- Home

- »

- Biotechnology

- »

-

Immune Repertoire Sequencing Market, Industry Report 2033GVR Report cover

![Immune Repertoire Sequencing Market Size, Share & Trends Report]()

Immune Repertoire Sequencing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service (Instruments, Assay Kits & Reagents), By Type, By Application (Oncology & Cancer Immunotherapy, Transplantation & Immune Tolerance), By End-use (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-819-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Immune Repertoire Sequencing Market Summary

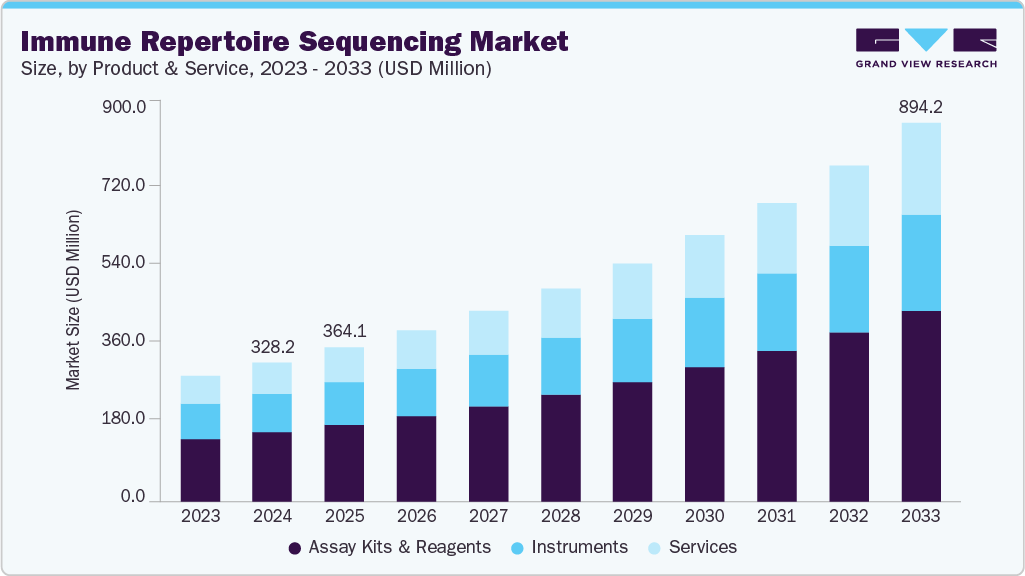

The global immune repertoire sequencing market size was estimated at USD 328.2 million in 2024 and is projected to reach USD 894.2 million by 2033, growing at a CAGR of 11.89% from 2025 to 2033. The increasing adoption of next-generation sequencing technologies, applications in immunotherapy and vaccine development, and investments in precision medicine research drive the market growth.

Key Market Trends & Insights

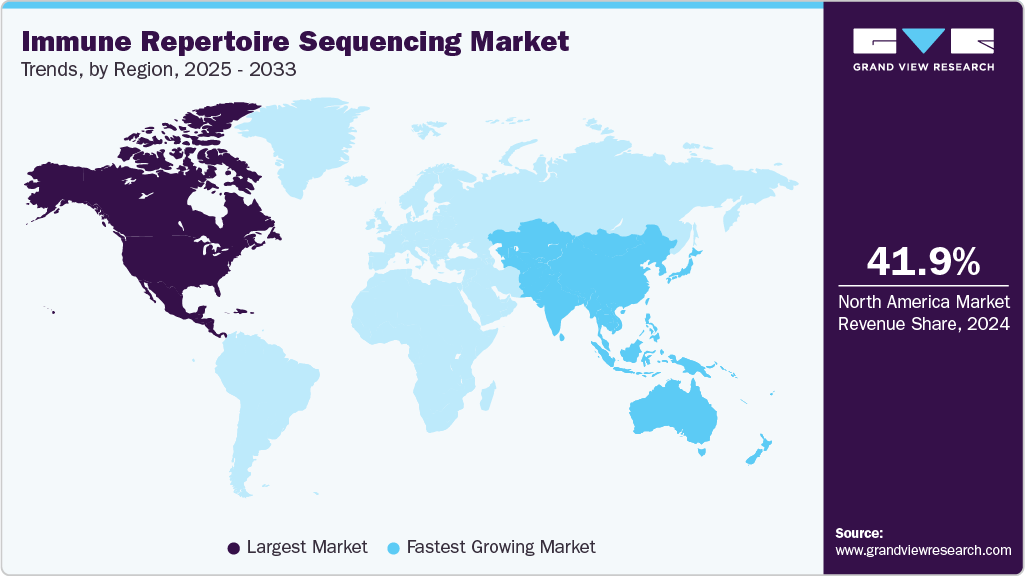

- The North America Immune repertoire sequencing market held the largest global share of 41.91% in 2024.

- The immune repertoire sequencing industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By product & service, the assay kits & reagents segment held the highest market share of 49.95% in 2024.

- By type, the bulk immune repertoire sequencing segment held the highest market share in 2024.

- By application, the oncology & cancer immunotherapy segment held the highest market share of 37.86% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 328.2 Million

- 2033 Projected Market Size: USD 894.2 Million

- CAGR (2025-2033): 11.89%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growth of immunotherapy, oncology, and autoimmune research

The growing applications of immunotherapy, oncology, and autoimmune research are the main factors driving demand in the immune repertoire sequencing (IRS) market. Researchers and clinicians are increasingly relying on immune profiling as precision medicine advances to comprehend the intricacies of the human immune system. The IRS enables the analysis of B-cell and T-cell receptor repertoires in great detail, providing important insights into immune responses associated with infectious diseases, cancer, autoimmune disorders, and transplant rejection.

Major commercially available kits for TCR profiling

Kit

Species

Protocol

UMI

Input material

Sequencing

Analysis

Milaboratories

Mouse, human, and monkey

Multiplex PCR

Yes

Up to 500 ng

Illumina

MIXCR and MIGEC

NEBNext immune sequencing

Mouse and human

5′ RACE

Yes

10 ng-1 µg RNA or RNA-contained cells

Illumina Miseq

Presto (Galaxy)

SMARTer TCR a/b profiling

Mouse and human

SMART technology

No

10 ng-3 µg of RNA or 50-10,000 cells

Illumina Miseq

Any softwares

iRepertoire

Mouse and human

arm-PCR

No

50 ng-1 µg RNA

Illumina

iRepertoire

Source: Frontiers in Genetics, Secondary Research, Grand View Research

Moreover, as more healthcare systems and research institutions use high-throughput immune sequencing for diagnostic and prognostic applications, the growing prevalence of infectious and autoimmune diseases fuels market expansion. The technology's usefulness in immunology and vaccine development is enhanced by its ability to describe immune diversity and track the progression of disease. The market's growth has also been accelerated by rising investments from biotechnology and pharmaceutical firms to incorporate immune repertoire sequencing into drug discovery pipelines.

Advances in sequencing and genomics technologies

Technological advancements in next-generation sequencing (NGS) have become a major growth driver for the immune repertoire sequencing industry. Continuous improvements in sequencing chemistry, library preparation, and bioinformatics have made immune profiling faster, more accurate, and cost-effective, enabling large-scale analysis of immune receptors. The falling cost of sequencing has expanded access beyond major research centers to clinical and diagnostic laboratories, supporting broader adoption across immunology, oncology, and drug discovery.

Moreover, advancements like spatial transcriptomics, single-cell sequencing, and multi-omics integration are expanding the scope of immune analysis. The use of these technologies in precision medicine and biomarker discovery is fueled by their comprehensive insights into immune cell function, antigen specificity, and disease mechanisms. Global demand for sophisticated IRS platforms and analytical solutions is predicted to increase as these tools become more widely available and clinically relevant.

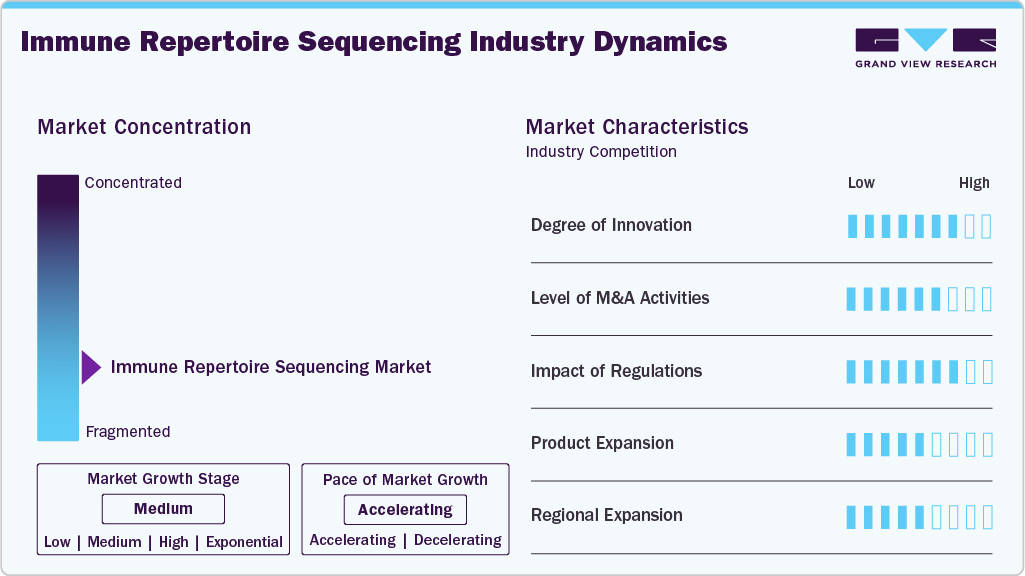

Market Concentration & Characteristics

The immune repertoire sequencing market demonstrates a high degree of innovation driven by advancements in next-generation sequencing (NGS), bioinformatics, and single-cell analysis. A deeper understanding of immune diversity and clonal evolution is made possible by increased sequencing accuracy, throughput, and cost-effectiveness. Immune repertoire sequencing is now a crucial tool in immunotherapy, vaccine research, and disease diagnostics thanks to the combination of AI, cloud-based analytics, and innovative library preparation techniques, which also improve data interpretation and workflow automation.

The immune repertoire sequencing industry exhibits a moderate yet rising level of M&A activity, driven by growing interest in immune profiling and precision medicine. As the industry becomes more consolidated and technologically synergistic, major genomics and biopharma companies are expanding their sequencing, bioinformatics, and immune-profiling capabilities by acquiring or working with niche companies.

Regulations significantly impact the immune repertoire sequencing market, as strict FDA and international standards for NGS-based diagnostics necessitate thorough validation and data quality assurance. These standards improve clinical confidence, data security, and reliability while increasing development costs and time to market. This supports the wider use of immune repertoire sequencing in research and diagnostics.

Product expansion in the market for immune repertoire sequencing is accelerating as businesses launch sophisticated assay kits, integrated sequencing workflows, and AI-driven analysis tools. These developments enhance the precision of immune profiling and broaden its applications in immunotherapy, vaccine development, and clinical diagnostics, thereby propelling market expansion and wider adoption.

The regional expansion of the immune repertoire sequencing industry is characterized by established dominance in North America, driven by a robust research infrastructure, growing genomics initiatives, increasing healthcare investment, and rising demand in nations such as China, India, and Japan.

Product & Service Insights

The assay kits & reagents segment dominated the market, accounting for the largest revenue share of 49.95% in 2024, and is expected to witness the fastest growth throughout the forecast period. The increasing use of immune repertoire sequencing workflows, which rely on premium library preparation kits, amplification reagents, and consumables, is driving its expansion. The position of this segment has been further reinforced by ongoing advancements in reagent chemistries and ready-to-use kits, which enable precise, repeatable, and economical sequencing in both clinical and research applications.

The services segment is expected to witness a significant CAGR during the forecast period. A growing number of researchers and businesses are relying on service providers for high-quality, cost-effective, and rapid turnaround solutions, as immune repertoire analysis requires specialized expertise and advanced data processing.

Type Insights

The bulk immune repertoire sequencing segment dominated the immune repertoire sequencing market, accounting for the largest revenue share in 2024, owing to its cost-effectiveness, high throughput, and suitability for large-scale population studies. Because it offers strong insights into overall immune diversity at a significantly lower cost than single-cell approaches, its widespread adoption in oncology, vaccine research, and autoimmune disease profiling further solidifies its position.

The single-cell immune repertoire sequencing segment is expected to exhibit the fastest CAGR over the forecast period, due to its capacity to offer high-resolution insights into paired chain information and clonal dynamics at the individual cell level. Adoption is being accelerated by the expanding use of precision immunology, antibody discovery, and advanced oncology research, as scientists look for more precise and in-depth descriptions of immune cell populations.

Application Insights

The oncology & cancer immunotherapy segment dominated the immune repertoire sequencing industry, accounting for the largest revenue share of 37.86% in 2024. This is primarily attributed to its cost-effectiveness, consistency in quality, and scalability in production. Synthetic supplements offer precise formulations and standardized dosages, making them a preferred choice for both consumers and manufacturers seeking reliable and affordable options.

The infectious diseases & vaccine development segment is expected to register the fastest CAGR over the forecast period, due to the growing need for immune repertoire profiling to monitor pathogen-specific immune responses, assess vaccine efficacy, and facilitate rapid vaccine design. The growing global emphasis on pandemic preparedness and new infectious threats further accelerates the segment's growth.

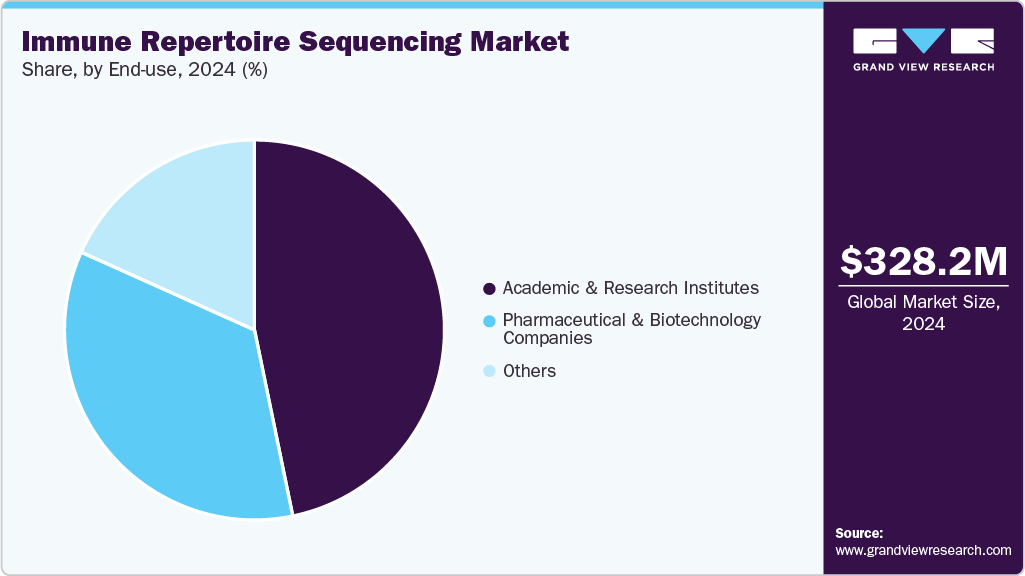

End-use Insights

The academic & research institutes segment dominated the market, accounting for the largest revenue share of 46.77% in 2024. Robust funding support, ongoing large-scale research projects, and the extensive use of advanced sequencing platforms across research centers and universities further support the segment's dominance.

The pharmaceutical & biotechnology companies segment is expected to register the fastest CAGR over the forecast period. Growing investments in immunotherapy development, the increasing use of high-throughput immune-profiling tools for biomarker discovery, and the expansion of clinical pipelines targeting oncology, infectious diseases, and autoimmune disorders are the primary drivers of this growth.

Regional Insights

North America dominated the immune repertoire sequencing market, accounting for the largest revenue share of 41.91% in 2024, driven by innovations in immune monitoring, vaccine development, and cell therapy applications. Moreover, the regional demand has been further accelerated by partnerships among pharmaceutical companies, biotech companies, and academic institutions.

U.S. Immune Repertoire Sequencing Market Trends

The U.S. immune repertoire sequencing industry has experienced rapid growth, owing to substantial government funding for genomics and immunology research, a robust healthcare infrastructure, and the early adoption of cutting-edge sequencing platforms. Key players, including Adaptive Biotechnologies, Illumina, and Thermo Fisher Scientific, continue to expand their portfolios, which further drives demand in the market.

Europe Immune Repertoire Sequencing Market Trends

The Europe immune repertoire sequencing industry is witnessing steady growth, supported by strong public-private research collaborations, a harmonized regulatory framework, and a focus on precision and translational medicine. Moreover, the growth of high-throughput sequencing labs and the regional focus on sustainable biopharmaceutical innovation support market development.

The UK immune repertoire sequencing market is expanding due to robust genomics research, government-backed health programs, and strong academic-industry partnerships. The UK’s National Health Service (NHS) Genomic Medicine Service and the 100,000 Genomes Project have laid the groundwork for integrating immune repertoire sequencing into clinical workflows. For instance, in November 2023, Oxford Nanopore and Genomics England in the UK collaborated on long-read sequencing for rare diseases, advancing innovations that enhance immune repertoire profiling and multiomic analysis.

The immune repertoire sequencing market in Germany is expected to grow during the forecast period. Germany is a leading European market for immune repertoire sequencing, supported by advanced healthcare infrastructure, strong R&D investment, and government initiatives such as "Industrie 4.0" and the "Health Research Framework Programme." Immune repertoire sequencing is actively used in cancer and autoimmune research by research institutes like the Max Planck Institute and DKFZ, enhancing Germany's standing as a regional center for immunogenomics innovation.

Asia Pacific Immune Repertoire Sequencing Market Trends

The Asia Pacific immune repertoire sequencing industry is projected to record the fastest CAGR of 13.32% from 2025 to 2033, driven by rising investments in genomics, expanding biotechnology capabilities, and a growing burden of infectious and chronic diseases. The increasing demand for personalized medicine, coupled with regional partnerships and infrastructure development, is driving the rapid adoption of immune profiling technologies.

The China immune repertoire sequencing market is expected to grow during the forecast period. China is a major player in immune repertoire sequencing, supported by government initiatives such as “Healthy China 2030,” robust biotech growth, and large-scale genomics projects.

The immune repertoire sequencing market in Japan is expected to grow steadily during the forecast period. This growth is driven by precision medicine initiatives, advanced biotech research, and government programs, such as the “Moonshot R&D Program.”

Middle East Immune Repertoire Sequencing Market Trends

The Middle East & Africa immune repertoire sequencing industry is still in the early stages of development. Still, it shows strong potential due to growing investments in life sciences, rising awareness of genomic medicine, and expanding healthcare infrastructure. The region is increasingly engaging in collaborations to build local sequencing capabilities and foster biotechnology innovation.

Kuwait's immune repertoire sequencing market is gradually emerging as a prominent segment, supported by efforts to modernize healthcare and promote biomedical research. Collaborations with foreign organizations and academic institutions are helping establish sequencing and bioinformatics capabilities in the nation.

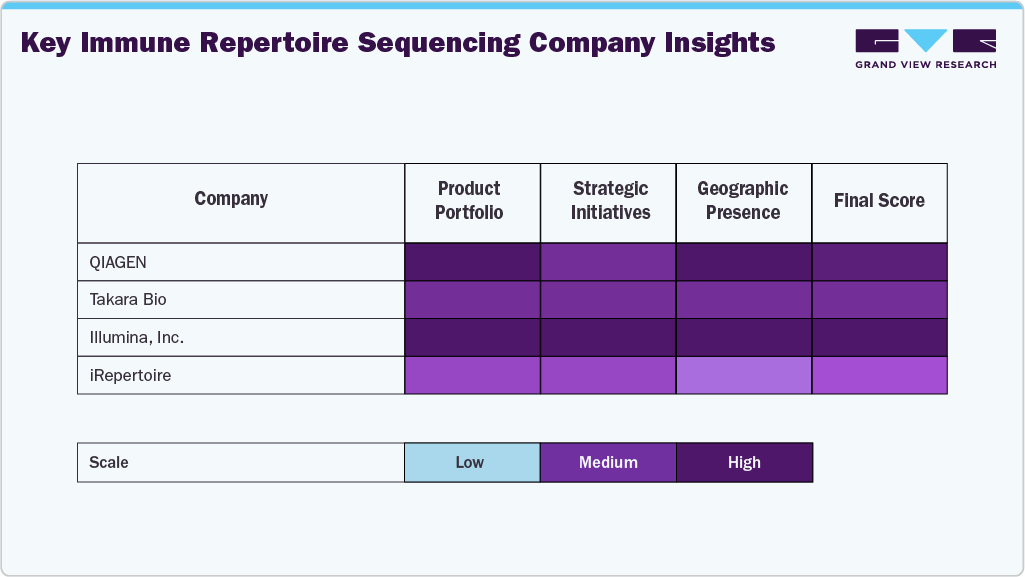

Key Immune Repertoire Sequencing Company Insights

The immune repertoire sequencing market is shaped by a strong presence of established players that continue to dominate through robust product portfolios, advanced sequencing technologies, and sustained investments in R&D. Leading companies such as QIAGEN, New England Biolabs, Takara Bio, Illumina, Inc., and BGI have secured significant market share owing to their comprehensive assay kits, high-performance sequencing platforms, and global distribution networks that support both clinical and research applications.

Companies including iRepertoire, Creative Biolabs, Nucleus Biotech, and Celemics, Inc. are steadily expanding their footprint by delivering specialized immune-profiling services, customizable sequencing workflows, and targeted reagent solutions.

Businesses are well-positioned to provide long-term value and drive revolutionary breakthroughs in this rapidly evolving field when they successfully combine scientific excellence with user-centric solutions.

Key Immune Repertoire Sequencing Companies:

The following are the leading companies in the immune repertoire sequencing market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- New England Biolabs

- Takara Bio

- Illumina, Inc.

- iRepertoire

- BGI

- Danaher

- Creative Biolabs

- Nucleus Biotech

- Celemics, Inc.

Recent Developments

-

In June 2025, QIAGEN in the Netherlands partnered with U.S.-based Incyte to develop an NGS-based multimodal companion diagnostic panel for CALR-mutant myeloproliferative neoplasms, validated on Illumina’s NextSeq 550Dx platform.

-

In April 2025, QIAGEN in the Netherlands launched new QIAseq panels, expanded sequencing partnerships, and introduced HSMD Research, strengthening NGS capabilities and driving rising demand for advanced profiling solutions in the immune-repertoire sequencing market.

Immune Repertoire Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 364.1 million

Revenue forecast in 2033

USD 894.2 million

Growth rate

CAGR of 11.89%from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, India, China, Japan, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait

Key companies profiled

QIAGEN; New England Biolabs; Takara Bio; Illumina, Inc.; iRepertoire; BGI; Danaher; Creative Biolabs; Nucleus Biotech; Celemics, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Immune Repertoire Sequencing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global immune repertoire sequencing market report based on product & service, type, application, end-use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Assay Kits & Reagents

-

TCR kits

-

BCR kits

-

Others

-

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Bulk immune‑repertoire sequencing

-

Single‑cell immune‑repertoire sequencing

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology & Cancer Immunotherapy

-

Autoimmune & Inflammatory Diseases

-

Infectious Diseases & Vaccine Development

-

Transplantation & Immune Tolerance

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immune repertoire sequencing market size was estimated at USD 328.2 million in 2024 and is expected to reach USD 364.1 million in 2025.

b. The global immune repertoire sequencing market is expected to grow at a compound annual growth rate of 11.89% from 2025 to 2033 to reach USD 894.2 million by 2033.

b. North America dominated the immune repertoire sequencing market with a share of 41.91% in 2024. This is attributable to its strong genomic research ecosystem, high adoption of advanced sequencing technologies, and significant investments in precision medicine initiatives.

b. Some key players operating in the immune repertoire sequencing market include QIAGEN; New England Biolabs; Takara Bio; Illumina, Inc.; iRepertoire; BGI; Danaher; Creative Biolabs; Nucleus Biotech; Celemics, Inc.

b. Key factors driving the growth of the immune repertoire sequencing market include the rising adoption of precision medicine, the increasing prevalence of cancer and autoimmune diseases, advancements in high-throughput sequencing technologies, and the growing demand for biomarker discovery and immunotherapy development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.