- Home

- »

- Communications Infrastructure

- »

-

5G IoT Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![5G IoT Market Size, Share & Trends Report]()

5G IoT Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By IoT Connectivity (Sub-Massive IoT, Broadband IoT), By Network Architecture, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-063-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

5G IoT Market Summary

The global 5G IoT market size was estimated at USD 7.72 billion in 2024 and is projected to reach USD 89.42 billion by 2030, growing at a CAGR of 50.3% from 2025 to 2030. Growth of this market is primarily driven by the key capabilities of technology including improved speed, lower latency, and superior performance in significant functions such as communication and data transmission.

Key Market Trends & Insights

- Asia Pacific 5G internet of things market dominated the global market with a revenue share of 39.4% in 2024.

- The U.S. 5G Internet of Things market dominated the regional industry in 2024.

- Based on component, the hardware segment dominated the 5G internet of things market with a revenue share of 44.3% in 2024.

- Based on IoT connectivity, the massive IoT segment dominated the market in 2024.

- Based on network architecture, the 5G non-standalone segment accounted for the largest revenue share of the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.72 Billion

- 2030 Projected Market Size: USD 89.42 Billion

- CAGR (2025-2030): 50.3%

- Asia Pacific: Largest market in 2024

The growing use of sensor technology in the automotive industry, manufacturing process automation, and multiple other industries is facilitating the growth of this market. In recent years, the reliability offered by the Internet of Things (IoT) technology has resulted in rapid growth in adoption and utilization. When coupled with unmatched speed and lower latency ensured by 5G, Internet of Things offers improved capabilities to machines, processes, systems, and more. Governments and telecom enterprises' increasing focus on establishing and enhancing the infrastructure required for seamless operations of 5G networks are also supporting the growth of this market. Over the forecast period, widespread active 5G networks are anticipated to facilitate large-scale roll-outs of IoT-driven devices, IoT nodes, and associated technologies.New product launches by key telecom companies are adding to the growth opportunities for this market. For instance, TEAL (Teal Communications, Inc.), one of the advanced technology providers, launched an Internet of Things (IoT) eSIM equipped with unlimited 5G data plans. Set to lead significant changes in location-specific IoT solutions, the eSIM offers limitless access to Tier-1 networks in the U.S.

The growing development of smart infrastructure is expected to present lucrative opportunities for this market in the forecast period. Smart infrastructure applications such as smart traffic management, smart parking, smart grids, and more feature IoT integration for improved performance and enhanced control. The use of IoT-powered sensors, cameras, and other technologies supported by 5G networks is expected to drive the 5G Internet of Things market growth over the next few years.

Government investments and multiple other organizations in the development of well-equipped 5G networks are expected to add significant growth opportunities for this market. For instance, in 2023, the U.S. National Science Foundation Directorate for Technology, Innovation, and Partnerships (TIP) announced an investment of USD 25 million to address challenges associated with 5G communication infrastructure and operations.

Component Insights

The hardware segment dominated the 5G internet of things market with a revenue share of 44.3% in 2024. The segment growth can be attributed to significant innovation and investment in the coming years as companies seek to capitalize on the potential of this new technology. As 5G networks become more widely available, the costs associated with hardware components of 5G technology are expected to reduce remarkably. This would make it cheaper for manufacturers to incorporate 5G IoT hardware into their business processes and utilize smart cities, industrial automation, and autonomous cars. The combination of 5G technology with IoT has the potential to alter businesses and generate demand for 5G IoT hardware over the forecast period.

The services segment is projected to witness remarkable growth over the forecast period. The segment is expected to grow over the forecast period in line with the continued adoption of IoT devices in manufacturing, transportation, and automotive, among other industries and industry verticals. The support & maintenance segment is anticipated to witness the fastest growth over the forecast period. Businesses increasingly depend on 5G IoT services to suit their demands as the number of IoT devices linked to the internet rises and the demand for a high-speed connection and real-time data processing rises.

IoT Connectivity Insights

The massive IoT segment dominated the market in 2024. The growing number of massive IoT connections is expected to grow the segment. Massive IoT connects massive amounts of devices that require minimal connectivity and computing resources and are low-power, low-cost devices. Smart agriculture, asset tracking, supply chain management, smart energy, industrial monitoring, smart homes, and wearables are just a few industries where the combination of 5G with large IoT has applications. The advantages of Massive IoT propel its acceptance in the 5G IoT industry.

Industrial automation IoT is anticipated to emerge as the fastest-growing segment over the forecast period. Industrial automation IoT adds cellular connection into the wired industrial infrastructure needed for real-time sophisticated automation. This technology enables greater communication between industrial equipment and systems by merging 5G technologies with Ethernet-based industrial protocols and Time-Sensitive Networking. Industrial automation IoT is projected to alter how organizations function by enabling seamless integration of cellular connection into the industrial infrastructure, resulting in increased cost savings, improved performance, and enhanced capabilities, consequently boosting the segment's growth.

Network Architecture Insights

The 5G non-standalone segment accounted for the largest revenue share of the global market in 2024. The growth can be attributed to the early deployment of 5G non-standalone networks worldwide, which use the existing 4G infrastructure to provide 5G connectivity.

During the first implementation of 5G networks, the non-standalone 5G network design is expected to play a critical role in enabling users with faster data transfer speeds while utilizing the current 4G/LTE infrastructure. Since built on existing infrastructure, they offer the most affordable and time-efficient way of upgrading to 5G, which is contributing to their dominant share in the market. The 5G standalone segment is projected to grow at the highest CAGR over the forecast period. The segment's growth is primarily due to its ability to maintain continuous machine-to-machine communication, which requires ultra-reliable, high-frequency, and low-latency connectivity.

5G standalone is a 5G network architecture solely based on 5G infrastructure and designed to deliver a more efficient and effective network for IoT devices. Globally, growing industrial digitization is creating new opportunities for service providers. The combination of these trends is expected to drive the segment's 5G IoT market growth over the coming years.

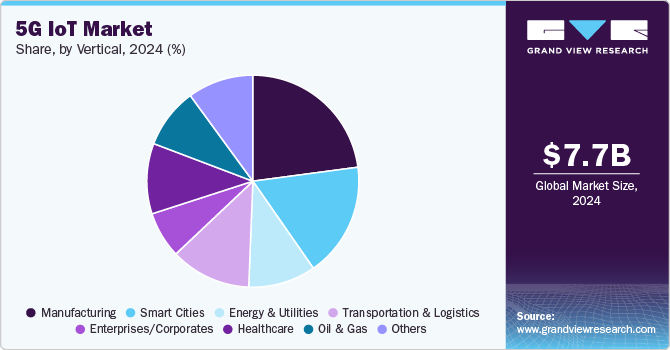

Vertical Insights

The manufacturing segment dominated the market in 2024. 5G IoT has the potential to revolutionize the manufacturing industry and fuel the growth of Industry 4.0 transformation. Its various applications in the manufacturing industry, including automation, autonomous vehicles, machine-to-machine connectivity, machine health monitoring, asset tracking, supply chain management, and predictive maintenance, contribute to the segment’s growth.

Adoption of 5G IoT would be critical in assisting manufacturing entities in accelerating this transformation by providing enhanced visibility across the entire ecosystem and laying the groundwork for the implementation of cutting-edge technologies such as artificial intelligence (AI) and ML. This would result in the creation of novel use cases and improved commercial outcomes.

The smart cities segment is expected to grow significantly over the forecast period. The rising deployment of connected sensors and devices, such as smart streetlights, traffic sensors, and waste management systems in smart cities, are the major factors driving the growth opportunities for the segment. These devices collect and transmit data in real-time, allowing city managers to optimize operations and improve citizen services.

Additionally, with the rise of urbanization and population growth, cities worldwide face numerous challenges related to traffic management, energy consumption, and environmental sustainability. To address these challenges, smart cities increasingly turn to 5G IoT technologies to enable real-time monitoring, analysis, and optimization of city services and infrastructure.

Regional Insights

North America 5G internet of things market is expected to witness significant growth over the forecast period. Increasing 5G infrastructure investments are a key component fueling the region's expansion. Considerable investments are made in 5G infrastructure, including installing fiber-optic cables and other network elements. Moreover, the regional governments are encouraging the use of 5G technology through various programs and laws designed to enhance the network infrastructure. These elements promote the region's progress throughout the study period.

U.S. 5G IoT Market Trends

The U.S. 5G Internet of Things market dominated the regional industry in 2024. This market is mainly driven by aspects such as large enterprises working in the IT and telecom industry, multiple companies offering an extensive range of IoT solutions, and increasing investments in 5G network developments and roll-outs. Growing industrial automation in the manufacturing industry, increasing use of sensor technology and IoT-enabled systems, and rising demand for high-performance network capabilities are adding opportunities to this market.

Asia Pacific 5G IoT Market Trends

Asia Pacific 5G internet of things market dominated the global market with a revenue share of 39.4% in 2024. The growth is attributed to the increasing focus of multiple manufacturers on embracing IoT-driven automation, growing investments by government and organizations in the telecom industry in the development of reliable 5G networks, and favorable government measures for automation in the region. Additionally, APAC is characterized by countries with large populations, emerging economies, and evolving businesses and startups, which offers a significant growth opportunity for 5G IoT network providers owing to a sizeable untapped consumer base in the region.

5G internet of things marketin China held the largest revenue share of the Asia Pacific 5G Internet of Things market in 2024. Multiple technology enterprises in the country mainly drive this market, heavy investments by companies in developing advanced technology components, a strong, active manufacturing industry, and more.

India 5G Internet of Things market is anticipated to experience noteworthy growth from 2025 to 2030. This market is mainly driven by the growing focus of the government on the development of infrastructure that supports 5G rollouts and facilitates increasing adoption of IoT-enabled automation in multiple industries. The increasing availability of IoT solutions, ongoing research and development in the country, and numerous manufacturers that develop components such as hardware, sensor technology, and others in India are adding to the growth experienced by this market.

Europe 5G IoT Market Trends

Europe was identified as one of the key regions of the global 5G Internet of Things market in 2024. This is attributed to the rapid pace of digital transformation in the region and the growing inclination of multiple industries towards embracing large-scale automation, as well as IoT-enabled technology solutions for improved processes and performances. Numerous manufacturers, especially from sectors such as automotive, personal care, chemical, paints and coatings, consumer goods, and others, are expected to drive growing demand for IoT-enabled solutions over the forecast period.

5G internet of things market in Germany held the largest revenue share of the regional industry in 2024. This market is mainly driven by aspects such as the country's robust manufacturing industry, increasing availability of IoT-based solutions designed for industry-specific requirements, and 5G network roll-outs.

The UK 5G Internet of Things market is expected to experience substantial growth from 2025 to 2030. This market is primarily driven by the rapid digital transformation of multiple industries in the country and the growing demand for IoT-enabled business solutions, which are mainly focused on process improvements, automation, and more.

Key 5G IoT Company Insights

Some of the key companies in the 5G internet of things industry include Nokia Corporation, AT&T INC., ZTE Corporation, Verizon Communications Inc., Huawei Technologies Co., Ltd. and others. To address the growing demand for IoT-enabled solutions and increasing competition in the market, the key market participants are adopting strategies such as new product launches, adoption of advanced technologies, collaborations, and more.

-

AT&T INC., a global telecommunication company, specializes in a wide range of services, including the Internet, wireless technology, media, and more. It offers networks, management platforms, and edge solutions associated with IoT technology. It also offers 5G eSIM support.

-

Nokia Corporation, one of the key players in the telecommunication and information and communication technology industry, offers innovation-based B2B technology solutions. It is actively involved in developing 5G technology that addresses the requirements of the Internet of Things (IoT). This includes solutions such as WING and technology solutions such as 5G RedCap.

Key 5G IoT Companies:

The following are the leading companies in the 5G IoT market. These companies collectively hold the largest market share and dictate industry trends.

- Nokia Corporation

- TELEFONAKTIEBOLAGET LM ERICSSON

- ZTE Corporation

- AT&T INC.

- Huawei Technologies Co., Ltd.

- Verizon Communications Inc.

- Thales Group

- Vodafone Group Plc.

- China Mobile Limited

- Microsoft Corporation

Recent Developments

-

In September 2024, ZTE Corporation partnered with Suzhou Branch of China Telecom to deploy innovation-based 5G IoT integrated network solution for The First Affiliated Hospital of Soochow University.

-

In February 2024, Wipro Limited, one of the global technology solutions and services providers, collaborated with Nokia Corporation to launch a 5G-driven private wireless network solution for enterprise users, enabling the scalability of digital transformation.

5G IoT Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.67 billion

Revenue forecast in 2030

USD 89.42 billion

Growth rate

CAGR of 50.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, IoT connectivity, network architecture, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; and South Africa

Key companies profiled

Nokia Corporation; TELEFONAKTIEBOLAGET LM ERICSSON; ZTE Corporation; AT&T INC.; Huawei Technologies Co. Ltd.; Verizon Communications Inc.; Thales Group; Vodafone Group Plc.; China Mobile Limited; Microsoft Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G IoT Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global 5G IoT market report based on component, IoT connectivity, network architecture, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2020 - 2030)

-

Hardware

-

Software

-

Services

-

Integration & Installation

-

Network Connectivity Services

-

Training & Consulting

-

Support & Maintenance

-

-

-

IoT Connectivity Outlook (Revenue, USD Million, 2020 - 2030)

-

Sub-Massive IoT

-

Broadband IoT

-

Critical IoT

-

Industrial Automation IoT

-

-

Network Architecture Outlook (Revenue, USD Million, 2020 - 2030)

-

5G Non-standalone

-

5G Standalone

-

-

Vertical Outlook (Revenue, USD Million, 2020 - 2030)

-

Manufacturing

-

Smart Cities

-

Energy & Utilities

-

Transportation & Logistics

-

Enterprises/Corporates

-

Healthcare

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G internet of things market size was estimated at USD 7.72 billion in 2024 and is expected to reach USD 11.67 billion in 2025.

b. The global 5G internet of things market is expected to grow at a compound annual growth rate of 50.3% from 2025 to 2030 to reach USD 89.42 billion by 2030.

b. Asia Pacific dominated the 5G IoT market with a share of 39.4% in 2024. This is attributed to the increasing number of 5G IoT initiatives, such as smart cities, in nations like as China and India. At the same time, favorable government measures for automation and technologically advanced start-ups in the country are propelling the regional market's growth.

b. Some key players operating in the 5G internet of things (IoT) market include Nokia Corporation; TELEFONAKTIEBOLAGET LM ERICSSON; ZTE Corporation; AT&T INC.; Huawei Technologies Co., Ltd.; Verizon Communications Inc.; Thales Group; Vodafone Group Plc.; China Mobile Limited; Microsoft Corporation.

b. The rising demand for connected devices and the use of 5G IoT in industry 4.0 is a significant factor driving the market growth. 5G enables the most advanced network, designed to link nearly anything and everyone, including objects, machines, and gadgets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.