- Home

- »

- Biotechnology

- »

-

Gene Editing Market Size & Share, Industry Report, 2033GVR Report cover

![Gene Editing Market Size, Share & Trends Report]()

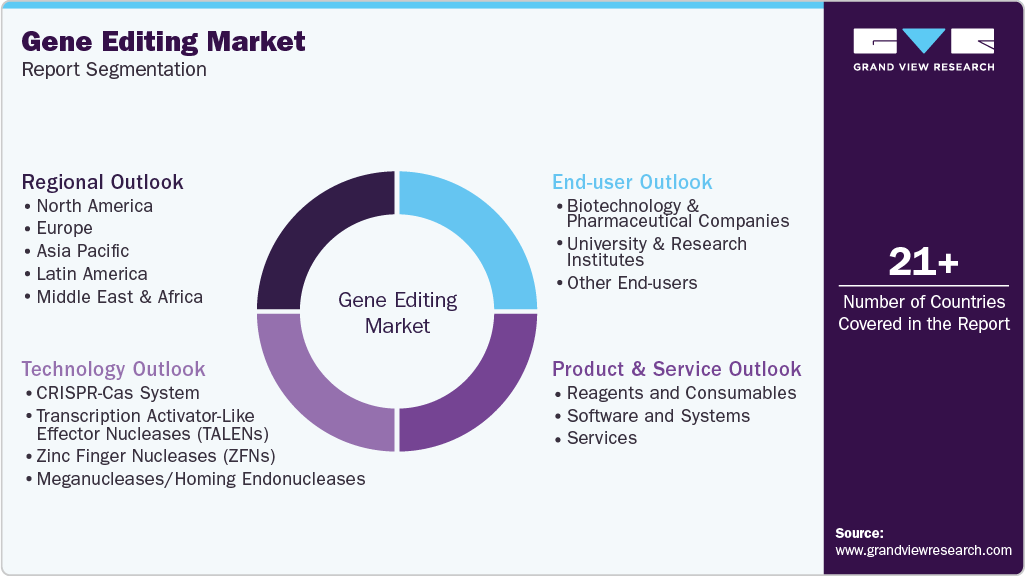

Gene Editing Market (2026 - 2033) Size, Share & Trends Analysis Report By Product & Service (Reagents & Consumables, Software & Systems, Services), By Technology (CRISPR-Cas System, Transcription Activator-Like Effector Nucleases), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-845-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gene Editing Market Summary

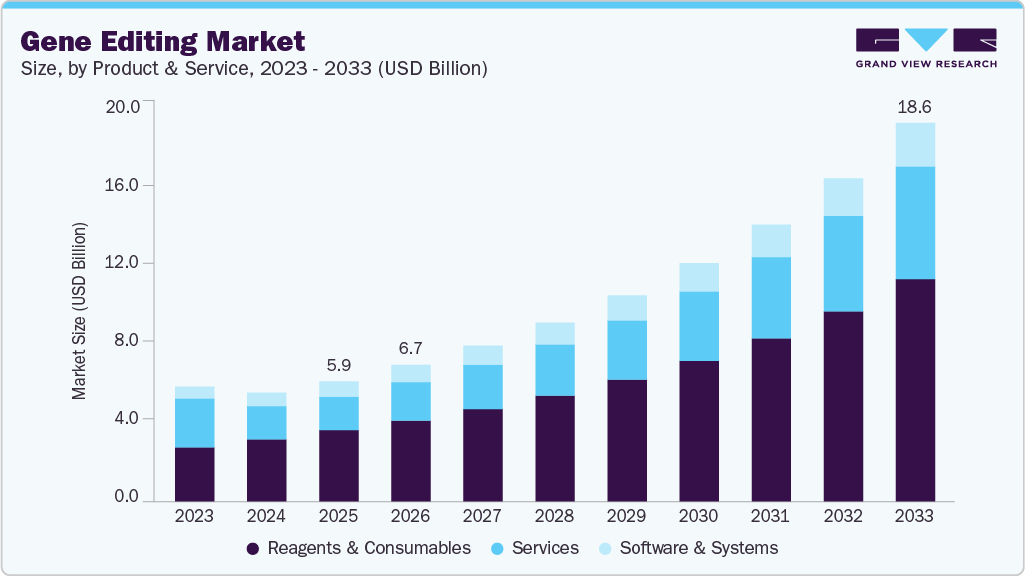

The global gene editing market size was estimated at USD 5.87 billion in 2025 and is projected to reach USD 18.55 billion by 2033, growing at a CAGR of 15.71% from 2026 to 2033. This growth is supported by rising adoption of advanced gene therapies, increasing investments in biopharmaceutical research, and growing demand for precision medicine.

Key Market Trends & Insights

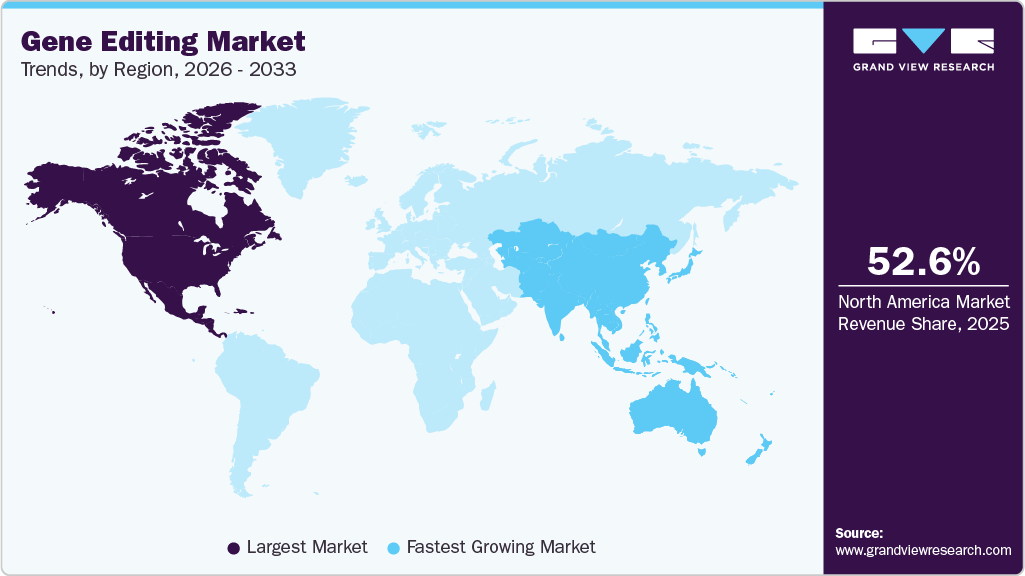

- The North America gene editing market held the largest global share of 52.65% in 2025.

- The gene editing industry in the U.S. is expected to grow significantly from 2026 to 2033.

- By product & service, the reagents and consumables segment held the highest market share of 59.35% in 2025.

- By technology, the CRISPR-Cas system segment held the highest market share of 75.32% in 2025.

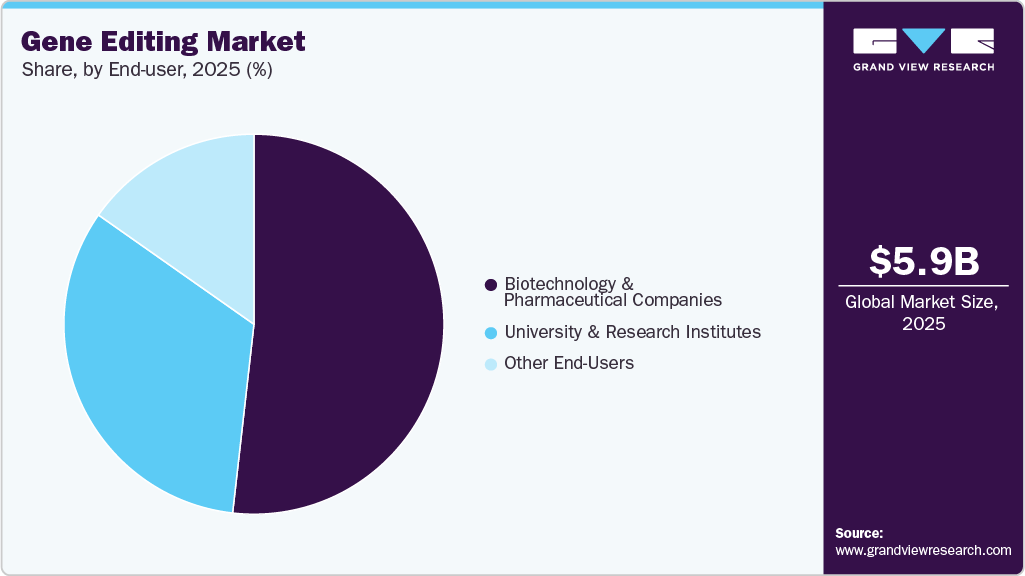

- By end-user, the biotechnology and pharmaceutical companies segment led the gene editing industry, accounting for the largest revenue share of 51.79% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.87 Billion

- 2033 Projected Market Size: USD 18.55 Billion

- CAGR (2026-2033): 15.71%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Growing demand for curative genetic therapiesThe increasing need for precision medicine in rare and genetic disorders is one of the main factors driving the gene editing market, as health care systems are increasingly inclined to shift from symptomatic management to more targeted, root-cause interventions. Many rare diseases are monogenic, making them appropriate candidates for gene-editing techniques that can directly fix, silence, or alter the defective genes. The customary chronic treatment approaches often entail lifelong prescription of medicines with limited effect. However, gene editing opens the door to either single or very rare interventions with lasting results.

Investment initiatives in precision medicine

Sr. No

Company/Initiative

Investment Amount (USD million)

Description

1

Addition Therapeutics

100

Secured funding to develop RNA-based genetic therapies, advancing next-generation therapeutic platforms.

2

Cure Rare Disease

7.4

Awarded a CIRM grant to advance gene therapy for Limb Girdle Muscular Dystrophy Type 2i, supporting rare disease innovation.

3

Link Cell Therapies

60

Closed a financing round with backing from J&J and BMS to accelerate development of cell therapy platforms aligned with gene-modified therapies.

Source: U.S. FDA, Investor Presentations, Primary Interviews, Grand View Research

The developers need much more than basic editing tools. They need to perform mutation-specific programs with advanced editing enzymes, guide RNA design, delivery optimization, and robust analytical validation. As a result, there has been a continuous demand for gene-editing reagents, GMP-grade components, and specialized contract research and manufacturing services. The combination of the above factors, namely unmet clinical need, precision-focused healthcare strategies, and scalable platform development, has made gene editing a critical growth engine in the next generation of therapeutic innovations.

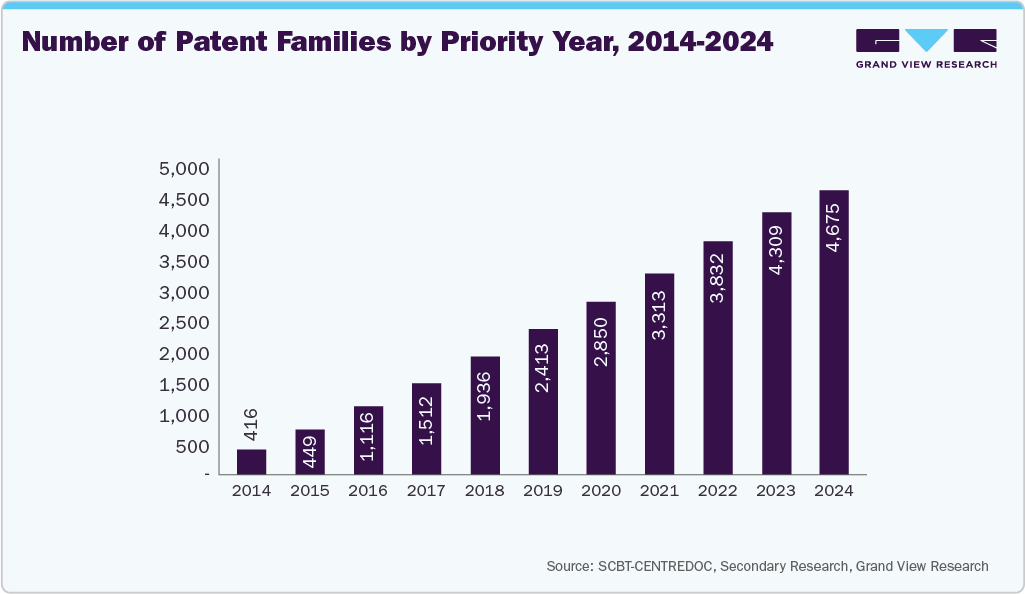

Patent Analysis

The gene editing market is shaped by a complex and rapidly evolving patent landscape. As gene editing technologies transition from laboratory research to commercial applications in therapeutics and industrial biotechnology, patents have become essential for securing market exclusivity and establishing competitive advantages. This landscape spans multiple generations of technologies, each with its own innovation trajectory and associated intellectual property. Early programmable gene editing tools, such as zinc finger nucleases, laid the groundwork for precise genome manipulation. Foundational patents in this area remain significant, particularly for therapeutic delivery and application methods, but the commercial focus has shifted toward more versatile and efficient technologies. Transcription activator-like effector nucleases (TALENs) emerged as a prominent alternative to zinc finger nucleases, driving increased patent activity in the early 2010s.

The most transformative and contested segment of the patent landscape is the CRISPR-Cas family of technologies. Foundational patents covering CRISPR-Cas9 and its derivatives encompass genome editing methods and applications across human therapeutics, agricultural biotechnology, and diagnostics. Successive generations, including Cas12 and Cas13 systems, as well as emerging approaches like base editing and prime editing, have produced an expanding portfolio of patents, ranging from broad claims on core technology to highly specific claims on delivery methods, tissue targeting, and disease-specific interventions.

According to a report published by the Swiss Center for Business & Technology Intelligence, as of December 2024, over 23,000 patent families have been filed in the CRISPR domain, with approximately 19,000 focused on genome editing claims. Other significant areas of innovation include modified organisms spanning plant, animal, human, and cellular applications, as well as therapeutics and diagnostics. This breadth underscores CRISPR’s versatility and transformative potential across multiple sectors. Furthermore, patent filings have grown exponentially since 2014, primarily driven by claims related to genome editing. This trend mirrors rising commercial and academic interest in securing intellectual property over foundational technologies and downstream applications. The following figure illustrates this temporal distribution, highlighting a consistent upward trajectory over the past decade.

Expansion of the enabling ecosystem

The expanding enabling ecosystem is a key commercial driver of the gene editing industry’s growth, as it significantly lowers entry barriers for emerging biotechnology companies. Broad access to custom reagents, GMP-grade enzymes, standardized guide RNA design, validated delivery systems, and advanced analytical platforms reduces upfront capital requirements and reliance on in-house expertise, enabling smaller and mid-sized firms to initiate programs faster and operate with greater flexibility.

This ecosystem-driven model accelerates development timelines, expands and diversifies pipelines, enhances stakeholder collaboration, and supports sustained long-term market growth by enabling scalable, capital-efficient participation from innovation-led biotech firms across therapeutic, research, and emerging gene-editing end users globally.

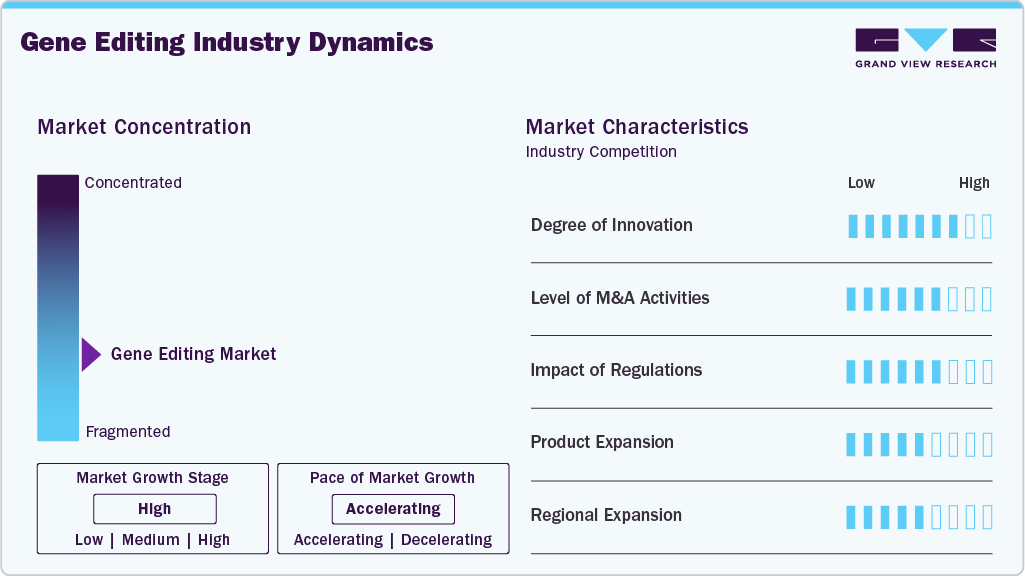

Market Concentration & Characteristics

The gene editing industry has seen rapid innovation, driven by advances in tools, reagents, and enabling technologies that have improved efficiency, precision, and accessibility across research and therapeutic end users.

The gene editing market is also characterized by a high level of merger and acquisition activity among leading players, as companies seek to strengthen technology portfolios, expand therapeutic pipelines, secure intellectual property, and accelerate market entry through strategic consolidation.

Regulations significantly influence the market by shaping research, clinical development, and commercialization timelines. While strict safety and ethical requirements increase compliance costs and approval timelines, clearer regulatory pathways in major markets help reduce uncertainty and support responsible innovation and investment.

Product and service expansion is a key growth driver in the gene editing market, with companies broadening offerings beyond core tools to include custom reagents, GMP-grade enzymes, guide RNA services, delivery systems, and analytical platforms.

Regional expansion is a key strategy in the gene editing industry, with companies moving beyond North America and Europe into high-growth regions such as Asia Pacific and Latin America. Establishing local partnerships and support infrastructure helps firms access new customers, address regional regulations, and capitalize on expanding biotech ecosystems.

Product & Service Insights

The reagents and consumables segment dominated the market, accounting for the largest share of 59.35% in 2025. This dominant position reflects the high demand for essential components in gene-editing workflows, the widespread use by research and clinical end users, and the recurring nature of consumable purchases.

The services segment is expected to grow at the fastest CAGR over the forecast period. Limited in-house expertise across the full gene-editing workflow is driving demand for outsourced offerings, such as custom gene editing, cell line development, and validation services, enabling customers to access specialized capabilities without substantial upfront investment.

Technology Insights

The CRISPR-Cas system segment led the market with a 75.32% share in 2025 and is expected to register the fastest CAGR from 2026 to 2033, driven by its high precision, efficiency, broad applicability, and expanding adoption in research, therapeutics, and clinical development, supported by continued technological advancements and rising investment in CRISPR-based therapies.

The transcription activator-like effector nucleases segment is expected to grow at a significant CAGR over the forecast period. Transcription activator-like effector nucleases (TALENs) remain relevant in gene editing due to their high specificity and low off-target activity. Precise, customizable DNA recognition supports their continued use in complex genomic targets, particularly in academic research and regulated therapeutic development.

End-user Insights

The biotechnology and pharmaceutical companies segment led the gene editing industry, accounting for the largest revenue share of 51.79% in 2025, and is projected to grow at the fastest CAGR from 2026 to 2033, driven by increased R&D investment, expanding gene therapy pipelines, wider adoption of gene editing for precision medicine, and support from strategic collaborations and technological advancements.

The university and research institutes segment is expected to grow at a significant CAGR over the forecast period. Universities and research institutes drive foundational gene editing research, generating proof-of-concept data that supports investment and downstream commercialization. Their focus on publishing, protocol sharing, and researcher training accelerates method adoption across academic and industry labs, thereby sustaining strong demand for gene editing tools, reagents, software, and services.

Regional Insights

North America held the largest revenue share of 52.65% in 2025, supported by a mature biotechnology ecosystem, strong research capabilities, and sustained capital investment. The region’s high concentration of gene therapy developers, advanced manufacturing infrastructure, and leading academic institutions enables rapid translation of innovation into clinical and commercial outcomes.

U.S. Gene Editing Market Trends

The U.S. gene editing industry is witnessing significant growth, driven by strong investment momentum, rapid technological advancements, and expanding end-user scope across therapeutics, agriculture, and industrial biotechnology.

Europe Gene Editing Market Trends

The Europe gene editing industry continued to expand in 2025, driven by robust investments in life sciences research, the growing adoption of advanced gene-editing technologies, and a focus on personalized medicine.

The UK gene editing market is witnessing strong growth, driven by increasing investment in life sciences research, rapid adoption of advanced genomic technologies, and expanding end-user markets across therapeutics, agriculture, and industrial biotechnology.

The gene editing market in Germany is witnessing robust growth. This growth can be attributed to the growing focus on precision medicine, coupled with the expansion of gene therapy pipelines targeting rare and genetic disorders.

Asia Pacific Gene Editing Market Trends

The Asia Pacific region is expected to witness the fastest growth at a CAGR of 17.09% over the forecast period. The increasing healthcare investments, the prevalence of genetic disorders, and the expanding focus on advanced therapeutics across the region drive market growth.

The China gene editing market is experiencing strong growth, supported by rapid advances in biotechnology, expanding domestic research capabilities, and increasing investment across academic, clinical, and industrial settings.

The gene editing market in Japan is experiencing strong growth, driven by increasing adoption of advanced genome engineering technologies across therapeutic research, drug discovery, and functional genomics.

MEA Gene Editing Market Trends

The MEA gene editing industry remains at an early yet advancing stage, supported by selective regulatory approvals and rising investment in advanced therapeutics. Israel and Oman have emerged as notable markets with the approval of high-value gene therapies, which is driving the regional demand in the editing industry.

Kuwait’s gene editing market is expected to grow over the forecast period. The country’s gene editing ecosystem is in an early growth phase, with market analysts projecting expanding demand in research, clinical, and biotechnology end users.

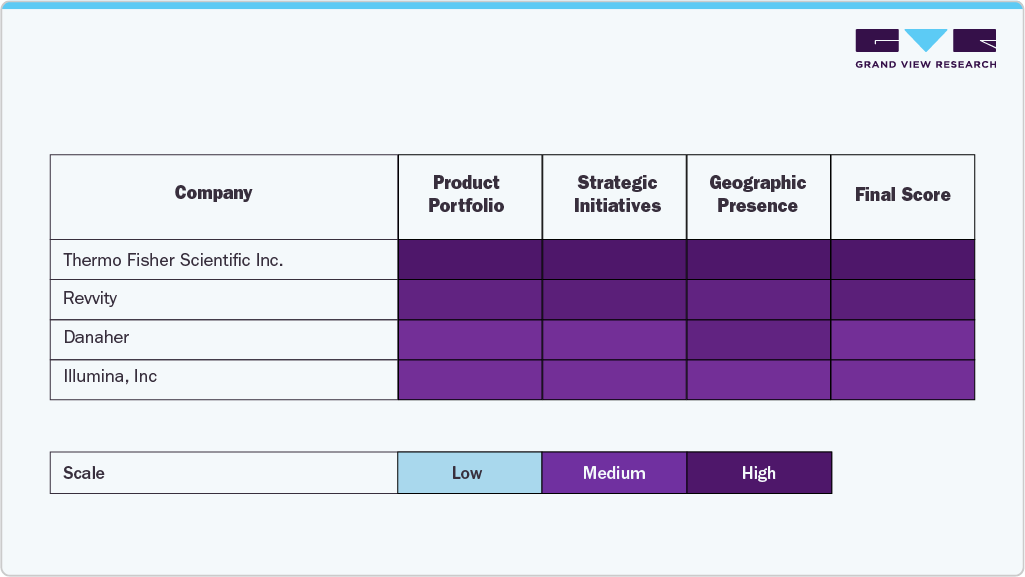

Key Gene Editing Company Insights

Leading companies such as Thermo Fisher Scientific Inc., Revvity, Danaher, Intellia Therapeutics, Sangamo Therapeutics, Beam Therapeutics, Illumina, Inc., Editas Medicine, and Synthego have secured significant market positions by leveraging cutting-edge gene editing technologies, broad end-user capabilities, and global distribution networks.

Ongoing advances in CRISPR, base and prime editing, and delivery technologies, coupled with competitive pressures, are driving the gene editing market. Companies that combine scientific excellence with customer-focused solutions are best positioned to capture long-term value in this rapidly evolving sector.

Key Gene Editing Companies:

The following are the leading companies in the gene editing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Revvity

- Danaher

- Intellia Therapeutics

- Sangamo Therapeutics

- Beam Therapeutics

- Illumina, Inc.

- Editas Medicine

- Synthego

Recent Developments

-

In July 2025, QIAGEN launched dedicated CRISPR products (QIAprep& CRISPR Kit and CRISPR Q-Primer Solutions) for the rapid and simplified analysis of gene-editing experiments.

-

In December 2024, Vivlion GmbH announced the launch of its new flagship fixed-pair Alexandria PRCISR CRISPR library. It was engineered to support a wide range of end users, including gene function studies, disease modeling, and therapeutic target discovery.

Gene Editing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.68 billion

Revenue forecast in 2033

USD 18.55 billion

Growth rate

CAGR of 15.71% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, technology, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Revvity; Danaher; Intellia Therapeutics; Sangamo Therapeutics; Beam Therapeutics; Illumina, Inc.; Editas Medicine; Synthego

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gene Editing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global gene editing market report based on product & service, technology, end-user, and region:

-

Product & Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Reagents and Consumables

-

Software and Systems

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

CRISPR-Cas System

-

Transcription Activator-Like Effector Nucleases (TALENs)

-

Zinc Finger Nucleases (ZFNs)

-

Meganucleases/Homing Endonucleases

-

-

End-user Outlook (Revenue, USD Billion, 2021 - 2033)

-

Biotechnology and Pharmaceutical Companies

-

University and Research Institutes

-

Other End-users

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gene editing market size was estimated at USD 5.87 billion in 2025 and is expected to reach USD 6.68 billion in 2026.

b. The global gene editing market is expected to grow at a compound annual growth rate of 15.71% from 2026 to 2033 to reach USD 18.55 billion by 2033.

b. North America dominated the gene editing market with a share of 52.65% in 2025. This is attributable to rising adoption of gene editing technologies in research and development activities.

b. Some key players operating in the gene editing market include Thermo Fisher Scientific Inc.; Revvity, Danaher, Intellia Therapeutics, Sangamo Therapeutics, Beam Therapeutics, Illumina, Inc, Editas Medicine, Synthego

b. Key factors driving market growth include the rising adoption of advanced gene therapies, increasing investments in biopharmaceutical research, and growing demand for precision medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.