- Home

- »

- Communications Infrastructure

- »

-

Data Center Insulation Market Size, Industry Report, 2033GVR Report cover

![Data Center Insulation Market Size, Share & Trends Report]()

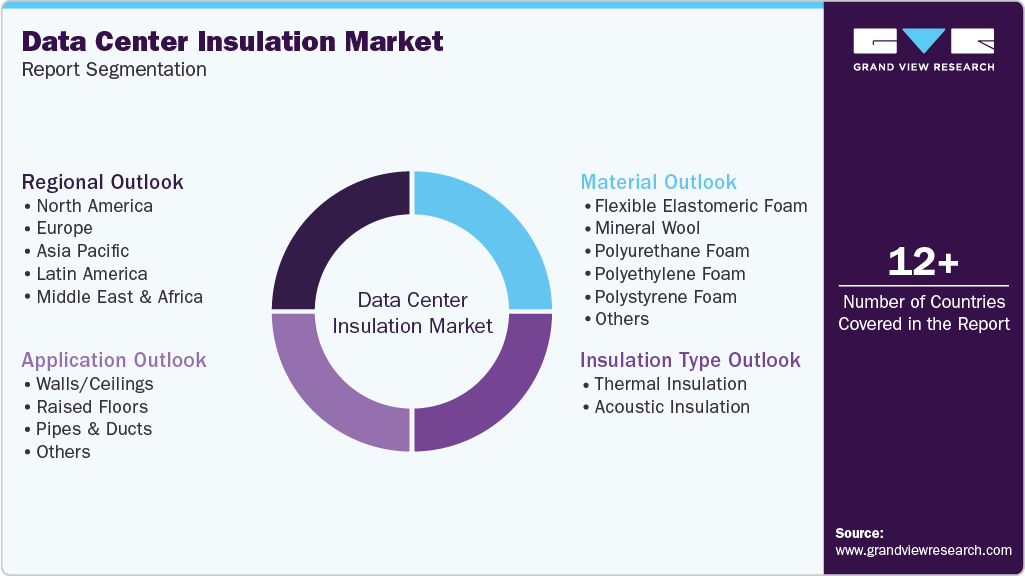

Data Center Insulation Market (2025 - 2033) Size, Share & Trends Analysis Report By Insulation Type (Thermal Insulation, Acoustic Insulation), By Material (Flexible Elastomeric Foam, Mineral Wool), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-658-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Insulation Market Summary

The global data center insulation market size was valued at USD 455.6 million in 2024 and is projected to reach USD 1,555.9 million by 2033, growing at a CAGR of 15.2% from 2025 to 2033. The growth is primarily driven by the increasing demand for insulation solutions in data centers, spurred by the global expansion of data center infrastructure.

Key Market Trends & Insights

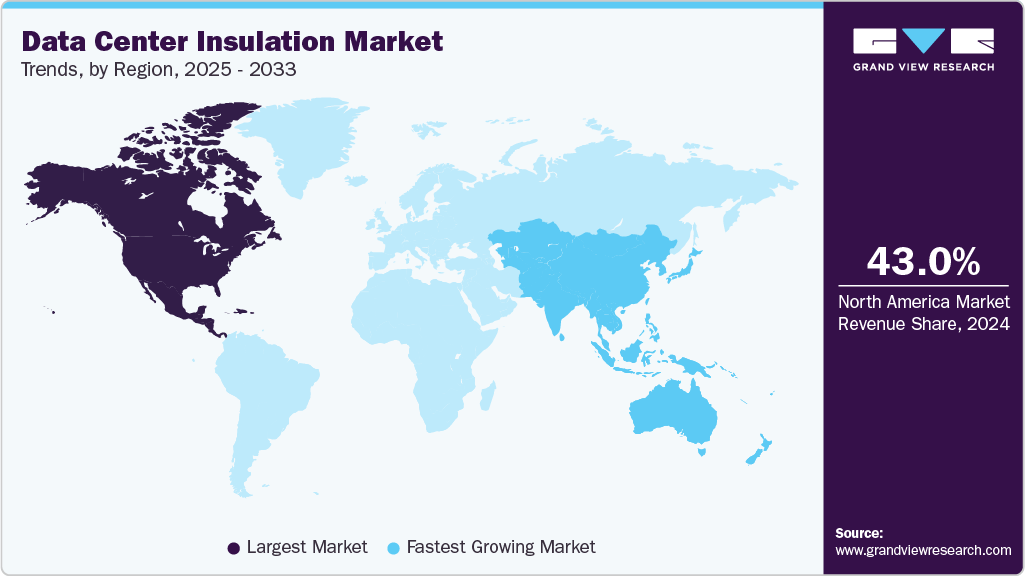

- North America data center insulation dominated the global market with the largest revenue share of over 43% in 2024.

- The data center insulation Market in the U.S. led the North America market and held the largest revenue share in 2024.

- By material type, the mineral wool segment accounted for a market share of over 29.0% in 2024.

- By insulation type, thermal insulation led the market and held the largest revenue share in 2024.

- By application, the raised floors segment is expected to grow at the fastest CAGR of over 15.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 455.6 Million

- 2033 Projected Market Size: USD 1,555.9 Million

- CAGR (2025-2033): 15.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This surge is largely due to rising energy consumption and the need for cost-effective cooling strategies. Effective insulation helps regulate and maintain temperatures, minimizing heat loss and improving a building’s Power Usage Effectiveness (PUE).The rapid increase in global data traffic driven by cloud computing, IoT devices, video streaming, and AI workloads has significantly boosted the demand for high-performance data center infrastructure. As businesses and consumers rely more heavily on digital services, hyperscale, enterprise, and edge data centers are being constructed at an accelerated pace across the globe. This expansion has created a parallel demand for efficient thermal management systems to support continuous, high-density computing operations. Insulation plays a critical role in maintaining stable internal temperatures, reducing energy consumption, and enhancing equipment reliability. Without effective insulation, cooling systems must work harder, resulting in higher operational costs and environmental impact. As a result, data center operators are prioritizing advanced insulation materials that contribute to better thermal control, improved Power Usage Effectiveness (PUE), and compliance with green building standards. This trend is expected to intensify as data volumes continue to grow exponentially in the coming years.

The global push toward sustainability has made environmental regulations and green certifications key drivers in the data center insulation market. Governments and regulatory bodies are increasingly enforcing stricter carbon emission norms, while organizations seek certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) to demonstrate their commitment to sustainability. These standards require data centers to meet rigorous energy efficiency and environmental performance benchmarks. In response, data center operators are adopting high-performance insulation materials that minimize thermal losses, reduce HVAC energy demand, and support overall operational efficiency. Materials like mineral wool, spray foam, and elastomeric foam are favored for their low environmental impact, high R-values, and long-term performance. Additionally, many insulation solutions now feature recyclable content or low-emission formulations, aligning with circular economy goals. As environmental accountability becomes a core aspect of digital infrastructure, sustainable insulation will remain a priority for future-ready data centers.

As major technology companies commit to carbon-neutral and net-zero goals, green data centers are becoming the industry standard. Achieving these targets requires a comprehensive approach to energy efficiency, where insulation plays a critical role. By minimizing heat loss and reducing the burden on cooling systems, insulation directly lowers a data center’s energy consumption and carbon footprint. As a result, demand is rising for sustainable insulation materials such as recyclable foams, low-VOC (volatile organic compound) products, and bio-based alternatives. These eco-friendly solutions not only improve thermal performance but also support compliance with environmental standards and corporate sustainability strategies, making them essential in future-focused data center designs.

Material Type Insights

The mineral wool segment accounted for a market share of over 29.0% in 2024. Mineral wool offers excellent thermal resistance (high R-value) and strong sound-absorbing capabilities, making it ideal for data center environments. It helps regulate internal temperatures efficiently while reducing noise from HVAC systems and server racks crucial for maintaining equipment performance and enhancing comfort in adjacent work areas. In addition to its performance benefits, mineral wool is a highly cost-effective solution compared to advanced options like aerogels or specialty foams. Its affordability, combined with widespread availability and mature supply chains, makes it a practical choice for both new data center construction and retrofit projects. These advantages drive its growing adoption in energy-efficient and large-scale infrastructure.

The polyethylene foam segment is anticipated to grow at a significant CAGR of 16.5% during the forecast period. Polyethylene (PE) foam features a closed-cell structure that offers excellent resistance to moisture, vapor, and air infiltration, crucial for maintaining humidity control in data centers and preventing issues like condensation and corrosion. Additionally, its lightweight nature makes it easy to handle and install, even in confined spaces such as ducts and raised floors. This simplifies the installation process, reduces labor costs, and accelerates project timelines, making PE foam a practical and efficient insulation solution for both new and retrofit data center applications.

Insulation Type Insights

The thermal insulation segment accounted for the largest market share in 2024. Data centers consume vast amounts of energy, with cooling systems alone accounting for 40-50% of total usage. As demand for high-performance computing grows, especially in hyperscale and high-density facilities, thermal insulation plays a critical role in reducing heat transfer and easing the load on HVAC systems. This results in lower energy consumption and operational costs. Additionally, data center operators are under increasing pressure to improve Power Usage Effectiveness (PUE), a key metric for energy efficiency. Thermal insulation enhances PUE by minimizing thermal losses across walls, ceilings, ducts, and raised floors, making it an essential investment in both new construction and retrofit projects.

The acoustic insulation segment is expected to register a significant CAGR during the forecast period. Data centers contain high-speed servers, cooling fans, HVAC systems, and backup generators, all of which generate substantial noise. In high-density setups, this noise can reach disruptive decibel levels, affecting adjacent workspaces or external environments. Acoustic insulation helps mitigate this by absorbing and dampening sound, ensuring a quieter and safer facility. Additionally, the growing trend of urban and edge data centers situated near offices, city centers, and residential zones has heightened the need for effective noise control. To comply with local noise regulations and avoid disturbing nearby communities, operators are increasingly investing in acoustic insulation as a standard design element for both new builds and retrofits.

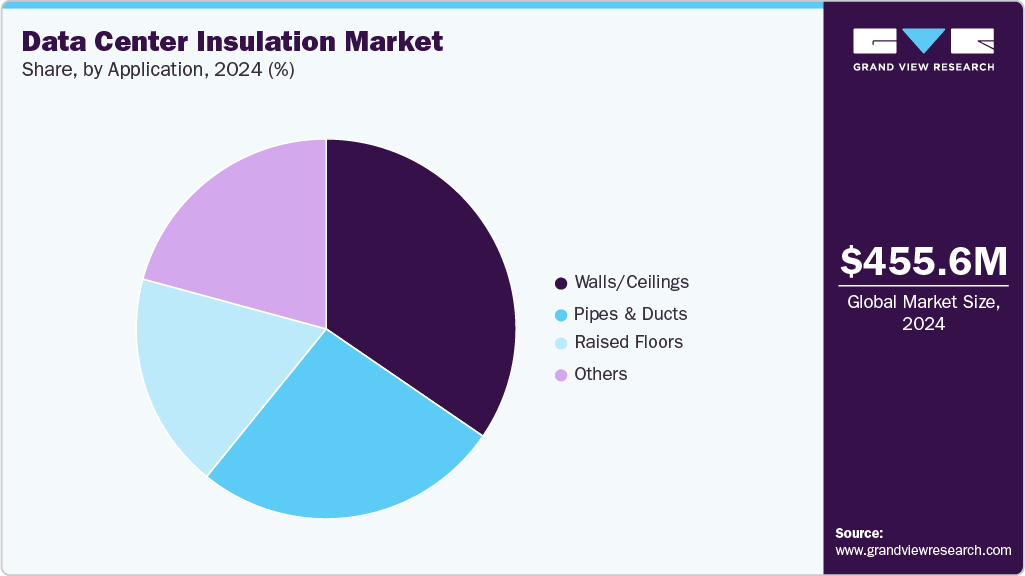

Application Insights

The walls/ceilings segment accounted for the largest market share in 2024. Walls and ceilings are the primary structural surfaces in a data center, making them critical zones for thermal insulation. By minimizing heat exchange with the external environment, insulation on these surfaces enhances HVAC efficiency, lowers energy consumption, and supports temperature stability essential for optimal server performance. Additionally, these surfaces often transmit noise from high-speed servers and cooling systems. Applying acoustic insulation to walls and ceilings helps absorb and dampen sound, significantly reducing noise pollution. This is particularly important in edge data centers or facilities situated near office spaces or urban areas, where maintaining a quieter environment is essential for operational comfort and regulatory compliance.

The raised floors segment is expected to grow at a significant CAGR during the forecast period. Raised floors play a vital role in managing airflow within data centers by acting as primary channels for cold air distribution from precision cooling systems. Insulating these areas helps minimize thermal losses, allowing conditioned air to be delivered more efficiently to server racks. This insulation is especially important in high-density environments where consistent cooling is critical. Additionally, insulating raised floors significantly enhances overall energy efficiency by reducing the workload on HVAC systems. This contributes to better Power Usage Effectiveness (PUE), a key metric in measuring data center efficiency. As a result, insulation under raised floors supports both cost savings and long-term sustainability goals for operators.

Regional Insights

North America data center insulation industry held a significant share of over 43%in 2024. North America, especially the United States, is home to numerous hyperscale data centers run by major tech companies like AWS, Microsoft, Google, Meta, and Apple. These massive facilities demand highly energy-efficient infrastructure to support dense computing operations. As a result, there is a strong need for advanced insulation materials that enhance thermal management, reduce energy consumption, and support sustainability goals, making insulation a critical component of their design and operations.

U.S. Data Center Insulation Industry Trends

The data center insulation industry in the U.S. is expected to grow significantly from 2025 to 2033. The U.S. enforces strict energy efficiency standards through regulations like ASHRAE, LEED certifications, and Title 24 in California. These frameworks mandate the use of high-performance building materials, including advanced insulation, to minimize energy usage and environmental impact. For data centers, complying with these standards means integrating thermal and acoustic insulation that supports efficient cooling, reduces operational costs, and aligns with national and corporate sustainability goals.

Europe Data Center Insulation Industry Trends

The data center insulation market in Europe is expected to grow at a CAGR of 14.8% from 2025 to 2033. Europe’s leadership in environmental regulation, through initiatives like the European Green Deal and Fit for 55, is driving the adoption of energy-efficient technologies across all sectors, including data centers. These frameworks emphasize reducing carbon emissions and improving energy use, pushing operators to adopt high-performance insulation. Compliance with green building standards such as BREEAM and ISO 50001 makes insulation a critical component of sustainable data center design and operation.

The UK data center insulation industry is expected to grow rapidly in the coming years. The rise of edge computing, AI applications, and 5G is accelerating the deployment of modular and edge data centers in the U.K. These compact facilities require pre-insulated systems to ensure efficient thermal regulation within limited spaces, enabling reliable performance and energy efficiency in diverse and often remote environments.

The data center insulation market in Germany held a substantial market share in 2024. Germany is a leading data center hub in Europe, with major cities like Frankfurt, Berlin, and Munich attracting hyperscale investments from AWS, Microsoft Azure, and Google Cloud. As these large-scale facilities expand, the need for advanced insulation grows to effectively manage heat loads, enhance energy efficiency, and meet strict operational and environmental performance standards.

Asia Pacific Data Center Insulation Industry Trends

The data center insulation market in Asia Pacific is expected to grow at a CAGR of 16.8% from 2025 to 2033. The region has a rapidly growing internet user base, with high mobile and data consumption. This has led to a spike in edge computing and regional data center expansion, especially in Southeast Asia. These new facilities often rely on compact, energy-efficient insulation to support remote or constrained environments.

China data center insulation industryheld a substantial market share in 2024. China is among the world’s largest data center markets, with hyperscale growth led by Tencent, Alibaba Cloud, Baidu, Huawei Cloud, and other domestic players. These large-scale facilities require high-performance thermal and acoustic insulation to manage increasing heat loads and optimize cooling efficiency.

The data center insulation industry in Japan held a substantial share in 2024. Japan has committed to achieving carbon neutrality by 2050, encouraging eco-friendly construction materials and energy-efficient technologies in data centers. Insulation materials with low environmental impact, such as low-VOC foams and recyclable panels, are in rising demand to align with national climate goals.

India data center insulation industry is driven by the aggressive expansion of global players and domestic firms amidst surging cloud, AI, and IoT adoption. Additionally, the booming IT/ITeS sector and digital economy (UPI, e-commerce) are generating massive data storage requirements.

Key Data Center Insulation Companies Insights

Key players operating in the data center insulation market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Data Center Insulation Companies:

The following are the leading companies in the data center insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Aeroflex Co. Ltd.

- Armacell

- Aspen Aerogels

- Boyd Corporation

- IAC Acoustics

- Johns Manville

- Kaimann GmbH

- Kingspan Group

- Knauf Insulation

- Owens Corning

- Recticel Insulation

- Rockwool International

- Saint-Gobain

- Sika AG

- Ventac

Recent Developments

-

In June 2025, Armacell announced the opening of its a state-of-the-art aerogel insulation plant in Maharashtra, India, doubling its production capacity for the breakthrough ArmaGel XG range. The facility will manufacture two high-performance blankets: ArmaGel XGH for applications up to +650 °C and ArmaGel XGC for conditions from -196 °C to +250 °C, both compliant with ASTM standards. This expansion addresses surging global demand for advanced, energy-efficient insulation solutions.

-

In May 2025, Saint-Gobain announced the construction of a new stone wool insulation plant in Bridgend, Wales, under its Isover brand. The facility will boost the U.K.’s supply of high-performance, sustainable insulation materials and support national decarbonization goals. With production expected to start in 2026, the plant will create local jobs, reduce import dependency, and enhance energy efficiency in buildings aligning with the U.K.’s green construction and net-zero emission targets.

-

In October 2024, Johns Manville launched the AP Foil25 to its product lineup a polyisocyanurate (polyiso) foam board insulation with a foil facing on both sides. Designed for use in walls and ceilings, it offers high thermal resistance and moisture control. Ideal for commercial and industrial buildings, including data centers, AP Foil25 enhances energy efficiency and meets key fire and building code requirements, aligning with the growing demand for high-performance, code-compliant insulation solutions.

Data Center Insulation Market Report Scope

Report Attribute

Details

Market size in 2025

USD 500.2 million

Market Size forecast in 2033

USD 1,555.9 million

Growth rate

CAGR of 15.2% from 2025 to 2033

Actual data

2021 - 2023

Base year

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Insulation type, material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Armacell; Kingspan Group; Rockwool International; Johns Manville; Owens Corning; Sika AG; Kaimann GmbH; Saint-Gobain; IAC Acoustics; Aeroflex Co. Ltd.; Knauf Insulation; Aspen Aerogels; Recticel Insulation; Ventac; Boyd Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Insulation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data center insulation market report based on insulation type, material, application, and region.

-

Insulation Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Thermal Insulation

-

Acoustic Insulation

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Flexible Elastomeric Foam

-

Mineral Wool

-

Polyurethane Foam

-

Polyethylene Foam

-

Polystyrene Foam

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Walls/Ceilings

-

Raised Floors

-

Pipes & Ducts

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center insulation market size was estimated at USD 455.6 million in 2024 and is expected to reach USD 500.2 billion in 2025.

b. The global data center insulation market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2033 to reach USD 1,555.9 billion by 2033.

b. The thermal insulation segment accounted for over 64.0% share in 2024. Data centers consume vast amounts of energy, with cooling systems alone accounting for 40–50% of total usage. As demand for high-performance computing grows, especially in hyperscale and high-density facilities, thermal insulation plays a critical role in reducing heat transfer and easing the load on HVAC systems.

b. The key market players in the global data center insulation market include Armacell, Kingspan Group, Rockwool International, Johns Manville, Owens Corning, Sika AG, Kaimann GmbH, Saint-Gobain, IAC Acoustics, Aeroflex Co. Ltd., Knauf Insulation, Aspen Aerogels, Recticel Insulation, Ventac, and Boyd Corporation.

b. The market growth is primarily driven by the increasing demand for insulation solutions in data centers, spurred by the global expansion of data center infrastructure. This surge is largely due to rising energy consumption and the need for cost-effective cooling strategies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.