- Home

- »

- Communications Infrastructure

- »

-

Data Center Liquid Cooling Market, Industry Report, 2033GVR Report cover

![Data Center Liquid Cooling Market Size, Share, & Trend Report]()

Data Center Liquid Cooling Market (2026 - 2033) Size, Share, & Trend Analysis By Component (Solution, Service), By Type of Cooling (Immersion Cooling, Cold Plate Cooling), By Data Center (Hyperscale, Enterprise), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-596-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Liquid Cooling Market Summary

The global data center liquid cooling market size was estimated at USD 6.65 billion in 2025 and is projected to reach USD 29.46 billion by 2033, growing at a CAGR of 20.1% from 2026 to 2033. The rapid escalation of computing density, driven by AI, machine learning, and high-performance computing workloads, is fueling the growth of the market.

Key Market Trends & Insights

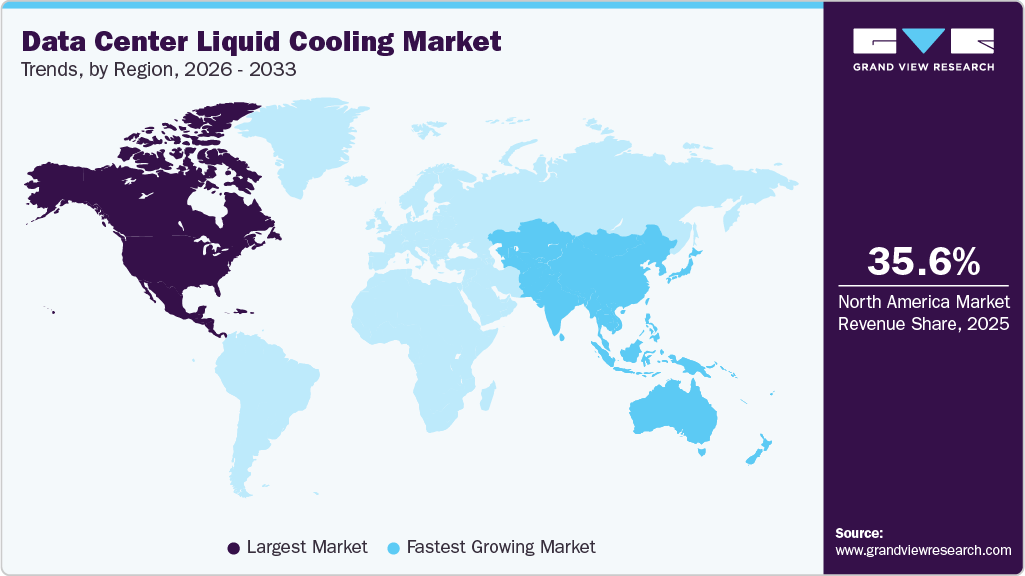

- North America held 35.6% revenue share of the global data center liquid cooling industry in 2025.

- The data center liquid cooling industry in the U.S. is expected to grow significantly over the forecast period.

- By component, the solution segment held the largest revenue share of 74.5% in 2025.

- By end use, the IT segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.65 Billion

- 2033 Projected Market Size: USD 29.45 Billion

- CAGR (2026-2033): 20.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Modern processors, especially GPUs and AI accelerators, operate at extremely high power levels and generate far more heat per rack than traditional enterprise servers. Conventional air-based cooling systems struggle to dissipate this concentrated thermal load efficiently, resulting in hotspots, reduced performance, and increased failure risks. Liquid cooling technologies, including direct-to-chip and immersion cooling, offer superior heat transfer capabilities, enabling data centers to support higher rack densities while maintaining thermal stability.

The rapid growth of hyperscale and colocation data centers is driving the market growth. Hyperscale facilities, operated by cloud giants and major digital service providers, are proliferating rapidly across North America, Europe, and the Asia-Pacific region to support AI, big data, and cloud-native applications. Similarly, colocation providers are expanding their footprints to accommodate enterprises seeking secure, scalable infrastructure without owning their facilities. Both segments feature extreme rack densities and continuous high utilization, particularly in AI model training, GPU-accelerated compute clusters, and intensive storage workloads, resulting in thermal loads that traditional air-cooling systems struggle to manage efficiently. As power densities per rack often exceed 30-50 kW and, in some cases, reach 100 kW or more, the limitations of air cooling become apparent: lower heat transfer rates, significant energy costs, and difficulty maintaining uniform temperatures across densely populated compute zones. This performance gap drives operators to adopt liquid cooling, which transfers heat more effectively and can sustain high, consistent thermal loads, enabling hyperscale and colocation facilities to maximize throughput while maintaining reliability and uptime.

The increasing specialization of AI and HPC hardware is further driving the adoption of liquid cooling in data centers. As AI workloads become more sophisticated, data centers are deploying GPUs, tensor processing units (TPUs), and AI accelerators that generate concentrated heat in specific regions of the server. These components require highly localized thermal management that conventional air cooling cannot provide effectively. Liquid cooling systems, such as direct-to-chip or immersion solutions, are capable of targeting these hotspots directly, maintaining optimal thermal conditions even under prolonged high-intensity workloads. This precise heat management allows operators to safely integrate next-generation hardware into existing infrastructure without redesigning the facility or compromising performance, making liquid cooling a key enabler for AI and HPC innovation.

Component Insights

The solution segment dominated the market and accounted for the revenue share of over 74.5% in 2025, driven by technological, environmental, and economic factors. The solution segment of the market is being driven by the increasing preference of data center operators for end-to-end, integrated cooling solutions rather than standalone components. As thermal challenges become more complex due to rising rack densities and heterogeneous workloads, operators are seeking turnkey liquid cooling solutions that combine hardware, control software, monitoring, and system integration into a single offering. These comprehensive solutions reduce deployment risk and simplify procurement by providing validated architectures that are already optimized for high-density environments.

The service segment is anticipated to grow at a CAGR of 36.2% during the forecast period due to the increasing complexity of liquid cooling systems, which require specialized expertise for installation, maintenance, and optimization. Unlike traditional air-cooling systems, liquid cooling involves advanced technologies such as direct-to-chip cooling, immersion cooling, and rear-door heat exchangers.

Solution Insights

The direct liquid cooling segment dominated the market in 2025. The need to support extreme rack power densities, which are becoming standard in next-generation data centers, is driving the direct liquid cooling segment growth. Direct liquid cooling is particularly well-suited for environments where rack densities exceed 30 kW and move toward 50 kW, 80 kW, or even higher. At these levels, air cooling becomes inefficient and impractical due to the complexity of airflow management and excessive fan energy consumption. Direct liquid cooling systems can handle these densities with greater stability and predictability, enabling data center operators to plan capacity expansions without being constrained by thermal limits.

The indirect liquid cooling segment is expected to grow at a significant CAGR over the forecast period. The growing prevalence of mixed workload environments further supports the adoption of indirect liquid cooling. Many data centers host a diverse range of workloads, from traditional enterprise applications to moderately demanding analytics, private cloud, and edge computing tasks. These mixed environments require flexible cooling strategies that can accommodate varying thermal profiles across racks and zones. Indirect liquid cooling systems can be selectively deployed in high-density areas while coexisting with conventional air cooling elsewhere in the facility. This flexibility allows operators to tailor cooling capacity to workload requirements without committing to a single, uniform cooling architecture across the entire data center.

Service Insights

The installation and deployment segment dominated the market in 2025. The acceleration of AI and GPU cluster deployments is driving the growth of the installation and deployment segment. AI workloads are often deployed under aggressive timelines due to competitive pressure, funding cycles, or cloud service expansion plans. Liquid cooling systems must be installed, tested, and commissioned quickly to avoid delays in bringing high-value compute resources online. Specialized deployment teams enable faster rack-level and pod-level rollouts by using standardized installation frameworks, prefabricated piping assemblies, and modular CDU configurations.

The maintenance and support segment is expected to grow at a significant CAGR over the forecast period. The growing focus on predictive and proactive maintenance strategies is driving adoption in this segment. Modern liquid cooling systems can generate continuous streams of operational data, including fluid temperature, flow rates, pressure levels, and pump efficiency. Maintenance and support services utilize this data to predict potential failures before they occur, schedule preventive interventions, and optimize system performance in real time. This predictive approach reduces unplanned downtime, improves the reliability of sensitive AI and HPC workloads, and enhances overall operational efficiency.

Type of Cooling Insights

The cold plate cooling segment dominated the market in 2025. The rapid growth of processor packaging and chiplet architectures is accelerating demand for cold plate cooling. Advanced CPUs and GPUs are increasingly utilizing chiplets, stacked dies, and high-bandwidth memory configurations, which create uneven thermal profiles across the package. Traditional heat sinks and air-based cooling struggle to address these hotspots efficiently. Cold plates can be engineered with customized internal channel designs to match the thermal map of specific processors, ensuring even heat removal across complex silicon layouts. This design flexibility makes cold plate cooling well-suited to next-generation processors used in AI and HPC clusters, driving adoption as hardware complexity increases.

The immersion cooling segment is expected to grow at a significant CAGR over the forecast period. The data center liquid immersion cooling segment is driving the growth of the market as data center operators confront the thermal limitations of air-based cooling in high-density compute environments. Data center liquid immersion cooling submerges servers or server components directly into thermally conductive dielectric fluids, allowing heat to be transferred away from processors and other heat-generating components with exceptional efficiency.

Data Center Insights

The hyperscale data centers segment dominated the market in 2025. The hyperscale data center segment is a major driver of the market, as hyperscale operators are increasingly designing facilities specifically for ultra-high-density computing. Unlike traditional enterprise data centers, hyperscale environments are designed for massive scale, standardized deployments, and continuous utilization of compute resources. As these operators roll out large AI training clusters, cloud-native platforms, and data-intensive analytics at unprecedented scale, thermal loads rise sharply across entire campuses rather than in isolated racks.

The edge data centers segment is expected to grow at a significant CAGR over the forecast period. The edge data centers segment is increasingly driving adoption in the market as computing workloads shift closer to end users to support latency-sensitive applications. Edge data centers are deployed to enable real-time processing for various use cases, including 5G networks, autonomous systems, smart cities, industrial IoT, AR/VR, and content delivery.

End Use Insights

The IT segment dominated the market in 2025. The IT segment is a major driver of the market, as enterprise IT environments undergo rapid transformation driven by digitalization, virtualization, and the increasing demand for data-intensive workloads. Modern IT infrastructures increasingly rely on high-density servers, virtualization platforms, containerized applications, and real-time data processing, all of which place sustained thermal stress on compute hardware. Liquid cooling enables IT-focused data centers to support higher rack densities while maintaining stable operating temperatures, ensuring consistent application performance, and minimizing the risk of thermal throttling that can disrupt mission-critical IT services.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. The rapid adoption of AI and machine learning in clinical and research applications is a major driver within the healthcare segment. Healthcare providers and life sciences organizations are increasingly using AI for medical imaging analysis, predictive diagnostics, drug discovery, genomics sequencing, and personalized medicine. These applications rely heavily on GPU-accelerated and HPC-style computing environments, which generate concentrated heat at the chip level. Liquid cooling data center solutions, such as cold plates and immersion cooling, enable healthcare data centers to support these high-power systems while maintaining precise temperature control.

Regional Insights

North America Data Center Liquid Cooling Industry Trends

The data center liquid cooling market in North America held a significant share of nearly 35.6% in 2025. The North America market is witnessing robust growth, driven by increasing demand for energy-efficient thermal management solutions in high-performance computing, AI, and cloud-native workloads. Enterprises and hyperscale operators are increasingly adopting liquid cooling to manage rising heat densities, improve operational efficiency, and reduce energy consumption. Sustainability initiatives, regulatory mandates, and the need for reliable, scalable infrastructure are further accelerating adoption across the U.S. and Canadian data center landscapes.

U.S. Data Center Liquid Cooling Industry Trends

The data center liquid cooling market in the U.S. is expected to grow significantly from 2026 to 2033. The U.S. market is shaped by the rapid expansion of AI, high‑performance computing (HPC), and cloud workloads, which have dramatically increased thermal management demands beyond the limits of traditional air cooling.

Europe Data Center Liquid Cooling Industry Trends

The data center liquid cooling market in Europe is expected to grow during the forecast period. Europe's market is largely influenced by strict environmental regulations and the region's commitment to sustainability. With the European Union's Green Deal and its target for achieving carbon neutrality by 2050, data centers in the region are under pressure to adopt energy-efficient technologies. Liquid cooling solutions are considered highly effective in reducing energy usage and lowering emissions, making them a preferred choice for data center operators.

The UK data center liquid cooling market is expected to grow rapidly in the coming years. The market is advancing strongly as data center operators confront the limitations of traditional air‑based cooling in managing heat from high‑density compute workloads such as artificial intelligence, machine learning, and cloud services. Increasing emphasis on energy efficiency, sustainability, and stringent environmental regulations is driving the adoption of liquid cooling data center technologies that improve power usage effectiveness (PUE), reduce operational expenses, and support corporate net‑zero commitments.

The Germany data center liquid cooling market held a substantial market share in 2024. The market is expanding rapidly as operators respond to rising demand for high‑density compute capacity, driven by artificial intelligence, cloud services, and high‑performance computing workloads.

Asia Pacific Data Center Liquid Cooling Industry Trends

The data center liquid cooling market in the Asia Pacific is growing at a significant CAGR from 2025 to 2033, fueled by the rapid growth as the region’s expanding digital infrastructure, cloud adoption, and proliferation of artificial intelligence (AI) and high‑performance computing (HPC) workloads drive demand for advanced thermal management solutions. Countries like India, Singapore, and South Korea are witnessing a surge in data center development, driven by the increasing reliance on data for industries such as e-commerce, banking, and telecommunications.

The Japan data center liquid cooling market is expected to grow rapidly in the coming years. The Japan market is experiencing rapid expansion as the nation’s digital infrastructure evolves to support artificial intelligence (AI), high‑performance computing (HPC), cloud, and edge workloads. With Japan’s high energy costs and environmental concerns, liquid cooling offers a viable solution to reduce energy consumption while maintaining the reliability of data center operations.

The China data center liquid cooling market held a substantial market share in 2025. The market is also driven by local ecosystem development, partnerships, and standardization efforts aimed at accelerating innovation and scaling advanced cooling technologies. Leading technology providers and data center operators in China are investing in liquid cooling data center solutions that enhance efficiency and operational reliability while supporting hyperscale deployments. For instance, in October 2024 Chindata Group unveiled its AI Data Center Total Solution 2.0, which integrates advanced modular power, prefabrication techniques, and “X‑Cooling” systems that combine air, liquid, and hybrid cooling methods to address high‑density compute environments.

Key Data Center Liquid Cooling Company Insights

Key players operating in the data center liquid cooling industry are Asetek, Inc., COOLIT SYSTEMS, Dell Inc., Vertiv Group Corp., Fujitsu, and Schneider Electric. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Data Center Liquid Cooling Companies:

The following key companies have been profiled for this study on the data center liquid cooling market.

- Alfa Laval

- Asetek, Inc.

- Asperitas

- COOLIT SYSTEMS

- Dell Inc.

- Fujitsu

- Hitachi, Ltd.

- Iceotope Technologies

- Lenovo Group Limited

- LiquidStack

- Mitsubishi Electric Corporation

- NTT Ltd.

- Schneider Electric

- STULZ GMBH

- Vertiv Group Corp.

Recent Developments

-

In November 2025, LiquidStack Holding B.V. signed a memorandum of understanding with Innovo to establish a strategic collaboration focused on the joint development and commercialization of liquid-cooled modular data center solutions in the UAE and international markets. The partnership combines LiquidStack’s advanced liquid cooling technologies with Innovo’s modular manufacturing and systems integration capabilities, aiming to enable higher compute density, improved energy efficiency, and more sustainable data center deployments.

-

In April 2025, Fujitsu partnered with Super Micro Computer, Inc., a U.S.-based producer of high-performance servers, and Nidec Corporation, a Japanese manufacturer of electric motors, to improve data center energy efficiency. This partnership aims to combine Fujitsu's liquid-cooling monitoring and control software with Super Micro Computer, Inc.’s GPU servers for high performance and Nidec Corporation’s high-efficiency liquid-cooling systems. The goal is to develop a service that enhances power usage effectiveness for data centers, enabling more efficient energy consumption without compromising performance.

-

In November 2025, Schneider Electric broadened its EcoStruxure Data Center Solutions portfolio with new solutions aimed at addressing the elevated power and cooling demands of advanced AI and HPC environments. The update includes a prefabricated modular EcoStruxure Pod Data Center that brings together high-power busway, liquid cooling capabilities, and high-density NetShelter racks, along with upgraded EcoStruxure Rack Solutions designed to speed the deployment of AI and high-performance computing infrastructure.

Data Center Liquid Cooling Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.17 billion

Revenue forecast in 2033

USD 29.45 billion

Growth rate

CAGR of 20.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, solution, service, type of cooling, data center, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Alfa Laval; Asetek, Inc.; Asperitas; COOLIT SYSTEMS; Dell Inc.; Fujitsu; Hitachi, Ltd.; Iceotope Technologies; Lenovo Group Limited; LiquidStack; Mitsubishi Electric Corporation; NTT Ltd.; Schneider Electric; STULZ GMBH; Vertiv Group Corp.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Liquid Cooling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the data center liquid cooling market report based on component, solution, service, type of cooling, data center, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Service

-

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Direct Liquid Cooling

-

Indirect Liquid Cooling

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Design and Consulting

-

Installation and Deployment

-

Maintenance and Support

-

-

Type of Cooling Outlook (Revenue, USD Billion, 2021 - 2033)

-

Immersion Cooling

-

Cold Plate Cooling

-

Spray Liquid Cooling

-

-

Data Center Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hyperscale Data Centers

-

Enterprise Data Centers

-

Colocation Data Centers

-

Edge Data Centers

-

High-Performance Computing (HPC) Data Centers

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT

-

Telecom

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Entertainment & Media

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the data center liquid cooling market include Alfa Laval, Asetek, Inc., Asperitas, COOLIT SYSTEMS, Dell Inc., Fujitsu, Hitachi, Ltd., Iceotope Technologies, Lenovo Group Limited, LiquidStack, Mitsubishi Electric Corporation, NTT Ltd., Schneider Electric, STULZ GMBH, Vertiv Group Corp.

b. The global data center liquid cooling market size was estimated at USD 6.65 billion in 2025 and is expected to reach USD 8.17 billion in 2026.

b. The global data center liquid cooling market is expected to grow at a compound annual growth rate of 20.1% from 2026 to 2033 to reach USD 29.46 billion by 2033.

b. The data center liquid cooling market in North America held a significant share of nearly 35.6% in 2025, driven by increasing demand for energy-efficient thermal management solutions in high-performance computing, AI, and cloud-native workloads.

b. The data center liquid cooling market has experienced significant growth due to factors such as the rapid escalation of computing density, driven by AI, machine learning, and high-performance computing workloads. Modern processors, especially GPUs and AI accelerators, operate at extremely high power levels and generate far more heat per rack than traditional enterprise servers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.