- Home

- »

- Biotechnology

- »

-

U.S. Regenerative Medicine Market, Industry Report, 2030GVR Report cover

![U.S. Regenerative Medicine Market Size, Share & Trends Report]()

U.S. Regenerative Medicine Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cell-based Immunotherapies, Gene Therapies), By Therapeutic Category, And Segment Forecasts

- Report ID: GVR-4-68040-289-6

- Number of Report Pages: 230

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Regenerative Medicine Market Trends

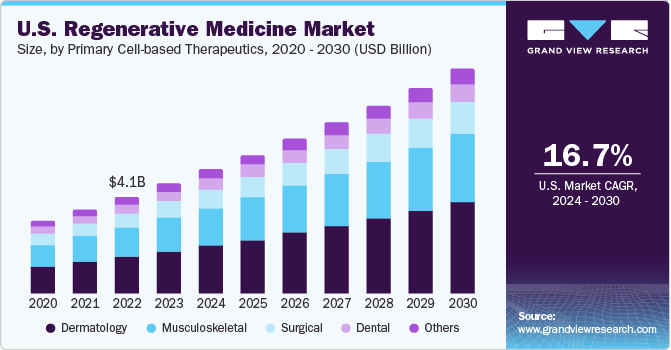

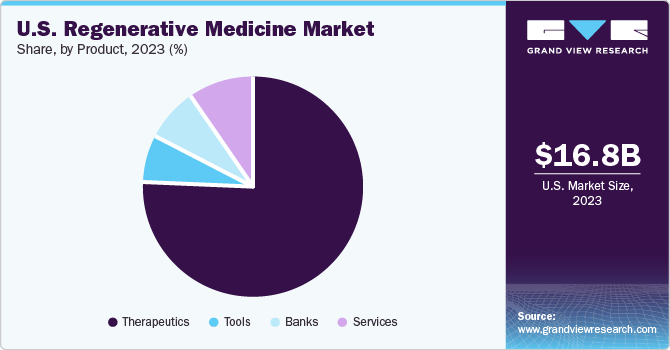

The U.S. regenerative medicine market size was valued at USD 16.81 billion in 2023 and is expected to grow at a CAGR of 16.72% from 2024 to 2030. The growth can be attributed to factors such as increasing investments in the regenerative medicine domain and a growing focus on launching new centers for regenerative medicine. Moreover, the developments in gene therapy, cell therapy, and tissue-engineered products in the country are expected to fuel further competition.

U.S. accounted for over 55% of the global regenerative medicine market in 2023. Academic and medical centers are providing funding to improve the regenerative medicine sector in the country. For instance, in October 2022, Cedars-Sinai was granted a 5-year, USD 8 million funding from California’s stem cell agency to establish a new clinic to improve training and research in regenerative medicine. Due to easy access to data through genomic, proteomic, and Electronic Health Record (EHR) databases, numerous companies are investigating various cell-based therapies to aid in the treatment of previously untreatable conditions.

Furthermore, the growing demand for robust therapies to address the rising cancer prevalence is contributing to growth in clinical trial numbers. Moreover, leading firms are investigating and developing pipeline products for diabetes & neurological disorders, such as Parkinson’s & Alzheimer’s diseases, cancers, and cardiovascular diseases, including myocardial infarction, heart failure, and ischemic heart diseases. Hence, the rising prevalence of these diseases increased the investments to improve the treatment of regenerative medicines.

Technological advancements such as stem cells, tissue engineering, and nanotechnology have made regenerative medicines a highly lucrative field of science. For instance, the wide acceptance of cell-based therapies in orthopedic surgeries significantly contributed to the overall stem cell market revenue. This can be attributed to stem cells forming an integral part of therapies based on regenerative medicine. Stem cells have been proven to accelerate treatment outcomes, expanding their usage. This has created multiple potential avenues for stem cell therapies that span orthopedics and other specialties.

Market Concentration & Characteristics

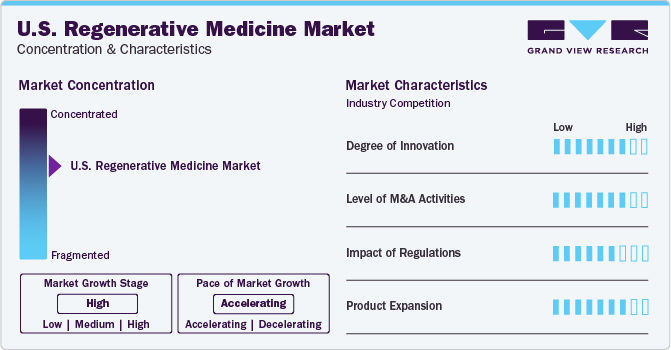

The U.S. industry is consolidated by nature, exhibiting a high growth stage and accelerated pace of the industry. Several companies, including public and private players, are investing more in bolstering the capabilities of regenerative medicine. Companies invest heavily in R&D to upgrade their products with the latest technology and fulfill the unmet needs of patients. Around 700 companies are currently working on developing cell-based therapies for various diseases. This is anticipated to increase the competition among companies to create a specific and efficient pipeline.

The U.S. is a hub for research and innovation in regenerative medicine. Leading universities, research institutions, and biotech companies are driving advancements in the field.Moreover, the players and industry participants are focusing on launching new centers for regenerative medicine, which is anticipated to boost the market competition. For instance, in May 2023, Integra LifeSciences Holdings Corporation opened a New Center of Innovation And Learning in New Jersey. This newly inaugurated facility is expected to strengthen the company's commitment to offer regenerative technologies to address unmet clinical needs.

Merger & acquisition (M&A), collaborations, and partnerships between academia, industry, & healthcare providers are expected to accelerate research and translation of discoveries into clinical applications. For instance, in July 2023, Carmell Therapeutics entered into a definitive agreement to merge with Axolotl Biologix, a regenerative medicine company that focuses on developing and marketing human amnion-based allograft products for esthetics, active soft tissue repair, and orthopedic applications. Such strategies undertaken by industry players in the U.S. are expected to propel the competition for regenerative medicine.

The country has well-established regulatory agencies such as the U.S. FDA that provide clear guidelines for the development and approval of regenerative therapies, ensuring safety & efficacy. Owing to the wide coverage of regenerative medicine it is regulated as an advanced therapy medicinal product. Advanced therapies are further classified as those regulated under Section 361 and Section 351 according to the Public Health Service Act. In the U.S., the FDA approved the commercialization of two ex vivo and two in vivo gene therapies. Furthermore, the U.S. FDA offers excellent support for innovations in the gene therapy space via several policies concerning product development.

Therapeutic Category Insights

The oncology segment held the largest market share of 31.3% in 2023. The increasing prevalence of cancer coupled with combinational approaches using stem cells, immunotherapy, and gene therapy is expected to influence segment growth over the forecast period. Moreover, companies are developing various cell-based and gene therapies for cancer. Furthermore, many government organizations and industrial companies are investing in cancer research & expansion of regenerative medicines, including cell & gene therapies.

The cardiovascular segment is expected to witness a considerable CAGR during the forecast period owing to increasing prevalence of Cardiovascular Diseases (CVD) and the rising demand for products to treat these disorders. In addition, advancements in regenerative medicines and cell-based therapies have accelerated growth of the segment. The companies are undertaking various strategies to expand their pipelines in this segment and promoting further growth.

Product Insights

The therapeutics segment held the largest market share of 75.9% in 2023. Over the years, geriatric population of U.S. has witnessed significant growth which resulted in a higher incidence of degenerative and age-related disorders. The rising prevalence of these disorders with unmet medical needs, such as diabetes, cancer, and NDs, including Age-related Macular Degeneration (AMD), has prompted researchers to create alternative treatment options such as cell therapy. Demand for such therapies is further anticipated to increase significantly owing to advances in stem & progenitor cell therapies and their high potential in treating a broad range of conditions.

The bank segment is expected to witness the fastest CAGR from 2024 to 2030 owing to its usage of large-scale collection, preparation, provision, research, and storage of stem cells. In recent years, the number of private cord blood banks has witnessed a rapid rise. This can be attributed to the availability of guidelines on using stem cells and umbilical cords for research purposes. Moreover, companies are undertaking various strategies to promote biobanking. The rapid adoption of private cord blood banking by people in the country is expected to significantly contribute to segment growth.

Key U.S. Regenerative Medicine Company Insights

Some prominent U.S. regenerative medicine market companies include Vitrolife; AstraZeneca; F. Hoffmann-La Roche Ltd.; Integra LifeSciences: Astellas Pharma Inc.; COOK BIOTECH; Merck KGaA; Vericel Corporation; Novartis Pharmaceuticals Corporation; bluebird bio, Inc.; and Bristol-Myers Squibb Company. Key market companies are adopting multifaceted strategies to remain in competition in the ever-evolving market setting.

They are initiating strategic M&A activities, partnerships, and collaborations with other market players and academic institutions intending to exchange knowledge and accelerate innovations. In addition, key players are undertaking various strategies, such as collaborations with Contract Manufacturing Organizations (CMOs), to sustain their market position. These companies are also prioritizing regulatory navigation, to ensure on-time approvals and access to the market.

Key U.S. Regenerative Medicine Companies:

- AstraZeneca plc

- F. Hoffmann-La Roche Ltd.

- Integra Lifesciences Corp.

- Astellas Pharma, Inc.

- Cook Biotech, Inc.

- Bayer AG

- Pfizer, Inc.

- Merck KGaA

- Abbott

- Vericel Corp.

- Novartis AG

- GlaxoSmithKline (GSK)

Recent Developments

-

In May 2023, Canon entered into the regenerative medicine space with the acquisition of cell culture manufacturer Kyoto Seisakusho

-

In September 2022, Bluebird Bio, Inc. received accelerated approval from the U.S. FDA to decrease the course of neurological dysfunction in 4 to 17 year-old boys with early, and active Cerebral Adrenoleukodystrophy (CALD)

-

In January 2022, REGENXBIO, Inc. announced the approval of its Investigational New Drug Application by the U.S. FDA to evaluate RGX-202, a one-time gene therapy used for the treatment of Duchenne muscular dystrophy in a first-in-human clinical trials.

U.S. Regenerative Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.51 billion

Revenue forecast in 2030

USD 49.32 billion

Growth rate

CAGR of 16.72% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, therapeutic category

Country scope

U.S.

Key companies profiled

AstraZeneca plc; F. Hoffmann-La Roche Ltd.; Integra Lifesciences Corp.; Astellas Pharma, Inc.; Cook Biotech, Inc.; Bayer AG; Pfizer, Inc.; Merck KGaA; Abbott; Vericel Corp.; Novartis AG; GlaxoSmithKline (GSK).

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Regenerative Medicine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the U.S. regenerative medicine market report based on product, and therapeutic category:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Primary Cell-based Therapeutics

-

Dermatology

-

Musculoskeletal

-

Surgical

-

Dental

-

Others

-

Stem Cell & Progenitor Cell-based Therapeutics

-

Autologous

-

Allogenic

-

Others

-

Cell-based Immunotherapies

-

Gene Therapies

-

Tools

-

Banks

-

Services

-

-

Therapeutic Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology

-

Musculoskeletal

-

Immunology & Inflammation

-

Oncology

-

Cardiovascular

-

Ophthalmology

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. regenerative medicine market size was estimated at USD 16.81 billion in 2023 and is expected to reach USD 19.51 billion in 2024.

b. The U.S. regenerative medicine market is expected to grow at a compound annual growth rate of 16.72% from 2024 to 2030 to reach USD 49.32 billion by 2030.

b. The therapeutics segment dominated the regenerative medicine market with a share of 75.9% in 2023. This is attributable to the availability of advanced technologies and the presence of research institutes involved in developing novel therapeutics.

b. Some key players operating in the regenerative medicine market include Integra LifeSciences Corporation; MiMedx Group, Inc.; AstraZeneca; F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; Pfizer Inc.; and Baxter.

b. Key factors that are driving the market growth include the presence of a strong pipeline portfolio and a high number of clinical trials, high economic impact of regenerative medicine and technological advances in regenerative medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.