- Home

- »

- Renewable Chemicals

- »

-

U.S. Palm Oil Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Palm Oil Market Size, Share & Trends Report]()

U.S. Palm Oil Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Crude Palm Oil, Palm Kernel), By End-use (Food & Beverages, Biofuels, Personal Care & Cosmetics, Animal Feed), And Segment Forecasts

- Report ID: GVR-4-68040-521-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Palm Oil Market Size & Trends

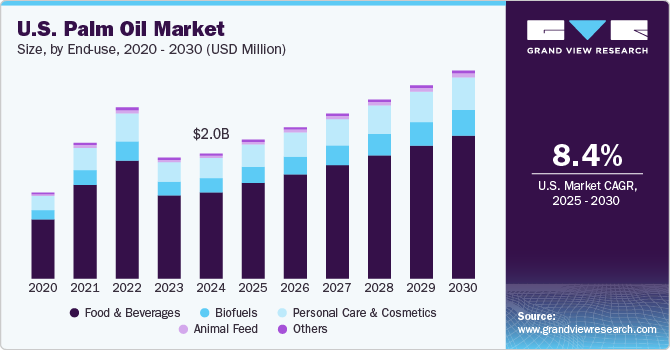

The U.S. palm oil market size was estimated at USD 2.02 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. The market is driven by exponentially growing demand from the food, beverage, biofuel, energy, personal care, and cosmetics industries. The market is highly competitive and comprehensive due to a large number of all-scale players trying to gain a competitive edge over others with their high production, superior distribution networks, product quality, and various competitive strategies.

Palm oil is one of the most consumed vegetable oils. It is used in several packaged product formulations that are readily available in supermarkets. The product is highly demanded in the formulation of ice cream, margarine, chocolates, and cookies as it imparts a smooth and shiny appearance and creamy taste and texture. The market demand is also driven by its neutral taste, desired melting points, health benefits, and versatile usage as an ingredient in cooking oils, frying fats, margarine, confectionery, supplements, and condiments.

Palm oil is purchased widely due to its cheaper prices compared to other vegetable oils. Developing economies have an advantage over production costs compared to developed countries. Manufacturers are still looking for better alternatives to reduce the total production costs of the product. Key players in the market are inclined toward complying with several production standards and competing over quality and prices.

Drivers, Opportunities & Restraints

The market is primarily driven by the increasing consumer preference for sustainable palm oil products, which is fueling demand for certified sustainable palm oil (CSPO). The growing biofuel market, which utilizes palm oil as a key feedstock for biodiesel production, also contributes significantly to market growth.

In addition, palm oil's versatility as an ingredient in various products, including food, cosmetics, and personal care items, coupled with its cost-effectiveness, makes it an attractive option for manufacturers in the US. The potential health benefits associated with palm oil, such as its antioxidant content, further contribute to the demand for palm oil-based products in the US market.

Environmental concerns surrounding deforestation, habitat loss, and biodiversity depletion associated with palm oil production create negative perceptions and consumer resistance. Health concerns related to palm oil's high saturated fat content also limit its wider acceptance, particularly in the food industry.

Price volatility due to global market trends, weather conditions, and geopolitical factors creates uncertainty for both producers and buyers. Furthermore, compliance with sustainability standards like RSPO certification can be costly and burdensome, especially for smaller producers. Competition from other vegetable oils, such as soybean and canola, also challenges palm oil's market share.

Growing demand for sustainable products allows for increased market penetration of certified sustainable palm oil (CSPO), offering a premium price point and appealing to environmentally conscious consumers. Expansion in the biofuel sector, driven by government mandates and incentives, provides a significant avenue for palm oil utilization in biodiesel production. Product innovation, such as developing palm oil-based ingredients with improved nutritional profiles or functional properties, can cater to health-conscious consumers and expand market share. Furthermore, strategic partnerships with food manufacturers and other industries can secure consistent demand and establish palm oil as a preferred ingredient.

End-use Insights

The food and beverage segment dominated the market with a share of 68.9% in 2024 during the forecast period. Its high share is attributable to increasing product usage in industry end use applications and increasing product portfolios that demand palm oil as a raw material. The rise in the global population has also affected global product growth, boosting product demand in the international market. With a scanty difference in their revenue share following the food and beverage end use segments are personal care & cosmetics and biofuel & energy end use segments. These are growing segments and are expected to attain prompt growth in the coming years as the advancement of technologies will occur.

The diversification in product portfolios and increasing demand for organic and sustainable plant-based products are expected to drive demand from this segment. Contrary to the personal care and cosmetics segment, which is an established market, biofuel is a budding market that is expected to gain its full potential in the foreseen period as technology advances. In the near future, as the deposits for non-renewable resources are declining, biofuel, which is an environment-friendly alternative to conventional fuels, can become a light of hope for the energy industry. The demand for palm oil in animal feed applications in the U.S. is increasing due to various factors. Palm oil is a cost-effective and readily available energy source for livestock, making it an attractive option for feed producers. It can improve feed efficiency and promote weight gain in animals, particularly in dairy cows. Moreover, palm oil can be easily incorporated into various feed formulations, offering flexibility for producers. As the demand for animal products, particularly dairy, continues to grow in the US, the use of palm oil in animal feed is expected to rise in tandem.

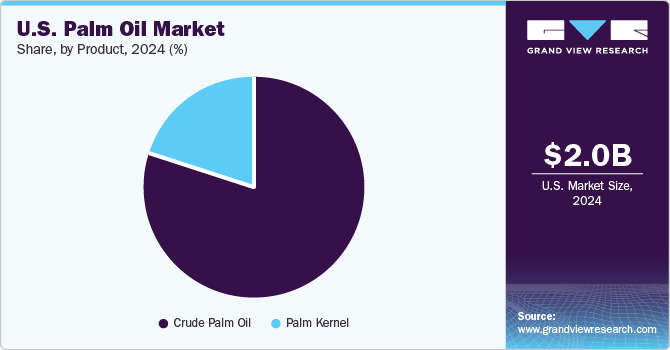

Product Insights

The crude palm oil segment dominated with a market share of 82.3% in 2024 during the forecast period. This is attributable to its major end-use application in the food & beverage industry. Vitamin A gives this product segment an edge over the other segments, making its utilization in edible products more desirable. Its extensive use in the food industry is expected to drive market demand. There is also significant demand for CPO from the cosmetics and pharmaceutical end-use industries, as it is a crucial ingredient in producing many products from these industries.

The demand for palm kernel oil (PKO) in the U.S. is growing due to several factors. PKO is a versatile oil with a wide range of applications, including food, cosmetics, and industrial products. It's used in products like chocolate, ice cream, and baked goods in the food industry due to its stability and texture. The cosmetics industry utilizes PKO in soaps, lotions, and other personal care items for its moisturizing properties. Furthermore, PKO is finding increasing use in producing biofuels and oleochemicals, further driving demand. While concerns about sustainability and environmental impact exist, the demand for PKO in the U.S. continues to rise due to its versatility and diverse applications.

Key U.S. Palm Oil Company Insights

Some key players operating in the market include Wilmar International Ltd. and ADM.

-

Archer Daniels Midland Company (ADM) is a global leader in agricultural origination, processing, and human and animal nutrition. Founded in 1902, ADM connects crops to markets on six continents, transforming agricultural products into ingredients and solutions for food, beverages, health and wellness, and animal feed. With a vast network of processing plants, grain elevators, and transportation assets, ADM provides many products and services, including plant-based proteins, sweeteners, oils, flours, animal feed ingredients, and biofuels. The company is committed to sustainability and innovation, working with farmers and customers to develop solutions that meet the world's growing demand for food and nutrition.

-

Wilmar International Ltd. is one of the world's largest agribusiness companies, engaged in cultivating, processing, and trading palm oil and other agricultural products. Founded in 1991 and headquartered in Singapore, Wilmar operates an integrated business model spanning the entire value chain, from upstream plantation management to downstream processing, branding, and distribution. The company's operations include oil palm cultivation, edible oil refining, consumer product manufacturing, and trading a wide range of agricultural commodities. Wilmar has a significant presence in Southeast Asia, Africa, and South America and is a major global market player. While facing scrutiny regarding sustainability practices, Wilmar has committed to no deforestation, peat, or exploitation (NDPE) policies.

Key U.S. Palm Oil Companies:

- ADM

- Wilmar International Ltd.

- Cargill

- Colonial Chemical

- CIRANDA

- PK Chem Industries Ltd

- GreenChem Industries, LLC

- Agrolane

- Mehsom Corpl

Recent Developments

-

In November 2022, PT Mahkota Group acquired a palm oil mill through its subsidiary, PT Berlian Inti Mekar. This plant produces CPO-based products such as cooking oil or olein and processes about 400 tons of palm kernel oil daily.

U.S. Palm Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.24 billion

Revenue forecast in 2030

USD 3.36 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Key companies profiled

ADM; Wilmar International Ltd.; Cargill; Colonial Chemical; CIRANDA; PK Chem Industries Ltd; GreenChem Industries, LLC; Agrolane; Mehsom Corpl

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Palm Oil Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. palm oil market report based on product, & end-use:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Crude Palm Oil

-

RBD Palm Oil

-

Palm Olein

-

Palm Stearin

-

-

Palm Kernel

-

Palm Kernel Oil

-

Palm Kernel Cake/Meal

-

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Biofuels

-

Personal Care & Cosmetics

-

Animal Feed

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. palm oil market size was estimated at USD 2.02 billion in 2024 and is expected to reach USD 2.24 billion in 2025.

b. The U.S. palm oil market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 3.36 billion by 2030.

b. RBD Palm Oil product segment holds the largest market share in 2024.

b. Some key players operating in the U.S. palm oil market include ADM, Wilmar International Ltd., Cargill, Colonial Chemical, CIRANDA, PK Chem Industries Ltd, GreenChem Industries, LLC, Agrolane, Mehsom Corpl.

b. The U.S. palm oil market is growing due to growing demand from the food, beverage, biofuel, energy, personal care, and cosmetics industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.