- Home

- »

- Communications Infrastructure

- »

-

Wireless Gigabit Market Size, Share & Growth Report, 2030GVR Report cover

![Wireless Gigabit Market Size, Share & Trends Report]()

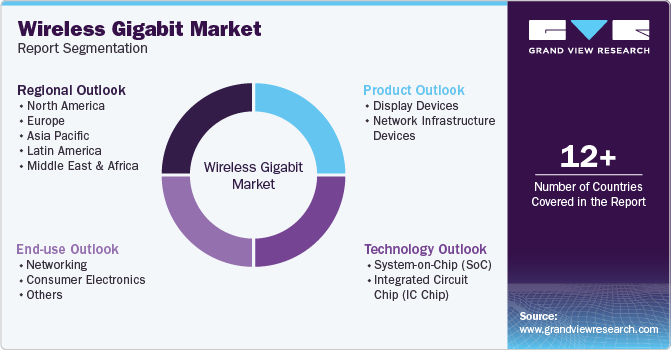

Wireless Gigabit Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Technology (System-on-Chip, Integrated Circuit Chip), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-279-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wireless Gigabit (WiGig) Market Summary

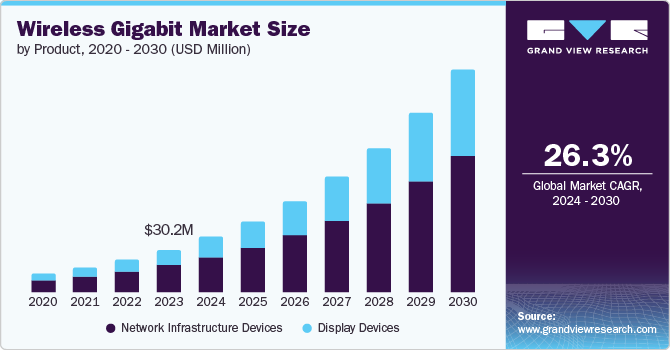

The global wireless gigabit market size was valued at USD 30.2 million in 2023 and is expected to reach USD 159.1 million by 2030, growing at a CAGR of 26.3% from 2024 to 2030. The rising demand for high-speed wireless connectivity and the increasing integration of interconnected devices across several sectors is driving the market growth for wireless gigabit (WiGig).

Key Market Trends & Insights

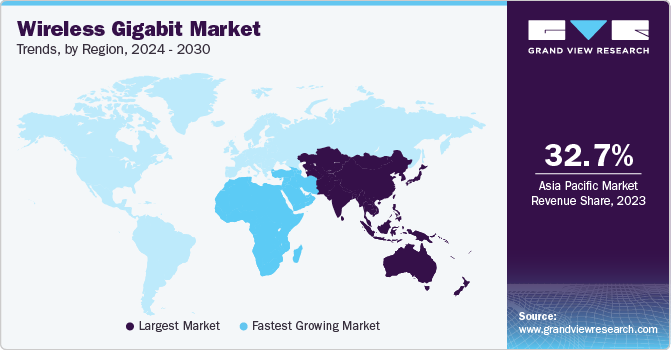

- Asia Pacific wireless gigabit (WiGig) market held the largest market revenue share with 32.7% in 2023.

- U.S. dominated the regional wireless gigabit (WiGig) market accounting for the market revenue share of 77.2% in 2023.

- Based on product, the network infrastructure devices segment held the largest market revenue share of 64.4% in 2023.

- Based on technology, the system on chip (SoC) segment held the largest market revenue share in 2023

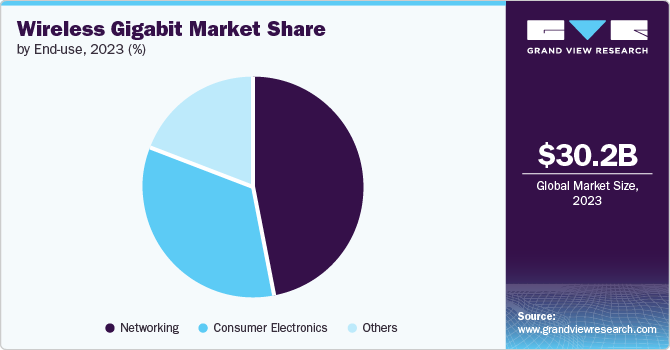

- Based on end use, the networking segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 30.2 Million

- 2030 Projected Market Size: USD 159.1 Million

- CAGR (2024-2030): 26.3%

- Asia Pacific: Largest market in 2023

- Middle East and Africa: Fastest growing market

With the growing adoption of IoT devices, which are becoming essential in workplaces and industrial areas, the demand for high-bandwidth wireless connectivity solutions increases due to their ability to exchange data efficiently between various connected devices. The rapidly increasing adoption of 5G network technology and the introduction of innovative Wi-Fi technologies such as Wi-Fi 6 is also one of the key drivers for the growth of the wireless gigabit (WiGig) market. 5G technology provides fast wireless connectivity solutions with low latency, requiring wireless gigabit solutions. Wi-Fi 6 is recognized for providing high data rates, improved network capacity, and enhanced performing capabilities within highly dense network usage areas, making wireless gigabit a preferred choice for integrating wireless gigabit networks in offices, industrial environments, and households. The exponential growth in data consumption, fueled by the proliferation of high-definition video streaming, online gaming, and the increasing use of virtual and augmented reality applications. These activities require robust, high-speed internet connections that can handle large volumes of data with minimal latency. WiGig, with its capability to deliver multi-gigabit speeds, meets these demands efficiently, providing a seamless and high-quality user experience.

The rise of remote work and telecommuting has also contributed to the growing demand for WiGig. With more people working from home, there is an increased need for high-speed, reliable internet connections to support video conferencing, file sharing, and other bandwidth-intensive tasks. WiGig's ability to deliver stable and ultra-fast wireless connectivity helps remote workers maintain productivity and efficiency, replicating the high-speed internet experience typically in corporate environments.

Additionally, the advancement of WiGig technology itself has made it more accessible and attractive. Improvements in chipset design, cost reductions, and the development of compatible devices have all contributed to its growing adoption. As more manufacturers integrate WiGig into their products, from laptops and smartphones to routers and access points, consumers and businesses are more likely to adopt the technology.

Product Insights

The network infrastructure devices segment held the largest market revenue share of 64.4% in 2023. The rapid growth of data-intensive applications, such as video streaming, online gaming, and virtual reality, necessitates higher bandwidth and faster data transfer rates, which wireless gigabit technology can provide. Additionally, the proliferation of connected devices in homes and businesses, driven by the Internet of Things (IoT), requires robust and efficient network infrastructure to manage and support numerous simultaneous connections. Moreover, advancements in wireless technology, such as the development of WiGig (802.11ad) and WiFi 6 (802.11ax), offer improved performance, lower latency, and enhanced user experiences, prompting upgrades to existing network infrastructure.

The display devices segment is projected to grow at the fastest CAGR of 27.9% over the forecast period. The proliferation of high-definition content and the need for seamless streaming experiences drive consumers and businesses to seek advanced display solutions that can efficiently handle large data transfers. WiGig technology offers the high bandwidth and low latency necessary for smooth, high-quality video streaming and gaming, making it highly attractive for modern display devices. Additionally, the growing popularity of virtual reality (VR) and augmented reality (AR) applications, which require robust and rapid wireless connections to deliver immersive experiences, further boosts demand.

Technology Insights

The system on chip (SoC) segment held the largest market revenue share in 2023. The demand for the system on chip (SoC) segment in the wireless gigabit (WiGig) market is rising due to its ability to integrate multiple functions into a single chip, leading to improved performance, reduced power consumption, and lower costs. As wireless gigabit technology becomes essential for faster data transmission and better connectivity in smartphones, tablets, and IoT devices, SoCs provide a streamlined solution that enhances efficiency and functionality.

The integrated circuit chip (IC Chip) segment is projected to grow at the fastest CAGR over the forecast period. The growing adoption of high-speed data transfer technologies in consumer electronics, such as smartphones, tablets, and laptops, drives the need for more efficient and powerful IC chips. These chips enable faster wireless communication and support high-bandwidth applications like streaming, gaming, and augmented reality. Additionally, the proliferation of IoT devices and the expansion of 5G networks are further boosting the demand, as these advancements require robust IC chips to manage the increased data traffic and ensure seamless connectivity. As a result, manufacturers invest heavily in developing advanced IC chip technologies to meet these evolving requirements, fueling the segment's growth.

End-use Insights

The networking segment dominated the market in 2023. The digitalization of the media and entertainment industry heavily relies on high-speed networking technologies for content creation, distribution, and streaming. Wireless gigabit technology ensures seamless workflows and efficient data transfer throughout the entire process of video production and broadcasting. Businesses and organizations increasingly depend on wireless gigabit networks for seamless communication, fast file transfer, and collaboration. High-speed networking enables video conferencing, cloud-based applications, and large-scale data transfers within organizations.

The consumer electronics segment is projected to grow at the fastest CAGR over the forecast period. The rapidly increasing usage of smart devices such as smartphones, tablets, smart TVs, and wearables drives the demand for faster wireless communication technologies. Consumers are looking to connect multiple devices simultaneously while maintaining speed and quality. Wireless gigabit technology delivers the convenience of cable-free connectivity, allowing users to move freely within their environment. This mobility factor is specifically appealing in consumer electronics such as laptops, home entertainment systems, and IoT devices.

Regional Insights

North America wireless gigabit market held a significant market revenue share in 2023. The market growth is attributed to the continuous technological advancements in the wireless networking industry as key market players are significantly investing in research and development. With innovation in wireless networking technologies, including Wi-Fi 6 and 5G, customers seek faster and more dependable connectivity systems. This rapidly increasing demand for high-speed wireless network connectivity is boosting the integration of wireless gigabit solutions within several industries, such as telecommunications, healthcare, automotive, and infrastructure developments.

U.S. Wireless Gigabit Market Trends

U.S. dominated the regional wireless gigabit (WiGig) market accounting for the market revenue share of 77.2% in 2023. As remote work and online education have become more prevalent, the need for high-speed, reliable internet connections has surged. WiGig technology, operating in the 60 GHz spectrum, offers faster data transfer rates and lower latency than traditional Wi-Fi. It is ideal for applications requiring substantial bandwidth, such as video conferencing, online gaming, and streaming high-definition content.

Europe Wireless Gigabit Market Trends

Europe wireless gigabit (WiGig) market is anticipated to witness a significant growth in the coming years. The adoption of 5G technology across Europe is driving the integration of WiGig as a complementary solution to enhance wireless performance, especially in indoor and short-range applications. Furthermore, the push for digital transformation and smart cities by European governments and the European Union's digital strategy is accelerating the deployment of advanced wireless technologies like WiGig to support seamless connectivity and innovative applications.

Germany wireless gigabit (WiGig) market is anticipated to witness prominent growth over the forecast period. Germany has a robust industrial base focusing on the manufacturing, automotive, and engineering sectors. These industries increasingly rely on high-speed wireless connectivity for automation, IoT integration, and real-time data transmission, creating a significant market for wireless gigabit solutions. In addition, the country's focus on research and development, primarily in the telecommunications sector, drives the adoption of advanced wireless gigabit technologies.

Asia Pacific Wireless Gigabit Market Trends

Asia Pacific wireless gigabit (WiGig) market held the largest market revenue share with 32.7% in 2023. The region is experiencing rapid urbanization and digital transformation, driving the need for high-speed internet to support smart city initiatives and advanced digital services. Countries like China, South Korea, and Japan are leading in 5G deployment, which complements the adoption of wireless gigabit technologies. Additionally, the growing popularity of bandwidth-intensive applications such as video streaming, online gaming, and remote work necessitates faster and more reliable internet connections. The significant investments in telecommunications infrastructure by both governments and private sectors across the Asia-Pacific further bolster the expansion and adoption of wireless gigabit networks, making it a critical component in the region's technological advancement and economic growth.

Japan wireless gigabit (WiGig) market is witnessed as lucrative in this industry. Japan's robust push towards a digital economy and its leadership in technological innovation are primary drivers. The government's initiatives to promote smart cities and digital transformation across various sectors, including healthcare, education, and manufacturing, necessitate high-speed, low-latency connectivity that wireless gigabit can provide. Additionally, the increasing adoption of IoT devices, the growth of remote work, and the rising need for seamless, high-speed internet for households and businesses further fuel this demand.

Middle East & Africa Wireless Gigabit Market Trends

Middle East and Africa is projected to grow with the fastest CAGR over the forecast period. Rapid urbanization and the expansion of smart city projects are driving the need for high-speed, reliable internet connections to support advanced infrastructure and services. Governments and private sectors are heavily investing in digital transformation initiatives to enhance economic growth and connectivity across urban and rural areas. The proliferation of mobile devices and increasing internet penetration rates further contribute to the demand for faster wireless networks.

Key Wireless Gigabit Company Insights

Some of the key companies in the wireless gigabit (WiGig) market include: PERASO TECHNOLOGIES INC.; Qualcomm Technologies, Inc.; Panasonic Holdings Corporation; Tensorcom, Inc.; and others.

-

PERASO TECHNOLOGIES INC. with its 802.11ad/ay wireless networking solutions provides a perfect substitute for fiber. It produces high-performance 60 GHz phased-array radios which support up to 3 Gbps PtMP networks.

-

Qualcomm Technologies, Inc. provides 802.11ad which is a multi-gigabit Wi-Fi technology that enables users to download and share 4K videos in a fraction of seconds and allows access to cloud content in near real time. It provides ultra-high-speed zones delivering the speed of 4.6 Gbps.

Key Wireless Gigabit (WiGig) Companies:

The following are the leading companies in the wireless gigabit (WiGig) market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom

- Cisco Systems, Inc.

- Intel Corporation

- NETGEAR

- Panasonic Holdings Corporation

- PERASO TECHNOLOGIES INC.

- Qualcomm Technologies, Inc.

- Samsung

- Tensorcom, Inc.

- Ubiquiti Inc.

Recent Developments

-

In January 2024, Peraso announced the launch of the DUNE platform, a fixed wireless access solution designed for dense urban environments. This mmWave technology leverages the 60 GHz band to provide high-speed, low-latency connectivity, addressing urban network congestion issues without needing spectrum ownership. Peraso aims to deploy DUNE globally through partnerships with system vendors and equipment suppliers.

-

In April 2022, Broadcom announced the Launch of new Wi-Fi 7 chips, aiming to deliver enhanced performance and connectivity. These chips promise faster speeds, lower latency, and improved efficiency, catering to the increasing demand for high-bandwidth applications such as virtual reality, augmented reality, and 4K video streaming.

Wireless Gigabit Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.2 million

Revenue forecast in 2030

USD 159.1 million

Growth rate

CAGR of 26.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE.

Key companies profiled

Broadcom; Cisco Systems, Inc.; Intel Corporation; NETGEAR; Panasonic Holdings Corporation; PERASO TECHNOLOGIES INC.; Qualcomm Technologies, Inc. ; Samsung; Tensorcom, Inc.; Ubiquiti Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wireless Gigabit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global wireless gigabit (WiGig) market report based on product, technology, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Display Devices

-

Network Infrastructure Devices

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

System-on-Chip (SoC)

-

Integrated Circuit Chip (IC Chip)

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Networking

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.