- Home

- »

- Next Generation Technologies

- »

-

Embedded AI Software Market Size, Industry Report, 2033GVR Report cover

![Embedded AI Software Market Size, Share & Trends Report]()

Embedded AI Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment (On-premises, Cloud, Hybrid), By Technology (Machine Learning, Deep Learning, Natural Language Processing, Computer Vision), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-749-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Embedded AI Software Market Summary

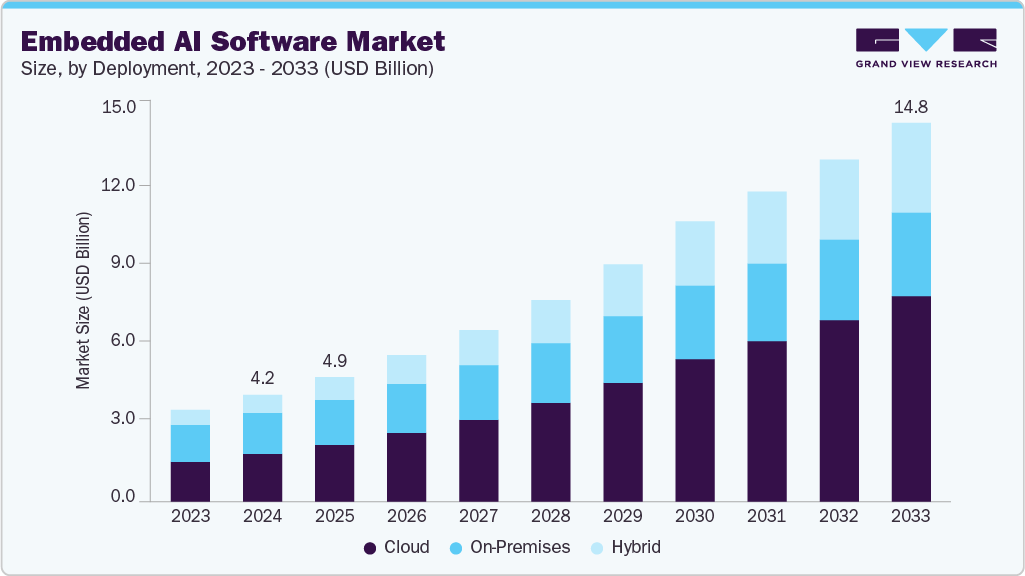

The global embedded AI software market size was valued at USD 4.18 billion in 2024 and is projected to reach USD 14.81 billion by 2033, growing at a CAGR of 14.9% from 2025 to 2033. The industry is driven by rising demand for intelligent edge devices, advancements in IoT ecosystems, and increasing adoption across automotive, consumer electronics, and industrial automation.

Key Market Trends & Insights

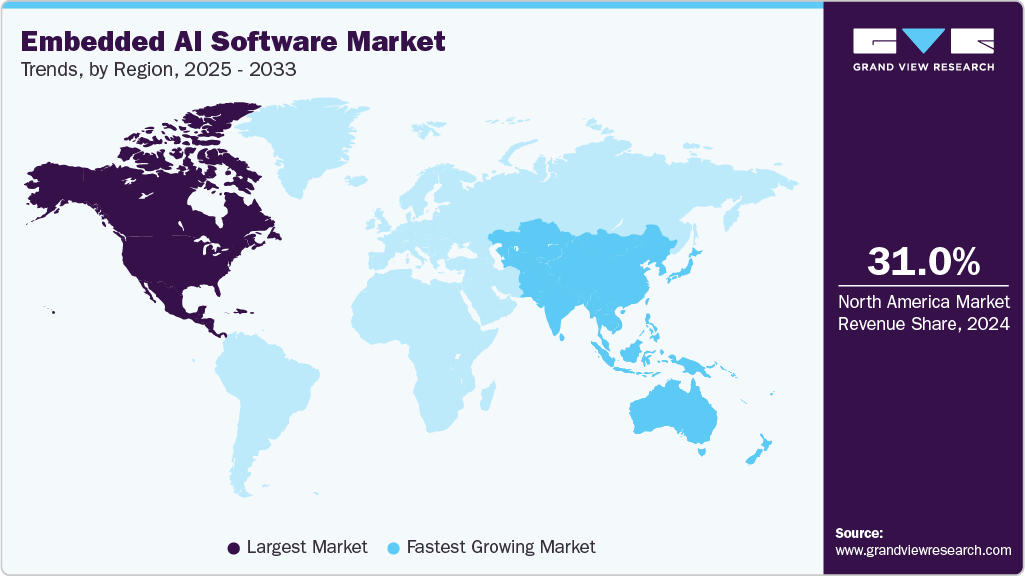

- North America dominated the global embedded AI software market with the largest revenue share of 31.0% in 2024.

- The embedded AI software market in the U.S. led the North America market and held the largest revenue share in 2024.

- By deployment, the cloud segment led the market, holding the largest revenue share of 44.9% in 2024.

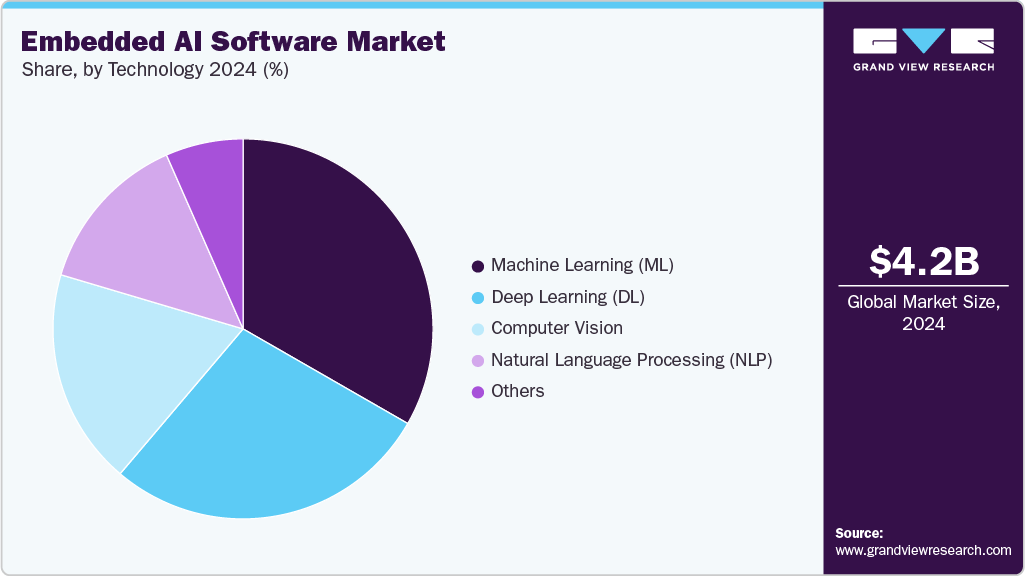

- By technology, the machine learning segment held the dominant position in the market.

- By end use, the manufacturing held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 4.18 Billion

- 2033 Projected Market Size: USD 14.81 Billion

- CAGR (2025-2033): 14.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growth is further fueled by reduced latency needs, improved real-time analytics, and integration of AI in chipsets, enabling smarter decision-making, enhanced efficiency, and personalized user experiences across diverse applications. The industry is driven by the rising demand for intelligent edge computing and real-time data processing. As industries shift from cloud-based to edge-based architectures, embedded AI software enables faster decision-making, reduced latency, and greater operational efficiency. This is particularly essential in various applications such as autonomous vehicles, robotics, and industrial automation, where milliseconds of delay can impact safety and performance. Moreover, the growing adoption of IoT devices in sectors such as healthcare, smart homes, and manufacturing is fueling the need for embedded AI to analyze data locally, thereby enhancing responsiveness while minimizing dependency on centralized servers.

The increasing integration of AI algorithms within hardware components such as processors, microcontrollers, and chipsets is another major growth driver. Semiconductor manufacturers are embedding AI capabilities directly into chips to support lightweight machine learning models, which power devices such as smartphones, wearables, drones, and connected appliances. This convergence of hardware and software accelerates innovation, delivering enhanced functionality, energy efficiency, and cost-effectiveness. Additionally, rising investment in AI research and development by technology companies, coupled with advancements in low-power AI models, is broadening the adoption of embedded AI software across both consumer and enterprise ecosystems.

Growing industry specific applications are also propelling market growth. In automotive, embedded AI software supports advanced driver-assistance systems (ADAS), predictive maintenance, and autonomous navigation. In healthcare, it enables medical imaging, diagnostics, and personalized monitoring solutions, while in industrial settings, it drives predictive analytics, process optimization, and defect detection. Consumer electronics further contribute to adoption, with smart assistants, AR/VR, and connected devices becoming mainstream. As organizations prioritize efficiency, personalization, and automation, the embedded AI software market is witnessing strong momentum, supported by rising government initiatives, digital transformation efforts, and expanding 5G infrastructure, which collectively create a favorable environment for accelerated deployment.

Deployment Insights

The cloud segment dominated the market with a share of over 44.9% in 2024, driven by its scalability, cost-efficiency, and flexibility, enabling enterprises to deploy AI models without heavy investment in on-premises infrastructure. Cloud platforms facilitate faster training, testing, and deployment of AI algorithms, supporting continuous updates and real-time analytics. They also enable seamless integration with IoT and big data ecosystems, enhancing edge-to-cloud collaboration for smarter decision-making. Moreover, various cloud providers are expanding AI-focused services, including pre-trained models, APIs, and development environments, lowering entry barriers for businesses. Growing reliance on remote operations, global accessibility, and secure data storage further strengthen the adoption of cloud-deployed embedded AI solutions.

The hybrid segment is expected to register a significant CAGR over the forecast period. The hybrid deployment segment in the embedded AI software market is witnessing strong growth due to its ability to combine the benefits of both on-device and cloud-based AI processing. Organizations increasingly prefer hybrid models for enhanced flexibility, scalability, and cost efficiency, allowing critical tasks to run locally while leveraging cloud resources for complex computations and data storage. This approach ensures low-latency responses, improved security, and better compliance with data privacy regulations. Additionally, hybrid deployment supports real-time analytics, remote monitoring, and predictive maintenance in industrial, automotive, and consumer electronics applications, driving adoption among enterprises seeking optimized performance and intelligent decision-making capabilities.

End-use Insights

Manufacturing accounted for the largest revenue share, driven by the need for smart automation, predictive maintenance, and enhanced operational efficiency. AI-powered embedded systems enable real-time monitoring of machinery, reducing downtime and optimizing production processes. The integration of AI with Industrial Internet of Things (IIoT) devices allows manufacturers to leverage advanced analytics for quality control, supply chain optimization, and energy management. Additionally, the rising demand for mass customization, robotics, and smart factories is fueling investments in embedded AI solutions. Growing emphasis on cost reduction, workforce safety, and sustainability further accelerates adoption, positioning manufacturing as a key growth driver in the embedded AI software market.

The retail segment is expected to register the highest CAGR over the forecast period, driven by the growing demand for personalized shopping experiences, operational efficiency, and intelligent decision-making. Retailers are adopting embedded AI solutions to enable real-time data processing at the edge, powering applications such as smart shelves, automated checkouts, predictive inventory management, and customer behavior analysis. The integration of AI-driven recommendation engines, visual recognition systems, and chatbots enhances customer engagement while reducing costs. Additionally, the rising adoption of IoT-enabled devices, fraud detection mechanisms, and dynamic pricing strategies further supports embedded AI growth in retail, making it a key enabler of digital transformation and competitive advantage.

Technology Insights

The machine learning (ML) segment held the largest market share in 2024. The ML technology segment in the embedded AI software market is primarily driven by the increasing need for intelligent, autonomous systems across industries. ML enables devices to analyze real-time data, improve operational efficiency, and support predictive maintenance, particularly in automotive, industrial, and healthcare applications. The surge in IoT adoption and edge computing accelerates ML integration, allowing low-latency decision-making without reliance on cloud infrastructure. Additionally, advancements in algorithms, model compression techniques, and specialized hardware facilitate deployment on resource-constrained devices. Growing demand for personalized consumer experiences, enhanced safety features, and energy-efficient solutions further propels the adoption of ML technologies within embedded AI ecosystems.

The deep learning segment is expected to register the highest CAGR over the forecasted period, propelled by the growing need for advanced data processing and real-time decision-making at the edge. Increasing deployment of smart devices, including autonomous vehicles, drones, and industrial robots, relies on deep learning algorithms for image recognition, natural language processing, and predictive maintenance. Continuous advancements in GPU and AI accelerator chips enhance computational efficiency, enabling complex models to run on resource-constrained devices. Additionally, rising demand for personalized user experiences, intelligent healthcare monitoring, and AI-driven consumer electronics drives adoption. The segment benefits from reduced latency, improved accuracy, and seamless integration of AI capabilities directly into embedded systems, accelerating overall market growth.

Regional Insights

North America dominated the embedded AI software industry with a revenue share of 31.0% in 2024, driven by strong demand for intelligent automation across industries such as automotive, healthcare, manufacturing, and consumer electronics. The region benefits from advanced digital infrastructure, high R&D spending, and the presence of major technology players fostering innovation in AI algorithms and chip-level integration. Growing adoption of IoT-enabled devices and edge computing solutions further accelerates market growth by enabling faster, real-time decision-making. Additionally, rising investments in autonomous vehicles, smart factories, and connected healthcare systems are expanding the application scope of embedded AI software. Supportive government initiatives and robust venture capital funding also strengthen the region’s competitive position.

U.S. Embedded AI Software Market Trends

The embedded AI software industry in the U.S. is expected to grow significantly, driven by rapid adoption of intelligent edge devices, growth in IoT ecosystems, and rising demand for real-time data processing across industries. Increasing integration of AI in automotive systems, robotics, and consumer electronics is fueling innovation in embedded platforms. Strong investments from tech companies and startups, coupled with supportive government initiatives for AI R&D, further accelerate market expansion. The surge in demand for predictive analytics, energy-efficient chips, and adaptive machine learning models enhances adoption. Additionally, rising industrial automation, healthcare digitization, and defense modernization programs strengthen the market’s growth outlook in the U.S.

Europe Embedded AI Software Market Trends

The embedded AI software market in Europe is expected to grow significantly over the forecast period, driven by rapid adoption of Industry 4.0, strong demand for intelligent automation, and advancements in edge computing that reduce latency and enhance real-time decision-making. Increasing investments in connected vehicles, smart manufacturing, and healthcare devices are fueling demand for embedded AI solutions that enable predictive maintenance, adaptive control, and efficient resource management. The region’s focus on sustainability and energy efficiency further accelerates adoption in smart grids and IoT-enabled infrastructure. Moreover, supportive EU regulations on digital transformation, cybersecurity, and AI ethics are encouraging enterprises to deploy embedded AI technologies across automotive, industrial, and consumer electronics sectors.

Asia Pacific Embedded AI Software Market Trends

The embedded AI software industry in the Asia Pacific region is anticipated to witness the fastest CAGR over the forecast period, driven by rapid digital transformation, widespread adoption of IoT devices, and increasing demand for smart electronics across industries such as automotive, healthcare, manufacturing, and consumer electronics. Rising government initiatives promoting AI innovation, coupled with heavy investments from technology companies and startups, are fueling market expansion. The region’s growing semiconductor ecosystem, along with advancements in 5G connectivity, is accelerating the deployment of embedded AI solutions for real-time decision-making and automation. Moreover, rising demand for edge computing, smart city projects, and industrial automation further strengthens the adoption of embedded AI software across Asia Pacific.

Key Embedded AI Software Companies Insights

Key players operating in the embedded AI software market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Embedded AI Software Companies:

The following are the leading companies in the embedded artificial intelligence (AI) software market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- Microsoft

- IBM Corporation

- NVIDIA Corporation

- Oracle

- NXP Semiconductors.

- STMicroelectronics

- Renesas Electronics Corporation

- Intel Corporation

- Qualcomm Technologies, Inc.

Recent Developments

-

In August 2025, NVIDIA Corporation launched Jetson AGX Thor, a developer kit and production modules. Jetson AGX Thor was developed for the developers working on robotic systems. It offers high performance, improved energy efficiency, and supports running multiple generative AI models at the edge, making it a key platform for advancing physical AI and general robotics.

-

In March 2025, Qualcomm Technologies, Inc. acquired EdgeImpulse Inc., an edge AI software company. It bolsters Qualcomm’s software stack & developer tools in edge AI. It accelerates time-to-market for numerous applications, such as predictive maintenance, anomaly detection, and audio & vision tasks.

-

In December 2024, STMicroelectronics launched the STM32N6 microcontroller series, embedding its proprietary Neural-ART Accelerator NPU, delivering up to 600× more ML performance than prior high-end STM32 MCUs. Concurrently, it launched the ST Edge AI Suite, an integrated collection of software tools to simplify the design, optimization, and deployment of ML on its hardware.

Embedded AI Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.89 billion

Revenue forecast in 2033

USD 14.81 billion

Growth rate

CAGR of 14.9% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Google LLC; Microsoft; IBM Corporation; NVIDIA Corporation; Oracle; NXP Semiconductors; STMicroelectronics; Renesas Electronics Corporation; Intel Corporation; Qualcomm Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Embedded AI Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global embedded AI software market report based on deployment, technology, end-use, and region:

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premises

-

Hybrid

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning

-

Deep Learning

-

Natural Language Processing

-

Computer Vision

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare

-

BFSI

-

IT & Telecom

-

Retail

-

Media & Entertainment

-

Automotive

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global embedded AI software market size was estimated at USD 4.18 billion in 2024 and is expected to reach USD 4.89 billion in 2025.

b. The global embedded AI software market is expected to grow at a compound annual growth rate of 14.9% from 2025 to 2033 to reach USD 14.81 billion by 2033.

b. North America dominated the embedded AI software market with a share of 31.0% in 2024. This is attributable to the strong demand for intelligent automation across industries such as automotive, healthcare, manufacturing, and consumer electronics. The region benefits from advanced digital infrastructure, high R&D spending, and the presence of major technology players fostering innovation in AI algorithms and chip-level integration.

b. Some key players operating in the embedded AI software market include Google LLC; Microsoft; IBM Corporation; NVIDIA Corporation; Oracle; NXP Semiconductors; STMicroelectronics; Renesas Electronics Corporation; Intel Corporation; and Qualcomm Technologies, Inc.

b. Key factors that are driving the embedded AI software market growth include rising demand for intelligent edge devices, advancements in IoT ecosystems, and increasing adoption across automotive, consumer electronics, and industrial automation. Growth is further fueled by reduced latency needs, improved real-time analytics, and integration of AI in chipsets, enabling smarter decision-making, enhanced efficiency, and personalized user experiences across diverse applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.