- Home

- »

- Advanced Interior Materials

- »

-

Waste Sorting Equipment Market Size, Industry Report, 2030GVR Report cover

![Waste Sorting Equipment Market Size, Share & Trends Report]()

Waste Sorting Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Waste Type (Plastic Waste, Paper & Cardboard), By Operation Mode (Automatic, Manual, Semi-Automatic), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-582-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Waste Sorting Equipment Market Summary

The global waste sorting equipment market size was estimated at USD 962.3 million in 2024 and is projected to reach USD 1,432.8 million by 2030, growing at a CAGR of 7.0% from 2025 to 2030. The demand for waste sorting equipment is anticipated to be driven by the growing environmental concerns and stricter government regulations focused on sustainable waste management.

Key Market Trends & Insights

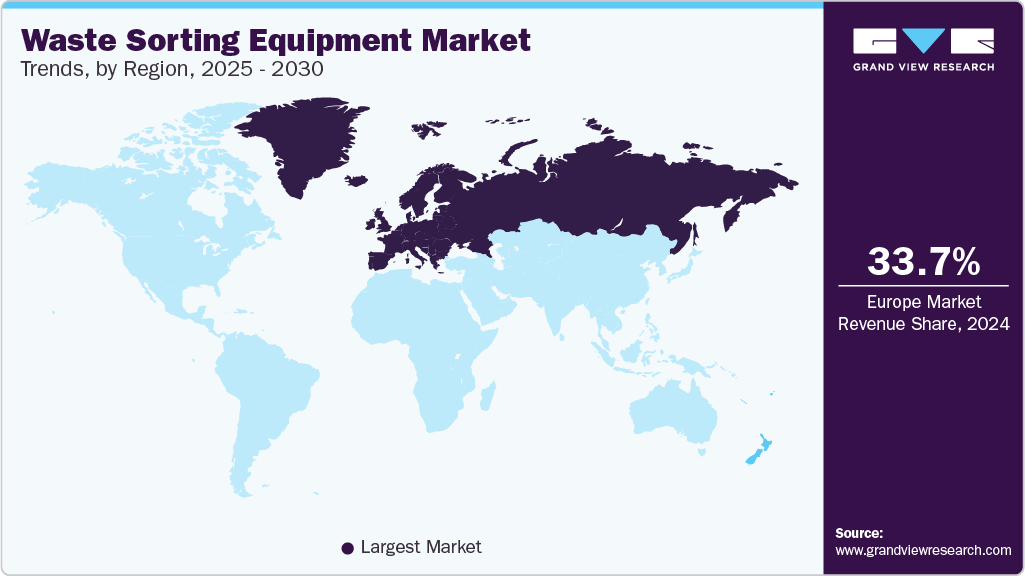

- The Europe region led the market and accounted for 33.7% of the global waste sorting equipment market in 2024.

- Germany waste sorting equipment market is expected to grow at a CAGR of 6.9% over the forecast period.

- By waste type, the plastic waste segment held the significant share in the market and accounted for a share of 35.1% in 2024.

- In terms of technology, the sensor-based segment held a significant share of the market and accounted for a share of 45.3% in 2024.

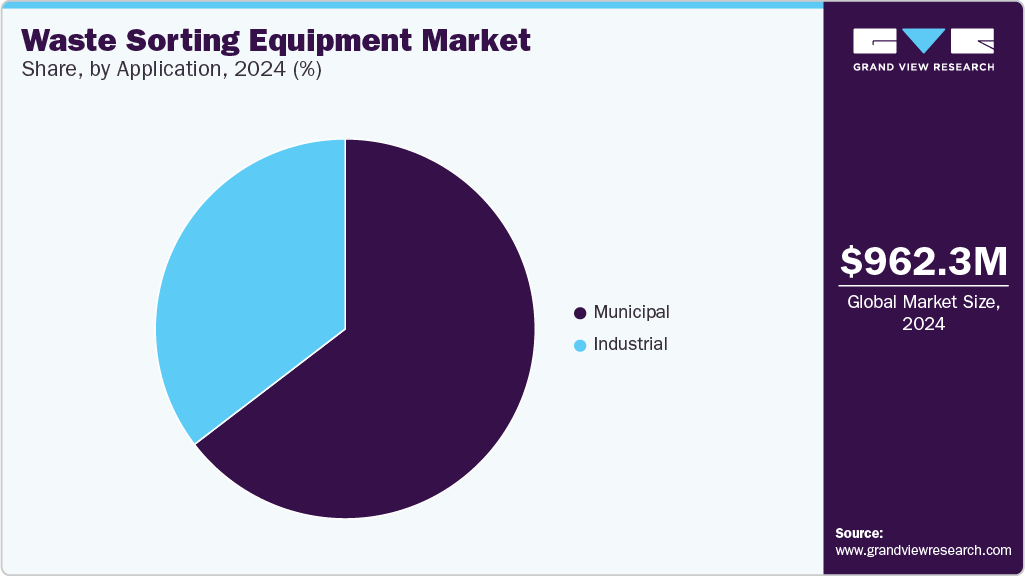

- By application, the municipal segment held a significant share of the market and accounted for a share of 64.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 962.3 Million

- 2030 Projected Market Size: USD 1,432.8 Million

- CAGR (2025-2030): 7.0%

- Europe: Largest market in 2024

With increasing urbanization and population expansion, the volume of waste generated is rising, prompting governments to implement policies that encourage recycling and reduce landfill dependency. Another key factor driving the market is the advancement and adoption of automation and smart technologies. Incorporating artificial intelligence, Internet of Things (IoT), and robotics into sorting equipment improves the precision and speed of separating recyclable materials, while minimizing the need for manual labor. Additionally, the global shift toward a circular economy model, which prioritizes resource recovery and waste reduction, is encouraging investments in innovative sorting solutions, particularly in regions such as Europe, North America, and the rapidly developing Asia Pacific markets.

The global trade landscape for waste sorting equipment is influenced by a combination of environmental regulations, technology advancements, and regional waste management priorities. Developed regions such as Europe and North America are net exporters of advanced waste sorting technologies, driven by stringent recycling mandates and mature manufacturing ecosystems. Conversely, emerging economies in Asia Pacific, Latin America, and parts of the Middle East are major importers, seeking to upgrade infrastructure in line with growing urban waste volumes and sustainability targets. Trade flows are also impacted by government incentives, import duties, and bilateral agreements related to circular economy initiatives.

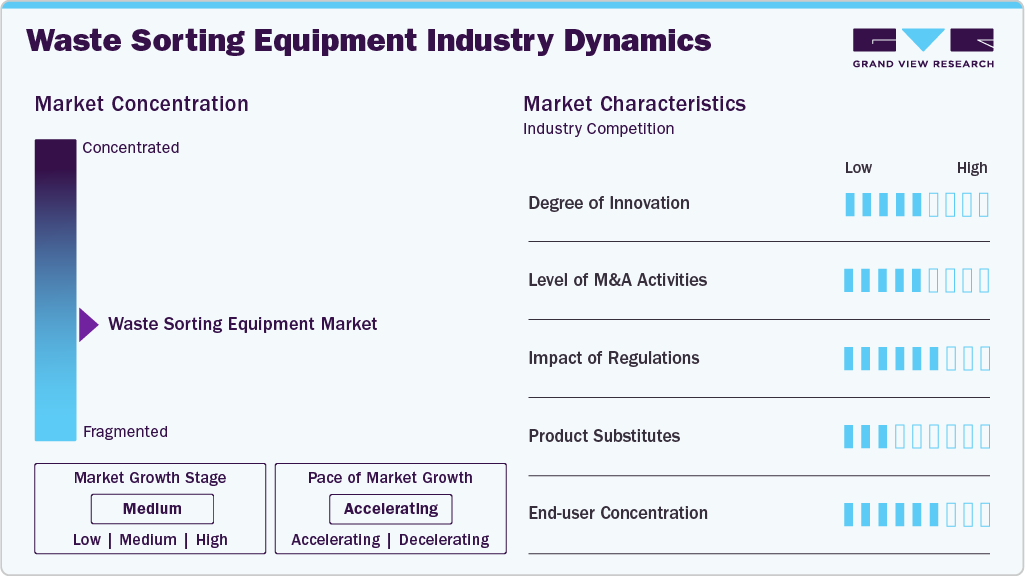

Market Concentration & Characteristics

The waste sorting equipment market is moderately fragmented, with several regional and global players competing based on technology, efficiency, and cost-effectiveness. Key players such as TOMRA Systems ASA, Bühler Group, Satake Corporation focus on advancing AI-powered and sensor-based sorting systems to improve recycling accuracy and throughput. These companies are investing in R&D, forming partnerships, and expanding into emerging markets to strengthen their positions. The moderate fragmentation reflects a dynamic competitive environment with room for smaller players to thrive alongside established industry leaders.

Regulations play a critical role in shaping the waste sorting equipment market by setting mandatory recycling targets, landfill diversion goals, and material recovery standards. Policies such as the European Union’s Waste Framework Directive, Extended Producer Responsibility (EPR) schemes, and bans on landfilling recyclable materials push public and private sectors to invest in advanced sorting technologies. These regulations create a stable demand for automated, AI-driven, and sensor-based systems to ensure compliance. As environmental standards become more stringent globally, manufacturers must innovate continuously to meet legal requirements and support circular economy goals.

While opportunities are abundant maintenance and operational costs are significant restraints in the waste sorting equipment market. These systems often involve complex machinery and advanced technologies like robotics, sensors, and AI, which require regular upkeep to maintain performance and avoid breakdowns. Skilled technicians are needed for operation and troubleshooting, adding to labor expenses. In addition, the energy consumption of automated equipment, especially in large-scale facilities, can be substantial. These ongoing costs can strain the budgets of smaller companies or municipalities, making it harder to justify the investment.

Drivers, Opportunities & Restraints

The market for waste sorting equipment is driven by increasing urban populations and the resulting surge in productivity, which creates a strong demand for efficient waste management solutions. Growing environmental concerns and stricter government mandates worldwide are encouraging the adoption of advanced sorting technologies to boost recycling and reduce landfill dependency. Moreover, innovations such as AI, automation, and IoT integration are improving sorting precision and operational productivity, further fueling market growth.

Significant growth opportunities exist as more industries and municipalities shift toward automated and AI-enabled sorting systems that enhance recycling effectiveness and lower labor expenses. The global push toward circular economy model is motivating greater investment in sophisticated sorting equipment to optimize material recovery. In addition, fast-developing regions such as Asia Pacific, supported by favorable policies and rising industrial activity, present promising markets for expansion.

The high upfront costs of purchasing and maintaining advanced sorting machinery can be a barrier, especially for smaller organizations and those in developing economies. Challenges related to integrating new technologies with existing waste management setups and the need for trained personnel to operate complex equipment also limit market penetration. Furthermore, inconsistent regulations across regions and contamination issues in waste streams complicate efforts to standardize and maximize sorting efficiency.

Waste Type Insights

The plastic waste segment held the significant share in the market and accounted for a share of 35.1% in 2024. The widespread use of plastics, particularly single-use items, combined with growing environmental concerns, has driven governments and industries to adopt advanced sorting technologies to enhance recycling efficiency. This segment sees significant growth in regions such as Asia Pacific, where rapid industrialization and supportive policies are encouraging better plastic waste management.

Organic waste represents the fastest-growing segment in the market, driven by increased focus on sustainable waste handling and renewable energy production methods such as composting and anaerobic digestion. Awareness about the environmental impact of organic waste and government incentives for bio-waste recycling are accelerating the deployment of specialized sorting equipment designed to handle organic materials effectively.

Operation Mode Insights

The automatic segment held the significant share in the market and accounted for a share of 61.2% in 2024 owing to its high efficiency, accuracy, and ability to handle large volumes of waste with minimal human intervention. Automated systems, equipped with advanced sensors and AI technology, provide faster sorting speeds and improved material recovery rates, making them the preferred choice for large-scale waste management facilities and municipalities.

The semi-automatic segment is the fastest-growing in the market, driven by its balance between cost-effectiveness and operational efficiency. Semi-automatic systems offer enhanced control and flexibility compared to fully manual operations, making them ideal for small to medium-sized enterprises and regions where full automation is not yet feasible. This growth is fueled by increasing demand for scalable solutions that improve sorting accuracy while managing investment costs.

Technology Insights

Sensor-based segment held a significant share of the market and accounted for a share of 45.3% in 2024. Sensor-based sorting technology holds the largest share in the global waste sorting equipment market because of its ability to quickly and accurately differentiate materials. Utilizing various sensors like optical, near-infrared, X-ray, and electromagnetic types, this technology efficiently sorts waste based on characteristics such as color, size, and material composition. Its widespread use in industries like recycling and food processing helps reduce manual effort and operational expenses, contributing to its dominant position.

Robotic sorting is the fastest growing segment, driven by innovations in AI, machine learning, and computer vision. These robotic systems enable automated, precise sorting of a wide variety of waste materials in real time. Increasing demands for higher sorting efficiency, lower labor costs, and adherence to environmental standards are fueling the rapid adoption of robotic sorting technologies, particularly in municipal and industrial waste management sectors.

Application Insights

Municipal segment held a significant share of the market and accounted for a share of 64.6% in 2024. The municipal segment dominates the global waste sorting equipment market due to the increasing volume of municipal solid waste generated by urban populations worldwide. Governments and municipalities are investing heavily in advanced sorting technologies to improve waste segregation, recycling rates, and landfill diversion, driven by stringent environmental regulations and sustainability goals. This segment benefits from the growing demand for efficient public waste management infrastructure in both developed and developing regions.

The industrial segment is the fastest-growing application area, fueled by rising industrialization and the increasing need for sustainable waste disposal in manufacturing, chemical, and processing industries. Heightened regulatory pressure to manage hazardous and non-hazardous industrial waste responsibly is driving adoption of sophisticated sorting equipment. In addition, industries are focusing on resource recovery and cost reduction, which further accelerates the demand for automated and specialized sorting solutions in this sector.

Regional Insights

The Europe region led the market and accounted for 33.7% of the global waste sorting equipment market in 2024. Europe’s waste sorting equipment market is expanding rapidly, driven by strong environmental regulations and policies that promote recycling and waste reduction. Initiatives focused on creating a circular economy encourage the adoption of advanced sorting technologies to enhance recycling efficiency and minimize landfill usage. Growing emphasis on e-waste management and increased automation are also contributing to market growth across the region.

Germany waste sorting equipment market is expected to grow at a CAGR of 6.9% over the forecast period. Germany holds a dominant position in the European waste sorting equipment market, largely due to its highly developed waste management system that emphasizes waste prevention, reuse, and recycling. The country boasts one of the highest municipal recycling rates globally, supported by stringent regulations such as the Green Dot System that require manufacturers to ensure their packaging is recyclable

The waste sorting equipment market in UK is projected to grow at a CAGR of 6.0% over the forecast period driven by ongoing efforts to reduce landfill use and increase recycling rates. The UK’s commitment to achieving a circular economy and net-zero emissions by 2050 is prompting investments in advanced sorting technologies. In addition, labor shortages post-Brexit are encouraging industries to adopt automation in sorting processes, further accelerating market expansion in the region.

Asia Pacific Waste Sorting Equipment Market Trends

Asia Pacific region is growing due to rapid urbanization, industrialization, and increasing waste generation. Governments and private sectors in this region are investing heavily in modernizing waste management infrastructure and adopting advanced sorting technologies to improve recycling rates and reduce environmental impact.

China waste sorting equipment market held a significant share in the Asia Pacific marketdriven by its extensive industrial base and well-established infrastructure, which together enable efficient production and supply chain integration. Strong government support through policies and investments encourages the adoption of innovative technologies and sustainable waste management practices.

The waste sorting equipment market in the India is projected to grow at a CAGR of 8.6% from 2025 to 2030 and is propelled by its expanding urban population and rising consumption patterns. Government programs focused on cleanliness and resource efficiency, such as the Swachh Bharat Mission, play a crucial role in promoting better waste segregation and recycling. The country’s informal waste sector also contributes significantly by recovering recyclable materials, while growing environmental concerns and policy reforms encourage the adoption of modern waste processing technologies.

North America Waste Sorting Equipment Market Trends

North America waste sorting equipment market is driven by strong investments in waste management infrastructure and stringent environmental regulations. The United States dominates the regional market with widespread adoption of advanced sorting technologies and government initiatives focused on sustainability.

U.S. Waste Sorting Equipment Waste Market Trends

The waste sorting equipment market in the U.S. is expected to grow at a CAGR of 7.5% from 2025 to 2030. U.S. holds the largest share of the waste sorting equipment market in North America due to its advanced waste management systems and significant investments in automation technologies for both residential and commercial applications. Growing urban populations and increasing amounts of municipal solid waste create a strong need for efficient sorting solutions.

Latin America Waste Sorting Equipment Market Trends

Latin America waste sorting equipment market is driven by increasing urbanization and industrial activities, which contribute to higher waste generation. Growing environmental awareness and government regulations promoting sustainable waste practices further support this expansion. Investments in advanced collection and recycling technologies, along with a rising focus on circular economy models, are also key contributors to the market’s progress

Brazil waste sorting equipment market leads Latin America due to strong government initiatives such as the National Basic Sanitation Plan aimed at improving waste collection and recycling rates nationwide. Increasing urbanization and waste volumes create demand for efficient waste management solutions, including waste-to-energy technologies. In addition, private sector involvement, regulatory support, and growing environmental consciousness among consumers and businesses are accelerating market development

Middle East & Africa Waste Sorting Equipment Market Trends

Middle East and Africa region is experiencing steady growth in waste management driven by rapid urbanization, population increase, and expanding industrial activities. Government initiatives promoting recycling, waste-to-energy projects, and stricter environmental regulations are key factors supporting this growth. In addition, technological advancements such as smart waste collection systems and public-private partnerships are enhancing operational efficiency and sustainability efforts across the region.

UAE waste sorting equipment market is projected to grow at 7.2% of CAGR during the forecast period driven by rapid urbanization, industrial expansion, and strong government commitment to sustainability. Strategic initiatives like the UAE Vision 2021 and Dubai’s Clean Energy Strategy 2050 emphasize waste reduction, increased recycling, and waste-to-energy projects. Investments in advanced technologies and regulatory frameworks targeting landfill diversion and hazardous waste management further propel market development, making the UAE a regional leader in innovative waste management solutions.

Key Waste Sorting Equipment Company Insights

Some of the key players operating in the market include TOMRA Systems ASA, Bühler Group, and Satake Corporation.

-

TOMRA Systems ASA is a leading provider of sensor-based sorting solutions for industries including recycling, food processing, and mining. The company integrates advanced AI and machine learning technologies to enhance sorting accuracy and operational efficiency. TOMRA is known for its innovative reverse vending machines and waste management solutions that support circular economy initiatives, making it a dominant and continuously growing player in the global market.

-

Bühler Group specializes in optical sorting technology primarily for the food industry, focusing on ensuring food safety and quality. Their high-precision sorting equipment is designed to be energy-efficient and sustainable, addressing the needs of food processors and grain millers worldwide. Bühler invests heavily in R&D and collaborates with industry partners to advance digitalization and automation in sorting processes, maintaining a strong global presence.

Key Waste Sorting Equipment Companies:

The following are the leading companies in the waste sorting equipments market. These companies collectively hold the largest market share and dictate industry trends.

- TOMRA Systems ASA

- Bühler Group

- Key Technology.

- Satake Corporation.

- Steinert GmbH

- MSWsorting

- Beston (Henan) Machinery Co., Ltd.

- CP Manufacturing Inc

- REDWAVE

- Fazzini Meccanica

- BHS-Sonthofen

- Wastequip, LLC

- KK Balers Limited

Recent Developments

-

In October 2024: TOMRA acquired an 80% stake in c-trace GmbH, a German company specializing in digital waste management solutions that combine software and hardware to improve waste operations. This acquisition expands TOMRA’s digital capabilities and supports its strategy to diversify revenue streams and enhance recycling infrastructure globally.

-

In February 2024: ZenRobotics unveiled its fourth-generation waste sorting robots, ZenRobotics 4.0, featuring enhanced AI capabilities and improved design for optimized recycling operations. The Heavy Picker 4.0 is equipped with the compact ZenBrain recognition system, boosting efficiency by 60-100% and enabling identification of over 500 waste categories.

Waste Sorting Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,023.7 million

Revenue forecast in 2030

USD 1,432.8 million

Growth rate

CAGR of 7.0% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, waste type, operation mode, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Pakistan; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

TOMRA Systems ASA; Bühler Group; Key Technology.; Satake Corporation.; Steinert GmbH; MSWsorting; Beston (Henan) Machinery Co., Ltd.; CP Manufacturing Inc; REDWAVE; Fazzini Meccanica; BHS-Sonthofen; Wastequip, LLC; KK Balers Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waste Sorting Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global waste sorting equipment market report based on application, waste type, operation mode, technology, and region.

-

Waste Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic Waste

-

Paper & Cardboard

-

Metal Waste

-

Organic Waste

-

Glass

-

Others

-

-

Operation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Manual

-

Semi-Automatic

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sensor-Based Sorting

-

Magnetic Separation

-

Mechanical Sorting

-

Robotic Sorting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global waste sorting equipment market size was estimated at USD 962.3 million in 2024 and is expected to be USD 1,023.7 million in 2025.

b. The global waste sorting equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 1,432.8 million by 2030.

b. Europe region led the market and accounted for 33.7% of the global waste sorting equipment market in 2024. Europe’s waste sorting equipment market is expanding rapidly, driven by strong environmental regulations and policies that promote recycling and waste reduction.

b. Some of the key players operating in the global waste sorting equipment market include TOMRA Systems ASA; Bühler Group; Key Technology.; Satake Corporation.; Steinert GmbH; MSWsorting; Beston (Henan) Machinery Co., Ltd.; CP Manufacturing Inc; REDWAVE; Fazzini Meccanica; BHS-Sonthofen; Wastequip, LLC; KK Balers Limited.

b. Key factor driving the market is the advancement and adoption of automation and smart technologies. Incorporating artificial intelligence, Internet of Things (IoT), and robotics into sorting equipment improves the precision and speed of separating recyclable materials, while minimizing the need for manual labor.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.