- Home

- »

- Homecare & Decor

- »

-

Wax Melts Market Size, Share, Trends Analysis Report, 2030GVR Report cover

![Wax Melts Market Size, Share & Trends Report]()

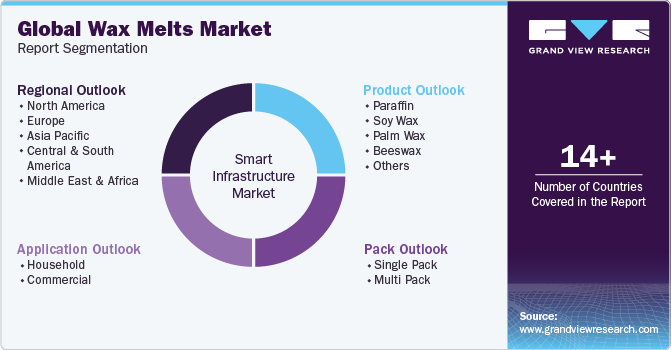

Wax Melts Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Paraffin, Soy Wax, Palm Wax, Beeswax), By Pack (Single Pack, Multi-Pack), By Application (Household, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-741-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wax Melts Market Summary

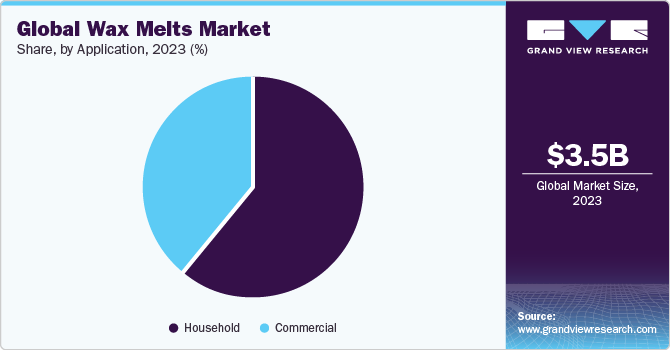

The global wax melts market size was estimated at USD 3,473.2 million in 2023 and is projected to reach USD 5,191.6 million by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The non-flammable property of wax melts can play a pivotal role in driving their market growth by appealing to safety-conscious consumers.

Key Market Trends & Insights

- North America dominated the market in 2023 with a share of around 34%.

- By product, the paraffin wax melts segment dominated the global market in 2023 with a revenue share of around 30%.

- By pack, the multi-pack wax melts segment dominated the global market in 2023 with a significant revenue share of around 69%.

- By application, the wax melts for household applications dominated the market with a share of around 61% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 3,473.2 Million

- 2030 Projected Market Size: USD 5,191.6 Million

- CAGR (2024-2030): 5.9%

- North America: Largest market in 2024

By positioning wax melts as a safe, versatile, and practical alternative to traditional candles, businesses can expand their customer base and drive revenue growth. The safety feature can help build trust and loyalty among customers, resulting in positive brand perception and increased market share. The pandemic has led to several changes in consumer behavior and their purchasing patterns for home décor products including increased demand for home fragrance products such as wax melts. According to an article published by The Vogue in January 2022, 85% of the people across the globe used home fragrances more often during the pandemic in 2020 leading the candles and wax melts industry to experience a surge in sales of those products. Additionally, the pandemic has put a renewed emphasis on health and well-being, and this has extended to the home fragrance market as well.With more people spending time at home, DIY and personalization have become popular trends. Consumers are now looking for ways to make their wax melts at home or purchase customizable wax melts with their preferred scents and designs. Furthermore, it has also led to an increased interest in seasonal scents, with consumers looking for wax melts that evoke a mental state of warmth and comfort during the colder months.

According to U.S. Fire Administration in 2022, 42 candle-related fires are reported daily on average in U.S. Increase in fire accidents related to traditional candles has raised consumer awareness about the potential safety hazards associated with these products. This trend presents a unique opportunity for businesses to promote their wax melt products as a safer alternative to traditional candles.

The key player in the wax melts industry position wax melts as a safe and convenient option for home fragrance by highlighting their non-flammable nature and ease of use. For instance, Fontana Candle Co. based i California, U.S. offers wax melts with different ingredient variants such as beeswax, coconut oils, and pure essential oils. The company sells products that are all-natural, non-flammable, and MADE SAFE certified.

Canada market is expected to expand significantly as a result of the wide range of fragrances available to buyers. Wax melts can be used in various ways for home decor; this versatility will help them flourish. Along with their aesthetic attributes, these products create a relaxed ambiance, reducing stress and promoting well-being. Moreover, collaborations and expansions are increasing as companies strive to strengthen their market position.

For instance, in June 2022, French luxury candle and wax melt brand Diptyque announced its first store in the Canadian market in Toronto’s Yorkdale Shopping Center. It is a part of the direct-to-consumer expansion of the brand. Diptyque will also join other nearby beauty brands, including Aesop and a large Sephora store.

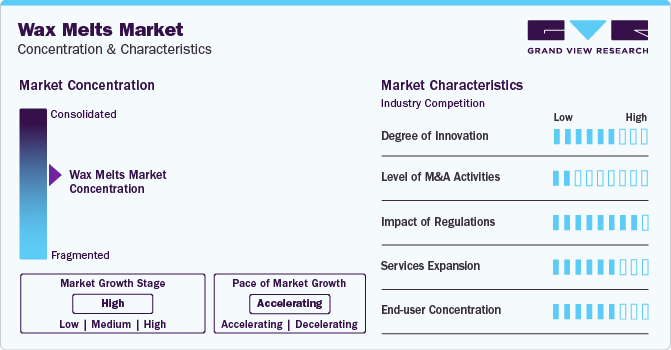

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. The wax melts market is characterized by an increase in adoption of natural and eco-friendly wax melts that are free from harmful chemicals. The market is also characterized by a low level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the expansion of geographic presence, reach to a wider consumer base, enhancement of sales, and need to consolidate in a rapidly growing market and achieve economies of scale.

Furthermore, the market is also subject to moderate regulatory scrutiny. Regulatory trends focus on ensuring consumer safety and product compliance. Regulatory authorities may impose guidelines on the use of specific ingredients to prevent health hazards and allergic reactions.

There are moderate number of direct product substitutes for wax melts. The market is vulnerable to the threat of substitution due to products like candles, diffusers, and essential oil diffusers.

End-user concentration is a significant factor in the market for wax melts. Since there is a diverse end-user base with varying degrees of concentration. Understanding these demographics and their motivations is crucial for manufacturers and retailers to develop effective marketing strategies and target specific customer segments.

Product Insights

The paraffin wax melts segment dominated the global market in 2023 with a revenue share of around 30%. These wax melts are a popular choice among consumers due to their affordability and widespread availability. This type of wax is commonly used in the candle industry as it can hold a large amount of fragrance and is suitable for use in various types of wax melt warmers. To cater to the rising demand from consumers, market players are concentrating on integrating paraffin wax with innovative scents that appeal to their target audiences. Companies have also raised their R&D expenditure. In January 2022, Yankee Candle Company, Inc. launched a single wax melt, a medium square jar with three wicks, and a big square jar with two wicks that are all available in the Well Living Collection. Such initiatives are expected to help companies boost their product visibility and revenues.

The palm wax melts segment is anticipated to witness a significant CAGR during the forecast period. Palm wax candles are made of hydrogenated palm oil. These candles are increasingly used as an alternative to industrially produced wax. Palm wax has a similar burn quality as paraffin wax but is comparatively less toxic to the environment. Non-profit associations such as the Roundtable on Sustainable Palm Oil (RSPO) help in regulating and sourcing palm oil from ethical farms. According to the RSPO in 2022, approximately 3.51 million-hectare production areas are certified globally. Palm wax melts are known for their ability to hold a significant amount of fragrance oil, which makes them a great choice for creating unique and exotic scents. There is a growing trend toward using more complex fragrance blends, including floral, herbal, and fruity notes.

Pack Insights

The multi-pack wax melts segment dominated the global market in 2023 with a significant revenue share of around 69%. Demand for multi-pack wax melts for aromatherapy has been increasing in recent years, particularly as more consumers seek to create relaxing and calming environments in their homes and workplaces. Offering multi-pack wax melt can help key players generate more revenue by encouraging customers to purchase in bulk. This can be especially effective when paired with promotional discounts or other incentives to drive sales aiding revenue growth.

The single-pack wax melt segment is anticipated to grow at a fastest CAGR during the forecast period. Consumers may opt to purchase a single wax melt, as it is cost-effective for the consumer to purchase a single wax melt rather than investing in a larger quantity. Additionally, consumers who prefer to wax melt try out a new scent or brand before committing to a larger purchase, and buying a single wax melt allows them to do so without significant financial risk. Furthermore, some consumers may prefer to switch up their fragrance options frequently, and purchasing single wax melt enables them to do so without the need to commit to a larger quantity. This can be particularly useful for consumers who have limited storage space or prefer to use wax melt in smaller rooms.

Application Insights

Wax melts for household applications dominated the market with a share of around 61% in 2023. Wax melts are a popular alternative to scented candles that can be used for various household applications. They are essentially scented wax pieces that are melted in a wax warmer, diffusing fragrance into the air. Wax melts can be used to eliminate unpleasant odors, freshen up a room, create a relaxing atmosphere, and enhance the ambiance of any space. They are commonly used in living rooms, bedrooms, bathrooms, and kitchens to create a cozy and inviting environment.

Wax melts for commercial application is estimated to expand with the fastest CAGR during the forecast period. The demand for multi-pack candles for commercial purposes such as aromatherapy has been steadily increasing in recent years. This trend can be attributed to several factors, such as the growing awareness of the benefits of aromatherapy, the increased focus on self-care, and the popularity of scented candles as home decor items.

Regional Insights

North America dominated the market in 2023 with a share of around 34%. The rising trend of self-care has made scented candles popular among millennials and positively impacts the U.S. market. Millennials focus on mental well-being and do not hesitate to spend a premium amount on fragranced candles. According to the NPD Group in the U.S., fragrance sales have increased since August 2020 and continued to increase in 2021. The first quarter of 2020 included the onset of the COVID-19 pandemic when uncertainty and fear started affecting customer preferences and behavior patterns. The surge in sales of home fragrance products can be attributed to the COVID-19 pandemic and associated lockdown measures. During this challenging period, individuals sought to create a sense of mental escape while remaining at home, leading to an increased demand for home fragrance products positively impacting the U.S. wax melts market.

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period. Additionally, the Indian market size is estimated to be USD 204.6 million in 2022 due to the significant growth of the organic wax melts market over the forecast period. The demand for wax melts especially scented that are made of beeswax wax and soy wax is increasing due to the rising awareness about the wax materials and their consequences on the environment as they are eco-friendly in nature as compared to paraffin wax and palm wax. In addition, according to the L'OCCITANE Group’s annual report in 2021, changing consumer preferences in developing countries are expected to increase spending on premium personal care products such as skincare, scented wax melts, perfume, and hair care, thereby resulting in luxury brands gaining significant market share.

Key Companies & Market Share Insights

The market for wax melts is highly competitive, with numerous businesses offering a range of products. To stay competitive, several key players are prioritizing new product offerings, collaborations, and expanding into untapped markets.

East Coast Candles is one of the emerging eco-friendly manufacturer of candles that are hand-poured and come in small batches. Utilizing 100% natural soy wax sourced from and produced in the U.S., East Coast Candles ensures a commitment to sustainability. The candle collections feature different fragrances achieved through phthalate-free oils, complemented by cotton wicks that are both lead and zinc-free.

Key Wax Melts Companies:

- East Coast Candles

- The Yankee Candle Company

- Michaels Stores, Inc.

- Scentsy, Inc.

- Bridgewater Candle Company

- Bramble Bay Candle Co.

- AFFCO Holdings

- Candles by Victoria

- Stora Enso Oyj

- C. Johnson & Sons Inc.

- NEST Fragrances, LLC.

Recent Developments

-

In November 2021, LUMIRA Co Pty Ltd. released the Botanica fragrance, the third and final scent in their Gardens collection. The Australian Botanic Garden in Mount Annan served as inspiration for this scent. The Botanica Candle, which is available for a limited time and has a burn time of about 80 hours, is the full-size version of this fragrance.

-

In September 2020, Ellis Brooklyn secured a seed round of USD 1 million from Stage 1 Fund and NYX founder Toni Ko. The company plans to utilize the funds to enhance its global distribution network and hire additional staff to strengthen its e-commerce operations.

Wax Melts Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.63 billion

Revenue forecast in 2030

USD 5.19 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pack, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; Australia; New Zealand; Indonesia; Brazil; South Africa

Key companies profiled

East Coast Candles; The Yankee Candle Company; Michaels Stores, Inc.; Scentsy, Inc.; Bridgewater Candle Company; Bramble Bay Candle Co.; AFFCO Holdings; Candles by Victoria; C. Johnson & Sons Inc.; NEST Fragrances, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wax Melts Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global wax melts market based on product, pack, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Paraffin

-

Soy Wax

-

Palm Wax

-

Beeswax

-

Others

-

-

Pack Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Pack

-

Multi Pack

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Australia & New Zealand

-

-

Middle East & Africa

-

South Africa

-

-

Central & South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global wax melts market was estimated at USD 3.47 billion in 2023 and is expected to reach USD 3.63 billion in 2024.

b. The global wax melts market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 5.19 billion by 2030.

b. North America dominated the wax melts market with a share of around 34% in 2023. The growth of the regional market is driven on account of the consumers' positive outlook towards air care and aromatherapy along with growing consumer awareness regarding environmental and health hazards.

b. Some of the key players operating in the wax melts market include East Coast Candles; The Yankee Candle Company; Michaels Stores, Inc.; Scentsy, Inc.; Bridgewater Candle Company; Bramble Bay Candle Co.; AFFCO Holdings; Candles by Victoria; C. Johnson & Sons Inc.; and NEST Fragrances, LLC.

b. Key factors that are driving the wax melts market growth include an increase in the demand for aromatherapy and a rise in the demand for home décor products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.