- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Fluorescent Pigment Market Size And Share Report, 2030GVR Report cover

![Fluorescent Pigment Market Size, Share & Trends Report]()

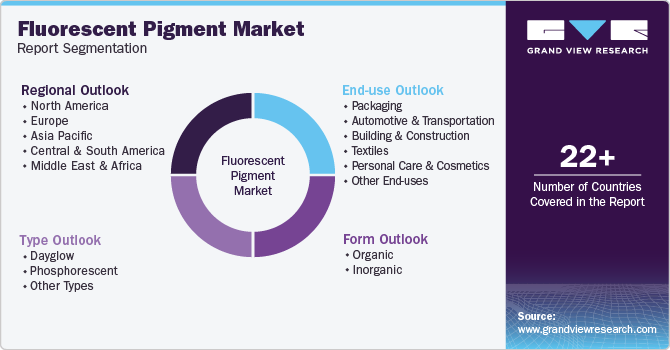

Fluorescent Pigment Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Organic, Inorganic), By Type (Dayglow, Phosphorescent), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-423-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluorescent Pigment Market Summary

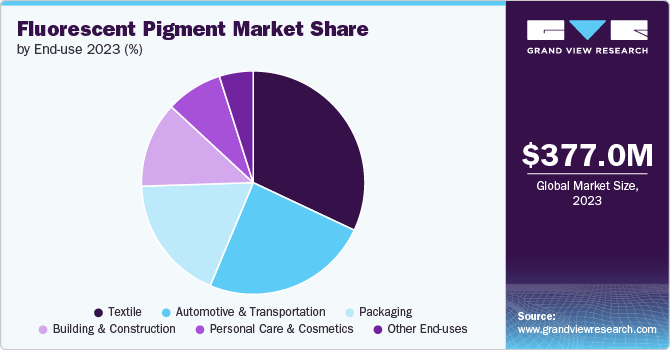

The global fluorescent pigment market size was estimated at USD 377.0 million in 2023 and is projected to reach USD 560.9 million by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The market driven by the increasing demand for vibrant and visually striking colors across various industries.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a 40.5% share in 2023.

- By form, organic coatings segment dominated the market and accounted for a revenue share of approximately 58.7% in 2023.

- By type, dayglow segment dominated the market and accounted for a revenue share of approximately 31.7% in 2023.

- By end-use, textile dominated the market and accounted for a revenue share of 32.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 377.0 Million

- 2030 Projected Market Size: USD 560.9 Million

- CAGR (2024-2030): 5.9%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

Fluorescent pigments are renowned for their high brightness and ability to glow under UV light, making them highly sought after in applications such as textiles, plastics, paints, and coatings.

The fashion and automotive industries, in particular, have shown a growing preference for these pigments to create eye-catching designs that enhance product appeal.

Drivers, Restraints & Opportunities

Fluorescent pigments are known for their ability to produce bright, eye-catching colors that appear to glow under UV light, making them particularly appealing in sectors such as textiles, paints, and coatings. For instance, the cosmetics industry has embraced these pigments to create vivid color formulations that enhance product appeal. As consumer preferences shift towards unique and bold aesthetics, manufacturers are compelled to incorporate these offerings into their products, thereby driving market expansion.

The push for sustainability and compliance with environmental regulations is also influencing the market. Manufacturers are increasingly focusing on developing eco-friendly and non-toxic products to meet stringent regulations regarding hazardous materials. This shift not only addresses regulatory requirements but also aligns with the growing consumer preference for sustainable products. For instance, companies are innovating to create fluorescent pigments that are free from harmful substances, thereby appealing to environmentally conscious consumers. This trend is expected to enhance market growth as more industries seek sustainable alternatives in their product offerings.

A significant challenge for the market is the complex processing and production costs associated with fluorescent pigments. The manufacturing of these pigments often involves intricate chemical processes that require specialized equipment and expertise, leading to higher production costs. For instance, the use of heavy metals in some fluorescent pigments can complicate the production process and increase regulatory scrutiny, making it more expensive for manufacturers to comply with environmental standards. This cost-intensive nature can deter smaller companies from entering the market, limiting competition and innovation.

Advancements in 3D printing technology are creating new applications for fluorescent pigments, further driving market opportunities. As 3D printing becomes more prevalent across various industries, the incorporation of these products into 3D-printed materials can enhance the visual appeal and functionality of products. For instance, companies are exploring the use of fluorescent pigments in creating custom promotional items, prototypes, and even architectural models that require vibrant colors. This integration not only expands the application scope of these products but also encourages collaboration between manufacturers and 3D printing firms, fostering innovation and market growth.

Form Insights

“Organic emerged as the fastest growing form with a CAGR of 6.1%”

Organic coatings dominated the market and accounted for a revenue share of approximately 58.7% in 2023. They are derived from carbon-based compounds and are known for their vibrant colors and high brightness. These pigments are widely used in applications such as textiles, printing inks, and cosmetics due to their ability to produce intense hues and their compatibility with various substrates.

In addition, the cosmetics market has adopted organic fluorescent pigments in products such as nail polishes and lipsticks, providing consumers with visually striking options that stand out in the marketplace. The versatility of organic pigments also allows them to be used in specialized applications, such as UV-reactive body paints for festivals and events, further driving demand in this segment.

Inorganic fluorescent pigments are typically made from metal compounds and minerals. These pigments are known for their excellent stability, heat resistance, and durability, making them suitable for a range of industrial applications, including coatings, plastics, and construction materials. Inorganic offerings also play a critical role in safety and signage applications. For example, fluorescent yellow-green pigments are commonly used in road signage, safety vests, and emergency equipment, enhancing visibility in low-light conditions. This application is crucial for ensuring public safety, as it allows for better recognition of important information, especially in hazardous environments.

Type Insights

“Dayglow emerged as the fastest growing type with a CAGR of 6.3%”

Dayglow dominated the market and accounted for a revenue share of approximately 31.7% in 2023. They are characterized by their ability to appear exceptionally bright and vibrant under natural light as well as under ultraviolet (UV) light. These products absorb UV light and re-emit it at a longer wavelength, resulting in a striking glow that is highly visible. Dayglow products are widely used in applications such as safety signage, advertising, and packaging.

Phosphorescent pigments, commonly referred to as glow-in-the-dark pigments, have the unique ability to absorb light and then re-emit it over an extended period, even after the light source has been removed. This property makes them particularly useful in applications where visibility in low-light conditions is essential. For example, phosphorescent offerings are increasingly being used in road infrastructure, such as cycling paths and safety signs, to improve visibility for cyclists and pedestrians at night.

In addition to Dayglow and phosphorescent pigments, the market also includes other types of fluorescent pigments that serve specialized purposes. These can encompass a range of formulations, including thermoplastic fluorescent pigments, which are known for their superior solvent resistance and versatility across different applications. For instance, these products are often used in the production of plastics and coatings, where durability and color retention are critical. The growing demand for innovative applications, such as in 3D printing and specialty inks, is driving the development of new formulations that enhance the performance of fluorescent products.

End-use Insights

“Textile emerged as the fastest growing End Use with a CAGR of 6.2%”

Textile dominated the market and accounted for a revenue share of 32.0% in 2023. The textile industry is one of the largest consumers of fluorescent pigments, leveraging their vibrant colors to create eye-catching fabrics and garments. These products are particularly popular in fashion and sportswear, where bright colors are essential for attracting consumer attention. For instance, brands such as Nike and Adidas often incorporate these offerings into their athletic apparel to enhance visibility during outdoor activities, especially in low-light conditions.

In the automotive and transportation sector, fluorescent pigments play a crucial role in enhancing safety and aesthetic appeal. These products are commonly used in vehicle coatings, where they provide bright, attention-grabbing colors that improve visibility on the road. For example, fluorescent yellow and orange pigments are often used in emergency vehicles, construction equipment, and safety gear to ensure they are easily seen by other drivers. This application is vital for reducing accidents and improving overall road safety.

The packaging industry is another significant End Use segment for fluorescent pigments, where they are utilized to enhance the visual appeal of products and attract consumer attention. Fluorescent products are particularly effective in labels, tags, and packaging materials, making products stand out on crowded shelves. For instance, brands in the food and beverage sector often use fluorescent inks to create vibrant packaging that captures the eye of consumers, thereby increasing sales.

Regional Insights

“North America emerged as the fastest growing market with a CAGR of 6.3% from 2024-2030”

North America is the fastest growing region in global fluorescent pigment market, primarily driven by the U.S. and Canada. The region's demand is largely fueled by applications in safety signage, packaging, and automotive coatings. For example, these products are extensively used in safety gear and emergency vehicles to ensure high visibility, which is crucial for public safety. The packaging industry in North America also leverages these offerings to create vibrant and attractive product packaging that stands out on retail shelves.

Asia Pacific Fluorescent Pigment Market Trends

Asia Pacific dominated the market and accounted for a 40.5% share in 2023. It is driven by rapid industrialization and urbanization in countries such as China, India, and Japan. The increasing demand for vibrant colors in textiles, automotive, and packaging applications is a key factor propelling market growth. For instance, the automotive sector in countries like South Korea is utilizing these pigments for vehicle coatings to enhance visibility and aesthetics. The region's robust manufacturing capabilities and the presence of major pigment producers further contribute to its dominance in the global market.

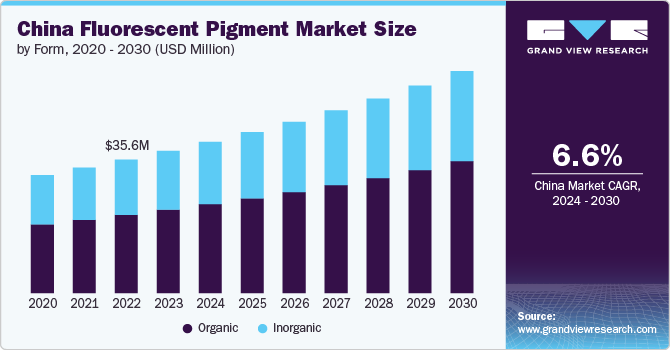

China Fluorescent Pigment Market Trends

China is the largest producer of fluorescent pigments but also a major consumer, driven by its booming manufacturing sectors, including textiles, automotive, and packaging. The Chinese government is actively promoting the use of high-quality fluorescent pigments in various applications, including security and anti-counterfeiting measures. In addition, the growing middle class in China is driving demand for vibrant consumer products, further fueling the market in the forecasted period.

Europe Fluorescent Pigment Market Trends

Europe is another key region in the fluorescent pigment market, characterized by a strong emphasis on sustainability and regulatory compliance. The European market is witnessing a shift towards eco-friendly and non-toxic products, driven by stringent regulations aimed at reducing environmental impact. The European Union has implemented regulations that restrict the use of hazardous substances in consumer products, prompting manufacturers to develop safer alternatives. This trend is particularly evident in the cosmetics and packaging industries, where brands are increasingly seeking sustainable solutions that meet consumer demand for environmentally friendly products.

Key Fluorescent Pigment Company Insights

The competitive landscape of the global fluorescent pigment market is characterized by a diverse array of players, each employing various strategies to enhance their market presence and drive growth. Companies are investing significantly in R&D to develop new formulations of fluorescent pigments that offer improved performance, stability, and environmental compliance. For instance, manufacturers are exploring the use of non-toxic and eco-friendly materials to create sustainable fluorescent pigments that meet the growing demand for environmentally responsible products. Initiatives by the companies include reducing the use of hazardous materials, minimizing waste, and implementing energy-efficient production methods. Companies that prioritize sustainability not only enhance their brand reputation but also position themselves favorably in a market that is increasingly valuing environmental responsibility.

Some of the key players operating in the global fluorescent pigment market include

-

Radiant Color NV, based in Belgium, is a prominent manufacturer of high-quality fluorescent pigments known for their vibrant colors and excellent performance. The company specializes in producing organic and inorganic pigments that are widely used in various applications, including paints, coatings, plastics, and printing inks.

-

BASF SE offers a diverse range of organic specialty pigments, dyes, and dispersions that are designed to provide exceptional brightness and lightfastness. Luminochem's products are particularly notable for their ability to fluoresce under various UV light conditions, making them ideal for applications in security features, packaging, and graphic arts.

-

Wanlong Chemical Co., Ltd., based in China, is a leading manufacturer of fluorescent pigments with a strong focus on research and development. The company produces a wide array of fluorescent pigments that are utilized in various industries, including textiles, coatings, and plastics.

Key Fluorescent Pigment Companies:

The following are the leading companies in the fluorescent pigment market. These companies collectively hold the largest market share and dictate industry trends.

- Radiant Color NV

- Luminochem

- Wanlong Chemical Co., Ltd.

- Sinloihi Co., Ltd.

- Wuxi Minghui International Trading Co., Ltd.

- DayGlo Color Corp.

- Aron Universal Limited

- Vicome Corp.

- Hangzhou Aibai Chemical Co., Ltd.

- Brilliant Group Inc.

Recent Developments

-

In March 2024, The Grolman Group announced the expanision of its partnership agreement with Radiant Color. The group also announced an expansion of operations in Hungary, ensuring technical support and availability in the advanced materials product range in the country.

-

In March 2023, DayGlo Color Corp., announced the launch of Elara Luxe, its latest offering of fluorescent color technology to be used in the personal care and cosmetics sector. The product line, comprising of seven novel plant based fluorescent pigments would enable consumers to create shades of colors with improved intensity.

Fluorescent Pigment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 398.0 million

Revenue forecast in 2030

USD 560.9 million

Growth Rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Radiant Color NV; Luminochem; Wanlong Chemical Co., Ltd.; Sinloihi Co., Ltd.; Wuxi Minghui International Trading Co., Ltd.; DayGlo Color Corp.; Aron Universal Limited; Vicome Corp.; Hangzhou Aibai Chemical Co., Ltd.; Brilliant Group Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluoroscent Pigment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fluorescent pigment market report based on form, type, end-use and region.

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Organic

-

Inorganic

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dayglow

-

Phosphorescent

-

Other Types

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive & Transportation

-

Building & Construction

-

Textiles

-

Personal Care & Cosmetics

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fluorescent pigment market size was estimated at USD 377.0 million in 2023 and is expected to reach USD 398.0 million in 2024.

b. The global fluorescent pigment market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 560.9 million by 2030.

b. Asia Pacific dominated the fluorescent pigment market with a share of 40.5% in 2023. This is attributable to the increasing demand for vibrant colors in textiles, automotive, and packaging applications is a key factor propelling market growth.

b. Some key players operating in the fluorescent pigment market include Radiant Color NV, Luminochem, Wanlong Chemical Co., Ltd., Sinloihi Co., Ltd., Wuxi Minghui International Trading Co., Ltd., DayGlo Color Corp., Aron Universal Limited, Vicome Corp., Hangzhou Aibai Chemical Co., Ltd., Brilliant Group Inc.

b. Key factors that are driving the market growth include increasing demand for vibrant and visually striking colors across various industries. Fluorescent pigments are renowned for their high brightness and ability to glow under UV light, making them highly sought after in applications such as textiles, plastics, paints, and coatings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.