- Home

- »

- Biotechnology

- »

-

Biotechnology Reagents & Kits Market Size Report, 2030GVR Report cover

![Biotechnology Reagents & Kits Market Size, Share & Trends Report]()

Biotechnology Reagents & Kits Market (2023 - 2030) Size, Share & Trends Analysis Report By Kit Type (Detection Kits, Isolation Kits), By Technology (PCR, Sequencing), By Tested Parameters, By Purpose, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-287-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biotechnology Reagents & Kits Market Summary

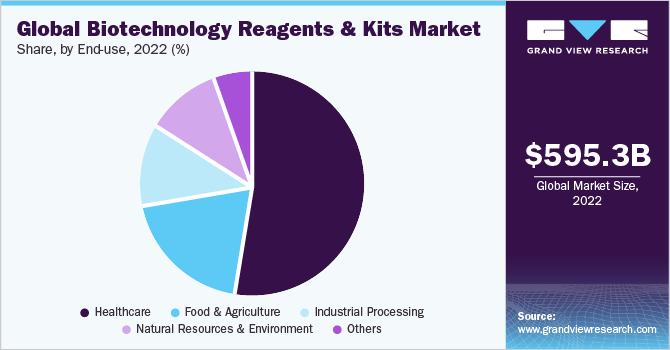

The global biotechnology reagents & kits market size was estimated at USD 595.3 billion in 2022 and is projected to reach USD 1,377.2 billion by 2030, growing at a CAGR of 10.94% from 2023 to 2030. Increasing R&D investments, expanding applications of molecular biology, development of advanced & cost-effective technologies, and growing demand for synthetic biology are key factors driving the growth of this market.

Key Market Trends & Insights

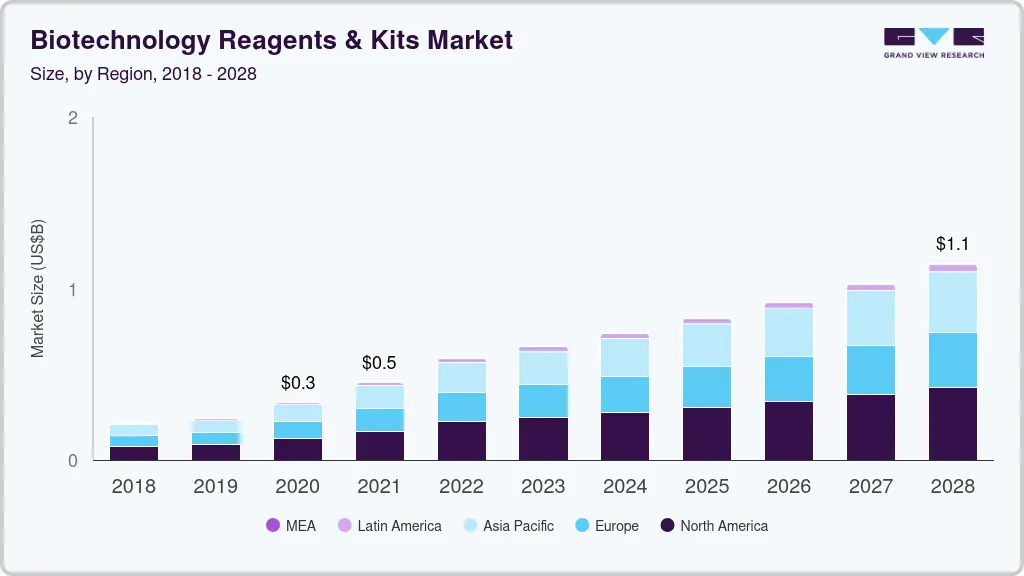

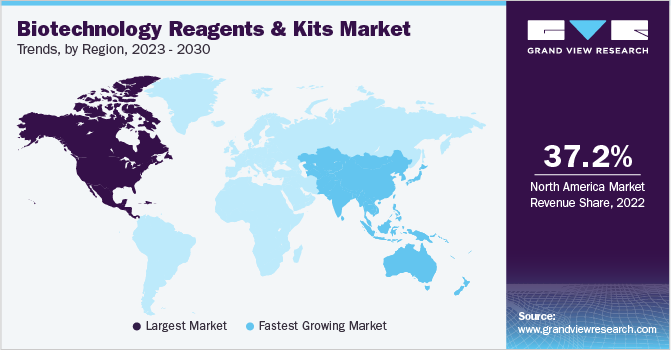

- North America dominated the market in 2022 with the largest revenue share of 37.2%.

- Based on kit type, the detection kit segment held the largest revenue share in 2022

- Based on technology, the cell culture segment held the largest revenue share in 2022.

- In terms of tested parameters, the RNA segment held the largest revenue share in 2022

Market Size & Forecast

- 2022 Market Size: USD 595.3 Billion

- 2030 Projected Market Size: USD 1,377.2 Billion

- CAGR (2023-2030): 10.9%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The increased use of testing kits such as cytometry-based methods for diagnosing and assessing the immune responses to COVID-19 had further surged the growth of this market during the pandemic. Recent advancements in the molecular biology arena and several engineering tools facilitated the development of new and advanced kits to cope with rising market demand.The increasing focus on research in molecular biology and technological advancements in the field of genomic sequencing since the inception of the first revolutionary DNA sequencing technique has added to the increasing demand for biotechnology reagents & kits. In the past few years, there have been extraordinary developments in areas, including high-throughput sequencing, genome engineering, big-data analysis & storage, and gene therapy.

The new development in high-throughput sequencing is helping in the reduction of costs related to DNA sequencing. As per a study published in the National Library of Medicine in September 2022, platforms such as Roche-454 GS Junior, Ion Torrent, and FLX+ can produce large amounts of data in less time and cost, which has made these technologies more accessible.

Moreover, during the COVID-19 pandemic, RT-PCR assay was the most widely used method for the detection of viral RNA in patient samples and several more assays were developed specifically to detect COVID-19. The Centers for Disease Control (CDC) also developed a separate test protocol after validating and comparing several kits used in the extraction of nucleic acids, which is an integral part of the COVID-19 testing workflow.

The huge demand for nucleic acid isolation and purification kits during the pandemic has led to a global shortage of these kits. However, leveraging this opportunity, several companies undertook various initiatives, such as the expansion of their production capabilities, distribution agreements, and new product launches, to enhance their market positions. This also accelerated the entry of new players into the market, thereby boosting market growth.

Kit Type Insights

Based on kit type, the detection kit segment held the largest revenue share in 2022 due to the increasing utilization of several detection kits at various end-use settings, such as healthcare, food and agriculture, industrial processing, and others. The increasing prevalence of diseases such as diabetes and cancer is adding to the growth of this segment. For instance, according to the International Diabetes Federation Atlas 2021, 10.5% of the population aged between 20 to 79 years is suffering from diabetes.

Moreover, in May 2021, the Defence Institute of Physiology and Allied Sciences (DIPAS), introduced DIPCOVAN DIPAS-VDx SARS-CoV-2 IgG, an antibody-dependent kit and ELISA, an antibody Microwell for sero-surveillance. This kit can recognize Spikes as well as Nucleocapsid (S&N) protein found in the COVID-19 virus with 97% sensitivity and 99% specificity. The detection kit is manufactured in collaboration with Vanguard Diagnostics Private Limited.

The amplification kits segment is expected to grow at the fastest CAGR over the forecast period. The emergence of various new diseases and the increasing prevalence of existing ones is driving the need for the development of more advanced tools. Moreover, the technological advancements in the field of biotechnology, and increasing R&D investments are also expected to boost the growth of this segment in the future.

Technology Insights

Based on technology, the cell culture segment held the largest revenue share in 2022. It is considered one of the most important investigating techniques regarding biochemistry, biology, and metabolism of diseased and wild-type cells. Therefore, there is an increasing demand for cell culture reagents by the research community. Furthermore, the comprehensive portfolio of cell culture media and reagents owned by companies is driving the market growth.

Moreover, the advancement of cell culture technology in the field of drug discovery and development can further add to the growth of this segment. For instance, due to their high efficiency and increased advantages, 3D culture models are now being adopted over 2D models in the early drug discovery process. A study published in the National Library of Medicine in August 2022 suggests that 3D culture models can mimic the tissue factors and represent the in vivo cellular phenomena in a better manner than 2D models, which helps in the better understanding of cell-to cell interaction, tumor properties, metabolomics, and pathophysiology of various diseases.

The market for sequencing reagents is anticipated to witness significant growth over the forecast period owing to the advancements in sequencing techniques. Next-Generation Sequencing (NGS) is now considered a reliable and powerful tool for the characterization of cell lines used for the production of gene therapy, vaccines, and recombinant proteins.

Tested Parameters Insights

In terms of tested parameters, the RNA segment held the largest revenue share in 2022. Research on extracellular RNA for clinical diagnosis has increased over the past five years. Companies and universities are entering the field for the development of RNA-based therapeutics by transcriptomic technologies. Key industry participants are introducing new products to drive the market. For instance, in March 2021, PromegaCorp. launched XpressAmp Direct amplification reagent. It enables RNA extraction-free sample preparation, which is automation-friendly. These advancements are anticipated to drive market growth for this segment.

Moreover, the DNA segment is anticipated to register a significant CAGR during the forecast period owing to the increasing demand for DNA diagnostics technology. DNA testing has significant applications in newborn genetic screening, identity diagnostics & forensics, pharmacogenomics diagnostic testing, and drug metabolism, which can further boost the growth of this segment.

Purpose Insights

Based on purpose, the on-site segment held the largest revenue share in 2022 owing to the rising utilization of Point-of-Care (POC) testing services. Several governmental and non-governmental organizations are also supporting POC testing services for their efficient operations. The efficient and timely POC testing based on the availability of POC reagents can further add to the segment's growth.

On-site testing applications in the food and beverage industry also aided the market expansion. It includes microbiological on-site testing and enzymatic on-site testing. Microbiological on-site testing is used in the detection of viruses, bacteria, and molds in food. Enzymatic on-site testing is used in the measurement of constituents, such as acid or alcohol, and sugar in foods. This test is essential when analyzing beverage and dairy products.

A broad variety of research reagents contribute to the growth of various fields in science and medicine. Laboratory reagents are employed in various assays and methodologies, such as to support Immunohistochemistry (IHC), cell culture, flow cytometry, cell selection, flow, protein purification, immunodepleting, and others. Moreover, in vitro reagents are considered crucial in clinical chemistry and testing laboratories.

End-use Insights

In terms of end-use, the healthcare sector dominated the market with a revenue share of 52.2% in 2022. The segment is expected to retain its position throughout the forecast period owing to the ongoing clinical trials and research & development activities for clinical diagnostics. Moreover, a shift in the preference toward molecular diagnostics and personalized medicine has increased mergers and collaborations for developing novel technology, which has subsequently driven the demand for various advanced products in the healthcare sector. For instance, in March 2021, Roche and GenMark Diagnostics entered into a merger agreement to introduce innovative technology to test a wide range of pathogens with one patient specimen. The platform provides quick and effective results that can aid further treatment for various life-threatening diseases.

The industrial processing segment is expected to grow at the fastest CAGR over the forecast period from 2023 to 2030. The increasing use of biotechnology in the production of industrial enzymes and chemicals to create more advanced and sustainable materials is expected to drive the growth of this segment. For instance, the process of bio-cementation is performed in the construction industry that uses bacteria for the precipitation of calcium carbonate within the concrete. The process helps in making it stronger and more durable.

Regional Insights

North America dominated the market in 2022 with the largest revenue share of 37.2%. The presence of several key players actively developing technologically advanced novel products coupled with the introduction of innovative products by emerging start-ups has majorly contributed to the dominance of the region.

The U.S.-based players and organizations are continuously involved in high-quality life science research, thereby affecting ancillary markets. Various strategic initiatives by key companies to maintain regional presence and market share add to the growth of this market. For instance, in March 2021, Agilent Technologies acquired Resolution Bioscience Inc., a liquid biopsy firm, to offer an NGS-based noninvasive liquid biopsy test platform, in turn, strengthening its genomics business.

Asia Pacific is expected to grow at the fastest CAGR of 11.8% during the forecast period. The growing disposable income, increasing healthcare expenditure, improving diagnostics & therapeutic infrastructure, and increasing research activities for the development of effective therapeutics are some key factors that have driven the market growth in Asia Pacific. For instance, according to an article published in the Economic Times in February 2022, a science and technology company, Merck, announced the opening of its Healthcare R&D Excellence Centre in Bengaluru, India. This development can lead to the improvement of healthcare facilities and make life-saving treatments accessible to patients globally.

Key Companies & Market Share Insights

The market is expected to witness tremendous growth over the forecast period. Key players in the market are actively engaged in forming technological collaborations, expanding product portfolios, and increasing R&D investments to increase their share in the market. The new product developments undertaken by key companies are positively impacting the market growth and adding to their competitiveness in the market. The emergence of new diseases such as COVID-19 has further created opportunities for players to capitalize on untapped avenues and regions. Some prominent players in the global biotechnology reagents & kits market include:

-

Thermo Fisher Scientific

-

QIAGEN

-

New England Biolabs

-

Illumina, Inc.

-

Agilent Technologies, Inc.

-

Bio-Rad Laboratories

-

F. Hoffmann-La Roche Ltd.

-

Merck KGaA

-

Promega Corp.

-

Takara Bio, Inc.

-

LGC Ltd.

-

Toyobo Co. Ltd.

Biotechnology Reagents & Kits Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 665.9 billion

Revenue forecast in 2030

USD 1,377.2 billion

Growth rate

CAGR of 10.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Kit type, technology, tested parameters, purpose, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific; QIAGEN; New England Biolabs; Illumina, Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories; F. Hoffmann-La Roche Ltd.; Merck KGaA; Promega Corp.; Takara Bio, Inc.; LGC Ltd.; Toyobo Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biotechnology Reagents & Kits Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biotechnology reagents & kits market report based on kit type, technology, tested parameters, purpose, end-use, and region

-

Kit Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Purification Kits

-

Amplification Kits

-

Detection Kits

-

Isolation Kits

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

LAMP Technology

-

PCR

-

Cell Culture

-

Sequencing

-

Chromatography

-

Electrophoresis

-

Flow Cytometry

-

Other Technologies

-

-

Tested Parameters Outlook (Revenue, USD Billion, 2018 - 2030)

-

DNA

-

RNA

-

Enzymes

-

Proteins

-

Others

-

-

Purpose Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-site

-

Laboratory

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Food & Agriculture

-

Natural Resources & Environment

-

Industrial Processing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biotechnology reagents & kits market size was estimated at USD 595.3 billion in 2022 and is expected to reach USD 665.95 billion in 2023.

b. The global biotechnology reagents & kits market is expected to grow at a compound annual growth rate of 10.94% from 2023 to 2030 to reach USD 1,377.2 billion by 2030.

b. The detection kits segment dominated the biotechnology reagents & kits market in 2022 with a revenue share of over 22%.

b. Some key players operating in the biotechnology reagents & kits market include Thermo Fisher Scientific, QIAGEN, New England Biolabs, Illumina Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd., and Merck KGaA.

b. Key factors that are driving the biotechnology reagents & kits market growth include increasing R&D expenditure by biotechnology companies, expanding applications of molecular biology, technological advancements in the field of biotechnology, and growing demand for synthetic biology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.