- Home

- »

- Advanced Interior Materials

- »

-

Zero-waste Construction Materials Market Size Report, 2033GVR Report cover

![Zero-waste Construction Materials Market Size, Share & Trends Report]()

Zero-waste Construction Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Recycled Aggregates & Concrete, Recycled Metals), By End-use (Residential Construction, Non-residential Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-815-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Zero-waste Construction Materials Market Summary

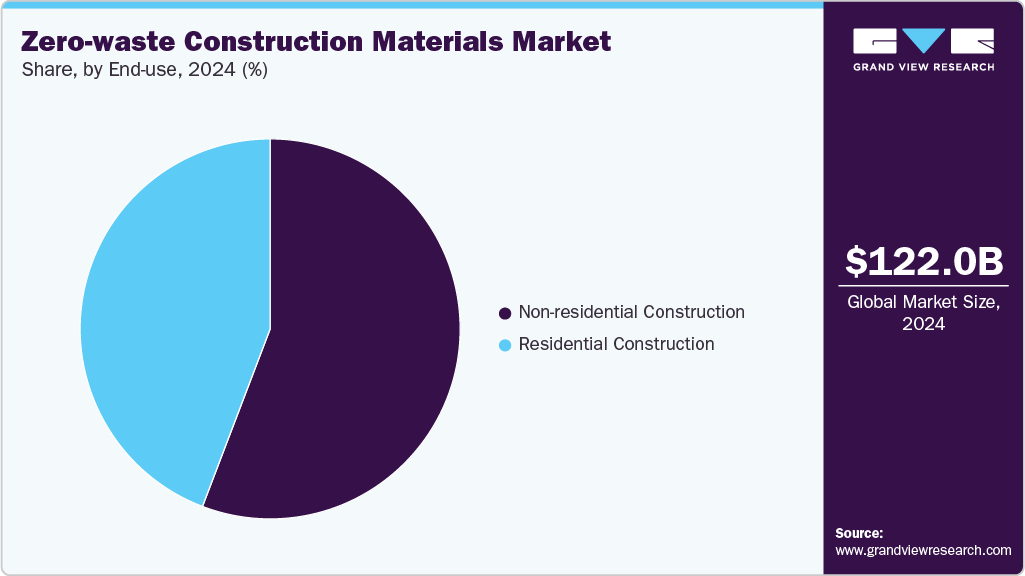

The global zero-waste construction materials market size was estimated at USD 122.04 billion in 2024 and is projected to reach USD 208.29 billion by 2033, growing at a 6.1% from 2025 to 2033. The demand for zero-waste construction materials is increasing as the global building industry transitions toward sustainability and circular economy models.

Key Market Trends & Insights

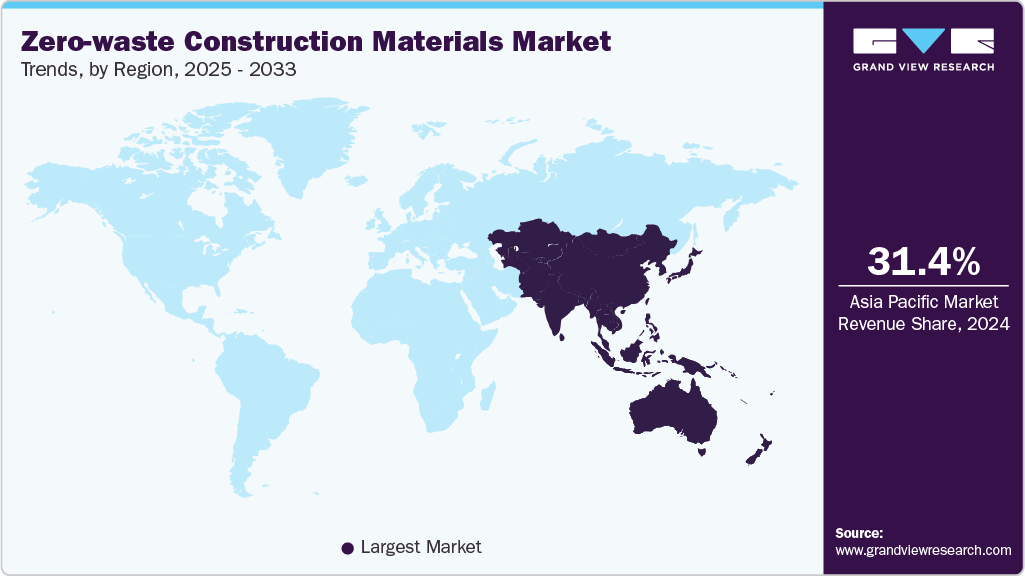

- Asia Pacific dominated the zero-waste construction materials market with the largest revenue share of 31.4% in 2024.

- China’s zero-waste construction materials market is propelled by national circular-economy strategies and urban regeneration programs.

- By product type, the recycled aggregates and concrete segment held the highest revenue market share of 44.1% in 2024.

- By end-use, the non-residential construction segment held the highest revenue market share of 55.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 122.04 Billion

- 2033 Projected Market Size: USD 208.29 Billion

- CAGR (2025-2033): 6.1%

- Asia Pacific: Largest market in 2024

Escalating volumes of construction and demolition (C&D) waste have intensified concerns over resource depletion and landfill overuse. As governments tighten environmental regulations, developers and contractors are turning to materials that minimize waste generation and enable reuse or recycling within the construction life cycle. Increasing urbanization, the rise of green-certified buildings, and growing corporate commitments toward carbon neutrality are further propelling market growth.

Major growth drivers include the integration of circular-economy principles in construction, stricter waste-management frameworks, and advancements in sustainable material science. Builders are increasingly adopting recycled aggregates, fly-ash-based cement, reclaimed timber, and bio-composites to comply with regulatory norms and certification standards such as LEED, BREEAM, and IGBC. Technological advancements, including Building Information Modelling (BIM) and digital twin applications, enabling waste-optimized design and precise material utilization. Rising raw material costs and landfill disposal expenses are prompting companies to seek cost-effective, waste-free alternatives. The shift from a linear “take-make-dispose” approach to a closed-loop model is now a defining transformation in the construction sector, promoting large-scale adoption of zero-waste materials.

Governments across regions are implementing targeted policies to encourage zero-waste construction. India’s Green Building Council (IGBC) launched the Net-Zero Waste Rating to reduce construction-site waste, while the European Union’s Green Deal and Waste Framework Directive promote circular construction practices across member states. In the U.S., the Environmental Protection Agency’s Sustainable Materials Management (SMM) Program is driving waste-reduction targets for both public and private projects. China’s Ministry of Housing and Urban-Rural Development has introduced recycling standards for demolition waste, encouraging domestic manufacturing of eco-friendly materials. These initiatives are complemented by tax incentives, mandatory recycling quotas, and procurement preferences for green building materials, fostering market expansion and industrial collaboration.

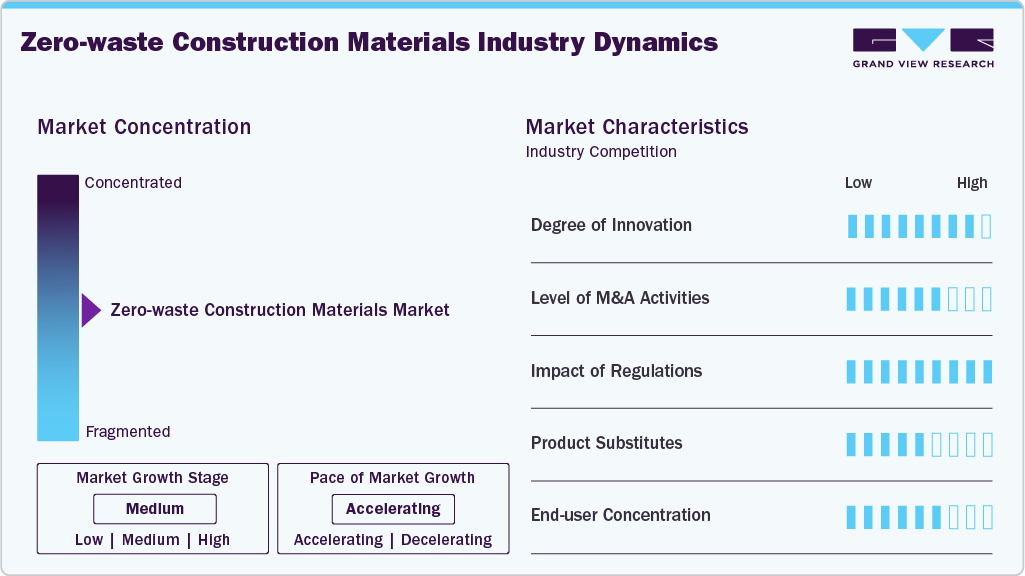

Market Concentration & Characteristics

The zero-waste construction materials market is moderately fragmented, characterized by a mix of established construction material manufacturers and emerging circular economy start-ups. Strategic partnerships between developers, recycling firms, and technology providers are becoming common to enhance waste recovery and material reuse. The competitive landscape is driven by innovation, with companies differentiating themselves through lifecycle performance, compliance, and cost efficiency. Consolidation is expected to occur over time as leading players acquire specialized, sustainability-focused firms.

Conventional construction materials such as virgin concrete, steel, and plastics remain major substitutes due to their established supply networks and relatively lower costs. However, increasing regulatory stringency and landfill taxes are eroding their competitiveness. Within the sustainable-materials category, alternatives such as bio-based composites, recycled plastics, and reclaimed aggregates compete with one another based on cost, performance, and environmental credentials. The overall threat of substitutes is moderate, as the market continues to mature and zero-waste options achieve parity in terms of strength, cost, and durability with traditional materials. As circular-construction practices gain regulatory and commercial traction, the substitution risk will continue to decline.

Product Type Insights

The recycled aggregates and concrete segment held the highest revenue market share of 44.1% in 2024, driven by its widespread adoption in large-scale infrastructure and urban redevelopment projects. The use of crushed concrete, reclaimed asphalt, and other inert debris as substitutes for virgin aggregates significantly reduces landfill disposal and raw material extraction. Governments and municipal bodies are promoting the use of recycled aggregates through public procurement policies and green certification requirements, particularly in Europe, North America, and India. The segment benefits from well-established recycling infrastructure and consistent performance standards, making it a preferred choice for road base, subgrade, and concrete production.

The recycled plastics and polymers segment is expected to grow at the fastest CAGR of 7.1% over the forecast period, propelled by innovation in sustainable materials and circular construction initiatives. Companies are transforming plastic waste into durable building materials, such as bricks, tiles, panels, and paver blocks, that offer superior water resistance and insulation properties. Technological advancements in polymer processing, combined with government bans on single-use plastics, have encouraged the adoption of recycled polymers in the construction industry. The segment is also gaining traction in modular and prefabricated housing, furniture, and infrastructure applications. Startups such as ANGIRUS, Arqlite, and Greenful are leading this transition by introducing patented technologies that convert mixed plastic waste into high-strength, lightweight composites. This shift supports waste valorization while helping achieve carbon-neutral construction targets.

End-use Insights

The non-residential construction segment held the highest revenue market share of 55.8% in 2024, due to the high demand for sustainable materials in commercial, industrial, and institutional buildings. Developers and corporations are prioritizing green certifications such as LEED and BREEAM, which encourage the use of recycled and circular materials. The segment benefits from large-scale procurement and advanced design capabilities that allow for material recovery, reuse, and modular assembly. Infrastructure projects, public facilities, and corporate campuses are increasingly incorporating zero-waste strategies into their design and execution to align with ESG mandates.

The residential construction segment is expected to grow at the fastest CAGR of 6.8% over the forecast period, as homeowners, builders, and developers adopt eco-friendly and cost-effective building materials. Rising consumer awareness of sustainability, combined with stricter energy and waste management regulations, is encouraging the use of recycled aggregates, plastics, and natural fibers in homes. Prefabricated panels, green insulation materials, and low-carbon concrete are becoming mainstream in affordable and luxury housing alike. The emergence of startups offering modular, zero-waste housing solutions, such as Strawcture and Rawblox, is further expanding this market. Financial incentives for green housing and the rising preference for healthy, sustainable living environments are also key factors fueling this growth.

Regional Insights

Asia Pacific dominated the global zero-waste construction materials market, accounting for the largest revenue share of 31.4% in 2024, driven by large-scale urbanization, rapid infrastructure expansion, and a strong government emphasis on sustainable development. China, Japan, and India are implementing waste-reduction frameworks and recycling mandates in public projects. The region’s cost-efficient manufacturing capabilities, combined with rising green-building certifications, create favourable conditions for growth. Ongoing smart-city initiatives and industrial corridor developments have also expanded the use of recycled and reusable materials. Increasing foreign investment in sustainable infrastructure further reinforces Asia Pacific’s dominance in this market.

China’s zero-waste construction materials market is propelled by national circular-economy strategies and urban regeneration programs. The government’s strict recycling mandates for C&D waste and incentives for low-carbon materials are key growth drivers. State-backed enterprises and private manufacturers are investing heavily in eco-bricks, recycled aggregates, and modular systems designed for reuse. The transition toward carbon neutrality by 2060 supports continuous innovation in sustainable construction practices. Although challenges such as inconsistent material standards persist, the market outlook remains highly positive due to strong regulatory support and technological capacity.

North America Zero-waste Construction Materials Market Trends

North America is witnessing steady growth in the adoption of zero-waste materials, primarily driven by ESG commitments, LEED certification programs, and state-level waste-reduction mandates. Prefabrication and modular construction are gaining traction as efficient methods to minimize waste. Partnerships between recycling firms and contractors are improving supply-chain integration for reclaimed materials. However, inconsistent recycling infrastructure and high upfront costs limit broader adoption. Despite these constraints, federal initiatives promoting sustainable construction ensure long-term opportunities for market expansion.

U.S. Zero-waste Construction Materials Market Trends

In the United States, the market for zero-waste construction materials is supported by strong policy direction and corporate sustainability goals. The EPA’s material-reuse initiatives and state-specific landfill diversion targets are catalyzing adoption in commercial and public projects. Developers are incorporating recycled concrete, steel, and reclaimed timber into buildings to meet LEED and WELL certification requirements. The rise of digital platforms that facilitate material reuse and the spread of modular building techniques further enhance waste minimization. The U.S. market is gradually shifting from traditional practices toward a circular construction model that prioritizes waste elimination.

Europe Zero-waste Construction Materials Market Trends

Europe remains a global leader in zero-waste construction, driven by robust policy frameworks under the European Green Deal and Circular Economy Action Plan. Countries such as Germany, the Netherlands, and the U.K. have advanced recycling infrastructures and offer strong incentives for circular building materials. Developers increasingly rely on Environmental Product Declarations (EPDs) and Life-Cycle Assessments (LCAs) to validate sustainability claims. Innovation in modular construction, mycelium-based composites, and low-carbon cement continues to strengthen Europe’s leadership position. However, higher production costs and slow adoption outside major urban areas remain moderate challenges.

Germany’s zero-waste construction landscape is shaped by its stringent environmental policies, advanced engineering capabilities, and strong public awareness. The government’s commitment to circular construction underpins growing demand for recycled aggregates and modular components. German firms are pioneers in developing materials designed for disassembly and reuse. However, high labor costs and strict compliance requirements can restrain market expansion in smaller projects. The continued integration of digital waste-management systems and the expansion of producer-responsibility schemes are expected to sustain market momentum in the coming years.

Central & South America Zero-waste Construction Materials Market Trends

Central & South America’s zero-waste construction materials market is emerging, supported by urban growth, regional sustainability programs, and rising environmental awareness. Countries such as Brazil, Chile, and Mexico are piloting circular-construction initiatives, focusing on recycling C&D waste and promoting prefabricated building systems. Limited recycling infrastructure and cost constraints currently challenge large-scale adoption. However, the entry of international investors and partnerships with green-technology firms are gradually transforming the landscape. Over the next decade, infrastructure projects backed by multilateral agencies are expected to drive steady growth.

Middle East & Africa Zero-waste Construction Materials Market Trends

The Middle East & Africa region is gradually embracing zero-waste construction, driven by mega-projects, sustainable-city developments, and national visions for carbon neutrality. Countries such as the UAE and Saudi Arabia are implementing green-building codes and circular-economy roadmaps that encourage recycled and reusable materials. Despite challenges such as limited recycling capacity and high dependence on imported technologies, the region is showing progress through pilot initiatives and public-private partnerships. Growing investment in waste-processing infrastructure and sustainable housing will further enhance the market potential in the coming years.

Key Zero-waste Construction Materials Company Insights

Some of the key players operating in the market include Strawcture Eco Pvt., NOVACRET

-

Strawcture Eco Pvt. Ltd. is a leading Indian startup specializing in zero-waste and carbon-negative building materials. The company produces structural insulated panels made from agricultural residue such as straw, reducing waste generation and carbon emissions in the construction process. Its solutions focus on replacing traditional bricks and cement with high-performance, eco-friendly alternatives that offer thermal insulation and long-term sustainability. Strawcture’s products are widely used in prefabricated buildings, green housing projects, and sustainable infrastructure developments across India.

-

NOVACRET is an emerging player in the sustainable construction materials market, offering high-performance, recyclable, and waste-free alternatives to conventional concrete. The company’s product line emphasizes material circularity through the use of industrial by-products and recycled aggregates. With a strong focus on zero-waste manufacturing and reduced CO₂ footprint, NOVACRET is actively contributing to green building certifications and urban sustainability initiatives.

ANGIRUS IND PVT LTD and a:gain are some of the emerging market participants in the zero-waste construction materials market.

-

ANGIRUS Industries Pvt. Ltd. manufactures eco-friendly bricks and paver blocks using 100% recycled waste materials, including construction debris and plastic waste. The company’s patented ‘WRICKS’ technology enables the production of lightweight, durable, and non-fired bricks that eliminate the need for soil or kiln firing-key contributors to construction waste and emissions. ANGIRUS plays a vital role in advancing India’s circular economy goals by turning solid waste into high-value building materials.

-

a:gain is a Denmark-based company specializing in circular construction materials made from industrial and demolition waste. The company develops scalable products that can be reused and upcycled, supporting the principles of a regenerative built environment. a:gain collaborates closely with architects, developers, and construction firms to incorporate zero-waste materials into large-scale urban projects.

Key Zero-waste Construction Materials Companies:

The following are the leading companies in the zero-waste construction materials market. These companies collectively hold the largest Market share and dictate industry trends.

- Strawcture Eco Pvt.

- Tvasta

- ANGIRUS IND PVT LTD

- NOVACRET

- ARQLITESPC

- Rawblox

- a:gain

- Greenfiber

- Yi Design

- Greenful Group LLC

Recent Developments

-

In September 2024, ANGIRUS IND PVT LTD developed WRICKS, bricks made 100% from recycled waste (plastic and industrial/ C&D waste), with patented tech, field trials, and laboratory validations.

-

In December 2023, Yi Design introduced an innovative solution to combat urban flooding by developing the Permeable YiBrick, a porous brick made from recycled ceramic waste.

Zero-waste Construction Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 129.51 billion

Revenue forecast in 2033

USD 208.29 billion

Growth rate

CAGR of 6.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Strawcture Eco Pvt.; Tvasta; ANGIRUS IND PVT LTD; NOVACRET; ARQLITESPC; Rawblox; a:gain; Greenfiber; Yi Design; Greenful Group LLC

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Zero-waste Construction Materials Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the zero-waste construction materials market on the basis of product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Billion, 2021-2033)

-

Recycled Aggregates & Concrete

-

Recycled Metals

-

Reclaimed Wood & Timber

-

Recycled Plastics & Polymers

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2021-2033)

-

Residential Construction

-

Non-residential Construction

-

-

Regional Outlook (Revenue, USD Billion, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the zero-waste construction materials market include Strawcture Eco Pvt., Tvasta, ANGIRUS IND PVT LTD, NOVACRET, ARQLITESPC, Rawblox, a:gain, Greenfiber, Yi Design, and Greenful Group LLC.

b. Key factors driving the zero-waste construction materials market include rising sustainability mandates, circular economy initiatives, stringent waste management regulations, growing adoption of green building certifications, and increasing demand for cost-efficient, eco-friendly construction solutions.

b. The global zero-waste construction materials market size was estimated at USD 122.04 billion in 2024 and is expected to reach USD 129.51 billion in 2025.

b. The global zero-waste construction materials market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 208.29 billion by 2033.

b. The recycled aggregates and concrete segment held the highest revenue market share of 44.1% in 2024, driven by its widespread adoption in large-scale infrastructure and urban redevelopment projects

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.