- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. TPE Films And Sheets Market, Industry Report, 2033GVR Report cover

![U.S. TPE Films And Sheets Market Size, Share & Trends Report]()

U.S. TPE Films And Sheets Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (SBC, TPU, TPO, TPV), By Form (Films, Sheets), By Application (Medical & Healthcare, Automotive, Consumer Goods, Packaging), And Segment Forecasts

- Report ID: GVR-4-68040-681-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. TPE Films And Sheets Market Summary

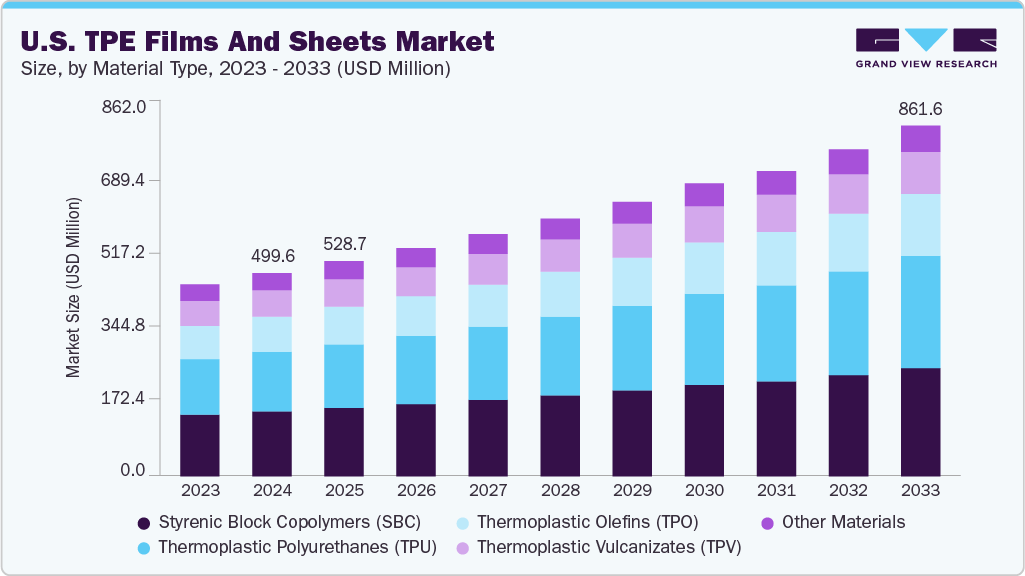

The U.S. TPE films and sheets market size was estimated at USD 499.6 million in 2024 and is projected to reach USD 861.6 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The U.S. TPE films and sheets market is a mature yet rapidly evolving industry within the flexible materials industry.

Key Market Trends & Insights

- By material type, the Thermoplastic Polyurethanes (TPU) segment is expected to grow at the significant CAGR of 7.4% from 2025 to 2033.

- By form, films led the U.S. TPE films and sheets industry with the largest revenue share of 62.02% in 2024.

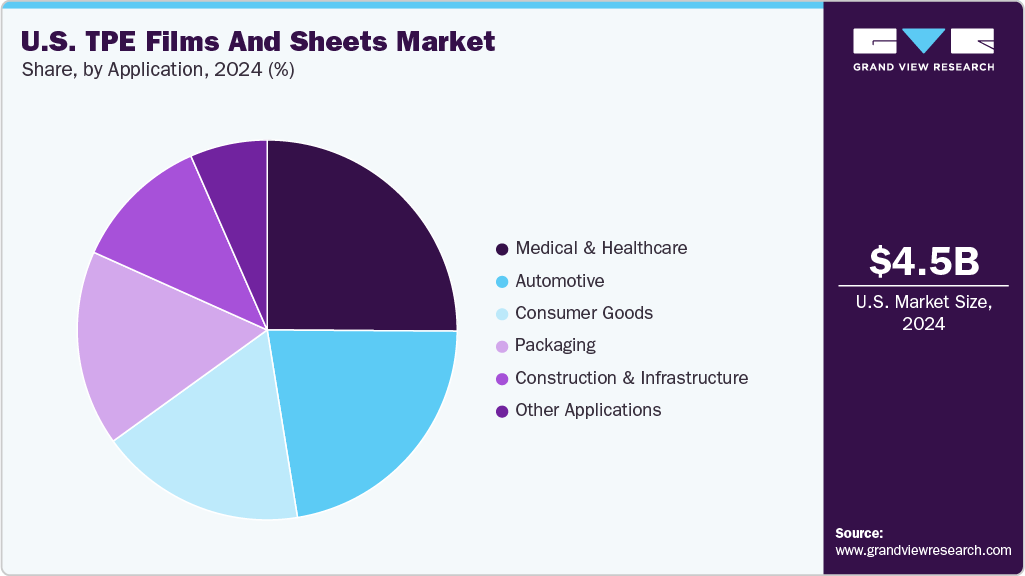

- By application, the medical & healthcare dominated the U.S. TPE films and sheets market across applications in terms of revenue, accounting for a market share of 25.10% in 2024..

Market Size & Forecast

- 2024 Market Size: USD 499.6 Million

- 2033 Projected Market Size: USD 861.6 Million

- CAGR (2025 - 2033): 6.3%

The growth of the U.S. TPE films and sheets industry is driven by robust demand across healthcare, automotive, personal care, consumer electronics, and industrial packaging sectors. Thermoplastic elastomers (TPEs) offer rubber-like elasticity with thermoplastic processability, making them ideal for applications that require comfort, compliance, and durability. Moreover, the biocompatibility, transparency, softness, and lightweighting of TPE films and sheets are further projected to boost the product demand in the country.

The country’s strong manufacturing ecosystem and focus on sustainability, safety, and innovation have helped establish the U.S. as a major hub for high-end TPE film applications. In addition, medical-grade TPU films, recyclable SBC-based hygiene films, and multi-layer elastomeric sheets for automotive interiors are key contributors to market demand. U.S. firms are at the forefront of material innovation, leveraging advanced extrusion, surface modification, and formulation technologies to meet evolving industry standards, particularly in regulated sectors like healthcare and food contact packaging.

Drivers, Opportunities & Restraints

One of the primary drivers of the U.S. TPE films and sheets market is the expanding medical and healthcare sector, supported by advanced R&D capabilities, a highly regulated environment, and a growing focus on patient comfort and safety.

Thermoplastic elastomer films are widely used in surgical drapes, wound care, diagnostic devices, and flexible tubing covers. Additionally, TPU and SBC variants are preferred for their biocompatibility, hypoallergenic properties, and sterilizability. The U.S. medical devices market, being one of the largest globally, ensures a strong and steady demand for high-performance, skin-contact-safe films.

The development of sustainable and recyclable TPE film solutions, particularly those that align with circular economy goals and Extended Producer Responsibility (EPR) frameworks, is an emerging opportunity in the U.S. market.

Manufacturers are exploring bio-based TPU, solvent-free SBC films, and blends that incorporate post-consumer recycled (PCR) content. These innovations cater to the growing demand from brand owners and retailers in sectors like personal care, food packaging, and electronics that are pledging carbon reduction and zero-waste goals.

However, the high cost of high-performance TPE formulations, particularly TPU and TPV, can limit their use in price-sensitive or commodity-grade applications. While these materials offer superior mechanical and safety properties, they are often costlier to produce due to complex polymer structures, processing conditions, and additive requirements. This pricing premium can deter adoption in large-volume applications like bulk packaging or industrial liners, where cost efficiency is prioritized over technical performance.

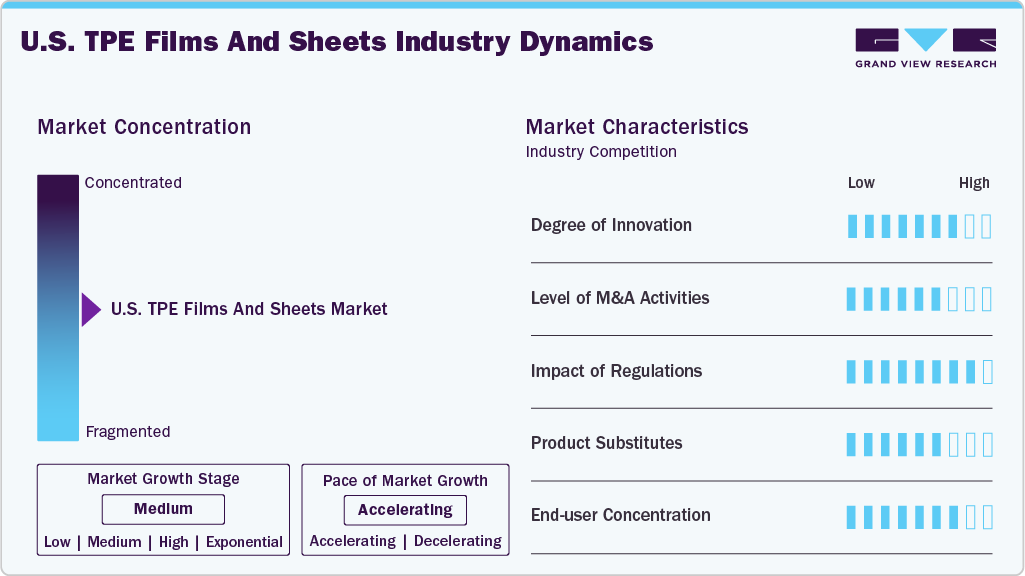

Market Concentration & Characteristics

The U.S. TPE films and sheets industry displays a high degree of innovation, with companies investing heavily in bio-based polymers and recyclable film structures. Manufacturers like The Lubrizol Corporation, Teknor Apex, and Covestro AG are actively launching new TPE grades tailored for emerging markets in wearables, medical diagnostics, and premium packaging.

M&A activity is moderate, driven by the need to access new technologies, expand specialty capabilities, and strengthen market presence in niche segments like healthcare and advanced packaging. Larger players have acquired smaller converters or compounders with expertise in sustainable or medical-grade films to accelerate growth and diversification. Additionally, partnerships with biotechnology firms and cross-border acquisitions have helped U.S. companies build global supply resilience and sustainability leadership.

U.S. regulations around food contact safety, medical device materials, and recyclability play a pivotal role in shaping TPE film formulations. The market also responds to EPA guidelines and state-level plastic waste bans that promote biodegradable, compostable, or recyclable materials in packaging.

Thermoplastic elastomer films and sheets in the U.S. market face competition from flexible PVC, silicone rubber films, EVA, and polyolefin-based films. While TPEs offer a balance of safety, elasticity, and sustainability. In packaging or construction, polyolefins dominate, whereas in medical or wearable sectors, silicones offer a challenge due to their superior thermal stability.

The U.S. TPE films and sheets market shows moderate to high end-user concentration, with dominant demand from sectors like healthcare, automotive, and personal care. Large OEMs and brands, especially in medical technology, mobility, and hygiene, hold substantial influence over material specifications, performance standards, and sustainability criteria. While new applications in electronics and wearables are expanding the user base, a handful of industry leaders still account for a significant portion of overall consumption, driving demand for specialized, high-performance TPE materials.

Material Type Insights

Styrenic Block Copolymers (SBC) dominated the U.S. TPE films and sheets market with the largest revenue share of 31.94% in 2024. In the U.S. market, SBC-based TPE films are widely adopted in hygiene, packaging, and medical products due to their softness, skin-friendliness, and cost-effectiveness. SBCs are especially favored in disposable applications like baby diapers, personal care items, and breathable laminates.

Thermoplastic Polyurethanes (TPU) are anticipated to grow at a significant CAGR of 7.4% through the forecast period. TPU films are a mainstay in U.S. medical, electronics, and performance wearables markets owing to their high abrasion resistance, flexibility, and biocompatibility. High-end applications, such as wound dressings, flexible sensors, and outdoor gear, rely heavily on TPU films that meet FDA and ISO medical-grade standards.

TPO films and sheets are predominantly used in the U.S. automotive and construction markets for interior panels, weather seals, and roofing membranes. The chemical resistance and UV durability of TPOs are cost-effective substitutes for PVC and other rigid plastics in structural and outdoor applications. In the U.S., OEMs in automotive and building materials value TPO’s recyclability and lightweighting capabilities in alignment with sustainability mandates.

TPV films and sheets find robust use in the U.S. automotive and industrial sectors, especially where thermal resistance and long-term performance are required. Used in under-the-hood applications, gaskets, and vibration dampeners, TPVs are selected for their combination of rubber-like performance and ease of thermoplastic processing. U.S. manufacturers are expanding TPV use in weatherable exterior films and hybrid material solutions.

Form Insights

Films led the U.S. TPE films and sheets industry with the largest revenue share of 62.02% in 2024. In the U.S., thermoplastic elastomer films are widely used in medical drapes, consumer wearables, hygiene products, and flexible packaging, where properties like softness, stretchability, and sealing ability are critical.

TPU and SBC dominate film usage in skin-contact applications and flexible medical packaging, where clarity and regulatory compliance are essential. U.S. innovation is focused on producing solvent-free, breathable films for both healthcare and smart product applications.

The sheets segment is expected to expand at a substantial CAGR of 5.6% through the forecast period. TPE sheets serve a significant role in automotive interiors, industrial mats, and thermoformed packaging in the U.S. market.

TPV and TPO sheets are also preferred for their durability, heat resistance, and dimensional stability, especially in vehicle cabins and exterior panels. Sheet applications are also expanding into the sports, equipment, and construction segments where thicker, impact-resistant elastomeric surfaces are needed.

Application Insights

Medical & healthcare dominated the U.S. TPE films and sheets market across applications in terms of revenue, accounting for a market share of 25.10% in 2024. The U.S. healthcare sector drives strong demand for TPE films and sheets in wound care, surgical barriers, medical wearables, and device enclosures. Materials like TPU and SBC are used for their biocompatibility, flexibility, and sterility.

The packaging segment is projected to witness a substantial CAGR of 7.2% over the forecast period. TPE films are gaining interest in premium and functional packaging within the U.S. market, particularly for personal care, medical, and tech products. SBC-based films are favored for breathable hygiene applications, while TPU’s sealing and barrier properties make it suitable for sterile packaging formats.

In the U.S. automotive market, thermoplastic elastomer (TPE) sheets are used in soft-touch interior panels, floor mats, and NVH-reducing components, while films are gaining adoption in decorative and protective laminates. The push for vehicle lightweighting, recyclability, and improved cabin comfort is driving TPE usage across EV and ICE vehicle segments. TPO and TPV lead usage in sheets, while multi-layer TPE films are being tested for sensor integration in smart interiors.

U.S. consumer goods manufacturers utilize TPE films and sheets in sportswear, personal care items, electronics accessories, and lifestyle products. TPU films are especially popular in high-durability cases, straps, and grips for consumer electronics, while SBC films provide softness and stretch in products like razors, grips, and sanitary wear. U.S. brands prioritize aesthetics, touch-feel, and sustainability-areas where TPEs offer a competitive edge.

Key U.S. TPE Films And Sheets Company Insights

The U.S. TPE films and sheets market is characterized by a strong presence of global leaders, specialty chemical companies, and regional converters that serve high-end applications in medical devices, automotive interiors, consumer electronics, and packaging. Innovation, regulatory compliance, and sustainability shape the competitive landscape.

Leading players focus on product customization, biocompatibility, and recyclability, especially to serve the stringent requirements of the healthcare and food-contact industries. Strong R&D ecosystems and access to high-tech processing capabilities provide U.S.-based companies with a competitive edge in value-added applications.

Key U.S. TPE Films And Sheets Companies:

- The Lubrizol Corporation

- Kraton Corporation

- American Polyfilm, Inc.

- RTP Company

- 3M

- Adhesive Films, Inc.

- Polycast Industries

- SWM International

- Novotex Italiana S.p.A.

- Reeves Extruded Products

Recent Developments

-

In February 2025, Prism Worldwide had partnered with Sherwood Industries to introduce Ancora TPE, made from high percentages of recycled end‑of‑life tires, into Sherwood’s extruded rubber sheets. In 2024 alone, Sherwood produced over 7.5 million sq ft of rubber sheets and invested in a dedicated extruder to scale up production, signaling a strong move toward commercialization. This partnership targets demand in automotive, household goods, and sporting equipment, offering a sustainable, circular‐economy alternative that meets industry performance standards.

-

In January 2025, Teknor Apex announced its latest innovations for the healthcare sector at MD&M West 2025, featuring two standout developments: their new MD‑90000 Series medical-grade TPEs, designed as high-performance, cost-effective alternatives to silicone tubing. The products offer high clarity, flexibility, chemical resistance, and biocompatibility for applications such as drug delivery and analytical instrumentation engineered for optimal processability, biocompatibility, and regulatory compliance in medical device manufacturing.

U.S. TPE Films And Sheets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 528.7 million

Revenue forecast in 2033

USD 861.6 million

Growth rate

CAGR of 6.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material type, form, application

Country scope

U.S.

Key companies profiled

The Lubrizol Corporation; Kraton Corporation; American Polyfilm, Inc.; RTP Company; 3M; Adhesive Films, Inc.; Polycast Industries; SWM International; Novotex Italiana S.p.A.; Reeves Extruded Products

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. TPE Films And Sheets Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. TPE films and sheets market report based on material type, form, and application:

-

Material Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Styrenic Block Copolymers (SBC)

-

Thermoplastic Polyurethanes (TPU)

-

Thermoplastic Olefins (TPO)

-

Thermoplastic Vulcanizates (TPV)

-

Other Materials

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Films

-

Sheets

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Medical & Healthcare

-

Automotive

-

Consumer Goods

-

Packaging

-

Construction & Infrastructure

-

Other Applications

-

Frequently Asked Questions About This Report

b. Key factors driving the U.S. TPE films and sheets market are robust demand across healthcare, automotive, personal care, consumer electronics, and industrial packaging sectors.

b. The U.S. TPE films and sheets market size was estimated at USD 499.6 million in 2024 and is expected to reach USD 528.7 million in 2025.

b. The U.S. TPE films and sheets market is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2033, reaching USD 861.6 million in 2033.

b. Medical & healthcare dominated the U.S. TPE films and sheets market with a revenue share of 25.10% in 2024, as the U.S. healthcare sector drives strong demand for TPE films and sheets in wound care, surgical barriers, medical wearables, and device enclosures.

b. Some of the key players in the U.S. TPE films and sheets market include The Lubrizol Corporation, Kraton Corporation, American Polyfilm, Inc., RTP Company, 3M, Adhesive Films, Inc., Polycast Industries, SWM International, Novotex North Americ, and Reeves Extruded Products

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.