Utility Asset Management Market Trends

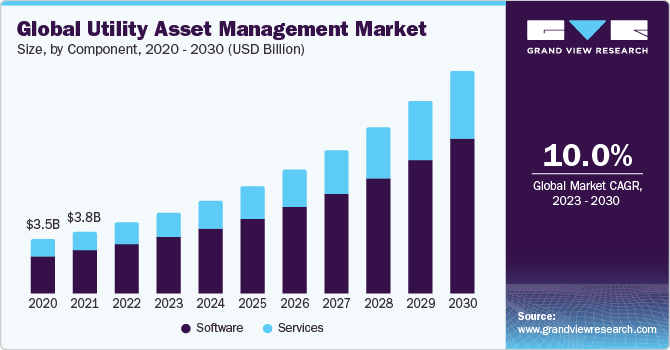

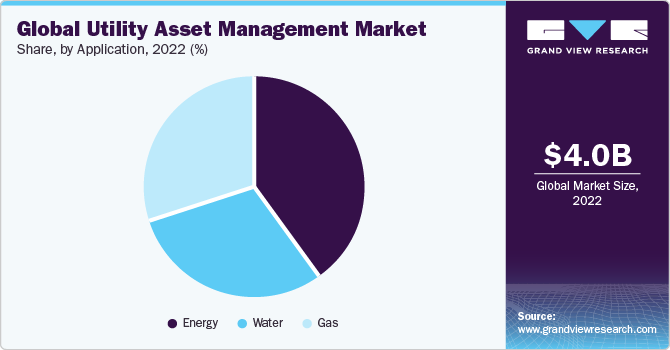

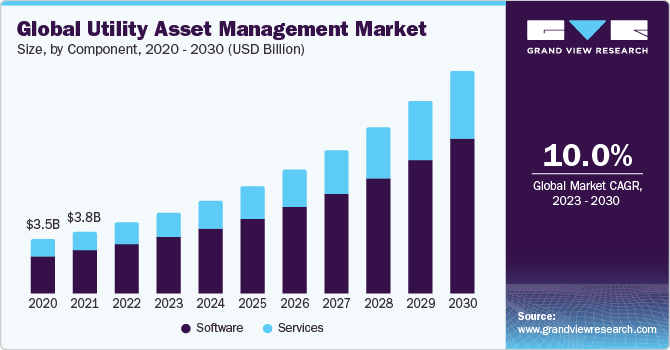

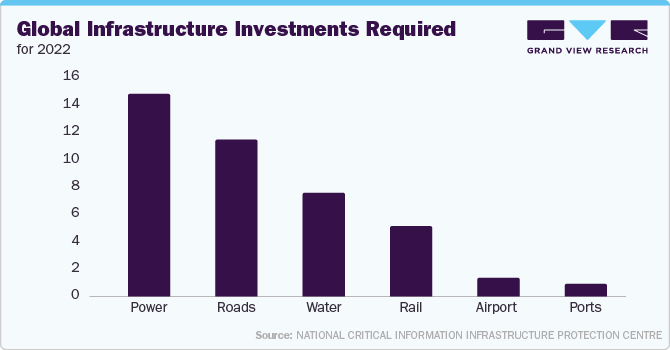

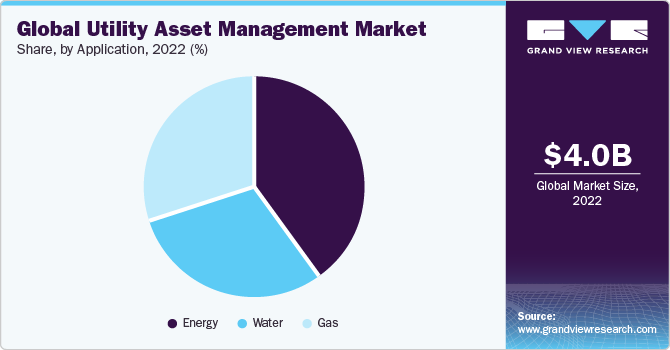

The global utility asset management market size was valued at USD 4.05 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.0% from 2023 to 2030. Utilities worldwide are adopting sophisticated asset management solutions to optimize maintenance schedules, minimize downtime, and extend the lifespan of critical infrastructure. A number of countries are adopting concepts such as smart cities, where infrastructure asset management is used for the management of the energy infrastructure. This trend is likely to bode well for the growth of energy infrastructure application segment in the near future.

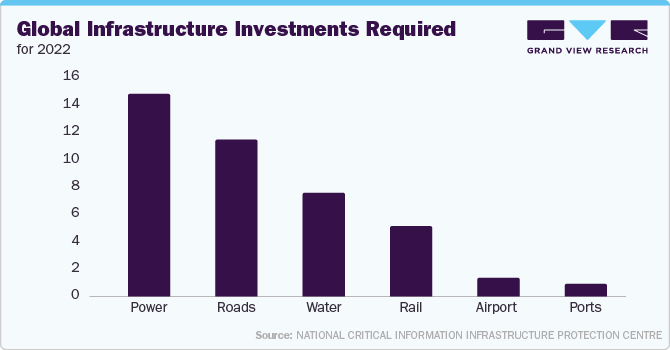

The incorporation of cutting-edge technologies like IoT, data analytics, and predictive maintenance tools with the utility asset management solutions can play a pivotal role, enabling utilities to actively monitor assets and make decisions based on real-time data. The market's growth is further fueled by regulatory mandates emphasizing compliance and the imperative to tackle issues related to aging infrastructure. In addition, effective use of asset management solutions could enable utilities to proactively address potential issues, reducing the risk of service disruptions and enhancing overall reliability.

Infrastructure asset management services are being rapidly adopted for various benefits offered by it, such as tracking-ability of assets, infrastructure security and longevity, and ecological sustainability. Government agencies across the world have increased their emphasis on changing the way in which infrastructure is managed by replacing traditional methods with technologies that utilize internet services such as global positioning system (GPS), and cloud computing. Moreover, the growing awareness regarding the benefits provided integrating IoT asset management solutions is expected drive the market growth.

Component Insights

Based on the component, the market is segmented into solutions and services. The solution segment held the largest market share in 2022. The segmental growth can be attributed to the rising demand for integrated and technologically advanced utility asset management platforms, offering real-time monitoring, predictive analytics, and seamless integration of IoT devices. This increasing preference for comprehensive solutions underscores the industry's recognition of the critical role that sophisticated technology plays in enhancing the efficiency and performance of utility asset management systems.

Utility Type Insights

Based on the utility type, the market is segmented into private utilities and public utilities. The private utilities segment held the largest market share in 2022. The growing trend of private investment in utility infrastructure, where companies focus on leveraging advanced technologies and efficient asset management practices to enhance service delivery, optimize operations, and ensure long-term sustainability.

Application Insights

Based on application, the market is segmented into energy, water, and gas. The energy segment held the largest market share in 2022. The integration of smart grids, smart meters, and IoT-based devices has prompted energy companies to embrace utility asset solutions to manage the energy efficiently. This adoption is driven by the need for real-time monitoring, predictive maintenance, and data-driven decision-making to optimize energy production, distribution, and overall operational efficiency in response to the evolving landscape of the energy sector.

Regional Insights

North America dominated the utility asset management market in 2022. This is attributed to the region's robust technological infrastructure, increasing investments in modernizing utility networks, and a heightened focus on implementing advanced asset management solutions. Additionally, stringent regulatory frameworks in North America drive the adoption of utility asset management practices to ensure compliance, operational efficiency, and resilience in the delivery of essential utility services.

Key Companies & Market Share Insights

Key players operating in the utility asset management market include Siemens AG, General Electric Company, IBM Corporation, Schneider Electric SE, ABB Ltd, Oracle Corporation, and Sensus (Xylem Inc.), among others. In addition, these players aim to provide end-to-end solutions that cover the entire lifecycle of utility assets. This involves offering integrated platforms that facilitate real-time monitoring, predictive maintenance, and data-driven decision-making to optimize asset performance and reliability.

In October 2022, Adani Power Limited (APL) enlisted the services of Black & Veatch to enhance the efficiency and reliability of its power assets in India. The primary objectives include minimizing unplanned shutdowns and enhancing operational efficiencies for a more reliable and environmentally responsible power generation operation.