- Home

- »

- Biotechnology

- »

-

Cell Culture Supplements Market Size, Industry Report, 2033GVR Report cover

![Cell Culture Supplements Market Size, Share & Trends Report]()

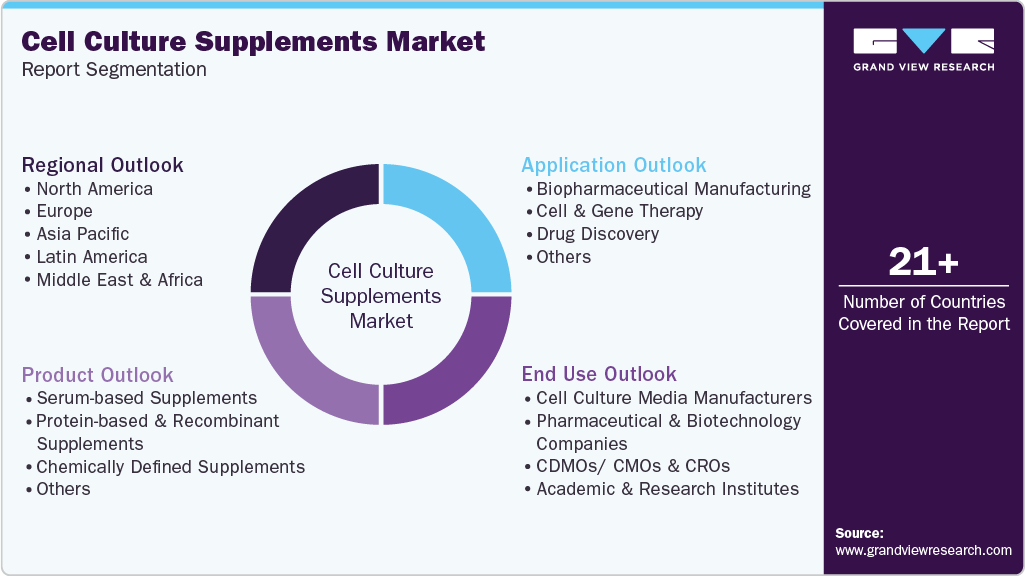

Cell Culture Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Protein-Based & Recombinant Supplements, Chemically Defined Supplements), By Application (Cell & Gene Therapy, Drug Discovery), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-692-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Culture Supplements Market Summary

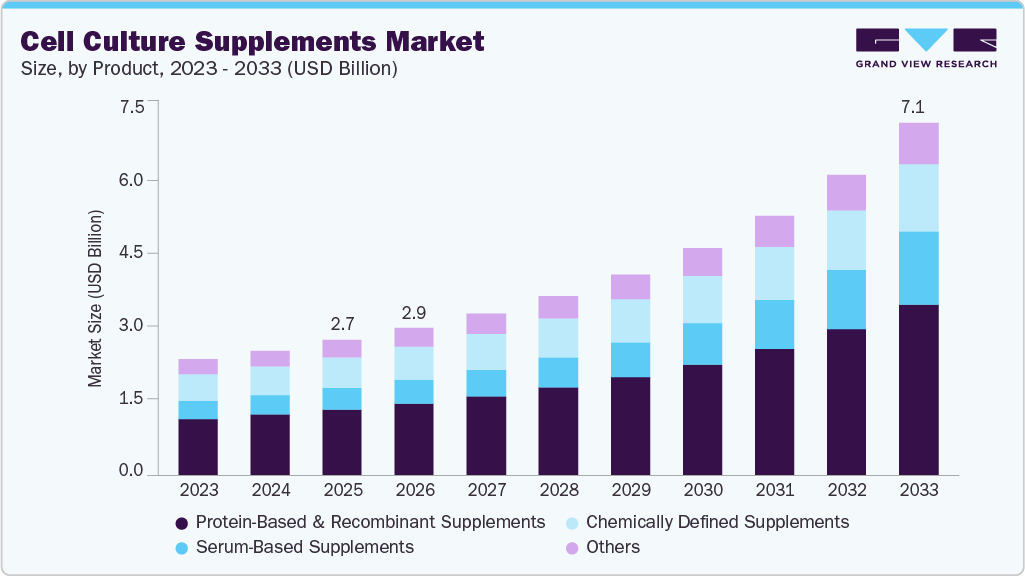

The global cell culture supplements market size was estimated at USD 2.53 billion in 2024 and is projected to reach USD 7.14 billion by 2033, growing at a CAGR of 12.74% from 2025 to 2033. This growth is driven by increasing demand for biopharmaceuticals, advancements in cell culture technology, and the rising focus on personalized medicine and regenerative therapies.

Key Market Trends & Insights

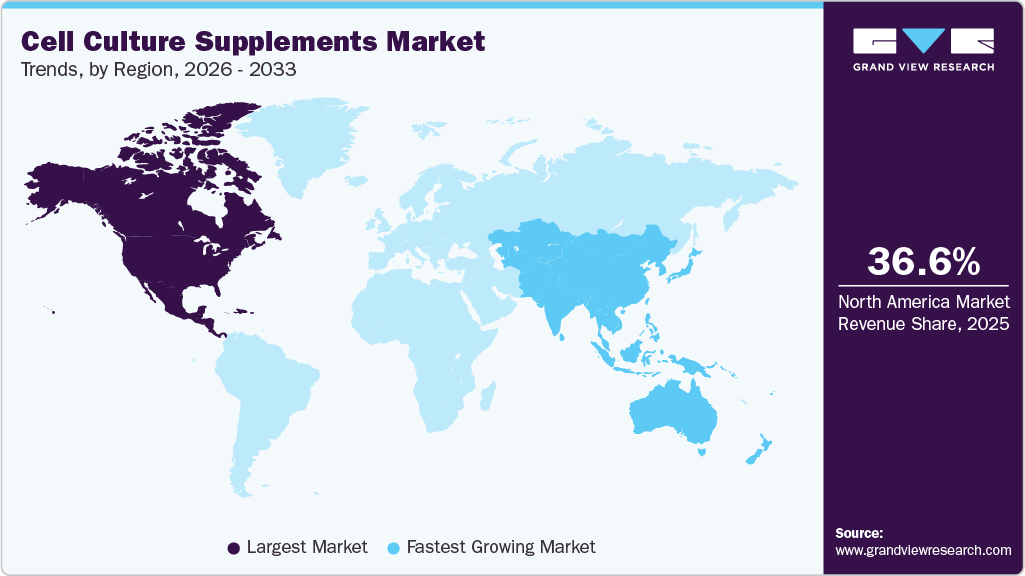

- The North America cell culture supplements market held the largest share of 36.54% of the global market in 2024.

- The cell culture supplements industry in the U.S. is expected to grow at the fastest CAGR over the forecast period.

- By product, the protein-based & recombinant supplements segment held the highest market share of 42.50% in 2024.

- Based on application, the biopharmaceutical manufacturing segment held the highest market share in 2024.

- By end use, the pharmaceutical & biotechnology companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.53 Billion

- 2033 Projected Market Size: USD 7.14 Billion

- CAGR (2025-2033): 12.74%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in 3D Cell Culture and Organoid ModelsThe growing adoption of 3D cell culture systems and organoid technologies significantly drives market demand for global cell culture supplements. Unlike conventional 2D cultures, 3D models accurately represent in vivo cellular environments, allowing researchers to study complex biological processes such as tissue development, cancer metastasis, and drug responses better. Organoids, in particular, have become vital tools in regenerative medicine and disease modeling, as they replicate the architecture and function of real human organs. For instance, a study published in Scientific Reports in July 2025 detailed the advancements in organoid-based models for infectious disease research. These 3D cell culture systems, derived from stem cells, offer more physiologically relevant human organ simulations than traditional 2D cultures. The study underscores the potential of organoid technology to accelerate drug discovery and reduce reliance on animal models. These advanced models require highly specific culture conditions and specialized supplements, including growth factors, extracellular matrix proteins, and defined media components to support cell differentiation, viability, and function.

Pharmaceutical companies, biotech firms, and academic institutions increasingly turn to these innovative models to improve drug discovery efficiency and reduce dependence on animal testing. As a result, the demand for cell culture supplements tailored to complex systems like 3D cultures and organoids is expected to grow significantly, reinforcing the segment’s position as a critical enabler of next-generation biomedical research and therapeutic development.

Rapid Growth in Regenerative Medicine and Stem Cell Research

The expanding regenerative medicine and stem cell research field is a major driver boosting the global cell culture supplements industry. Regenerative medicine focuses on repairing or replacing damaged tissues and organs by harnessing the body’s healing mechanisms, often through stem cell-based therapies. Stem cells possess the unique ability to self-renew and differentiate into multiple cell types, making them invaluable for treating various conditions, including neurodegenerative diseases, cardiovascular disorders, and injuries. For instance, a clinical trial reported in The New England Journal of Medicine in June 2025 announced a significant advancement in type 1 diabetes treatment. Their study demonstrated that a single infusion of lab-grown pancreatic islet cells enabled patients to produce sufficient insulin independently. Within a year, 10 out of 12 participants no longer required supplemental insulin, marking a potential paradigm shift in diabetes management. Culturing these delicate stem cells requires highly specialized supplements that maintain their pluripotency or multipotency. These supplements provide essential nutrients, growth factors, cytokines, and signaling molecules that promote cell proliferation, viability, and controlled differentiation.

The surge in clinical trials and increasing regulatory approvals of stem cell therapies worldwide are accelerating the demand for reliable and scalable cell culture systems. Tissue engineering and personalized medicine approaches rely heavily on optimized cell culture conditions supported by advanced supplements. This trend is expected to sustain strong growth in the market, as supplements play a crucial role in ensuring the success and safety of emerging regenerative treatments and stem cell applications.

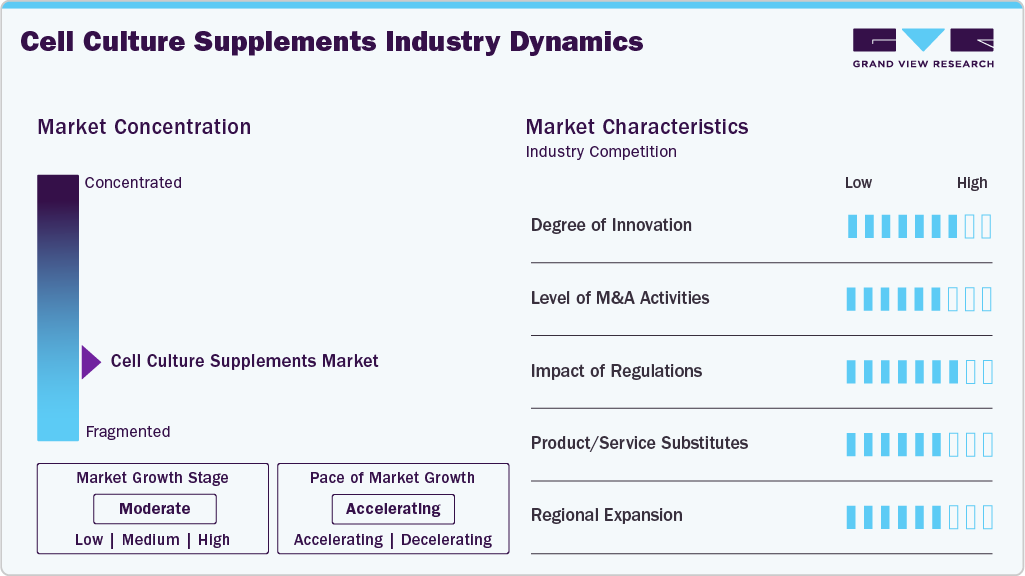

Market Concentration & Characteristics

The degree of innovation in the cell culture supplements industry is significant, driven by the need for safer, more consistent, and ethically sourced products. Innovations such as chemically defined, serum-free and animal-free supplements have transformed traditional cell culture processes by reducing contamination risks and improving reproducibility. For instance, in May 2025, PL BioScience, a German life sciences company, announced the first-ever production of an artificial human platelet lysate (HPL). This innovation utilizes lab-grown platelets to create a scalable, animal-free cell culture supplement. The new HPL offers a sustainable alternative to fetal bovine serum and donor-derived HPL, enhancing cell performance and safety for regenerative medicine and biopharmaceutical applications. These cutting-edge developments enable more precise control over cell growth and differentiation, fueling progress in regenerative medicine, drug discovery, and personalized treatments, and positioning the market for robust future growth.

The level of mergers and acquisitions (M&A) activity in the cell culture supplements industry has been moderately high in recent years, reflecting a growing interest from major pharmaceutical, biotechnology, and life sciences companies seeking to expand their portfolios and strengthen their cell-based research and therapeutics capabilities. This consolidation trend is driven by the increasing demand for high-quality, scalable, and regulatory-compliant products to support biologics manufacturing, regenerative medicine, and stem cell research. As the market matures and competition intensifies, M&A activity is expected to remain active, with companies aiming to enhance their technological edge and global market reach.

Regulations significantly impact the cell culture supplements industry, shaping product development, quality standards, and commercialization pathways. Regulatory bodies such as the FDA, EMA, and other global authorities mandate stringent quality, safety, and traceability requirements, particularly for supplements used in clinical and therapeutic applications. This has led to a growing shift toward chemically defined, animal-free, and GMP-compliant formulations to meet regulatory expectations and minimize the risk of contamination or variability. Moreover, evolving regulations around stem cell therapies, biologics, and personalized medicine further influence the demand for high-purity and consistent supplements, reinforcing the importance of regulatory alignment for sustained market success.

Service expansion is playing a critical role in the growth of the cell culture supplements industry, as companies increasingly diversify their offerings beyond just product supply. Leading players are expanding into custom media formulation, technical consulting, process optimization, and cell line development support to meet the complex and evolving needs of pharmaceutical, biotech, and research clients. This shift toward integrated services enables end uses to streamline workflows, improve reproducibility, and accelerate development timelines, especially in biopharmaceutical production and regenerative medicine. As demand for specialized cell culture solutions grows, service expansion is becoming a key differentiator and a driver of long-term client retention.

Regional expansion is a key growth strategy in the cell culture supplements industry, as companies aim to tap into emerging markets and strengthen their global presence. Rapid advancements in biotechnology, increased government funding for life sciences research, and a growing biopharmaceutical industry in regions such as Asia-Pacific, Latin America, and the Middle East are driving demand for high-quality cell culture products. Major players are investing in local manufacturing facilities, distribution networks, and partnerships with regional research institutes and biotech firms to capitalize on these opportunities. For instance, countries like China, India, and South Korea are becoming hubs for biologics and stem cell research, prompting suppliers to expand their footprint to meet local regulatory and production needs. Regional expansion not only enhances market accessibility and customer responsiveness but also helps companies mitigate supply chain disruptions and navigate region-specific compliance requirements.

Product Insights

Protein-based & recombinant supplements dominated the market, with the largest revenue share of 42.50% in 2024. This growth is driven by the increasing demand for high-performance, defined supplements that offer consistency, safety, and scalability, especially in biopharmaceutical manufacturing and regenerative medicine. Recombinant proteins, such as insulin, transferrin, and growth factors, are favored for their ability to reduce variability and eliminate the risks associated with animal-derived components, aligning with the industry's shift toward chemically defined and animal-free culture systems. For instance, in January 2024, Core Biogenesis partnered with Nucleus Biologics in the U.S. to supply GMP plant-derived proteins, launching thermostable FGF-2 for cell and gene therapy media systems, further driving the segment growth.

Chemically defined supplements are expected to grow at the fastest CAGR from 2025 to 2033. This rapid growth is driven by increasing demand for reproducible, animal-component-free media formulations that minimize variability and support regulatory compliance in biopharmaceutical production. Advances in cell culture technology and rising preference for sustainable and ethically sourced products further accelerate the adoption of chemically defined supplements across research and commercial applications.

Application Insights

The biopharmaceutical manufacturing segment led the market in 2024, accounting for the largest revenue share of 48.70%. This leadership is driven by the expanding production of monoclonal antibodies, vaccines, and recombinant proteins, which require optimized cell culture environments for high yield and quality. The increasing demand for biologics, coupled with advancements in bioprocessing technologies, continues to fuel the growth of this segment within the market.

The cell & gene therapy segment is expected to grow at the fastest CAGR over the forecast period, driven by rising investments in advanced therapies, increasing prevalence of genetic disorders and cancers, and the growing adoption of personalized medicine. Moreover, advancements in cell culture technologies and regulatory support for innovative therapeutics are accelerating the demand for specialized supplements that enhance the efficacy and safety of cell and gene therapy products.

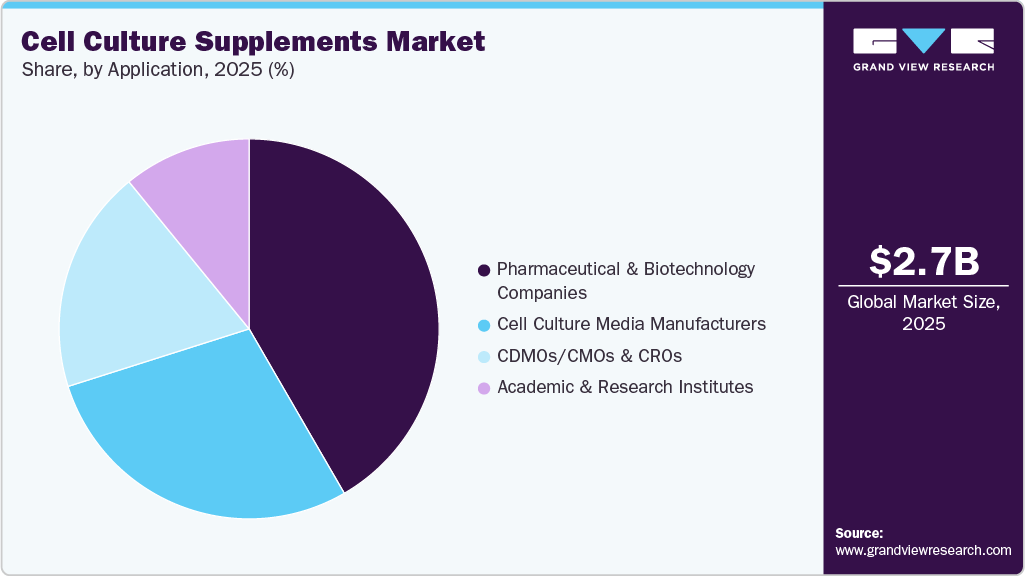

End Use Insights

Based on end use, the pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 41.58% in 2024, driven by increasing investments in biopharmaceutical research and development, rising demand for biologics and personalized medicines, and expanding manufacturing capacities. The growing focus on innovative therapies and streamlined production processes has further bolstered the adoption of advanced cell culture supplements within this segment.

The CDMOs/ CMOs & CROs segment is projected to grow at the fastest CAGR during the forecast period, driven by pharmaceutical and biotechnology companies' increasing outsourcing of drug development and manufacturing activities. This trend is fueled by the need to reduce operational costs, accelerate time-to-market, and leverage the specialized expertise offered by contract service providers. Moreover, the expanding pipeline of biologics and advanced therapies is boosting demand for high-quality cell culture supplements within this segment.

Regional Insights

North America cell culture supplements industry dominated globally with the largest revenue share of 36.54% in 2024, owing to a well-established biopharmaceutical industry, advanced research infrastructure, and strong government and private funding for life sciences and biomedical research. The region benefits from a high concentration of pharmaceutical and biotechnology companies, leading academic institutions, and contract research organizations (CROs), all contributing to high demand for reliable and high-quality cell culture supplements.

U.S Cell Culture Supplements Market Trends

The cell culture supplements industry in the U.S. is expected to grow at the fastest CAGR over the forecast period, driven by the country’s strong emphasis on biomedical research, cutting-edge biotechnology advancements, and increasing investments in regenerative medicine and biologics production. The growing prevalence of chronic diseases, rising demand for cell-based therapies, and the expanding pipeline of biopharmaceuticals further accelerate the need for high-performance, scalable cell culture solutions.

Europe Cell Culture Supplements Market Trends

The cell culture supplements industry in Europe is expected to grow significantly over the forecast period, supported by strong government funding for life sciences research, a growing biopharmaceutical sector, and increasing focus on advanced therapies such as stem cell and gene therapy. The region is also witnessing a shift toward animal-free and chemically defined supplements, aligning with strict regulatory and ethical standards. This, combined with increased R&D activity and public-private partnerships, is expected to drive substantial demand for high-quality cell culture supplements across the region.

The UK cell culture supplements industry is expected to grow significantly over the forecast period. The presence of leading academic institutions, research organizations, and a dynamic biotech sector supports robust demand for high-quality cell culture products. Moreover, government initiatives like the UK Life Sciences Vision and funding from agencies like Innovate UK are fostering research in regenerative medicine, personalized therapies, and biologics development. The UK is also a hub for early-stage clinical trials, particularly in stem cell and gene therapy, further boosting the need for reliable and specialized culture supplements. This growth is reinforced by the country's push for ethical and sustainable science, with rising interest in serum-free and chemically defined media.

The cell culture supplements industry in Germany is expected to grow at a substantial CAGR over the forecast period, driven by the supportive government policies and funding initiatives to foster innovation and accelerate drug development, further propelling market growth in the cell culture supplements industry.

Asia Pacific Cell Culture Supplements Market Trends

The cell culture supplements industry in Asia Pacific is anticipated to witness the fastest CAGR of 14.97% throughout the forecast period. The expanding pharmaceutical industry, rising prevalence of chronic diseases, and increasing adoption of personalized medicine fuel demand for high-quality cell culture supplements. The region’s cost advantages and growing collaborations between local and global companies also contribute to its position as the fastest-growing market globally.

The cell culture supplements industry in China is expected to grow at a significant CAGR over the forecast period. China’s large patient population and increasing demand for advanced therapeutics, coupled with the establishment of numerous research institutions and biopharmaceutical companies, fuel market growth.

The Japan cell culture supplements industry is anticipated to grow significantly over the forecast period. Increasing demand for high-quality, animal-free, chemically defined supplements supporting complex cell culture applications also contributes to market growth. Moreover, Japan’s aging population and rising prevalence of chronic diseases are accelerating the development of novel cell-based treatments, further boosting the need for reliable and efficient cell culture supplements.

MEA Cell Culture Supplements Market Trends

The cell culture supplements industry in the Middle East and Africa is projected to grow significantly during the forecast period. This is driven by increasing awareness of advanced therapeutic approaches, such as regenerative medicine and stem cell therapies, coupled with government initiatives to enhance research capabilities, which are fueling market expansion.

The cell culture supplements industry in Kuwait is poised for growth, driven by the country's strategic initiatives to diversify its economy and enhance its life sciences infrastructure, fostering innovation in regenerative medicine and cell-based therapies.

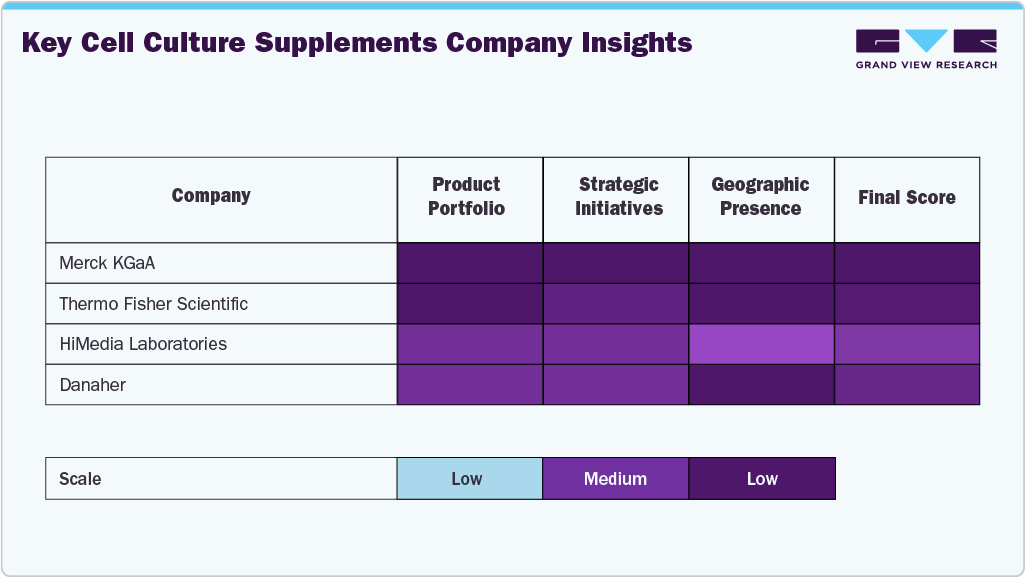

Key Cell Culture Supplements Company Insights

The cell culture supplements industry is dominated by several established players who maintain leadership through extensive product portfolios, strategic collaborations, and continuous investments in research and development. Key companies such as Merck KGaA, Thermo Fisher Scientific, HiMedia Laboratories, Danaher, among others hold significant market share owing to their advanced supplement formulations, broad application coverage, and robust global distribution networks.

Emerging and mid-sized players are expanding their footprint by providing innovative, customizable, and application-specific cell culture supplement solutions tailored to the diverse needs of pharmaceutical manufacturers, biotechnology companies, and academic research institutions. These firms focus on delivering serum-free, chemically defined, and animal component-free supplements that meet stringent regulatory standards and support complex cell culture systems, including stem cells, organoids, and 3D cultures.

Market leaders continue reinforcing their dominance by combining cutting-edge technological advancements with comprehensive service offerings and strategic growth initiatives such as acquisitions and partnerships. Their ability to address the increasing demand for high-quality, reproducible, and scalable supplements in areas like regenerative medicine, biopharmaceutical production, and personalized therapies has solidified their positions at the forefront of the industry. As demand for cell-based therapies, biologics, and advanced research tools continues to grow, the market’s future will be shaped by commitments to product innovation, regulatory compliance, and sustainable manufacturing practices.

The cell culture supplements industry is witnessing a dynamic interplay between established giants and innovative challengers. Strategic mergers and acquisitions, alliances, and breakthroughs in supplement formulations and production efficiency are intensifying competition. Companies that effectively integrate scientific expertise with tailored, customer-centric solutions are poised to generate sustained value and drive growth in this rapidly evolving sector.

Key Cell Culture Supplements Companies:

The following are the leading companies in the cell culture supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Thermo Fisher Scientific Inc.

- HiMedia Laboratories

- Danaher

- Sartorius AG

- Corning Inc.

- R&D Systems (Bio-Techne)

- STEMCELL Technologies

- Repligen Corporation

- Proteintech Group, Inc

Recent Developments

-

In April 2025, RoosterBio partnered with Thermo Fisher (USA) to enhance cell and exosome therapy manufacturing. The deal strengthens their position in the growing cell culture supplements industry with scalable, GMP-compliant solutions.

-

In December 2024, Merck KGaA’s U.S. unit, MilliporeSigma, acquired HUB Organoids (Netherlands) to expand its 3D cell model capabilities. This move supports the growing cell culture supplements industry by boosting demand for advanced media formulations tailored to organoid and 3D cultures critical for drug discovery and reducing animal use in preclinical testing.

Cell Culture Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.74 billion

Revenue forecast in 2033

USD 7.14 billion

Growth rate

CAGR of 12.74% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Merck KGaA; Thermo Fisher Scientific Inc.; HiMedia Laboratories; Danaher; Sartorius AG; Corning Inc.; R&D Systems (Bio-Techne); STEMCELL Technologies; Repligen Corporation; Proteintech Group, Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Culture Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global cell culture supplements market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Serum-based Supplements

-

Protein-based & Recombinant Supplements

-

Chemically Defined Supplements

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical Manufacturing

-

Cell & Gene Therapy

-

Drug Discovery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Culture Media Manufacturers

-

Pharmaceutical & Biotechnology Companies

-

CDMOs/ CMOs & CROs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell culture supplements market size was estimated at USD 2.53 billion in 2024 and is expected to reach USD 2.74 billion in 2025.

b. The global cell culture supplements market is expected to grow at a compound annual growth rate of 12.74% from 2025 to 2033 to reach USD 7.14 billion by 2033.

b. North America dominated the cell culture supplements market with the largest revenue share of 36.54% in 2024, owing to a well-established biopharmaceutical industry, advanced research infrastructure, and strong government and private funding for life sciences and biomedical research.

b. Some key players operating in the cell culture supplements market include Merck KGaA; Thermo Fisher Scientific Inc.; HiMedia Laboratories; Danaher; Sartorius AG; Corning Inc.; R&D Systems (Bio-Techne); STEMCELL Technologies; Repligen Corporation; Proteintech Group, Inc.

b. The increasing demand for biologics, coupled with advancements in bioprocessing technologies, and others, continues to fuel the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.