- Home

- »

- Plastics, Polymers & Resins

- »

-

Capacitor Films Market Size & Trends, Industry Report, 2030GVR Report cover

![Capacitor Films Market Size, Share & Trends Report]()

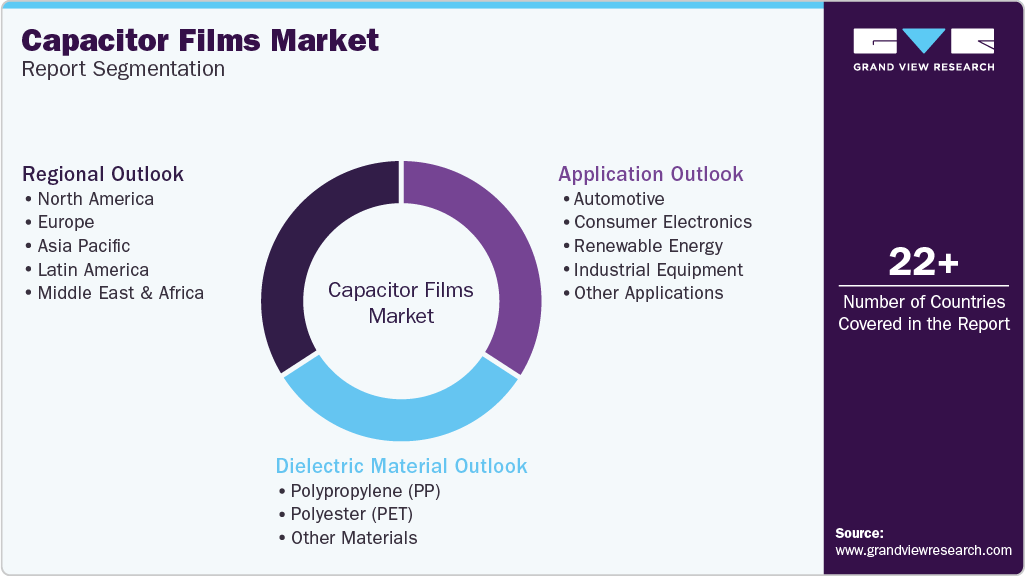

Capacitor Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Dielectric Material (PP, PET), By Application (Automotive, Consumer Electronics, Renewable Energy, Industrial Equipment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-590-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Capacitor Films Market Size & Trends

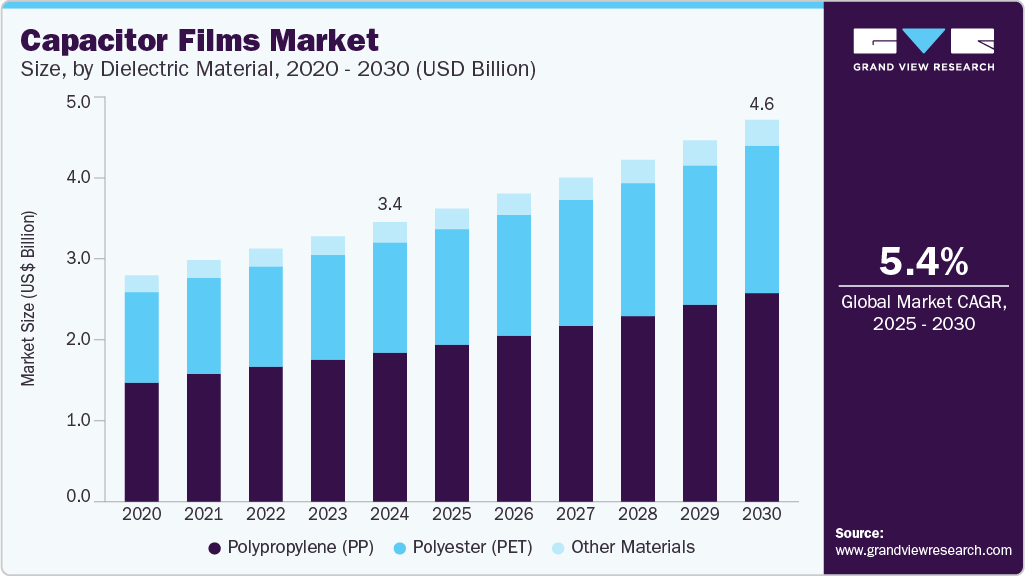

The global capacitor films market size was valued at USD 3.38 billion in 2024 and is expected to grow at a CAGR of 5.40% from 2025 to 2030. The growing demand for consumer electronics like smartphones, laptops, and TVs drives the need for capacitor films due to their role in energy storage and signal filtering.

Key Highlights:

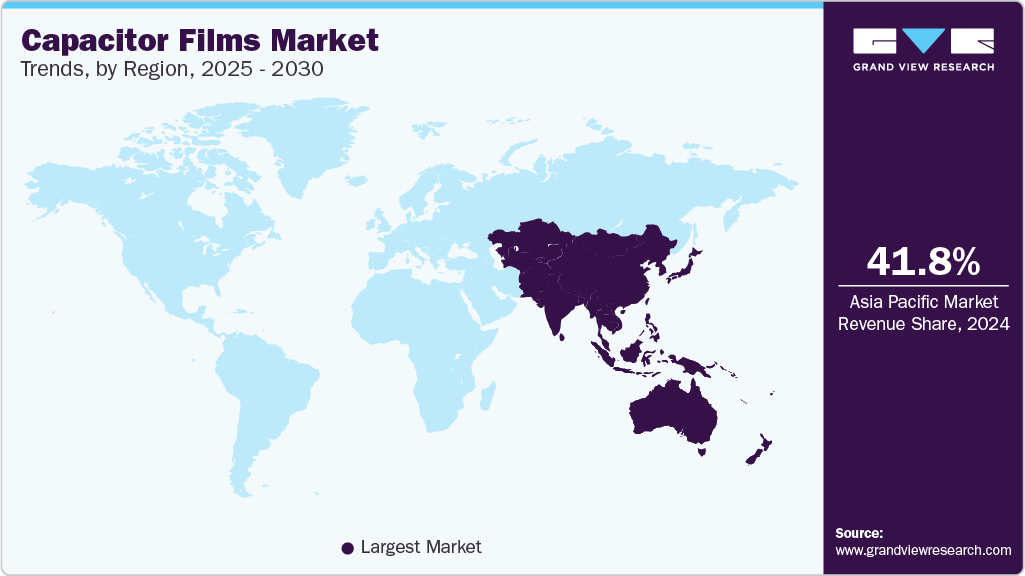

- Asia Pacific capacitor films market accounted for the largest revenue share of 41.77% in 2024.

- The capacitor films market in China is driven by initiatives to dominate electric mobility and renewable energy technologies.

- By dielectric material, the Polypropylene (PP) segment accounting for a market share of 53.50% in 2024.

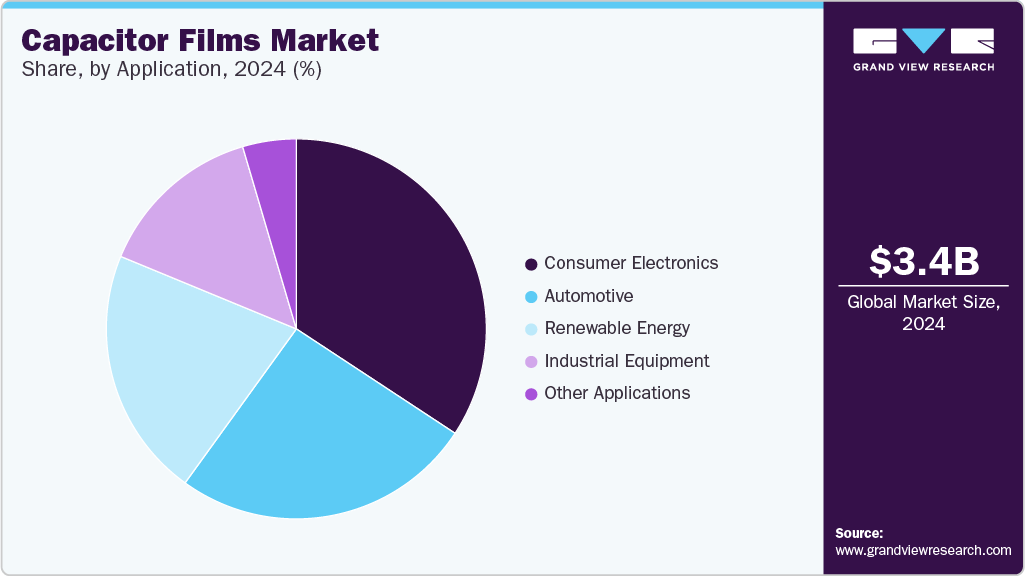

- By application, the consumer electronics segment accounting for a revenue share of 34.26% in 2024.

Their lightweight, compact design makes them ideal for miniaturized electronic devices. A notable trend redefining the capacitor films industry is their accelerated adoption in cutting-edge power electronic systems, particularly in electric vehicles (EVs), renewable energy infrastructure, and industrial automation. Capacitor films, especially polypropylene-based variants, are being engineered for higher thermal stability, dielectric strength, and self-healing properties to meet the evolving requirements of high-voltage, high-frequency applications.

As silicon carbide (SiC) and gallium nitride (GaN)-based power semiconductors become more prevalent, the demand for film capacitors operating in compact, high-efficiency systems has intensified. Manufacturers are now investing in film technologies that enable smaller footprints and enhanced performance longevity, aligning with the miniaturization and sustainability trends in power systems design.

Drivers, Opportunities & Restraints

The capacitor films industry is significantly driven by the robust expansion of the electric mobility ecosystem, encompassing not just electric passenger cars but also commercial EVs, two-wheelers, and electric public transport infrastructure. Capacitor films are critical in power conditioning and battery management systems, where they support stable energy transfer, voltage smoothing, and electromagnetic interference (EMI) suppression.

An emerging opportunity lies in capacitor film production's localization and vertical integration, particularly across Asia Pacific and Eastern Europe. As geopolitical tensions and global supply chain disruptions challenge the availability of high-grade polymer films and metallized substrates, local players are exploring backward integration to control quality and ensure supply continuity. This shift not only enhances regional competitiveness but also enables customization of film capacitors to suit local application needs across industrial, consumer electronics, and automotive sectors.

A key restraint to market growth is the high sensitivity of capacitor film production to fluctuations in raw material prices, particularly petroleum-based polymers like polypropylene and polyethylene terephthalate (PET). The unpredictable pricing environment, driven by crude oil dynamics and supply chain imbalances, often compresses margins and hinders long-term procurement planning.

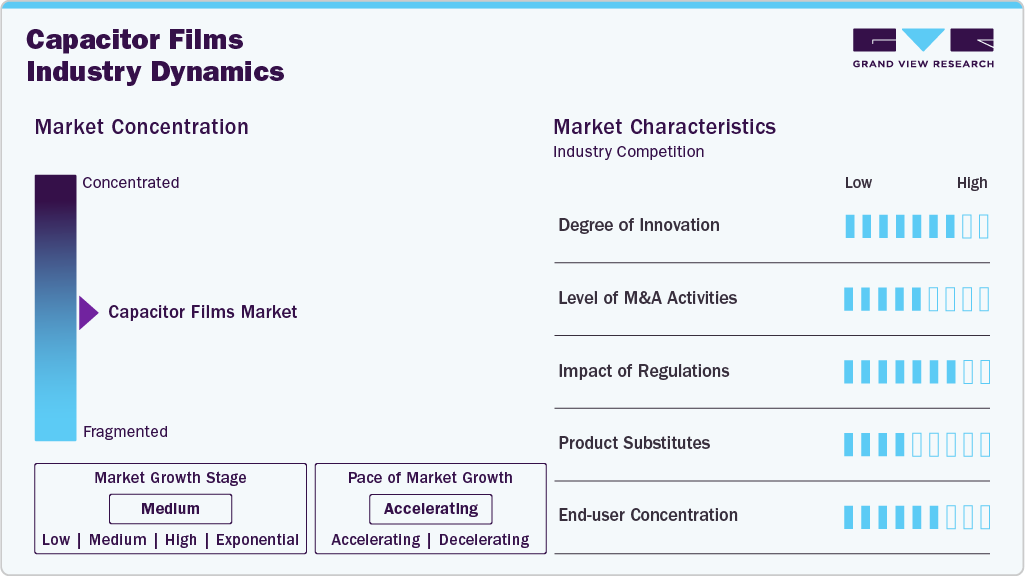

Market Concentration & Characteristics

The market growth stage of the market is medium, and the pace is accelerating. The market exhibits a significant level of market concentration, with key players dominating the industry landscape. Major companies like JPFL Films, Cosmo Films, Toray Industries, Mitsubishi Shindoh Co., Ltd., TDK Corporation, Panasonic Corporation, AVX Corporation, Terichem Tervakoski, a.s., Xiamen Hongfa Electroacoustic Co., Ltd., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The market exhibits a moderately high degree of innovation, particularly driven by the push for ultra-thin, high-temperature-resistant films tailored for compact, high-voltage systems. Innovations are centered around nanolayer extrusion, metallization processes, and polymer blends that enhance dielectric stability and lifespan. Companies are also exploring recyclable and bio-based film alternatives to align with global sustainability mandates, reflecting a growing convergence between material science and environmental performance.

While ceramic capacitors and electrolytic capacitors present viable substitutes in certain low-frequency or low-cost applications, they lack the thermal resilience, self-healing properties, and long operational life of film capacitors. In high-reliability segments such as EV powertrains, solar inverters, and aerospace systems, the substitution threat is minimal due to the performance-critical nature of film technology. That said, advancements in multilayer ceramics (MLCCs) and hybrid capacitor designs are being closely monitored as emerging alternatives in high-density, space-constrained environments.

Dielectric Material Insights

Polypropylene (PP) dominated the market across the dielectric material segmentation in terms of revenue, accounting for a market share of 53.50% in 2024. The rising preference for polypropylene (PP) films in high-frequency power electronics is being fueled by their exceptional dielectric strength, low dissipation factor, and superior thermal resistance. As inverter-based systems in electric vehicles, industrial drives, and renewable energy applications become more demanding, PP films are increasingly seen as the gold standard for reliability and stability under harsh operating conditions.

The polyester (PET) segment is anticipated to grow at a significant CAGR of 5.06% through the forecast period, due to the growing penetration of low-cost, general-purpose capacitors in mass-market electronics and lighting systems. PET films offer balanced mechanical and dielectric properties and are particularly attractive for consumer applications requiring moderate voltage and temperature tolerances.

Application Insights

Consumer electronics dominated the market across the application segmentation in terms of revenue, accounting for a market share of 34.26% in 2024. The proliferation of compact, high-performance consumer electronics, such as smartphones, tablets, wearables, and gaming consoles, is a key driver behind the increasing use of capacitor films. As device manufacturers push for thinner form factors with higher processing capabilities, there’s growing demand for film capacitors that offer superior reliability, low ESR (Equivalent Series Resistance), and thermal stability within constrained spaces.

The renewable energy segment will witness a substantial CAGR of 6.46% through the forecast period. The sector is driving strong demand for capacitor films, particularly in solar inverters, wind turbine converters, and grid interconnection systems. As energy systems become more decentralized and power conversion efficiency grows in importance, film capacitors are being leveraged for their low inductance and long-term stability.

Regional Insights

North America capacitor films market is expected to register significant CAGR over the forecast period. In North America, the transition toward grid modernization and decentralized energy storage is a primary driver for capacitor films. With increasing investment in utility-scale battery storage and smart grid infrastructure, especially across Canada and select U.S. states, film capacitors are vital for managing power quality and stabilizing frequency response. This trend is further reinforced by incentives under climate-driven legislation like the U.S. Inflation Reduction Act, which accelerates demand for durable and high-efficiency capacitor components.

U.S. Capacitor Films Market Trends

The U.S. capacitor films market is being specifically propelled by the rapid scaling of domestic electric vehicle production and associated charging infrastructure. Major automakers and EV startups are localizing battery and power electronics manufacturing, requiring advanced film capacitors in DC link and inverter systems. Moreover, the Department of Energy’s emphasis on reshoring critical components in the EV supply chain is creating strategic opportunities for capacitor film producers to establish local manufacturing footprints.

Asia Pacific Capacitor Films Market Trends

Asia Pacific dominated the global capacitor films market and accounted for the largest revenue share of 41.77% in 2024. Asia Pacific continues to lead global growth in capacitor films due to the rapid expansion of its electronics manufacturing base and accelerating adoption of industrial automation. Markets like South Korea, Japan, and India heavily invest in smart manufacturing, robotics, and 5G infrastructure-all of which rely on compact, stable film capacitors.

The China capacitor films market is aggressively driven by state-backed initiatives to dominate electric mobility and renewable energy technologies. The country’s leadership in EV manufacturing directly boosts demand for high-performance film capacitors used in traction inverters and onboard electronics. Simultaneously, China's investments in solar and wind energy, combined with a maturing ultra-high-voltage (UHV) transmission network, are creating consistent demand for large-format capacitor films with high dielectric endurance.

Europe Capacitor Films Market Trends

Stringent regulatory pressure to decarbonize Europe's transport and energy sectors is driving Europe’s capacitor films market. The European Green Deal and the Fit for 55 initiative push automakers and renewable energy developers to adopt high-efficiency electrical systems that rely heavily on film capacitors for their reliability and low-loss characteristics.

Key Capacitor Films Company Insights

The capacitor films market is highly competitive, with several key players dominating the landscape. Major companies include JPFL Films, Cosmo Films, Toray Industries, Mitsubishi Shindoh Co., Ltd., TDK Corporation, Panasonic Corporation, AVX Corporation, Terichem Tervakoski, a.s., and Xiamen Hongfa Electroacoustic Co., Ltd.. The market is characterized by a competitive landscape with several key players driving innovation and growth. Major companies in this sector are investing heavily in research and development to enhance their products' performance, cost-effectiveness, and sustainability.

Key Capacitor Films Companies:

The following are the leading companies in the capacitor films market. These companies collectively hold the largest market share and dictate industry trends.

- JPFL Films

- Cosmo Films

- Toray Industries

- Mitsubishi Shindoh Co., Ltd.

- TDK Corporation

- Panasonic Corporation

- AVX Corporation

- Terichem Tervakoski, a.s.

- Xiamen Hongfa Electroacoustic Co.,Ltd.

Recent Developments

-

In October 2024, JPFL Films, part of the BC Jindal Group, announced that it had fully utilized its capacitor films production capacity and planned to double it by 2025 with a capital investment of approximately USD 30 million. This expansion aimed to meet growing demand in the capacitor market, reduce import dependency, and support the Indian government’s Make in India initiative.

-

In January 2024, Cosmo Films, a global leader in specialty films, launched metalised capacitor-grade BOPP films designed for manufacturing various AC and DC capacitors. These capacitors serve industries including electronics, automotive, electric vehicles, and renewable energy.

Capacitor Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.55 billion

Revenue forecast in 2030

USD 4.62 billion

Growth rate

CAGR of 5.40% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Dielectric material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

JPFL Films; Cosmo Films; Toray Industries; Mitsubishi Shindoh Co., Ltd.; TDK Corporation; Panasonic Corporation; AVX Corporation; Terichem Tervakoski, a.s.; Xiamen Hongfa Electroacoustic Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Capacitor Films Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global capacitor films market report on the basis of dielectric material, application, and region:

-

Dielectric Material Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Polypropylene (PP)

-

Polyester (PET)

-

Other Materials

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Renewable Energy

-

Industrial Equipment

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global capacitor films market size was estimated at USD 3.38 billion in 2024 and is expected to reach USD 3.55 billion in 2025.

b. The global capacitor films market is expected to grow at a compound annual growth rate of 5.40% from 2025 to 2030 to reach USD 4.62 billion by 2030.

b. Consumer electronics dominated the capacitor films market across the application segmentation in terms of revenue, accounting for a market share of 34.26% in 2024. The proliferation of compact, high-performance consumer electronics, such as smartphones, tablets, wearables, and gaming consoles, is a key driver behind the increasing use of capacitor films.

b. Some key players operating in the Capacitor Films market include JPFL Films, Cosmo Films, Toray Industries, Mitsubishi Shindoh Co., Ltd., TDK Corporation, Panasonic Corporation, AVX Corporation, Terichem Tervakoski, a.s., and Xiamen Hongfa Electroacoustic Co., Ltd..

b. Growing demand for consumer electronics like smartphones, laptops, and TVs is driving the need for capacitor films due to their role in energy storage and signal filtering. Their lightweight, compact design makes them ideal for miniaturized electronic devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.