- Home

- »

- Animal Health

- »

-

Veterinary Cardiology Market Size, Industry Report, 2030GVR Report cover

![Veterinary Cardiology Market Size, Share & Trends Report]()

Veterinary Cardiology Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Companion, Production), By Product (Pharmaceuticals, Diagnostics), By Indication, By End-use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-399-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Cardiology Market Summary

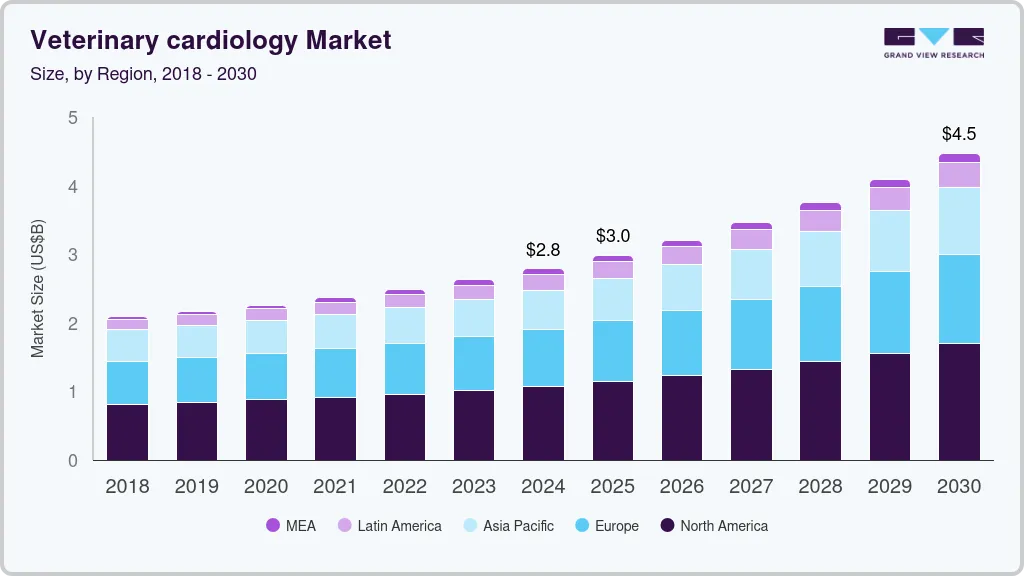

The global veterinary cardiology market size was estimated at USD 2,787.0 million in 2024 and is projected to reach USD 4,468.3 million by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The high prevalence of cardiologic disorders among companion animals, particularly dogs, is a significant market driver for the veterinary cardiology sector.

Key Market Trends & Insights

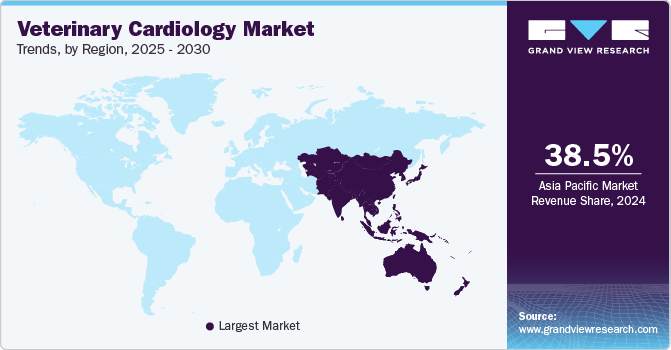

- North America dominated the overall global market and accounted for the largest revenue share of 38.48% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2030.

- By animal type, the companion animals segment accounted for the largest market share of over 67.28% in 2024.

- By indication, the congestive heart failure segment dominated the market with share of over 37.93% in 2024.

- By product, the pharmaceuticals segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,787.0 Million

- 2030 Projected Market Size: USD 4,468.3 Million

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

Research indicates that approximately 10% of all dogs seen in primary care animal settings are diagnosed with heart disease, with this figure rising to over 60% in older dogs. Among these cases, myxomatous mitral valve disease (MMVD) stands out, accounting for 75% of canine heart disease cases in the U.S., primarily affecting heart valves. Another critical condition, dilated cardiomyopathy (DCM), directly impacts the heart muscle. The widespread occurrence of these disorders underscores the growing demand for advanced diagnostics, therapeutics, and specialized animal care, fueling the expansion of the market.

For instance, in June 2024, the Indian Council for Agricultural Research published a study examining the incidence of cardiac arrhythmias in 435 dogs with a history of generalized diseases over 14 months from July 2022 to September 2023. The assessment was aimed to determine the occurrence of arrhythmias and found that 114 dogs (26.21%) displayed various types, including atrial fibrillation (30.70%), ST-segment coving, sinus arrest (9.65% each), and ST-segment elevation (8.77% each). Moreover, there is a rising prevalence of CHD among cattle which is further driving the market growth. For instance, according to the Large Animal Review (LAR) study published in June 2023, CHD is a heart condition that is present at birth, with a reported prevalence ranging from 0.2% to 2.7% in cattle.

Moreover, the increasing awareness regarding preventive health has led pet owners to spend more on their health to improve their overall well-being. The rising expenditure on animal care is a notable driver for the growth of the market. According to the article published in February 2024, the Bureau of Labor Statistics found that the cost of veterinary services increased by 7.5% from September 2022 to September 2023. This upward trend reflects growing pet ownership, heightened awareness of pet health, and advancements in veterinary diagnostics and treatments. As pet owners increasingly prioritize specialized care, including cardiology services, this surge in spending supports the demand for innovative solutions and expanded animal cardiology offerings.

The growing advancements in animal medications and knowledge about various treatment options available for different disorders, including heart diseases that pets may face, are propelling the market growth. Pet health awareness programs enable pet owners to explore these treatment options. For instance, in June 2023, the Veterinary Innovation Summit (VIS) was organized to bring together professionals, innovators, and thought leaders in the field of animal health care to discuss and shape the future of veterinary medicine. VIS 2023 is expected to be a groundbreaking event that is likely to inspire attendees to drive innovation and advancements in animal health care.

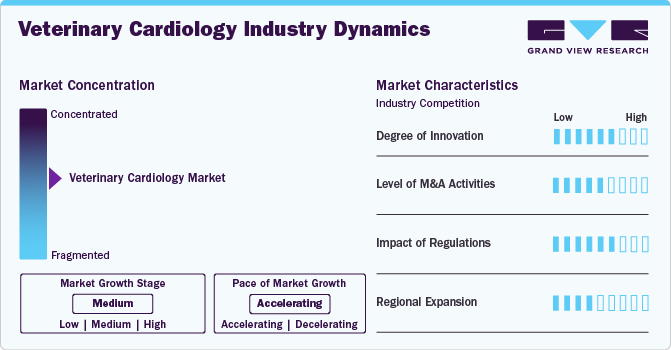

Market Concentration & Characteristics

The veterinary cardiology industry exhibits a moderate level of concentration. Characteristics include rapid technological advancements, such as the integration of artificial intelligence (AI) and cardiac monitoring. The industry showcases continuous innovation and expansion fueled by rising animal healthcare expenditure, the growing prevalence of cardiac disorders, and the growing adoption of veterinary healthcare solutions.

The veterinary cardiology market is characterized by a high degree of innovation, driven by advancements in diagnostic tools, therapeutic options, and interventional procedures. Innovations in imaging technologies, such as echocardiography and cardiac MRI, have significantly improved the accuracy of diagnosing heart conditions in animals. Additionally, the development of novel pharmaceuticals and biologics for treating heart diseases in pets, such as ACE inhibitors and beta-blockers, mirrors advancements in human cardiology. Minimally invasive procedures, including catheter-based interventions, are becoming more common, reducing recovery times and improving outcomes for animal patients.

The veterinary cardiology market has seen a moderate level of mergers and acquisitions (M&A) activity, reflecting a trend towards consolidation within the broader animal healthcare sector. Larger companies are acquiring specialized firms to expand their product portfolios and enhance their technological capabilities. For instance, Mars Inc.'s acquisition of VCA Inc., a provider of animal services, included numerous specialty hospitals with cardiology services. Such M&A activities allow companies to broaden their geographic reach, leverage economies of scale, and integrate innovative technologies more efficiently. This consolidation trend also helps in creating integrated platforms that offer comprehensive animal care, including specialized cardiology services.

Regulations play a crucial role in shaping the veterinary cardiology market, influencing everything from the approval of new medications and devices to the standards of care provided. Regulatory bodies such as the European Medicines Agency (EMA) and U.S. Food and Drug Administration (FDA) oversee the approval process for animal pharmaceuticals and medical devices, ensuring their safety and efficacy. Additionally, regulations related to animal practice standards, such as those set by the American Veterinary Medical Association (AVMA) and the European Board of Veterinary Specialization (EBVS), impact how cardiology services are delivered. Compliance with these regulations is essential for market players, as it affects their ability to innovate and bring new products to market. Regulatory frameworks also ensure that veterinary professionals are adequately trained and certified to perform advanced cardiology procedures.

The market is experiencing significant regional expansion, driven by increasing pet ownership, rising awareness of pet health, and the growing availability of advanced animal services. North America and Europe currently dominate the market owing to their well-established veterinary infrastructure and high expenditure on pet healthcare. Companies are expanding their operations and investing in local partnerships to tap into these burgeoning markets. For instance, Zoetis has been actively expanding its presence in Asia through strategic investments and partnerships, aiming to meet the rising demand for veterinary care, including cardiology services.

Animal Type Insights

The companion animals segment accounted for the largest market share of over 67.28% in 2024. Awareness programs, collaborations, and government initiatives are key drivers in advancing the companion animal cardiology market. A notable example is the University of Florida College of Veterinary Medicine's pioneering open-heart surgery program for dogs, launched in August 2023, which marked its first year in August 2024. In the U.S., this program focuses on mitral valve repair surgery for dogs that suffer from degenerative mitral valve disease, the most prevalent canine heart condition. Within its first year, the program performed over 40 surgeries, significantly enhancing the quality of life for affected animals. The program's success is attributed to the expertise of Dr. Katsuhiro Matsuura, a renowned veterinary cardiac surgeon, whose collaboration brought advanced techniques from Japan, where he achieved a 90% success rate in over 100 mitral valve repairs. Initiatives like this raise awareness and set benchmarks, driving growth and innovation in the segment and further contributing to market growth.

The production animals segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is owing to the increasing incidences of heart diseases in cattle, as cardiovascular diseases can significantly impact the performance and overall welfare of production animals. For instance, according to the article published in September 2024, congestive heart failure, once largely confined to cattle raised at high altitudes, is now increasingly observed in cattle at lower elevations, with inspections revealing abnormally swollen hearts in 34% of some groups of grain-fed steers and heifers at slaughter plants. This condition not only compromises animal welfare but also results in significant economic losses, particularly in the late stages of feeding programs. The rise in heart and lameness issues—up to 8% in grain-fed cattle, compared to nearly zero two decades ago—is linked to genetic selection for rapid growth and large ribeye size. Addressing these health challenges has become critical, driving the demand for advanced diagnostic and treatment solutions in veterinary cardiology for production animals.

Product Insights

The pharmaceuticals segment dominated the market in 2024, driven by the increasing prevalence of cardiac diseases in pets, including conditions such as congestive heart failure, arrhythmias, and valvular disorders. As pets live longer due to improved healthcare and nutrition, they are more likely to develop age-related cardiac issues, creating a growing market for pharmaceutical interventions. Additionally, advancements in veterinary medicine have led to better diagnostics and increased awareness among pet owners regarding the importance of cardiac health in animals. This has resulted in a higher demand for effective pharmaceutical solutions tailored to the specific needs of veterinary cardiology patients. Furthermore, research and development efforts focused on novel drug therapies for animal cardiac conditions have expanded, driven by the need for safer and more productive treatment options. The collaboration between veterinarians, pharmaceutical companies, and regulatory bodies also plays a significant role in driving innovation and ensuring the availability of high-quality pharmaceutical products for veterinary cardiology.

The diagnostics segment is anticipated to grow at a fastest CAGR over the forecast period. Advancements in diagnostic technologies have made it easier to detect cardiac abnormalities in animals through non-invasive procedures such as echocardiography, electrocardiography, and blood tests. These technological innovations have increased the accuracy and efficiency of diagnosing cardiac conditions in veterinary medicine. For instance, in November 2024, Dahsboard Vet launched a new feature that enables user to share their horse’s ECG with veterinarian directly. Arioneo’s latest software is specifically designed to offer an advanced ECG analysis program for vets. Digitalization of the diagnosis and monitoring process in veterinary cardiology is set to open new ways in the development of diagnostics segment.

Indication Insights

The congestive heart failure segment dominated the market with share of over 37.93% in 2024. This growth is owed to the increasing valvular heart disease and dilated cardiomyopathy, which leads to volume overload, pressure overload, or both, ultimately resulting in CHF and enlargement of the heart chambers & impaired contractility, leading to poor cardiac function and eventual CHF, respectively. Frequent studies and advancements in treating CHF contribute to the growth of this segment. For instance, according to the article published in 2024, doctors from the Colorado State University (CSU), along with Hongyu Medical and Avalon Medical, performed transcatheter edge-to-edge repair (TEER) of the mitral valve in a dog. With this successful method the team introduced an innovative surgery option for congestive heart failure in dogs. Moreover, hypertension is also a common driver of CHF in veterinary patients, as increased blood pressure puts additional strain on the heart muscle over time, leading to its deterioration and eventual failure.

The arrhythmias segment is anticipated to grow at a fastest CAGR over the forecast period. The growth is attributed to the growing structural heart disease, such as dilated cardiomyopathy or valvular disease, can lead to electrical abnormalities in the heart and predispose animals to arrhythmias. Metabolic disorders such as hypothyroidism or hyperkalemia can also disrupt the normal electrical conduction system of the heart, resulting in arrhythmias. Additionally, certain breeds are genetically predisposed to specific arrhythmias, highlighting the role of genetics in driving this segment of veterinary cardiology. Other factors, such as electrolyte imbalances, drug toxicities, and systemic diseases, including neoplasia, are likely to further contribute to the development of arrhythmias in animals.

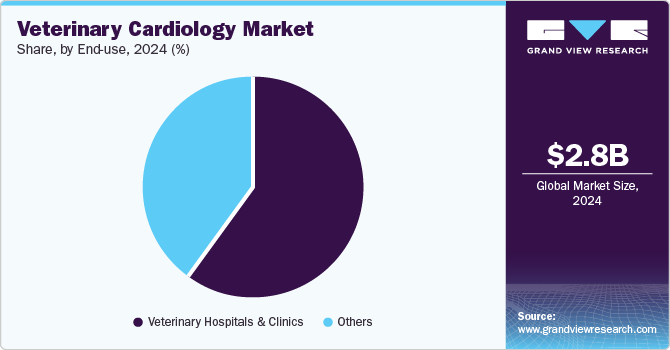

End Use Insights

The veterinary hospitals & clinics segment accounted for the largest market share in 2024. The increasing advancements in veterinary cardiology technology and treatment options have expanded the capabilities of these facilities, allowing them to offer cutting-edge diagnostic tools and innovative treatment modalities. Additionally, the rising prevalence of cardiac conditions in companion animals leads to a higher caseload for veterinary cardiologists. This trend necessitates the presence of well-equipped hospitals and clinics with skilled professionals to cater to the growing number of cardiac patients.

Moreover, collaborations between veterinary cardiologists & other specialists and growing expansions within these facilities contribute to comprehensive care for animals with complex cardiac issues, further driving the growth and importance of veterinary hospitals and clinics in the veterinary cardiology market. For instance, according to MJH Life Sciences updates published in April 2024, the founder and CEO of Boulevard Veterinary (BLVD Vet), along with the co-owner and director of design, launched their first BLVD Vet location in 2015. Since then, they have expanded their chain of Chicago-based clinics to four locations in Illinois. The most recent addition is the Lakeview East clinic, which opened its doors in February 2023. This new establishment has been recognized as the winner of the dvm360 2023 Hospital Design360 Competition in the "under-8000-square-feet" category.

Distribution Channel Insights

The hospital/ clinic pharmacy segment dominated the market in 2024. The rising awareness among pet owners about the importance of cardiac health in animals has fueled the growth of the veterinary cardiology market, prompting hospitals and clinics to expand their pharmacy offerings to cater to this specific niche. Furthermore, the increasing collaboration between veterinary cardiologists and pharmaceutical companies plays a significant role in driving the veterinary cardiology market's hospital/clinic pharmacy segment.

This partnership between industry players and healthcare providers ensures that cutting-edge medications are readily available at hospital pharmacies specializing in veterinary cardiology. For instance, in April 2023, the Columbus Zoo and Aquarium in Ohio partnered with the Great Ape Heart Project to enhance cardiac care for their great apes. This collaboration aims to improve the understanding and treatment of heart disease in great apes, particularly focusing on gorillas, orangutans, bonobos, and chimpanzees.

The e-commerce segment is anticipated to grow at the fastest rate during the forecast period. The increasing adoption of technology and digital platforms in the healthcare industry has led to a growing acceptance of online platforms for purchasing medical supplies and equipment, including those related to veterinary cardiology. The rise of telemedicine and remote consultations in veterinary care has created a need for quick and seamless access to specialized equipment such as cardiology devices. E-commerce platforms provide a convenient solution for procuring these items without physical visits to brick-and-mortar stores. This is particularly beneficial for veterinary practices located in remote areas or with limited access to specialized suppliers. Additionally, the availability of product reviews and ratings on e-commerce sites helps build trust among buyers, especially when investing in critical medical equipment like those used in veterinary cardiology.

Regional Insights

North America Veterinary Cardiology market dominated the overall global market and accounted for the largest revenue share of 38.48% in 2024. This growth is attributed to the growing investment and increasing insurance facilities for advancing animal healthcare. For instance, according to North American Pet Health Insurance Association article published its State of the Industry (SOI) Report in April 2024 which highlighted significant growth in the pet insurance sector in 2023. The report revealed that the industry experienced a substantial increase of 21.9% compared to the previous year. This growth propelled the North American pet insurance industry past the USD 4 billion mark for the first time, with total premiums reaching USD 4.27 billion in 2023.

Moreover, the growing awareness programs regarding animal healthcare is further propelling the market growth in the region. For instance, in January 2023, the 40th annual Veterinary Meeting & Expo (VMX) was organized in Florida at the Orange County Convention Center. This event is renowned as the world’s largest and most comprehensive veterinary conference, attracting veterinary professionals from over 65 countries. The attendees are offered the opportunity to delve into the latest advancements in animal medicine, including cutting-edge diagnoses, surgical techniques, pharmaceutical breakthroughs, and more.

U.S. Veterinary Cardiology Market Trends

The veterinary cardiology market in the U.S. held a significant share of North America's veterinary cardiology market in 2024. The growth is attributed to the rising successful application of animal heart surgeries in the country. For instance, in October 2023, the University of Florida’s College of Veterinary Medicine conducted the first open-heart surgery on a dog in the U.S. The surgery involves tightening the area around the mitral valve and repairing the chordae tendineae to reduce mitral regurgitation.

Moreover, the pet insurance market in the U.S. has been experiencing significant growth in recent years. According to PHI Direct report published in September 2023, there are approximately 5.36 million pets insured by their owners out of over 86.9 million pet-owning households in the country as of 2022. Additionally, certain states such as California, New York, and Florida account for more than 30% of all enrolled pets in the country. This regional concentration highlights the varying levels of adoption and acceptance of pet insurance across different parts of the U.S.

Europe Veterinary Cardiology Market Trends

The Europe veterinary cardiology market is witnessing growth fueled by greater awareness and a growing advancement in cardiology in veterinary practices. For instance, multiple events and conferences are arranged in European countries to explore innovative technologies, treatment options, and many other. 28th World Cardiology Conference is organized in France on December 2024 that will comprise of discussions on innovation, integration and implementation of advanced cardiovascular care in animals. Another 35th International Conference on Cardiology and Healthcare is planned to take place in February 2025 in Netherlands, which will revolve around prevention and early intervention in cardiovascular health in vets. Such events feature comprehensive programs covering multiple cardiology topics, including staging of myxomatous mitral valve disease, arrhythmias, new techniques for treating mitral valve and congenital heart disease, and approaches to patients with cardiac conditions, further boosting partnerships and collaborations to augment the market growth.

The veterinary cardiology market in the UK is one of the major markets in the European region. The growth is attributed to the increasing number of pet lovers, and rising adoption of pets in the country. As per the PHI Direct report published in September 2023, the UK has a significant number of individuals who opt for pet insurance, with approximately 3.7 million people carrying pet insurance policies. These policies cover a total of 4.3 million pets across the country, with dogs and cats comprising the most insured animals. The pet insurance industry in the UK is experiencing steady growth, estimated at around 5% per year. This growth is reflected in the processing of over 1 million claims annually.

Moreover, a notable trend within the UK pet insurance market is that about 20% of pet insurance purchasers are considering transitioning to more affordable policies in the upcoming year. This suggests a potential shift in consumer behavior towards seeking better value or cost-effective options for insuring their pets.

The veterinary cardiology market in Germany is projected to expand in the forecast period. The rising incidence of cardiovascular diseases in animals is a significant driver of the veterinary cardiology market in Germany. According to the Purina Institute Advancing Science for Pet Health, cardiovascular diseases are common in dogs and cats, with approximately 10% of dogs and 15% of cats suffering from heart disease. This increasing prevalence of cardiovascular diseases in animals has led to a growing demand for veterinary cardiology services, including diagnosis, treatment, and management of heart conditions.

Moreover, government initiatives and regulations aimed at improving animal health and welfare have also driven the growth of the veterinary cardiology market in Germany. For instance, the German government has implemented regulations to improve animal welfare, including the Animal Welfare Act, which has led to an increased focus on animal health, including cardiovascular health.

Asia Pacific Veterinary Cardiology Market Trends

The veterinary cardiology market in the Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2030. Technological advancements are a pivotal driver in the region's growth of the veterinary cardiology market, as exemplified by groundbreaking innovations like the minimally invasive mitral valve repair (MVR) surgery developed in Thailand. In January 2024, a team of doctors at Chulalongkorn University successfully performed MVR using a mitral clamp on a dog for the first time in the country. This technique, which eliminates the need for an artificial heart or lung machine, offers several advantages, including reduced surgical wounds, faster recovery times, and lower costs for pet owners. Additionally, the procedure enhances the heart’s function, delaying the progression of heart failure and improving the animal's quality of life. Such innovations highlight the transformative impact of advanced treatment methods in veterinary cardiology, driving increased adoption and market growth in the region.

The veterinary cardiology market in India holds a significant share of the Asia Pacific regional market revenue. This growth is owed to the presence of some key players focusing on improving the overall well-being of animals. For instance, In October 2023, Drools Pet Food Pvt introduced an initiative called ‘Drools Vet Thrive’ aimed at upgrading veterinary clinics across the country. This initiative signifies a significant step towards enhancing the quality of veterinary care and services available to pets and their owners. The primary objective of the ‘Drools Vet Thrive’ initiative is to improve the standards of veterinary clinics in the country. By upgrading these facilities, Drools aims to provide better healthcare services for pets, ensuring they receive top-notch treatment and care from qualified professionals.

The veterinary cardiology market in China is expected to grow significantly faster. The growth is attributed to theincrease in pet adoption in the country, coupled with increasing awareness regarding preventive healthcare for pets, are major drivers for the growth of the veterinary medical services market in China; for instance, according to an article published by GlobalPETS in September 2021, the number of people opting for pet insurance in the country increase from about 5,000 to more than 160,000 in the duration of five years. This shows the increasing demand for preventive healthcare services in the country.

In addition, rising investment in the animal health industry can further boost market growth. For instance, New Ruipeng, the largest animal health operator in China, with about 1,400 centers in over 80 cities, received huge investment funding from Tencent in September 2020. This investment is likely to further advance medical services in these hospitals and assist in market development.

Latin America Veterinary Cardiology Market Trends

The veterinary cardiology market in Latin America is experiencing significant growth, which is attributed to the rising advances in veterinary cardiology. Latin America has profoundly impacted the market by fostering collaboration, education, and innovation within the field. For instance, as per the Virginia-Maryland College of Veterinary Medicine updates published in September 2023, Dr. Gerardo Carvallo, a veterinary cardiologist at the Virginia-Maryland College of Veterinary Medicine, contributed to advancing veterinary cardiology in Latin America through his efforts to establish a network of specialists and provide training opportunities for veterinarians in the region. His work has significantly impacted the field by raising awareness about cardiovascular diseases in animals and improving access to specialized care.

Furthermore, Dr. Carvallo’s collaborations with veterinary schools and clinics in the region have facilitated the exchange of information and expertise, leading to improved diagnosis and treatment of cardiac diseases in animals. Through these partnerships, he has helped build a foundation for ongoing research and veterinary cardiology advancements that benefit practitioners and their patients.

The veterinary cardiology market in Brazil is anticipated to expand in the forecast period due to increasing government initiatives and the rapid expansion of high-quality veterinary care providers like WeVets. In November 2024, L Catterton, a global investment firm with extensive experience in the pet care sector, invested in WeVets, a leading veterinary hospital group in Brazil, to support the expansion of its tech-driven model and deliver comprehensive services, including specialty care such as cardiology. Strategic expansion through acquisitions and organic growth, combined with its focus on operational excellence in primary and urgent care, surgery, and diagnostics in veterinary care, positions it as a potential market in veterinary cardiology, meeting the increasing need for specialized pet care.

Middle East & Africa Veterinary Cardiology Market Trends

The veterinary cardiology market in MEA is expected to witness significant growth over the forecast period. The growing awareness programs for the development of animal healthcare in the region. For instance, in 2023, the Middle East Animal Veterinary Conference (MEAVC) Satellite Events was organized to provide veterinarians with training opportunities in various disciplines without the need to travel outside their country. The first MEAVC Satellite Event took place in Abu Dhabi, UAE, on March 4-5, 2023. The event focused on two disciplines: Cardiology and Anesthesiology. Renowned specialists were present to train and engage with the attending veterinarians.

The veterinary cardiology market in Saudi Arabia is anticipated to expand in the forecast period due to increasing advancements in veterinary medicine and technology, which are enabling veterinarians to diagnose and treat cardiac conditions in animals more effectively. Moreover, government initiatives aimed at improving animal welfare standards and promoting access to quality veterinary care are also contributing to the expansion of the veterinary cardiology market in Saudi Arabia.

Key Veterinary CardiologyCompany Insights

The global market is highly competitive. Key companies deploy strategic initiatives, such as product development, launches, and sales & marketing strategies to increase product awareness and regional expansions and partnerships to strengthen their market share. Market players are also involved in conducting clinical testing of their products, patent applications, and increasing product penetration.

Key Veterinary Cardiology Companies:

The following are the leading companies in the veterinary cardiology market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Jurox Pty Limited

- Ceva

- Merck & Co., Inc.

- IDEXX

- Apex Bio Medical

- SOUND

- General Electric Company

- FUJIFILM Holdings America Corporation

- ESAOTE SPA

Recent Developments

-

In June 2024, Boehringer Ingelheim launched the VETMEDIN solution for the management of congestive heart failure (CHF) in dogs. It is the first oral solution approved by the FDA for CHF treatment in canines, enabling easy administration. The solution has proved to increase the survival time of dogs affected by the condition. The delivery of robust innovations in the field of veterinary cardiology is expected to boost market growth in the coming years.

-

In April 2024, FDA approved first generic Pimomedin (pimobendan) chewable tablets indicated for the treatment of mild to severe congestive heart failure in dogs, occurred due to clinical myxomatous mitral valve disease (MMVD) or dilated cardiomyopathy (DCM). This generic drug is also sponsored by Cronus Pharma Specialties India Private Ltd., based in India. Such generic product launches will support adoption of veterinary pharmaceuticals and contribute in veterinary cardiology market.

Veterinary Cardiology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.98 billion

Revenue forecast in 2030

USD 4.46 billion

Growth Rate

CAGR of 8.41% from 2025 to 2030

Actual data

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, indication, end use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico; UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Boehringer Ingelheim International GmbH; Jurox Pty Limited; Ceva; Merck & Co., Inc.; IDEXX; Apex Bio Medical; SOUND; General Electric Company; FUJIFILM Holdings America Corporation; ESAOTE SPA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Cardiology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global veterinary cardiology market report on the basis of animal type, product, indication, end use, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Production Animals

-

Cattle

-

Poultry

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Pimobendan

-

Spironolactone and benazepril hydrochloride

-

Others

-

-

Diagnostics

-

Physical exam

-

Chest X-rays

-

Electrocardiogram (ECG)

-

Others

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Congestive Heart Failure

-

Myocardial (Heart Muscle) Disease

-

Arrhythmias

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital/ Clinic Pharmacy

-

Retail

-

E-Commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary cardiology market size was valued at USD 2.79 billion in 2024 and is expected to reach USD 2.98 billion in 2025.

b. The global veterinary cardiology market size is projected to grow at a compound annual growth rate (CAGR) of 8.41% from 2025 to 2030 to reach USD 4.46 billion by 2030

b. The companion animals segment accounted for the largest market share of over 67.28% in 2024. The segment is primarily driven by evolving role of pets, especially dogs, in meeting human emotional needs such as companionship and stress relief—the increasing awareness and understanding of heart disease in pets among owners and veterinarians.

b. Some key players operating in the veterinary cardiology market include Boehringer Ingelheim International GmbH; Jurox Pty Limited; Ceva; Merck & Co., Inc.; IDEXX; Apex Bio Medical; SOUND; General Electric Company; FUJIFILM Holdings America Corporation; ESAOTE SPA

b. Key factors that are driving the market growth include increasing pet humanization, rising pet ownership and rising prevalence of cardiologic disorders among companion animals

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.