- Home

- »

- Clinical Diagnostics

- »

-

Blood Filtration And Purification Market, Industry Report, 2030GVR Report cover

![Blood Filtration And Purification Market Size, Share & Trends Report]()

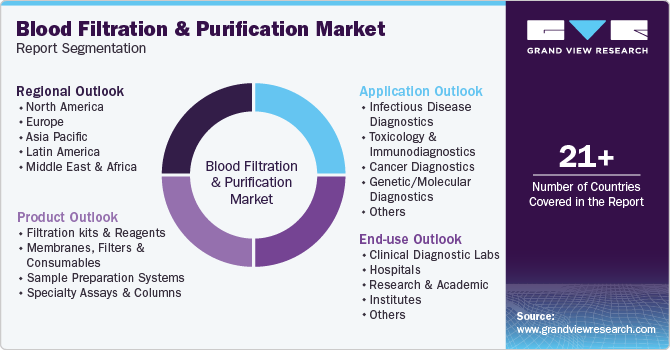

Blood Filtration And Purification Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Filtration Kits & Reagents, Membranes, Filters & Consumables, Sample Preparation Systems), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-560-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Filtration & Purification Market Trends

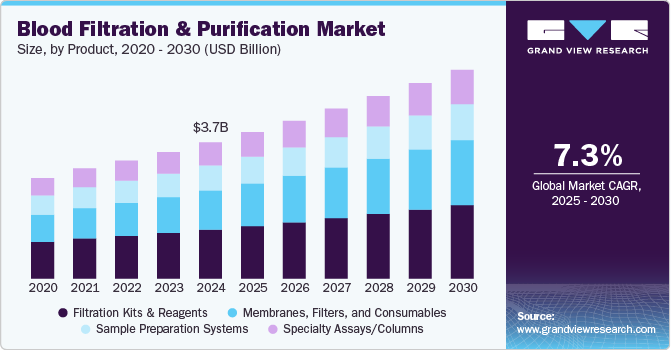

The global blood filtration and purification market size was estimated at USD 3.67 billion in 2024 and is projected to grow at a CAGR of 7.34% from 2025 to 2030. The rising prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) is a significant driver of the blood filtration and purification industry. Globally, approximately 9.1% of the population, or over 700 million individuals, are affected by CKD, with diabetes and hypertension being primary contributors to its progression to ESRD.

According to 2023 CDC, an estimated 35.5 million U.S. adults approximately 14% of the adult population-are affected by chronic kidney disease (CKD). This surge in CKD and ESRD cases leads to a heightened demand for dialysis services, including hemodialysis and peritoneal dialysis, which are essential for patients with kidney failure. Consequently, healthcare systems are expanding dialysis facilities and integrating advanced blood purification technologies to manage the increasing patient load. The rising incidence of these renal conditions underscores the critical need for effective blood filtration and purification solutions, thereby propelling market growth in this sector.

The blood filtration and purification industry within the field of clinical diagnostics is undergoing substantial growth, driven by the expanding global need for high-quality, analyte-rich samples in disease detection, monitoring, and personalized medicine. In modern diagnostics, the ability to efficiently process blood-separating plasma, serum, nucleic acids, or cells with minimal loss and contamination-is critical to the accuracy and reliability of downstream testing. Whether the goal is to detect viral RNA in an infectious disease panel, isolate circulating tumor DNA (ctDNA) in oncology, or analyze inflammatory cytokines in autoimmune diseases, robust and standardized blood purification processes are now a foundational component of the clinical diagnostic workflow. This shift has positioned blood filtration and purification tools as not just preparatory aids, but as integral diagnostic enablers.

One of the primary market drivers is the global rise in non-communicable diseases and complex conditions like cancer, sepsis, cardiovascular disorders, and autoimmune syndromes. These clinical areas increasingly rely on blood-based testing because of its minimally invasive nature, reproducibility, and rich information content. For instance, in oncology, liquid biopsies now allow clinicians to screen for tumor markers or mutations using just a few milliliters of blood, reducing the need for invasive tissue biopsies. This has led to a surge in demand for highly efficient purification systems that can isolate rare biomarkers like cfDNA, miRNA, or circulating tumor cells (CTCs) from whole blood with high specificity and sensitivity. Companies like Qiagen have responded to this need with products such as the QIAamp Circulating Nucleic Acid Kit, a widely adopted solution in both clinical and research labs that require reliable recovery of low-concentration nucleic acids.

Automation has emerged as another powerful force shaping this market. Modern laboratories are rapidly integrating automated sample preparation systems to eliminate variability, improve consistency, and reduce labor costs. Instruments like Roche’s MagNA Pure 24 System and Thermo Fisher Scientific’s KingFisher Flex allow clinical labs to process dozens of blood samples in parallel with minimal manual handling. These systems combine filtration and purification chemistry with robotic liquid handling, streamlining processes for viral load testing, pathogen detection, and genetic analysis. In high-throughput hospital laboratories and national reference labs, such platforms are now essential to meeting growing test volumes, especially in the wake of the COVID-19 pandemic which dramatically highlighted the need for scalable, efficient diagnostic infrastructure.

Meanwhile, membranes, filters, and consumables continue to see robust demand, particularly in sample prep for serological assays, ELISAs, and PCR testing. Products like Pall Corporation’s Acrodisc syringe filters and MilliporeSigma’s MultiScreen vacuum filtration plates are standard components of diagnostic workflows, providing fast, sterile separation of plasma and removal of cellular debris. These tools are also being integrated into point-of-care (POC) diagnostic kits that enable rapid sample handling in decentralized settings-essential for rural clinics, emergency departments, and mobile testing units. As healthcare systems decentralize and seek faster diagnostic turnaround in outpatient settings, demand for compact, pre-assembled, and single-use blood filtration devices is rising sharply.

The market is also increasingly influenced by specialty assays and column-based purification technologies, especially in immunology and transplant diagnostics. Systems like Dynabeads from Thermo Fisher or MACS columns from Miltenyi Biotec are widely used to isolate rare immune cell populations or antigens for diagnostic or therapeutic monitoring. These tools enable highly selective purification steps required for companion diagnostics, cellular immunophenotyping, and post-transplant rejection surveillance. As the clinical lab moves toward personalized and immune-driven diagnostics, specialty purification kits that can accommodate targeted enrichment and biomarker profiling are in high demand.

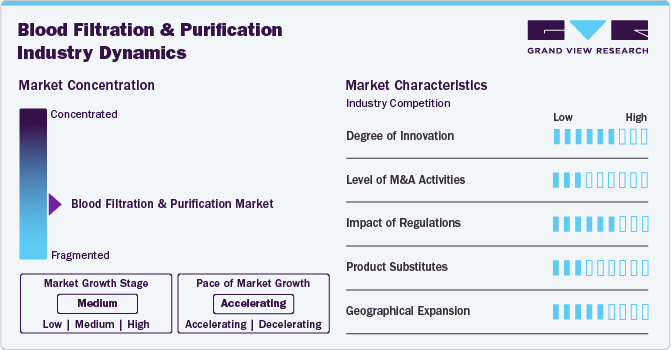

Market Concentration & Characteristics

The degree of innovation is high in the market characterized by experiencing significant innovation, driven by advancements in technology and a focus on improving patient outcomes. Key innovations include the development of high-flux membranes, biocompatible coatings, wearable devices and AI-integrated systems that enhance the efficiency and safety of blood purification processes. The increasing adoption of these technologies is contributing to the market's growth and transformation, offering new opportunities for both healthcare providers and patients.

The blood filtration and purification industry is low in merger and acquisition (M&A) activity, reflecting its rapid growth and the increasing demand for advanced therapeutic solutions.

Regulations for blood filtration and purification products and services are strict, ensuring device safety and efficacy while also influencing market dynamics. The strict regulations impact the market by setting high standards for product development and testing, which can drive innovation and investment in the industry. The FDA's recent rule to regulate laboratory-developed tests (LDTs) aims to enhance the reliability and safety of diagnostic tools used in critical care settings, including those related to blood purification. While this move intended to ensure test accuracy and patient safety, it may also introduce challenges such as increased compliance costs and potential delays in bringing new diagnostic innovations to market.

The product substitute is generally high for the market. In the blood filtration & purification industry, key substitutes include centrifugation, magnetic bead-based separation, microfluidics, solid-phase extraction (SPE) columns, automated sample prep workstations, and chemical lysis kits. These alternatives offer varying benefits such as automation, higher throughput, or cost-efficiency, depending on the use-case.

The regional expansion in the market is primarily focused on reaching out to hospitals and blood banks in various countries, with these entities being the primary consumers of blood filtration & purification products and services. Hospitals, due to their extensive use of blood filtration & purification for patient care, including emergency situations, surgeries, and organ transplantations, represent a significant portion of the sector. Blood banks, on the other hand, rely heavily on accurate blood filtration & purification to ensure safe and effective transfusions. Other end-users, such as clinical laboratories and specialized testing facilities, also contribute to the sector but are less concentrated compared to hospitals and blood banks.

Product Insights

The filtration kits & reagents segment led the market with the largest revenue share of 35.97% in 2024 and is anticipated to grow at a lucrative CAGR over the forecast period, due to their critical role in ensuring the safety and efficacy of blood transfusions, therapeutic treatments, and medical research. These kits remove harmful impurities like microaggregates, pathogens, and toxins, preventing complications such as immune reactions and sepsis. Technological advancements in filtration materials and a growing global demand for high-quality blood products further contribute to the dominance of filtration kits and reagents in the market. For instance, in November 2024, HWTAi launched a disposable blood filter which effectively removes microaggregates and impurities from various blood products, including whole blood, red blood cells, platelets, concentrated granulocytes, plasma.

The membranes, filters, and consumables segment is anticipated to grow at the fastest CAGR over the forecast period, due to their essential role in a wide range of clinical and research applications. With increasing demand for advanced, cost-effective, and disposable filtration solutions, innovations in membrane technology, such as improved biocompatibility and filtration efficiency, are driving rapid growth. The expanding need for personalized medicine, critical care treatments, and the global rise in chronic diseases contribute to the accelerated adoption of these products.

Application Insights

Based on application, the infectious disease diagnostics segment led the market with the largest revenue share of 32.51% in 2024. Infectious disease diagnostics are the largest segment in the blood purification and filtration market due to the growing global prevalence of infectious diseases and the critical need for accurate, rapid diagnostics. Blood filtration technologies play a vital role in removing pathogens such as bacteria, viruses, and parasites from the bloodstream, ensuring safe transfusions and improving patient outcomes. The rise in diseases like sepsis, HIV, and hepatitis, combined with advancements in diagnostic tools and filtration methods, drives the demand for efficient filtration systems. These innovations help detect infections early and manage treatment more effectively, making infectious disease diagnostics a key market leader.

The genetic/molecular diagnostics segment is anticipated to grow at the fastest CAGR over the forecast period. The Genetic/Molecular Diagnostics segment plays a vital role in enhancing diagnostic precision by purifying blood samples for genetic and molecular testing. Blood filtration technologies in this segment are critical for removing contaminants or unwanted materials such as excess proteins, blood cells, or pathogens, which could interfere with the analysis of genetic markers or mutations.One of the key products in this segment includes DNA/RNA purification systems, which isolate and clean the genetic material from blood samples before conducting molecular diagnostics. These purification systems ensure that the genetic material is free from inhibitors or contaminants that could impact the accuracy of downstream analyses. For example, Magnetic Bead-based Purification Systems by companies like Thermo Fisher Scientific and QIAGEN are widely used for isolating DNA or RNA, ensuring high-quality samples for further genetic testing.Furthermore, filtering devices designed for the removal of cellular debris or exosomes from blood plasma are crucial for isolating genetic material in the context of liquid biopsy tests. Liquid biopsy technologies are becoming increasingly important in cancer diagnostics. For example, Guardant Health’s Guardant360 test utilizes purified blood samples to detect multiple genetic mutations associated with cancers such as lung, breast, and colon cancer.

Furthermore, PCR-based purification products are commonly used for enhancing the performance of polymerase chain reaction (PCR) assays, which are integral to genetic diagnostics. These products remove contaminants from the blood sample to ensure that the genetic material is preserved for accurate mutation analysis, particularly for conditions like genetic disorders, viral infections, and oncological studies.

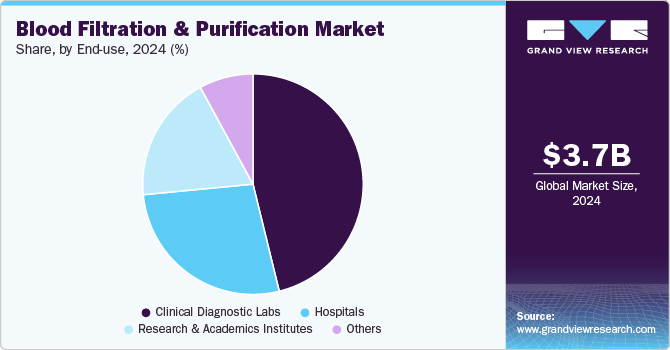

End-use Insights

Based on end use, the clinical diagnostic laboratories segment led the market with the largest revenue share of 47.24% in 2024, due to their essential role in disease detection and monitoring. These laboratories rely on advanced filtration technologies to obtain high-quality, contaminant-free blood samples for accurate testing, especially in infectious disease diagnostics, genetic testing, and oncology. With the rise of personalized medicine and early disease detection, clinical diagnostic labs are adopting cutting-edge filtration technologies, driving both the size and growth of this market segment. The growth of personalized medicine, where treatments are tailored to individual patients based on genetic information, has further accelerated the need for high-quality blood samples. In addition, the rise in chronic diseases, such as diabetes and cardiovascular conditions, which often require regular monitoring through blood tests, has led to greater adoption of purification technologies. Clinical diagnostic labs also benefit from innovations in molecular diagnostics and AI-driven testing, which rely on purified blood for accurate results.

As healthcare systems around the world focus on improving diagnostic capabilities and expanding laboratory infrastructure, clinical diagnostic laboratories are driving both the size and speed of market growth.

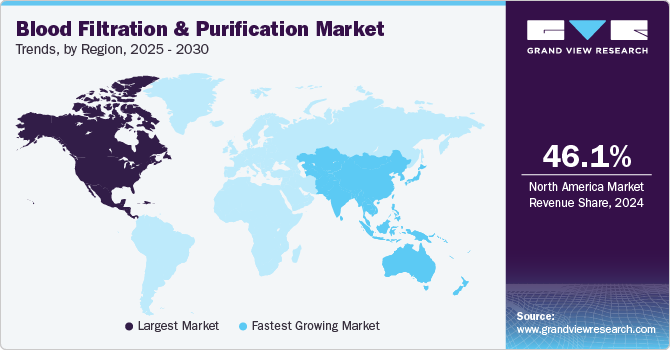

Regional Insights

North America dominated the blood filtration & purification market with the largest revenue share of 46.14% in 2024, owing to factors such as region's well developed healthcare infrastructure and large number of transfusions happening in the region. Major companies operating in the sector, such as Thermo Fisher Scientific Inc., Roche Lifescience, Avantor and QIAGEN N.V have significant expertise, resources, and established distribution networks. These companies' comprehensive product portfolios, expansive global footprint, and well-established brand recognition further support region dominance.

The high burden of chronic kidney disease on regional healthcare systems is a major driver for market growth, necessitating the need for blood filtration & purification. In February 2025, a study conducted in collaboration with Cedars- Sinai Medical Center, University of Southern California, and the Keck School of Medicine ExThera Medical's Seraph 100 Microbind Affinity Blood Filter (Seraph 100) can selectively adsorb specific tumor-associated microparticles from the blood of patients with pancreatic ductal adenocarcinoma (PDAC), providing a promising new approach for managing the disease.

U.S. Blood Filtration & Purification Market Trends

The blood filtration & purification market in the U.S. is expected to grow at the fastest CAGR over the forecast period, due to rising healthcare expenditure advancements in medical technology and burden of aging population. Hence, these reasons expand the market for blood filtration & purification. For instance, on December 2024, GVS S.p.A, entered into a binding agreement to acquire Haemonetics Corporation’s Transfusion Medicine business. By acquiring Haemonetics' proprietary solutions for blood collection, processing, filtration, and transfusion, GVS significantly expands its product offerings in the sector.

Europe Blood Filtration & Purification Market Trends

The blood filtration & purification market in Europe was identified as a lucrative region in this industry. The market growth in the region can be attributed to a rising chronic diseases aided with an increase in research funding and the local presence of key market players in this region.

The UK blood filtration & purification market is expected to grow at a significant CAGR over the forecast period, due to the presence of well-established healthcare infrastructure, government investments in healthcare and regulatory support and innovation.

The blood filtration & purification market in France is expected to grow at a substantial CAGR over the forecast period, attributed to increasing focus on preventive healthcare and improving access to healthcare infrastructure in the country.

The Germany blood filtration & purification market is expected to grow at a significant CAGR over the forecast period, due to the rising number of initiatives been taken by government focusing on preventive healthcare encouraging early detection and proactive management of chronic diseases. Research and development is actively developing new and more efficient blood filtration and purification technologies.

Asia Pacific Blood Filtration & Purification Market Trends

The blood filtration & purification market in the Asia Pacific is anticipated to witness at the fastest CAGR during the forecast period, due to a combination of demographic, economic, healthcare, and technological factors. Governments and private healthcare systems are expanding access to advanced medical technologies, including blood filtration and purification systems. Growing low and middle class in countries like India, China, and Indonesia is leading to greater demand for high-quality healthcare and medical treatments, including dialysis and other blood-related therapies. Technological advancements in healthcare, such as new molecular diagnostic tools, facilitate rapid and reliable group identification, providing opportunities for market growth. There is growing awareness of chronic kidney disease, sepsis, and other blood-related conditions across the Asia Pacific region. With better access to healthcare services and growing public health initiatives, early diagnosis of diseases that require blood purification treatments is improving.

The China blood filtration & purification market is expected to grow at a significant CAGR over the estimate period, due in medical technology, particularly in the development of blood filtration and purification devices. Innovations such as artificial intelligence (AI), wearable dialysis devices, and home-based dialysis systems are enhancing the accessibility and efficiency of treatments. The growing use of these cutting-edge technologies, combined with advancements in personalized medicine and blood purification systems, is anticipated to fuel significant market growth.

The blood filtration & purification market in Japan is expected to grow at a significant CAGR over the projected period, due to the presence of well-established healthcare system, high aging population and promoting healthcare expenditure. As awareness of chronic conditions such as CKD, hypertension, and diabetes increases in Japan, more people are seeking early treatment and interventions.

Latin America Blood Filtration & Purification Market Trends

The blood filtration & purification market in Latin America was identified as a lucrative region in this industry. The market for blood filtration and purification is expected to grow due to several factors, including demographic shifts, increasing healthcare needs, rising awareness of chronic diseases, and advancements in medical technology.

The Brazil blood filtration & purification market is expected to grow at a significant CAGR over the forecast period, due to the one of the largest numbers of dialysis patients in Latin America, with a steady increase in the number of people requiring hemodialysis and other blood purification treatments. Local and international companies are increasingly forming strategic partnerships in Brazil to enhance the availability of blood filtration and purification technologies.

MEA Blood Filtration & Purification Market Trends

The blood filtration & purification market in MEA was identified as a lucrative region in this industry. The market in this region is driven by the high prevalence of chronic diseases, aided with improvements in healthcare infrastructure. Technological advancements, the expansion of medical tourism, and rising healthcare awareness are also contributing to the demand for dialysis and other blood purification treatments

The Saudi Arabia blood filtration & purification market is expected to grow at a significant CAGR over the forecast period, owing to several factors that include the increasing prevalence of chronic diseases, government initiatives, and advancements in healthcare infrastructure. the need for better diagnostics and improvements in treatment options due to the rising prevalence of chronic kidney diseases.

Key Blood Filtration And Purification Company Insights

Some of the leading players operating in the blood filtration & purification industry include Thermo Fischer Scientific, Roche Life Sciences, Avantor and QIAGEN N.V. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

HWTAi, Promega and Canvax are some of the emerging market participants in the blood filtration & purification industry. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Blood Filtration And Purification Companies:

The following are the leading companies in the blood filtration and purification market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fischer Scientific

- MilliporeSigma

- Roche lifescience

- Sigma Aldrich

- Avantor

- Takara Bio

- MP Biomedicals.

- QIAGEN N.V

- HiMedia

- Biotage

Recent Developments

-

In December 2024, MagMAX Total Nucleic Acid Isolation Kit launched for fast, high-throughput extraction of RNA and genomic DNA from various sample types, including viral, blood, and bacterial sources. It utilizes magnetic bead-based purification technology to ensure efficient and reliable nucleic acid isolation.

-

In March 2024, The Nanobind launched Nanobind PanDNA kit facilitates the extraction of high molecular weight (HMW) DNA from a range of samples, including cells, bacteria, blood, saliva, tissue, and nuclei. Its main application is in genomic research.

-

On November 2022, HiMedia launched HiPurA Blood Genomic DNA Miniprep Purification Kit is a spin column-based DNA extraction tool designed for isolating genomic DNA from various blood samples. It employs advanced silica-based membrane technology in a convenient spin column format. This design facilitates the efficient binding, washing, and elution of genomic DNA, allowing for the simultaneous processing of multiple samples.

Blood Filtration And Purification Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.95 billion

Revenue forecast in 2030

USD 5.63 billion

Growth rate

CAGR of 7.34% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Thermo Fischer Scientific; MilliporeSigma; Roche Life Sciences; Sigma Aldrich; Avantor; Takara Bio; MP Biomedicals; QIAGEN N.V; HiMedia, Biotage.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Filtration And Purification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood filtration & purification market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Filtration kits and Reagents

-

Membranes, Filters and Consumables

-

Sample preparation systems

-

Specialty assays and columns

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Disease Diagnostics

-

Toxicology and Immunodiagnostics

-

Cancer Diagnostics

-

Genetic/Molecular Diagnostics

-

Others (Metabolic, Rare Disease Panels)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Diagnostic Labs

-

Hospitals

-

Research and Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global blood filtration and purification market size was estimated at USD 3.67 billion in 2024 and is expected to reach USD 3.95 billion in 2025.

b. The global blood filtration and purification market is expected to grow at a compound annual growth rate of 7.34% from 2025 to 2030 to reach USD 5.63 billion by 2030.

b. The Filtration Kits & Reagents segment dominated the spectrometry market and accounted for the largest revenue share of 35.97% in 2024.

b. Some key players operating in the blood filtration & purification market include Thermo Fischer Scientific, MilliporeSigma, Roche Life Sciences, Sigma Aldrich, Avantor, Takara Bio, MP Biomedicals, QIAGEN N.V, HiMedia, Biotage.

b. The rising prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) is a significant driver of the blood filtration and purification market. Globally, approximately 9.1% of the population, or over 700 million individuals, are affected by CKD, with diabetes and hypertension being primary contributors to its progression to ESRD. According to 2023 CDC, an estimated 35.5 million U.S. adults approximately 14% of the adult population are affected by chronic kidney disease (CKD). This surge in CKD and ESRD cases leads to a heightened demand for dialysis services, including hemodialysis and peritoneal dialysis, which are essential for patients with kidney failure

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.