- Home

- »

- Biotechnology

- »

-

U.S. Protein Labeling Market Size, Industry Report, 2030GVR Report cover

![U.S. Protein Labeling Market Size, Share & Trends Report]()

U.S. Protein Labeling Market Size, Share & Trends Analysis Report By Product (Reagents, Kits), By Method, By Application (Mass Spectrometry, Cell-based Assays), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-241-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Protein Labeling Market Size & Trends

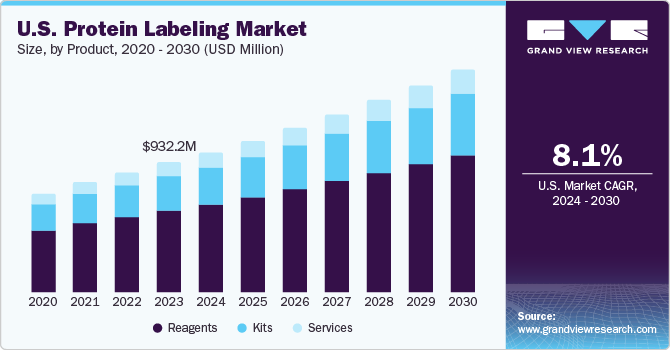

The U.S. protein labeling market size was estimated at USD 932.2 million in 2023 and is expected to grow at a CAGR of 8.09% from 2024 to 2030. The key growth factors include the development of high-throughput proteomics platforms, advancements in mass spectrometry, and the integration of proteomics with other omics technologies like genomics and metabolomics.

U.S. protein labeling market accounted for a 42.0% share of the global protein labeling market in 2023. The protein labeling market has experienced significant growth due to the increased adoption of bioengineering techniques. This growth is fueled by researchers embracing innovative methods to engineer proteins with enhanced functionalities, opening up opportunities in drug delivery, diagnostics, and biotechnology. Advancements in analytical technologies, particularly in mass spectrometry and chromatography, have allowed for deeper exploration of protein structures to understand better their roles in health, disease, and drug development. The pharmaceutical companies increased focus on research and development has led to a greater emphasis on proteomics for identifying drug targets and elucidating mechanisms of action. For instance, in September 2023, the NIH allocated approximately USD 50.3 million for multi-omics research on diseases and human health. This investment aims to establish research focused on generating and analyzing multi-omics data to advance the study of human health.

Moreover, introducing various techniques and customizable protocols has enhanced the flexibility of protein labeling, enabling the simultaneous detection of multiple proteins and accommodating diverse experimental designs. Novel labeling agents with improved specificity and stability broaden the technology's scope for researchers. Collaborations within the industry and the adoption of open platforms are creating an ecosystem that fosters technological innovation at an accelerated pace. These factors collectively drive the market.

Market Concentration & Characteristics

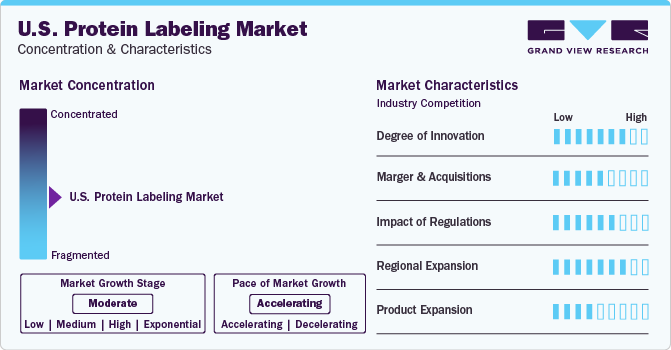

The U.S. protein labeling industry is characterized by fragmentation, with a presence of small companies offering diverse services, contributing to a competitive industry landscape. This industry is experiencing rapid growth driven by innovation, M&A activities, regulatory influences, and expansion strategies.

Companies in the U.S. protein labeling market are highly significantly influenced by a high degree of innovation to improve patient outcomes and sustain their position in the industry. Moreover, providing grants to perform innovative R and D activities further increases production efforts and demand in the industry. For instance, in November 2023, Cytiva revolutionized protein purification through its innovative affinity technology compatible with all recombinant proteins. The novel tag technology is self-cleaving and traceless, facilitating drug developers and manufacturers.

Smaller companies are being acquired by larger companies as a strategic move to enhance their market positions. This approach allows companies to bolster their capabilities, broaden product portfolios, and enhance competencies. For instance, in July 2023, INOVIQ Limited and Promega Corporation entered into a collaborative marketing agreement to jointly promote INOVIQ's EXO-NET exosome capture technology and Promega's Nucleic Acid purification systems globally.

Regulatory entities such as the U.S. FDA are crucial in approving proteomic-based diagnostic instruments. Biopharmaceuticals, including therapeutic proteins manufactured using biotechnology, fall under the regulation of the FDA's Center for Drug Evaluation & Research (CDER) or the Center for Biologics Evaluation & Research (CBER), depending on the product's characteristics.

Major companies acquire smaller companies to broaden the market reach of their products and improve accessibility across diverse geographic regions. Larger corporations employ a strategy that involves buying smaller entities to boost their market presence, widen their product offerings, and improve their competitive edge in various regions.

Product Insights

Reagent segment dominated the market with a share of 63% in 2023. Reagenst plays a significant role in protein labeling and facilitates a wide range of applications in research performed for cellular mechanisms and the development of therapeutics. They are segmented into proteins, enzymes, probes/tags, monoclonal antibodies, and other reagents. Additionally, prominent companies focusing on customized solutions based on different protocols are expected to drive this segment.

The kits segment is expected to grow fastest from 2024 to 2030. These kits offer essential requirements such as buffers, antibodies, and protocols to achieve specific labeling experiments. They serve as potential tools, reduce experimental complexity, and optimize reproducibility. Moreover, key companies are actively developing kits for protein labeling, which smoothens researchers' work and outcomes. Such features are anticipated to boost the segment's growth in the coming years. For instance, in February 2022, Biotium introduced a newly designed Mix-n-Stain™ Antibody Labeling kit for producing antibody conjugates ideal for super-resolution stochastic optical reconstruction microscopy (STORM).

Method Insights

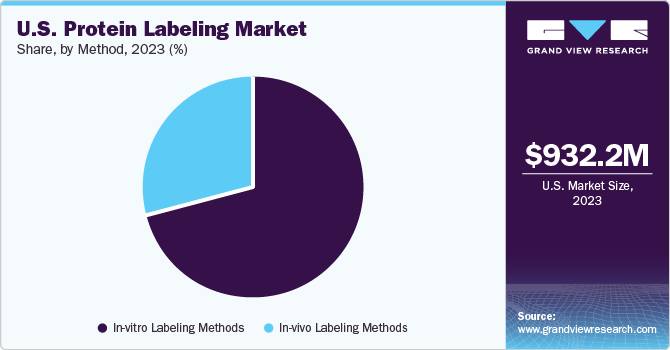

The in-vitro protein labeling method held the largest share of 71.0% in 2023. This segment is further fragmented into in-vitro enzymatic labeling, in-vitro dye-based labeling, in-vitro site-specific labeling, in-vitro nanoparticle, and more. This procedure uses tags, including enzymes, dyes, and nanoparticles, offering efficient protein labeling. This method utilizes tags such as enzymes, dyes, and nanoparticles to facilitate effective protein labeling. These techniques demonstrate stability, prevent metal-antibody interactions, and enhance protein detection and quantification sensitivity. These developments are expected to accelerate the growth of this segment.

The in-vivo methods segment will expand significantly from 2024 to 2030. These methods enable researchers to analyze protein interactions and structures within live cells precisely. Developing innovative fluorescent probes enhances the efficiency and accuracy of in-vivo protein complex analysis. Such factors are expected to boost this market's growth over the forecast period.

Application Insights

The immunological technique segment accounted for the largest share in 2023. This sector's growth is driven by the increased investment in research and development by biotech and pharmaceutical companies, as well as the rise in cases of chronic diseases. Immunological techniques such as flow cytometry, immunofluorescence, and immunoassays are widely used in studies related to cancer and autoimmune disorders and in the development of therapies. Furthermore, these methods are commonly utilized in identifying various conditions. The high detection capabilities of these techniques are expected to drive the expansion of this segment.

The fluorescence microscopy segment is expected to grow at the fastest CAGR from 2024 to 2030. The high-throughput fluorescence microscopy in academic research has advanced rapidly, aiding the analysis of cellular pathways. This segment is expected to grow significantly shortly. Protein labeling has become a crucial technique used in drug discovery to track the impact of potential drugs on cellular functions. These factors are predicted to drive the market growth over the coming years.

Key U.S. Protein Labeling Company Insights

There is intense competition in the U.S. protein labeling market due to the abundance of global and regional competitors providing a diverse array of reagents. This is driven by the growing incidence of target diseases and the surge in research and development initiatives. Along with that, innovative technologies, high M&A activities, and regional expansion are expected to fuel the market growth.

Key U.S. Protein Labeling Companies:

- Thermo Fisher Scientific, Inc

- Revvity Inc

- Promega Corporation

- New England Biolabs

- LI-COR, Inc

- Danaher

- Aragen Bioscience

- ARVYS Proteins

- Aldevron

- GenScript

- Sigma-Aldrich

Recent Developments

-

In January 2023, BASF and Cargill expanded their partnership to offer innovative enzyme-based solutions to U.S. animal protein producers. This collaboration aims to bring distinctive value to animal feed customers by combining BAF's enzyme research and development strengths with Cargill's application expertise.

-

In March 2024, ImmunoPrecise Antibodies Ltd. announced the acquisition of Carterra®'s LSA® instrument platform. This strategic move aims to enhance ImmunoPrecise Antibodies' capacity for high-throughput surface plasmon resonance-based antibody characterizations, significantly boosting its capabilities in various label-free protein interaction analyses.

U.S. Protein Labeling Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.60 billion

Growth rate

CAGR of 8.09% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, application

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc; Revvity Inc; Promega Corporation; New England Biolabs; LI-COR, Inc; Danaher

Aragen Bioscience; ARVYS Proteins; Aldevron; GenScript; Sigma-Aldrich

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

U.S. Protein Labeling Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. protein labeling market report based on product, method, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Proteins

-

Enzymes

-

Probes/Tags

-

Monoclonal Antibodies

-

Other Reagents

-

-

Kits

-

Services

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

In-vitro Labeling Methods

-

Enzymatic Labeling

-

Dye-based Labeling

-

Co-translational Labeling

-

Site-specific Labeling

-

Nanoparticle Labeling

-

Others

-

-

In-vivo Labeling Methods

-

Photoreactive Labeling

-

Radioactive Labeling

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell-based Assays

-

Fluorescence Microscopy

-

Immunological Techniques

-

Protein Microarray

- Mass Spectrometry

-

Frequently Asked Questions About This Report

b. The U.S. protein labeling market size was estimated at USD 932.2 million in 2023

b. The U.S. protein labeling market is expected to grow at a compound annual growth rate of 8.09% from 2024 to 2030 to reach USD 1.60 billion by 2030.

b. Based on product, the reagent segment dominated the market with a share of 63% in 2023.

b. Some of the key players in the market are Thermo Fisher Scientific, Inc; Revvity Inc; Promega Corporation; New England Biolabs; LI-COR, Inc; Danaher Aragen Bioscience; ARVYS Proteins; Aldevron; GenScript; and Sigma-Aldrich.

b. Some of the key factors driving the market include femand for highly specific and advanced technologies from end-users in the diagnostic pharmaceutical sector in the detection and purification of proteins of interest.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."