- Home

- »

- Communications Infrastructure

- »

-

B2C E-commerce Market Size, Share & Trends Report, 2030GVR Report cover

![B2C E-commerce Market Size, Share & Trends Report]()

B2C E-commerce Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Category (Automotive, Consumer Electronics, Clothing & Footwear), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-691-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

B2C E-commerce Market Summary

The global B2C e-commerce market size was estimated at USD 5.47 trillion in 2023 and is anticipated to reach USD 17.77 trillion by 2030, growing at a CAGR of 19.1% from 2024 to 2030. The widespread availability of high-speed internet and the proliferation of smartphone use have made internet access widely available.

Key Market Trends & Insights

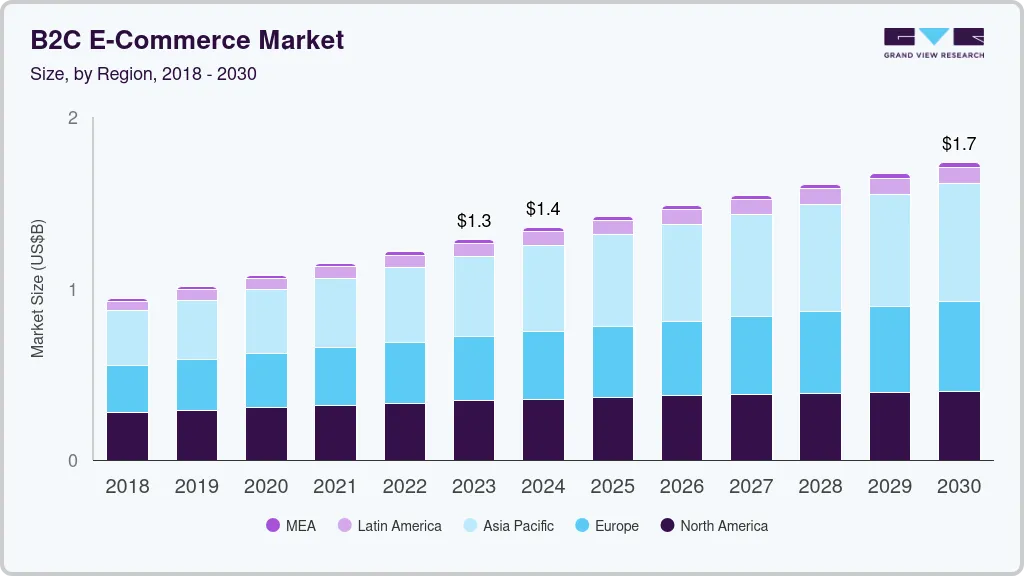

- The B2C E-commerce market in Asia Pacific dominated the revenue in and accounted for around 58% share 2023.

- The B2C E-commerce market in the U.S. is growing significantly at a CAGR of 15.5% from 2024 to 2030.

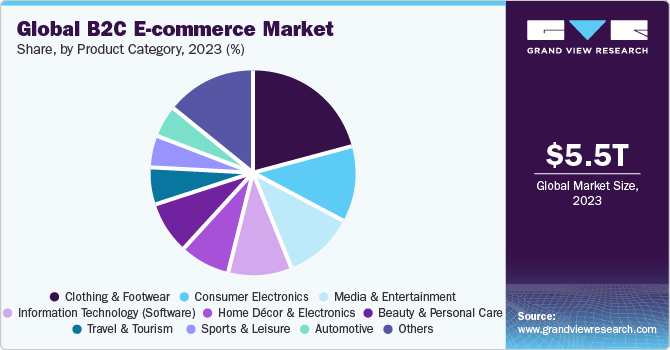

- By product category, the clothing & footwear segment accounted for the largest revenue market share of 21.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.47 Trillion

- 2030 Projected Market Size: USD 17.77 Trillion

- CAGR (2024-2030): 19.1%

- Asia Pacific: Largest market in 2023

This allows customers to explore and purchase from anywhere, anytime, boosting online shopping activities. Mobile applications have become a key business-to-consumer (B2C) e-commerce platform, offering a convenient and mobile shopping experience. Integrating social media with e-commerce has significantly fueled the growth of B2C e-commerce sector. Social media is a communication tool and platform for product discovery and shopping. Influencer culture significantly promotes market growth, where individuals with large online followings endorse products, influencing consumer buying choices.

As technology advances, integrating artificial intelligence (AI), machine learning (ML), augmented reality (AR), and virtual reality (VR) into B2C e-commerce platforms has enriched the shopping experience. These technologies offer interactive visualizations of products, virtual try-ons, and personalized recommendations, enabling businesses to stand out and draw in customers. The globalization of markets has opened new avenues for companies to extend their operations beyond their home countries, explore international markets, and serve a diversified consumer base, thus driving the market's growth. In the highly competitive business-to-consumer (B2C) e-commerce industry, companies are driven to innovate and distinguish themselves by offering unique value propositions, inventive products, customer-centric strategies, and enhanced shopping experiences.

The deployment of 5G technology empowers companies to offer enriched multimedia content, fully immersive experiences, and instant interactions, enhancing the overall online shopping experience for B2C e-commerce customers. The widespread availability of high-speed internet and mobile devices like smartphones and tablets, along with secure online payment methods, has fostered an environment conducive to the growth of this sector. These technological advancements enable companies to engage with a broader audience, streamline online transactions, and increase revenue. In addition, incorporating voice commerce into B2C e-commerce platforms facilitates effortless voice-activated shopping, personalized suggestions, and precisely targeted promotions, significantly boosting customer engagement and loyalty in the projected growth period of the market.

Market Concentration & Characteristics

The B2C e-commerce market growth stage is high, and the pace of the market growth is accelerating. The B2C (business-to-consumer) e-commerce landscape is highly competitive, with global e-commerce powerhouses, specialized platforms, and traditional retailers vying for a market share and consumers' attention. This sector has grown and expanded, driven by increased internet connectivity, smartphone adoption, and worldwide digital literacy. B2C e-commerce enjoys substantial penetration in regions like North America, Europe, and Asia-Pacific, where many consumers frequently make online purchases. Robust infrastructures, dependable digital payment systems, and widespread internet coverage support the market's growth. The expansion of e-commerce platforms, marketplaces, and online stores, offering diverse products, competitive prices, and added-value services, has propelled market penetration, attracting a broad customer base.

To protect B2C e-commerce platforms, sensitive information, and financial transactions from cyber threats such as malware, phishing attacks, ransomware, and DDoS attacks, organizations aim to implement multi-layered security measures, advanced threat detection solutions, and regular security evaluations. Furthermore, addressing changing consumer expectations, preferences, and behaviors and keeping up with growing technical trends and advances are essential for retaining competitiveness, relevance, and market growth.

The initial investment expenses associated with building, implementing, and managing business-to-consumer (B2C) e-commerce platforms, connecting systems, and maintaining compliance with industry standards and regulations can be significant. Several regulations and laws govern the B2C e-commerce market. For instance, the Anticybersquatting Consumer Protection Act (ACPA) empowers trademark owners to initiate legal actions against cybersquatters and seek domain name forfeitures and monetary compensations.

Expansion into emerging markets in Asia Pacific, MEA, Latin America, and other regions will accelerate as businesses seek to enter new markets and expand their customer base. In the forecasted period, organizations will gain insights into supply chain dynamics,

performance metrics and potential outages by implementing supply chain technologies such as IoT sensors, real-time monitoring, RFID tracking, and advanced analytics. These technologies enable proactive management, informed decision-making, and rapid actions to improve supply chain structures in the market.The rapid pace of technological innovation in the consumer electronics industry contributes to the growth of the B2C e-commerce market. As new products and advancements are introduced, consumers are keen to upgrade their devices and stay updated with the latest technology trends. E-commerce platforms enable consumers to easily access cutting-edge electronics, pre-order upcoming releases, and explore innovative features and functionalities.

In the projected period, hyper-personalization and improved customer experiences (CX) will become central to business-to-consumer (B2C) e-commerce market strategies as companies aim to deliver tailored, significant, and entertaining experiences that meet the distinctive needs, tastes, and demands of B2C e-commerce customers.

Product Category Insights

The clothing & footwear segment accounted for the largest revenue market share of 21.1% in 2023 and is expected to grow at the highest CAGR during the forecast period. Factors such as diverse fashion items, cultural trends, and style ideas from various countries and markets have enriched the apparel sector. This fusion fosters innovation, creativity, and diversity in the design and representation of fashion within the B2C e-commerce space. The adoption of AR and VR for virtual try-ons enables shoppers to visualize, test, and personalize clothing and shoe options digitally, leading to more confident purchases, enhancing the shopping experience, and reducing return rates in the B2C e-commerce domain. Collaborations with social media influencers, fashion bloggers, and celebrities help clothing and footwear brands and retailers expand their visibility and connect with their target demographics more effectively, significantly boosting brand presence, trustworthiness, and influence in this market segment.

The home decor and electronics sector is expected to experience a notable CAGR during the forecast period. The development of digital infrastructure, improvements in Internet connectivity, and the increasing ownership of smartphones, tablets, and other devices capable of connecting to the Internet have made online shopping platforms more accessible, enabling consumers to explore, engage with, and purchase from B2C e-commerce brands, retailers, and marketplaces. The uptick in time spent at home, the shift towards remote work, and changes in lifestyle preferences have spurred the demand for home decor and electronics items, tools, and solutions. These products help consumers to redesign, enhance, and make the most of their living environments in the B2C e-commerce market.

Regional Insights

North America is expected to grow significantly at a CAGR of 15.9% from 2024 to 2030. Technological improvements, e-commerce solutions, and digital platforms have enabled enterprises, retailers, and online platforms to enhance their operations, foster user experiences, and drive growth in the business-to-consumer (B2C) e-commerce sector in North America.

U.S. B2C E-commerce Market Trends

The B2C E-commerce market in the U.S. is growing significantly at a CAGR of 15.5% from 2024 to 2030. The U.S. B2C e-commerce sector, known for its innovation, focus on the consumer, and creative prowess, plays a significant role in global digital commerce. Understanding the forces, trends, and key elements influencing the U.S. B2C e-commerce market is crucial for companies, brands, and stakeholders amid the expanding digital economy and shifting consumer preferences.

Asia Pacific B2C E-commerce Market Trends

The B2C E-commerce market in Asia Pacific dominated the revenue in and accounted for around 58% share 2023. It is growing significantly at a CAGR of 20.0% from 2024 to 2030. The swift expansion of the B2C e-commerce market in the APAC region is largely due to the widespread use of smartphones and mobile devices and the increase in mobile internet access, which have propelled the rise of mobile commerce. This has enabled consumers to browse and make purchases, significantly enhancing the reach, accessibility, and convenience of the B2C e-commerce market in the APAC area.

China B2C E-commerce market dominated the Asia Pacific region in revenue share in 2023 and is growing significantly at a CAGR of 18.2% from 2024 to 2030. There is a strong preference for online shopping, digital payments, and contactless transactions among citizens across the country. This trend has expedited the uptake of e-commerce platforms, payment services, and digital wallets, contributing to convenience, security, and smooth shopping experiences within the B2C e-commerce environment.

B2C E-commerce market in India is growing significantly at a CAGR of 23.8% from 2024 to 2030. Various public and government investments and initiatives such as Make in India, Startup India, and Digital India are fostering entrepreneurship and bolstering the growth of Small and Medium-Sized Enterprises (SMEs) in India. The Make in India initiative encourages domestic manufacturing, Startup India promotes start-up ventures, and Digital India focuses on digital infrastructure development. By supporting SMEs through these initiatives, the government cultivates a conducive ecosystem for business growth, stimulating the demand for factoring services to facilitate the financing needs of emerging enterprises.

Japan B2C E-commerce market is growing significantly at a CAGR of 16.8% from 2024 to 2030. The rising geriatric population is one of the major driving factors driving the growth of the Japan B2C e-commerce market. Individuals facing mobility issues particularly prefer shopping from home. B2C e-commerce platforms offer an attractive solution for such individuals by providing access to a wide range of products and services while annulling the need to visit physical stores.

Europe B2C E-commerce Market Trends

The B2C E-commerce market in Europe is growing significantly, at a CAGR of 19.7% from 2024 to 2030. European consumers' shifting preferences for convenience and flexibility are prompting them to consider online shopping, thereby driving the market.

UK B2C E-commerce market is growing significantly at a CAGR of 16.5% from 2024 to 2030. The high purchasing power of individuals is significantly fueling the market's growth. With a robust economy and high disposable income levels, UK consumers have a high spending power to invest in various clothing brands and footwear.

B2C E-commerce market in Germany is growing significantly, with a CAGR of 21.7% from 2024 to 2030. The growth of the automotive industry in Germany is contributing significantly to the expansion of the country's B2C e-commerce market, creating an opportunity for platform providers and sellers to cater to the diverse needs of automotive consumers.

France B2C E-commerce market is growing significantly at a CAGR of 20.8% from 2024 to 2030. The presence of various apparel brands in France bodes well for the growth of the country's B2C e-commerce market. France can be considered a global fashion hub characterized by various fashion houses, luxury brands, and designer labels, such as Chanel, Dior, Louis Vuitton, and Balmain, among others, favored by consumers valuing high-quality and fashionable apparel.

Middle East & Africa B2C E-commerce Market Trends

The B2C E-commerce market in the Middle East & Africa region is growing at the highest CAGR of 21.8% from 2024 to 2030. Retailers in the Middle East and Africa are increasingly adopting Omni channel approaches that integrate online and offline channels to provide seamless shopping experiences for consumers. This integration allows consumers to browse products online and make purchases in-store, or vice versa, enhancing convenience and flexibility. By embracing Omni channel retailing, businesses can meet consumers’ diverse needs and preferences, driving the market's growth.

Saudi Arabia B2C E-commerce market is growing significantly at a CAGR of 23.5% from 2024 to 2030. The increasing digital literacy among consumers in Saudi Arabia bodes well for market growth. As more consumers become familiar with online shopping platforms and digital payment methods, they increasingly find comfort and confidence in purchasing online. Efforts to educate consumers about the benefits of e-commerce, including convenience, product variety, and price transparency, are also driving the preference for B2C e-commerce platforms.

Key B2C E-commerce Company Insights

Some of the key players operating in the market include Amazon.com, Inc., Alibaba.com, and eBay Inc.

-

Amazon.com, Inc.is a multinational American technology company specializing in cloud computing, artificial intelligence, digital streaming, and e-commerce. The company has organized its business operations into North America, International, and AWS segments. The North America segment deals with transactions from retail sales of subscriptions and consumer products through physical and online stores in the North American region.

-

Alibaba.comoperates through business segments: China commerce, International Commerce, Local Consumer Services, Digital Media and Entertainment, Innovation Initiatives and Others, Logistics, and Cloud. Alibaba.com China commerce offers a broad product portfolio of wholesale products shipped in bulk stock worldwide.

FirstCry.com and JD.com, Inc. are some of the emerging market participants in the B2C e-commerce market.

-

FirstCry.com operates as a B2C e-commerce portal dedicated to baby and children's items, presenting an extensive array of products, including clothing, toys, feeding equipment, diapers, nursery furniture, and maternity items. The company's assortment includes attire, shoes, toys, accessories, books, school supplies, baby equipment, feeding essentials, healthcare products, and maternity care items. The platform collaborates with leading brands, manufacturers, and suppliers to offer its customers a handpicked selection of premium products.

-

JD.com is a B2C e-commerce platform that provides a comprehensive online marketplace with a wide range of products in areas such as electronics, appliances, fashion, beauty, home goods, cars, and more. The platform collaborates with national and international brands, merchants, and suppliers to provide consumers with access to multiple items, reasonable prices, and quick shopping experiences.

Key B2C E-commerce Companies:

The following are the leading companies in the b2c e-commerc market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- ASOS

- eBay Inc.

- Flipkart.com

- FirstCry.com

- FARFETCH UK Limited

- JD.com, Inc.

- Jumia

- MercadoLibre SRL

- Rakuten Group, Inc.

- Rappi Inc.

- Shopee

- Walmart

- Zalando

Recent Developments

-

In March 2024, Blink, an Amazon company, launched the Blink Mini 2 camera. The new compact plug-in camera offers enhanced features such as person detection, a broader field of view, a built-in LED spotlight for night view in color, and improved image quality. The Blink Mini 2 is designed to work indoors and outdoors, with the option to purchase the Blink Weather Resistant Power Adapter for outdoor use.

-

In October 2023, Flipkart.com introduced the 'Flipkart Commerce Cloud,' a customized suite of AI-driven retail technology solutions for global retailers and e-commerce businesses. This extensive offering includes marketplace technology, retail media solutions, pricing, and inventory management features rigorously assessed by Flipkart.com. The company aims to equip international sellers with reliable and secure tools to enhance business expansion and efficiency within the competitive global market.

-

In August 2023, Shopify and Amazon.com, Inc. announced a strategic partnership that will allow Shopify merchants to seamlessly implement Amazon's "Buy with Prime" option on their sites. As a result of the agreement, Amazon.com, Inc. Prime customers will enjoy a more efficient checkout process on various platforms. This collaboration allows Amazon Prime members to utilize their existing Amazon payment options, while Shopify will handle the transaction processing through its system, showcasing a partnership between the two leading companies.

-

In February 2023, eBay acquired 3PM Shield, a developer of AI-powered online retail solutions. 3PM Shield uses machine learning and artificial intelligence to analyze extensive data sets, enhancing marketplace compliance and user experience. This acquisition aligns with eBay's goal to offer a "safe and reliable" platform by boosting its ability to block the sale of counterfeit and prohibited items. By incorporating 3PM Shield's sophisticated monitoring technologies, eBay seeks to enhance its capability to address problematic seller behavior and spot problematic listings, fostering a safer e-commerce space for its worldwide community of sellers and buyers.

B2C E-commerce Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.23 trillion

Market Value forecast in 2030

USD 17.77 trillion

Growth rate

CAGR of 19.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/trillion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product category, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon.com, Inc.; Alibaba Group Holding Limited; ASOS; eBay Inc.; Flipkart.com; FirstCry.com; FARFETCH UK Limited; JD.com, Inc.; Jumia; MercadoLibre SRL; Rakuten Group, Inc.; Rappi Inc.; Shopee.; Walmart; Zalando

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global B2C E-commerce Market Report Segmentation

This report forecasts market value growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global B2C e-commerce market report based on product category and region.

-

Product Category Outlook (Market Value, USD Billion, 2018 - 2030)

-

Automotive

-

Beauty & Personal Care

-

Books & Stationery

-

Consumer Electronics

-

Clothing & Footwear

-

Home Décor & Electronics

-

Sports & Leisure

-

Travel & Tourism

-

Media & Entertainment

-

Information Technology (Software)

-

Others

-

-

Regional Outlook (Market Value, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global B2C e-commerce market size was estimated at USD 5.47 trillion in 2023 and is expected to reach USD 6.23 trillion in 2024.

b. The global B2C e-commerce market is expected to grow at a compound annual growth rate of 19.1% from 2024 to 2030 to reach USD 17.77 trillion by 2030.

b. Asia Pacific dominated the B2C e-commerce market with a share nearly of 58% in 2023. The rapid growth of the APAC B2C e-commerce market can be attributed to the proliferation of smartphones, mobile devices, and mobile internet connectivity has fueled the growth of mobile commerce in the APAC region, allowing consumers to explore and shop, thereby broadening the coverage, availability, and convenience of the APAC region's B2C e-commerce market.

b. Some key players operating in the B2C e-commerce market include Amazon.com, Inc.; Alibaba Group Holding Limited; ASOS; eBay Inc.; Flipkart.com; FirstCry.com; FARFETCH UK Limited; JD.com, Inc.; Jumia; MercadoLibre SRL; Rakuten Group, Inc.; Rappi Inc.; Shopee.; Zalando.

b. Key factors that are driving the B2C e-commerce market growth are the incorporation of artificial intelligence (AI), machine learning, augmented reality (AR), and virtual reality (VR) into B2C e-commerce platforms improve the shopping experience by providing interactive product graphical representation, virtual try-ons and customized recommendations, allowing businesses to differentiate themselves and attract customers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.