- Home

- »

- Communications Infrastructure

- »

-

Data Center Fabric Market Size, Share, Industry Report, 2030GVR Report cover

![Data Center Fabric Market Size, Share & Trends Report]()

Data Center Fabric Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Enterprise Size (SMEs, Large Enterprises), By Type (Traditional 3-Tier Fabric, Fabric Switches), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-500-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Fabric Market Size & Trends

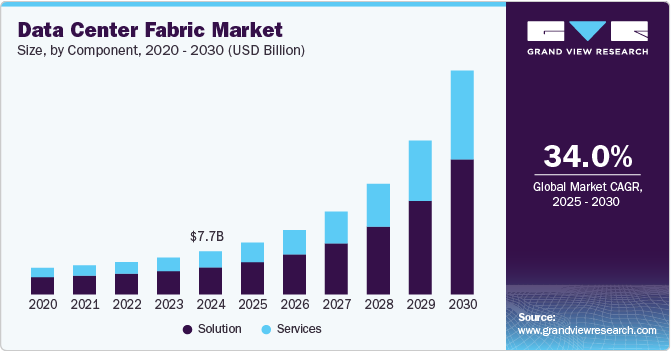

The global data center fabric market size was estimated at USD 7,679.8 million in 2024 and is anticipated to grow at a CAGR of 34.0% from 2025 to 2030. The data center fabric industry encompasses a framework of interconnected nodes, switches, and servers within a data center designed to optimize the performance, scalability, and efficiency of data center operations. It facilitates seamless communication between devices, enabling low-latency data transfer and improved load balancing. As organizations adopt digital transformation, the demand for robust IT infrastructure has grown exponentially, driving the adoption of data center fabric solutions.

Cloud computing, the proliferation of Internet of Things (IoT) devices, and the need for data-intensive applications such as AI and machine learning have further bolstered the market growth. The exponential increase in data generation from activities like video streaming, cloud-based applications, IoT devices, and e-commerce transactions is a primary driver for data center fabric adoption. As data volumes grow, organizations require scalable, high-performance infrastructure to handle traffic efficiently, fueling market growth. In addition, the rise of hyperscale data centers, capable of supporting vast computational workloads, has underscored the need for sophisticated fabric architectures to ensure reliable and efficient operations.

The integration of artificial intelligence and machine learning within data center fabric systems is another significant trend, providing predictive analytics and automated resource optimization. Multi-cloud strategies are becoming commonplace, prompting the need for fabrics that support hybrid environments with consistent performance and security. The adoption of NVMe-over-Fabric (NVMe-oF) is transforming storage architectures, reducing latency, and enhancing data transfer speeds. Furthermore, the emphasis on energy efficiency and green data centers is driving innovation in low-power fabric technologies, aligning with corporate sustainability goals.

The demand for greener data centers is propelling innovation in energy-efficient fabric technologies. Low-power solutions, such as advanced network switches and optimized interconnect architectures, are being developed to reduce energy consumption while maintaining high performance. Organizations are prioritizing sustainability to meet environmental regulations and corporate ESG goals, which include lowering carbon footprints and operational costs. Technologies like dynamic power scaling and renewable energy integration in data centers further enhance efficiency. This focus on eco-friendly operations not only aligns with global sustainability trends but also opens lucrative growth opportunities for energy-efficient fabric solutions in the market.

High initial deployment costs, including investments in advanced switches, cabling, and management software, pose financial barriers for many organizations. Integrating modern fabric solutions into legacy systems adds complexity, often requiring significant time, expertise, and resources. In addition, the interconnected nature of fabric systems increases cybersecurity vulnerabilities, exposing data centers to potential threats like breaches and attacks. Addressing these concerns demands robust security measures and skilled personnel, which can further escalate costs. These factors collectively create hurdles, particularly for small and mid-sized enterprises looking to adopt fabric technologies.

Component Insights

The solution segment accounted for a market share of over 63% in 2024. As businesses grow and adopt data-intensive applications such as AI, IoT, and cloud computing, the need for solutions capable of managing increased data traffic and workloads becomes paramount. Scalable data center fabric solutions offer flexible and modular architectures that allow organizations to expand their infrastructure seamlessly as requirements evolve. These solutions ensure optimal performance, reduce downtime, and improve resource utilization by dynamically adapting to changing workloads. Their ability to support both small-scale operations and hyperscale data centers makes them essential for modern, agile IT environments, driving their widespread adoption.

The services segment is anticipated to grow at a significant CAGR of 35.6% during the forecast period. The growing complexity of data center fabric deployments, incorporating SDN, NVMe-over-Fabric, and multi-cloud integrations, necessitates professional services to ensure seamless implementation. Organizations require expertise in consulting, integration, and deployment to manage these intricate architectures effectively. Professional services help address technical challenges, optimize performance, and streamline setup processes, enabling businesses to adopt advanced fabric solutions while minimizing operational disruptions and ensuring scalability for evolving IT requirements.

Type Insights

The fabric switches segment accounted for the largest market share in 2024. The surge in data traffic from cloud computing, video streaming, and AI applications is driving a significant demand for higher bandwidth and faster data transfers. Fabric switches, with their ability to provide low-latency, high-throughput connectivity, are essential for handling these growing data requirements efficiently. The rise of hyper-converged infrastructure (HCI) further boosts the need for fabric switches. HCI integrates storage, computing, and networking components into a unified system, and fabric switches are crucial in ensuring seamless communication between these elements. This combination of growing data traffic and the adoption of HCI is increasing the demand for advanced fabric switches, making them a cornerstone of modern data center architectures.

The hyperconverged fabrics segment is expected to grow at a significant rate during the forecast period. Hyperconverged fabrics play a crucial role in optimizing the performance of cloud-native applications and virtualized environments. They enable seamless connectivity between cloud environments and on-premise data centers, allowing for efficient workload distribution across hybrid and multi-cloud infrastructures. This ensures high availability and resource optimization, meeting the growing demand for flexible, scalable, and resilient data architectures, which boosts the adoption of hyperconverged fabrics in modern IT environments.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 63% in 2024. Large enterprises are increasingly dealing with vast amounts of data generated by cloud services, IoT devices, and AI applications, which creates a need for high-speed, low-latency connectivity. Advanced data center fabric solutions are essential to meet these bandwidth and performance requirements, enabling efficient handling of data-intensive operations. In addition, large enterprises often operate in complex IT environments with multiple business units, geographic locations, and critical applications. Data center fabrics offer a flexible, scalable, and easily manageable infrastructure solution that seamlessly interconnects diverse IT components across departments, regions, and cloud environments. This enhances communication, optimizes resource utilization, and supports efficient operations, which is crucial for large organizations.

The small & medium-sized enterprises segment is expected to grow at a significant CAGR during the forecast period. Small and medium-sized enterprises (SMEs) often operate with limited IT budgets and require cost-effective solutions that maximize performance while minimizing operational costs. Data center fabric solutions, with their ability to consolidate networking, storage, and compute resources into a single platform, offer SMEs an affordable way to scale their IT infrastructure without significant upfront costs.

Application Insights

The IT & Communications segment accounted for the largest market share in 2024. The IT and communications sector is experiencing an exponential increase in data traffic, driven by the growth of internet services, cloud computing, and mobile networks. Data center fabrics are crucial in addressing these demands, providing the high-speed, low-latency connectivity needed to ensure optimal performance and handle large-scale data traffic efficiently.

The healthcare segment is expected to grow at a significant CAGR during the forecast period. The healthcare sector is experiencing an explosion of data due to the growing adoption of electronic health records (EHRs), medical imaging, patient monitoring devices, and genomics data. Data center fabrics are crucial for managing, storing, and transmitting this vast volume of data efficiently. Their ability to provide high-speed, low-latency connectivity ensures that healthcare providers can access and process this data quickly, improving patient care and operational efficiency.

End-use Insights

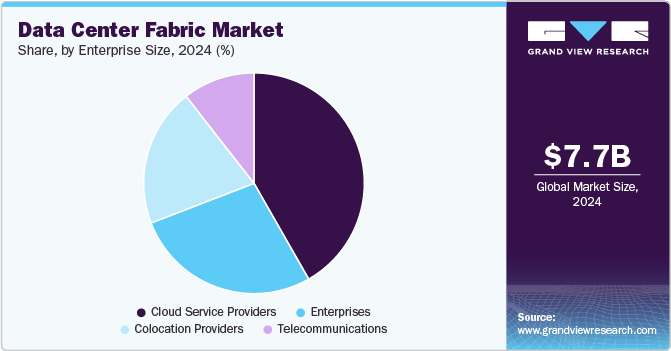

The cloud service providers segment accounted for the largest market share in 2024. As businesses increasingly move their operations to the cloud, the demand for reliable and scalable data center infrastructures has skyrocketed. Cloud service providers (CSPs) require data center fabrics to manage the massive data efficiently flows and ensure seamless connectivity between distributed cloud services. Data center fabrics offer the high bandwidth, low latency, and scalability needed to handle the growing volumes of data and support the global infrastructure required for cloud-based applications.

The telecommunications segment is expected to grow at a significant CAGR during the forecast period. Telecommunications providers are embracing NFV and SDN to improve network efficiency, flexibility, and scalability. Data center fabrics support the integration of NFV and SDN technologies by enabling the virtualization of network functions and the dynamic management of network resources. These fabrics help telecom operators optimize their networks, reduce operational costs, and improve service delivery by offering automated, programmable, and scalable infrastructure.

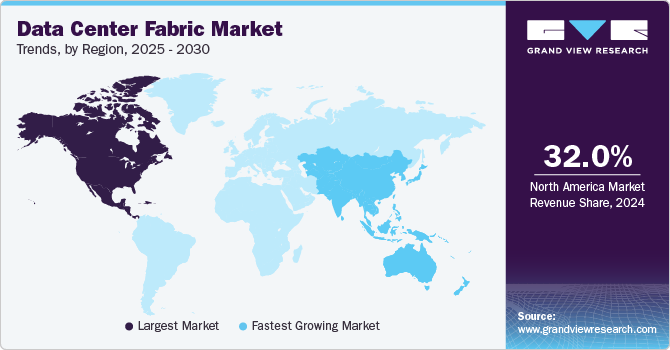

Regional Insights

North America data center fabric market held a significant global share of over 32% in 2024. North America continues to lead the global cloud computing market, with major players such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud providing cloud-based infrastructure and services to businesses. As the demand for cloud adoption and cloud-native applications increases, data center fabrics are essential for ensuring the high performance, scalability, and flexibility needed to manage massive volumes of data and interconnect cloud environments. The ongoing growth of public, private, and hybrid cloud models is driving the adoption of advanced data center fabric solutions.

U.S. Data Center Fabric Market Trends

The data center fabric market in the U.S. is expected to grow significantly from 2025 to 2030. The increasing adoption of edge computing in the U.S. is spurred by industries like retail, healthcare, and manufacturing, where real-time data processing is critical. Data center fabrics enable seamless interconnectivity between edge and core data centers, ensuring low latency and efficient data transfer. This trend is particularly significant in supporting applications such as autonomous vehicles, smart cities, and real-time IoT analytics.

Europe Data Center Fabric Market Trends

The data center fabric market in Europe is growing significantly at a CAGR of over 33.0% from 2025 to 2030. Europe is at the forefront of sustainability initiatives, driven by government regulations like the European Green Deal and corporate commitments to reducing carbon footprints. Data center operators are investing in energy-efficient technologies to align with these goals. Advanced data center fabrics that optimize energy usage reduce power consumption, and enhance cooling efficiency are gaining traction in the market.

The UK data center fabric industry is expected to grow rapidly in the coming years. UK businesses are accelerating digital transformation to enhance operational efficiency and customer experience. Data center fabrics are pivotal in supporting these initiatives by enabling the integration of emerging technologies such as artificial intelligence (AI), big data analytics, and the Internet of Things (IoT).

The Germany data center fabric market held a substantial market share in 2024. Germany is a global leader in industrial automation and manufacturing innovation through Industry 4.0 initiatives. These advancements generate massive data volumes, requiring high-performance data center infrastructures. Data center fabrics enable seamless connectivity and real-time data processing, supporting smart manufacturing and IoT-driven operations.

Asia Pacific Data Center Fabric Market Trends

The data center fabric marketin the Asia Pacific is growing significantly at a CAGR of over 37.0% from 2025 to 2030. The rise of IoT ecosystems, smart cities, and connected devices across the region generates massive data traffic, necessitating robust data center infrastructures. Data center fabrics provide the low-latency, high-bandwidth connectivity needed to support real-time processing and interconnectivity between devices and data centers.

The China data center fabric industry held a substantial market share in 2024. Leading global and local cloud providers, including Alibaba Cloud, Tencent Cloud, and Huawei Cloud, are expanding their data center footprints in China. The increasing demand for hybrid and multi-cloud solutions is driving the need for advanced data center fabric technologies.

The data center fabric industry in Japan held a substantial market share in 2024. Japan's leadership in IoT-enabled manufacturing and smart factories generates vast data volumes that require real-time analysis. Data center fabrics facilitate low-latency, high-throughput connectivity essential for IoT-driven operations and Industry 4.0 applications.

The India data center fabric industry is growing rapidly due to its push toward digitalization, supported by government initiatives like Digital India, which is driving the demand for scalable and efficient data center infrastructures. Data center fabrics play a critical role in enabling seamless connectivity and data processing across industries. With the increasing adoption of cloud-based solutions among enterprises and SMEs, cloud service providers are expanding their operations in India. This growth requires robust data center fabric solutions to support hybrid and multi-cloud environments.

Key Data Center Fabric Company Insights

The key market players in the global data center fabric industry include Arista Networks, Inc., Brocade Communications Systems (Broadcom), Cisco Systems, Inc., Dell Technologies, Extreme Networks, Hewlett Packard Enterprise (HPE), Huawei Technologies Co., Ltd., IBM Corporation, Juniper Networks, Inc., and VMware, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Arista Networks introduced an AI-optimized network fabric designed to enhance the performance of AI and machine learning workloads. The solution integrates advanced features like low latency, high bandwidth, and scalability to meet the demands of AI-driven data centers. It supports seamless integration with GPU clusters and high-performance computing environments, ensuring efficient data movement and processing. This innovation underscores Arista's commitment to enabling next-generation networking for AI and data-intensive applications.

-

In June 2024, Cisco unveiled the Nexus HyperFabric, a simplified data center infrastructure solution developed in collaboration with NVIDIA, tailored for generative AI applications. This cutting-edge fabric optimizes performance with high bandwidth, low-latency connectivity, and seamless integration with NVIDIA AI clusters. Designed for scalability, it supports demanding AI workloads while simplifying deployment and management. The Nexus HyperFabric highlights Cisco's commitment to empowering data centers for next-generation AI and machine learning innovations.

Key Data Center Fabric Companies:

The following are the leading companies in the data center fabric market. These companies collectively hold the largest market share and dictate industry trends.

- Arista Networks, Inc.

- Brocade Communications Systems (Broadcom)

- Cisco Systems, Inc.

- Dell Technologies

- Extreme Networks

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Juniper Networks, Inc.

- VMware, Inc.

Data Center Fabric Market Report Scope

Report Attribute

Details

Market size in 2025

USD 9,245.0 million

Market Size forecast in 2030

USD 39,993.0 million

Growth rate

CAGR of 34.0% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, type, enterprise size, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa

Key companies profiled

Arista Networks, Inc., Brocade Communications Systems (Broadcom), Cisco Systems, Inc., Dell Technologies, Extreme Networks, Hewlett Packard Enterprise (HPE), Huawei Technologies Co., Ltd., IBM Corporation, Juniper Networks, Inc., and VMware, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Fabric Market Report Segmentation

This report forecasts market size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center fabric market report based on component, type, enterprise size, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Switches

-

Routers

-

Controllers

-

Storage systems

-

Others

-

-

Services

-

Consulting Services

-

Integration & Deployment

-

Support & Maintenance

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional 3-Tier Fabric

-

Fabric Switches

-

Hyperconverged Fabric

-

Open Fabric

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Sized Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Communication

-

Banking & Financial Services

-

Healthcare

-

Retail

-

Government

-

Media and entertainment

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud Service Providers

-

Colocation Providers

-

Enterprises

-

Telecommunications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center fabric market size was estimated at USD 7,679.8 million in 2024 and is expected to reach USD 9,245.0 million in 2025.

b. The global data center fabric market is expected to grow at a compound annual growth rate of 34.0% from 2025 to 2030 to reach USD 39,993.0 million by 2030

b. The solution segment accounted for a market share of over 63% in 2024. As businesses grow and adopt data-intensive applications such as AI, IoT, and cloud computing, the need for solutions capable of managing increased data traffic and workloads becomes paramount. Scalable data center fabric solutions offer flexible and modular architectures that allow organizations to expand their infrastructure seamlessly as requirements evolve. These solutions ensure optimal performance, reduce downtime, and improve resource utilization by dynamically adapting to changing workloads.

b. The key market players in the global data center fabric market include Arista Networks, Inc., Brocade Communications Systems (Broadcom), Cisco Systems, Inc., Dell Technologies, Extreme Networks, Hewlett Packard Enterprise (HPE), Huawei Technologies Co., Ltd., IBM Corporation, Juniper Networks, Inc., and VMware, Inc.

b. As organizations adopt digital transformation, the demand for robust IT infrastructure has grown exponentially, driving the adoption of data center fabric solutions. Cloud computing, the proliferation of Internet of Things (IoT) devices, and the need for data-intensive applications such as AI and machine learning have further bolstered the market. The exponential increase in data generation from activities like video streaming, cloud-based applications, IoT devices, and e-commerce transactions is a primary driver for data center fabric adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.