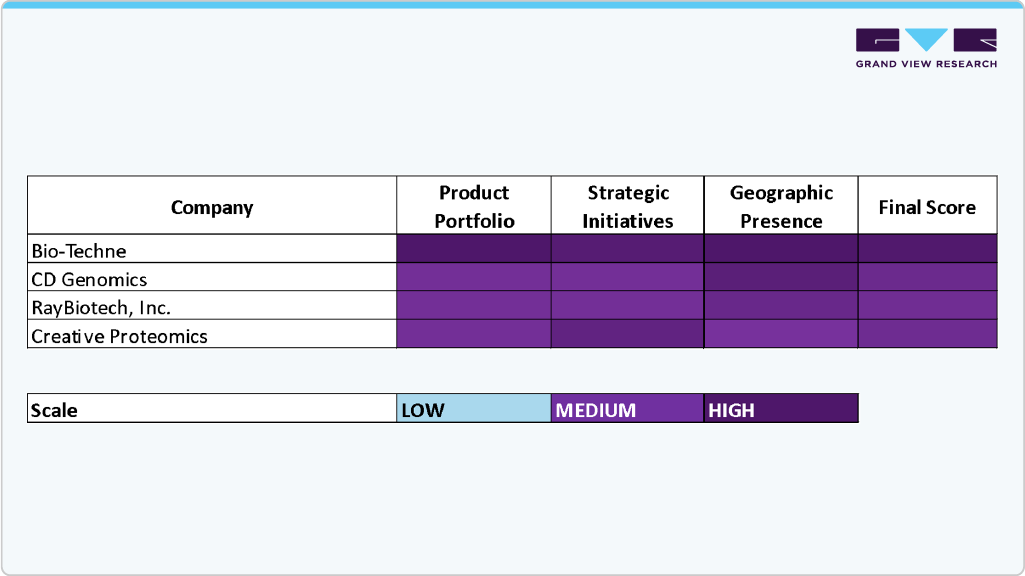

The U.S. multiomics services market is shaped by a diverse range of companies known for their robust service offerings, cutting-edge research capabilities, and strong customer bases across the healthcare, pharmaceutical, and biotechnology sectors. Leading players such as Bio-Techne, CD Genomics, RayBiotech, Inc., and Creative Proteomics have established strong market positions by offering a wide range of multiomics solutions, including advanced data analysis tools, sequencing platforms, and integrated services for genomics, proteomics, and metabolomics. These firms continue to innovate through substantial R&D investments, strategic partnerships, and expanding their product portfolios to meet the growing demand for personalized healthcare solutions and more precise disease diagnostics.

Companies like Psomagen, Source BioScience, and Persistent Systems have strengthened their market presence by offering specialized services in genomic sequencing, bioinformatics, and tailored multiomics solutions for researchers and healthcare providers. Their ability to provide high-quality, scalable, and regulatory-compliant services has made them essential partners for pharmaceutical and biotech companies seeking to integrate multiomics into their drug development pipelines. These firms also play a key role in advancing precision medicine by leveraging multiomics data to uncover disease mechanisms and identify novel therapeutic targets.

Emerging players such as Metware Biotechnology Inc., Dalton Bioanalytics Inc., and Sapient Bioanalytics, LLC are expanding their influence in the multiomics space through strategic investments, technological innovations, and custom offerings tailored to meet the needs of research institutions, clinical labs, and contract research organizations.

These companies are crucial for maintaining a stable and cost-effective supply chain for multiomics services, addressing key challenges such as data integration, scalability, and bioinformatics support. As the U.S. multiomics services market continues to evolve, the focus is on enhancing collaboration and developing comprehensive, end-to-end solutions that can accelerate scientific discoveries and improve patient outcomes in areas like oncology, neurology, and chronic diseases.

Key U.S. Multiomics Service Companies:

- Bio-Techne

- CD Genomics

- RayBiotech, Inc.

- Creative Proteomics

- Psomagen

- Source BioScience

- Persistent Systems

- Metware Biotechnology Inc.

- Dalton Bioanalytics Inc.

- Sapient Bioanalytics, LLC.

Recent Developments

-

In May 2025, Psomagen was selected as a key service provider for the Chan Zuckerberg Initiative's Billion Cells Project, utilizing Ultima Genomics' UG-100 sequencer to accelerate large-scale genomic research and innovation.

-

In April 2025, Leica Biosystems and Bio-Techne expanded their partnership to enable protease-free workflows for automated spatial multiomics on the BOND RX research staining instrument, enhancing precision and efficiency in biomarker research.

-

In April 2025, Source BioScience partnered with CCL to enhance its capabilities in genomic testing and precision medicine, aiming to advance diagnostic solutions and support critical healthcare innovations.

-

In June 2022, Bruker launched the timsTOF HT, which features an extended dynamic range to enhance unbiased, high-confidence 4D proteomics and offers significant advancements in proteomic research and biomarker discovery.

U.S. Multiomics Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 470.0 million

Revenue forecast in 2033

USD 1.66 billion

Growth rate

CAGR of 17.10% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, type, application, end-use

Key companies profiled

Bio-Techne; CD Genomics; RayBiotech, Inc.; Creative Proteomics; Psomagen; Source BioScience; Persistent Systems; Metware Biotechnology Inc.; Dalton Bioanalytics Inc.; Sapient Bioanalytics, LLC.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Multiomics Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the U.S. multiomics market on the basis of service, type, application, and end-use:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Research Services

-

Data Analysis Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-cell Multiomics

-

Bulk Multiomics

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Biomarker Discovery

-

Drug Discovery & Development

-

Synthetic Biology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic & Research Institutes

-

Pharmaceutical and Biotechnology Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. multiomics services market size was estimated at USD 398.7 million in 2024 and is expected to reach USD 470.0 million in 2025.

b. The U.S. multiomics services market is expected to grow at a compound annual growth rate of 17.10% from 2025 to 2033 to reach USD 1.66 billion by 2033.

b. Bulk multiomics dominated the U.S. multiomics services market with a share of 77.01% in 2024. This is attributable to rising adoption of bulk multiomics techniques for clinical research and development activities.

b. Some key players operating in the U.S. multiomics services market include Bio-Techne; CD Genomics; RayBiotech, Inc.; Creative Proteomics; Psomagen; Source BioScience; Persistent Systems; Metware Biotechnology Inc.; Dalton Bioanalytics Inc.; Sapient Bioanalytics, LLC.

b. Key factors that are driving the market growth include increasing demand for personalized medicine, the rising prevalence of chronic and complex diseases, and the growing need for integrated biological data to enhance diagnostic accuracy and treatment strategies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.