- Home

- »

- Biotechnology

- »

-

Density Gradient Media Market Size, Industry Report, 2033GVR Report cover

![Density Gradient Media Market Size, Share & Trends Report]()

Density Gradient Media Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Application (Cell Isolation, Viral Purification), By Formulation (Liquid Media, Powdered Media), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-801-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Density Gradient Media Market Summary

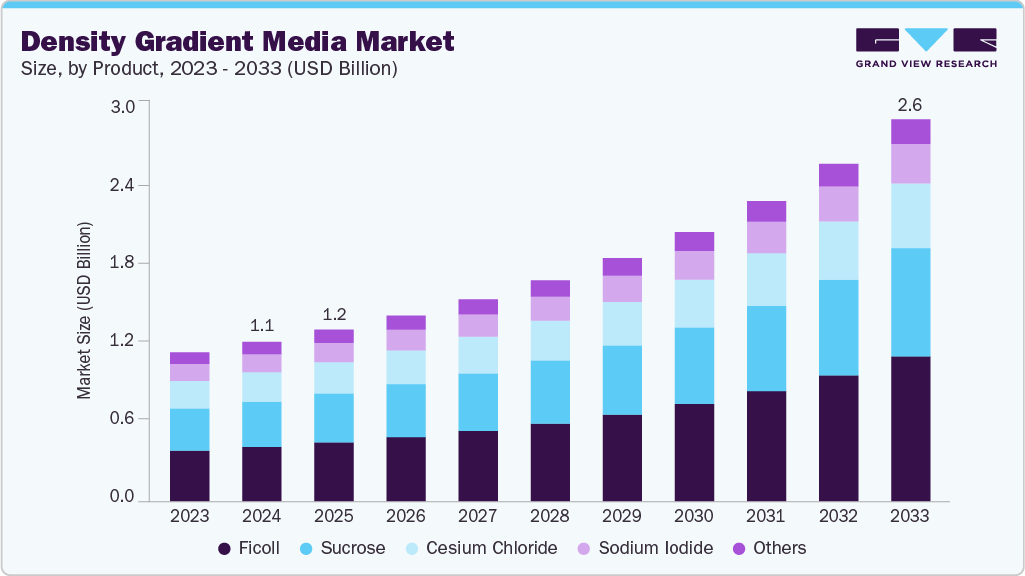

The global density gradient media market size was estimated at USD 1.11 billion in 2024 and is projected to reach USD 2.65 billion by 2033, growing at a CAGR of 10.51% from 2025 to 2033. The market is primarily driven by the growing adoption of advanced cell and molecular biology techniques across biotechnology and pharmaceutical research.

Key Market Trends & Insights

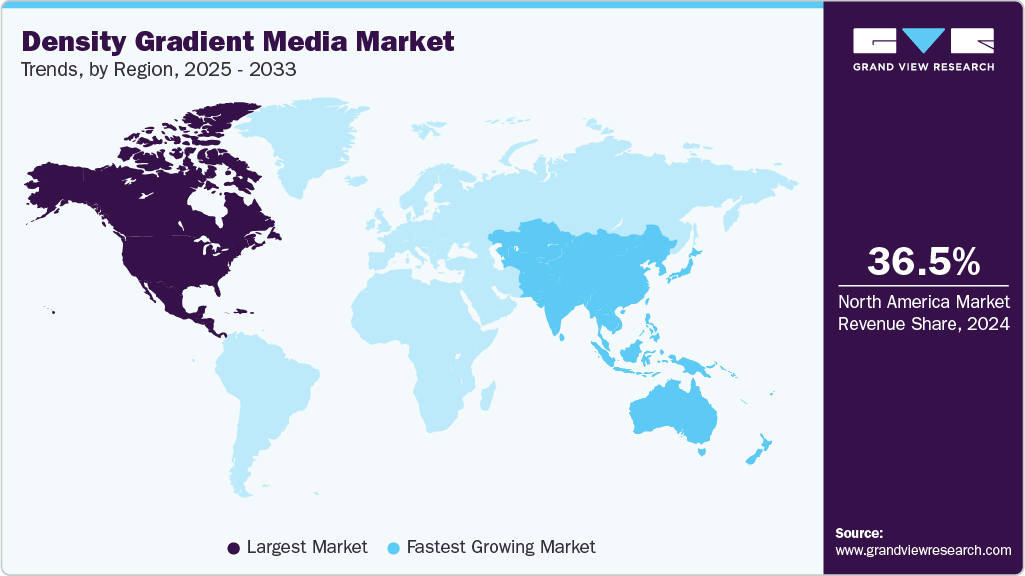

- The North America density gradient media market held the largest share of 36.54% of the global market in 2024.

- The density gradient media industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the ficoll segment held the highest market share in 2024.

- By formulation, the liquid media segment held the highest market share in 2024.

- Based on application, the cell isolation segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.11 Billion

- 2033 Projected Market Size: USD 2.65 Billion

- CAGR (2025-2033): 10.51%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These media are essential for high-purity cell isolation, viral vector purification, and nucleic acid separation, making them indispensable in cell therapy, gene therapy, and vaccine development. Increasing investment in R&D by both academic institutions and biopharma companies has fueled demand, as reliable separation media directly impact experimental accuracy and downstream processing efficiency.

Growing Adoption in Cell and Gene Therapy Research

Density gradient media are critical for isolating specific cell types and purifying viral vectors, which are fundamental steps in developing cell- and gene-based therapies. As the demand for innovative therapies such as CAR-T, stem cell treatments, and gene-editing approaches increases, research and biopharma laboratories are investing heavily in high-quality, reliable gradient media to ensure reproducibility, purity, and efficiency in their workflows.

This trend is particularly pronounced in regions with mature biotechnology sectors, such as North America and Europe, where well-established research institutions and biopharmaceutical companies are advancing clinical programs. The expansion of cell and gene therapy pipelines worldwide further amplifies the need for specialized density gradient media, making it a critical consumable in translational research and large-scale bioprocessing. As more therapies progress from research to clinical stages, the adoption of density gradient media continues to rise, reinforcing its role as a key enabler in next-generation therapeutics.

Rising Investment in Life Science Research

Governments, academic institutions, and private organizations are increasingly allocating funds toward molecular biology, regenerative medicine, and biopharmaceutical research. This surge in funding supports the adoption of advanced laboratory consumables, including density gradient media, which are essential for cell separation, viral vector purification, and nucleic acid isolation. Higher research spending enables laboratories to procure premium, high-purity media that improve experimental reproducibility and efficiency.

Additionally, growing life science investments are fostering innovation and expansion in emerging markets, particularly in Asia Pacific and the Middle East. New research centers, biotech incubators, and public-private partnerships are creating opportunities for wider adoption of density gradient media in academic and industrial research. As these investments continue, demand for reliable, application-specific gradient media is expected to rise, supporting the market’s sustained growth and encouraging companies to expand product portfolios and regional reach.

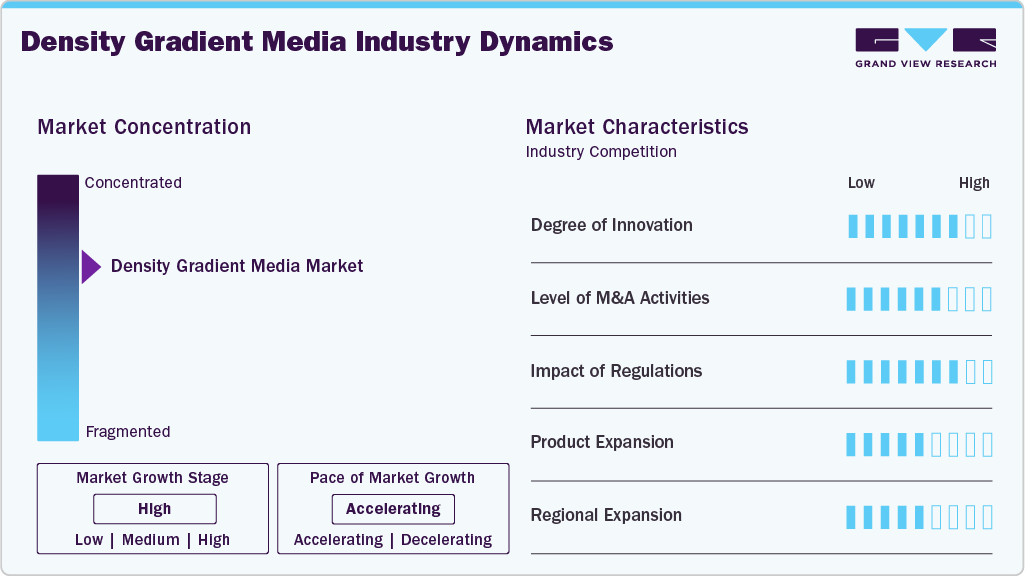

Market Concentration & Characteristics

Innovation in the density gradient media industry is high, driven by the demand for improved purity, reproducibility, and application-specific media for cell isolation, viral vector purification, and nucleic acid separation. Companies are developing new chemistries, pre-made gradient solutions, and automated gradient preparation systems to enhance workflow efficiency and reduce variability, reflecting a continuous focus on R&D.

Mergers and acquisitions have been moderately active in this density gradient media industry, with large life science corporations acquiring smaller specialized suppliers to expand product portfolios, enhance technological capabilities, and enter new geographies. Strategic acquisitions are often aimed at integrating novel media chemistries, improving supply chain control, and strengthening the presence in emerging markets.

Regulatory compliance significantly affects the industry, particularly for density gradient media used in clinical, diagnostic, and GMP-compliant manufacturing settings. Companies must adhere to strict quality standards and documentation practices, which can increase production costs but also serve as a barrier to entry for smaller or new players lacking regulatory expertise.

Product expansion is a key growth strategy, with firms introducing new formulations, ready-to-use liquid media, custom gradient solutions, and automated systems to address diverse research and industrial applications. This continuous broadening of product lines helps companies differentiate themselves and capture specialized market segments such as cell therapy, viral vector purification, and regenerative medicine.

Regional expansion is another strategic focus, with companies investing in manufacturing and distribution infrastructure across North America, Europe, and Asia-Pacific to meet rising demand. Emerging markets, particularly in Asia and the Middle East, are attracting increased attention due to growing biopharma activity and government-backed research initiatives, creating opportunities for both global leaders and niche suppliers.

Product Insights

The ficoll segment led the density gradient media industry with the largest revenue share of 34.17% in 2024. Ficoll-based media, such as Ficoll-Paque, remain a gold standard in clinical research, immunology, and diagnostic testing due to their high reproducibility, low cytotoxicity, and ability to preserve cell viability. The growing emphasis on cell-based assays, immunotherapy research, and single-cell analysis across academic, biopharma, and diagnostic laboratories further boosts demand.

The sucrose segment is expected to grow significantly during the forecast period. The market is driven by its continued use in subcellular fractionation, organelle isolation, and virus purification due to its cost-effectiveness, ease of preparation, and compatibility with a wide range of biological samples. Sucrose gradients are a foundational tool in cell biology and molecular research, particularly for separating mitochondria, endoplasmic reticulum, and Golgi vesicles, making them indispensable in basic life science and academic research. Moreover, their non-toxic and biocompatible nature supports use in biochemical assays and virology studies.

Formulation Insights

The liquid media segment led the density gradient media industry with the largest revenue share in 56.06% 2024. Ready-to-use liquid formulations eliminate the need for manual preparation, reducing variability and contamination risks, critical advantages for GMP-compliant biopharma and cell therapy manufacturing. These media are widely adopted in applications such as viral vector purification, exosome isolation, and cell separation, where reproducibility and purity are paramount. Leading suppliers like Cytiva and Merck continue to expand their liquid media portfolios to meet growing demand from biomanufacturers and research labs seeking scalable and validated gradient solutions.

The custom gradient solutions segment is expected to grow fastest during the forecast period. The growing demand for tailored separation media in specialized applications, particularly in cell and gene therapy, viral vector purification, and exosome isolation. Custom solutions offer flexibility in density, osmolarity, and volume, enabling higher recovery rates, improved purity, and reproducibility in complex workflows. As the personalization of bioprocessing and translational research expands, demand for these bespoke media continues to rise, making custom gradient solutions one of the fastest-growing segments within the density gradient media market.

Application Insights

The cell isolation segment led the density gradient media industry with the largest revenue share of 38.43% in 2024. Density gradient media such as Ficoll and Percoll enable high-purity, viable cell recovery, which is critical for immunology studies, single-cell analysis, and regenerative medicine workflows. The rising adoption of cell- and gene-based therapies, along with growing investment in translational and academic research, has further amplified demand, making cell isolation the largest and most consistent application segment in the global market.

The viral purification segment is expected to grow at the fastest CAGR over the forecast period. As the biotech industry scales up development of viral vectors for gene therapies, vaccines, and oncolytic viruses, there is increasing need for high‑purity, high‑titre virus stocks, and density gradient media have become a preferred solution because they enable better recovery, fewer impurities, and lower cytotoxicity compared to traditional methods like sucrose or CsCl gradients.

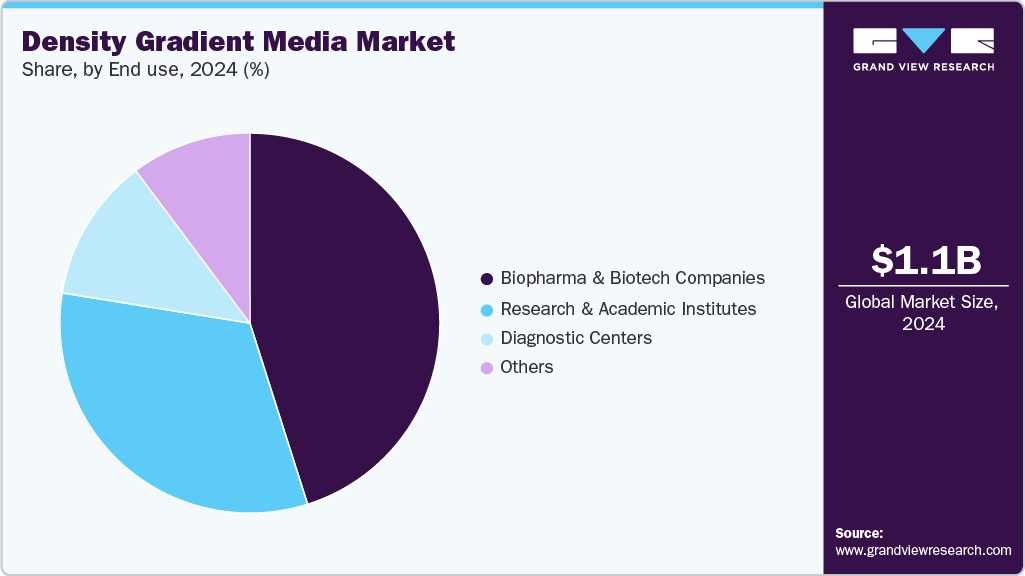

End Use Insights

Based on end use, the biopharma & biotech companies segment led the density gradient media industry with the largest revenue share of 45.09% in 2024, driven by the increasing scale and complexity of cell and gene therapy, viral vector production, and regenerative medicine workflows. These companies require high-purity, reproducible, and scalable gradient media to ensure consistent results in cell isolation, viral purification, and downstream processing under GMP-compliant conditions. Rising investment in biopharmaceutical R&D, coupled with the expansion of clinical pipelines and commercial manufacturing of advanced therapies, has fueled demand for both ready-to-use liquid media and custom gradient solutions, making biopharma and biotech firms the largest end-use segment in the market.

The research & academic institutes segment is expected to grow at the significant CAGR during the forecast period. Universities and research centers rely heavily on Ficoll, sucrose, and other gradient media for studies in immunology, stem cell biology, and basic life sciences due to their reproducibility, ease of use, and compatibility with standard laboratory workflows. Growing funding for academic research, expansion of translational studies, and increasing adoption of advanced techniques like single-cell analysis and organelle isolation further sustain demand, making research and academic institutes a stable and significant contributor to the overall density gradient media market.

Regional Insights

North America dominated the density gradient media market with a share of 36.54% in 2024. The market is driven by strong investment in life science research, extensive biopharmaceutical manufacturing capabilities, and growing applications in cell and gene therapy. The region’s well-established research infrastructure, coupled with advanced laboratory technologies and high demand for high-purity cell isolation, supports steady market growth.

U.S. Density Gradient Media Market Trends

In the U.S., rapid expansion of the biotechnology and pharmaceutical industries is the primary growth driver. Increased funding for precision medicine, viral vector production, and academic research programs fuels the adoption of density gradient media in both clinical and translational applications. The presence of leading suppliers and a robust regulatory framework further enhance market advancement.

Europe Density Gradient Media Market Trends

Europe’s density gradient media market is growing due to expanding biomedical research activities, particularly in molecular biology and regenerative medicine. Government initiatives to support academic-industry collaboration and regional investments in life sciences infrastructure encourage greater utilization of gradient media for research and diagnostics.

In the UK density gradient media market, growth is supported by strong academic research programs, innovation funding for biotech start-ups, and early adoption of advanced lab consumables. The country's focus on cell therapy, genomics, and bioprocessing has increased demand for high-performance separation media in research and production facilities.

The Germany density gradient media market is witnessing significant growth due to the country’s increasing leadership in biotechnology and diagnostics through high R&D spending and the presence of numerous biopharma companies. Continuous development of cell and molecular biology research infrastructure and government-backed innovation funding contribute significantly to market expansion.

Asia Pacific Density Gradient Media Market Trends

The density gradient media market in the Asia Pacific is anticipated to grow at the fastest CAGR of 12.70% over the forecast period, fueled by expanding biotech infrastructure, rising academic research output, and government incentives for local biomanufacturing. Increasing demand for efficient cell separation and purification solutions in developing economies further supports regional growth.

The China density gradient media market is propelled by large-scale investments in biotechnology, strong government initiatives promoting domestic innovation, and the expansion of high-throughput research facilities. The country’s growing focus on gene therapy, diagnostics, and vaccine production has intensified demand for gradient media used in cell and viral vector purification.

The Japan density gradient media market benefits from advanced research institutions, growing regenerative medicine initiatives, and strong collaborations between academia and industry. The country’s emphasis on high-quality laboratory standards and increasing biopharma activity sustain consistent market growth.

Middle East & Africa Density Gradient Media Market Trends

The Middle East market is expanding gradually due to the establishment of new research centers, investment in biotechnology, and modernization of healthcare infrastructure. Governments are encouraging technology transfer and partnerships with global life science firms, creating new opportunities for gradient media suppliers.

In the Kuwait density gradient media market, increasing healthcare spending, expansion of research laboratories, and participation in regional biotechnology programs are driving adoption of density gradient media. The country’s focus on improving laboratory capabilities and diagnostic accuracy is fostering slow but steady market growth.

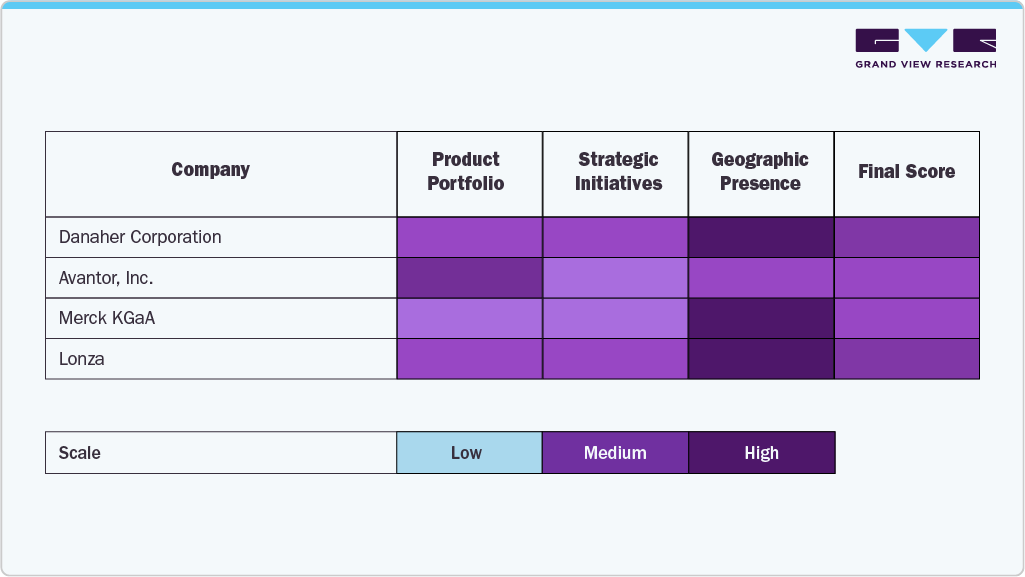

Key Density Gradient Media Company Insights

The density gradient media market is moderately consolidated, with key players such as Cytiva (Danaher Corporation), Merck KGaA (Sigma-Aldrich), Avantor (VWR International), Lonza Group, STEMCELL Technologies, FUJIFILM Irvine Scientific, and MP Biomedicals dominating global supply. These companies compete primarily on product purity, reproducibility, and application versatility across cell isolation, viral purification, and nucleic acid separation workflows.

Strategic initiatives such as product line expansions, partnerships with biopharma firms, and investments in GMP-compliant media production have strengthened their positions. Emerging players like pluriSelect Life Science, Kitazato Corporation, and REPROCELL Inc. are focusing on niche research and custom formulations, catering to academic and translational research markets. Overall, market competition is shaped by technological innovation, regulatory compliance, and regional distribution strength.

Key Density Gradient Media Companies:

The following are the leading companies in the density gradient media market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher Corporation

- Avantor, Inc.

- Merck KGaA

- MP Biomedicals LLC

- STEMCELL Technologies Inc.

- REPROCELL Inc.

- Kitazato Corporation

- FUJIFILM Holdings Corporation

- pluriSelect Life Science

- Lonza

Recent Developments

-

In August 2025, EDM Resources Inc. announced the final results of the Dense Media Separation Study conducted on all zinc and lead composite samples from its Scotia Mine. The final tests indicated that it was possible to pre-concentrate crushed run-of-mine material using Dense Media Separation (DMS) prior to flotation, potentially reducing the overall cost of mineral processing at the Scotia Mine.

-

In June 2025, Cytiva, a subsidiary of Danaher Corporation, announced the completion of approximately US $1.6 billion in strategic investments across the U.S., Europe, and Asia-Pacific aimed at expanding its manufacturing capacity for media and other consumables, while strengthening its global supply chain.

Density Gradient Media Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.19 billion

Revenue forecast in 2033

USD 2.65 billion

Growth rate

CAGR of 10.51% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Danaher Corporation; Avantor, Inc.; Merck KGaA; MP Biomedicals LLC; STEMCELL Technologies Inc.; REPROCELL Inc.; Kitazato Corporation; FUJIFILM Holdings Corporation; pluriSelect Life Science; Lonza

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Density Gradient Media Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global density gradient media market report on the basis of product, formulation, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sodium Iodide

-

Cesium Chloride

-

Ficoll

-

Sucrose

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid Media

-

Powdered Media

-

Custom Gradient Solutions

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Isolation

-

Viral Purification

-

Protein Purification

-

Nucleic Acid Extraction

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharma & Biotech Companies

-

Research & Academic Institutes

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.