- Home

- »

- IT Services & Applications

- »

-

Call And Contact Center Outsourcing Market Report, 2030GVR Report cover

![Call And Contact Center Outsourcing Market Size, Share & Trends Report]()

Call And Contact Center Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Voice, Chat Support), By Outsourcing Type, By Services, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-174-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Call And Contact Center Outsourcing Market Summary

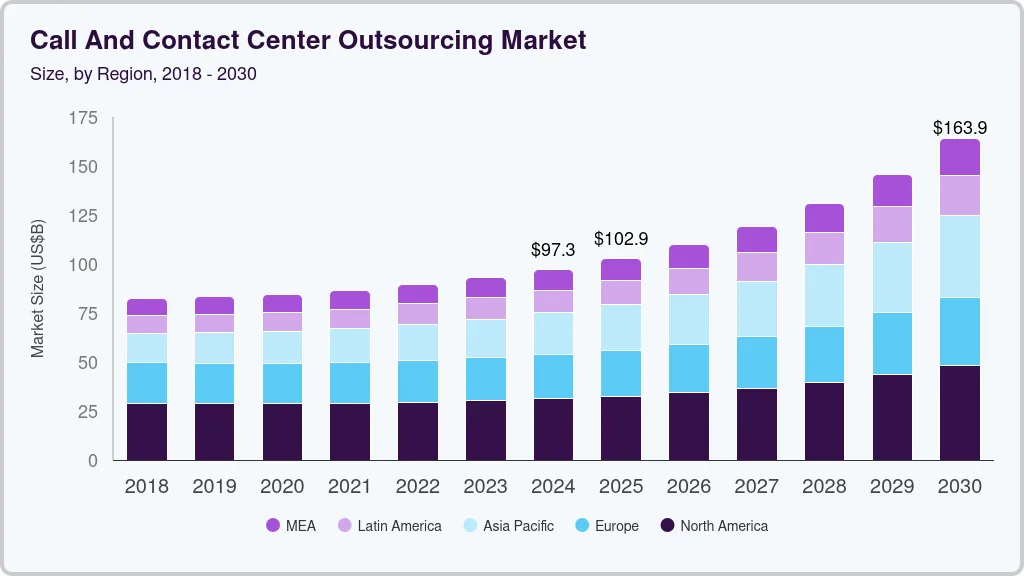

The global call and contact center outsourcing market size was estimated at USD 97.31 billion in 2024 and is anticipated to reach USD 163.86 billion by 2030, growing at a CAGR of 9.8% from 2025 to 2030. Several key factors are driving market growth. Organizations across industries increasingly focus on enhancing customer experience while reducing operational costs, leading them to outsource their customer service functions to specialized providers.

Key Market Trends & Insights

- North America held the major share of over 32% of the call and contact center outsourcing industry in 2024.

- The call and contact center outsourcing industry in the U.S. is expected to grow significantly from 2025 to 2030.

- By type, the voice segment accounted for the largest market share of 34.0% in 2024.

- By outsourcing type, the onshore segment accounted for the largest market share of over 57% in 2024.

- By services, the inbound services segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 97.31 Billion

- 2030 Projected Market Size: USD 163.86 Billion

- CAGR (2025-2030): 9.8%

- North America: Largest market in 2024

These outsourcing firms offer advanced technological capabilities, including artificial intelligence (AI)-powered chatbots, omnichannel communication platforms, and advanced analytics tools, which help improve service efficiency and customer satisfaction. Moreover, the rising demand for 24/7 customer support, particularly from e-commerce, healthcare, and banking, further propels market expansion. In addition, outsourcing enables companies to access a global talent pool, providing multilingual support and ensuring better customer engagement across diverse geographies. The growing trend of digital transformation, coupled with the increasing adoption of cloud-based contact center solutions, also contributes significantly to market growth.

One of the primary factors driving market growth is the increasing focus of organizations on enhancing customer experience while simultaneously optimizing operational efficiency. Businesses across various sectors, including retail, banking, healthcare, and telecommunications, are constantly pressured to deliver high-quality, personalized customer service to maintain competitiveness and foster customer loyalty. Outsourcing these functions to specialized service providers allows organizations to leverage the expertise, infrastructure, and technologies required to manage large-scale customer interactions effectively. This, in turn, enables businesses to focus on their core operations while ensuring that customer queries, complaints, and support requests are handled professionally and promptly.

Another crucial factor contributing to market expansion is the growing adoption of advanced technologies in outsourced contact centers. Service providers are increasingly incorporating artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) into their service offerings to enhance operational efficiency and improve the quality of customer interactions. AI-powered chatbots and virtual assistants can handle routine inquiries, enabling faster response times and reducing the workload on human agents. In addition, omnichannel platforms are becoming standard in outsourced contact centers, allowing seamless customer engagement across multiple communication channels, such as voice, email, chat, and social media. These technological advancements enhance customer experience and contribute to cost savings and operational agility.

The rising demand for round-the-clock customer support, particularly from e-commerce, financial services, and healthcare sectors, also accelerates the demand for outsourcing services. Customers today expect immediate assistance, regardless of time zone or location, which places significant pressure on organizations to maintain 24/7 customer service capabilities. Outsourcing to contact centers across different regions enables businesses to meet these expectations without investing heavily in their infrastructure or human resources. This benefits multinational companies seeking consistent, high-quality customer support across diverse geographic markets.

Furthermore, the need for multilingual customer support is driving the outsourcing trend, particularly for companies operating in global markets. Outsourced contact centers, especially in regions with strong language capabilities such as India, the Philippines, and Eastern Europe, offer multilingual services that help businesses engage effectively with customers in their preferred languages. This capability enhances customer satisfaction and helps organizations build stronger relationships with diverse customer bases, ultimately contributing to increased brand loyalty and market penetration.

Type Insights

The voice segment accounted for the largest market share of 34.0% in 2024. This market domination is primarily due to its effectiveness in handling complex and high-value customer interactions. Customers prefer real-time, personalized communication when addressing urgent issues, seeking detailed explanations, or resolving sensitive concerns. Voice interactions allow agents to build rapport with customers through tone and empathy, often critical for customer satisfaction and loyalty, particularly in the banking, healthcare, and telecommunications sectors. Moreover, voice support remains essential for older demographics and less tech-savvy customers who may be less comfortable with digital channels, further reinforcing its dominance within the outsourcing market.

Chat support is expected to grow significantly during the forecast period due to the increasing demand for instant and convenient communication channels, particularly among younger, digitally native customers. The rapid proliferation of e-commerce, digital banking, and online services has further accelerated the need for real-time chat support, which allows businesses to engage with customers directly through websites, mobile apps, and social media platforms. Moreover, advancements in artificial intelligence and chatbot technologies have significantly enhanced the scalability and cost-effectiveness of chat support, enabling outsourced providers to handle large volumes of routine inquiries while seamlessly escalating complex issues to human agents. As businesses prioritize omnichannel strategies to enhance customer experience, adopting chat support in outsourced contact centers is expected to continue its strong upward trajectory.

Outsourcing Type Insights

The onshore segment accounted for the largest market share of over 57% in 2024.Onshore outsourcing continues to dominate the market due to its ability to offer superior alignment with local customer preferences, regulatory requirements, and cultural nuances. Businesses, particularly those in healthcare, financial services, and government, often prioritize onshore outsourcing to ensure compliance with stringent data privacy and security regulations. Onshore providers also offer the advantage of employing agents with a deep understanding of the local market, language, and cultural context, contributing to improved communication, customer satisfaction, and brand reputation. Furthermore, for high-value or sensitive customer interactions, companies often perceive onshore outsourcing as a lower-risk option, further reinforcing its dominance in the market.

Offshore is expected to grow significantly during the forecast period, driven by its cost-effectiveness and access to a large pool of skilled labor in countries such as India, the Philippines, and Latin American nations. Businesses increasingly turn to offshore outsourcing to benefit from lower labor and operational costs while gaining access to advanced contact center technologies and multilingual capabilities. Furthermore, offshore providers continually enhance service quality through investments in agent training, technology integration, and improved infrastructure, helping dispel traditional concerns about service consistency. As businesses seek to balance cost savings with service quality in an increasingly globalized economy, the demand for offshore outsourcing is expected to grow steadily, particularly among organizations expanding their customer base across international markets.

Services Insights

The inbound services segment accounted for the largest market share in 2024. This growth is due to the fundamental need for businesses to provide responsive, high-quality customer support and service resolution. Organizations across industries prioritize efficient handling of customer inquiries, technical support requests, order management, and complaint resolution to enhance customer satisfaction and retention. Outsourced inbound contact centers offer specialized expertise, advanced technologies, and 24/7 availability, enabling businesses to deliver consistent and professional customer service without requiring extensive in-house infrastructure. The growing emphasis on customer experience as a key competitive differentiator, particularly in healthcare, e-commerce, BFSI, and telecommunications, further strengthens the dominance of inbound services within the outsourcing market.

Outbound services is expected to grow at the fastest rate during the forecast period as businesses increasingly leverage proactive customer engagement strategies to enhance sales, marketing, and customer relationship management efforts. Outsourced contact centers support outbound activities such as lead generation, telemarketing, customer surveys, debt collection, and follow-up calls. Advances in data analytics and customer profiling enable outsourced providers to execute highly targeted and personalized outbound campaigns, improving conversion rates and customer satisfaction. Moreover, businesses are adopting a more customer-centric approach by using outbound services to provide proactive notifications, service reminders, and personalized offers, strengthening customer loyalty and lifetime value. As businesses seek to balance customer acquisition with retention and relationship management, demand for outbound services is expected to grow significantly within the outsourcing market.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2024, due to their substantial customer bases, complex service requirements, and greater financial capacity to invest in outsourcing partnerships. These organizations often operate across multiple regions and industries, requiring large-scale, multilingual, and omnichannel customer support, which specialized outsourcing providers are well-equipped to deliver. Furthermore, large enterprises increasingly rely on outsourcing to streamline operations, reduce costs, and enhance service quality through access to advanced technologies such as artificial intelligence, automation, and analytics. Their established relationships with leading outsourcing providers, combined with a strategic focus on enhancing customer experience and operational efficiency, solidify the dominance of large enterprises in the outsourcing segment.

Small enterprises is expected to grow fastest during the forecast period as they increasingly recognize the benefits of outsourcing in order to remain competitive and improve customer service capabilities. With limited in-house resources and budgets, small enterprises turn to outsourcing providers to gain access to professional customer support services, advanced technologies, and operational scalability without substantial upfront investments. The growing availability of flexible, cloud-based contact center solutions tailored to the needs and budgets of small businesses further supports this trend. As small enterprises expand their digital presence and customer engagement efforts, particularly in e-commerce, technology, and online services, their reliance on outsourcing is expected to grow rapidly, driving significant expansion within this segment.

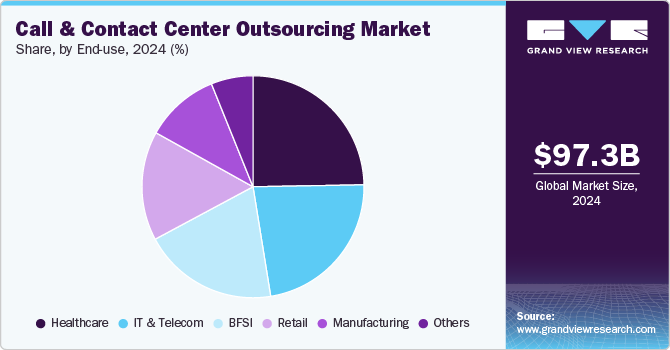

End-use Insights

The healthcare segment accounted for the largest market share in 2024. The healthcare sector dominates the market due to the critical need for effective patient communication, appointment scheduling, medical inquiries, and support services. With the increasing focus on patient-centered care, healthcare providers are leveraging outsourcing to ensure timely and accurate communication across various touchpoints, from hospitals and clinics to insurance companies and telehealth services. Outsourcing providers specializing in healthcare services offer trained agents with expertise in medical terminology, regulatory compliance, and data security, ensuring high-quality service while adhering to stringent privacy regulations. The growing demand for telemedicine, chronic disease management programs, and post-discharge follow-ups further drives the need for specialized outsourced contact center services, reinforcing the healthcare sector's dominance in the market.

BFSI is expected to grow at a significant rate during the forecast period due to the increasing need for seamless customer support across banking, insurance, and investment services. As digital banking and fintech solutions become more prevalent, BFSI companies rely on outsourced contact centers to provide 24/7 support, fraud prevention assistance, and personalized financial advisory services to a growing customer base. In addition, the rise in online transactions and digital payments has heightened the demand for customer verification, dispute resolution, and cybersecurity-related support, all efficiently handled through outsourced services. Outsourcing providers with expertise in financial services can offer trained agents who understand regulatory requirements, compliance standards, and the importance of secure data handling. As BFSI companies focus on enhancing digital customer experiences while optimizing costs, the sector's reliance on outsourcing is expected to continue expanding significantly.

Regional Insights

North America held the major share of over 32% of the call and contact center outsourcing industry in 2024. North America's call and contact center outsourcing industry is characterized by rapid digital transformation across industries, with a strong focus on hybrid and multi-cloud environments. Companies increasingly adopt cloud solutions for enhanced scalability, security, and cost-efficiency. The rise of edge computing, AI-driven automation, and increased regulatory requirements, particularly data privacy and security, also drive regional growth.

U.S. Call and Contact Center Outsourcing Market Trends

The call and contact center outsourcing industry in the U.S. is expected to grow significantly from 2025 to 2030. This market is witnessing significant growth due to widespread cloud adoption in the healthcare, finance, and telecom sectors. The need for enhanced cybersecurity, compliance with regulations like HIPAA, and the adoption of AI and machine learning are key trends fueling this market.

Europe Call and Contact Center Outsourcing Market Trends

The call and contact center outsourcing industry in Europe is growing significantly at a CAGR of over 8% from 2025 to 2030. The industry is evolving due to regulatory pressures, particularly around GDPR and the increasing adoption of cloud-native technologies. European businesses focus on cloud solutions to improve efficiency, reduce costs, and meet compliance requirements while integrating artificial intelligence and machine learning into cloud services.

The UK call and contact center outsourcing industry is expected to grow rapidly in the coming years. There is a growing demand for cloud services in sectors like finance and public services. Companies are moving towards cloud-based solutions for enhanced security, improved business agility, and regulatory compliance, especially following Brexit, which has heightened data residency concerns.

The call and contact center outsourcing industry in Germany held a substantial market share in 2024. The industry is expanding rapidly, driven by the country's strong manufacturing sector and a growing focus on Industry 4.0. German companies are adopting cloud solutions to support digitalization, automation, and innovation in manufacturing, while compliance with GDPR remains a top priority.

Asia Pacific Call and Contact Center Outsourcing Market Trends

The call and contact center outsourcing industry in Asia Pacific is growing significantly at a CAGR of over 12% from 2025 to 2030. The industry is growing rapidly in Asia as businesses in countries like China, Japan, and India embrace digital transformation. The demand for cloud solutions is driven by the rise of IoT, smart cities, and the need for scalable and flexible IT infrastructure to support fast-growing economies and industries.

China call and contact center outsourcing industry held a substantial share in 2024. In China, the market is expanding rapidly due to the government's push for digital infrastructure development, e-commerce, and large-scale cloud adoption by both state-owned and private enterprises. The focus on cybersecurity and data localization regulations also plays a crucial role.

The call and contact center outsourcing industry in Japan held a substantial share in 2024. Japan's call and contact center outsourcing industry is growing as manufacturing, automotive, and retail companies seek to modernize their IT infrastructure. Adopting cloud-based services and integrating AI and automation enables businesses to enhance operational efficiency and innovation.

India call and contact center outsourcing industry is expanding rapidly. The industry is witnessing significant growth, driven by the increasing digitalization of enterprises, a large IT services outsourcing sector, and the rise of startups. The growing demand for cloud adoption among Small Enterprises and government initiatives promoting digital infrastructure further accelerates market expansion.

Key Call And Contact Center Outsourcing Company Insights

Key players operating in the market include Alorica, Inc., Arvato, Concentrix, Capgemini, CGS Inc., DATAMARK Inc., Infosys BPM, Konecta Group, Raya Customer Experience, SCICOM (MSC) BERHAD, SERCO GROUP, Teleperformance, TTEC, Webhelp, and Wipro. These companies focus on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Call And Contact Center Outsourcing Companies:

The following are the leading companies in the call and contact center outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Alorica, Inc.

- Arvato

- Concentrix

- Capgemini

- CGS Inc

- DATAMARK Inc.

- Infosys BPM

- Konecta Group

- Raya Customer Experience

- SCICOM (MSC) BERHAD

- SERCO GROUP

- Teleperformance

- TTEC

- Webhelp

- Wipro

Recent Developments

-

In February 2025, Concentrix announced its acquisition of VoiceWorx.AI, a Texas-based provider of AI-powered conversational analytics solutions. This strategic move is intended to enhance Concentrix's capabilities in conversational intelligence by integrating VoiceWorx.AI's advanced AI and natural language processing (NLP) technologies into its portfolio. Concentrix aims to provide clients with deeper insights into customer interactions through this acquisition, enabling improved customer experience management and more effective decision-making. The acquisition aligns with Concentrix's broader strategy of investing in next-generation technologies to strengthen its position as a customer experience (CX) solutions leader. The financial details of the transaction were not disclosed.

-

In January 2023, Alorica Inc. announced its plans to expand into Africa and Europe by establishing operations in Cairo, Egypt, and Łódź, Poland. As one of the world's largest BPO providers, with 100,000 employees across 17 countries and over 24 years of experience in customer experience management, Alorica continues to broaden and diversify its high-performing workforce. The expansion into Egypt and Poland will further enhance the company's ability to meet the evolving needs of multinational clients by delivering multilingual customer care, revenue generation, content management and moderation, technical support, and CX consulting services. Operations in both countries were expected to commence during the second quarter of 2023.

Call And Contact Center Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 102.89 billion

Revenue forecast in 2030

USD 163.86 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, outsourcing type, services, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Alorica, Inc.; Arvato; Concentrix; Capgemini; CGS Inc.; DATAMARK Inc.; Infosys BPM; Konecta Group; Raya Customer Experience; SCICOM (MSC) BERHAD; SERCO GROUP; Teleperformance; TTEC; Webhelp; Wipro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Call And Contact Center Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global call and contact center outsourcing market report based on type, outsourcing type, services, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Email Support

-

Chat Support

-

Voice

-

Other

-

-

Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offshore

-

Onshore

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inbound Services

-

Outbound Services

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail

-

IT & Telecom

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global call and contact center outsourcing market size was estimated at USD 97.31 billion in 2024 and is expected to reach USD 102.89 billion by 2025.

b. The global call and contact center outsourcing market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 163.86 billion by 2030.

b. The voice segment accounted for the largest revenue share of more than 30% in 2024. The voice segment growth can be attributed to the implementation of voice biometrics and safe authentication procedures in voice-enabled transactions to handle security problems while maintaining customer data privacy.

b. The key players operating in the call and contact center outsourcing market include Alorica, Inc.; Arvato; Concentrix; Capgemini; CGS Inc; DATAMARK Inc.; Infosys BPM; Konecta Group; Raya Customer Experience; SCICOM (MSC) BERHAD; SERCO GROUP; Teleperformance; TTEC; Webhelp; Wipro.

b. The market growth can be attributed to the proliferation of call and contact center outsourcing services companies are realizing the essential need to provide unparalleled client experiences to foster brand loyalty and obtain an edge over competitors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.