- Home

- »

- Advanced Interior Materials

- »

-

Fire Protection System Pipes Market, Industry Report, 2033GVR Report cover

![Fire Protection System Pipes Market Size, Share & Trends Report]()

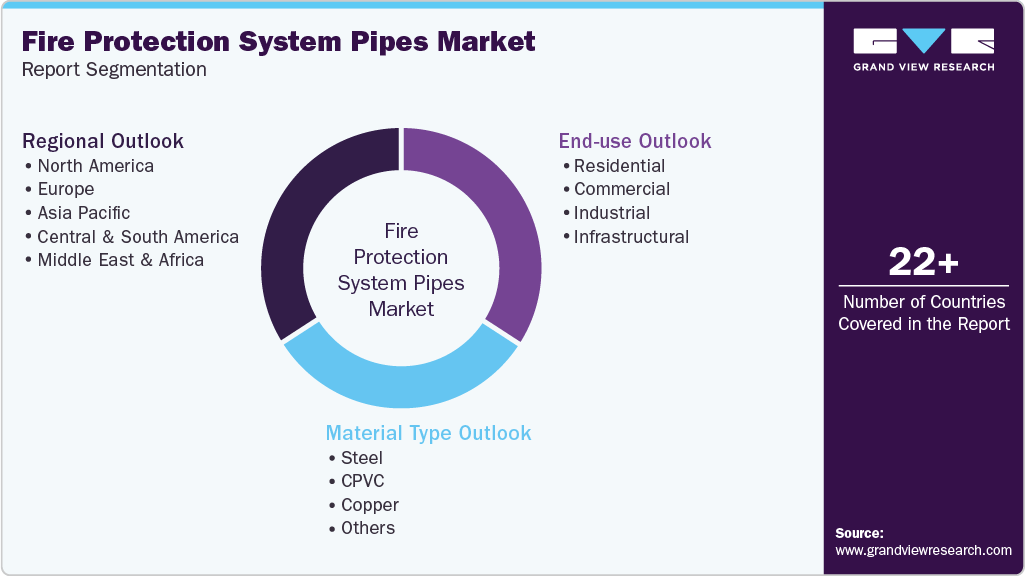

Fire Protection System Pipes Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (Steel, CPVC, Copper), By End-use (Residential, Commercial, Industrial, Infrastructural), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-717-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Protection System Pipes Market Summary

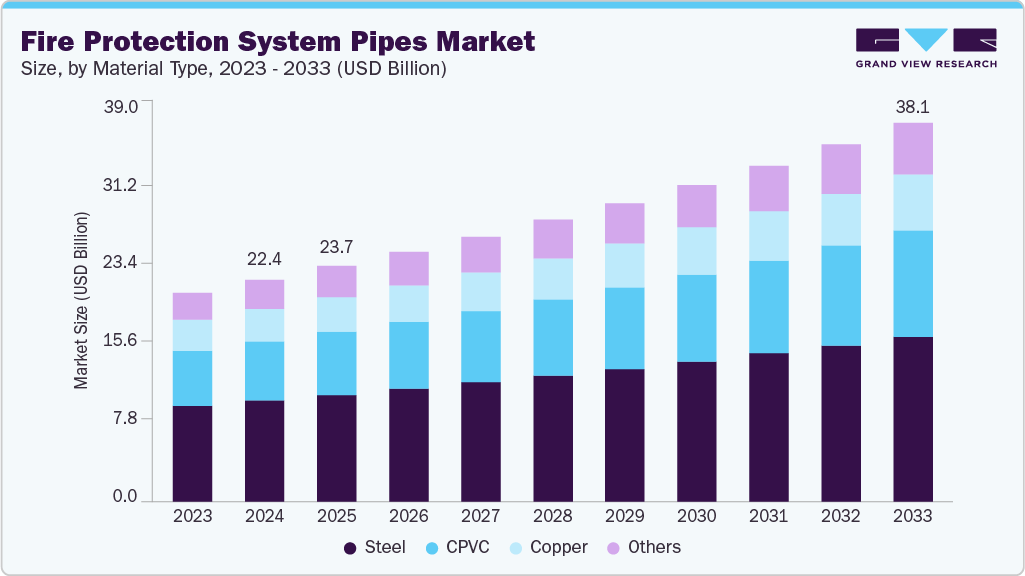

The global fire protection system pipes market size was estimated at USD 22.37 billion in 2024 and is projected to reach USD 38.11 billion by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The demand for fire protection system pipes is increasing due to rising urbanization, expansion of commercial complexes, and stricter safety codes worldwide.

Key Market Trends & Insights

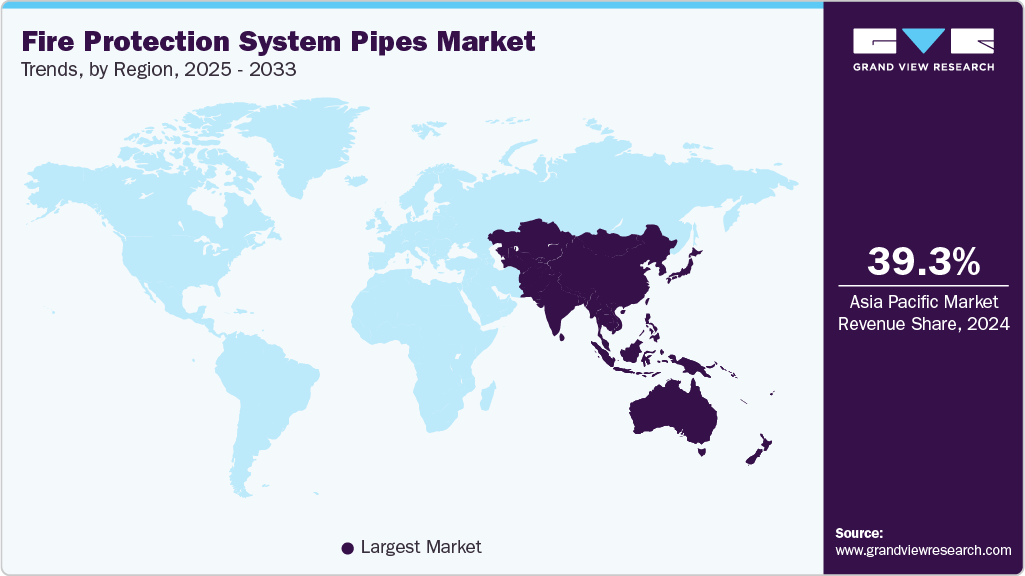

- Asia Pacific dominated the fire protection system pipes market with the largest revenue share of 39.3% in 2024.

- The fire protection system pipes market in China is expanding rapidly, fueled by massive urbanization and industrialization programs.

- By material type, the CPVC segment is expected to grow at the fastest CAGR of 6.8% over the forecast period.

- By end use, the residential segment is expected to grow at the fastest CAGR of 6.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 22.37 Billion

- 2033 Projected Market Size: USD 38.11 Billion

- CAGR (2025-2033): 6.1%

- Asia Pacific: Largest market in 2024

With growing high-rise construction and industrial activities, the need for reliable fire suppression infrastructure is more critical than ever. Insurance companies and regulators are mandating advanced fire safety installations in residential, commercial, and industrial buildings, thereby boosting adoption. In addition, public awareness regarding safety and property protection has risen significantly. The increasing occurrence of fire accidents globally is further compelling stakeholders to invest in robust systemsKey drivers include stricter building safety codes, increasing investments in infrastructure, and the growth of industries prone to fire hazards, such as petrochemicals, power plants, and manufacturing. Insurance premium benefits for fire-protected buildings also encourage adoption. The rising construction of smart cities and megaprojects, especially in Asia-Pacific and the Middle East, is pushing demand for fire protection system pipes. The trend of prefabricated buildings and modular construction has also accelerated the installation of advanced piping systems.

Governments across regions are implementing strict fire safety regulations, thereby mandating installation of certified fire protection pipes in buildings. In the U.S., NFPA (National Fire Protection Association) codes regulate fire safety measures in all public and commercial spaces. In Europe, EN standards mandate compliance in both new and renovated buildings. In emerging economies, governments are integrating fire protection into urban planning initiatives such as India’s Smart Cities Mission and China’s urban infrastructure expansion. Middle Eastern countries like Saudi Arabia and UAE enforce strict fire safety codes in high-rise and oil & gas projects.

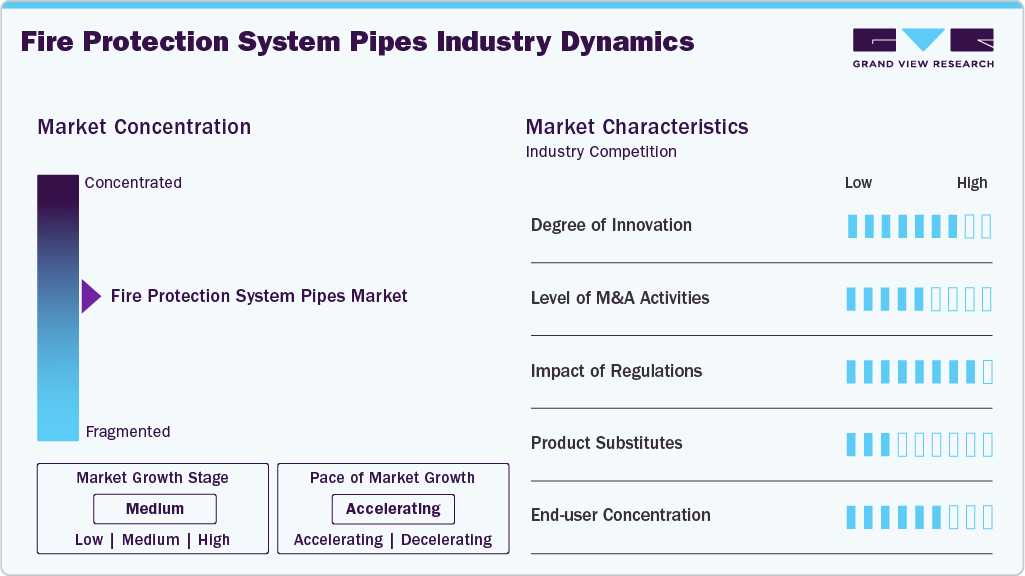

Market Concentration & Characteristics

The fire protection system pipes industry is witnessing innovations in lightweight and corrosion-resistant materials, which reduce installation and maintenance costs. CPVC and HDPE pipes are becoming popular alternatives to traditional steel due to their high performance, cost-effectiveness, and ease of handling. Integration of IoT and smart monitoring sensors in fire protection networks is also a rising trend. Prefabricated piping systems for faster installation in large projects are gaining traction. Sustainability trends are pushing manufacturers toward eco-friendly, recyclable, and lead-free piping materials.

The fire protection system pipes industry is moderately consolidated, with a few global players dominating due to technological expertise, certifications, and large-scale manufacturing. Companies like Johnson Controls, Victaulic, Tata Steel, and China Lesso have a strong foothold, supported by distribution networks and strategic partnerships. However, several regional manufacturers and local suppliers serve niche segments, especially in developing markets. Competitive intensity is high, as companies differentiate through quality, compliance with NFPA/EN/UL standards, and innovation in lightweight materials.

Material Type Insights

The steel segment led the market with the largest revenue share of 45.7% in 2024, due to their long-established reliability, strength, and compliance with global safety standards such as UL and FM. They are widely used in high-rise commercial buildings, industrial facilities, and oil & gas projects where high pressure and durability are critical. The material’s fire resistance and ability to withstand extreme conditions make it the preferred choice for large-scale fire suppression networks. In addition, steel’s compatibility with grooved fittings and widespread availability supports its market leadership.

The CPVC segment is expected to grow at the fastest CAGR of 6.8% over the forecast period, driven by their lightweight design, cost-effectiveness, and ease of installation compared to steel. They offer corrosion resistance, lower maintenance costs, and excellent hydraulic performance, making them increasingly attractive for residential, commercial, and institutional buildings. CPVC pipes are also UL-listed and FM-approved, enabling compliance with strict fire safety codes worldwide. With growing adoption in retrofitting projects and sustainable construction, CPVC is rapidly gaining market share, especially in the Asia-Pacific and North America.

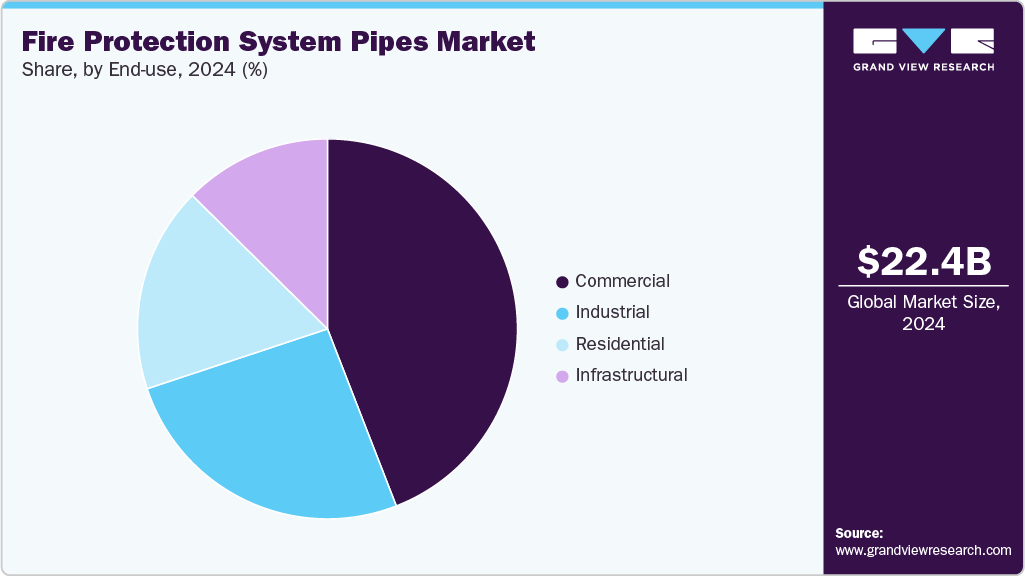

End Use Insights

The commercial segment led the market with the largest revenue share of 44.1% in 2024, as large office complexes, shopping malls, hospitals, airports, and hotels require extensive and reliable fire suppression networks. Stringent fire safety codes and insurance requirements in these establishments ensure heavy use of durable materials like steel and ductile iron pipes. Rapid urbanization and expansion of commercial infrastructure globally have further strengthened this dominance. The need for advanced sprinkler systems and integration with smart building technologies also sustains demand in this segment.

The residential segment is expected to grow at the fastest CAGR of 6.9% over the forecast period, fueled by rising urban housing projects, smart homes, and government-driven affordable housing initiatives. Increasing awareness of fire safety among homeowners, along with mandates in multi-family apartments and high-rise housing, is accelerating the adoption of CPVC and HDPE fire protection pipes. Lightweight, cost-effective, and easy-to-install solutions make these materials particularly suitable for residential buildings. With rapid population growth and urban housing demand in the Asia-Pacific and the Middle East, the residential segment is set to expand significantly in the coming years.

Regional Insights

The fire protection system pipes market in North America is a mature yet steadily growing market due to continuous refurbishment and compliance with stringent NFPA standards. The region benefits from high awareness of fire safety among businesses, insurers, and property owners. Replacement of old systems with modern, durable CPVC and HDPE fire pipes is a key trend. Growth in warehousing, logistics, and large-scale retail facilities further supports demand. Prefabricated fire piping and lightweight solutions are increasingly preferred for efficiency. Investments in smart infrastructure and retrofitting programs also contribute to expansion.

U.S. Fire Protection System Pipes Market Trends

The fire protection system pipes market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by strict enforcement of fire safety codes and advanced infrastructure requirements. Rising construction of data centers, warehouses, and logistics hubs significantly boosts demand for reliable fire systems. Insurance companies and building regulators mandate UL-listed piping solutions, creating high demand for CPVC and HDPE. The market also sees strong retrofitting activity, with older infrastructures being upgraded to meet modern standards. Industrial sectors such as oil & gas, manufacturing, and power generation add to the demand base.

Asia Pacific Fire Protection System Pipes Market Trends

Asia Pacific dominated the global fire protection system pipes market with the largest revenue share of 39.3% in 2024, driven by rapid urbanization, massive infrastructure projects, and stringent government safety mandates. Countries like China, India, and Japan are investing heavily in smart cities, industrial hubs, and high-rise construction. The growing oil & gas industry in Southeast Asia also fuels demand. Availability of low-cost raw materials and regional manufacturing capabilities further strengthens market leadership.

The fire protection system pipes market in China is expanding rapidly, fueled by massive urbanization and industrialization programs. Government policies under initiatives like the New Infrastructure Plan enforce strict fire protection mandates across commercial, residential, and industrial spaces. High-rise construction and petrochemical facilities are major demand drivers, requiring advanced piping solutions. Domestic manufacturers dominate materialization, although international players are gradually increasing their presence through partnerships. CPVC and steel fire pipes are widely used for their durability and compliance with regulations. The country’s commitment to safety and modernization ensures steady growth.

Europe Fire Protection System Pipes Market Trends

The fire protection system pipes market in Europe is characterized by strict EN standards that ensure widespread compliance and adoption of fire protection systems. Western Europe is a leading adopter, supported by stringent codes and the modernization of commercial and residential infrastructure. Eastern Europe is gradually catching up as industrial and urban development expands. Sustainability is a key theme, with demand growing for recyclable, eco-friendly fire protection materials. Industrial refurbishment projects, particularly in manufacturing and logistics, are fueling the market. Prefabricated and lightweight pipe systems are gaining traction for faster installations.

The Germany fire protection system pipes market is shaped by strict building codes, industrial safety culture, and strong regulatory oversight. High adoption is seen across the commercial, residential, and industrial segments, particularly in the automotive and manufacturing sectors. The demand for fire protection pipes is reinforced by the extensive construction of high-rise and smart buildings. CPVC and steel pipes are the most widely used due to their performance and regulatory compliance. German companies focus on quality, certifications, and innovation, ensuring reliable adoption. Retrofitting older structures is also contributing to demand growth.

Central & South America Fire Protection System Pipes Market Trends

The fire protection system pipes market in Central & South America is experiencing gradual growth, driven by urbanization and industrialization. Brazil and Mexico dominate due to regulatory improvements and infrastructure development. Rising construction of commercial complexes, shopping centers, and industrial hubs supports adoption. The oil & gas industry is another key demand generator, requiring advanced fire systems for safety compliance. However, the market faces challenges such as economic volatility and uneven enforcement of safety codes. Despite these barriers, increasing awareness and adoption of global standards are improving uptake. Infrastructure investments are expected to sustain growth across major countries in the region.

Middle East & Africa Fire Protection System Pipes Market Trends

The fire protection system pipes market in the Middle East & Africa is strongly driven by mega construction projects, high-rise developments, and large-scale oil & gas facilities. Countries like UAE and Saudi Arabia enforce strict fire safety regulations, making adoption mandatory in commercial, industrial, and residential spaces. South Africa also contributes to urban and industrial expansion. Tourism-led construction, including hotels, malls, and entertainment complexes, significantly boosts demand. Global players are actively investing in the region due to strong growth potential. Prefabricated and lightweight piping solutions are gaining popularity for their ease of installation.

Key Fire Protection System Pipes Company Insights

Some of the key players operating in the market include Johnson Controls International plc, Tata Steel Limited.

-

A global leader in building safety and fire protection solutions, offering UL/FM-certified fire protection pipes and fittings integrated into complete suppression systems for commercial, residential, and industrial markets.

-

A major steel producer that manufactures UL-listed and FM-approved steel pipes used in fire sprinkler and suppression systems, serving construction and industrial fire safety applications worldwide.

China Lesso Group Holdings Ltd. and JM Eagle, Inc. are some of the emerging market participants in the global fire protection system pipes industry.

-

One of the largest piping system manufacturers in China, producing CPVC and HDPE fire protection system pipes widely adopted in residential, commercial, and industrial projects across Asia-Pacific and global markets.

-

A leading U.S.-based plastic pipe manufacturer, offering UL-certified CPVC fire sprinkler pipes designed for residential, commercial, and institutional buildings, with a strong presence in the North American market.

Key Fire Protection System Pipes Companies:

The following are the leading companies in the fire protection system pipes market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Controls International plc

- Victaulic Company

- China Lesso Group Holdings Ltd.

- Tata Steel Limited

- Georg Fischer AG

- Aliaxis Group S.A.

- JM Eagle, Inc.

- Astral Pipes

- Tyco Fire Products

- Zurn Industries LLC

Recent Developments

-

In May 2025, Johnson Controls International plc expanded its fire suppression portfolio with advanced smart fire detection and sprinkler systems integrated with AI-driven monitoring.

-

In November 2024, Victaulic Company opened an expanded manufacturing facility in Pennsylvania, U.S., to increase production of fire protection pipe fittings.

Fire Protection System Pipes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.73 billion

Revenue forecast in 2033

USD 38.11 billion

Growth rate

CAGR of 6.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea

Key companies profiled

Johnson Controls International plc; Victaulic Company; China Lesso Group Holdings Ltd.; Tata Steel Limited; Georg Fischer AG; Aliaxis Group S.A.; JM Eagle, Inc.; Astral Pipes; Tyco Fire Products; Zurn Industries LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Protection System Pipes Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fire protection system pipes market report based on the material type, end use, and region:

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Steel

-

CPVC

-

Copper

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Infrastructural

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global fire protection system pipes market size was estimated at USD 22.37 billion in 2024 and is expected to reach USD 23.73 billion in 2025.

b. The global fire protection system pipes market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 38.11 billion by 2033.

b. The steel segment held the highest revenue market share of 45.7% in 2024, due to its long-established reliability, strength, and compliance with global safety standards such as UL and FM.

b. Some of the key players operating in the fire protection system pipes market include Johnson Controls International plc, Victaulic Company, China Lesso Group Holdings Ltd., Tata Steel Limited, Georg Fischer AG, Aliaxis Group S.A., JM Eagle, Inc., Astral Pipes, Tyco Fire Products, and Zurn Industries LLC.

b. Key factors driving the fire protection system pipes market include stringent fire safety regulations, rapid urbanization, growth in high-rise and industrial construction, increasing fire accident awareness, and adoption of advanced materials like CPVC and HDPE.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.