- Home

- »

- Biotechnology

- »

-

Apoptosis Assay Market Size & Share, Industry Report, 2030GVR Report cover

![Apoptosis Assay Market Size, Share & Trends Report]()

Apoptosis Assay Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Kits, Reagents, Instruments), By Technique (Flow Cytometry, Spectrophotometry), By Assay Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-134-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Apoptosis Assay Market Summary

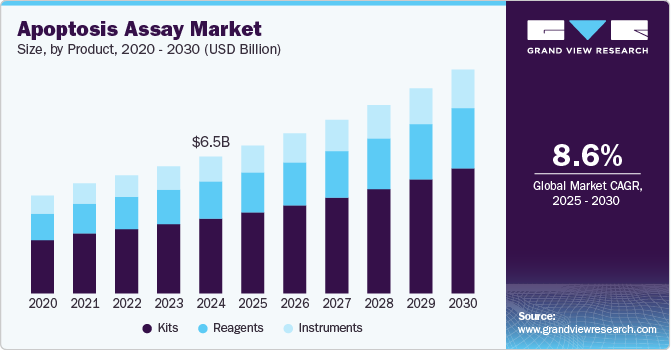

The global apoptosis assay market size was estimated at USD 6.47 billion in 2024 and is projected to reach USD 10.57 billion by 2030, growing at a CAGR of 8.65% from 2025 to 2030. The increasing prevalence of chronic diseases, including cancer and neurodegenerative disorders, is driving the expansion of the apoptosis assay industry.

Key Market Trends & Insights

- North America dominates the market with the largest revenue share of 46.77% in 2024.

- Based on product, the kits segment led the market with the largest revenue share of 54.71% in 2024.

- Based on technique, the flow cytometry segment led the market with the largest revenue share of 34.09% in 2024.

- Based on type, the caspase assay segment led the market with the largest revenue share of 28.94% in 2024.

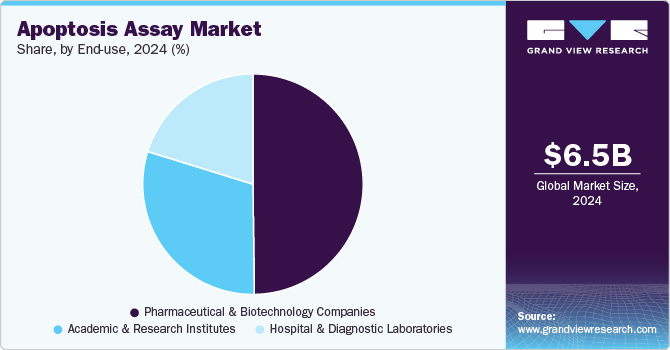

- Based on end use, the pharmaceutical and biotechnology companies segment led the market with the largest revenue share of 49.81% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.47 Billion

- 2030 Projected Market Size: USD 10.57 Billion

- CAGR (2025-2030): 8.65%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

As the demand for effective drug discovery and development rises, researchers rely on apoptosis assays to study cell death mechanisms and develop targeted therapies.Pharmaceutical and biotechnology companies are investing in advanced assay technologies to enhance precision and efficiency in evaluating therapeutic compounds. The growing need for personalized medicine further fuels market growth, as apoptosis is crucial in understanding disease progression and treatment responses. Advancements in molecular biology techniques are also contributing to the market's expansion.

Moreover, technological innovations in apoptosis detection methods are driving the market forward. The introduction of high-throughput screening and flow cytometry-based assays enables researchers to analyze cell viability more accurately and quickly. Similarly, fluorescence and luminescence-based assays are gaining popularity due to their sensitivity and ability to detect early apoptotic events. Integrating artificial intelligence and automation in laboratory workflows enhances data analysis and minimizes human error. These advancements improve research outcomes, leading to a higher adoption rate of apoptosis assays across various scientific domains.

Another key growth driver is the increasing application of apoptosis assays in toxicology and drug safety assessment. Pharmaceutical companies use these assays to evaluate the cytotoxic effects of drug candidates during preclinical studies. The ability to detect apoptotic cell death helps identify potential adverse effects and optimize drug formulations. In addition, researchers in environmental sciences are utilizing apoptosis assays to assess the impact of pollutants and chemicals on human health. The expanding scope of applications across different industries supports market growth and innovation in assay development.

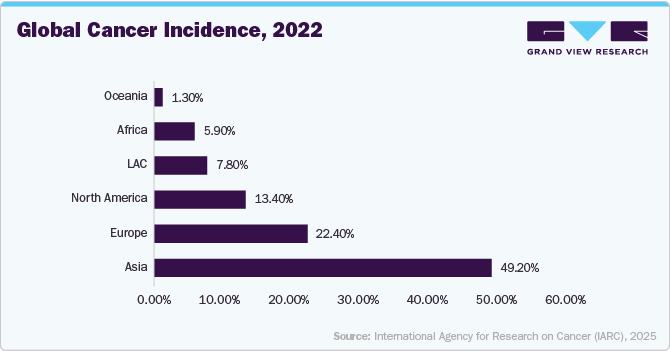

Rising Prevalence Of Cancer And Chronic Diseases

The increasing prevalence of cancer and other chronic diseases has significantly boosted the demand for apoptosis assays in research and diagnostics. According to the American Cancer Society, the number of cancer cases is predicted to reach 35 million by 2050 million. Apoptosis, or programmed cell death, plays a crucial role in understanding cancer progression and drug resistance.

Source: International Agency for Research on Cancer (IARC), 2025

Researchers rely on apoptosis assays to develop targeted therapies that selectively induce cell death in cancerous cells. In addition, neurodegenerative diseases such as Alzheimer's and Parkinson's involve apoptosis dysregulation, further driving research in this field. As the global burden of these diseases rises, the need for apoptosis detection tools continues to grow.

Advancements in Molecular Biology And Drug Discovery

Technological advancements in molecular biology have led to the development of more precise and efficient apoptosis assay techniques. Flow cytometry, fluorescence microscopy, and high-throughput screening have improved the sensitivity and accuracy of apoptosis detection. These innovations allow researchers to study cell death mechanisms more effectively, accelerating drug discovery. Pharmaceutical and biotech companies increasingly use apoptosis assays to evaluate the efficacy of new cancer therapies. As new technologies emerge, the demand for advanced apoptosis assay solutions is expected to rise.

However, the high cost of apoptosis assay kits, reagents, and specialized instruments presents a barrier to market growth. Flow cytometers, fluorescence imaging systems, and other advanced tools required for apoptosis studies are expensive. Many small research laboratories and academic institutions struggle to afford these technologies, limiting their adoption. In addition, maintaining and calibrating these instruments adds to the overall expense. As a result, budget constraints in developing countries slow down market expansion to a certain extend.

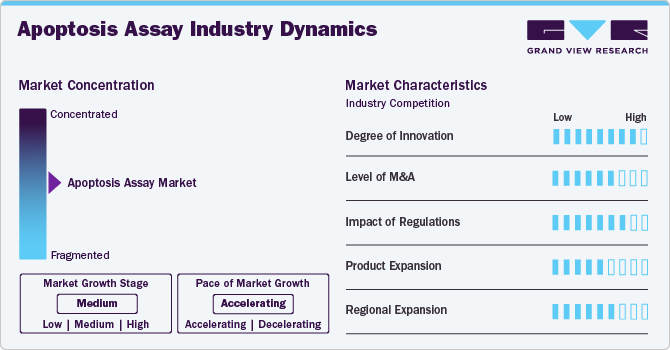

Market Concentration & Characteristics

The apoptosis assay industry is marked by continuous innovation, with advancements in high-throughput screening, flow cytometry, and live-cell imaging techniques. Companies are integrating AI-driven analytics and automation to enhance accuracy and efficiency. Developing novel biomarkers and assay kits tailored for specific applications, such as cancer and neurodegenerative diseases, is driving differentiation. In addition, the emergence of 3D cell culture models further revolutionizes apoptosis research.

The apoptosis assay industry has witnessed moderate-to-high merger and acquisition (M&A) activity, with major biotech and pharmaceutical companies acquiring innovative assay developers and niche technology firms. These acquisitions help expand assay portfolios, enhance R&D capabilities, and strengthen market presence. Strategic collaborations with academic institutions and research organizations are also common. Such consolidations aim to accelerate product innovation and commercialization.

Regulatory frameworks significantly influence the apoptosis assay industry, particularly in clinical research and drug discovery applications. Agencies such as the FDA and EMA impose strong guidelines to ensure assay validation, reproducibility, and accuracy. Compliance with Good Laboratory Practice (GLP) and ISO standards is crucial for manufacturers. Stringent regulations can extend product development timelines and enhance credibility and adoption in regulated sectors.

Companies diversify their product portfolios by offering multiplex assay kits, cell-based assays, and real-time apoptosis detection solutions. The demand for customized assays tailored to specific research needs is driving expansion. Innovations in reagent stability, automation, and assay sensitivity have broadened applications in oncology, immunology, and stem cell research. A growing demand for personalized medicine and drug screening also fuels this expansion.

Leading companies in the apoptosis assay industry are actively expanding their global footprint through acquisitions, partnerships, and direct investments. Major players such as Thermo Fisher Scientific, Bio-Rad, and Merck have strengthened their presence in Asia-Pacific by establishing research facilities and distribution networks in China, India, and South Korea. Similarly, European biotech firms are entering North America through strategic collaborations with research institutions. Emerging markets in Latin America and the Middle East also witness increased investments as companies seek to capitalize on growing biomedical research and healthcare infrastructure.

Product Insights

The kits segment led the market with the largest revenue share of 54.71% in 2024, driven by the growing demand for ready-to-use solutions that simplify experimental workflows. Researchers prefer assay kits due to their convenience, reproducibility, and ability to generate reliable results. The increasing focus on drug discovery and personalized medicine has further accelerated the adoption of these kits. Advancements in assay technologies have led to the development of more sensitive and specific detection methods. Expanding research activities in academic institutions and pharmaceutical companies has increased market growth.

The reagents segment is projected to grow at a significant CAGR over the forecast period, fueled by the increasing demand for flexible and customizable assay solutions. Researchers prefer individual reagents to design experiments tailored to specific study requirements. The growing focus on mechanistic studies of apoptosis pathways in disease progression has increased the adoption of high-quality reagents. The expanding applications of apoptosis assays in cell-based research and drug screening have further supported this growth. The availability of a wide range of fluorogenic and colorimetric reagents has enhanced the sensitivity and accuracy of apoptosis detection. Continuous innovations in reagent formulations are expected to improve assay performance and drive market expansion.

Technique Insights

Based on technique, the flow cytometry segment led the market with the largest revenue share of 34.09% in 2024, which can be attributed to its ability to provide rapid and quantitative single-cell analysis. Researchers favor this technique for its capability to detect multiple apoptotic markers simultaneously. High-throughput capabilities have made flow cytometry an essential pharmaceutical and clinical research tool. Advancements in laser and detection technologies have improved sensitivity and accuracy, further increasing its adoption.

The fluorescence microscopy segment is projected to grow at the fastest CAGR over the forecast period due to the increasing adoption of live-cell imaging techniques in apoptosis research. Researchers use fluorescence microscopy to visualize apoptotic processes in real time, providing valuable insights into cellular responses. Advancements in fluorescent probes and imaging software have improved the resolution and specificity of apoptosis detection. The expanding use of this technique in neuroscience, oncology, and regenerative medicine has contributed to market growth. The ability to analyze spatial distribution and morphological changes in apoptotic cells has made fluorescence microscopy a preferred choice in research. The rising investment in high-content screening technologies is expected to drive further adoption of fluorescence-based apoptosis assays.

Type Insights

Based on type, the caspase assay segment led the market with the largest revenue share of 28.94% in 2024, which can be attributed to its critical role in measuring apoptotic activity. Caspases are key enzymes in programmed cell death, making their detection essential for apoptosis studies. Researchers widely use caspase assays in drug discovery and cancer research to evaluate therapeutic responses. The availability of highly sensitive luminescent and fluorometric caspase assays has improved detection accuracy. The increasing prevalence of cancer and inflammatory diseases has fueled demand for caspase-based apoptosis detection. Advancements in assay design have led to the development of multiplex platforms, further enhancing market adoption.

The mitochondrial assays segment is projected to grow at the fastest CAGR over the forecast period, due to the rising focus on mitochondrial dysfunction in disease pathology. Mitochondria play a central role in apoptosis, making their analysis crucial for understanding cell death mechanisms. Researchers utilize mitochondrial assays to investigate metabolic changes associated with apoptosis. The increasing application of these assays in neurodegenerative diseases and metabolic disorders has supported market expansion. Technological advancements have improved the sensitivity and specificity of mitochondrial membrane potential and cytochrome c release assays. The growing use of mitochondrial assays in drug toxicity screening has further accelerated their adoption.

End Use Insights

Based on end use, the pharmaceutical and biotechnology companies segment led the market with the largest revenue share of 49.81% in 2024, driven by the increasing need for apoptosis-based drug development and screening. Researchers in these industries rely on apoptosis assays to evaluate the efficacy and safety of new therapeutics. The rising demand for targeted cancer therapies has intensified the use of apoptosis assays in preclinical and clinical studies. Expanding research in immuno-oncology and neuropharmacology has further increased assay adoption. Integrating automation and high-throughput screening technologies has enhanced workflow efficiency in pharmaceutical research. The growing investment in biopharmaceutical innovation has contributed to the strong market presence of this segment.

The hospital and diagnostic laboratories segment is projected to grow at the fastest CAGR over the forecast period, fueled by the rising adoption of apoptosis assays in clinical diagnostics. The increasing prevalence of cancer and autoimmune diseases has driven demand for apoptosis-based diagnostic tests. Researchers and clinicians use apoptosis assays to assess disease progression and treatment response. Technological advancements have improved assay sensitivity, enabling early detection of apoptotic markers in patient samples. The growing shift toward personalized medicine has led to increased adoption of apoptosis assays in clinical laboratories. Expanding diagnostic applications in hematology, oncology, and infectious diseases will drive market growth.

Regional Insights

North America dominates the apoptosis assay market with the largest revenue share of 46.77% in 2024, due to the strong presence of pharmaceutical and biotechnology companies. Rising investments in cancer research and personalized medicine contribute to market expansion. The increasing prevalence of chronic diseases fuels the demand for advanced apoptosis detection methods. Technological advancements in flow cytometry and imaging systems enhance research efficiency. The availability of skilled professionals supports the adoption of apoptosis assays in research institutes. The region’s well-established healthcare infrastructure accelerates innovation and product adoption.

U.S. Apoptosis Assay Market Trends

The apoptosis assay market in the U.S. holds a significant share, driven by high healthcare spending. The presence of leading biotech firms ensures continuous research and development in apoptosis-related studies. The growing burden of cancer and neurodegenerative disorders increases the demand for apoptosis assays. Academic institutions and research organizations actively explore novel apoptosis pathways. The expansion of drug discovery programs boosts assay adoption in preclinical studies. Advanced laboratory facilities enable accurate and efficient apoptosis analysis.

Europe Apoptosis Assay Market Trends

The apoptosis assay market in Europe exhibits steady growth due to increasing cancer prevalence. Rising investments in pharmaceutical research drive the demand for apoptosis-based diagnostic tools. The adoption of high-throughput screening methods enhances apoptosis research in drug discovery. Growing awareness about cell-based assays supports their usage in toxicology studies. The expansion of biotechnology firms strengthens apoptosis-related advancements. Improvements in laboratory automation accelerate apoptosis assay adoption across research facilities.

The UK apoptosis assay market significantly contributes to expanding biopharmaceutical sector. The rise in clinical trials for targeted therapies necessitates precise apoptosis detection techniques. The growing interest in regenerative medicine drives research in apoptosis modulation. The increasing burden of chronic diseases fuels apoptosis-related drug development efforts. Advanced microscopy and imaging systems improve assay sensitivity and accuracy. Strong academic collaborations foster innovation in apoptosis assay methodologies.

The apoptosis assay market in Germany is a well-established pharmaceutical industry and has strengthens its position in the German market. Continuous advancements in molecular biology techniques enhance apoptosis detection capabilities. The presence of leading life science companies supports the development of innovative assay technologies. The rising demand for personalized medicine increases apoptosis research applications. Expanding toxicology and safety assessment studies fuel the adoption of apoptosis assays. Investments in automation improve workflow efficiency in apoptosis-based research.

Asia Pacific Apoptosis Assay Market Trends

The apoptosis assay market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, due to rapid healthcare advancements. Increasing investments in biotechnology research accelerate apoptosis assay adoption. The rising incidence of cancer and infectious diseases drives demand for early detection tools. Expanding pharmaceutical manufacturing boosts the need for apoptosis-based drug screening. The region's growing clinical research sector enhances apoptosis assay utilization. Improvements in laboratory infrastructure support the development of novel apoptosis-based therapies.

The China apoptosis assay market is expanding due to a surge in biopharmaceutical research. Increasing cancer cases necessitate advanced apoptosis detection techniques for early diagnosis. The growing presence of contract research organizations accelerates apoptosis assay adoption. Rising investments in precision medicine strengthen apoptosis-related drug development. Expanding academic research initiatives enhances apoptosis pathway studies. The availability of cost-effective laboratory solutions supports overall market growth.

The apoptosis assay market in Japan strong focus on biomedical research drives the demand for apoptosis assays. The increasing prevalence of age-related diseases elevates apoptosis-related therapeutic developments. Technological innovations in imaging systems improve apoptosis detection accuracy. Expanding collaborations between research institutes and pharmaceutical companies boost assay utilization. The presence of advanced healthcare facilities enhances apoptosis-based clinical studies. Automation in laboratory workflows optimizes apoptosis assay performance.

Middle East and Africa Apoptosis Assay Market Trends

The apoptosis assay market in the Middle East and Africa is growing due to increasing investments in life sciences. Rising cancer prevalence fuels demand for apoptosis-based diagnostic tools. Expanding pharmaceutical and biotechnology industries accelerate apoptosis assay adoption. The development of specialized research centers strengthens apoptosis-based studies. Improvements in laboratory infrastructure enhance assay efficiency. Increasing clinical trials for targeted therapies drive the need for advanced apoptosis detection methods.

The Saudi Arabia apoptosis assay market is advancing with the expansion of biomedical research. The rising demand for precision medicine contributes to the adoption of apoptosis-based studies. Increasing investments in healthcare infrastructure support apoptosis research initiatives. The growing prevalence of chronic diseases elevates the need for apoptosis detection tools. Advancements in laboratory technologies improve the accuracy of apoptosis assays. Expanding pharmaceutical manufacturing enhances the adoption of apoptosis-based drug screening.

The apoptosis assay market in Kuwait is growing focus on healthcare research strengthens its apoptosis assay industry. The increasing incidence of cancer and metabolic disorders drives assay adoption. Expanding collaborations with international research organizations enhance apoptosis-based studies. The demand for high-throughput screening in drug discovery accelerates apoptosis assay utilization. Improvements in diagnostic laboratories contribute to efficient apoptosis detection. Rising investment in biomedical research supports apoptosis-based clinical applications.

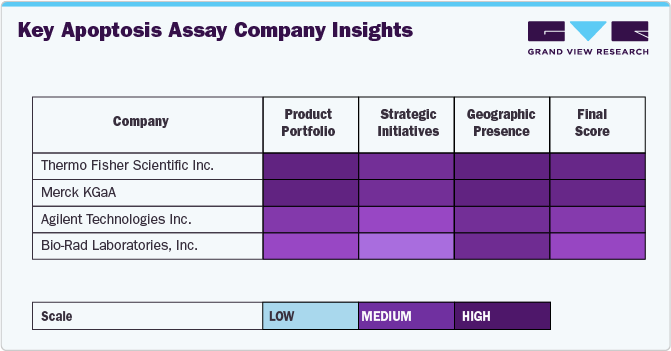

Key Apoptosis Assay Company Insights

The below figure provides a comparative analysis of four major players in the apoptosis assays industry. Thermo Fisher Scientific Inc. scores high across all parameters, indicating a strong overall market position. Comprehensive product offerings, aggressive expansion strategies, and broad global reach make it a market leader. Merck KGaA is also positioned high in all three categories, reflecting significant investment in R&D and expansion. Agilent Technologies Inc.'s company positioning indicates a strong core offering but may be less aggressive in partnerships, acquisitions, or pipeline expansion. Whereas, Bio-Rad Laboratories, Inc. displays medium-to-high performance, particularly in strategic initiatives.

Partnerships, collaborations, and product launches were the most adopted strategies by key players. Companies such as Bio-Rad Laboratories launched Annexin V conjugated to eight StarBright Dyes to enhance apoptosis detection via flow cytometry to expand their market reach globally.

Key Apoptosis Assay Companies:

The following are the leading companies in the apoptosis assay market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories

- Bio-Techne

- Biotium

- GeneCopoeia, Inc.

- Becton, Dickinson & Company (BD)

- Promega Corporation

- Sartorius AG

- Merck KGaA

- Abcam plc.

- Takara Bio Inc.

Recent Developments

-

In August 2024, Bio-Rad Laboratories launched Annexin V conjugated to eight StarBright Dyes to enhance apoptosis detection via flow cytometry. These conjugates optimized laser utilization, minimized spillover, and improved data resolution. Hilary Mavor, Marketing Director of Bio-Rad’s Life Science Group, highlighted that this expansion provided researchers with greater flexibility and accuracy in apoptosis detection.

-

In January 2024, Thermo Fisher Scientific and C-CAMP announced a collaboration to establish a Centre of Excellence in Bengaluru and equip it with advanced flow cytometry and molecular biology solutions. This initiative aimed to accelerate biotechnology innovation and provide research and training opportunities for scientists in academia, start-ups, and biopharma.

-

In September 2022, Merck KGaA, Darmstadt, Germany, announced that xevinapant, an IAP inhibitor, enhanced apoptotic signaling and significantly improved survival in patients with unresected locally advanced squamous cell carcinoma of the head and neck when combined with chemoradiotherapy (CRT). The Phase II trial demonstrated that xevinapant promoted tumor cell apoptosis, leading to a five-year survival rate of 53% versus 28% in the placebo group.

Apoptosis Assay Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.98 billion

Revenue forecast in 2030

USD 10.57 billion

Growth rate

CAGR of 8.65% from 2025 to 2030

Base year for estimation

2024

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, assay type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; and South Africa

Key companies profiled

Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories; Bio-Techne; Biotium; GeneCopoeia, Inc.; Becton, Dickinson & Company (BD); Promega Corporation; Sartorius AG; Merck KGaA; Abcam plc.; Takara Bio Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Apoptosis Assay Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global apoptosis assay market report based on product, technique, assay type, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Kits

-

Reagents

-

Instruments

-

-

Technique Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flow Cytometry

-

Fluorescence Microscopy

-

Spectrophotometry

-

Other Techniques

-

-

Assay Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Caspase Assays

-

DNA Fragmentation Assays

-

Cell Permeability Assays

-

Mitochondrial Assays

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospital & Diagnostic Laboratories

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global apoptosis assay market size was estimated at USD 6.47 billion in 2024 and is expected to reach USD 6.98 billion in 2025.

b. The global apoptosis assay market is expected to grow at a compound annual growth rate of 8.65% from 2025 to 2030 to reach USD 10.57 billion by 2030.

b. The caspase assay segment dominated the apoptosis assay market with a share of 28.94% in 2024. This is attributed to the substantial number of research activities that back the significance of caspase in activation of programmed cell death.

b. Some key players operating in the apoptosis assay market includeThermo Fisher Scientific, Inc.; Bio-Rad Laboratories; Bio-Techne; Biotium; GeneCopoeia, Inc.; Becton, Dickinson & Company (BD); Promega Corporation; Sartorius AG; Merck KGaA; Abcam plc.; Takara Bio Inc.

b. Key factors that are driving the apoptosis assay market growth include the proven potential of cell-death assays in designing therapeutic strategies, wide acceptance of clinically useful cytoprotective & cytotoxic agents, and the advent of novel radionuclide tracers such as, caspase inhibitors & radiolabeled annexin V.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.