- Home

- »

- Next Generation Technologies

- »

-

Crypto Asset Management Market Size & Share Report, 2030GVR Report cover

![Crypto Asset Management Market Size, Share & Trends Report]()

Crypto Asset Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Custodian Solution, Wallet Management), By Deployment, By Application, By Operating System, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-365-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crypto Asset Management Market Summary

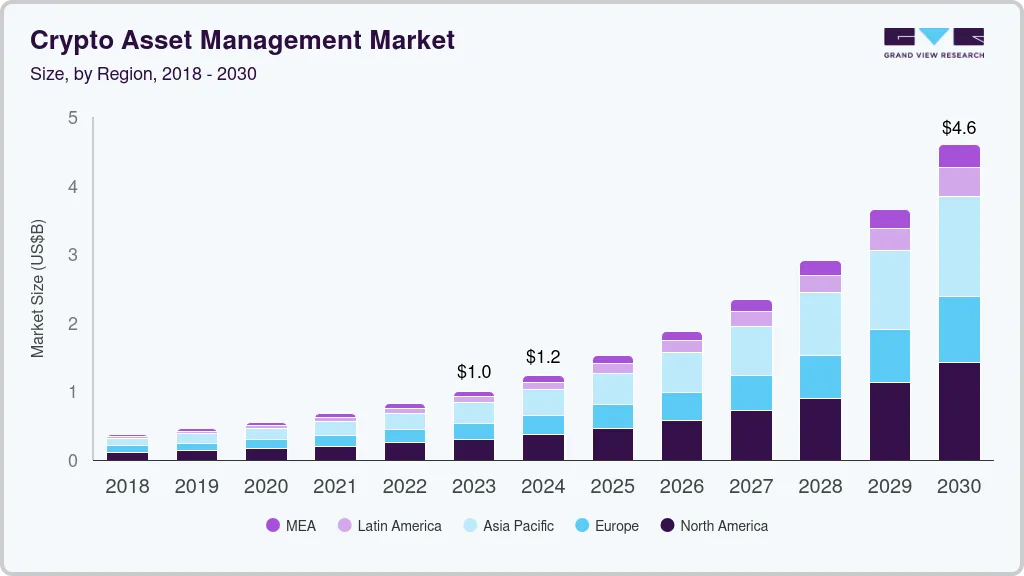

The global crypto asset management market size was estimated at USD 1,001.5 million in 2023 and is projected to reach USD 4,594.2 million by 2030, growing at a CAGR of 24.6% from 2024 to 2030. The proliferation of blockchain technology is a significant driver for the growth of the market. As blockchain technology becomes more widely adopted, its applications extend beyond just cryptocurrencies to various industries, including finance, supply chain, healthcare, and more.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, custodian solution accounted for a revenue share of over 62% in 2023.

- Custodian Solution is the most lucrative solution segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,001.5 Million

- 2030 Projected Market Size: USD 4,594.2 Million

- CAGR (2024-2030): 24.6%

- North America: Largest market in 2023

This widespread adoption underscores the importance of managing digital assets securely and efficiently. Innovations in blockchain technology also enhance the security, transparency, and functionality of crypto assets, making them more attractive to investors. Consequently, the growing reliance on blockchain technology boosts demand for advanced asset management solutions to handle the increasing volume and complexity of digital assets.

The increased involvement of institutional crypto investors is a major catalyst for the expansion of the market. Large financial institutions are beginning to include crypto-assets in their portfolios, which significantly boosts the total amount of assets under management. This shift not only validates the credibility and potential of cryptocurrencies but also elevates the standards and requirements for the professional management of these assets. Institutions seek robust, secure, and compliant management solutions to meet their rigorous investment criteria and regulatory obligations. As a result, the influx of institutional capital drives the demand for sophisticated asset management services tailored to the needs of large-scale investors.

The rising investment and widespread adoption of cryptocurrencies are key drivers of growth in the crypto asset management market. More individual investors and businesses are recognizing the potential of cryptocurrencies as both investment vehicles and means of transaction, leading to a substantial increase in market participation. This surge in interest requires efficient and secure management solutions to handle diverse and expanding portfolios of digital assets. As cryptocurrencies become more integrated into mainstream financial systems, the demand for comprehensive management tools and services grows correspondingly. The expanding adoption of cryptocurrencies underscores the need for advanced asset management strategies to optimize investment performance and ensure security.

The integration of crypto asset management platforms with traditional financial and banking systems is poised to significantly drive the market's growth. By bridging the gap between digital assets and conventional financial infrastructures, these integrations simplify transactions, making it easier for users to manage their crypto investments alongside traditional assets. This seamless interoperability enhances user experience, increases trust, and facilitates wider adoption among both individual and institutional investors. Furthermore, it enables financial institutions to offer comprehensive asset management services that include cryptocurrencies, thereby expanding their service offerings and attracting a broader client base. As traditional and digital financial systems converge, the demand for integrated crypto asset management solutions is set to rise.

The application of Artificial Intelligence (AI) and Machine Learning (ML) in crypto asset management can significantly contribute to the market's growth by automating management processes and enhancing data analysis capabilities. AI and ML technologies can streamline routine tasks such as portfolio rebalancing, risk assessment, and transaction processing, increasing efficiency and reducing operational costs. Using cryptocurrency asset management solutions that are capable of efficiently handling a variety of digital assets has become a requisite for modern investors, as well as the financial professionals who help them. Cryptocurrency asset management solutions enable users to tie in several crypto accounts and wallets so that they can simply keep track of all of their digital assets holdings using a single dashboard. Many cryptocurrency asset management solutions also have analytical and chart features that give individuals and enterprises insights into the performance of their investments, thereby helping them make informed decisions.

Solution Insights

The custodian solution segment dominated the market with a revenue share of 62.3% in 2023. The segment is experiencing robust growth, driven by several key trends. The increasing involvement of institutional investors in the cryptocurrency market has heightened the demand for secure and compliant custodial services, ensuring the safe storage of substantial digital assets. Banks across the globe are focusing on launching crypto custody platforms for institutional investors. For instance, in November 2023, DZ Bank unveiled a digital assets custody platform to handle and protect digital financial instruments on the blockchain. The bank has teamed up with Swiss firm Metaco, utilizing Metaco's custody technology platform, Harmonize, to manage its crypto services. This initiative positions DZ Bank as one of the pioneering credit institutions to offer blockchain-based services for institutional clients.

The growth of wallet management solutions can be attributed to its ability to enable individuals and enterprises to secure their respective digital assets and streamline business operations. Financial institutions and asset managers are widely adopting wallet management solutions owing to their various use cases. The increasing adoption of cryptocurrencies by both individual and institutional investors necessitates secure and user-friendly wallet solutions to manage and store digital assets. Additionally, advancements in wallet technology, such as multi-signature authentication and biometric security features, are enhancing the safety and reliability of digital wallets, making them more attractive to users. The integration of wallets with decentralized finance (DeFi) platforms allows users to seamlessly participate in various financial activities, such as lending, borrowing, and staking, directly from their wallets.

Deployment Insights

The cloud segment dominated the market in 2023. The increasing reliance on cloud-based solutions for their scalability and flexibility, allowing firms to efficiently manage growing volumes of digital assets is a significant factor contributing to the growth of the market. Additionally, the enhanced security protocols and compliance measures offered by leading cloud providers are attracting more institutions seeking robust and reliable asset management platforms. The integration of advanced technologies such as artificial intelligence and machine learning into cloud-based solutions is further optimizing portfolio management, risk assessment, and transaction processing. Moreover, the ability to access and manage crypto assets from anywhere, at any time, is driving widespread adoption among both individual and institutional investors, making cloud solutions an essential component of modern crypto asset management strategies.

The rising demand for enhanced security and control over digital assets, which on-premise solutions offer by keeping data and infrastructure within the organization is a significant factor contributing to the growth of the market. This is particularly appealing to institutions with stringent compliance and regulatory requirements, as it allows for tailored security measures and direct oversight. Additionally, advancements in hardware security modules (HSMs) and other on-premise technologies are providing robust protection against cyber threats, further boosting confidence in these solutions. Furthermore, the customization capabilities of on-premise systems enable organizations to integrate their crypto asset management with existing IT infrastructure seamlessly, offering a cohesive and highly secure approach to managing digital assets.

Application Insights

The mobile segment dominated the market in 2023. The proliferation of smartphones globally has increased accessibility to cryptocurrencies, prompting a surge in demand for mobile-based management solutions. Mobile apps offer convenience, allowing users to manage their digital assets on-the-go, which appeals to both retail investors and traders. The advancements in mobile security technologies, such as biometric authentication and secure enclaves, are enhancing the safety of transactions and storage on mobile platforms. Furthermore, the integration of mobile wallets with decentralized finance (DeFi) protocols is enabling seamless participation in yield farming, staking, and other DeFi activities directly from mobile devices. These trends underscore the growing importance of mobile solutions in the crypto asset management landscape, catering to a diverse and increasingly mobile-savvy user base.

The web-based segment is witnessing robust growth, driven by the accessibility and cross-platform compatibility of web-based platforms making them versatile tools for managing crypto portfolios. Investors and institutions appreciate the ability to access their assets from any device with an internet connection, facilitating real-time monitoring and management. Additionally, the integration of advanced analytics and reporting capabilities in web-based platforms provides investors with valuable insights into market trends and portfolio performance. These trends highlight the web-based segment's role in democratizing access to crypto asset management tools and supporting the diverse needs of investors in the digital economy.

Operating System Insights

The Android segment dominated the market in 2023. The integration of decentralized finance (DeFi) applications, allowing users to manage, trade, and stake cryptocurrencies directly from their mobile devices is a significant factor contributing to the growth of the segment. The proliferation of crypto wallets on Android has facilitated secure storage and seamless transactions, leveraging advancements in blockchain technology and cryptographic protocols. Additionally, Android's openness to third-party development has spurred innovation in crypto tracking apps, portfolio management tools, and real-time market analytics, catering to both novice investors and seasoned traders. As Android devices continue to evolve with enhanced processing power and connectivity options, they are poised to play an increasingly integral role in shaping the future of crypto assets management.

The iOS segment can be attributed to the rising expansion of crypto wallet functionalities, providing users with intuitive interfaces for managing multiple digital assets securely. iOS devices are at the forefront of integrating blockchain technology into mainstream applications, enabling seamless interaction with decentralized exchanges (DEXs) and NFT marketplaces. The integration of AI and machine learning in iOS apps enhances crypto portfolio management, offering predictive insights and personalized recommendations based on market trends and user preferences. Privacy-conscious features, such as biometric authentication and encrypted communications, reinforce iOS's appeal among crypto enthusiasts seeking heightened security measures.

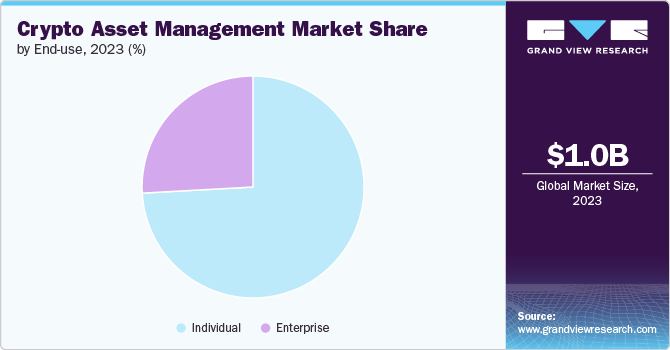

End Use Insights

The individual segment held the largest market share in 2023. The increasing mainstream adoption of cryptocurrencies has spurred interest among individual investors seeking to diversify their portfolios beyond traditional assets. The rise of user-friendly trading platforms and mobile applications has made it easier for individuals to buy, sell, and manage their crypto assets. Additionally, the growing awareness of decentralized finance (DeFi) and the potential for high returns has attracted a broader audience, including younger, tech-savvy investors. Educational initiatives and resources about cryptocurrencies and blockchain technology are also playing a crucial role in empowering individuals to make informed investment decisions.

The institutional adoption and infrastructure development are driving significant trends. Enterprises are increasingly incorporating cryptocurrencies into their treasury management strategies, leveraging blockchain technology for transparent and efficient financial transactions. Key trends include the integration of custodial solutions that offer secure storage of digital assets and compliance with regulatory standards. Enterprise-grade crypto asset management platforms are emerging to cater to the complex needs of corporations, providing features such as multi-signature wallets, audit trails, and risk management tools. Moreover, there is a growing demand for blockchain analytics platforms that enable enterprises to monitor transactions, detect anomalies, and ensure regulatory compliance.

Regional Insights

North America dominated the global market in 2023 and accounted for a 30.4% share. North America continues to lead the global market with a robust ecosystem supported by regulatory clarity, institutional investment, and technological innovation. The mainstream adoption of cryptocurrencies by retail and institutional investors, facilitated by user-friendly platforms and regulatory frameworks that provide clarity on taxation and compliance is also contributing to the growth of the regional market. The region is also witnessing a surge in crypto asset funds, crypto exchanges, and blockchain startups, driven by a strong venture capital ecosystem and favorable government policies promoting fintech innovation.

U.S. Crypto Asset Management Market Trends

The expansion of crypto exchanges, brokerages, and payment processors that facilitate seamless trading and investment in digital assets contributes to the market growth.

Asia Pacific Crypto Asset Management Market Trends

The growth in the Asia Pacific market can be attributed to the widespread adoption of cryptocurrencies among tech-savvy populations, supported by a vibrant startup ecosystem and expanding access to digital financial services. Countries such as Japan, South Korea, Singapore, and Australia are leading the region in crypto regulation, providing clarity that encourages both retail and institutional investment in digital assets. The rise of crypto exchanges, trading platforms, and fintech solutions tailored to local markets is fueling liquidity and market participation. Moreover, advancements in blockchain technology are driving initiatives in sectors such as supply chain management, logistics, and digital identity verification across the region.

Europe Crypto Asset Management Market Trends

Europe is emerging as a pivotal region in the global market, characterized by diverse regulatory approaches, technological advancements, and increasing institutional involvement. Key trends include the integration of cryptocurrencies into traditional financial services, supported by regulatory frameworks that promote innovation while ensuring consumer protection and market integrity. The region is witnessing the rise of crypto-friendly jurisdictions and initiatives aimed at fostering blockchain adoption in sectors such as finance, supply chain, and healthcare. European financial institutions are increasingly offering crypto custody and investment products, catering to a growing demand from retail and institutional investors seeking exposure to digital assets.

Key Crypto Asset Management Company Insights

The market players are constantly focusing on new product development, mergers & acquisitions activities, and other organic and inorganic strategic alliances to stay ahead of the market competition. The following are some instances of such initiatives.

Key Crypto Asset Management Companies:

The following are the leading companies in the crypto asset management market. These companies collectively hold the largest market share and dictate industry trends.

- Gemini Trust Company, LLC

- BitGo

- Ripple

- CRYPTO FINANCE AG

- Coinbase

- Fidelity Digital Assets

- Bakkt

- Paxos Trust Company, LLC

- Ledger SAS

- Anchorage Digital

Recent Developments

-

In September 2023, Gemini Trust Company, LLC planned to invest USD 24 million for their expansion in India. This comes shortly after the company’s announcement in May 2023 regarding the establishment of its development centre in Gurgaon, India. The funds/investments are planned to be used to grow their development centre in India.

-

In June 2023, Amberdata announced its expansion into Asia-Pacific with a new office in Hong Kong. The new office will provide Asia-Pacific customers with local sales and support for the company’s full suite of products, including DeFi, spot, comprehensive, granular on-chain, and derivatives market data and market intelligence.

Crypto Asset Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.23 billion

Revenue forecast in 2030

USD 4.59 billion

Growth Rate

CAGR of 24.6% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, application, operating system, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Gemini Trust Company, LLC; BitGo, Ripple; CRYPTO FINANCE AG; Coinbase; Fidelity Digital Assets; Bakkt; Paxos Trust Company, LLC; Ledger SAS; Anchorage Digital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crypto Asset Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global crypto asset management market report based on solution, deployment, application, operating system, end use, and region.

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Custodian Solution

-

Wallet Management

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Mobile

-

-

Operating System Outlook (Revenue, USD Million, 2018 - 2030)

-

iOS

-

Android

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual

-

Enterprise

-

Institutions

-

Retail & E-commerce

-

Healthcare

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crypto asset management market size was estimated at USD 1.00 billion in 2023 and is expected to reach USD 1.23 billion in 2024.

b. The global crypto asset management market is expected to grow at a compound annual growth rate of 24.6% from 2024 to 2030 to reach USD 4.59 billion by 2030.

b. North America dominated the crypto asset management market with a share of 30.4% in 2023. North America continues to lead the global crypto assets management market with a robust ecosystem supported by regulatory clarity, institutional investment, and technological innovation.

b. Some key players operating in the crypto asset management market include Gemini Trust Company, LLC; BitGo, Ripple; CRYPTO FINANCE AG; Coinbase; Fidelity Digital Assets; Bakkt.; Paxos Trust Company, LLC; Ledger SAS; and Anchorage Digital.

b. Key factors that are driving the market growth include increasing adoption of blockchain technology across end use industries and growing adoption of cryptocurrency for trading and remittances purposes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.