- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Automotive Aftermarket Glass Market Size Report, 2030GVR Report cover

![Automotive Aftermarket Glass Market Size, Share & Trends Report]()

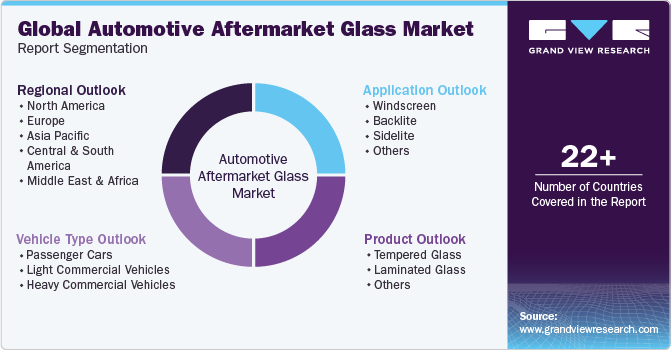

Automotive Aftermarket Glass Market Size, Share & Trends Analysis Report By Product (Tempered Glass, Laminated Glass, Others), By Vehicle Type, By Application (Windscreen, Backlite), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-154-2

- Number of Report Pages: 133

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

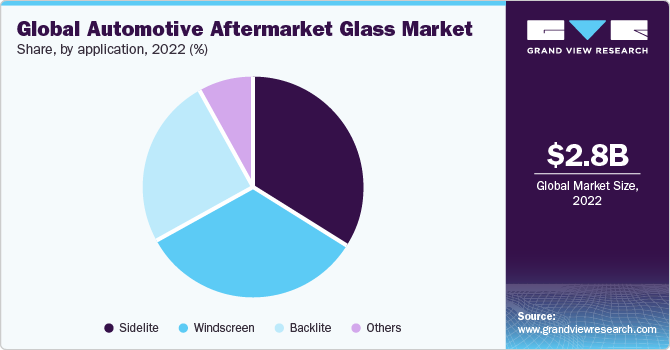

The global automotive aftermarket glass market size was valued at USD 2.79 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Increasing cases of road traffic accidents across the world coupled with high vehicle production are anticipated to boost the consumption of glass in the automotive aftermarket. The rising popularity of car rental services is projected to further propel the growth of the aftermarket, as these new fleet owners have raised the maintenance standards of the vehicles. This has also led the glass suppliers to develop dedicated offerings for the fleet owners along with customized solutions.

The presence of a large number of millennials is bringing about a change in the ideology pertaining to owning a personal vehicle like a car. Factors, such as depreciation, rising fuel prices, and availability of affordable mobility like car rental services, have led to the growth of vehicle leasing. According to the Association of Dutch Vehicle Leasing Companies, leased vehicles constituted over 45% of newly purchased light vehicles in 2017. Thus, the growing trend of leasing, re-leasing, and mobility services is anticipated to boost the global market for automotive aftermarket glass.

The automotive industry has witnessed phenomenal growth over the past few years, leading to a rise in the number of vehicles on the roads, thus, offering a bigger target market to the aftermarket players. According to the National Highway Traffic Safety Administration, the average number of car accidents in the U.S. is six million per year. Sidelite and windshield are the most common vehicle parts that require replacement after an accident. The rising number of vehicles on the roads along with accident cases is projected to propel the market growth over the forecast period.

Although the market is anticipated to witness steady growth in the forthcoming years, there are certain challenges such as inventory management and rising digitization, which may hinder the growth to an extent. The presence of innumerable car models across the world makes it challenging for the vendors in the market to manage inventory as per customer requirements. Also, increased consumer awareness regarding product prices and available options due to digitization is likely to lead to diminished margins for vendors.

The market is anticipated to witness steady growth over the forecast period owing to the rising production of new vehicles in emerging economies including China and India. The auto aftermarket glass market is indirectly dependent on the Original Equipment Manufacturer (OEM). Auto aftermarket glass demand has an upward shift owing to contributing factors such as a rise in accidents, an inclination towards personalization, and increasing repair and replacement of auto parts over a period of time.

The sidelight, backlight, and windscreen are the most common parts that require replacement after an accident. The windscreen plays a crucial role in supporting the structure of the car and also the safety of the driver & passengers. Aftermarket glass manufacturers and expert glass fabricators produce the same quality windscreen offered by OEMs in the vehicle glass industry.

The rising production of commercial vehicles represents a growth opportunity for the automotive aftermarket glass industry in the long term. This can be attributed to the fact that automotive glass needs to be replaced after a certain prolonged period of time since the loss of quality and visibility of automotive glass decreases with time owing to dust or weather effects. Aftermarket glass is also distributed in the market by OEM’s trusted dealers.

Consumers of used vehicles prefer laminated glass over tempered glass due to high durability, minimal cost of fitting, and toughness in nature. Laminated glass is preferred in windshields over the tempered glass, especially in developed economies of North America and Europe. Lamination in the glass helps it to not break into pieces, thus it is more expensive than its counterparts.

The aftermarket manufacturers of glass industries are extensively using high quality raw material for producing glass products. The rising inclination to acquire high purity materials including soda ash, silica, limestone, among others is likely to increase the procurement cost for glass vendors over the near future. Thereby, directly impacting the cost for glass related products.

Raw materials constitute a major part of the cost structure of the glass manufacturing process and thus, their prices have a significant impact on the overall cost of manufacturing glass. Soda ash is the key raw material used for manufacturing automotive aftermarket glass. The price of soda ash has been increasing for the past couple of years. The raw material required for these glasses includes silica fine sand, soda ash dolomite, culet, and limestone. Rising inflation in developed countries including Germany and U.S. as well as increasing raw material prices are major restraints of the aftermarket glass market that can pose challenges in coming years.

Product Insights

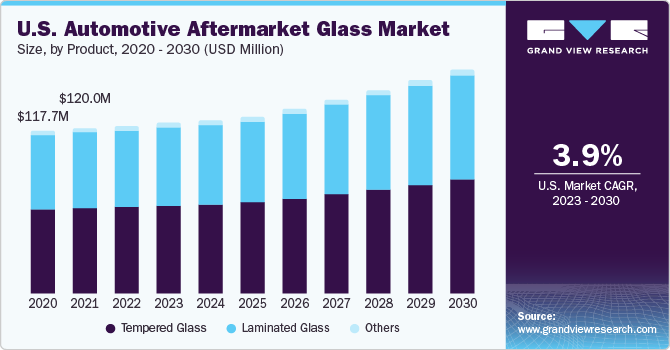

The tempered glass segment accounted for the largest revenue share of 51.3% in 2022 on account of its exceptional characteristics and low-cost compared to laminated glass. The manufacturing process of tempered glass gives it high strength and robustness, which has increased its utilization in vehicles, mainly in sidelite and backlite.

The laminated glass segment is expected to grow at the fastest CAGR of 6.2% during the forecast period. Growing consumer awareness pertaining to safety concerns is projected to drive the demand for laminated glass for windshields in the replacement market. The structure of the glass restricts falling and breaking into pieces, which has boosted its utilization in windshields.

The rising demand for glass in the automotive aftermarket is encouraging the manufacturers to enhance their production capacities and invest in new and advanced technologies. For instance, in January 2019, Fuyao North America Inc. announced the launch of a new processing center with an investment of USD 16.1 million in the U.S., and its parent company has been engaged in producing glass for both OEMs and aftermarket suppliers. Also, in March 2019, Vitro announced its investment of USD 60 million in new technologies focusing on the supply of automotive glass to both OEMs and aftermarket customers.

Vehicle Type Insights

The passenger cars segment accounted for the largest revenue share of around 66.2% in 2022. Passenger cars account for a share of over 70% of global vehicle production and their demand is driven by increasing consumer spending, especially in developing economies. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global vehicle production increased by 6% in 2022 compared to the previous year. This is a positive sign for the market growth over the forecast period.

The light commercial vehicles (LCV) segment is estimated to register the fastest CAGR of 6.5% over the forecast period. According to the OICA, light commercial vehicle production increased by 7% in 2022 compared to the total LCV production in 2021. The global production of LCV was recorded at 19.86 million units in 2022. North America witnessed the fastest growth rate of 11.0% from 2021 to 2022 in terms of the production of light commercial vehicles, followed by Asia-Oceania and South America with 3.0%. The demand for glass in commercial vehicles is propelled by the depreciation in the quality and visibility along with an increasing number of road accidents, which lead to glass replacement.

Application Insights

The sidelite segment held the largest revenue share of 33.8% in 2022 due to the fact that these vehicle parts incur maximum damage in case of and require frequent replacement. The increasing size of the windshield is anticipated to drive the usage of glass, thereby, boosting the growth of the segment. Sidelites, also known as side windows along with backlite, also known as the rear windshield, or rear window, of vehicles, are generally manufactured using tempered glass.

The backlite segment is expected to grow at the fastest CAGR of 6.6% over the forecast period. Technological developments coupled with increasing cases of car component thefts and road accidents worldwide are expected to boost the utilization of better-quality glasses for sidelites and backlites. The increasing market for sunroofs is a key factor anticipated to augment the demand for glass in the automotive market. However, sunroofs are less likely to get damaged in case of accidents. This factor is expected to limit the product demand in the aftermarket.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 54.2% in 2022 owing to changing consumer lifestyles and rising disposable income in the region. In addition, factors such as high domestic demand, raw material availability, cheap labor cost, and abundant land availability result in a lower glass manufacturing cost in the Asia Pacific. The Asia Pacific is the fastest growing market owing to the high economical aftermarket glass production units existing in the countries including India and China. China is the major contributor to the aftermarket glass market owing to the highest manufacturing facilities producing replacement parts such as tempered glass and laminated glass in the market.

North America is expected to grow at a CAGR of 4.1% during the forecast period owing to the increasing OEM production of light commercial vehicles. A heated windscreen offered by aftermarket glass players is ideal for cold weather in states such as Pennsylvania in the U.S. for defogging and defrosting faster than standard alternatives available in the market. Digital channels are gaining increasing importance in terms of influencing customer purchasing decisions and research processes in the developed markets across the North American region.

Key Companies & Market Share Insights

The market is competitive in nature with the presence of various established players. Multiyear agreements, new product development, and capacity expansion are the key strategies adopted by the market players to strengthen their market positions. In June 2019, AGC Automotive Europe signed a franchise agreement with Belron, a VGRR group. Under this agreement, AGC’s 37 VGRR locations in Poland operating under the NordGlass brand and 19 VGRR locations in the Czech Republic operating under the AG Experts brand are expected to now operate under the Belron brand.

Key Automotive Aftermarket Glass Companies:

- AGC Inc.

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain

- Xinyi Glass Holdings Limited

- Vitro

- Central Glass Co., Ltd.

- Corning Incorporated

- Guardian Industries

- TAIWAN GLASS IND. CORP.

- Şişecam

Recent Development

-

In May 2022, NSG Group unveiled its intention to integrate its automotive glass business in China with SYP Kangqiao Autoglass Co., Ltd., a leading manufacturer of automotive glass in China. This strategic integration with SYP Automotive aims to strengthen NSG Group's capacity to effectively cater to the increasing demands from automobile manufacturers within the Chinese market.

-

In March 2022, LKQ Corporation entered into an agreement with One Equity Partners to sell PGW Auto Glass, a prominent distributor of aftermarket glass within the North American automotive industry. As per the information available on its official website, PGW claims an extensive network comprising over 100 distribution branches and a customer base of more than 27,000 across the U.S. and Canada. Through its fleet of 500 vehicles, the company efficiently delivers windshields, tempered glass, and various other automotive products to over 9,000 installation customers.

-

In March 2019, an automotive-glass manufacturer in North America, Vitro, committed a substantial investment of USD 60 million towards the development and implementation of cutting-edge technologies. These investments were strategically targeted at the North American market, aiming to enhance Vitro's dominant position in the automotive glass sector. The company intended to strengthen its role as a premier supplier to original equipment manufacturers (OEMs) and aftermarket customers in the region.

Automotive Aftermarket Glass Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.90 billion

Revenue forecast in 2030

USD 4.31 billion

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, volume in thousand sq. meters, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; & MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Turkey; China; Japan; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Argentina; South Africa; Morocco

Key companies profiled

AGC Inc.; Fuyao Glass Industry Group Co., Ltd.; Nippon Sheet Glass Co., Ltd; Saint-Gobain;

Xinyi Glass Holdings Limited; Vitro; Central Glass Co., Ltd.; Corning Incorporated; Guardian Industries; TAIWAN GLASS IND. CORP.; Şişecam

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Aftermarket Glass Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive aftermarket glass market report on the basis of product, vehicle type, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

-

Tempered Glass

-

Laminated Glass

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

-

Windscreen

-

Backlite

-

Sidelite

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global automotive aftermarket glass market size was estimated at USD 2.79 billion in 2022 and is expected to reach USD 2.90 billion in 2023.

b. The global automotive aftermarket glass market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 4.31 billion by 2030.

b. Windscreen dominated the automotive aftermarket glass market with a share of 33.4% in 2022. This is attributable to the fact that these vehicle parts incur maximum damage in case of accidents and require frequent replacement along with the increasing size of the windshield.

b. Some key players operating in the automotive aftermarket glass market include AGC, Inc.; Fuyao Glass Industry Group Co., Ltd.; Nippon Sheet Glass Co., Ltd.; Saint-Gobain; Xinyi Glass Holdings Co., Ltd.; Taiwan Glass Ind. Corp.; and Vitro.

b. Key factors that are driving the automotive aftermarket glass market growth include increasing cases of road traffic accidents across the world coupled with high vehicle production.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Vehicle Type

1.1.3. Application

1.1.4. Regional scope

1.1.5. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. GVR’s internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Vehicle Type outlook

2.2.3. Application outlook

2.2.4. Regional outlook

2.3. Competitive Insights

Chapter 3. Automotive Aftermarket Glass Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Value Chain Analysis

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market driver analysis

3.5.2. Market restraint analysis

3.5.3. Industry opportunities & challenges

3.6. Automotive Aftermarket Glass Market Analysis Tools

3.6.1. Industry Analysis - Porter’s

3.6.1.1. Supplier power

3.6.1.2. Buyer power

3.6.1.3. Substitution threat

3.6.1.4. Threat of new entrant

3.6.1.5. Competitive rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political landscape

3.6.2.2. Technological landscape

3.6.2.3. Economic landscape

3.6.2.4. Social landscape

3.6.2.5. Environmental landscape

3.6.2.6. Legal landscape

Chapter 4. Supplier Portfolio Analysis

4.1. List of Suppliers

4.2. Kraljic Matrix

4.3. Sourcing Best Practices

4.4. Negotiation Strategies

Chapter 5. Automotive Aftermarket Glass Market: Product Estimates & Trend Analysis

5.1. Automotive Aftermarket Glass Market: Key Takeaways

5.2. Automotive Aftermarket Glass Market: Movement & Market Share Analysis, 2022 & 2030

5.3. Tempered Glass

5.3.1. Tempered glass market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

5.4. Laminated Glass

5.4.1. Laminated glass market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

5.5. Others

5.5.1. Others market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

Chapter 6. Automotive Aftermarket Glass Market: Vehicle Type Estimates & Trend Analysis

6.1. Automotive Aftermarket Glass Market: Key Takeaways

6.2. Automotive Aftermarket Glass Market: Movement & Market Share Analysis, 2022 & 2030

6.3. Passenger Cars

6.3.1. Passenger cars market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

6.4. Light Commercial Vehicles

6.4.1. Light commercial vehicles market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

6.5. Heavy Commercial Vehicles

6.5.1. Heavy commercial vehicles market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

Chapter 7. Automotive Aftermarket Glass Market: Application Estimates & Trend Analysis

7.1. Automotive Aftermarket Glass Market: Key Takeaways

7.2. Automotive Aftermarket Glass Market: Movement & Market Share Analysis, 2022 & 2030

7.3. Windscreen

7.3.1. Windscreen market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

7.4. Backlite

7.4.1. Backlite market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

7.5. Sidelite

7.5.1. Sidelite market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

7.6. Others

7.6.1. Others market estimates and forecasts, 2018 to 2030 (USD Million, Thousand Square Meters)

Chapter 8. Automotive Aftermarket Glass Market: Regional Estimates & Trend Analysis

8.1. Regional Outlook

8.2. Automotive Aftermarket Glass Market by Region: Key Takeaway

8.3. North America

8.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.3.2. U.S.

8.3.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.3.3. Canada

8.3.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.3.4. Mexico

8.3.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.4. Europe

8.4.1. UK

8.4.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.4.2. Germany

8.4.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.4.3. France

8.4.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.4.4. Italy

8.4.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.4.5. Spain

8.4.5.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.4.6. Turkey

8.4.6.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.5. Asia Pacific

8.5.1. Japan

8.5.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.5.2. China

8.5.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.5.3. India

8.5.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.5.4. Australia

8.5.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.5.5. Thailand

8.5.5.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.5.6. South Korea

8.5.6.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.5.7. Indonesia

8.5.7.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.5.8. Malaysia

8.5.8.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.6. Central & South America

8.6.1. Brazil

8.6.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.6.2. Argentina

8.6.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.7. MEA

8.7.1. South Africa

8.7.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

8.7.2. Morocco

8.7.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million; Volume, Thousand Square Meters)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Market Participant Categorization

9.2.1. AGC Inc.

9.2.1.1. Company overview

9.2.1.2. Financial performance

9.2.1.3. Product benchmarking

9.2.1.4. Strategic initiatives

9.2.2. Fuyao Glass Industry Group Co., Ltd.

9.2.2.1. Company overview

9.2.2.2. Financial performance

9.2.2.3. Product benchmarking

9.2.2.4. Strategic initiatives

9.2.3. Nippon Sheet Glass Co., Ltd

9.2.3.1. Company overview

9.2.3.2. Financial performance

9.2.3.3. Product benchmarking

9.2.3.4. Strategic initiatives

9.2.4. Saint-Gobain

9.2.4.1. Company overview

9.2.4.2. Financial performance

9.2.4.3. Product benchmarking

9.2.4.4. Strategic initiatives

9.2.5. Xinyi Glass Holdings Limited

9.2.5.1. Company overview

9.2.5.2. Financial performance

9.2.5.3. Product benchmarking

9.2.5.4. Strategic initiatives

9.2.6. Vitro

9.2.6.1. Company overview

9.2.6.2. Financial performance

9.2.6.3. Product benchmarking

9.2.6.4. Strategic initiatives

9.2.7. Central Glass Co., Ltd.

9.2.7.1. Company overview

9.2.7.2. Financial performance

9.2.7.3. Product benchmarking

9.2.7.4. Strategic initiatives

9.2.8. Corning Incorporated

9.2.8.1. Company overview

9.2.8.2. Financial performance

9.2.8.3. Product benchmarking

9.2.8.4. Strategic initiatives

9.2.9. Guardian Industries

9.2.9.1. Company overview

9.2.9.2. Financial performance

9.2.9.3. Product benchmarking

9.2.9.4. Strategic initiatives

9.2.10. TAIWAN GLASS IND. CORP.

9.2.10.1. Company overview

9.2.10.2. Financial performance

9.2.10.3. Product benchmarking

9.2.10.4. Strategic initiatives

9.2.11. Şişecam

9.2.11.1. Company overview

9.2.11.2. Financial performance

9.2.11.3. Product benchmarking

9.2.11.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 3 North America automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 4 North America automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 5 North America automotive aftermarket glass market, by region, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 6 U.S. automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 7 U.S. automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 8 U.S. automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 9 Canada automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 10 Canada automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 11 Canada automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 12 Mexico automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 13 Mexico automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 14 Mexico automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 15 Europe automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 16 Europe automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 17 Europe automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 18 Europe automotive aftermarket glass market, by region, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 19 Germany automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 20 Germany automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 21 Germany automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 22 UK automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 23 UK automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 24 UK automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 25 France automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 26 France automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 27 France automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 28 Italy automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 29 Italy automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 30 Italy automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 31 Spain automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 32 Spain automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 33 Spain automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 34 Turkey automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 35 Turkey automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 36 Turkey automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 37 Asia Pacific automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 38 Asia Pacific automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 39 Asia Pacific automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 40 Asia Pacific automotive aftermarket glass market, by region, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 41 China automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 42 China automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 43 China automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 44 Japan automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 45 Japan automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 46 Japan automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 47 India automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 48 India automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 49 India automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 50 Australia automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 51 Australia automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 52 Australia automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 53 Thailand automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 54 Thailand automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 55 Thailand automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 56 South Korea automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 57 South Korea automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 58 South Korea automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 59 Indonesia automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 60 Indonesia automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 61 Indonesia automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 62 Malaysia automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 63 Malaysia automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 64 Malaysia automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 65 Central & South America automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 66 Central & South America automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 67 Central & South America automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 68 Central & South America automotive aftermarket glass market, by region, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 69 Brazil automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 70 Brazil automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 71 Brazil automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 72 Argentina automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 73 Argentina automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 74 Argentina automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 75 Middle East and Africa automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 76 Middle East and Africa automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 77 Middle East and Africa automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 78 Middle East and Africa automotive aftermarket glass market, by region, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 79 South Africa automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 80 South Africa automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 81 South Africa automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 82 Morocco automotive aftermarket glass market, by product, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 83 Morocco automotive aftermarket glass market, by vehicle type, 2018 - 2030 (USD Million, Thousand Square Meters)

Table 84 Morocco automotive aftermarket glass market, by application, 2018 - 2030 (USD Million, Thousand Square Meters)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Automotive aftermarket glass: Market outlook

Fig. 9 Automotive aftermarket glass: Competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 Automotive aftermarket glass market driver impact

Fig. 15 Automotive aftermarket glass market restraint impact

Fig. 16 Automotive aftermarket glass market strategic initiatives analysis

Fig. 17 Automotive aftermarket glass market: Product movement analysis

Fig. 18 Automotive aftermarket glass market: product outlook and key takeaways

Fig. 19 Tempered glass market estimates and forecasts, 2018 - 2030

Fig. 20 Laminated glass market estimates and forecasts, 2018 - 2030

Fig. 21 Others market estimates and forecasts, 2018 - 2030

Fig. 22 Automotive aftermarket glass market: Vehicle type movement analysis

Fig. 23 Automotive aftermarket glass market: Vehicle type outlook and key takeaways

Fig. 24 Passenger Cars market estimates and forecasts, 2018 - 2030

Fig. 25 Light commercial vehicles market estimates and forecasts, 2018 - 2030

Fig. 26 Heavy commercial vehicles market estimates and forecasts, 2018 - 2030

Fig. 27 Automotive aftermarket glass market: Application movement analysis

Fig. 28 Automotive aftermarket glass market: Application outlook and key takeaways

Fig. 29 Windscreen market estimates and forecasts, 2018 - 2030

Fig. 30 Backlite market estimates and forecasts, 2018 - 2030

Fig. 31 Sidelite market estimates and forecasts, 2018 - 2030

Fig. 32 Others market estimates and forecasts, 2018 - 2030

Fig. 33 Global automotive aftermarket glass market: Regional movement analysis

Fig. 34 Global automotive aftermarket glass market: Regional outlook and key takeaways

Fig. 35 North America market estimates and forecasts, 2018 - 2030

Fig. 36 U.S. market estimates and forecasts, 2018 - 2030

Fig. 37 Canada market estimates and forecasts, 2018 - 2030

Fig. 38 Mexico market estimates and forecasts, 2018 - 2030

Fig. 39 Europe market estimates and forecasts, 2018 - 2030

Fig. 40 UK market estimates and forecasts, 2018 - 2030

Fig. 41 Germany market estimates and forecasts, 2018 - 2030

Fig. 42 France market estimates and forecasts, 2018 - 2030

Fig. 43 Italy market estimates and forecasts, 2018 - 2030

Fig. 44 Spain market estimates and forecasts, 2018 - 2030

Fig. 45 Turkey market estimates and forecasts, 2018 - 2030

Fig. 46 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 47 Japan market estimates and forecasts, 2018 - 2030

Fig. 48 China market estimates and forecasts, 2018 - 2030

Fig. 49 India market estimates and forecasts, 2018 - 2030

Fig. 50 Australia market estimates and forecasts, 2018 - 2030

Fig. 51 Thailand market estimates and forecasts, 2018 - 2030

Fig. 52 South Korea market estimates and forecasts, 2018 - 2030

Fig. 53 Indonesia market estimates and forecasts, 2018 - 2030

Fig. 54 Malaysia market estimates and forecasts, 2018 - 2030

Fig. 55 Central & South America market estimates and forecasts, 2018 - 2030

Fig. 56 Brazil market estimates and forecasts, 2018 - 2030

Fig. 57 Argentina market estimates and forecasts, 2018 - 2030

Fig. 58 Middle East and Africa. market estimates and forecasts, 2018 - 2030

Fig. 59 South Africa market estimates and forecasts, 2018 - 2030

Fig. 60 Morocco market estimates and forecasts, 2018 - 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Automotive Aftermarket Glass Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Automotive Aftermarket Glass Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Automotive Aftermarket Glass Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Automotive Aftermarket Glass Regional Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- North America

- North America Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- North America Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- North America Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Widescreen

- Backlite

- Sidelite

- Others

- U.S.

- U.S. Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- U.S. Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- U.S. Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- U.S. Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Canada

- Canada Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Canada Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Canada Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Canada Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Mexico

- Mexico Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Mexico Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Mexico Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Mexico Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- North America Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Europe

- Europe Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Europe Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Europe Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- UK

- UK Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- UK Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- UK Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- UK Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Germany

- Germany Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Germany Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Germany Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Germany Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- France

- France Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- France Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- France Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- France Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Italy

- Italy Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Italy Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Italy Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Italy Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Spain

- Spain Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Spain Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Spain Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Spain Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Turkey

- Turkey Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Turkey Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Turkey Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Turkey Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Europe Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Asia Pacific

- Asia Pacific Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Asia Pacific Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Asia Pacific Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Japan

- Japan Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Japan Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Japan Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Japan Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- China

- China Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- China Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- China Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- China Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- India

- India Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- India Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- India Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- India Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Australia

- Australia Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Australia Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Australia Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Australia Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Thailand

- Thailand Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Thailand Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Thailand Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Thailand Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- South Korea

- South Korea Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- South Korea Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- South Korea Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- South Korea Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Indonesia

- Indonesia Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Indonesia Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Indonesia Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Indonesia Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Malaysia

- Malaysia Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Malaysia Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Malaysia Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Malaysia Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Asia Pacific Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Central & South America

- Central & South America Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Central & South America Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Central & South America Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Brazil

- Brazil Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Brazil Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Brazil Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Brazil Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Argentina

- Argentina Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Argentina Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Argentina Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- Argentina Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Central & South America Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Middle East and Africa

- Middle East and Africa Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Dissolving

- Coated

- Others

- Middle East and Africa Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Middle East and Africa Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- South Africa

- South Korea Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- South Korea Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- South Korea Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

- South Korea Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Morocco

- Morocco Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

- Morocco Automotive Aftermarket Glass Market, Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Morocco Automotive Aftermarket Glass Market, Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Cosmetic

- Backlite

- Sidelite

- Others

- Morocco Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Middle East and Africa Automotive Aftermarket Glass Market, Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

Grand View Research employs comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For comprehensive understanding of the market, it is essential to understand the complete value chain and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia and trade journals. Technical data is also gathered from intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development and pricing trends is fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, and industry experience and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of technology landscape, regulatory frameworks, economic outlook and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restrains, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation, but also provide critical insights into the market, current business scenario and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market leading companies

• Raw material suppliers

• Product distributors

• BuyersThe key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectationsData Collection Matrix

Perspective

Primary research

Secondary research

Supply side

- Manufacturers

- Technology distributors and wholesalers

- Company reports and publications

- Government publications

- Independent investigations

- Economic and demographic data

Demand side

- End-user surveys

- Consumer surveys

- Mystery shopping

- Case studies

- Reference customers

Industry Analysis MatrixQualitative analysis

Quantitative analysis

- Industry landscape and trends

- Market dynamics and key issues

- Technology landscape

- Market opportunities

- Porter’s analysis and PESTEL analysis

- Competitive landscape and component benchmarking

- Policy and regulatory scenario

- Market revenue estimates and forecast up to 2030

- Market revenue estimates and forecasts up to 2030, by technology

- Market revenue estimates and forecasts up to 2030, by application

- Market revenue estimates and forecasts up to 2030, by type

- Market revenue estimates and forecasts up to 2030, by component

- Regional market revenue forecasts, by technology

- Regional market revenue forecasts, by application

- Regional market revenue forecasts, by type

- Regional market revenue forecasts, by component

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."