- Home

- »

- Plastics, Polymers & Resins

- »

-

Filler Masterbatch Market Size, Share & Trends Report, 2030GVR Report cover

![Filler Masterbatch Market Size, Share & Trends Report]()

Filler Masterbatch Market (2023 - 2030) Size, Share & Trends Analysis Report By Carrier Polymers (Polypropylene, Polyethylene), By Application (Injection & Blow Molding, Films & Sheets), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-651-1

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Filler Masterbatch Market Size & Trends

The global filler masterbatch market size was valued at USD 346.54 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. The growing utilization of common fillers such as talc, calcium carbonate, mica, clay, and titanium oxide is anticipated to trigger the growth of the market across the world in the coming years. The market is highly competitive due to the presence of various leading players such as European Plastic Company; EnviGreen; GCR Group; MEGAPLAST; and PMJ JOINT STOCK COMPANY.

Key manufacturers of filler masterbatches are engaged in the establishment of new production facilities to cater to the high demand for plastics from the packaging, automotive, and consumer goods industries. For instance, JJ Plastalloy announced the opening of a new production facility in Gujarat in March 2021 to offer masterbatches, as well as compounds for thermoplastic products.

Masterbatch is a concentrated mix of additives, pigments, and/or fillers which are utilized in the plastics industry to color or modify the properties of plastic materials during the manufacturing process. It is typically in the form of small pellets or granules, which are added to the plastic resin during processing to create a uniform color or to enhance its performance characteristics.

The growth of the global masterbatch market is expected to be driven by the increasing consumption of the product in various end-user industries such as packaging, construction, automotive, consumer goods, and agriculture sectors. Moreover, the packaging end-use sector has observed increased consumption of masterbatch due to its antilocking, processing (foaming agents, process aids, and release agents), barrier (optimal heat and light transmittance), antistatic, antioxidant (protection of foods), antifog, ultraviolet, antibacterial, and flame-retardant properties.

Filler masterbatches contain high levels of inorganic fillers, such as calcium carbonate, talc, and kaolin, in addition to pigments and other additives. These fillers are added to plastic resins during their processing to reduce the cost of final products and improve their mechanical properties, such as stiffness, impact resistance, and dimensional stability. Compared to other types of masterbatches, filler masterbatches have a higher filler content but lower pigment content. This makes these masterbatches highly cost-effective for manufacturers. Filler masterbatches are commonly used in applications, such as packaging materials, PVC pipes, and extruded profiles wherein the color of plastic products is not important.

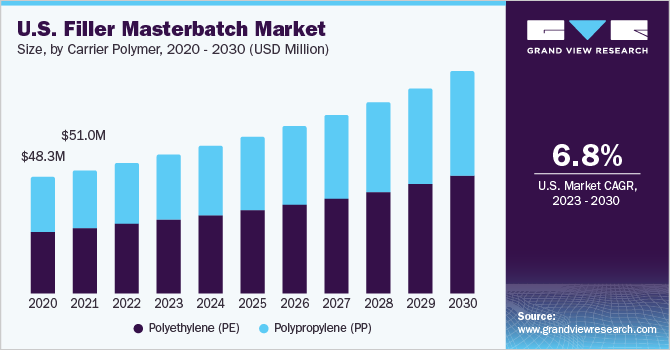

Carrier Polymer Insights

Polyethylene (PE) dominated the market with a revenue share of more than 53.37% in 2022. This is attributable to the advantages offered by polyethylene (PE) over polypropylene (PP) lead to its surged usage as a carrier polymer for filler masterbatches. Polyethylene (PE) is more flexible than polypropylene (PP), making it a better choice for applications wherein flexibility is important. As such, it is used for manufacturing films and bags. In addition, polyethylene (PE) has higher toughness than polypropylene (PP) which makes it more resistant to impact and puncture. As a result, polyethylene (PE) is used for manufacturing pipes, containers, and other products that are required to possess high durability and strength.

Polypropylene (PP) as a carrier polymer for filler masterbatches has various advantages over its counterparts. It has good compatibility with a wide range of fillers, including calcium carbonate, talc, and titanium dioxide. This compatibility allows good dispersion of filler particles within the polymer matrix, resulting in the development of a homogenous mixture.

Application Insights

Injection and blow molding application dominated the market with a revenue share of 52.15% in 2022. This is attributable to its rising application for the development of thin-film packaging, biodegradable packaging, paper packaging, and waste packaging solutions globally.

Filler masterbatch is a type of additive that is commonly used in the production of plastic films and sheets. It is made by mixing a high concentration of mineral fillers or other additives with a carrier resin. The use of filler masterbatches is prevalent in the production of films and sheets as they enhance the stiffness, strength, gloss, and elongation of the resulting products. The utilization of calcium carbonate fillers is widespread for the production of heavy-duty polyethylene bags, as they contribute to the hardening of plastics, leading to the creation of high-quality bags. Moreover, these fillers find application in the manufacture of polyethylene liquid packaging films.

Filler masterbatches are used in the production of tapes to improve their performance. Tapes are typically made from base polymers, such as polypropylene or polyester, which are extruded into thin, flat ribbon-like forms. Filler masterbatches can be added to base polymers during their processing to improve strength, stiffness, and other properties of final tapes developed from them. This is important for tapes that are to be used in applications wherein they are required to hold or support weight or they are subjected to bending or folding.

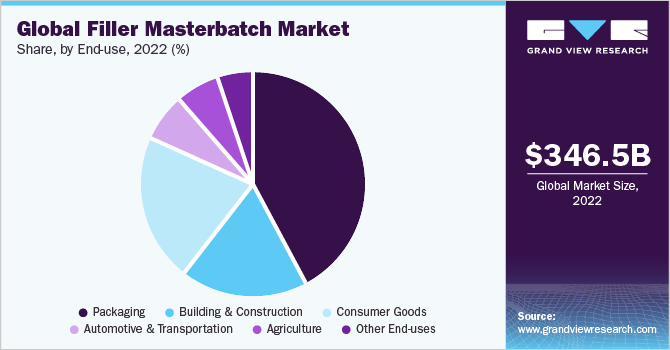

End-use Insights

Packaging end-use dominated the global filler masterbatch market with a revenue share of 42.23% in 2022. This is attributable to the growth in the e-commerce industry which is expected to be a significant factor for the growing packaging sector, which, in turn, is projected to fuel the consumption of filler masterbatch.

The rising demand for filler masterbatches in the building and construction industry can be attributed to the surged use of plastic polymers in siding, fencing, decking, railing, and roofing applications, along with their use as interior and exterior construction materials. Plastics are preferred as metal alternatives in this industry owing to their favorable properties and low costs. Additionally, the continuously increasing global population is expected to drive the demand for new housing, thereby contributing to the growth of the plastics industry in the construction sector.

Companies manufacturing consumer goods are likely to capitalize on the demands of emerging economies such as China and India and innovation in the existing product to extend their market reach.

Higher product volume business is also likely to drive the consumer goods industry due to an increase in consumption by the middle-class population coupled with growth in the business on account of the rising e-commerce. The consumer goods manufacturers use filler masterbatch, which, in turn, is likely to boost the demand for masterbatch in the consumer goods segment over the forecast period.

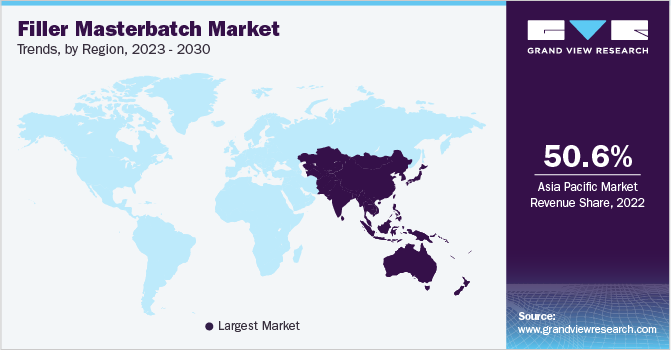

Regional Insights

Asia Pacific region dominated the global filler masterbatch market with a revenue share of 50.62% in 2022. This is attributable to the rise in demand for filler masterbatches owing to their surging use in the packaging, building & construction, automotive, and consumer goods industries. Moreover, the development of plastic-processing capabilities in the region is indispensable contributing to the growth of the filler masterbatch industry in the Asia Pacific.

Growing investments in research and development activities, coupled with government initiatives promoting the sustainable growth of bioplastics, are expected to propel the growth of the filler masterbatch market in Europe. Masterbatch is an integral component utilized in the manufacturing of bioplastics, which imparts color and durability. The increasing consumer awareness towards sustainability and the environment is anticipated to drive up the demand for filler masterbatch over the forecast period.

North America's filler masterbatch industry is likely to witness growth on account of its increased demand from various end-use industries such as packaging, automotive, and consumer goods. The growth in infrastructure spending is projected to lead to an increase in construction activities and, in turn, boost the demand for plastic construction components, thereby fueling the demand for filler masterbatch over the forecast period.

Key Companies & Market Share Insights

The global filler masterbatch market is highly competitive in nature. Key players penetrating the regions are involved in broadening their product portfolio and global presence. The market players are more inclined towards expansion in terms of distribution network as well as geographical footprint. For instance, in June 2021, Penn Color, Inc., announced its plan to expand its geographical footprint in the Asian market, under its overarching strategy to broaden the reach of its products.

Moreover, companies are investing in R&D activities to develop and increased their production plant capacity to meet the growing product demand in Middle East and African countries. In addition, manufacturing companies are also engaged in undertaking strategic initiatives such as mergers and acquisitions to bolster their hold in the global market. For example, in July 2020, PolyOne Corporation completed the acquisition of Clariant AG’s masterbatch business for a value of USD 1.56 billion. Some prominent players in the global filler masterbatch market include:

-

PMJ Joint Stock Company

-

PHU LAM Import Export Company Limited

-

A DONG Plastic Joint Stock Company (ADC Plastic JSC)

-

Vinares

-

Vina Color (Vietnam Colour Trading and Manufacturing Co., LTD.)

-

Pha Le Plastics Manufacturing

-

An Tien Industries

-

US Masterbatch JSC

-

Eco Green Plastic JSC

-

Megaplast

-

Plastiblends India Ltd.

-

Alok Masterbatches PVT. LTD.

-

Bajaj Superpack India Ltd.

-

Shivam Polychem Masterbatch SA (Pty) Ltd.

-

Heritage Plastics, Inc.

Filler Masterbatch Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 369.48 million

Revenue forecast in 2030

USD 606.90 million

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million, volume in kilotons, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Carrier polymer, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Southeast Asia; Brazil; Saudi Arabia

Key companies profiled

Heritage Plastics, Inc.; Shivam Polychem Masterbatch SA (Pty) Ltd.; Bajaj Superpack India Ltd.; Alok Masterbatches PVT. LTD.; Plastiblends India Ltd.; Megaplast; Eco Green Plastic JSC; US Masterbatch JSC; An Tien Industries; Pha Le Plastics Manufacturing; Vina Color (Vietnam Colour Trading and Manufacturing Co., LTD.); Vinares; A DONG Plastic Joint Stock Company (ADC Plastic JSC); PHU LAM Import Export Company Limited; PMJ Joint Stock Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Filler Masterbatch Market Report Segmentation

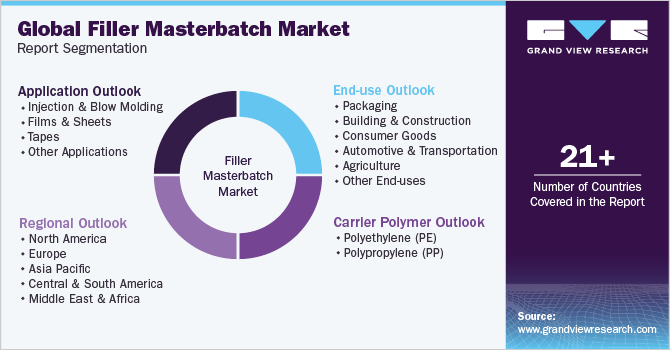

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global filler masterbatch market report based on carrier polymer, application, end-use, and region:

-

Carrier Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection & Blow Molding

-

Films & Sheets

-

Tapes

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Building & Construction

-

Consumer Goods

-

Automotive & Transportation

-

Agriculture

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global filler masterbatch market size was estimated at USD 346.54 million in 2022 and is expected to reach USD 369.48 million in 2023.

b. The filler masterbatch market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 606.90 million by 2030.

b. The polyethylene carrier polymer segment dominated the filler masterbatch market with a share of 53.37% in 2022. This is attributable to its versatility, easy processability, low cost, and recyclability making it useful for the manufacturing of various types of sheets and films.

b. Some key players operating in the filler masterbatch market include European Plastic Company; PLASTIKA KRITIS S.A.; Ferro Plastics; VH-FB Euro Ltd.; AURORA GLOBAL COLORS OY; GCR GROUP; CABAMIX; Plasper; Heritage Plastics, Inc.; Shivam Polychem; Masterbatch SA (Pty) Ltd.; Bajaj Superpack India Ltd.; ALOK MASTERBATCHES PVT. LTD.; Plastiblends; among others.

b. Key factors that are driving the filler masterbatch market growth include the increasing demand for plastics in the packaging industry and the growing replacement of metal by plastic in end-use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.