- Home

- »

- IT Services & Applications

- »

-

Bot Services Market Size And Share, Industry Report, 2030GVR Report cover

![Bot Services Market Size, Share & Trends Report]()

Bot Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Framework, Platform), By Mode (Website, Mobile Applications), By Interaction Type, By Application, By Deployment, By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-591-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bot Services Market Summary

The global bot services market size was estimated at USD 3.15 billion in 2024 and is projected to reach USD 18.79 billion by 2030, growing at a CAGR of 34.7% from 2025 to 2030. Organizations increasingly deploy chatbots and virtual assistants to reduce operational costs, handle customer inquiries, and streamline processes like claims and order management.

Key Market Trends & Insights

- North America bot services market dominated with a revenue share of over 30% in 2024.

- The U.S. bot services market is expected to grow significantly in 2024.

- By service type, platform segment led the market, accounting for over 53.1% of global revenue in 2024, due to its ability to provide end-to-end solutions that integrate various bot functionalities.

- By application, the customer engagement & retention segment accounted for the largest revenue share in 2024.

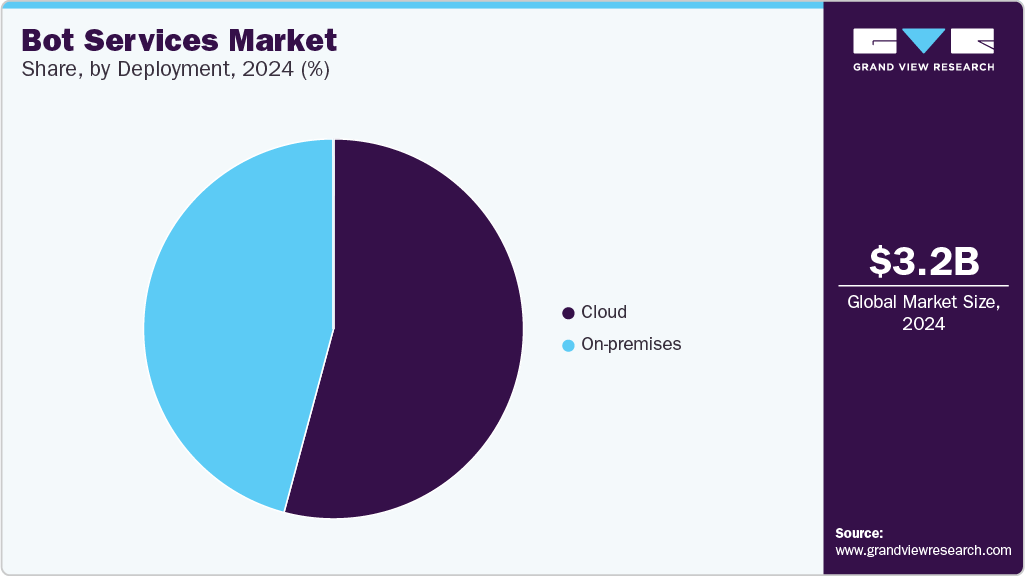

- By deployment, cloud segment accounted for the prominent revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.15 Billion

- 2030 Projected Market Size: USD 18.79 Billion

- CAGR (2025-2030): 34.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The widespread adoption of cloud-based bot platforms contributes to market scale by offering scalability, flexibility, and ease of deployment without heavy infrastructure investments. Large enterprises, with significant budgets and complex operational needs, drive much of the current market demand by integrating bots across customer service, HR, and IT operations. These factors collectively establish bot services as essential tools for improving efficiency and customer experience.

Moreover, market growth is supported by advancements in artificial intelligence, natural language processing, and machine learning, which enhance bot capabilities such as understanding user intent, sentiment analysis, and personalized interactions. The expansion of multi-channel integration enables bots to engage users seamlessly across websites, mobile apps, social media, and voice assistants, meeting customers where they are most active. Increasing smartphone penetration and social media usage stimulate the demand for mobile and messaging bots. In addition, rising interest in AI-driven self-learning chatbots and behavioral analytics supports more intelligent and adaptive bot services, broadening their application across sectors.

Future expansion depends on evolving regulatory frameworks emphasizing data privacy and secure identity verification, which encourage the adoption of compliant bot solutions. The growing need for 24/7 customer engagement, especially in digital-first industries, reinforces the importance of bots in delivering timely support and personalized experiences. Emerging use cases in agent performance management, internal process automation, and integration with Internet of Things (IoT) devices open new avenues for bot services. Continuous innovation in AI and cloud technologies, combined with increasing investments by key market players, sustains the market’s upward trajectory and integration into diverse business operations.

Service Type Insights

The platform segment led the market, accounting for over 53.1% of global revenue in 2024, due to its ability to provide end-to-end solutions that integrate various bot functionalities. These platforms offer scalability, ease of deployment, and support for multiple channels, leading to increased adoption by enterprises. The growing demand for automation across industries such as BFSI, retail, and healthcare further accelerates platform adoption, enabling businesses to enhance customer engagement and operational efficiency. In addition, advancements in AI and cloud technologies drive innovation within these platforms, making them more intelligent and adaptable to evolving enterprise needs.

The framework segment is predicted to foresee significant growth in the forecast years. Frameworks gain importance as companies seek modular and customizable bot development environments. They enable faster creation and deployment of bots tailored to specific business needs. The rise of AI and machine learning integration within frameworks enhances bot intelligence and adaptability. Frameworks also support seamless integration with existing IT infrastructure, increasing operational efficiency. These factors contribute to the expanding demand for bot frameworks.

Mode Insights

The website segment accounted for the largest revenue share in 2024. Websites are primary digital touchpoints where customers interact with businesses, generating significant bot usage. Web bots assist with customer support, lead generation, and user engagement. Their accessibility and ease of integration make them an ideal channel for many organizations. Website bots improve response times and reduce operational costs. These advantages support the segment’s leading revenue position.

The mobile applications segment is expected to grow at the highest CAGR over the forecast period as smartphone penetration increases globally. Bots embedded in mobile apps enhance user experience through personalized assistance and instant support. The rise of 5G networks improves app performance, encouraging more bot integrations. Mobile-first strategies adopted by businesses drive investment in app-based bots, accelerating the segment’s expansion.

Interaction Type Insights

The text & rich media segment accounted for the largest revenue share in 2024 due to their widespread use in messaging platforms and social media. These bots handle diverse content types, including images, videos, and interactive elements, enriching customer interactions. Their ability to deliver personalized and engaging experiences across multiple channels has significantly boosted user engagement and satisfaction. Furthermore, the rising demand for omnichannel communication solutions is expected to drive continued growth in this segment over the coming years.

The audio segment is expected to grow at the highest CAGR over the forecast period. Audio bots gain traction with the increasing adoption of voice assistants and smart speakers. Speech recognition and natural language understanding enhance conversational capabilities. Audio bots provide hands-free, convenient user experiences in customer service and home automation. The growth of voice-enabled devices supports expanding use cases. These factors contribute to the segment’s rapid growth.

Application Insights

The customer engagement & retention segment accounted for the largest revenue share in 2024. Customer engagement and retention remain critical as companies seek to reduce churn and increase loyalty. The rise of AI-powered chatbots and personalized messaging is revolutionizing how brands connect with customers, enabling seamless, real-time interactions across multiple channels. These bots are increasingly equipped with emotional AI and advanced natural language processing (NLP), allowing them to understand context and sentiment, enhancing customer interaction quality. With consumers preferring instant and personalized responses, companies leveraging these technologies are seeing significant improvements in customer satisfaction and lifetime value.

The agent performance management segment is expected to grow at the highest CAGR over the forecast period. Agent performance management bots assist in monitoring, coaching, and optimizing contact centers agents. These AI-driven tools help identify skill gaps, recommend training, and automate routine supervisory tasks, thereby improving agent productivity and reducing operational costs. As contact centers face increasing pressure to deliver exceptional customer experiences, businesses are investing heavily in these solutions to enhance agent effectiveness and morale. In addition, the integration of sentiment analysis and speech analytics enables bots to assess both agent and customer emotions, allowing for more nuanced coaching and improved service quality.

Deployment Insights

The cloud segment accounted for the prominent revenue share in 2024. Cloud deployment offers scalability, flexibility, and cost efficiency, making it the preferred choice for bot services. It enables rapid deployment and easy integration with other cloud-based applications. Cloud platforms support continuous updates and improvements without infrastructure constraints. Security enhancements and compliance certifications increase trust in cloud solutions. These advantages maintain the cloud segment’s leading position.

The on-premises segment is predicted to experience significant growth in the coming years. On-premises solutions appeal to organizations with strict data privacy and regulatory requirements. They offer greater control over data and customization options. These solutions offer greater control over data, infrastructure, and customization options, enabling enterprises to tailor their bot services to specific compliance standards and internal policies. Although on-premises deployments require higher upfront capital expenditure and dedicated IT resources, they provide enhanced security and reliability that cloud solutions may not fully guarantee. Furthermore, many organizations prefer on-premises models to maintain sovereignty over sensitive customer data and to avoid potential risks associated with third-party cloud providers.

Vertical Insights

The BFSI segment accounted for the largest revenue share in 2024. The BFSI sector extensively uses bots for customer service, fraud detection, and compliance automation. In addition, bots help automate anti-fraud measures by analyzing transaction patterns and flagging suspicious activities in real time, enhancing security. Compliance automation bots assist in monitoring regulatory changes and ensuring adherence to complex financial regulations, reducing the risk of penalties. The growing demand for digital banking and contactless services further accelerates bot adoption in this sector, helping institutions reduce operational costs while scaling services efficiently.

The healthcare segment is anticipated to grow at the highest CAGR during the forecast period. Healthcare increasingly adopts bots for patient engagement, appointment scheduling, and telemedicine support. Bots improve access to medical information and streamline administrative tasks. Rising demand for remote healthcare services and digital health initiatives drives growth. Enhanced AI capabilities enable personalized patient interactions. These developments accelerate healthcare segment expansion.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share in 2024. Large enterprises invest heavily in bot services to manage complex operations and diverse customer bases. Their substantial budgets enable the deployment of advanced platforms and frameworks. They prioritize automation to improve efficiency and competitive advantage. Large-scale data volumes require sophisticated analytics and integration. This scale supports their leading revenue contribution.

The SMEs segment is anticipated to grow at the highest CAGR during the forecast period. SMEs increasingly adopt bot services to enhance customer engagement and operational efficiency cost-effectively. Cloud-based and modular solutions lower entry barriers for smaller businesses. Growing digital awareness and competition encourage bot integration. Scalable platforms support SMEs’ evolving needs. These factors drive rapid growth in this segment.

Regional Insights

North America bot services market dominated with a revenue share of over 30% in 2024. North America benefits from advanced digital infrastructure and early technology adoption. The presence of major bot service providers and innovative startups fuels market activity. Strong corporate demand for automation and customer experience improvements supports growth. Regulatory frameworks encourage secure and compliant bot deployments.

U.S. Bot Services Market Trends

The U.S. bot services market is expected to grow significantly in 2024. The U.S. market experiences continuous innovation and investment in bot technologies. Large enterprises and technology companies drive adoption across sectors. Increasing focus on AI-powered automation enhances bot capabilities. Regulatory emphasis on data privacy shapes solution development.

Europe Bot Services Market Trends

The bot services market in Europe is expected to witness significant growth over the forecast period. Stringent data protection laws support the region’s growth, promoting secure bot implementations. The telecom and BFSI sectors invest in digital transformation and customer engagement. Government initiatives encourage AI and automation adoption. Diverse market needs drive tailored bot solutions. These trends support Europe’s expanding market presence.

Asia Pacific Bot Services Market Trends

The bot services industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Asia Pacific experiences rapid digitalization and growing smartphone penetration. Emerging economies invest heavily in telecom infrastructure and AI technologies. Increasing demand for customer service automation and digital engagement fuels growth. Public-private partnerships support innovation and adoption. These dynamics position Asia Pacific as the fastest-growing regional market.

Key Bot Services Company Insights

Some key players in the bot services industry, such as Microsoft, IBM Corporation, Google LLC, and Amazon Web Services, Inc., are actively working to expand their customer base and gain a competitive advantage.

-

Microsoft offers the Azure AI Bot Service, a comprehensive platform that enables businesses to build, connect, and deploy conversational AI bots across multiple devices and channels without requiring extensive coding. The service integrates advanced natural language processing and AI capabilities to create scalable, enterprise-grade chatbots that support customer engagement, automate routine tasks, and enhance operational efficiency. Microsoft’s bot services are widely used across industries such as retail, BFSI, and healthcare, benefiting from seamless integration with other Azure cloud services and AI tools.

-

IBM provides the Watson x Assistant, an AI-powered conversational platform designed to build virtual agents that deliver personalized, context-aware customer and employee experiences. The solution leverages large language models, natural language understanding, and machine learning to handle complex queries, automate workflows, and integrate with backend systems. IBM’s bot services emphasize enterprise-grade security, scalability, and compliance, serving sectors like BFSI, healthcare, and government to improve customer support, streamline operations, and drive productivity.

Key Bot Services Companies:

The following are the leading companies in the bot services market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- IBM Corporation

- Google LLC

- Amazon Web Services, Inc

- OpenAI

- Salesforce, Inc.

- SAP SE

- Kore.ai

- Yellow.ai

- Haptik

Recent Developments

-

In April 2025, Binance, one of the prominent cryptocurrency exchanges, enhanced its Spot trading platform by introducing additional trading pairs and launching new Trading Bot services. These improvements aim to provide users greater trading flexibility and automated strategies, enhancing the overall trading experience and market accessibility.

-

In March 2025, the government of Odisha partnered with Meta to enhance the delivery of citizen-centric services through a WhatsApp chatbot. This initiative aims to improve accessibility and streamline communication between the government and residents by providing timely information and support via the widely used messaging platform. The chatbot facilitates the efficient dissemination of service-related updates, enabling citizens to interact with government services conveniently and effectively.

-

In March 2025, Baidu introduced two advanced AI models, Ernie X1 and Ernie 4.5, as part of its ongoing efforts to strengthen its position in the global artificial intelligence landscape. Concurrently, Baidu made its Ernie Bot chatbot freely accessible by removing the paywall, thereby expanding user access to its conversational AI capabilities.

Bot Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.24 billion

Revenue forecast in 2030

USD 18.79 billion

Growth rate

CAGR of 34.7% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, vertical, application, organization size, service type, mode, interaction type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Microsoft; IBM Corporation; Google LLC; Amazon Web Services, Inc; OpenAI; Salesforce, Inc.; SAP SE; Kore.ai; Yellow.ai; Haptik

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bot Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bot services market report based on service type, mode, interaction type, application, deployment, organization size, vertical, and region.

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Framework

-

Platform

-

-

Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Website

-

Contact Centers

-

Social Media

-

Mobile Applications

-

-

Interaction Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Text & Rich Media

-

Audio

-

Video

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Customer Engagement & Retention

-

Workforce Management

-

Agent Performance Management

-

Content Management

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Media & Entertainment

-

Travel & Hospitality

-

IT & Telecom

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bot services market size was estimated at USD 3.15 billion in 2024 and is expected to reach USD 4.24 billion in 2025.

b. The global bot services market is expected to grow at a compound annual growth rate of 34.7% from 2025 to 2030 to reach USD 18.79 billion by 2030.

b. North America dominated the bot services market with a share of 30% in 2024. North America benefits from advanced digital infrastructure and early technology adoption. The presence of major bot service providers and innovative startups fuels market activity.

b. Some key players operating in the bot services market include Microsoft; IBM Corporation; Google LLC; Amazon Web Services, Inc; OpenAI; Salesforce, Inc.; SAP SE; Kore.ai; Yellow.ai; Haptik

b. Key factors that are driving the market growth include rising adoption of conversational interfaces and advancements in AI and NLP

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.