- Home

- »

- Renewable Chemicals

- »

-

Oleochemicals Market Size, Share & Growth Report, 2030GVR Report cover

![Oleochemicals Market Size, Share & Trends Report]()

Oleochemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Specialty Esters, Fatty Amines), By Application (Personal Care & Cosmetics, Consumer Goods), By Region, And Segment Forecasts

- Report ID: 978-1-68038-282-2

- Number of Report Pages: 164

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oleochemicals Market Summary

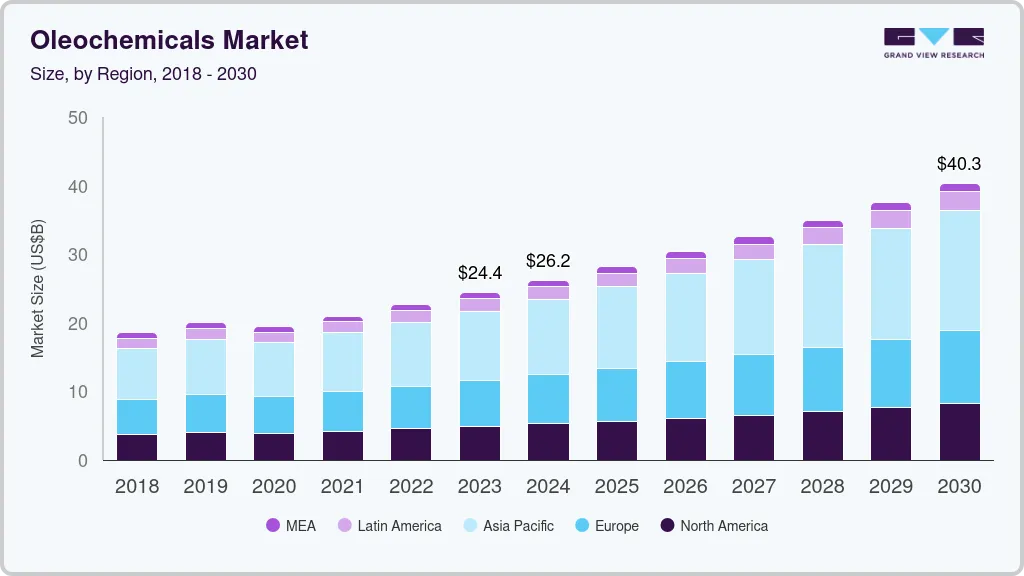

The global oleochemicals market size was estimated at USD 24,417.0 million in 2023 and is projected to reach USD 39,430.4 million by 2030, growing at a CAGR of 7.0% from 2024 to 2030. The market outlook is considered positive due to the increasing demand for biodegradable products and restrictions on petrochemical-based products.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, South Africa is expected to register the highest CAGR from 2024 to 2030.

- Based on the product, glycerol esters accounted for a revenue share of 35.55% in 2023.

- Fatty Acid Methyl Ester is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 24,417.0 Million

- 2030 Projected Market Size: USD 39,430.4 Million

- CAGR (2024-2030): 7.0%

- Asia Pacific: Largest market in 2023

Oleochemicals are the products derived from fats and oils. They can be produced from natural sources such as plant oils and animal fats as well as fossil fuel sources such as petrochemicals. Oleochemicals can be produced using various chemical or enzymatic reactions by the manufacturers. Fluctuating crude oil prices have resulted in a major shift toward the utilization of vegetable oils such as palm and palm kernel oil as a key feedstock for oleochemical production. The global oleochemicals market has an advantageous edge owing to the constantly increasing raw material availability, minor toxicity, and green image of the products.

The demand for oleochemicals derivatives is growing at a steady pace owing to an increase in the consumption of personal care, pharmaceutical, and food products. The demand for personal care products is witnessing growth due to an increase in disposable income, product innovation, and high market penetration. Oleochemicals are widely used in FMCG products such as soaps, toothpaste, and moisturizing lotions. The demand for these products is increasing as companies in the personal care industry are focusing on maximizing the visibility of the products to potential customers through online promotional activities, sweepstakes, and other initiatives in the developed regions.

A major opportunity for the global oleochemicals industry lies in the increasing demand for sustainable and renewable products across various industries. Oleochemicals, derived from natural fats and oils, offer a viable alternative to petroleum-based chemicals. As consumers become more environmentally conscious, there is a rising preference for products with a reduced carbon footprint. For instance, in the personal care industry, there is a growing demand for natural and organic ingredients. Oleochemicals such as coconut oil and palm oil derivatives are used in the production of soaps, shampoos, and skin care products due to their gentle and eco-friendly properties.

On the other hand, determining reliable sources of raw material suppliers and optimizing supply chain efficiency is one of the crucial challenges faced by the market on a global scale. However, the manufacturers have majorly adopted vertical integration to overcome the challenges mentioned above. For instance, IOI Corp Bhd and Kuala Lumpur Kepong Bhd (KLK) are some of the players that have established downstream integration into refineries and production of oleochemicals in Europe and China and upstream integration with the help of their plantations in Indonesia and Malaysia.

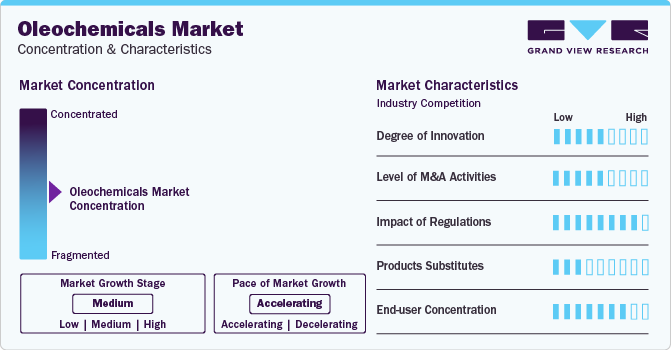

Market Concentration & Characteristics

Market growth stage is exponential with an accelerating pace. The oleochemicals industry is characterized by a high degree of strategic activities, especially mergers & acquisitions. The leading players in the global market have adopted the strategy of mergers & acquisitions to enhance the reach of their products in the market by using the network of acquired players and increasing the availability of their products in diverse geographies. For example, in April 2023, KLK Oleo acquired a controlling stake in Temix Oleo SpA. This strategy is likely to further diversify the company’s offerings in the oleochemicals sector. In addition, it will spur the product specialization strategy across its European operations.

The market is also subject to increasing regulatory scrutiny. Various regulatory bodies such as EC, REACH, JECFA, and ECHA among others, are governing the utilization of these products in numerous end-use applications globally. Regulatory approval is often a prerequisite for introducing oleochemicals into the market. Stringent approval processes ensure that these products meet safety and quality standards. The time and effort required for regulatory clearance can impact the speed at which new products reach consumers. On the contrary, regulatory requirements can drive innovation in the development of oleochemicals. Manufacturers may invest in research and development to create products that not only meet regulatory standards but also offer improved performance, thereby influencing consumption patterns. For example, lately, the methyl industry has witnessed several investments in research and development to develop bio-based and biodegradable products that can potentially replace crude oil and petrochemical-based products.

End user concentration is a significant factor in the global oleochemicals industry. Since there are a number of application areas that are increasingly utilizing these products in their product formulation, it often leads to larger volume purchases. This can lead to economies of scale for oleochemicals suppliers, potentially resulting in cost efficiencies in production and distribution. High end-user concentration may lead to long-standing relationships between oleochemicals suppliers and major players in the end-use industries. This stability can foster collaboration, mutual understanding, and consistent business partnerships.

Product Insights

Glycerol esters dominated the market and accounted for a share of approximately 35.55% in 2023. Glycerol esters, also known as acylglycerols or glycerides, are formed by a reaction between glycerol and fatty acids. Food-grade glycerol is significantly used in the production of ice creams, chewing gums, flavored beverages, and cosmetics. Glycerol has three hydroxyl groups, which can be esterified with one, two, or three fatty acids to form monoglycerides, diglycerides, and triglycerides. These are further used to produce glycerol monostearate (GMS), medium chain triglycerides (MCT), oleates, glycerol di-stearate, and other glycerides.

Specialty esters are an alternative to chemicals and materials that are manufactured using petroleum for various applications. These chemicals should be adhered to the Environmental Protection Agency (EPA) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) guidelines, which emphasize the use of biobased resources in environmentally sensitive applications to decrease the carbon footprint. Specialty esters include product categories such as isopropyl palmitate, glycol esters, sorbitan esters, and lactate esters. Isopropyl palmitate is a compound formed by mixing isopropyl alcohol and palmitic acid. It is characterized by anti-static, moistening, and emollient properties. Isopropyl palmitate finds significant application in manufacturing lipsticks, hair conditioners & styling gels, moisturizers, eye shadows, anti-aging products, concealers, lip glosses, and foundations as well as facial treatments owing to its aforementioned properties.

Alkoxylate is a group of nonionic surfactants, including ethoxylates of methyl ester, fatty amine, fatty acid, and fatty alcohol. These surfactants are used as emulsifiers for manufacturing fabric softeners, agrochemicals, and household care products. Rising application scope of surfactants in different industrial segments is likely to trigger the demand for alkoxylates over the forecast period. Alkoxylates are significantly used as wetting agents, dispersing agents, detergents, stabilizers, emulsifying agents, and cleaning agents. Among the several types of alkoxylates available, alcohol alkoxylates are most employed in various end use industries owing to their environment-friendly nature. They are widely utilized in the production of shampoos, detergents, and soaps to control and adjust lubricity and viscosity. According to the Environmental Protection Agency (EPA), although alcohol alkoxylates cause mild eye & skin irritation, they are acceptable for use in body care and cleaning products.

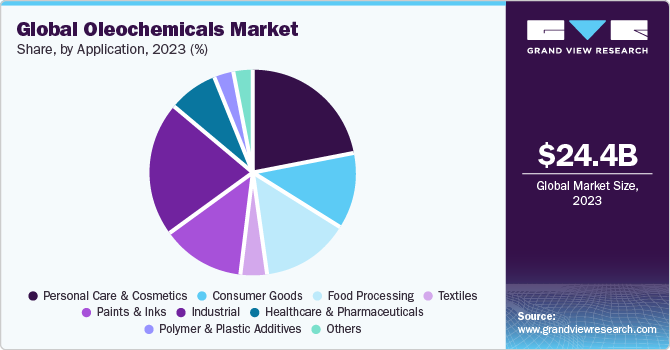

Application Insights

Personal care & cosmetics application dominated the market and accounted for a share of approximately 22.29% in 2023. In the personal care & cosmetics segment, specialty oleochemical derivatives/formulations find application in creams, skincare, sun care, hair care, and oral care products. The growing demand for organic and anti-aging products to maintain a youthful appearance is driving the demand for personal care products, which, in turn, is expected to trigger the demand for oleochemical derivatives in the personal care & cosmetics application segment. Over the past decade, this industry has shown continuous growth coupled with increasing shelf space in supermarkets, hypermarkets, retail stores, and boutique stores across the world.

Industrial segment includes oilfield chemicals, pulp & paper chemicals, construction chemicals, lubricant additives, metalworking fluids, agrochemicals, water management chemicals, and rubber processing. The physicochemical properties of specialty oleochemical derivatives have triggered their demand in lubricants and oil additives as these products are witnessing significant demand across various industries, including construction, rubber processing, metalworking, oilfield, and pulp & paper.

In the food processing segment, specialty oleochemical derivatives are used in frozen foods, confectionery, and beverage processing. Alcohol ethoxylates sulfates, sucrose esters, and glycerol esters are some of the specialty oleochemical derivatives that are majorly used in the food processing industry. Shifting consumer preference for healthier diet intake and consumer inclination toward weight loss programs are expected to steer the product demand in food additives and processing applications over the long term.

Regional Insights

North America oleochemicals marketis driven by stringent government regulations regarding the usage of petroleum-based products owing to their harmful environmental effects. This has fostered the demand for Oleochemicals in the North American region. Rising demand from several end use industries including personal care & cosmetics, healthcare, food processing is expected to augment the product consumption.

U.S. Oleochemicals Market Trends

The oleochemicals market in the U.S. is growing at a lucrative CAGR over the forecast period owing to the growing demand from several end use industries such as personal care & cosmetics, food processing, textiles etc. Also, the growing concern pertaining to aesthetics among women population has pushed them to opt for new and innovative cosmetic products. Oleo chemicals such as alkoxylates, fatty amines and glycerol esters among others are extensively used in formulating cosmetic & personal care products. Such a factor is likely to drive the product demand in the country.

Asia Pacific Oleochemicals Market Trends

Asia Pacific oleochemicals market dominated in 2023 globally and accounted for a global revenue share of 41.38%. Asia Pacific market is likely to witness the fastest growth over the forecast period. This can be attributed to the presence of a large number of manufacturers in Malaysian and Indonesian markets. The abundance of raw materials such as palm oil and palm kernel oil, coupled with huge captive consumption in the region, has been motivating manufacturers to increase their capacities in the region. The trend is expected to boost the market growth in the region over the forecast period.

The oleochemicals market in China is one of the prominent consumers of specialty oleochemicals in the Asia Pacific region. The products such as glycerol esters, fatty acid and fatty amines are being manufactured on a large scale, which are used in end use applications such as household cleaners, cosmetics, pharmaceuticals etc. Growing personal care, food processing and pharmaceutical industry in the country is expected to drive the product demand in the country.

The India oleochemicals market is witnessing increasing demand for biodiesel, which is expected to influence the market demand and lower product prices for biodiesel sectors. Increasing use of fatty amines and methyl esters in India, which are being used as a key raw material for agrochemical products is expected to enhance the oleochemicals demand in the country. West India controls the highest share of oleochemicals on account of the large number of soaps and detergent manufacturing industries in the area.

Europe Oleochemicals Market Trends

The oleochemicals market in Europe is driven by growing demand for biodiesel as an alternative to conventional petroleum diesel is expected to drive the demand for Oleochemicals, such as glycerin and methyl ester sulfonate, over the forecast period. However, Europe is expected to lose market share on account of the gloomy economic condition, which has affected key industries in the region.

The Germany oleochemicals market has relatively a smaller number of specialties oleochemical manufacturing plants. However, the demand from industries such as soap, cleaning products, and cosmetics & personal care products is expected to foster market growth in the country. Increasing cleaning products industry is expected to enhance the product demand, as it includes surfactants and wetting agents, which can be produced from oleochemical sources. Companies such as Procter and Gamble, a manufacturer of cleaning products in Europe majorly use oleochemicals, which are imported from Malaysia and Indonesia.

Central & South America Oleochemicals Market Trends

The Central & South America Oleochemicals market is expected to grow at a significant rate during the forecast period. Growing concerns regarding the depletion of petroleum reserves have emerged as a major factor driving the focus of various industries including plastics, energy, and paper & pulp toward oleochemicals as an alternative to petrochemicals. This trend is expected to propel the demand for Oleochemicals across Central & South America over the forecast period.

The Brazil oleochemicals market is expected to grow in the coming years due to the abundant availability of raw materials such as palm oil & palm kernel oil coupled with huge captive consumption, which has been motivating the manufacturers in Brazil to increase their capacities.

Middle East & Africa Oleochemicals Market Trends

The oleochemicals market in Middle East & Africa is driven by growing industrialization, mainly in Saudi Arabia (the Middle East) and South Africa (Africa), has been driving the demand for Oleochemicals in the region. In addition, various factors including positive demographics, favorable macroeconomics, and rising tourism activities are expected to promote food & beverage and pharmaceutical sectors, thereby, promoting the growth of the Oleochemicals market over the forecast period.

The Saudi Arabia oleochemicals market is expected to grow as the influence of the Palm Oil Trade Fair & Seminar (POTS) organized by the Malaysian Palm Oil Council, Jeddah Chamber of Commerce and Industry, and Malaysian Palm Oil Board focusing on trade improvements pertaining to palm oil is projected to bolster the market growth.

Key Oleochemicals Company Insights

Some of the key players operating in the market include Vantage Specialty Chemicals, Inc., Emery Oleochemicals, Evonik Industries AG, Wilmar International Ltd., and Kao Chemicals, among others.

-

Vantage Specialty Chemicals, Inc. is a specialty chemicals company that manufactures and distributes specialty derivatives, fatty acids, naturally derived specialty chemicals, and intermediates. The company is a vertically integrated provider and caters to four diverse markets, including personal care and beauty, food, life science and consumer care, and industrial specialties.

-

Evonik Industries AG is a key player in the oleochemical sector, and it manufactures and distributes specialty chemicals globally. The company operates through five business units, which include Specialty Additives, Nutrition & Care, Smart Materials, Performance Materials, And Technology & Infrastructure.

JNJ Oleochemicals, Incorporated, Stepan Company, Pepmaco Manufacturing Corporation, and Sakamoto Yakuhin Kogyo Co., Ltd. are some of the emerging market participants in the oleochemicals market.

-

JNJ Oleochemicals, Incorporated. is engaged in the manufacturing and distribution of biodiesel and oleo chemical products worldwide. The products are mainly derived from coconut oil. The company’s product portfolio includes methyl ester derivatives and glycerin, and it is vertically integrated along its value chain. The company has its manufacturing plant in Lucena City, Philippines.

-

Stepan Company manufactures and distributes intermediate chemicals including specialty products, surfactants, germicidal & fabric softening quaternaries, phthalic anhydride (P.A.), polyurethane polyols, and special ingredients for supplements, food, and pharmaceutical industries. The company provides a wide range of oleo chemical-based surfactants for the formulation of both home and industrial laundry detergents. It has 18 manufacturing units located in 11 countries in North America, South America, Europe, and Asia.

Key Oleochemicals Companies:

The following are the leading companies in the oleochemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Vantage Specialty Chemicals, Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Wilmar International Ltd.

- Kao Chemicals Global

- Ecogreen Oleochemicals

- Corbion N.V

- Cargill, Incorporated

- Oleon NV

- Godrej Industries

- IOI Corporation Berhad

- KLK OLEO

- Evyap

- JNJ Oleochemicals, Incorporated

- Sakamoto Yakuhin Kogyo Co., Ltd.

- Stepan Company

- Pepmaco Manufacturing Corporation

- Philippine International Dev.

Recent Developments

-

In May 2024, Corbion signed a partnership agreement with IMCD, a key distribution partner and formulating company of specialty chemicals and ingredients, to include hereby Corbion’s various products for the food & beverage sector in Thailand.

-

In April 2024, Vantage Specialty Chemicals expands METAUPON* NMT (N-Methyl Taurine) capacity at its Leuna site. This expansion aims to meet consumer demand in the personal care, industrial, and household sectors.

-

In January 2024, Godrej Industries signed an MoU with the Gujarat government to invest USD 71.8 million over the coming four years to increase the production capacity of oleochemicals. This expansion is to cater the surging product demand in the personal care, pharmaceuticals, and food industries

Oleochemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.24 billion

Revenue forecast in 2030

USD 39.43 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; Russia; Switzerland; Poland; Sweden; Belgium; China; India; Japan; South Korea; Malaysia; Singapore; Indonesia; Taiwan; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Vantage Specialty Chemicals, Inc.; Emery Oleochemicals; Evonik Industries AG; Wilmar International Ltd.; Kao Chemicals Global; Ecogreen Oleochemicals; Corbion N.V.; Cargill, Incorporated; Oleon NV; Godrej Industries; IOI Corporation Berhad; KLK OLEO; Evyap; JNJ Oleochemicals, Incorporated; Sakamoto Yakuhin Kogyo Co., Ltd.; Stepan Company; Pepmaco Manufacturing Corporation; Philippine International Dev

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oleochemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oleochemicals market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Specialty Esters

-

Fatty Acid Methyl Ester

-

Glycerol Esters

-

Alkoxylates

-

Fatty Amines

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Personal Care & Cosmetics

-

Consumer Goods

-

Food Processing

-

Textiles

-

Paints & Inks

-

Industrial

-

Healthcare & Pharmaceuticals

-

Polymer & Plastic Additives

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Russia

-

Switzerland

-

Poland

-

Sweden

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Singapore

-

Indonesia

-

Taiwan

-

Australia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global oleochemicals market size was estimated at USD 24.42 billion in 2023 and is expected to reach USD 26.24 billion in 2024.

b. The global oleochemicals market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 39.43 billion by 2030.

b. The industrial application segment accounted for the largest volumetric share of 22% in 2023 in the oleochemicals market. However, the personal care & cosmetics segment is estimated to account for the highest revenue share by 2030, growing at the fastest CAGR over the forecast years.

b. Asia Pacific accounted for the largest revenue share of over 41% in 2023 in the oleochemicals market due to the increased demand for sustainable plastics in various end-user industries, which, in turn, has driven the demand for raw materials such as fatty acids and other bio-based polymers.

b. Specialty esters accounted for the largest volume share of over 33% in 2023 in the oleochemicals market, owing to the wide usage of these products in the production of rubber and cosmetics, and as a lubricant in pharmaceutical applications.

b. Some key players operating in the oleochemicals market include BASF, SABIC, AkzoNobel, Cargill, Kuala Lumpur Kepong Berhad, Evonik, Wilmar International, Emery Oleochemicals, Oleon N.V., IOI Group Berhad, and Ecogreen Oleochemicals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.