- Home

- »

- Advanced Interior Materials

- »

-

Additive Manufacturing Equipment Market Size Report, 2033GVR Report cover

![Additive Manufacturing Equipment Market Size, Share & Trends Report]()

Additive Manufacturing Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Binder Jetting, Metal 3D Printing), By Material (Plastics, Metals), By Application (Production, Repair & Modification), By End-use (Automotive, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-805-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Additive Manufacturing Equipment Market Summary

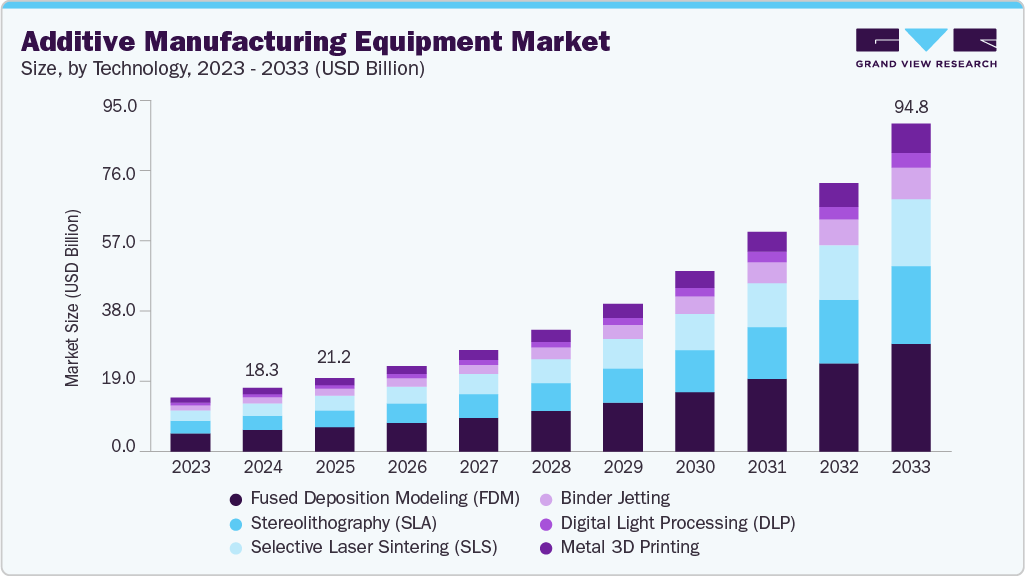

The global additive manufacturing equipment market size was estimated at USD 18,316.0 million in 2024 and is projected to reach USD 94,778.5 million by 2033, growing at a CAGR of 20.6% from 2025 to 2033. The market is witnessing steady expansion, driven by the increasing adoption of 3D printing across industries such as automotive, aerospace, healthcare, and consumer goods.

Key Market Trends & Insights

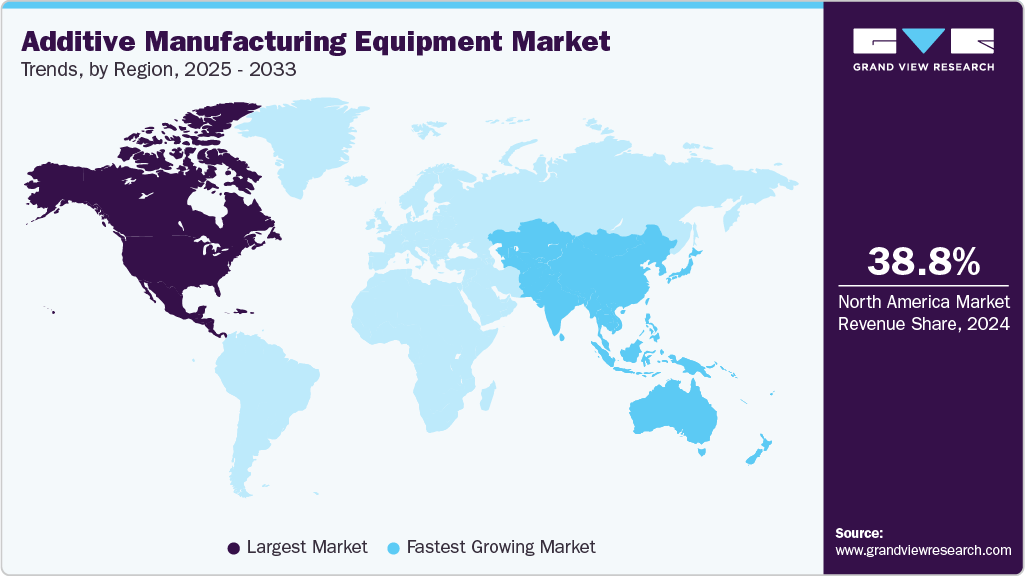

- North America dominated the additive manufacturing equipment market, accounting for the largest revenue share of 38.8% in 2024.

- The additive manufacturing equipment industry in the U.S. remains a sizeable national market.

- By technology, the Fused Deposition Modeling (FDM) segment dominated the market, accounting for 33.6% of total revenue in 2024.

- By application, the production segment dominated the market in 2024, accounting for a 67.9% share of the total revenue.

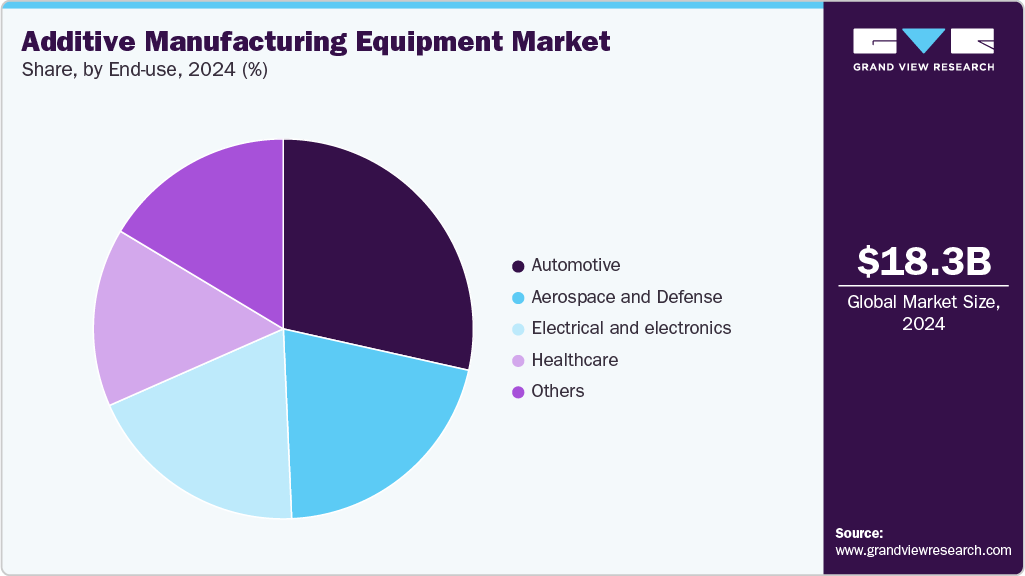

- By end-use, the automotive segment dominated the market in 2024, accounting for 28.5% of the revenue share.

Market Size & Forecast

- 2024 Market Size: USD 18,316.0 Million

- 2033 Projected Market Size: USD 94,778.5 Million

- CAGR (2025-2033): 20.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

These sectors are leveraging additive manufacturing for rapid prototyping, lightweight component production, and design flexibility. Companies are increasingly integrating additive systems into production workflows to reduce lead times and material waste, while also benefiting from the ability to produce customized components on demand.

Government initiatives promoting digital manufacturing and localized production are encouraging broader adoption across small and medium enterprises. As costs continue to decline and material diversity improves, additive manufacturing is transitioning into a mainstream production solution, enabling greater supply chain resilience and on-demand manufacturing flexibility across global industries.

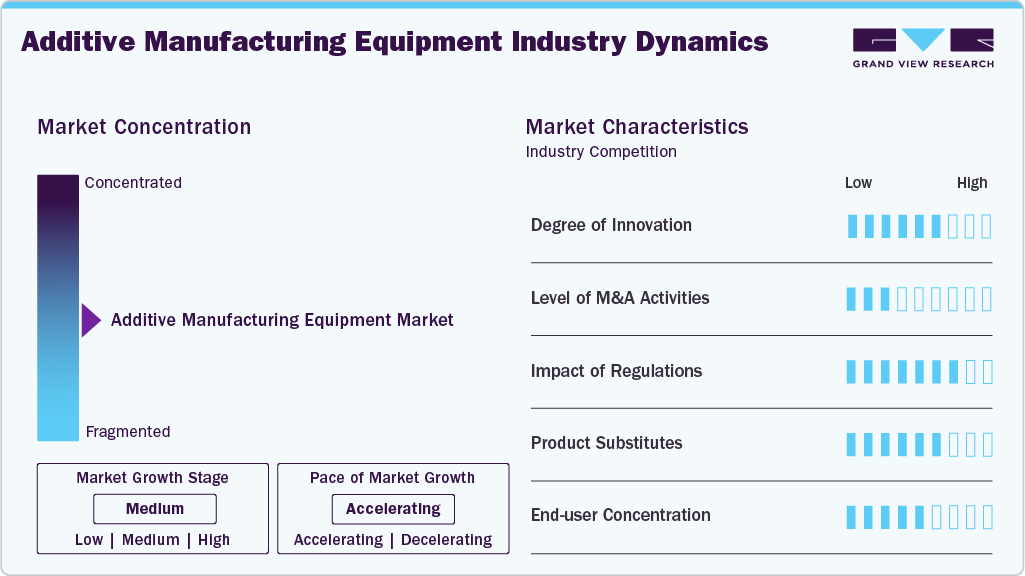

Market Concentration & Characteristics

The additive manufacturing equipment industry is moderately concentrated, with a few leading companies such as Stratasys, 3D Systems, EOS GmbH, HP Inc., and GE Additive accounting for a considerable share of global revenue. These firms dominate due to strong R&D capabilities, established client bases in aerospace, healthcare, and automotive sectors, and extensive patent portfolios. However, the market is witnessing growing participation from regional and niche players offering specialized solutions in metal, polymer, and hybrid printing technologies. Consolidation through mergers and strategic alliances continues to shape the competitive landscape, with larger firms acquiring startups focused on new materials and software-driven process optimization.

The global market is innovation-driven and capital-intensive, characterized by rapid technological evolution, high material specialization, and increasing integration with digital manufacturing ecosystems. The shift from prototyping to end-use production has altered purchasing behavior, with customers demanding greater reliability, precision, and throughput. The market also exhibits strong cross-industry relevance, as sectors such as aerospace, defense, automotive, healthcare, and industrial manufacturing all leverage 3D printing for customized and lightweight components. Besides, the industry benefits from a growing base of service bureaus and contract manufacturers, which are expanding accessibility for small and medium enterprises.

Regulatory frameworks are evolving to keep pace with additive manufacturing’s industrialization. Standards bodies such as ISO, ASTM International, and SAE are establishing guidelines for process validation, material traceability, and part certification, particularly in aerospace, medical devices, and defense applications. Compliance with these standards is critical for ensuring the consistency and safety of printed parts. Governments in the U.S., the EU, and the Asia-Pacific region are also offering incentives and funding programs for additive manufacturing research and development (R&D), thereby accelerating adoption among domestic manufacturers. However, regulatory uncertainty in emerging markets, especially regarding intellectual property and product qualification, remains a constraint, emphasizing the need for global harmonization of 3D printing standards.

Drivers, Opportunities & Restraints

The growing demand for lightweight, customizable, and cost-efficient manufacturing solutions across industries such as aerospace, automotive, healthcare, and consumer goods is a key driver of the additive manufacturing equipment market. Companies are adopting 3D printing to reduce material waste, shorten production cycles, and enable on-demand manufacturing. The technology’s ability to create complex geometries without tooling also lowers prototyping costs and accelerates product development. Furthermore, the increasing use of metal and polymer additive systems in industrial-scale production, coupled with technological advances in multi-material and high-speed printing, is fueling widespread adoption worldwide.

Significant opportunities exist in the expansion of large-format and metal additive systems, particularly in aerospace and automotive manufacturing, where precision and material strength are critical. The increasing adoption of bio-printing and medical-grade polymers for implants and prosthetics is opening high-value healthcare applications. Moreover, the integration of AI-driven design software, automation, and digital manufacturing platforms is enabling smarter, more efficient production workflows.Emerging economies in the Asia Pacific and Latin America offer long-term growth potential through government-led digitalization and localized production initiatives.

High equipment costs, material expenses, and post-processing requirements remain major barriers to mass adoption, particularly for small and medium enterprises. Limited standardization and the lack of unified regulatory frameworks in some regions pose challenges for part certification and quality consistency. Dependence on specialized materials and skilled technicians adds further complexity to scaling operations.Besides, slower production speeds compared to traditional manufacturing methods can restrict adoption for high-volume production, while economic volatility and fluctuating raw material prices may limit investment in advanced systems across emerging markets.

Technology Insights

The Fused Deposition Modeling (FDM) segment dominated the market, accounting for 33.6% of total revenue in 2024. FDM’s widespread use stems from its cost-efficiency, ease of operation, and compatibility with a wide range of thermoplastic materials such as ABS and PLA. It is the preferred technology for prototyping, design verification, and educational applications. The continued development of multi-nozzle and high-speed extrusion systems has enhanced FDM’s productivity and material precision, further solidifying its position as the most widely adopted 3D printing technology globally.

The Stereolithography (SLA) segment is the fastest-growing technology segment, reflecting rapid adoption where high surface finish, fine feature resolution, and precision are required. SLA’s superior part detail, smooth surface quality, and suitability for small, high-tolerance components are driving uptake in dental, jewelry, medical device prototyping, and tooling applications. Continued improvements in resin chemistry, faster curing systems, and reduced post-processing requirements are widening SLA’s use from specialist prototyping into higher-value production niches.

Material Insights

The plastics segment dominated the additive manufacturing equipment industry in 2024, accounting for 42.2% of the total revenue. Polymers such as ABS, PLA, and nylon are widely used for prototyping, tooling, and end-use components due to their versatility, low cost, and wide printer compatibility. Continuous innovation in high-performance and engineering-grade thermoplastics, including PEEK and ULTEM, is expanding their adoption in aerospace, automotive, and medical applications.

The metals segment is expected to grow at a significant CAGR of 22.0% from 2025 to 2033 in terms of revenue. Metals such as titanium, stainless steel, and aluminum alloys are increasingly being used to produce lightweight, high-strength parts that meet stringent structural and safety requirements. Continuous improvements in powder-bed fusion technologies and direct energy deposition (DED) processes are enhancing material density, surface finish, and production repeatability. As metal printing becomes more cost-competitive, its role is shifting from prototyping to large-scale manufacturing of critical components, solidifying its position as a key growth driver in the additive manufacturing equipment market.

Application Insights

The production segment dominated the market in 2024, accounting for a 67.9% share of the total revenue. This dominance is driven by the accelerating shift from prototyping to end-use part manufacturing, particularly in industries such as automotive, aerospace, and healthcare. Additive manufacturing enables the production of lightweight, geometrically complex, and customized components that traditional methods cannot easily achieve. Continuous advancements in multi-material printing, build speed, and process automation are making additive manufacturing increasingly viable for serial production.

Additive technologies, such as directed energy deposition (DED) and laser metal deposition, are being utilized to restore worn or damaged components, thereby extending the service life of high-value assets in the aerospace, energy, and heavy machinery industries. These methods minimize waste, reduce downtime, and eliminate the need for costly part replacements. As sustainability and circular manufacturing practices gain traction, additive-based repair and modification are emerging as critical applications for reducing lifecycle costs and improving operational efficiency.

End-use Insights

The automotive segment dominated the market in 2024, accounting for 28.5% of the revenue share. Automakers are increasingly integrating 3D printing into prototyping, tooling, and low-volume part production, benefiting from shorter design cycles and material efficiency. The technology’s ability to produce lightweight, complex geometries supports fuel efficiency goals and accelerates innovation in the development of electric and hybrid vehicles.

Additive manufacturing enables the production of high-strength, lightweight metal components, thereby optimizing engine performance and minimizing material waste. Continuous advancements in metal powder-bed fusion and electron beam melting technologies are expanding the range of flight-qualified components. The increasing certification of 3D-printed parts by aerospace authorities underscores the sector’s growing reliance on additive manufacturing for both prototyping and end-use component production.

Regional Insights

The North America additive manufacturing equipment market was the largest market in 2024, holding a 38.8% share, supported by advanced adoption in aerospace, defense, healthcare, and industrial manufacturing. The region benefits from a strong innovation ecosystem, well-established research infrastructure, and robust investment by companies such as Stratasys, 3D Systems, and GE Additive. Ongoing initiatives in supply chain localization and on-demand production are further accelerating growth, particularly in the U.S., where the technology is integral to advanced manufacturing strategies.

The additive manufacturing equipment industry in the U.S. remains a sizeable national market, driven by its strong industrial base, government-backed innovation programs, and early adoption in aerospace, defense, and healthcare. Major OEMs and service providers leverage 3D printing for production-grade parts, while continued investment in metal additive systems and automation ensures the country’s global technological leadership.

Europe Additive Manufacturing Equipment Market Trends

The additive manufacturing equipment industry in the Europe continues to experience steady growth, driven by the region’s strong regulatory frameworks, sustainability goals, and focus on industrial modernization. Countries such as Germany, the UK, and France are leading adoption through their advanced automotive and aerospace sectors. The European Union’s investment in digital manufacturing, through the Horizon Europe program, is promoting research and development in additive materials, process automation, and quality assurance. Growing emphasis on circular manufacturing and low-carbon production further strengthens regional market expansion.

The Germany additive manufacturing equipment industry gains from deep integration across automotive, engineering, and medical technology sectors. Supported by national Industry 4.0 initiatives, the country emphasizes precision manufacturing, quality certification, and material innovation. German OEMs such as EOS and Siemens continue to advance industrial-scale metal and polymer printing technologies.

The additive manufacturing equipment industry in the UK is expanding steadily, driven by strong academic–industrial collaboration and a focus on aerospace, defense, and medical device production. Government funding through programs like Innovate UK supports R&D in next-generation additive materials and process optimization. Growing emphasis on sustainability and localized manufacturing is fostering adoption across SMEs.

Asia Pacific Additive Manufacturing Equipment Market Trends

The additive manufacturing equipment industry in the Asia Pacific is propelled by rapid industrialization, government-led manufacturing programs, and a robust electronics and automotive base. China, Japan, South Korea, and India are at the forefront of adoption, supported by national strategies promoting Industry 4.0 and smart manufacturing. Lower material costs, expanding domestic production capabilities, and the rise of local printer manufacturers are making Asia Pacific the fastest-growing regional market through 2033.

The China additive manufacturing equipment industry leads the Asia Pacific landscape, supported by aggressive industrial digitalization policies and heavy state-backed investment in 3D printing infrastructure. The country’s manufacturing ecosystem increasingly integrates additive systems for prototyping, tooling, and end-use production. Local players are scaling up metal and large-format printers, making China a key exporter of additive manufacturing equipment.

The additive manufacturing equipment industry in India is rapidly emerging, propelled by initiatives such as the National Strategy on Additive Manufacturing (2022) and rising investment in defense and healthcare applications. The growing network of service bureaus and domestic printer manufacturers is expanding accessibility. Demand is particularly strong in automotive prototyping and industrial tooling.

Middle East & Africa Additive Manufacturing Equipment Market Trends

The additive manufacturing equipment industry in the Middle East & Africa region is emerging as a niche but high-potential market, particularly in the aerospace, construction, and healthcare sectors. The United Arab Emirates and Saudi Arabia are leading the adoption through smart city initiatives and investments in digital industrialization. In Africa, adoption remains in its early stages but is gaining traction through technology transfer partnerships and education-driven awareness. Increasing government support for diversification beyond oil-based economies is expected to create new opportunities for additive manufacturing over the next decade.

The Saudi Arabia additive manufacturing equipment industry is positioning as a key pillar of its Vision 2030 diversification plan, focusing on industrial, defense, and construction applications. Government-backed initiatives and partnerships with global technology providers are establishing local 3D printing hubs. The country’s emphasis on digital industrialization and sustainable infrastructure is accelerating long-term market potential.

Latin America Additive Manufacturing Equipment Market Trends

The additive manufacturing equipment industry in Latin America is witnessing gradual but steady adoption, driven by increasing awareness and pilot-scale industrial integration in countries such as Brazil and Mexico. While high equipment costs and limited technical expertise remain challenges, the regional expansion of multinational manufacturers and university-led research programs is improving accessibility. Growth is expected to strengthen as local industries explore additive technologies for prototyping, spare parts, and small-batch production.

The Brazil additive manufacturing equipment industry represents Latin America’s largest market, with growing adoption in aerospace, energy, and industrial manufacturing. Increased academic collaboration and public–private partnerships are fostering local innovation. While equipment costs and material imports remain challenges, Brazil’s manufacturing modernization programs are expected to boost adoption through the next decade.

Key Additive Manufacturing Equipment Company Insights

Some of the key players operating in the market include Stratasys Ltd and HP Inc.

-

Stratasys Ltd., headquartered in Minnesota, U.S., is one of the world’s prominent manufacturers of polymer-based 3D printing systems. The company is best known for pioneering Fused Deposition Modeling (FDM) and PolyJet technologies, which are widely used across industries such as aerospace, automotive, healthcare, and consumer goods for both prototyping and end-use part production.

-

HP Inc., California, U.S., is a major player in the global additive manufacturing market, recognized for its Multi Jet Fusion (MJF) and Metal Jet technologies. The company leverages its expertise in digital printing and imaging to produce high-throughput, precision 3D printing systems that cater to automotive, healthcare, and consumer product applications. HP’s additive manufacturing solutions are designed for scalable production.

Key Additive Manufacturing Equipment Companies:

The following are the leading companies in the additive manufacturing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Stratasys Ltd

- 3D Systems Corporation

- HP Inc.

- General Electric Company

- MakerBot Industries, LLC

- Empire Tool Rentals

- EOS GmbH

- Nikon SLM Solutions AG

- Markforged Inc

- Formlabs

- Eplus3D

- DMG MORI

- MELD Manufacturing Corporation

- Breton S.p.A.

- Additive Industries

Recent Developments

-

In November 2025, Additive Industries launched the MetalFab 420K, a modular metal additive manufacturing (AM) system designed for high productivity and industrial-grade quality in sectors such as aerospace, automotive, space, and high-technology. The machine features four full-field 1 kW lasers operating over a build volume of 420 × 420 × 400 mm, automated alignment and calibration, and a tunable beam‐diameter (100-500 µm) parameter that supports advanced materials and custom process development.

-

In October 2024,Eplus3D launched its EP-M4750, a metal additive manufacturing machine designed for batch production with a build chamber measuring 450 × 750 × 530 mm, enabling the printing of wide and high-precision metal parts for industries such as aerospace, automotive, tooling, and heavy machinery.

Additive Manufacturing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21,183.3 million

Revenue forecast in 2033

USD 94,778.5 million

Growth rate

CAGR of 20.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, application, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Stratasys Ltd.; 3D Systems Corporation; HP Inc.; General Electric Company; MakerBot Industries LLC; Empire Tool Rentals; EOS GmbH; Nikon SLM Solutions AG; Markforged Inc.; Formlabs; Eplus3D; DMG MORI; MELD Manufacturing Corporation; Breton S.p.A.; Additive Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Additive Manufacturing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global additive manufacturing equipment market report based on technology, material, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Fused Deposition Modeling (FDM)

-

Stereolithography (SLA)

-

Selective Laser Sintering (SLS)

-

Binder Jetting

-

Digital Light Processing (DLP)

-

Metal 3D Printing

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Metals

-

Ceramics

-

Composites

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Production

-

Repair & Modification

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Aerospace and Defense

-

Electrical and electronics

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global additive manufacturing equipment market size was estimated at USD 18,316.0 million in 2024 and is expected to reach USD 21,183.3 million in 2025.

b. The global additive manufacturing equipment market is expected to grow at a compound annual growth rate of 20.6% from 2025 to 2033 to reach USD 94,778.5 million by 2033.

b. The market in North America dominated the global revenue share accounting for 38.8% of the share, driven by strong demand from aerospace, healthcare, and industrial sectors. The region benefits from established manufacturing infrastructure and governmental support for advanced production technologies.

b. Some of the key players operating in the additive manufacturing equipment marke include Stratasys Ltd., 3D Systems Corporation, HP Inc., General Electric Company, MakerBot Industries LLC, Empire Tool Rentals, EOS GmbH, Nikon SLM Solutions AG, Markforged Inc., Formlabs, Eplus3D, DMG MORI, MELD Manufacturing Corporation, Breton S.p.A., and Additive Industries.

b. The key factors driving the additive manufacturing equipment market include the growing demand for lightweight, customizable, and cost-efficient production solutions across industries. Advancements in materials, automation, and multi-material printing technologies are further accelerating large-scale adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.