- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Plastic Compounding Market, Industry Report, 2030GVR Report cover

![Asia Pacific Plastic Compounding Market Size, Share & Trends Report]()

Asia Pacific Plastic Compounding Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Fossil-based, Bio-based), By Product (Polyethylene, Polypropylene), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-279-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

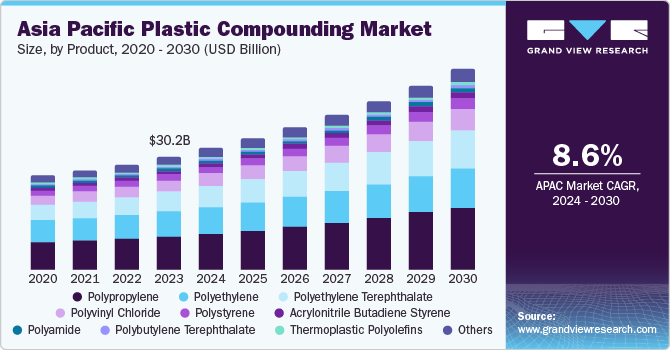

The Asia Pacific plastic compounding market size was estimated at USD 30.2 billion in 2023 and is expected to grow at a CAGR of 8.6% from 2024 to 2030. Increasing demand for consumer goods such as refrigerators and washing machines in countries such as India, Vietnam, the Philippines, China, and Thailand is expected to fuel the demand for plastic compounding in the region. Growing demand for automotive in the region is further projected to facilitate investment in Asia Pacific.

The region contributed to over 40% revenue share of the global plastic compounding market in 2023. Low manufacturing cost in China and India as compared to Europe is expected to propel the use of plastic compounding in automobiles. Companies from Northeast Asia are mainly engaged in pushing their economies to grow in key sectors of raw material extraction, manufacturing, and services. Thus, governments across the region have transformed rural industries into well-equipped world-class manufacturing facilities through the implementation of protectionism, financial investment, and regulatory support.

Moreover, the availability of cheap labor as well as proximity to raw material suppliers is further attracting the interest of investors in the region. China, Indonesia, South Korea, India, and Taiwan are expected to drive the regional market growth over the forecast period. Furthermore, government initiatives such as Make in India, smart cities, modified special incentives package scheme, Domestic Efficient Lighting Programme, 100% FDI in electronic hardware manufacturing, and National Electronic Policy are likely to propel electronics production in the region in the coming years. Technology transitions, such as IoT and 4G/LTE networks, are accelerating the adoption of electronic products, thereby fuelling the demand for plastic.

Product Insights

Based on product, polypropylene (PP) dominated the market with the largest revenue share of over 30% in 2023. Polypropylene is a thermoplastic polymer and is made by combining propylene monomers. The product is widely used in a variety of applications, in consumer goods packaging, in plastic parts for various industries including the automotive industry, and special devices such as hinges, and textiles.

The thermoplastic vulcanizates (TPV) segment is anticipated to grow at the fastest CAGR of 12.3% during the forecast period. TPV is widely used in building and construction projects, home appliances, electrical components, and others. Compared with conventional rubber materials, TPV improves component performance and final product profitability. Technological advances in improving TPV quality and biocompatibility have opened the way for the development of medical devices. Growing demand for products from the medical device industry ranging from syringe tips and surgical cable coatings to filter elements and diaphragms is expected to drive the market growth during the forecast period.

Source Insights

Based on the source, fossil-based compounded plastics held the largest market share in 2023. The major driving factor for the segment is the wide applicability of petrochemical-based plastics. Industries such as automotive, construction, and packaging are the major end-users of fossil-based compounded plastics. Moreover, petrochemical extraction from fossil fuels is fairly convenient as compared to the manufacturing of other plastics such as bio-based plastics.

Recycled plastics and bio-based plastics are gaining popularity and are expected to grow at a substantial rate during the forecast period. The segment growth is also backed by government initiatives and rising awareness of sustainability.

Application Insights

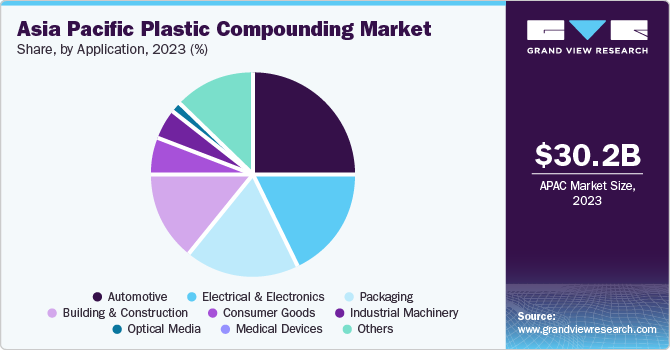

Automotive applications dominated the market with the largest revenue share in 2023. Increasing disposable income, growing middle-class population, availability of cheap labor, and other factors are contributing to the increase in automobile production, especially in the Asia Pacific region.

The optical media segment is anticipated to grow at the fastest CAGR during the forecast period. Plastic compounds are widely used for producing optical media devices such as compact discs, Blu-ray discs, and DVDs. Optical discs hold more data and are seven times more durable compared to traditional storage media such as magnetic media. Polycarbonate compounds are often blended with other additives and polymers to ensure optical media preservation.

Country Insights

China Plastic Compounding Market Trends

China plastic compounding market held a 56.8% share of the total market revenue in 2023. Healthy growth among the key manufacturing industries including automotive and electrical & electronics is likely to contribute substantially toward the ascending demand for plastics in China. The automotive industry in the country is expanding on account of a strong demand for cars as well as various other vehicle types including medium & heavy trucks and buses. Electric cars remain a promising category as the government is providing substantial subsidies to manufacturers and favorable discounts and incentives for customers who are buying these cars.

India Plastic Compounding Market Trends

The plastic compounding market in Indiais expected to grow at a substantial rate during the forecast period. The consumer electronics industry is majorly driving the growth of the plastic compounding market in India. The market is majorly driven by the increasing middle-class population, rising disposable income, and improving standard of living. In addition, the adoption of high-end technology devices and declining electronics prices are anticipated to fuel the market growth over the forecast period.

Key Asia Pacific Plastic Compounding Company Insights

Rising demand for plastic compounded products from multiple end-use industries such as automotive and packaging is pushing the manufacturers to work on mass production of polymers for plastic compounding.

Key Asia Pacific Plastic Compounding Companies:

- LyondellBasell Industries N.V.

- Teijin Plastics

- Kraton Polymers Inc.

- RTP Company

- BASF SE

- SABIC

- The 3M Company

- Polyplastics Asia Pacific Sdn Bhd

- Melchers Malaysia

- Helistrom Sdn Bhd

- Sheng Foong Plastic Industries Sdn Bhd

- The Inabata Group

- CIPC Resin

- Sin Yong Guan & Co.

- Eveready Manufacturing Pte Ltd.

- Compounding and Coloring Sdn Bhd

Recent Developments

-

In August 2022, several new products were launched by The Polyplastics Group. Topas COC, Laperos LCP, and Duracon POM are new addition to their plastic compounding product portfolio. With this launch, the company aims to cater better to the growing demand from end-use industries.

Asia Pacific Plastic Compounding Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 53.6 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, country

Regional scope

Asia Pacific

Country scope

Japan, China, India, South Korea

Key companies profiled

BASF SE; SABIC; LyondellBasell Industries N.V.; Kraton Polymers Inc.; RTP Company; The 3M Company; Teijin Plastics; Polyplastics Asia Pacific Sdn Bhd; Melchers Malaysia; Helistrom Sdn Bhd; Sheng Foong Plastic Industries Sdn Bhd; The Inabata Group; CIPC Resin; Sin Yong Guan & Co.; Eveready Manufacturing Pte Ltd.;

Compounding and Coloring Sdn Bhd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Plastic Compounding Market Report Segmentation

This report forecasts revenue and volume growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific plastic compounding market report based on source, product, application, and country:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fossil-based

-

Bio-based

-

Recycled

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Polyolefins (TPO)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Polyurethane (PU)

-

Polymethyl Methacrylate (PMMA)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & construction

-

Electrical & electronics

-

Packaging

-

Consumer goods

-

Industrial machinery

-

Medical devices

-

Optical media

-

Aerospace & Defense

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific plastic compounding market size was estimated at USD 30.2 billion in 2023 and is expected to reach USD 32.5 billion in 2024

b. The Asia Pacific plastic compounding market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 53.6 billion by 2030

b. The Polypropylene (PP) segment dominated the market with a share of over 30% in 2023, it is attributed to the increasing usage of PP in consumer goods packaging, plastic parts for various industries including the automotive industry, and special devices such as hinges, and textiles

b. Some key players operating in the Asia Pacific plastic compounding market include BASF SE; SABIC; LyondellBasell Industries N.V.; Kraton Polymers Inc.; RTP Company; The 3M Company; Teijin Plastics; Polyplastics Asia Pacific Sdn Bhd; Melchers Malaysia; Helistrom Sdn Bhd; Sheng Foong Plastic Industries Sdn Bhd; The Inabata Group; CIPC Resin; Sin Yong Guan & Co.; Eveready Manufacturing Pte Ltd.; Compounding and Coloring Sdn Bhd

b. Factors such as the increasing demand for consumer goods such as refrigerators and washing machines in countries such as India, Vietnam, the Philippines, China, and Thailand are driving the Asia Pacific plastic compounding market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.