- Home

- »

- Animal Feed and Feed Additives

- »

-

Vietnam Animal Feed Additives Market Size Report, 2030GVR Report cover

![Vietnam Animal Feed Additives Market Size, Share & Trends Report]()

Vietnam Animal Feed Additives Market Size, Share & Trends Analysis Report By Product (Antibiotics, Vitamins, Antioxidants, Amino Acids), By Livestock (Pork/Swine, Poultry, Cattle), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-434-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

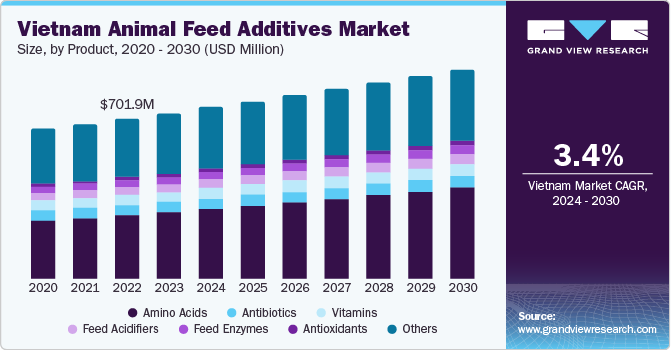

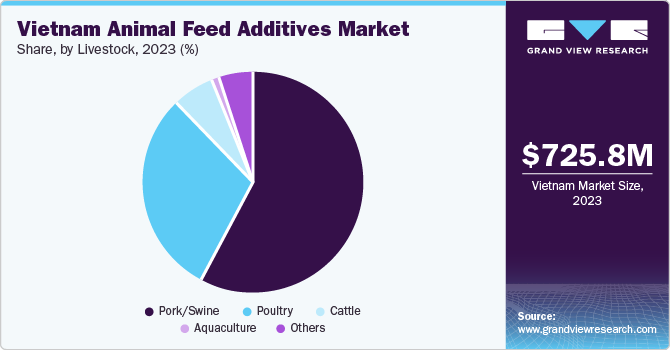

The Vietnam animal feed additives market size was valued at USD 725.8 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.4% from 2024 to 2030. This is attributed to the increasing poultry consumption in the country aided by changing lifestyles as well as growth of the processed food sector. Vietnam also has a huge market for pork as it forms an essential part of staple diet in the country. Hence, the increasing demand for poultry products and the shift in meat consumption patterns provide opportunities for market participants to develop and supply additives for poultry sector.

The increasing demand for animal protein and meat products is a key driver in the Vietnamese market. As the country's population continues to grow and incomes rise, there is a higher demand for animal protein sources such as poultry, pork, and aquaculture. This demand is driven by various factors such as urbanization, changing dietary preferences, and a growing middle class.

Vietnam’s increasing focus on animal health and welfare is a key factor in the growth of animal feed additives in the market. Consumers have steadily become conscious about the quality and safety of animal based products, leading to a growing demand for naturally sourced, safe, and sustainable additives.This has led to stricter regulations and guidelines on antibiotic usage in livestock production. As a result, there is an increasing demand for alternatives to antibiotics, such as probiotics, prebiotics, essential oils, and organic acids, which promote gut health, improve immunity, and reduce the need for antimicrobials in feed.

Technological advancements and innovation have been key in driving Vietnam’s animal feed additives sector. Technologies such as encapsulation allows the controlled release of active ingredients, improving their efficiency. Encapsulated enzymes and probiotics can withstand the harsh conditions of the digestive system and deliver their benefits to the gut, improving nutrient utilization and gut health.

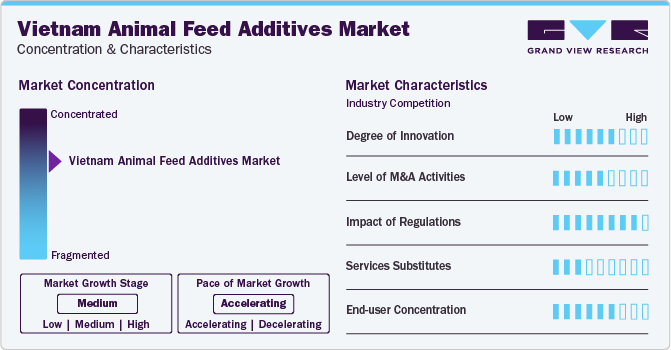

Market Concentration & Characteristics

The Vietnam animal feed additives market is considerably consolidated in nature, with key players such as BASF SE, Cargill, Incorporated, and dsm-firmenich are dominating the industry. This consolidation is driven by participation of larger companies with greater financial resources and economies of scale have a competitive advantage in terms of product development, quality control, and cost efficiency. For instance, Cargill, Incorporated, a multinational corporation with a strong presence in the Vietnamese animal nutrition industry. Cargill’s extensive resources and global reach enable them to develop innovative additives and provide comprehensive solutions to meet the evolving demands of the market.

The distribution of feed additives involves establishing strong relationships with feed manufacturers, livestock producers, and other stakeholders in the value chain. Key players in the market have well-established distribution networks and long-standing relationships with customers. These relationships and distribution capabilities create barriers to entry for new players and contribute to the market concentration. For instance, a multinational conglomerate with a significant presence in the agribusiness sector. Charoen Pokphand Foods PCL's extensive distribution network and strong relationships with farmers and manufacturers enable them to maintain a dominant position in the market.

The animal feed industry is subject to stringent regulations and quality standards to ensure the safety and efficacy of additives. For instance, the Circular 21/2019/TT-BNNPTNT, issued by the Vietnamese government, provides guidance on various aspects of animal feed. It covers topics such as production, labeling, quality control, and safety standards. Newer laws like Animal Husbandry Law, introduced in 2018 have banned the use of antimicrobial growth promoters in commercial products, aiming to promote the responsible use of antibiotics in animal production.

Product Insights

Amino Acids dominated the market in 2023. This high percentage can be attributed to them being used as essential building blocks of proteins and play a crucial role in the growth, development, and overall health of animals. Amino acids, such as lysine, methionine, and threonine, are vital for maintaining the health and well-being of animals. They contribute to the development of a strong immune system, improved gut health, and enhanced nutrient utilization. As a result, there is a growing trend of incorporating amino acid-based feed additives in diets to support optimal health and performance.

Vitamins is another major type of animal feed additives required in small quantities for the proper growth, development, and overall health of animals. They are involved in various physiological processes, including energy metabolism, immune function, and reproduction. Vitamins, such as vitamin E and vitamin C, act as antioxidants and contribute to the overall health and well-being of animals. Natural vitamin sources, such as plant extracts or fermentation products, are gaining popularity as they align with consumer preferences for clean and sustainable animal products.

Antibiotics are a class of feed additives used in livestock production to promote growth, prevent diseases, and improve efficiency.They help reduce the incidence of bacterial infections, improve gut health, and enhance overall animal performance. Due to concerns about antimicrobial resistance, the use of antibiotics in animal feed additives is now regulated in many countries, including Vietnam. The industry is also exploring alternatives to antibiotics, such as bacteriophages and essential oils, to maintain animal health and performance while reducing reliance on antibiotics.

Livestock Insights

The pork/swine livestock dominated the market and accounted for a share of 54.8% in 2023. This is attributable to the traditionally high consumption of pork in Vietnamese staple diet and it continues to grow due to population growth, rising incomes, and changing dietary preferences. The swine industry in Vietnam faces challenges related to disease outbreaks, such as African Swine Fever (ASF). To prevent and control diseases, feed additives are used to boost the immune system and improve the overall health of pigs.

Poultry is an important livestock segment for Vietnam animal feed additives. Poultry meat is considered a relatively affordable and versatile source of animal protein. This growing demand for poultry meat drives the need for effective additives to support the health, growth, and productivity of poultry. Additionally, additives like antioxidants and natural pigments are used to enhance the nutritional value and appearance of poultry products, meeting consumer expectations and preferences.

The cattle segment, although relatively smaller compared to pork and poultry, also contributes to the market in Vietnam. Vietnam has been transitioning from traditional extensive cattle farming to more intensive systems, driven by increasing demand for beef and dairy products. Intensive cattle farming requires the use of feed additives to optimize nutrition, enhance growth, and improve feed efficiency. Additives like rumen modifiers, growth promoters, and mineral supplements are commonly used to support the health and productivity of cattle.

Key Companies & Market Share Insights

Some of the key players operating in the market include Charoen Pokphand Foods PCL, Cargill, Incorporated, and dsm-firmenich.

-

Charoen Pokphand Foods PCL specializes in manufacturing of animal feed additives, producing products for livestock such as poultry, swine, and cattle. It offers livestock and aquaculture products under its feed business segment.

-

Cargill, Incorporated is a global agricultural and food processing company that also operates in Vietnam's animal feed additives market. It offers a range of products such as Intella, Cinergy, Notox, Valido, Proviox and Enzae under its PROMOTE range of additives.

Protexin, Nutreco and Novus International, Inc. are some of the emerging market participants in the Vietnam animal feed additives market.

-

Novus International, Inc. offers additive products for poultry, swine and dairy industry. It offers products under brands such as ACTIVATE, ALIMET, MHA, MINTREX and PROVENIA.

-

Nutreco is a provider of species focused solutions including feed products, nutritional knowledge and concepts. The company offers these services along with premixes under its Trouw Nutrition business line.

Key Vietnam Animal Feed Additives Companies:

- BASF SE

- Charoen Pokphand Foods PCL

- Cargill, Incorporated.

- dsm-firmenich

- Protexin

- Nutreco

- Novus International

- Vedan Vietnam Enterprise Corp.,Ltd

- EZ

- HONG HA NUTRITION JSC

Recent Developments

-

In November 2023, Entobel, a manufacturer of insect protein, inaugurated the largest new black soldier fly (BSF) manufacturing facility in Asia. The production facility will have a production capacity of 10,000 metric tons of insect protein.

-

In September 2023, Cricketone Asia, a Vietnamese firm dealing in edible insects, opened a cricket processing plant in Binh Phuoc near Saigon City. The facility will process 1,000 metric tons per year for now, increasing the capacity eventually to 10,000 tons till the year 2028.

-

In June 2023, Adisseo announced the acquisition of Nor-Feed Group along with its Vietnamese subsidiary Nor-Feed Vietnam. The acquisition is expected to help Adisseo expand into the specialty ingredients segment of animal nutrition around the world and specifically in the Vietnamese market.

Vietnam Animal Feed Additives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 750.6 million

Revenue forecast in 2030

USD 917.3 million

Growth Rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and livestock

Country scope

Vietnam

Key companies profiled

BASF SE; Charoen Pokphand Foods PCL; Cargill, Incorporated.; dsm-firmenich; Protexin; Nutreco; Novus International; Vedan Vietnam Enterprise Corp., Ltd; EZ; HONG HA NUTRITION JSC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Vietnam Animal Feed Additives Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Vietnam animal feed additives market report based on product and livestock.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Antibiotics

-

Vitamins

-

Antioxidants

-

Amino Acids

-

Feed Enzymes

-

Feed Acidifiers

-

Others

-

-

Livestock Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pork/Swine

-

Poultry

-

Cattle

-

Aquaculture

-

Others

-

Frequently Asked Questions About This Report

b. Key factors that are driving the Vietnam animal feed additives market growth include increasing meat consumption and growing demand for amino acids in swine and poultry feed.

b. The Vietnam animal feed additives market size was estimated at USD 725.8 million in 2023 and is expected to reach USD 750.6 million in 2024.

b. The global Vietnam animal feed additives market is expected to grow at a compound annual growth rate of 3.4% from 2024 to 2030 to reach USD 917.3 million by 2030.

b. The pork segment dominated the Vietnam animal feed additives market with a share of 58.0% in 2023. This is attributable to the increasing demand for pork meat in countries such as China, U.S., and Germany.

b. Some key players operating in the Vietnam animal feed additives market include Vedan VietNam Enterprises Co., Ltd., Cargill, Incorporated, BASF SE, Kemin Industries, Inc., Olmix Group, Hong Ha Nutrition JSC.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."