- Home

- »

- Advanced Interior Materials

- »

-

Copper Alloys For Connector Market, Industry Report, 2033GVR Report cover

![Copper Alloys For Connector Market Size, Share & Trends Report]()

Copper Alloys For Connector Market (2025 - 2033) Size, Share & Trends Analysis Report By Alloy Type (High-Conductivity Copper Alloys, Beryllium Copper Alloys), By End-use (Telecommunications & Data Centers, Medical Equipment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-672-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Copper Alloys For Connector Market Summary

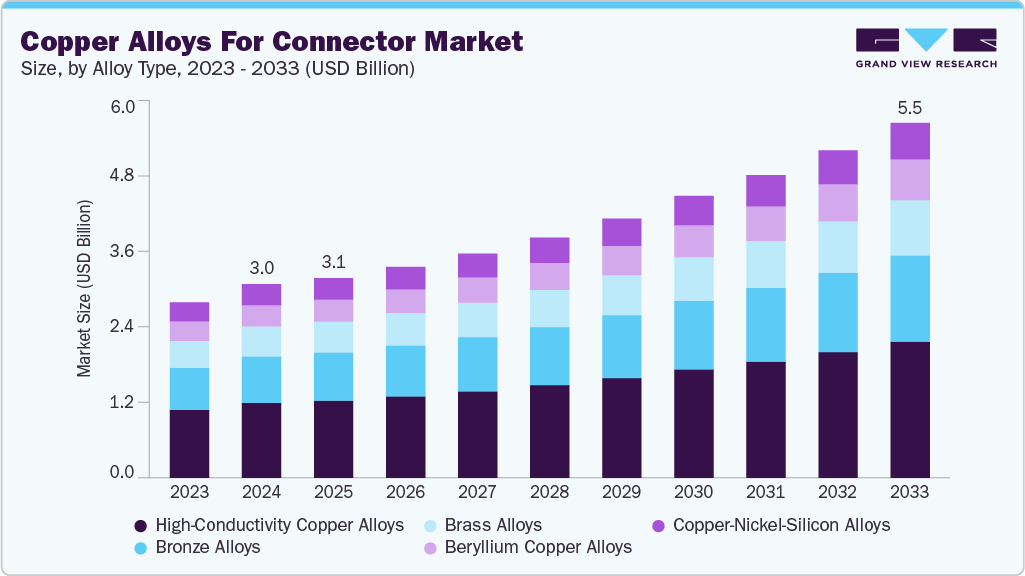

The global copper alloys for connector market size was estimated at USD 3.02 billion in 2024 and is projected to reach USD 5.54 billion by 2033, growing at a CAGR of 7.4% from 2025 to 2033. The market's growth is propelled by the rapid expansion of the electronics and electrical industry, especially in Asia Pacific and North America.

Key Market Trends & Insights

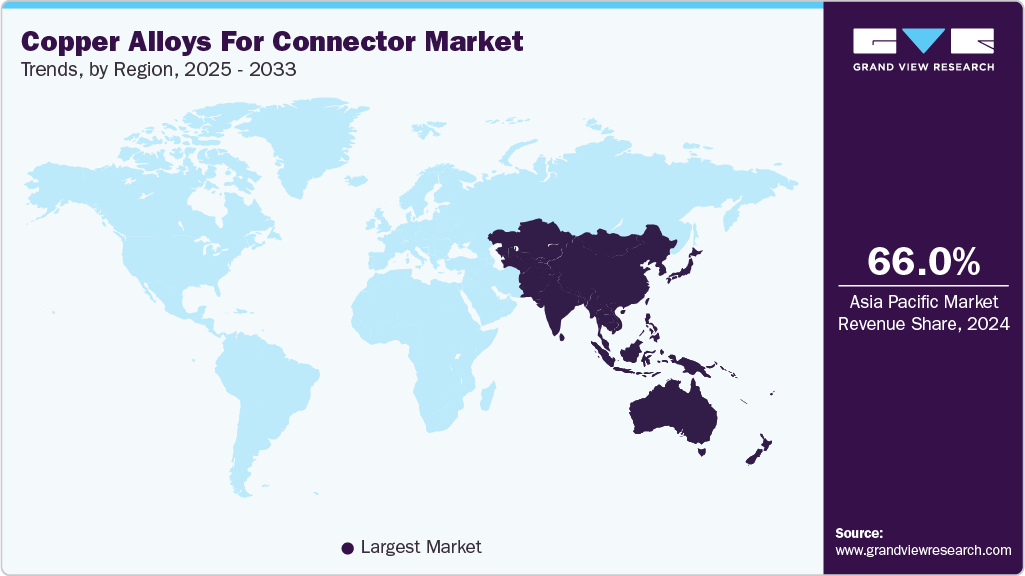

- Asia Pacific dominated the copper alloys for connector market with the largest revenue share of 66.0% in 2024.

- Copper alloys for connector market in the U.S. is expected to grow at a substantial CAGR of 6.8% from 2025 to 2033.

- By alloy type, high-conductivity copper alloys accounted for the largest market revenue share of over 38.7% in 2024.

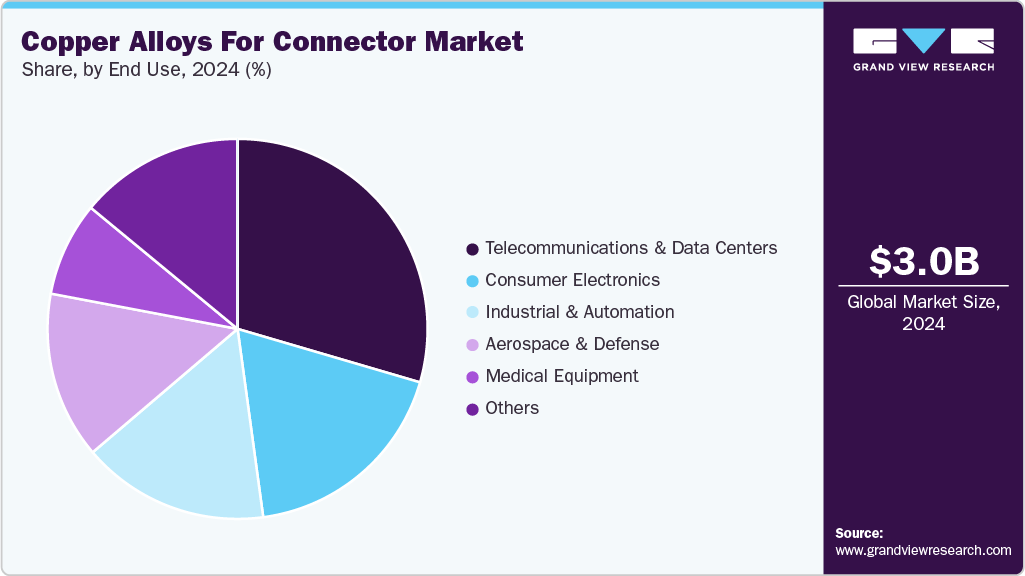

- By end use, the telecommunications & data centers segment held the revenue share of 29.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.02 Billion

- 2033 Projected Market Size: USD 5.54 Billion

- CAGR (2025-2033): 7.4%

- Asia Pacific: Largest market in 2024

The proliferation of smartphones, tablets, wearable devices, and smart appliances has significantly boosted the demand for miniature, high-performance connectors. Copper alloys are preferred in these applications due to their superior electrical conductivity, thermal stability, and mechanical resilience. As consumer electronics evolve toward smaller and more powerful designs, the need for compact, efficient connectors made from advanced copper alloys will continue to rise.The EV ecosystem demands a robust electrical architecture with highly reliable connectors for battery systems, charging infrastructure, and powertrain components. Alloys such as beryllium copper and copper-nickel-silicon offer the performance and durability required in these high-stress applications. With governments offering incentives and implementing regulations to accelerate EV adoption, the demand for connector-grade materials is expected to grow rapidly in the automotive segment.

The ongoing development of renewable energy infrastructure, especially solar and wind power, also catalyzes market growth. These systems rely heavily on electrical connectivity for energy transmission, conversion, and storage. Copper-based alloys provide corrosion resistance and electrical efficiency for harsh outdoor environments. Additionally, the growth of smart grids and energy-efficient buildings leads to increased deployment of sophisticated connectors and terminals, further boosting demand.

Technological advancements in telecommunication networks, including the global rollout of 5G and the expansion of data centers, are further contributing to market expansion. These applications require connectors with high-frequency performance, low signal loss, and excellent durability. Alloys such as phosphor bronze and copper-tin are widely used in high-speed data connectors, RF components, and fiber optics. The need for consistent signal integrity in high-bandwidth systems reinforces the demand for premium-grade materials.

Lastly, industrial automation and robotics are emerging as important growth drivers for the copper alloys for connector industry. As manufacturing facilities transition to Industry 4.0 and deploy more automated machinery, the need for reliable electrical connectors increases substantially. These environments demand components that can withstand vibration, wear, and high operating temperatures-characteristics well-matched by advanced copper alloys. As automation and smart manufacturing trends continue to reshape industrial operations, the market is set to benefit from robust long-term demand.

Drivers, Opportunities & Restraints

The copper alloys for the connector market’s growth is primarily driven by the rising demand for high-performance and miniaturized electronic devices across sectors such as automotive, consumer electronics, and industrial automation. These alloys offer superior conductivity, thermal resistance, and mechanical strength, making them ideal for connectors that withstand high temperatures and electrical loads. Additionally, the increasing penetration of electric vehicles (EVs) and the growing shift toward renewable energy infrastructure are creating a surge in the demand for reliable, durable connectors, further fueling the need for specialized copper alloys.

Significant growth opportunities lie in the ongoing technological advancements in 5G communication, Internet of Things (IoT), and data centers, which require robust high-frequency connectors. Emerging markets, especially in Asia-Pacific and the Middle East & Africa, are witnessing increased infrastructure investments and industrial automation, creating a favorable environment for copper alloy connector adoption. Moreover, the trend toward lightweight and energy-efficient materials in the aerospace and defense sectors opens avenues for developing novel copper-based alloys with enhanced performance characteristics.

Despite its promising outlook, the market faces certain restraints. Fluctuating raw material prices, particularly copper and alloying metals like beryllium and nickel, can significantly impact production costs and pricing strategies. Environmental regulations and health concerns regarding using certain alloying elements, such as beryllium, may also limit material selection and usage. Additionally, competition from alternative materials like aluminum or conductive polymers in low-cost applications may restrain market penetration in price-sensitive segments.

Alloy Type Insights

The high-conductivity copper alloys segment held the largest revenue share of 38.7% in 2024. High-conductivity copper alloys are gaining attention from various industries as demand for faster data transmission and miniaturized electronics exhibits significant growth. Copper alloy-based connectors offer an ideal balance of electrical performance, mechanical strength, and corrosion resistance, while serving numerous industries, including automotive, telecom, and consumer electronics. The significant pace of digital transformation, growing automation, and rising demand for electrical components, such as power connectors, terminals, and busbars, across industries are expected to support the growth of this segment.

The copper-nickel-silicon alloys segment is anticipated to register the fastest CAGR over the forecast period, as manufacturers seek materials that combine high strength, high thermal dissipation, and good conductivity. These alloys offer excellent stress relaxation, corrosion resistance, and fatigue strength. They are ideal for high-density, high-reliability connectors in electric vehicles, telecom infrastructure, industrial automation, and aerospace systems. CuNiSi alloys are preferred for their ability to maintain contact force and signal performance in compact, high-temperature environments.

End Use Insights

The telecommunications & data centers segment held the revenue share of 29.5% in 2024. The growing demand for sophisticated technology-powered networks and high-performance, high-speed data transfer has resulted in various changes in the telecommunications industry. The increasing global penetration of smartphone devices and appliances compatible with IoT and smart technology has created a need for reliable, high-performance connectors across sectors. For instance, in July 2025, Alibaba Cloud announced its new data centers in Malaysia and the Philippines to meet the growing demand for cloud services. It already has two data centers in Malaysia. It also announced the launch of the AI Global Competency Center (AIGCC) in Singapore. Such developments are expected to support segment growth over the forecast period.

The medical equipment segment is anticipated to grow significantly over the forecast period. The growing adoption of various medical devices, driven by advances in healthcare technology and the focus of healthcare systems on improved patient outcomes, is contributing to the rising demand for copper alloy-based connectors. Materials used in manufacturing medical devices in critical categories, such as implantable, are of greater significance. Biocompatibility and longevity of these materials play a crucial role in such cases. Copper alloys are recognized for their superior electrical conductivity, strong mechanical durability, and natural antimicrobial effects that reduce microbial transmission, making them a preferred choice for medical devices.

Regional Insights

Asia Pacific led the market with the largest revenue share of 66.0% in 2024. Asia Pacific is a major regional market in the global copper alloys for connector industry. The regional growth is driven by significant pace of industry transition to digitization and automation, rising adoption of digital technologies by customers and businesses, and presence of multiple manufacturing industry participants from sectors such as automotive, chemical & materials, electronics, household appliances, and consumer goods. Countries such as China, Japan, South Korea, and India play a vital role in expanding the application scope of copper alloys. According to the U.S. International Trade Commission, EV exports from China to the U.S. increased approximately 1,016% from 2018 to 2023, with nearly 1.6 million EVs exported in 2023. Such developments are projected to influence this market and generate greater opportunities for the copper alloys industry.

North America Copper Alloys For Connector Market Trends

The North America copper alloys for connector industry experienced substantial growth, primarily driven by increasing electrification and digitalization across several industries. The rise of EVs and ongoing advancements in aerospace, defense, and data center infrastructure significantly boost demand for connectors made from copper alloys. These materials offer excellent electrical conductivity, thermal stability, and durability, essential for managing high power loads and ensuring reliable signal transmission in demanding applications. As these sectors push for higher performance and miniaturization, copper alloys remain critical.

The U.S. copper alloys for connector industry’s growth is fueled by growing electrification and adoption of renewable energy adoption. The excellent conductivity of copper drives demand from industries, such as industrial automation, telecommunication, consumer electronics, and aerospace & defense. Advances in alloy technology enhance the mechanical strength and corrosion resistance of copper alloys, broadening their scope of application across the aerospace, automotive, and electronics industries.

Europe Copper Alloys For Connector Market Trends

Europe is one of the key regions in the global copper alloys for connector industry. A strong manufacturing sector operating across countries such as Germany, France, the UK, and others facilitates the growth of this market. In recent years, the EU has increased its focus on becoming carbon neutral and reducing 90.0% of its greenhouse gas emissions by 2050. Such initiatives by governing authorities stimulate industries and organizations to embrace digitalization and electrification, leading to a growing demand for copper alloy-based connectors.

Latin America Copper Alloys For Connector Market Trends

Latin America is the most significant region for raw materials supply in the copper alloys for connector industry, as about 65.0% of identified copper that is yet to be unearthed is found in just five key countries, including Chile and Peru. According to the U.S. Geological Survey, Mineral Commodity Summaries published in January 2025, Chile's estimated copper mine production in 2024 was 5,300 thousand metric tons, which accounted for nearly 23.0% of the global estimated copper mine production of 23,000 thousand metric tons.

Middle East & Africa Copper Alloys For Connector Market Trends

The Middle East & Africa region is starting to embrace copper alloys for connectors, driven by growing investments in infrastructure development, expanding telecommunications networks, and the rising adoption of electric vehicles and renewable energy systems that require reliable and efficient electrical connectivity solutions. Countries such as Zambia and Congo (Kinshasa) play a notable role in raw material and supply chain efficiencies of this market. According to the U.S. Geological Survey, Mineral Commodity Summaries, January 2025, the estimated copper mine production of Congo (Kinshasa) in 2024 was 3,300 thousand metric tons, and it was 680 thousand metric tons for Zambia.

Key Copper Alloys For Connector Company Insights

Some of the key players operating in the market include AMPCO METAL, KME Group, and others

-

AMPCO METAL is a global engineering materials provider renowned for its advanced alloy solutions. It caters to a broad spectrum of high-performance industries, such as aerospace, automotive, defense, marine, oil and gas, and electronics. The company stands out for its deep metallurgical expertise and consistent commitment to innovation in non-ferrous metals. AMPCO METAL's research-driven approach enables it to develop tailored alloys that meet stringent operational demands, such as high conductivity, corrosion resistance, and mechanical strength under extreme conditions.

-

KME Group is a global manufacturer of copper and copper-alloy semi-finished products recognized for its extensive metallurgical know-how and innovation-driven approach. As one of the world’s largest producers, the company fabricates rolled products, tubes, bars, cables, and custom-engineered components using advanced alloys. With a network of state‑of‑the‑art production plants across Europe and China, KME delivers tailored solutions for diverse industries, ranging from architecture and plumbing to electronics, automotive, and energy sectors.

Key Copper Alloys For Connector Companies:

The following are the leading companies in the copper alloys for connector market. These companies collectively hold the largest market share and dictate industry trends.

- AMPCO METAL

- KME Group

- Lebronze Alloys

- Materion Corporation

- Mitsubishi Materials Corporation

- Nexans

- NGK INSULATORS, LTD.

- Proterial, Ltd.

- thyssenkrupp Materials Services GmbH

- Wieland Group

Recent Development

-

In March 2025, Lebronze alloys has acquired two companies, Allied Copper Alloys (ACA) and AW Fraser, as a significant move in its growth strategy. This acquisition aims to enhance Lebronze alloys' global expansion, improve production and service capabilities, and strengthen its position in the specialty alloys market.

-

In December 2024, AMPCO METAL acquired Schmelzmetall Group, a Swiss-based producer of high-performance copper alloys. This acquisition, finalized in October 2024, marks a significant milestone for both companies, enabling them to combine their technological expertise and product portfolios. The integration expands AMPCO METAL's offerings to include Schmelzmetall's specialized copper alloys, such as Beryllium-containing powders and other high-purity materials, which are highly valued in aerospace, defense, additive manufacturing, and other advanced sectors.

Copper Alloys For Connector Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.12 billion

Revenue forecast in 2033

USD 5.54 billion

Growth rate

CAGR of 7.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

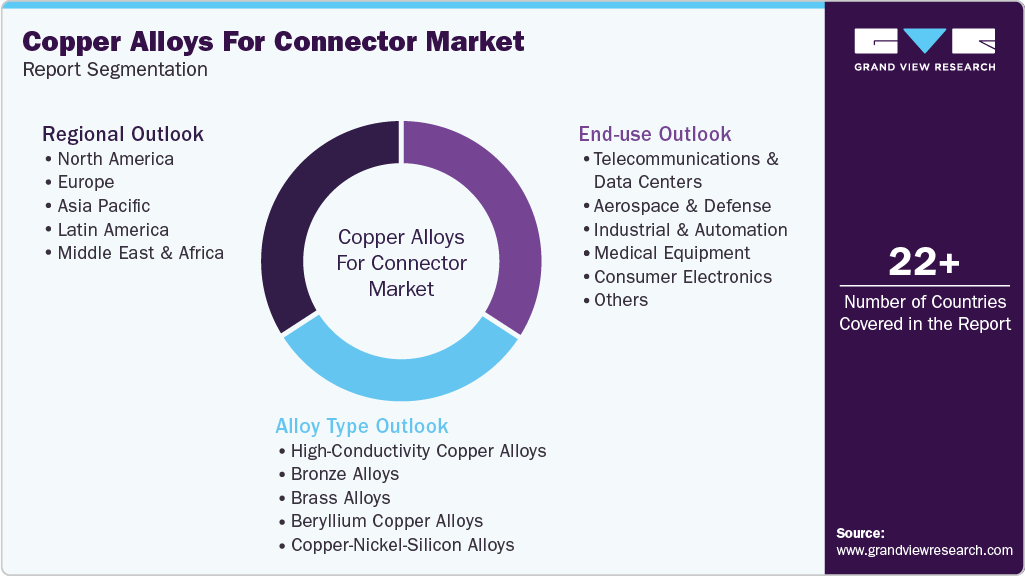

Segments covered

Alloy type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Brazil

Key companies profiled

AMPCO METAL; KME Group; Lebronze Alloys; Materion Corporation; Mitsubishi Materials Corporation; Nexans; NGK INSULATORS, LTD.; Proterial, Ltd.; thyssenkrupp Materials Services GmbH; Wieland Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Copper Alloys For Connector Market Report Segmentation

This report forecasts volume & revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global copper alloys for connector market report based on alloy type, end use, and region:

-

Alloy Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

High-Conductivity Copper Alloys

-

Bronze Alloys

-

Brass Alloys

-

Beryllium Copper Alloys

-

Copper-Nickel-Silicon Alloys

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Telecommunications & Data Centers

-

Aerospace & Defense

-

Industrial & Automation

-

Medical Equipment

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

South Korea

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global copper alloys for connector market size was estimated at USD 3.02 billion in 2024 and is expected to reach USD 3.12 billion in 2025.

b. The global copper alloys for connector market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2033 to reach USD 5.54 billion by 2033.

b. The high-conductivity copper alloys segment dominated the market with a revenue share of 38.7% in 2024.

b. Some of the key players of the global copper alloys for connector market are AMPCO METAL, KME Group, Lebronze Alloys, Materion Corporation, Mitsubishi Materials Corporation, Nexans, NGK INSULATORS, LTD., Proterial, Ltd., thyssenkrupp Materials Services GmbH, Wieland Group, and others.

b. The key factor driving the growth of the global copper alloys for connector market is the increasing demand for high-performance electrical and electronic components that require materials with excellent conductivity, strength, and corrosion resistance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.