- Home

- »

- Next Generation Technologies

- »

-

Farm Management Software Market Size, Share Report 2030GVR Report cover

![Farm Management Software Market Size, Share & Trends Report]()

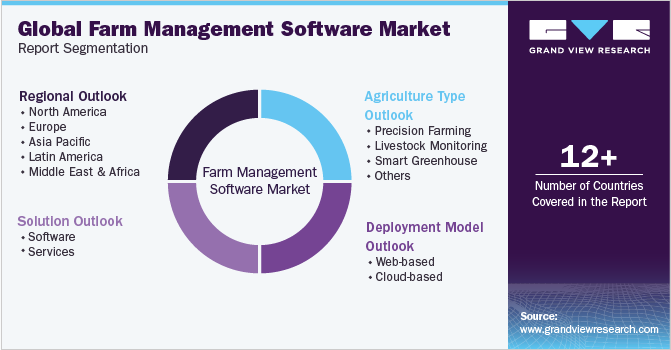

Farm Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Agriculture Type (Precision Farming, Livestock Monitoring, Smart Greenhouse), By Component, By Deployment, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-327-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Farm Management Software Market Summary

The global farm management software market size was estimated at USD 4.18 billion in 2024 and is projected to reach USD 10.58 billion by 2030, growing at a CAGR of 17.3% from 2025 to 2030. The market growth can be attributed to the increasing implementation of cloud computing for real-time farm data management.

Key Market Trends & Insights

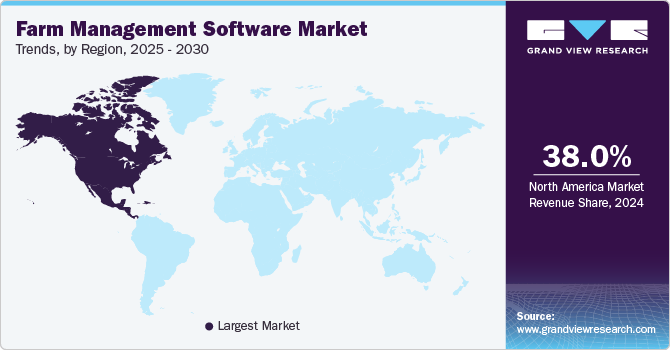

- The North America held a significant share of around 38.0% in 2024.

- The farm management software industry in the U.S. dominated in 2024.

- Based on component, the software segment dominated the farm management software industry with a revenue share of over 64.0% in 2024.

- Based on agriculture type, the precision farming segment dominated the industry with a revenue share of over 43.0% in 2024.

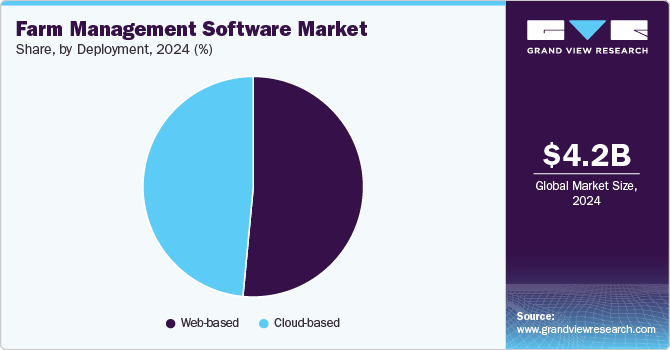

- Based on deployment, the web-based segment dominated the industry with a revenue share of over 51.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.18 Billion

- 2030 Projected Market Size: USD 10.58 Billion

- CAGR (2025-2030): 17.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Farm Management Software (FMS) involves the use of Information Communication Technology (ICT), particularly IoT and big data analytics, to address resource constraints such as shortage of energy, water, and labor and social issues such as environment, animal welfare and use of fertilizers, which negatively influence agricultural production.The adoption of remote sensing technology in the agriculture industry has increased due to the emergence of drones and GIS. Images captured through a device featuring remote sensing technology can be used to detect cop water stress, monitor weeds and crop diseases, classify crop species, and map soil properties. Some open-source remote sensing software includes Quantum GIS Semi-Automatic Classification Plugin (SCP), Optical and Radar Federated Earth Observation (ORFEO) toolbox, Opticks, and PolSARPro, among others.

In addition, increasing site-specific crop management is expected to reduce pesticide use, increase crop yields, and provide greater insight for farm management decisions. Farm management software equipped with advanced data analytics capabilities can process historical and real-time data to generate predictive models, enabling farmers to forecast crop performance under different environmental conditions. By analyzing factors like weather patterns, soil quality, and crop health, the software can offer valuable insights to make informed decisions regarding fertilization, pest control, and irrigation. Forecasting crop performance under various environmental situations can assist farmers in boosting their yield. Phenotyping aids in the understanding of several elements affecting crop growth, such as nitrogen depletion and soil pH levels. It is used to determine crop growth under various situations.

Furthermore, the rising popularity of integrated farm management systems, which provide end-to-end solutions for crop planning, field monitoring, livestock management, and supply chain optimization, is transforming traditional farming methods. Mobile applications and remote sensing technologies have made it easier for farmers to monitor their operations in real-time, even in remote areas. However, challenges such as high initial investment costs, lack of digital literacy among small-scale farmers, and concerns regarding data security remain barriers to widespread adoption. Despite these challenges, the market outlook remains promising, with continuous advancements in AI-powered analytics, automation, and machine learning expected to further enhance the capabilities and accessibility of farm management software. Farm management solutions will play a crucial role in ensuring sustainable and efficient food production worldwide as the agriculture sector continues to modernize.

Component Insights

Based on component, the market is segmented into software and services. The software segment dominated the farm management software industry with a revenue share of over 64.0% in 2024. Integrating IoT and cloud-based solutions has revolutionized FMS by offering real-time monitoring, remote access, and automated data processing. IoT-enabled sensors collect critical field data such as soil moisture, temperature, and nutrient levels, which FMS then analyzes to provide actionable insights. Cloud-based computing allows farmers to access their data from anywhere, improving convenience and collaboration among stakeholders in the agricultural supply chain.

The services segment is expected to grow at a CAGR of 16.6% over the forecast period. The rise of subscription-based and cloud-based FMS models is driving segment growth. Many FMS providers offer solutions, such as Software-as-a-Service (SaaS), which requires ongoing support, updates, and maintenance. Farmers subscribing to these services often rely on customer support teams for troubleshooting, software updates, and cybersecurity measures to protect their farm data.

Agriculture Type Insights

The market is segmented into precision farming, livestock monitoring, smart greenhouse, and others based on agriculture type. The precision farming segment dominated the industry with a revenue share of over 43.0% in 2024. The growing trend of data-driven farming drives the expansion of the precision farming market. With the increasing availability of big data, farmers can make informed decisions based on comprehensive data analysis rather than relying on traditional farming methods. This includes utilizing weather data, soil conditions, and crop health reports collected through sensors and remote sensing technologies. Integrating big data analytics with FMS allows farmers to identify patterns, predict outcomes, and fine-tune their practices to maximize efficiency and yield. As data-driven farming becomes more mainstream, the reliance on advanced farm management software systems is intensifying, thereby propelling the growth of the precision farming market.

The smart greenhouse segment is anticipated to grow at the fastest CAGR of 17.8% over the forecast period. Consumer demand for fresh, locally grown produce is driving the adoption of smart greenhouses. With the increasing interest in sustainable and organic farming, consumers are looking for ways to access fresh, high-quality produce grown without harmful chemicals. Smart greenhouses allow for year-round production of fruits, vegetables, and herbs in controlled environments, reducing reliance on traditional farming methods and long supply chains. FMS helps streamline operations, ensuring that crops are produced efficiently and at high standards, thus meeting consumer expectations for freshness and sustainability.

Deployment Insights

Based on deployment, the market is segmented into web-based and cloud based. The web-based segment dominated the industry with a revenue share of over 51.0% in 2024. The growing focus on data security and cloud computing played a pivotal role in the web-based FMS market’s expansion. Many farmers are more comfortable with cloud technology due to data encryption advancements and cybersecurity protocols protecting their sensitive farm data. As trust in cloud-based services increases, farmers are more willing to adopt these solutions to enhance operational efficiency without compromising data security.

The cloud-based segment is anticipated to grow fastest from 2025 to 2030. The advancement of precision agriculture technologies is driving the growth of cloud-based FMS. Precision farming relies heavily on data-driven insights to make real-time crop and resource management decisions. Cloud-based FMS supports precision agriculture by enabling seamless integration with GPS technology, remote sensing devices, drones, and other IoT tools that collect data about soil health, crop growth, and environmental conditions. These technologies enable farmers to tailor their practices to specific areas within a field, improving efficiency and sustainability while reducing waste and resource consumption. The ability to process large amounts of data from these advanced tools in the cloud makes it easier for farmers to implement large-scale precision farming strategies.

Regional Insights

North America held a significant share of around 38.0% in 2024. The consolidation of farms and the rise of large agribusinesses in North America are driving the demand for more advanced and comprehensive farm management software solutions. As farms grow larger and more complex, there is a need for more sophisticated software to manage various aspects of farm operations, from crop production to financial management. FMS platforms provide agribusinesses with the tools to streamline operations, track inventory, monitor labor, and manage finances in one integrated system. This efficiency level is critical for large-scale farming operations, and as the consolidation trend continues, the demand for comprehensive FMS solutions is expected to rise.

U.S. Farm Management Software Market Trends

The farm management software industry in the U.S. dominated in 2024. Government policies and initiatives play a significant role in driving the adoption of FMS in the U.S. The U.S. government has implemented several programs incentivizing farmers to adopt digital technologies to improve farm efficiency and sustainability. For example, programs from the U.S. Department of Agriculture (USDA) provide farmers with financial assistance and technical support to adopt precision agriculture tools and software solutions. In addition, implementing environmental regulations and sustainability goals, such as those aimed at reducing water usage and minimizing chemical inputs, encourages farmers to adopt FMS, which helps them meet compliance standards. These government-backed initiatives provide farmers with the necessary resources to integrate advanced technologies into their operations.

Europe Farm Management Software Market Trends

The farm management software industry in Europe is anticipated to register considerable growth from 2025 to 2030. The growing demand for organic and sustainably produced food drives European market growth. Consumers across the region are increasingly concerned about food safety, environmental impact, and the ethical treatment of animals, which has led to a rise in the demand for organic, locally sourced, and sustainably produced agricultural products. As a result, European farmers are under pressure to adopt farming practices that minimize the use of chemicals, reduce waste, and protect the environment. Farm management software plays a key role in enabling farmers to meet these consumer demands by providing tools for better resource management, waste reduction, and traceability.

The UK farm management software industry held a substantial market share in 2024. The growing consumer demand for traceability and transparency in food production is influencing the FMS market in the UK. Consumers are increasingly concerned about the origins of their food and the practices used to produce it. This trend is especially prominent in the UK, where consumers demand more information about food production's sustainability, quality, and ethical practices. Farm management software enables farmers to track and document various aspects of their farming practices, such as crop rotations, pesticide use, and harvest records. This level of transparency can help farmers demonstrate compliance with sustainability certifications and provide consumers with the information they need to make informed purchasing decisions.

The farm management software industry in Germany is expected to grow rapidly during the forecast period. Germany’s export-oriented industrial base, especially in automotive, machinery, and electronics, also drives the adoption of LCA. International markets increasingly demand sustainable, transparent supply chains and products with documented environmental performance. German manufacturers use LCA to generate Environmental Product Declarations (EPDs) and carbon footprint analyses that meet EU and global standards, enabling them to maintain competitiveness and meet customer expectations. Automakers, in particular, leverage LCA to assess the full lifecycle impact of vehicles, including electric vehicles (EVs), as part of their commitments to sustainable mobility.

Asia Pacific Farm Management Software Industry Trends

The farm management software market in Asia Pacific is expected to achieve the fastest CAGR of 17.8% during the forecast period. The growing concern over environmental sustainability and the impact of climate change on agriculture drives the market growth in the region. With extreme weather events such as droughts, floods, and storms becoming more frequent and severe, farmers are increasingly looking for ways to adapt to changing climatic conditions. Farm management software plays a critical role in this context by helping farmers manage their resources more efficiently and make data-driven decisions to mitigate the risks of climate change. As environmental sustainability becomes a priority for governments and consumers, FMS solutions are seen as an important tool for achieving more sustainable agricultural practices in the APAC region.

China farm management software industry held a substantial market share in 2024. The increasing availability of mobile technology is a key factor driving the growth of the FMS market in China. With the widespread use of smartphones and mobile internet, farmers in China can access mobile applications that enable them to manage their farm operations remotely. This is particularly important in rural areas, where farmers may have limited access to traditional infrastructure but have a high mobile phone penetration rate. Mobile farm management software allows farmers to monitor their crops, track inputs and outputs, access weather data, and receive updates on market prices, all from the palm of their hands. The accessibility and convenience of mobile-based FMS solutions are making them more appealing to farmers in China, especially as mobile technology continues to improve and become more affordable.

The farm management software market in India is expected to grow rapidly during the forecast period. The rise of e-commerce platforms and digital marketplaces in India is contributing to the growth of the FMS market. As more farmers look to sell their produce directly to consumers through online platforms, they need digital tools to manage inventory, track sales, and analyze market trends. Farm management software can help farmers integrate with e-commerce platforms, manage their supply chains, and set competitive prices based on real-time market data. This is particularly important in India, where traditional supply chains often involve intermediaries that reduce the farmer’s income. By enabling farmers to bypass intermediaries and directly reach consumers, FMS can help improve profitability and market access for Indian farmers.

Bottom of Form Key Farm Management Software Company Insights

Some key players operating in the market include Conservis, Agworld Pty Ltd, and Croptracker.

-

Conservis is a technology company specializing in providing software solutions tailored to the agricultural industry. Founded with the vision of helping farmers increase operational efficiency and profitability, Conservis offers a comprehensive farm management platform. The platform enables farmers to capture, manage, and analyze data across all aspects of their farming operations, from planting and harvesting to financial and inventory management. The company’s key product is its farm management software, which is designed to streamline farm operations, reduce waste, and enhance decision-making. Farmers can monitor and optimize the use of resources such as labor, machinery, and inputs through data-driven insights. This allows them to make informed decisions that improve yields, reduce costs, and contribute to sustainable farming practices.

Farmbrite and AGRIVI are some of the emerging market participants in the target market.

-

Farmbrite is a technology company that offers a comprehensive farm management software platform designed to help farmers and agricultural businesses streamline operations and increase productivity. The platform is tailored for small to mid-sized farms. It provides a user-friendly solution for managing various aspects of farming, including crop planning, livestock tracking, financial management, and inventory control. By consolidating farm data into a centralized platform, Farmbrite enables farmers to make more informed decisions and enhance overall farm efficiency. The software supports crop and livestock operations, making it versatile for various farming practices. Farmbrite also offers tools for budgeting, invoicing, and reporting, helping farmers manage finances and stay on top of expenses, revenues, and profitability.

Key Farm Management Software Companies:

The following are the leading companies in the farm management software market. These companies collectively hold the largest market share and dictate industry trends.

- Bushel Inc.

- Conservis

- Agworld Pty Ltd

- Farmbrite

- AGRIVI

- Croptracker

- AgriWebb

- Aegro

- xFarm Technologies

- AgriERP

- eAgronom

- Navfarm

Recent Developments

-

In May 2025, xFarm Technologies partnered with Checkplant, an AgTech company based in Brazil specializing in agricultural field management and monitoring solutions. This collaboration allows xFarm Technologies to expand its presence in Latin America, positioning itself as a more reliable partner for companies seeking to digitalize their global supply chains. In turn, Checkplant gains the opportunity to broaden its reach and enhance its services. The two companies complement each other well, with a combined global coverage of over 12 million hectares.

-

In December 2024, Syngenta France, a key innovator in agriculture, partnered with xFarm Technologies on a geospatial AI project focused on crop detection in France. This collaboration merges the expertise of Syngenta France with the advanced knowledge of xFarm Technologies. The company assists over 450,000 farms across 7 million hectares in more than 100 countries via its Farm Management Information System on the xFarm digital platform. The project is designed to provide enhanced support for farmers in France, where certain phytosanitary products are tightly regulated, especially when non-target crops are nearby.

-

In September 2024, AGRIVI partnered with the Barbados Agricultural Development and Marketing Corporation (BADMC) to launch the world’s first national AI Agronomic Advisor. This innovative AI-driven platform, accessible through WhatsApp, will provide Barbadian farmers with 24/7 real-time agricultural advice, enhancing productivity and sustainability across the island’s farming community. The partnership highlights Barbados’ dedication to digitizing its agricultural sector. The AI platform will function as a virtual agronomy expert, offering essential support to farmers of all scales. It serves as a direct communication channel between BADMC and farmers, offering guidance on various agricultural issues such as financing, subsidies, and government assistance.

Farm Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.76 billion

Revenue forecast in 2030

USD 10.58 billion

Growth rate

CAGR of 17.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, agriculture type, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Bushel Inc.; Conservis; Agworld Pty Ltd; Farmbrite; AGRIVI; Croptracker; AgriWebb; Aegro; xFarm Technologies; AgriERP; eAgronom; Navfarm

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Farm Management Software Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global farm management software market based on component, agriculture type, deployment, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

System Integration & Consulting

-

Maintenance & Support

-

Managed Services

-

Data Services

-

Analytic Services

-

Farm Operation Services

-

-

Assisted Professional Services

-

Supply Chain Management Services

-

Climate Information Services

-

-

-

-

Agriculture Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Precision Farming

-

Livestock Monitoring

-

Smart Greenhouse

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global farm management software market size was estimated at USD 4.18 billion in 2024 and is expected to reach USD 4.76 billion in 2025.

b. The global farm management software market is expected to grow at a compound annual growth rate of 17.3% from 2025 to 2030 to reach USD 10.58 billion by 2030.

b. North America dominated the farm management software market with a share of 38.3% in 2024. This is attributable to increasing government funding towards developing vertical farms in the region.

b. Some key players operating in the farm management software market include Ag Leader Technology; AgJunction LLC; BouMatic; CropX, Inc.; CropZilla Inc.; DeLaval; DICKEY-john; Deere & Company; Corteva; CNH Industrial; Trimble Inc.; Climate LLC.; Gamaya; GEA Group Aktiengesellschaft; Farmers Edge Inc.; and Grownetics, among others.

b. Key factors that are driving the market growth include increasing implementation of cloud computing for real-time farm data management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.